NPC Skating night, Washington DC 1919

“..different to previous episodes of dollar funding shortage such as the ones experienced during the Lehman crisis or during the euro debt crisis, the current one is not driven by banks.”

• The Global Dollar Funding Shortage Is Back With A Vengeance (Zero Hedge)

[..].. all else equal, there is at least enough downside to push the fx basis as far negative at -50 bps: this would make the USD shortage the most acute it has ever been, at least as calculated by this key metric! And since this is essentially a risk-free arb for credit issuers, and since there are many more stock buybacks that demand credit funding, one can be certain that the current fx basis print around – 20 bps will most certainly accelerate to a level never before seen, a level which would also hint that something is very broken with the financial system and/or that transatlantic counterparty risk has never been greater. Unlike us, JPM hedges modestly in its forecast where the basis will end up:

Whether the above YTD trends continue forward is a difficult call to make. The widening of USD vs. EUR credit spreads shown in Figure 4 has the propensity to sustain the strength of Reverse Yankee issuance putting more downward pressure on the basis. On the other hand, this potential downward pressure on the basis should be offset to some extent by Yankee issuance the attractiveness of which increases the more negative the basis becomes.

In all, different to previous episodes of dollar funding shortage such as the ones experienced during the Lehman crisis or during the euro debt crisis, the current one is not driven by banks. It is rather driven by the monetary policy divergence between the US and the rest of the world. This divergence appears to have created an imbalance in funding markets and a shortage in dollar funding. It is important to monitor how this dollar funding shortage and issuance patterns evolve over time even if the currency implications are uncertain.

And to think the Fed’s cheerleaders couldn’t hold their praise for the ECB’s NIRP (as first defined on these pages) policy. Because little did they know that behind the scenes the divergence in Fed and “rest of the world” policy action is leading to two things: i) the fastest emergence of a dollar shortage since Lehman and ii) a shortage which will be arbed to a level not seen since Lehman, and one which assures that over the coming next few months, many will be scratching their heads as to whether there is something far more broken with the financial system than merely an arbed way by US corporations to issue cheaper (hedged) debt in Europe thanks to Europe’s NIRP policies.

If and when the market finally does notice this gaping dollar shortage (as is usually the case with the mandatory 3-6 month delay), watch as the Fed will once again scramble to flood the world with USD FX swap lines in yet another desperate attempt to prevent the global dollar margin call from crushing a matched synthetic dollar short which according to some estimates has risen as high as $10 trillion. Until then, just keep an eye on the Fed’s weekly swap line usage, because if the above is correct, it is only a matter of time before they are put to full use once again. Finally what assures they will be put to use, is that this time the divergence is the direct result of the Fed’s actions, and its insistence that despite what is shaping up to be a 1% GDP quarter, that it has to hike rates. Well, as JPM just warned it in not so many words, be very careful what you wish for, and what you end up getting in your desire to telegraph just how “strong” the US economy is.

Absolute must read: “when the dollar rallies strongly, as is the case now, FX intervention rapidly dries up and can even reverse, exerting a massive monetary tightening on emerging economies and ultimately the entire over-inflated global financial complex…”

• “Ignore This Measure Of Global Liquidity At Your Own Peril” (Zero Hedge)

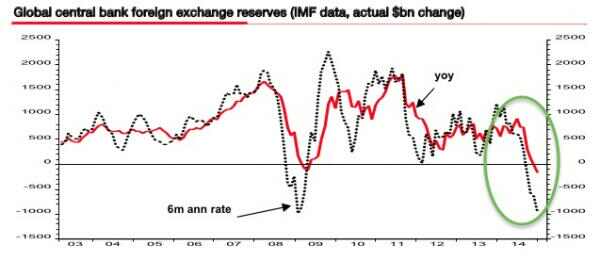

With all eyes squarely on the ECB as Mario Draghi prepares to flood the EMU fixed income market with €1.1 trillion in new liquidity starting Monday, Soc Gen’s Albert Edwards reminds us that “another type of QE” is drying up thanks largely to the relative strength of the US dollar. The printing of currency to buy US dollar denominated assets in an effort to prop up “mercantilist export-led growth models [is] no different to the Fed’s QE,” Edwards says, explicitly equating EM FX intervention with the asset purchase programs employed by the world’s most influential central banks in the years since the crisis. Via Soc Gen:

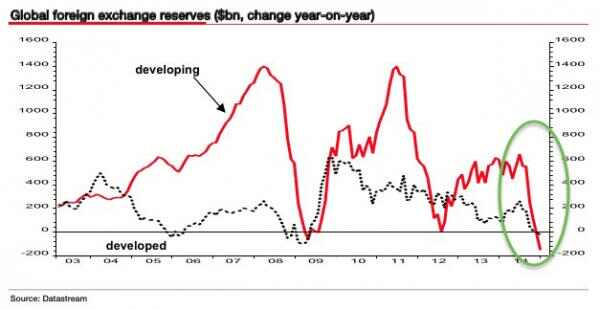

Clearly when the dollar is declining sharply, global FX intervention accelerates as the Chinese central bank, for example, needs to debauch its own currency at the same rate. Conversely, when the dollar rallies strongly, as is the case now, FX intervention rapidly dries up and can even reverse, exerting a massive monetary tightening on emerging economies and ultimately the entire over-inflated global financial complex… The swing in global foreign exchange reserves is one key measure of the global liquidity tap being turned on and off ? with the most direct and immediate effect being felt in emerging economies.

