Edward Hopper House tops 1921

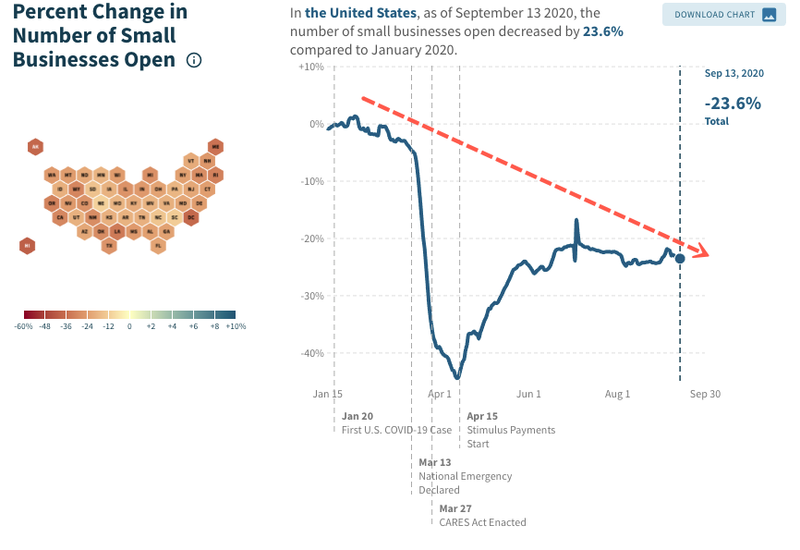

A bipartisan effort. Meanwhile, none of this ever made it:

“Back in March, Republican Sen. Tom Cotton proposed giving low- and middle-income Americans between $1,000 and $4,000 of aid per month. More recently, Republican Sen. Josh Hawley joined with Sen. Bernie Sanders to push for $1,200 checks. Meanwhile, President Donald Trump reportedly told allies he wanted at least $1,200 and up to $2,000..”

• $600 Is Not Enough, And It Won’t Get Easier (Sirota)

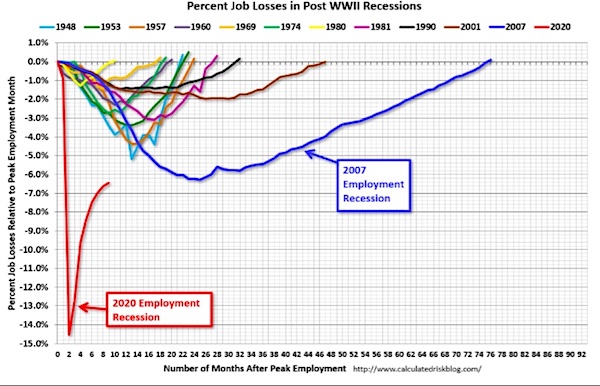

Congressional leaders announced an agreement on a new $900 billion stimulus bill that will deliver a boost in unemployment benefits and provide $600 checks to some families. Democratic leaders are depicting this as a big win and are promising that these kinds of emergency spending bills will become “much easier” in a new Congress under Joe Biden. Both of those arguments are ridiculous. Here’s the truth: Democrats had a rare opportunity to win on a wildly popular proposal for much bigger survival checks, but they chose to lose. Here’s some more truth: one-time means-tested checks of $600 is not a big victory, and not even the bare minimum that should be considered acceptable during an economic meltdown that has been punctuated by mass starvation and intensifying poverty.

Though the legislative language of the final package has not yet been released, it appears the meager checks come in a bill that will give new tax benefits to corporate executives to write off their meals and provide other tax breaks to businesses that used the Paycheck Protection Program — which will be a windfall for the wealthy. Will the bill change the law to similarly exempt emergency unemployment benefits from tax levies? We don’t yet know, but there’s no indication it will. According to a bill summary circulating on Capitol Hill, the legislation provides a mere $286 billion for the survival checks and unemployment benefits, and an additional $51 billion for food aid and rental assistance. That’s not nothing, but it’s obviously inadequate. For comparison, only three years ago, Republicans passed a $1.5 trillion tax cut that enriched the wealthiest one percent of households.

Much of the blame for this debacle certainly goes to Republican Sen. Mitch McConnell, who seems absolutely determined to starve the country. But much of it also goes to Democratic leaders who had one of the easiest political opportunities to forge a bipartisan coalition or a much bigger lifeline to Americans — and then decided to squander it. Let’s remember: Back in March, Republican Sen. Tom Cotton proposed giving low- and middle-income Americans between $1,000 and $4,000 of aid per month. More recently, Republican Sen. Josh Hawley joined with Sen. Bernie Sanders to push for $1,200 checks. Meanwhile, President Donald Trump reportedly told allies he wanted at least $1,200 and up to $2,000 — and he made a general demand for more money public in a Fox News interview last week.

