Jack Delano Street scene on a rainy day in Norwich, Connecticut 1940

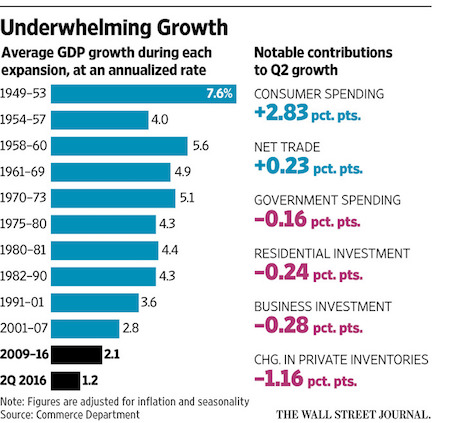

Only positive is consumer spending. But without knowing how much of that is borrowed (let alone manipulated), it’s a meaningless number.

• US GDP Grew a Disappointing 1.2% in Q2 As Q1 Revised Down to 0.8% (WSJ)

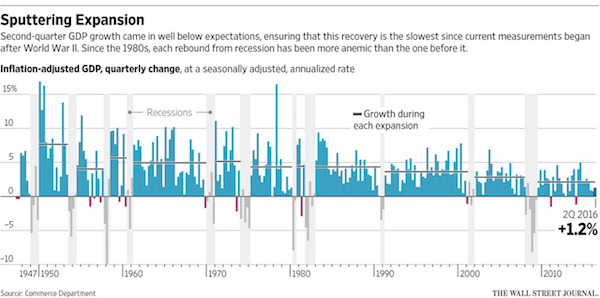

Declining business investment is hobbling an already sluggish U.S. expansion, raising concerns about the economy’s durability as the presidential campaign heads into its final stretch. GDP, the broadest measure of goods and services produced across the U.S., grew at a seasonally and inflation adjusted annual rate of just 1.2% in the second quarter, the Commerce Department said Friday, well below the pace economists expected. Economic growth is now tracking at a 1% rate in 2016—the weakest start to a year since 2011—when combined with a downwardly revised reading for the first quarter. That makes for an annual average rate of 2.1% growth since the end of the recession, the weakest pace of any expansion since at least 1949.

The output figures are in some ways discordant with other gauges of the economy. The unemployment rate stands at 4.9% after a streak of strong job gains, wages have begun to pick up, and home sales hit a post-recession high last month. Consumer spending also remains strong. Personal consumption, which accounts for more than two-thirds of economic output, expanded at a 4.2% rate in the second quarter, the best gain since late 2014. On the downside, the third straight quarter of reduced business investment, a large paring back of inventories and declining government spending cut into those gains. “Consumer spending growth was the sole element of good news” in the latest GDP figures, said Gregory Daco at Oxford Economics. “Weakness in business investment is an important and lingering growth constraint.”

“This is a market operation that will reinforce the capital position of the bank and free it completely of bad loans…” If it’s that easy, do it all over the place, I’d think. Who do they think they’re fooling?

• Rescue Package In Place For Europe’s Oldest Bank, Weakest In Stress Tests (G.)

A rescue package of the world’s oldest bank has been announced after a health check of the biggest banks across the EU showed that Banca Monte dei Paschi di Siena’s financial position would be wiped out if the global economy and financial markets came under strain. The much-anticipated result of the stress tests – for which there was no pass or fail mark – of 51 banks showed that Italy’s third largest bank emerged weakest from the assessment. But the test – which exposed banks to headwinds in the global economy and dramatic movements in currency markets – also underlined the drop in the capital position of bailed-out Royal Bank of Scotland and the hit taken by Barclays observed under the imaginary scenarios. Banks from Italy, Ireland, Spain and Austria fared worst.

Regulators said that the tests showed that the bank sector was much stronger than it had been at the time of the 2008 financial crisis, which led to the introduction of the stress tests. Even so, the European Banking Authority (EBA), which conducted the tests on lenders, acknowledged that more needed to done.Under the latest stress test scenario, some €269bn (£227bn) would be wiped off the capital bases of the banks. “The EBA’s 2016 stress test shows the benefits of capital strengthening done so far are reflected in the resilience of the EU banking sector to a severe shock,” said Andrea Enria, EBA chair. “This stress test is a vital tool to assist supervisors in accelerating the process of repair of banks’ balance sheets, which is so important for restoring lending to households and businesses.