Given the above, we should expect to see global foreign exchange reserves falling…

… with the most pronounced move in EM reserves…

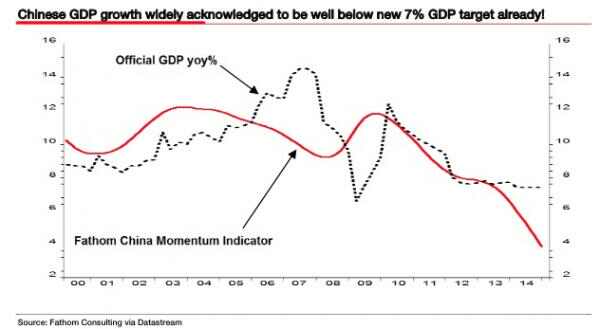

Edwards goes on to note that even as China dials back the market’s expectations for Chinese GDP growth, a look at the variables that Premier Li Keqiang himself has said are a better proxy for economic growth in the country (electricity usage, rail freight volume, and credit growth) suggest GDP growth in China may actually be running below 4%…

The bottom line is that in a world of over-inflated asset values, the strength of the dollar is resulting is a rapid tightening of global liquidity as emerging economies (and indeed the Swiss) stop printing money to buy the US dollar. This should be seen for what it is a clear tightening of global liquidity. Traditionally these periods of dollar strength are highly disruptive to emerging markets and often end in the weakest links blowing up the entire EM and commodity complex and sometimes much else besides! Investors ignore this at their peril.

The craziness continues unabated.

• China Inc Flocks To Euro Debt For Funding (FT)

Chinese companies are ditching the renminbi and flocking to the euro to raise new offshore debt, as the imminent launch of quantitative easing in the single currency bloc sends ripples through global markets. So far this year, mainland-based companies have sold $2.9 billion worth of euro-denominated debt, according to Dealogic, compared with nothing in the first quarter of last year and within striking distance of the $3.3 billion raised during the whole of 2014. Meanwhile, Chinese borrowers have shunned offshore renminbi debt, known better as “dim sum” bonds. The total raised in the market this year is only $250 million, a dramatic drop from the $6.6 billion issued during the first three months of last year. US dollar borrowing has been steadily high, with $16.3 billion of bonds sold this year.

Funding costs for euro debt have been tumbling since the ECB announced plans to start its own program of quantitative easing, which is due to begin on Monday. More than €1.5 trillion of sovereign eurozone bonds now offer investors negative yields, according to JPMorgan estimates. The new focus on euro debt also marks a change in Chinese corporate funding habits, in part a reflection of increasing eurozone assets held by some of Asia’s most acquisitive companies. Euro bonds can be used for deal financing or for currency management. In the past six months, the euro has dropped 13% against the renminbi, which has a managed peg to the US dollar.

Beijing-based State Grid, which owns stakes in grid operators in Portugal and Italy, borrowed €1 billion in January. Another euro bond issuer, Fosun International, already owns financial and healthcare assets in Portugal, duty free shops in Greece, and German fashion brand Tom Tailor. It successfully completed a €939 million deal for French holiday resort group Club Méditerranée last month. “Going out and borrowing in euros is a pretty good way to hedge,” said Jon Pratt, head of debt capital markets in Asia at Barclays, adding that many more Chinese companies were expected to tap the euro market in the coming months. “Investors are starting to follow it as an asset class. It’s reaching a real critical mass.”

Wait till German exposure starts to hit.

• Heta Damage Spreads in Austrian Downgrades, German Losses (Bloomberg)

Austria’s decision to wind down Heta Asset Resolution sent ripples through the financial system, causing credit rating downgrades in Austria and bank losses in Germany. Moody’s cut the rating of Carinthia province, which guarantees €10.2 billion of Heta’s debt, by four levels to Baa3 from A2, and said it may lower the ratings of three state-owned Austrian banks exposed to it. Dexia’s German unit, Deutsche Pfandbriefbank and NRW.Bank said yesterday they own Heta bonds that may suffer losses. “Notwithstanding the intention of the central government to protect taxpayers under the new banking resolution regime, Moody’s sees the steps taken so far as adding higher uncertainty to developments,” the ratings company said late Friday in a statement on the Carinthia downgrade. “Susceptibility to an adverse scenario has increased as a result.”

Austria paved the way for imposing losses on Heta’s bondholders when it ruled out further support for the “bad bank” of Hypo Alpe-Adria-Bank March 1. Using powers set out in European Union and Austrian bank laws covering debt reorganization, the Finanzmarktaufsicht regulator ordered a 15-month debt moratorium while it plans resolution of Heta’s €18 billion of assets. Carinthia’s guarantees, which peaked at €25 billion in 2006, were the main justification for Hypo Alpe’s public rescue in 2009 and the biggest conundrum in its wind-down. With budgeted revenue of €2.36 billion this year, the southern province of 556,000 people would be unable to honor the guarantees if they came due now or in a year’s time, Governor Peter Kaiser told Austrian radio ORF on Tuesday.