“Right now, I want to see checks – for more money than they’re talking about – going to people,” he said. “I’m pushing it very hard, and to be honest with you, if the Democrats really wanted to do the deal, they’d do the deal.” He tweeted on Sunday that Congress should give people “more money in direct payments.” You can try to argue that the words of a handful of maverick Republicans and Trump cannot be fully trusted — maybe that’s true, but it’s moot. The point here is that there was a huge opportunity for Democrats to triangulate a group of Republican senators and a Republican president against McConnell — and Democrats refused to do it.

Instead, House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer followed Sen. Joe Manchin, Mark Warner and other Democratic corporatists into budget negotiations that kept producing smaller and smaller stimulus proposals, and now they are trying to portray a meager $600 one-time payment as some sort of enormous victory.

When you read about overwhelmed health care systems in US, UK, etc, don’t forget this part.

• Hospital CEOs Have Gotten Rich Cutting Staff And Supplies (IC)

In 2006, Montefiore Medical Center in the Bronx had healthier patients, just enough nursing staff to take care of them, and a CEO who was earning $2 million a year, a senior nurse and union leader told The Intercept. Fifteen years later, its patients are sicker than ever before, its staffing levels are inadequate, and, as of 2018, its new CEO is earning $13 million per year. The nonprofit hospital, like hundreds of others across the nation, has been cutting costs, progressively going leaner on staffing and supplies over the years. This accelerated approach has meant that the pandemic has hit the hospital, especially health care workers, doubly hard. The nurse, Karine Raymond, has provided care at the facility for 27 years. In the second wave of Covid-19, as in the first, she and her colleagues are taking care of double the patients that they typically do.

“It’s untenable and unmanageable and left us feeling very concerned that perhaps we might have done better if circumstances were different,” said Raymond. “[Our CEO] makes $13 million. How many nurses would his salary pay for? I do have a problem with seeing the suffering of the community I’m supposed to serve while others are collecting funds that have been provided by state and federal governments just because they can.” Nurses were overworked before, but since March, many nurses have left the industry entirely, retiring early or seeking other work. While personal protective equipment supplies are more abundant now than in the spring, nurses are more burnt out than ever — just as hospitals are getting ready for another wave of Covid-19 patients.

The executives who typically make the decisions at the United States’s hospitals, whether for-profit or ostensibly nonprofit, are uniquely unprepared for the coming deluge, experts say. A decadeslong failure to recruit and retain health care workers like nurses, technicians, and nurse’s aides has made U.S. hospitals less able to manage the scope of a pandemic, and makes it much more likely that hospitals will break down, as they did in the spring in Wuhan, Italy, and New York City.

“Even before the pandemic hit us so hard hospitals were using a policy called ‘Lean,’ which is just-in-time staffing and supplies,” said Linda Aiken, a professor of nursing at the University of Pennsylvania who has long studied the relationship between nurse staffing and patient care. The concept of lean hospitals was developed by management consultant Mark Graban in 2009, but business practices imported from manufacturing based on lean staffing began to be introduced in health care starting in the early ’90s. “All of our research shows those policies were a failure well before Covid and now they are a disaster during this national emergency,” said Aiken.

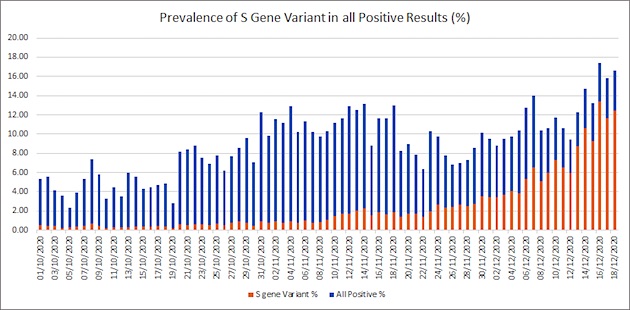

“..there was no evidence to date that this variant alters disease severity, either in terms of mortality or the seriousness of the cases of COVID-19 for those infected.”

• Coronavirus New Variant (Conv.)

