Ben Shahn Quick lunch stand in Plain City, Ohio Aug 1938

Oil producer Russia hikes rates to 10.5% as the ruble continues to plunge, while fellow producer Norway does the opposite, and cuts its rates, but also sees its currency plummet. As Greek stocks lose another 7.35% after Tuesday’s 13% loss on rumors about what the left leaning Syriza party will or will not do if it wins upcoming elections, and virtually anonymous Dubai drops 7.42%. We all know the story of the chain and its weakest link, and beware, these really still ARE global markets.

Meanwhile someone somewhere saved WTO oil from falling through the big, BIG, $60 limit for most of the day Thursday, and then it went south anyway. And that brings to mind the warnings about what would, make that will, happen to high yield energy junk bonds. Of which there’s a lot out there, but not much is being added anymore, that market has been largely shut to companies, especially in the shale patch. So how are they going to finance their fracking wagers? Hard to see.

And something tells me this Bloomberg piece is still lowballing the debt issue, though I commend them for making the link between shale and Fed ‘stimulus’ policies, something all too rare in what passes for press in the US these days.

Fed Bubble Bursts in $550 Billion of Energy Debt

The danger of stimulus-induced bubbles is starting to play out in the market for energy-company debt. Since early 2010, energy producers have raised $550 billion of new bonds and loans as the Federal Reserve held borrowing costs near zero, according to Deutsche Bank. With oil prices plunging, investors are questioning the ability of some issuers to meet their debt obligations. Research firm CreditSights predicts the default rate for energy junk bonds will double to 8% next year. “Anything that becomes a mania – it ends badly,” said Tim Gramatovich, chief investment officer of Peritus Asset Management. “And this is a mania.”

I think it’s obvious that the default rate could be much higher than 8%.

The Fed’s decision to keep benchmark interest rates at record lows for six years has encouraged investors to funnel cash into speculative-grade securities to generate returns, raising concern that risks were being overlooked. A report from Moody’s this week found that investor protections in corporate debt are at an all-time low, while average yields on junk bonds were recently lower than what investment-grade companies were paying before the credit crisis. Borrowing costs for energy companies have skyrocketed in the past six months as West Texas Intermediate crude, the U.S. benchmark, has dropped 44% to $60.46 a barrel since reaching this year’s peak of $107.26 in June.

Yields on junk-rated energy bonds climbed to a more-than-five-year high of 9.5% this week from 5.7% in June, according to Bank of America Merrill Lynch index data. At least three energy-related borrowers, including C&J Energy Services, postponed financings this month as sentiment soured. “It’s been super cheap” for energy companies to obtain financing over the past five years, said Brian Gibbons, a senior analyst for oil and gas at CreditSights in New York. Now, companies with ratings of B or below are “virtually shut out of the market” and will have to “rely on a combination of asset sales” and their credit lines, he said.

When you’re as addicted to debt as the shale industry has been – and still would be if they could still get their fix -, then seeing prices for your products drop over 40% and the yields on your bonds just about double (just for starters), then you have not a problem, but a disaster. And one that’s going to reverberate through all asset markets. It’s already by no means just oil that’s plunging, – industrial – commodities (iron ore, nickel, copper etc.) as a whole are way down from just a few months ago. I read a nice expression somewhere: “the economy is topped with a copper roof”, which supposedly means to say that where copper goes, the economy will follow.

But this is by no means all of the news, it’s not even the worst. To get back to oil, there are some very revealing numbers in the following from CNBC, which call out to us that we haven’t seen nothing yet.

Oil Pressure Could Sock It To Stocks

With crude sliding through the key $60 level, oil pressure could stay on stocks Friday. West Texas Intermediate futures for January closed at $59.95 per barrel, the first sub-$60 settle since July 2009. The $60 level, however, opens the door to the much bigger, $50-per-barrel level. Besides oil, traders will be watching the producer price index Friday morning, and it’s expected to be off 0.1% with the fall in energy. Consumer sentiment is also expected at 10 a.m. EST.

Consumers stepped up and spent in November, as evidenced in the 0.7% gain in that month’s retail sales Thursday. That better mood should show up in consumer sentiment. Stocks on Thursday gave up sizeable gains after oil reversed course and fell through $60.