The guarantees “could exceed Carinthia’s liquidity resources, lead to increased financial leverage and could require some form of extraordinary central government support,” Moody’s said. Finance Minister Hans Joerg Schelling has said repeatedly that the Austrian government isn’t liable to cover Carinthia’s guarantees. Among Heta’s liabilities affected by the moratorium and a future bail-in are €1.24 billion Heta owes to Pfandbriefbank, which issues bonds on behalf of Austrian provincial banks.

“There is a great deal of ruin in a nation,” said Adam Smith.”

• Europe Is Being Torn Apart – And The Torture Will Be Slow (Guardian)

“If the euro fails, Europe fails”: thus spake Angela Merkel. Unfortunately, the euro is failing, but it is failing slowly. Even if Greece grexits, the eurozone seems unlikely to fall apart in the near future, although there is still a chance that it will. There is a much higher chance that it will grind along like a badly designed Kazakh tractor, producing slower growth, fewer jobs and more human suffering than the same countries would have experienced without monetary union. However, the misery will be unevenly distributed between debtor and creditor countries, struggling south and still prospering north. These different national experiences will be reflected through rational elections, creating more tensions of the kind we have already seen between Germany and Greece. Eventually, something will give, but that process may take a long time.

“There is a great deal of ruin in a nation,” said Adam Smith. Given the extraordinary achievements of the 70 years since 1945, and the memories and hopes still invested in the European project, there is a lot of ruin still left in our continent. I recently participated in an event in Frankfurt attended by representatives of leading European investors. A multiple-choice instant poll was taken, offering a number of scenarios for how the eurozone would look in five years’ time, and asking which we found most probable. Nearly half those present opted, as I did, for “Japan in the 1990s”. Around 20% voted for “what eurozone?”; 18% went for “the UK after Thatcher”, by which they presumably meant a leaner, meaner economy, with the policies of austerity and structural reform producing growth, but also dislocation and inequality.

The catch is that even in this last, “best” case, the inequality would not be within one country, such as Britain, but unevenly distributed between different countries. Germans and a few other north European nations would go on taking most of the gain, others the pain. To say this is to endorse an economic analysis that mainstream German politicians and economists will fiercely dispute. Austerity and structural reform are the one true way to salvation, they insist. As Merkel put it in 2013: “What we have done, everyone else can do.”

There are at least three problems with this. First, as every wise doctor knows, even the theoretically right medicine can be disastrous if administered in too strong a dose to a weakened patient. Second, Greeks, Italians and French are not Germans. Their economies certainly need structural reforms, which have, for example, boosted exports from Spain, but their societies and companies simply do not respond in the same way. Third, even if the whole eurozone becomes one giant German-style Exportweltmeister, who will be the consumer? Some of the demand must come from inside the eurozone, and especially from richer countries such as Germany. If everyone else is to behave more like Germany, then Germany must behave a bit less like Germany. But Germany is not prepared to do that.

Curious notion.

• IMF Could Do More For EU Than ECB’s QE (CNBC)

Have you ever thought of the IMF as a peacemaker? Here is what Christine Lagarde, the IMF’s managing director, was telling the warring Ukrainians last Wednesday (March 4): “… We are trying to help Ukraine with … a set of reforms, massive financial support, but all of that is really going to depend on how it stabilizes … the east … and how the … conflict stops.” She went on to say that the fighting in the eastern part of Ukraine “has been a huge distraction” for the country’s leaders who, in her view, “are really determined to reform the economy.” The message is clear: Stop fighting, strive for peace and we – the IMF and international investors – will help you to rebuild, reform and modernize your economy. And here is the money. Ms. Lagarde announced that over the next four years $40 billion – half of that from the IMF – would be provided to support the Ukrainian economy.

If there is peace, you can think of these $40 billion as seed money. With its vast and fertile land, its skilled labor force and a diversified (if rusty) industrial base this beautiful country could easily attract large private direct investment inflows. The IMF is clearly playing a key role here, because it is hard to see how large-scale fund disbursements to support Ukraine’s meaningful and sustainable economic reforms can be carried out unless the guns fall silent. With no other source of finance readily available, the IMF’s political clout could be decisive in the successful implementation of the latest round of cease-fire and peace agreements negotiated in Minsk, Belarus, on February 12, 2015. Europe would then be extricated from the claws of its old demons of division, exclusion and medieval savagery.

That is what some European leaders are counting on. Their foreign policy chief Federica Mogherini told a meeting of the group’s top diplomats last Friday (March 6) that “… around our continent … cooperation is far better than confrontation.” She was echoing increasingly pressing calls to stop Ukraine’s fighting and restore Europe’s unimpeded flows of commerce and finance. All this puts the IMF in an interesting position. By forcing the warring parties in Ukraine to seek peace as a condition of economic survival, the IMF can also help the recovery of the European economy by removing obstacles to intra-regional trade that are costing hundreds of thousands of jobs.