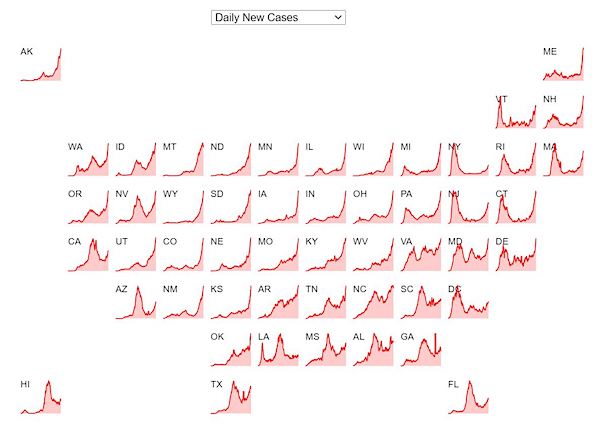

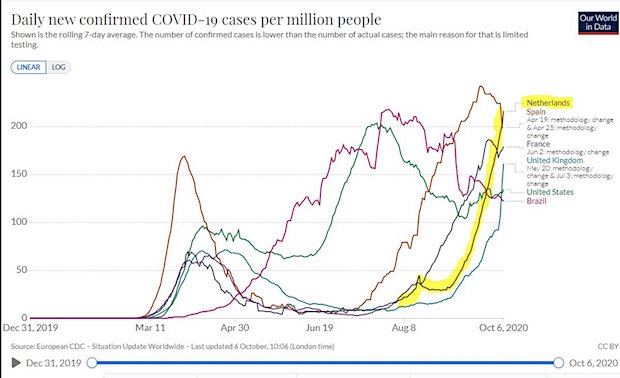

The new UK variant, known as VUI–202012/01 or lineage B.1.1.7, was first identified in the county of Kent on September 20. Matt Hancock, the health secretary, first announced the existence of the variant on December 14; it was subsequently confirmed by Public Health England and the UK’s COVID-19 sequencing consortium. The variant carries 14 defining mutations including seven in the spike protein, the protein that mediates entry of the virus into human cells. This is a relatively large number of changes compared to the many variants we have in circulation globally. To date, genetic profiles – or genomes – of this variant have been largely sequenced and shared from the UK but include some in Denmark and two cases in Australia.

There have also been reports of a case in the Netherlands. These countries all have very large genome sequencing efforts and it is very possible that these observations do not reflect the true distribution of this variant of the virus, which could exist undetected elsewhere. We will know more as more genomes are generated and shared. Thanks to the efforts of data sharing, genomic surveillance and COVID-19 test results in the UK, it seems that this variant is now starting to dominate over existing versions of the virus and that it may be responsible for an increasing proportion of cases in parts of the country, particular in regions where we also have rapidly expanding case numbers.

It is always very difficult to disentangle cause and effect in these cases. For example increases in the appearance of certain mutations can be due to viral lineages carrying them rising in frequency just because they happen to be the ones present in an area where transmission is high, for example due to human activities or choice of interventions. Though this is still a possibility, there are clearly enough concerning observations so far for this variant to warrant very careful characterisation, surveillance and interventions to curb transmission. Chris Whitty, the chief medical officer, stated clearly that there was no evidence to date that this variant alters disease severity, either in terms of mortality or the seriousness of the cases of COVID-19 for those infected. Work is underway to confirm this.

Where did the variant come from? Right now, we don’t know. To date, scientists have not identified any closely related viruses to support the theory that the variant had been introduced from abroad. The patterns of mutations observed are more supportive of an extended period of adaptive evolution most likely in the UK based on current data. Similar patterns of mutation to these have been observed in the evolution of SARS-CoV-2 in chronically infected patients with weaker immune systems. The current hypothesis is that such a scenario of chronic infection, in a single patient, may have played a role in the origin of this variant. This will continue to be investigated.

Anaphylaxis

THREAD (please see the entire thread)

URGENT MESSAGE ABOUT CV-19 V*CC*NE

**********************************************Dr. Vernon Coleman reads shocking data about anaphylaxis following m-RNA CV-19 V*cc*ne receipt

PLEASE SHARE WIDELY

************************* pic.twitter.com/xxP8Kw3k63— Ian Lyne (@lyne_ian) December 20, 2020

10 days before Brexit. Perfect timing.

• Covid Chaos Disrupts Kent Ports As France Bans UK Freight (G.)

Miles of lorry queues and travel chaos were expected across Kent on Monday morning after France announced a 48-hour ban on passengers and freight entering from the UK. The prime minister, Boris Johnson, is to chair a Cobra meeting on Monday that will address “the steady flow of freight into and out of the UK”, a number 10 spokesperson said, amid expected significant disruption at ports in the south-east. The European Union is to hold a similar crisis meeting today to coordinate its response to concerns about a fast-spreading new strain of Covid-19 after countries across the continent banned UK flight arrivals.

The UK transport secretary, Grant Shapps, warned of “significant disruption” following the snap travel ban that came into force on Sunday night. As a result of the announcement from Paris, Kent police implemented Operation Stack, where lorries will queue between junctions eight and 11 of the M20, southbound, to avoid gridlock on the county’s roads. A No 10 spokesman said: “The prime minister will chair a Cobra meeting tomorrow to discuss the situation regarding international travel, in particular the steady flow of freight into and out of the UK.”