“The EBA’s stress test is not a pass [or] fail exercise. While we recognise the extensive capital raising done so far, this is not a clean bill of health. There remains work to do which supervisors will undertake.” The bank that fared the worst was MPS, which suffered a dramatic 14 percentage point fall in its capital position. It had been expected to perform badly and talks had already been underway before the results of the stress tests were published to try to find a way to bolster its capital. New EU regulations prevented the Italian government from pumping any taxpayer money into MPS so efforts were needed to try to stop of tens of thousands of ordinary Italians – who had bought its bonds – losing their savings. Italy’s banks are in the spotlight as they are weighed down by €360bn of bad debts.

Italy’s finance minister, Pier Carlo Padoan – who as recently as Sunday said there was no crisis in Italy – endorsed the deal put together to raise €5bn from private investors and sell €9.2bn of bad debts. “The government is greatly satisfied with the operation [the deal] launched … by Monte dei Paschi of Siena,” he said. “This is a market operation that will reinforce the capital position of the bank and free it completely of bad loans. The operation will allow the bank to develop a solid industrial plan, thanks to which it will boost its support for the real economy through lending to families and businesses.”

Unintended consequences. Hilarious, really.

• ECB Bond Buying Risks Blocking Debt Restructurings (R.)

The European Central Bank could scupper future eurozone debt restructurings if it increases the amount of a country’s bonds it can buy under its economic stimulus program, a top debt lawyer warned. The problem, on the radar of European authorities suffering a hangover from the 2012 crisis, has been pushed to the fore by expectations the ECB will need to raise limits on its bond purchases to keep its quantitative easing scheme on track.

Kai Schaffelhuber, a partner at law firm Allen & Overy, said that if the ECB permitted itself to buy more than a third of a country’s debt it would make a restructuring of privately-held bonds more difficult, a move that could increase the likelihood of taxpayer rescues. In a debt restructuring, a quorum of investors has to agree the terms of a deal. The ECB cannot participate because it is forbidden from directly financing governments. “They (the ECB) should avoid a situation where they are holding so much (of a) debt that a restructuring becomes virtually impossible,” said Schaffelhuber, whose firm worked on Greece’s 2012 debt restructuring.

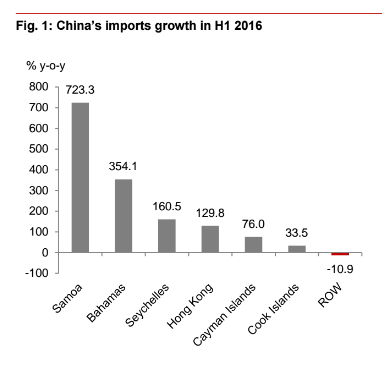

Samoa….

• Chinese Capital Outflows May Still Be Happening – But In Disguise (BBG)

When there’s a will to get money out of China, there’s a way: overpay. Authorities in the world’s second-largest economy have been able to pursue a policy of managed depreciation for the Chinese yuan without spooking markets and eliciting expectations of major foreign-exchange volatility, the way the one-off devaluation did last August. One big reason is that Beijing seems to have had success in cracking down on the flood of money leaving the country, which had been prompting sizable drawdowns in the central bank’s foreign currency reserves, to prop up the value of the yuan. But a report from a Nomura team led by Chief China Economist Yang Zhao says these capital outflows have merely taken another form: the over-invoicing of imports from select locales.

And this time, it’s not just a Hong Kong story. “A detailed breakdown by region shows imports from some tax haven islands or offshore financial centres surged” in the first half of the year, he writes, “against the backdrop of a large decline in overall imports.” Now, it may be the China’s appetite for copra and coconut oil, two key Samoan exports, has indeed surged. But Zhao has a different explanation. “This suggests to us that capital outflows may have been disguised as imports in China’s trade with these tax-haven or offshore financial centres, though the precise volumes are unknown,” according to the economist. “With stronger capital controls in place we believe continued capital outflows via the current account are likely.”

Exposing the uselessness of the whole idea.