Arguably, that would be of far greater help than the ECB’s debasement of the euro with an avalanche of new liquidity that no area economy needs with an already record-low interest rate of 0.05%. Even Germany opposed that ill-conceived policy. Never an advocate of a weak currency, Germany does not need a sinking euro to maintain a trade surplus exceeding 7% of its economy.

“Clearly Tsipras has been persuaded that the eurozone and the ECB will not allow Greece to go bankrupt and that things will change politically in Europe come autumn.”

• Tsipras At Crossroads Between Euro And Drachma (Kathimerini)

Prime Minister Alexis Tsipras will soon find himself having to choose between the euro and the drachma. He can’t take the euro road with Panayiotis Lafazanis and certain other SYRIZA officials on his team. Privatizations, looser labor laws, pension cuts and other measures required for a eurozone deal will not be approved by MPs who are of a completely different mindset. Nevertheless, the eurozone “bosses” have decided that rules are rules and that if the preliminary agreement with Tsipras and Finance Minister Yanis Varoufakis is not implemented swiftly the country’s liquidity will remain at zero. Meanwhile, the prime minister believes our partners are trying to bring back the troika and the memorandums through the back door.

Well, they never hid their intentions. While they may have dubbed the troika “institutions” and the memorandum “funding program,” they have never suggested that there would be no evaluation or a new program. Meetings with the troika may be taking place in Brussels and certain Greek government initiatives may be accepted but at the end of the day it comes down to strict supervision and the program. Some think that it is only Berlin insisting on terms. They are mistaken; everyone is behind it, from the governments of southern Europe, to the ECB and the IMF. People who care about our country, such as Commission chief Jean-Claude Juncker, have spent plenty of political capital by supporting Greece but will eventually give up. Besides, we have eroded their trust through leaks, irresponsible comments and an unbelievable lack of professionalism. We are losing friends on a daily basis and won’t admit it.

Clearly Tsipras has been persuaded that the eurozone and the ECB will not allow Greece to go bankrupt and that things will change politically in Europe come autumn. The problem is that autumn is too far away and a Greek default is no longer such a big threat. The IMF thinks it’s manageable, in contrast to 2012 when Christine Lagarde persuaded Angela Merkel of the opposite. Markets also believe it manageable and this is bad in terms of our own negotiating capital. Certain cabinet officials still suggest that a solution could come from China or Russia. Whatever assistance these countries could offer, it would not solve Greece’s funding problem or entail a rift with Europe.

Tsipras must keep his party and ministers under control in order to move on with the negotiation. He will also need to offer a couple of major trade-offs in order to persuade the “bosses” not to cut off the country’s cash flow. I don’t know what these could be but I can safely predict that they will not be an easy sell to his party. Tsipras cannot take the euro road as his party stands today. The danger is if he starts leaning toward a euro exit without actually having decided to do so, simply because time and political capital are running out.

He may feel forced to act if Grexit takes shape. He’s responsible for keeping it all together.

• Juncker Urges EU To Face Up To ‘Serious’ Greek Troubles (AFP)

European Commission head Jean-Claude Juncker called on the European Union to recognize the gravity of the situation in Greece — both for the country’s impoverished citizens and for the wider risks to the eurozone. “We must be sure that the situation does not continue to deteriorate in Greece. What worries me is that not everyone in the European Union has understood how serious the situation in Greece is,” Juncker told German paper Die Welt in an interview published Saturday. He did not specify whom his comments were aimed at, but they appeared two days after the European Central Bank took a tough stance on extending more financial help to Greece. Juncker noted in his comments that a quarter of Greeks are not covered by social security, unemployment is the highest in the eurozone and the country sees regular protests.

Although Greece’s debt problems are far from being resolved, Juncker repeated previous assertions that Athens should not leave the eurozone, noting this would amount to an “irreparable loss of reputation” for the single currency. However, the European Commission president also advised Greece to stick to reforms agreed upon with its creditors. “If the government wants to spend more money, it must compensate with savings or supplemental income,” he added. After July, when Greek bonds held by the European Central Bank come due, there needs to be “reflecting about the ways international creditors must behave toward countries that find themselves in a critical economic situation,” Juncker said. “It is not acceptable that a prime minister must negotiate reforms with civil servants. One is an elected official, the others are not,” he added.

Juncker did not directly mention the meeting of eurozone finance ministers set for Monday in Brussels nor the date of his next meeting with Greek Premier Alexis Tsipras. Tsipras called for the meeting just after a speech Thursday from ECB President Mario Draghi, which stated that all supplemental help to Greece would be conditional on the rapid completion of reforms promised by Athens. The ECB “is still holding the rope which we have around our necks,” said Tsipras, according to excerpts of an interview with German magazine Der Spiegel. The remark came after Athens received no help from the Frankfurt-based institution to address a cash squeeze caused by the non-delivery of promised loans.