The Department for Transport (DfT) said Manston Airport in Kent was being prepared to accommodate up to 4,000 lorries as another measure to ease the congestion. However due to the expected level of disruption, DfT also advised hauliers to avoid travel to Kent ports until further notice. “Following the French government’s announcement it will not accept any passengers arriving from the UK for the next 48hrs, we’re asking the public & particularly hauliers not to travel to Kent ports or other routes to France,” Shapps tweeted. “My department is urgently working with Highways England and Kent Council on contingency measures to minimise traffic disruption in the area.”

Just as you thought the world couldn’t get any smaller.

• Saudi Arabia Shuts Down Int’l Air, See & Land Travel Over New Covid Strain

Riyadh has sealed its borders for all passenger travel for at least a week, suspending international flights as well as entry to sea and land ports over a mutant Covid-19 variant that was first discovered in the UK. With a growing number of European countries locking out travel from the UK, Saudi Arabia has pulled all the stops in its effort to curb the spread of the new strain of the coronavirus, imposing a sweeping ban on all commercial travel, Saudi Press Agency reported on Sunday, citing an ”official source” with the country’s Interior Ministry.

The ban will see all international flights, save for “exceptional cases,” be suspended for a period of one week, that may be extended for yet another week. Land and sea ports will be closed for international arrivals as well. The measures were taken in “precaution” and until the nature of the strain, which is said to be highly contagious, “becomes clear,” the agency reported. A rapidly growing list of countries that have banned travel from the UK, citing concerns about the new virus, after British PM Boris Johnson announced strict Tier-4 lockdowns for parts of the country, including London, the Southeast and, Peterborough in the east of the UK.

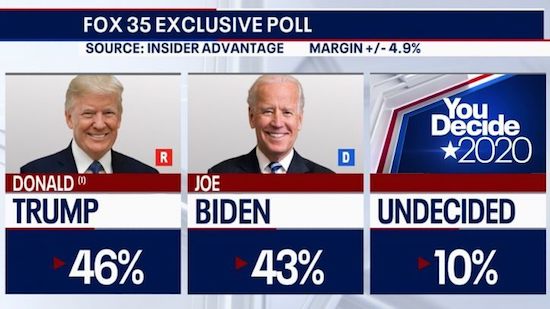

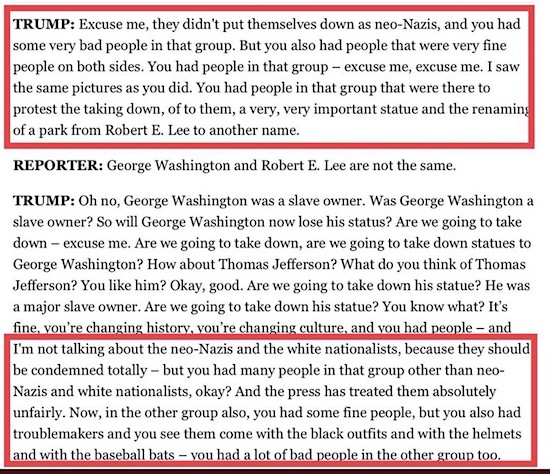

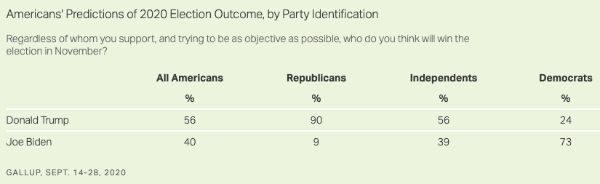

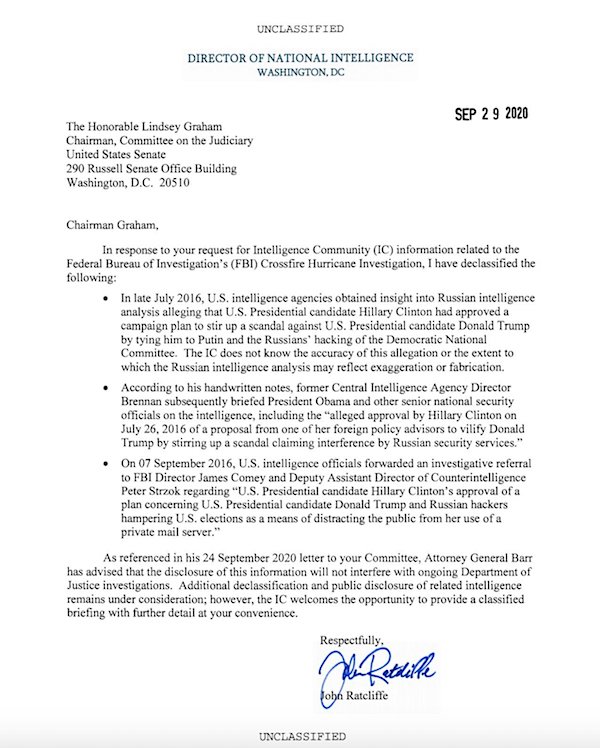

A bipartisan effort that happens every four years.