“Oil has pretty much spooked people,” said Daniel Greenhaus, chief global strategist at BTIG. “There just isn’t a bid. With everything in energy and the oil price collapsing as it is, who is going to step in and be a buyer now? The answer is nobody.” Oil continued to slide in after-hours trading. “The selling appears to have accelerated a little bit after the close with really no bullish news in sight,” said Andrew Lipow, president of Lipow Associates. WTI futures temporarily fell below $59 in late trading.

“The big level is going to be $50 now in terms of psychological support. Much as $100 is on the upside,” said John Kilduff of Again Capital. Oil stands a good chance of getting there too. Tom Kloza, founder and analyst at Oil Price Information Service, said the market could bottom for the winter in about 30 days, but then it will be up to whatever OPEC does.

That was just the intro. Now, wait for it, check this out:

“It’s (oil) actually much weaker than the futures markets indicate. This is true for crude oil, and it’s true for gasoline. There’s a little bit of a desperation in the crude market,” said Kloza.”The Canadian crude, if you go into the oil sands, is in the $30s, and you talk about Western Canadian Select heavy crude upgrade that comes out of Canada, it’s at $41/$42 a barrel.”

“Bakken is probably about $54.” Kloza said there’s some talk that Venezuelan heavy crude is seeing prices $20 to $22 less than Brent, the international benchmark. Brent futures were at $63.20 per barrel late Thursday.

“In the actual physical market, it’s fallen by even more than the futures market. That’s a telling sign, and it’s telling me that this isn’t over yet. This isn’t the bottoming process. The physical market turns before the futures,” he said.

I see very little reason to doubt that what’s happening is that the media are way behind the curve in their reporting of what’s really going on. WTI and Brent are standards, and standards are one thing, but what oil actually sells for is quite another matter. Many companies – and many oil-producing countries too – must sell at whatever price they can get just to survive. And there is no stronger force in the world to drive prices down.

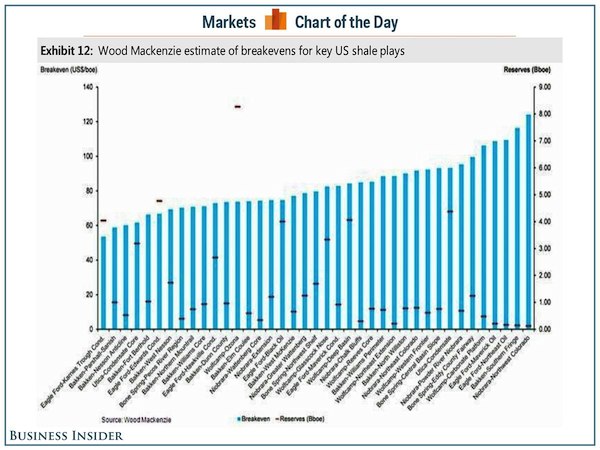

That is today’s reality. And while there are many different estimates around about breakeven prices for US shale plays, if we go with the ones from WoodMacKenzie, we get at least some idea of how bad the industry is hurting with prices below $60 (click to enlarge):

If prices fall any further (and what’s going to stop them?), it would seem that most of the entire shale edifice must of necessity crumble to the ground. And that will cause an absolute earthquake in the financial world, because someone supplied the loans the whole thing leans on. An enormous amount of investors have been chasing high yield, including many institutional investors, and they’re about to get burned something bad.

What it amounts to is that the falling oil price will chase a lot of zombie money out of the markets, the stuff created through a combination of QE-related ultra low interest rates and money printing, plus the demise of accounting standards that allowed companies to abandon mark-to-market practices. This has led to the record stock market valuation that we see today, and that could vanish in the wink of an eye once even just one asset, one commodity, starts being marked to market in defiance of the distortion official policies have imposed upon the global marketplace.

We might well be looking at the development of a story much bigger than just oil. I said earlier this week that it would be hard to find a way to bail out the US oil industry, but that’s merely one aspect here. Because if oil keeps going the way it has lately, the Fed may instead have to think about bailing out the big Wall Street banks once again.

Home › Forums › Will Oil Kill The Zombies?