“Europe’s image has suffered dramatically and also in terms of foreign policy, we don’t seem to be taken entirely seriously.”

• Jean-Claude Juncker Calls For EU Army (Guardian)

The EU needs its own army to help address the problem that it is not “taken entirely seriously” as an international force, the president of the European commission has said. Jean-Claude Juncker said such a move would help the EU to persuade Russia that it was serious about defending its values in the face of the threat posed by Moscow. However, his proposal was immediately rejected by the British government, which said that there was “no prospect” of the UK agreeing to the creation of an EU army. “You would not create a European army to use it immediately,” Juncker told the Welt am Sonntag newspaper in Germany in an interview published on Sunday. “But a common army among the Europeans would convey to Russia that we are serious about defending the values of the European Union.”

Juncker, who has been a longstanding advocate of an EU army, said getting member states to combine militarily would make spending more efficient and would encourage further European integration. “Such an army would help us design a common foreign and security policy,” the former prime minister of Luxembourg said. “Europe’s image has suffered dramatically and also in terms of foreign policy, we don’t seem to be taken entirely seriously.” Juncker also said he did not want a new force to challenge the role of Nato. In Germany some political figures expressed support for Juncker’s idea, but in Britain the government insisted that the idea was unacceptable. A UK government spokesman said: “Our position is crystal clear that defence is a national – not an EU – responsibility and that there is no prospect of that position changing and no prospect of a European army.”

Would make sense. As I said earlier on, they need a mandate to act.

• Greece Mulls Referendum as No Deal With Lenders in Sight (Bloomberg)

Greece’s anti-austerity coalition is considering calling a referendum on government policy as euro-area finance ministers are set to withhold further aid payments at a meeting in Brussels tomorrow. European Commission Vice President Valdis Dombrovskis said he doesn’t expect the Eurogroup to make any decisions on Greece on Monday. Reform proposals must first be approved by the Greek parliament and then implemented before the next bailout disbursement is made, Dombrovskis said in an interview with Frankfurter Allgemeine Zeitung. Dutch Finance Minister Jeroen Dijsselbloem said Greek reform plans are “far from” complete. No disbursements are seen in March, Dijsselbloem, who also chairs the meetings of the currency bloc’s finance ministers, said at an event organized by de Volkskrant in Amsterdam.

Greece’s anti-austerity coalition has so far been unable to agree with creditors on the terms for the disbursement of an outstanding aid tranche totaling about 7 billion euros ($7.6 billion). The deadlock threatens to lead the country into defaulting on its payments, since Greece’s only sources of financing are emergency loans from the euro area’s crisis fund and the International Monetary Fund. Its banks are being kept afloat by an Emergency Liquidity Assistance lifeline, subject to approval by the European Central Bank. “I can only say that we have money to pay salaries and pensions of public employees,” Greek Finance Minister Yanis Varoufakis told Italy’s Il Corriere della Sera in an interview today. “For the rest we will see.” In separate interviews this weekend, Greece’s finance and defense ministers said that if the country’s creditors raise requests which aren’t acceptable to the government, then the people of Greece may have to decide on how to break the deadlock.

Prime Minister Alexis Tsipras also signaled the referendum option is being considered. “If we were to hold a referendum tomorrow with the question, ‘do you want your dignity or a continuation of this unworthy policy,’ then everyone would choose dignity regardless of difficulties that would accompany that decision,” Tsipras told Der Spiegel Magazine, in an interview published Saturday. Greece may call new elections or hold a referendum if European finance ministers reject the government’s reform proposals, Varoufakis told Corriere della Sera. A referendum would only be held if negotiations with creditors fail, spokesman Gabriel Sakellaridis said by telephone. The government believes a solution will be found in negotiations with creditors, though it doesn’t expect an aid tranche disbursement decision from tomorrow’s meeting, Sakellaridis said. Any referendum is unlikely, and if held, it would approve or reject government policy, not consider Greece’s euro membership, he added.

“If [lenders] question the will of the Greek people and of the government, one possible response would be to carry out a referendum..”

• Greece Threatens New Elections If Eurozone Rejects Planned Reforms (Guardian)

Greece’s anti-austerity government has raised the spectre of further political strife in the crisis-plagued country by saying it will consider calling a referendum, or fresh elections, if its eurozone partners reject proposed reforms from Athens. Racheting up the pressure ahead of a crucial meeting of his eurozone counterparts on Monday, the Greek finance minister, Yanis Varoufakis, said the leftist-led government would hold a plebiscite on fiscal policy if faced with deadlock. “We are not attached to our posts. If needed, if we encounter implacability, we will resort to the Greek people either through elections or a referendum,” he told Italy’s Il Corriere della Sera in an interview on Sunday. Varoufakis was the second high-ranking official in as many days to suggest the possibility of a referendum being held.