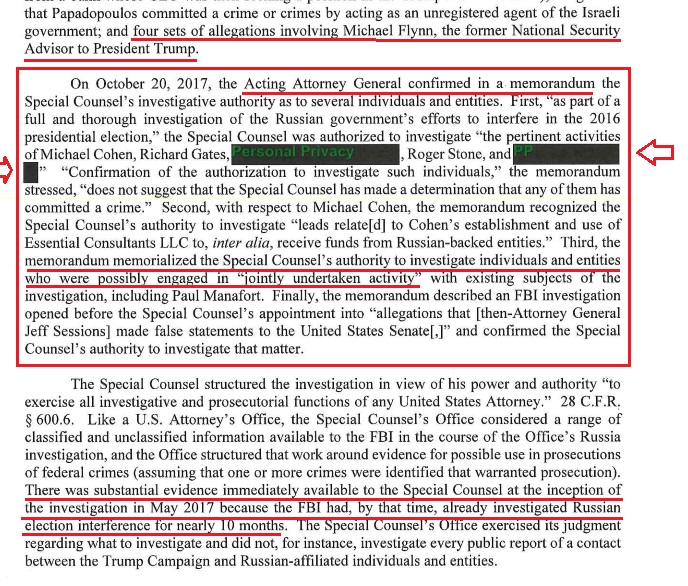

• US Deep State Preempts Reset in Relations With Russia (SCF)

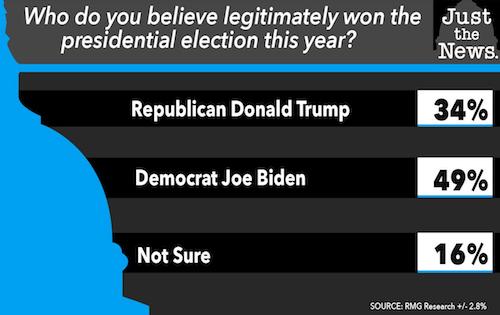

The flurry of U.S. media claims this week about alleged Russian cyber-attacks on government departments came just as Joe Biden was officially declared President-elect. As usual, there is no evidence to back up the sensational claims, but the objective seems to be to ensure that the incoming Biden administration maintains, or adopts a more, hostile policy towards Russia. The timing of all this is hardly coincidence. On Monday this week, the Electoral College in the United States cast its votes to confirm Biden’s election to the White House. The Democrat contender had already won the popular vote by a decisive margin against incumbent Republican President Donald Trump. Almost six weeks of controversy since the November 3 election day – due to Trump’s tenuous claims of voter fraud – were laid to rest this week when the Electoral College confirmed Biden as president-elect.

He is due to be inaugurated as the 46th occupant of the White House on January 20. Out of respect for the American electoral process being consummated, Russian President Vladimir Putin had waited until this week to make any comment. However, after the Electoral College executed its duties, Putin promptly telegrammed congratulations to Biden on his victory. The Russian leader expressed the hope that Russia and the United States would begin to normalize relations for the sake of global security. Ominously, the auspicious occasion was immediately marred by a U.S. media frenzy alleging a massive cyber-assault on the heart of American government and industries. Russia was predictably blamed as the offender.

The Kremlin dismissed the claims as yet another anti-Russia fabrication. For the past four years, the U.S. media have regularly peddled sensational claims of Russian malfeasance, from alleged interference in elections, to alleged assassination programs against U.S. troops in Afghanistan, among many other such tall stories. Never has any verifiable evidence been presented to back up these lurid allegations. The cyber domain is a particular favorite for such anti-Russia claims, most likely because these stories are handily told without any real evidence. All that is required is for anonymous cyber security agents to be quoted. The abstract and arcane cyber world also lends itself to mystery for most people. In short, it is amenable to false claims because of its elusive technical nature.

Now, it is feasible that some kind of malign cyber event did indeed happen in the U.S. government departments, agencies, infrastructure and private sector as reported this week. Though, what is very much in doubt is the question of who actually carried it out. The U.S. media and anonymous officials are fingering Russia. But where is the proof of Russia’s culpability? The FBI and Department of Homeland Security briefed members of Congress about the cyber-attacks. Senators emerged from the briefings fulminating against Russia. The second-highest ranking Democrat in the Senate, Dick Durbin, told media that “it was virtually a declaration of war by Russia on the United States”.= What is going on here is a classic case of “gas-lighting” whereby people are being manipulated to believe in something utterly false; for an ulterior agenda.

No question and no evidence.

• ‘No Question’ Russia Behind Latest Hacking Scare – Adam Schiff (RT)

Rep. Adam Schiff (D-Calif.) has joined Secretary of State Mike Pompeo in blaming Russia for a recent massive cyber attack. He also slammed President Donald Trump for the inconvenient suggestion China could have been the culprit. “Based on what I’ve seen, I don’t think there’s any question that it was Russia,” Schiff, who is the Chairman of the House Intelligence Committee, told MSNBC on Sunday, commenting on the hack. The hacking operation in question targeted the SolarWinds Orion Platform, a network monitoring tool used by US government agencies and numerous corporations. There has been no evidence presented that Russia was behind the hack, but Pompeo alleged otherwise in a recent interview.

The president broke with his secretary of state on Saturday and called out “fake news media” for their anonymous reports pinning the hack on Russia. He also suggested China may have been behind the hack, tying it to his ongoing allegations of voter fraud in key swing states during November’s election. Schiff, one of the president’s most vocal critics in the House and a supporter of evidence-free claims Russia colluded to influence the 2016 presidential election, called Trump’s tweets “uniformly destructive and deceitful and injurious” to the country’s “national security.” In a previous tweet, Schiff called the president’s China accusation “another scandalous betrayal of our national security.”

[..] When Trump assumed his post in January 2017, the stage had already been set for the worsening of relations with Moscow, which included dozens of Russian diplomats getting expelled by the Obama administration over the allegations of meddling in US affairs and over “hacking” of the election. As Trump’s term progressed, overshadowed by the failed ‘Russiagate’ investigation, initial hopes of a detente with Moscow have all but faded.

Rinse and repeat.

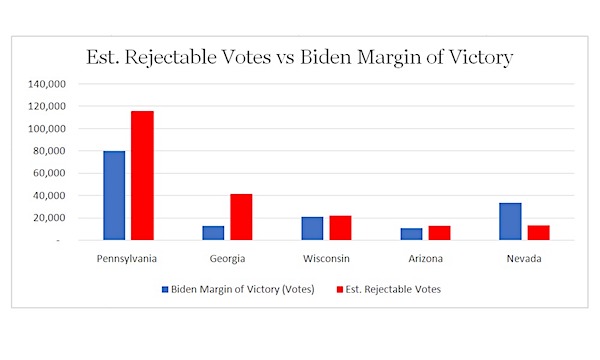

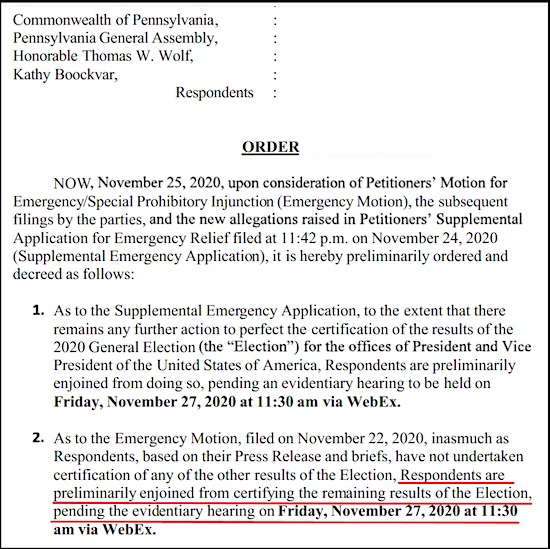

• Trump Campaign Take Election Battle To SCOTUS Over Pennsylvania Rulings (RT)

President Donald Trump’s legal team filed an appeal to the US Supreme Court on Sunday, requesting multiple rulings out of Pennsylvania be overturned in their latest attempt to overturn election results over alleged voter fraud. Trump attorney Rudy Giuliani announced the last ditch effort in a public statement, claiming a trio of Pennsylvania Supreme Court cases “illegally changed Pennsylvania’s mail balloting law immediately before and after the 2020 presidential election.” The appeal follows numerous legal battles in key swing states like Pennsylvania and Georgia. Trump and his team have alleged massive voter fraud in these and other states led to Joe Biden’s victory, which was certified by the Electoral College earlier this month.

Pennsylvania’s changing of the law, Giuliani claims, was “in violation of Article II of the U.S. Constitution.” These decisions “eviscerated the Pennsylvania’s Legislature’s protection against mail ballot fraud,” the release continues. The actual rulings include “prohibiting election officials” from checking signatures on mail-in ballots “during canvassing on Election Day” and “eliminating the right of campaign’s to challenge mail ballots during canvassing for forged signatures and other irregularities.” The legal team also claims the “right of campaigns to observe the canvassing of mail ballots” only meant observers were allowed to be “in the room,” but could not properly verify information because they were too far away.