On Saturday, Panos Kammenos, who heads the government’s junior partner in office, the small, rightwing Independent Greeks party, said such a ballot could be a “possible response” to protracted disagreement with creditor bodies propping up Greece’s debt-stricken economy. “If [lenders] question the will of the Greek people and of the government, one possible response would be to carry out a referendum,” Kammenos, who is also defence minister, told the financial weekly Agora. Reforms have been set as a condition for unlocking a €7.2bn (£5.2bn) tranche of aid that Athens has yet to draw down from its €240bn bailout programme agreed with the EU, ECB and IMF. With Greece shut out of capital markets, the disbursement is vital to meeting debt obligations.

A letter outlining prospective government reforms – including the novel idea of clamping down on tax evasion by enlisting the support of tourists and housewives – was dispatched to the Euro group chairman Jeroen Dijsselbloem on Friday. But with the proposals reportedly receiving a lukewarm response, the Greek finance ministry spent the weekend feverishly fine-tuning the policies. One EU official in Brussels was quoted as saying that the leaked letter “bore no relation” to the deal recently reached between Athens and its creditors enabling the country to extend its current bailout programme until June. Another described the proposals as “amateurish”. Faced with the prospect of a new credit crunch, the prime minister, Alexis Tsipras, also worked the phones at the weekend, speaking with French President François Hollande and the ECB president Mario Draghi.

Insolvent Greece has reached this point before. But patience is also running out with Athens. The elevation to office of Tsipras’ anti-establishment Syriza party has strained relations with partners – not least Germany, which has provided the bulk of Athens’s bailout finds – more than ever before.

Lovely choice of words/

• Eurozone: Greek Reform Outline Helpful, But Needs ‘Troika’ Scrutiny (Reuters)

The reform outline sent by Greece to eurozone ministers to unblock loans is “helpful,” but needs to be scrutinized by representatives of the country’s creditors, according to the head of the Eurogroup of eurozone finance ministers. Jeroen Dijsselbloem, whose group meets on Monday to discuss Greece, was responding to a letter he received on Friday from the new left-wing government in Athens asking for an immediate resumption of talks with creditors. It also described seven reforms it wants to launch to achieve goals agreed to by the previous government. Once steps to reach these goals are taken, Greece would become eligible for more credit from the euro zone and the International Monetary Fund, and its banks could again finance themselves at ECB open market operations. But time is pressing because Greece will run out of cash later this month.

“This document will be helpful in the process of specifying the first list of reform measures,” Dijsselbloem said in a written reply to the Greek letter ahead of Monday’s meeting. Greece’s main creditors are eurozone governments and the IMF. They are represented in talks with Athens by three institutions dubbed the troika – the European Commission, the ECB and the IMF. “The proposals described in your letter will thus need to be further discussed with the institutions,” Dijsselbloem wrote in the letter, obtained by Reuters. “Let me also clarify that in the course of the current review the institutions will have to take a broad view covering all policy areas,” Dijsselbloem wrote. His remarks refer to plans of the new Greek government to replace some of the budget consolidation measures agreed to by the previous government with different reforms. Eurozone officials say such substitution is fine only if the end result in budgetary terms will be the same.

Never will be.

• UK Treasury ‘Not Ready For Next Financial Crisis’ (Guardian)

The Treasury is not doing enough to prepare for the possibility of another financial crash, a cross-party committee of MPs said on Monday. The Commons public administration committee said that it was surprised financial and economic risks were not included in the government’s national risk register and that, although some planning has taken place, it has not been thorough enough. “The Treasury has done a lot, but there is more to be done to be ready for another financial crisis,” said Bernard Jenkin, the Conservative MP and chair of the committee, which set out its comments in a general report on how Whitehall addresses future challenges. “We still have institutions which are ‘too big to fail’ but with so much national borrowing capacity used up, they may prove ‘too big to save’ if it happens again.

We did not find evidence that government and the City are actively practising and exercising for this worst case scenario.” The committee said that financial risks should be included in the government’s national risk register, and that the Treasury should plan for financial crises that could be triggered by non-financial events. It also said there was “no comprehensive understanding across government as a whole of the future risks and challenges facing the UK”. But a Treasury spokesman flatly rejected the committee’s analysis, saying the report “takes no account of the relevant facts”. He went on: “By focusing on Whitehall procedures they have entirely missed the point: the lessons of the financial crisis have been learned and acted upon by putting in place a reformed regulatory system, ring-fencing the banks, ending the ‘too big to fail’ problem, and dealing with the risks posed to the economy by an unsustainable deficit.

“.. the rabbit falling out comatose in front of all the children seated in the front rows.”

• An Inflection Point For Keynesian Parlor Tricks (Mark St. Cyr)

Suddenly everywhere you look, one after another, a story is making its way into the main stream press (albeit a trickle but that’s a tidal wave in comparison) that we may be, in fact; experiencing a “bubble” in stock prices. All I can say is the line made famous by Jim Nabors as Gomer Pyle, “Well surprise – surrrr-prise!” But there’s a whole lot more going on here and it too is bubbling up more and more for all to see. The once magic trick performed by the Federal Reserve via QE is turning from a one time grand spectacle of illusion used to levitate the markets; and is quickly being laid bare and exposed for its street corner value of tricks. That fact is becoming unavoidable. Even those who still believe in unicorns and rainbows (cue CNBC™) are finding it harder and harder to hold onto the magic.