“Statutory requirements that voters properly sign, address, and date mail ballots” were also not enforced thanks to the state’s Supreme Court, they contend. Trump’s legal team is seeking for electors committed to Joe Biden be “vacated” and the Pennsylvania General Assembly be allowed to select replacements. With Congress set to meet on January 6 to certify the votes of the Electoral College, the campaign is seeking an “expedited” process and a response from the Supreme Court within days.

Let’s see the goodies.

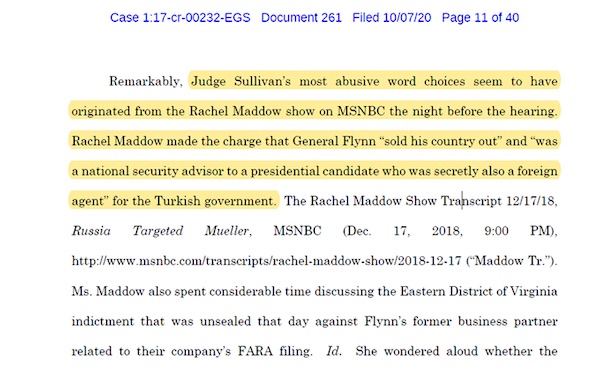

• Flynn: Foreign Intelligence Agencies Were Monitoring US Election (ET)

Former national security adviser Michael Flynn said he was provided information that foreign intelligence agencies were monitoring the U.S. election on Nov. 3 and are willing to provide evidence to President Donald Trump. “We have evidence now of foreign countries … were watching the attacks on our election system, our election process, on the 3rd of November,” Flynn told Fox Business on Friday. “So we now have that evidence and we received that today,” he said. He didn’t elaborate on what foreign intelligence agencies were involved, how he obtained that information, or the nature of the alleged attacks on the election system.

But the foreign governments “are willing to provide that directly to the president,” Flynn remarked. “There are foreign partners and allies that are willing to help us,” he said. [..] Flynn had been making reference to the SolarWinds cyberattack that impacted a considerable portion of federal government agencies. It is not clear if Flynn’s previous remarks about foreign countries monitoring the Nov. 3 election was linked to the SolarWinds hack. “I would say is SolarWinds is an entry point into the rest of our entire U.S. critical infrastructure,” Flynn added. “So everything that touches the United States government, if you enter through this SolarWinds attack that we perceive you basically have keys to the vault.”

Earlier in the week, the Department of Homeland Security’s (DHS) cybersecurity agency warned that the hack presents a risk to the Federal Government and state, local, tribal, and territorial governments as well as critical infrastructure entities” as well as the private sector.” These hackers compromised agencies, critical infrastructure programs, and private sector organizations starting in March 2020 or possibly before that, according to the agency. “You’re able to rummage around and do [expletive] near anything. So it’s a very, very serious attack … We’ve known about it for about six months as I understand it,” Flynn, a retired Army lieutenant general, added to Fox’s Lou Dobbs. “So when we talk about our election security, Lou, I think this is all part of it because there’s a relationship between these SolarWinds attacks which has basically penetrated our entire infrastructure as well as our election securities.”

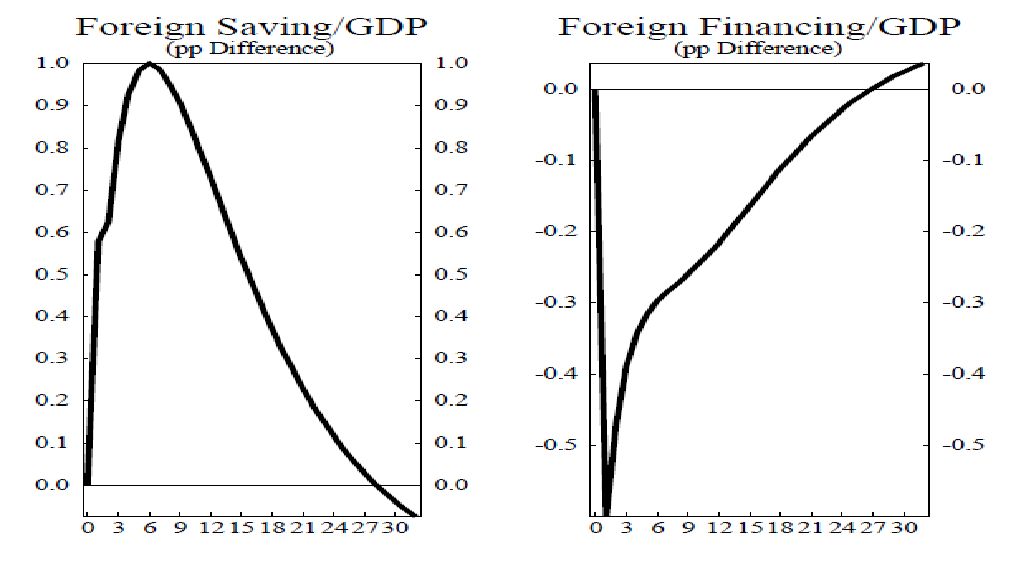

Growth?

• Japan Record $1 Trillion Budget Highlights COVID Challenge To Growth, Debt (R.)

Japan’s cabinet approved on Monday a record $1.03 trillion budget draft for the next fiscal year starting in April 2021, the Ministry of Finance said, as the coronavirus and stimulus spending puts pressure on already dire public finances. The 106.6 trillion yen ($1.03 trillion) annual budget also got a boost from record military and welfare outlays. It marked a 4% rise from this year’s initial level, rising for nine years in a row, with new debt making up more than a third of revenue. From Europe to America, policymakers globally have unleashed a torrent of monetary and fiscal stimulus to prevent a deep and prolonged recession as the pandemic shut international borders and sent many out of work.

In Japan, fiscal reform has been shelved as Prime Minister Yoshihide Suga prioritized efforts to contain the pandemic and boost growth, despite public debt at more than twice the size of Japan’s $5 trillion economy. “How to balance the coronavirus response with fiscal reform has hardly been debated in Japan,” said Izuru Kato, chief economist at Totan Research. “Ultralow interest rates under the Bank of Japan’s prolonged monetary easing may have caused fiscal discipline to be paralyzed.” The spending plan, which was in line with a Reuters report out last week, must be approved by parliament early next year.

It will be rolled out along with a third extra budget for this fiscal year as a combined 15-month budget aimed for seamless spending to ease the virus pain and back Suga’s goal of achieving carbon neutrality and digital transformation. “We had to strike a right balance between the needs to prevent the spread of infections, revive the economy and achieve fiscal reform,” Finance Minister Taro Aso told reporters after a cabinet meeting. “That was the most difficult task in compiling this budget.”

I guess there are still people who read the New York Times. Why?

• For NY Times, No News Is Fit To Print About Rep. Swalwell And A Spy (Hill)

If you’re a New York Times subscriber who also watches the broadcast network evening news and considers that your news diet, there’s a very good chance you haven’t heard about Rep. Eric Swalwell (D-Calif.) and his ties to an accused Chinese spy a few years ago. To review why this is absolutely worthy of coverage, Swalwell’s interaction with the alleged spy known as Fang Fang included, according to Axios, Fang placing an intern in Swalwell’s office and helping to fundraise for his 2014 reelection campaign. In 2015, the FBI provided Swalwell a “defensive briefing” to warn him of the threat she appeared to pose. So, the first obvious question is this: Given how easily Swalwell was duped, why did House Speaker Nancy Pelosi (D-Calif.) shortly thereafter place him on the House Intelligence Committee, which oversees the CIA and therefore has access to the highest level of sensitive, classified information?

The New York Times doesn’t seem to care about getting an answer to that question. Of the biases we see in major media, the sin of omission is one that seems to occur only when the protagonist of a major story has a (D) next to his or her name. So, when the New York Times, which has a whopping 7 million subscribers and is considered the country’s most influential publication, doesn’t see the Swalwell story as a story at all, it tells you just as much about its moral compass as it does its editorial decisions. Swalwell isn’t just a random lawmaker. He’s arguably the most ubiquitous D.C. figure on cable news – and particularly CNN and MSNBC – this side of Rep. Adam Schiff (D-Calif.) in conducting hundreds of interviews over the past four years, primarily to charge without evidence that President Trump is an agent of Russia.

The 40-year-old also somehow sits on the House Intelligence Committee, meaning he has access to the nation’s top classified information. The Swalwell/Chinese spy story was broken 10 days ago by Axios, which isn’t exactly a bastion of right-wing sentiment. No matter: Swalwell decided to allege that Axios had colluded with Trump in terms of how the story came to light. “I’ve been a critic of the president. I’ve spoken out against him. I was on both committees that worked to impeach him. The timing feels like that should be looked at,” Swalwell claimed on Dec. 9. Yep — Eric Swalwell, who ran for president for about five minutes in 2019, is such a threat to an outgoing president that a decision was made to work with Axios (which worked on the story for more than a year) to run with a Trump leak.

This is the same lawmaker who told MSNBC that Trump “is working on behalf of the Russians” and used his position on the Intel Committee to imply that he had evidence to back up such information. That evidence has yet to be presented, because it doesn’t exist. So, an obvious question is whether Swalwell should remain on the Intelligence Committee given the Chinese connection and the reckless statements about a sitting president working with a hostile nation. More than a dozen GOP House members are urging Speaker Pelosi to oust Swalwell from the committee; Pelosi has responded by saying she doesn’t have “any concerns” about the congressman.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.