Anyone with just a smidgen of common sense knows what’s being presented as “a miracle of economic intervention” has been nothing more than a grand escapade only made possible through the use of monetary smoke and mirrors. Everyone now knows how the tricks are being done. And those who continue espousing that this market is based on “fundamentals” as well as “fairly priced” (cue the media’s next in-rotation “everything is awesome” fund manager) are being hard pressed to control the snickering if not out right fits of laughter by others as they continue trying to make their case. e.g., “This past earnings season was a bona-fide beat!” In reality we all know its only been possible through the use of extraordinary record stock buy backs made possible by a ZIRP, along with such an adulteration of GAAP via Non-GAAP: it’s a wonder why they even need calculators any more.

These numbers (in my opinion) have more in common with illusion and magical thinking than anything based in reality – so why even bother. Be honest, just go for it, and declare, “We’re making all this shit up!” because: it just isn’t fooling anyone anymore. Now the real issue from here for both the Fed. as well as Keynesians everywhere will be in trying to maintain some form, as in: “illusion of control” going forward. Surely there’s more magical thinking and sleight of hand needed now more than ever to keep up this grand deceptive appearance or “wealth effect” we were all told we’d be experiencing by now. After all, unemployment just hit 5.5% and the markets are at record levels. “Where’s the pony?” Who needs an economy based on fundamental monetary principles when you can report economic numbers like this?

Unless you’re one of the over 92 million souls unable to find work. The Keynesian answer to this? You just apply today’s version of Keynesian economic math and principles to any statistic that gets in the way of the illusion. Then “poof” just like magic, another irritating issue to the “everything is awesome” narrative is gone. No cape required for that one. Yet the Fed board of magic seemed to have an issue with the illusion of “control” as it faltered a bit on Friday. Having more in common with an assistant dropping the magician’s hat: and the rabbit falling out comatose in front of all the children seated in the front rows.

Crazy world. Making a profit from buying back your own shares.

• Goldman Sachs Stress Test Results Could Endanger Big Profit Source (NY Times)

Concerns have emerged that Goldman Sachs — long the leader on Wall Street — may lose an important engine of profitability. On the Federal Reserve stress tests last week, Goldman performed poorly compared with other big banks. Now analysts and investors are worried that the bank could be barred by regulators from buying back its own stock or increasing dividends. Goldman has used dividends and share buybacks to appeal to investors at a time when other elements of the bank’s business have faced challenges. When companies buy shares of their own stock on the open market, it generally increases the amount of profits attributed to every share, an important metric for investors.

Several analysts have released research questioning whether the Federal Reserve would allow Goldman to continue its buyback programs given the results of the stress tests. Brian Kleinhanzl, an analyst with Keefe, Bruyette & Woods, estimated that if Goldman is unable to repurchase shares, it could earn 42 cents a share less than expected this year, and $1.78 a share less than expected next year. “There is an expectation that they could be at risk,” said Steve Chubak, a bank analyst with Nomura. Shares of Goldman fell 1.7% on Friday, the day after the stress tests, while the broader bank sector was up.

The bank’s predicament highlights how the Fed’s stress test, which has become a powerful tool for Wall Street regulators, can trip up even a bank like Goldman, which came out of the financial crisis looking stronger than many rivals. The stress tests are intended to ensure that banks have an adequate cushion to sustain losses if another financial crisis hits. The Fed does not allow banks to give money back to shareholders if it would leave the banks with less of a cushion than they would need in a severe crisis. The Fed will not publicly give its final verdict on Goldman’s buyback plans until Wednesday. Its decision is likely to hinge on how it analyzes the results of the stress test, and it may have determined that Goldman is strong enough to use profits to buy back shares.

The WaPo just can’t believe it… How can they not love us? It must be that conspiracy propaganda…..

• Russia’s Anti-US Sentiment Now Is Even Worse Than It Was In Soviet Union (WaPo)

Thought the Soviet Union was anti-American? Try today’s Russia. After a year in which furious rhetoric has been pumped across Russian airwaves, anger toward the United States is at its worst since opinion polls began tracking it. From ordinary street vendors all the way up to the Kremlin, a wave of anti-U.S. bile has swept the country, surpassing any time since the Stalin era, observers say. The indignation peaked after the assassination of Kremlin critic Boris Nemtsov, as conspiracy theories started to swirl – just a few hours after he was killed – that his death was a CIA plot to discredit Russia. (On Sunday, Russia charged two men from Chechnya, and detained three others, in connection with Nemtsov’s killing.) There are drives to exchange Western-branded clothing for Russia’s red, blue and white. Efforts to replace Coke with Russian-made soft drinks. Fury over U.S. sanctions.

And a passionate, conspiracy-laden fascination with the methods that Washington is supposedly using to foment unrest in Ukraine and Russia. The anger is a challenge for U.S. policymakers seeking to reach out to a shrinking pool of friendly faces in Russia. And it is a marker of the limits of their ability to influence Russian decision-making after a year of sanctions. More than 80% of Russians now hold negative views of the United States, according to the independent Levada Center, a number that has more than doubled over the past year and that is by far the highest negative rating since the center started tracking those views in 1988. Nemtsov’s assassination, the highest-profile political killing during Vladiimir Putin’s 15 years in power, was yet another brutal strike against pro-Western forces in Russia. Nemtsov had long modeled himself on Western politicians and amassed a long list of enemies who resented him for it.

The anti-Western anger stands to grow even stronger if President Obama decides to send lethal weaponry to the Ukrainian military, as he has been considering. The aim would be to raise the cost of any Russian intervention by making the Ukrainian response more lethal. But even some of Putin s toughest critics say they cannot support that proposal, since the cost is the lives of their nation’s soldiers. “The United States is experimenting geopolitically, using people like guinea pigs,” said Sergey Mikheev, director of the Kremlin-allied Center for Current Politics, on a popular talk show on the state-run First Channel last year. His accusations, drawn out by a host who said it was important to “know the enemy,” were typical of the rhetoric that fills Russian airwaves. “They treat us all in the same way, threatening not only world stability but the existence of every human being on the planet,” Mikheev said.

A 2nd chapter from her book.

• How Everything Will Change Under Climate Change (Naomi Klein)

The alarm bells of the climate crisis have been ringing in our ears for years and are getting louder all the time – yet humanity has failed to change course. What is wrong with us? Many answers to that question have been offered, ranging from the extreme difficulty of getting all the governments in the world to agree on anything, to an absence of real technological solutions, to something deep in our human nature that keeps us from acting in the face of seemingly remote threats, to – more recently – the claim that we have blown it anyway and there is no point in even trying to do much more than enjoy the scenery on the way down. Some of these explanations are valid, but all are ultimately inadequate. Take the claim that it’s just too hard for so many countries to agree on a course of action. It is hard.

But many times in the past, the United Nations has helped governments to come together to tackle tough cross-border challenges, from ozone depletion to nuclear proliferation. The deals produced weren’t perfect, but they represented real progress. Moreover, during the same years that our governments failed to enact a tough and binding legal architecture requiring emission reductions, supposedly because cooperation was too complex, they managed to create the World Trade Organisation – an intricate global system that regulates the flow of goods and services around the planet, under which the rules are clear and violations are harshly penalised. The assertion that we have been held back by a lack of technological solutions is no more compelling.

Power from renewable sources like wind and water predates the use of fossil fuels and is becoming cheaper, more efficient, and easier to store every year. The past two decades have seen an explosion of ingenious zero-waste design, as well as green urban planning. Not only do we have the technical tools to get off fossil fuels, we also have no end of small pockets where these low carbon lifestyles have been tested with tremendous success. And yet the kind of large-scale transition that would give us a collective chance of averting catastrophe eludes us.

Is it just human nature that holds us back then? In fact we humans have shown ourselves willing to collectively sacrifice in the face of threats many times, most famously in the embrace of rationing, victory gardens, and victory bonds during world wars one and two. Indeed to support fuel conservation during world war two, pleasure driving was virtually eliminated in the UK, and between 1938 and 1944, use of public transit went up by 87% in the US and by 95% in Canada. Twenty million US households – representing three fifths of the population – were growing victory gardens in 1943, and their yields accounted for 42% of the fresh vegetables consumed that year. Interestingly, all of these activities together dramatically reduce carbon emissions.

Sounds awesome.

• Upcoming Supermoon Eclipse Will Dazzle Britain, Hit Europe’s Power Grids (RT)

This spring should reward plenty of star-gazers, especially in Britain, which will experience its deepest solar eclipse in 15 years, as well as a Supermoon, all at the same time – an event that will sink the island into twilight for two whole hours. The Supermoon eclipse, as the phenomenon is known, is an astronomical alignment where the Moon is sent on a trajectory between the Sun and the Earth, depriving us of light. The event will occur on March 20 at around 8:40GMT. Scotland will have it best though, with a whopping 98% of the sky darkened, compared to about 85% for the south of England. For best results the Scottish need to look up starting 9:36 am. Other areas in Britain will only get around 30%. Similar events took place in 2006, 2008 and 2011, but neither of them can touch the upcoming Supermoon eclipse, except an event that occurred in 1999.

[..] Britain will remain relatively unscathed, compared to its European neighbors, where up to 10% of energy is generated sustainably, meaning they depend more on the sun. According to the UK’s energy body, only 1.5% of power there is generated by solar panels. And since people will be going out in droves to watch the spectacle, energy consumption should drop almost at the same time the shortages will strike, it says. The European Network Transmission System Operators for Electricity says, according to the Independent, “with the increase of installed photovoltaic energy generation, the risk of an incident could be serious without appropriate countermeasures.” “Within 30 minutes the solar power production would decrease from 17.5 gigawatts to 6.2GW and then increase again up to 24.6GW. This means that within 30 minutes the system will have to adapt to a load change of -10GW to +15GW,” said Patrick Graichen, executive director of the Berlin-based think-tank on renewable energy Agora Energiewende, as cited by the FT.