• Bank of Japan’s Quest for 2% Inflation (BBG)

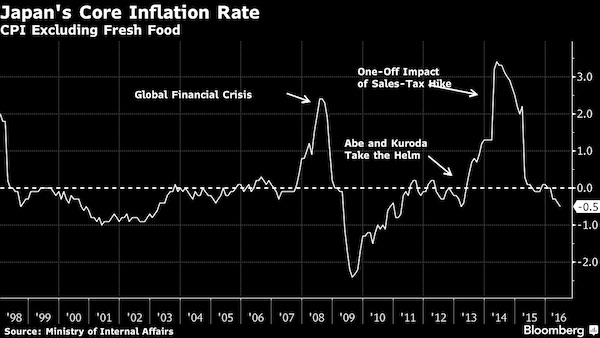

The U.S. Federal Reserve, the Bank of England and the ECB are among the world’s monetary authorities that have set an inflation target right around 2%. Nowhere, though, does the quest for this special number carry drama like it does in Japan, where Bank of Japan Governor Haruhiko Kuroda has vowed to do whatever it takes to stimulate prices. On Friday in Tokyo, the BOJ indicated there were risks to achieving this target anytime soon.

1. What’s so special about 2%? The BOJ set its current inflation target in January 2013, less than a month after Prime Minister Shinzo Abe came to power with a plan to pull the economy out of two decades of stagnation. In Japan and many other developed economies, prices rising by 2% a year is seen as optimal for encouraging companies to invest and consumers to spend. It’s also thought to be low enough to avoid sparking the runaway inflation that crippled Germany’s Weimar Republic in the 1920s and Zimbabwe in more recent times.

2. How close has Japan gotten to 2% inflation? Not very. What Japan has had, on-and-off since the late 1990s, is deflation – inflation below 0% – with prices dropping across a wide range of goods.

3. What caused deflation? It began with the bursting of a real estate and asset-price bubble. Wounded banks curbed lending, companies focused on cutting debt, wages stagnated and consumers reined in spending. Households became accustomed to falling prices and put off purchases. The global financial crisis of 2008, and the devastating earthquake, tsunami and nuclear meltdown at the Fukushima Daiichi plant in 2011, entrenched what Kuroda describes as a “deflationary mindset” among consumers and companies in Japan. The nation’s aging and shrinking population is now making matters worse.

I think they passed that crossroads long ago. Just didn’t recognize it for what it was.

• The Bank of Japan Is At A Crossroads (BBG)

After more than three years of pumping out wave after wave of cheap money that’s failed to secure its inflation target, the Bank of Japan has signaled a rethink. Instead of buying yet more government bonds, cutting interest rates or pushing further into uncharted territory, the BOJ disappointed some Friday when its policy meeting concluded with only a modest adjustment. Governor Haruhiko Kuroda, 71, and his colleagues declared it was time to assess the impact of their policies, which have variously spurred strong criticism from bankers, bond dealers and some lawmakers and former BOJ executives. The next gathering, on Sept. 20-21, offers a chance to either provide greater evidence that the current framework should continue, head further into uncharted territory, or scale back.

Regardless of the decision, this isn’t where one of the world’s most aggressive central bankers wanted to be in his fourth year in office. In early 2013, he expressed confidence the BOJ had the power to ensure its 2% inflation target could be reached within about two years. This year, with the shock adoption of a negative interest rate policy backfiring through a welter of warnings from commercial banks, there’s a growing perception monetary policy is losing effectiveness. “We are at a turning point” for the BOJ, because “it can no longer assume that stepping harder on the gas pedal would make this car go faster,” said Stephen Jen, co-founder of hedge fund SLJ Macro Partners and a former IMF economist. “Arrow 2 will take the lead now,” he said, in a reference to the three arrows of Abenomics – monetary, fiscal and structural-reform policies.

Yeah, that’ll result in some jail time….

• US Authorities Subpoena Goldman In 1MDB Probe (R.)

U.S. authorities have issued subpoenas to Goldman Sachs for documents related to the bank’s dealings with scandal-hit Malaysian state fund 1MDB, the Wall Street Journal reported late on Friday. Goldman received the subpoenas earlier this year from the U.S. Department of Justice and the Securities and Exchange Commission , the Journal reported, citing a person familiar with the matter. The authorities also want to interview current and former Goldman employees in connection with the inquiries, but none of those meetings had occurred by Friday, WSJ said.

1MDB, which was founded by Malaysian Prime Minister Najib Razak in 2009 shortly after he came to office, is being investigated for money-laundering in at least six countries including the United States, Singapore and Switzerland. Najib has consistently denied any wrongdoing. U.S. law enforcement officials are attempting to identify whether Goldman violated federal law after failing to flag a transaction in Malaysia, the Journal reported in June. New York state regulators have also asked the Wall Street bank for details about probes into billions of dollars it raised in a bond offering for 1MDB, Reuters reported in June, citing a person familiar with the matter.

Note – Steve says: “I’ve said “as early as” 2017 and “between 20% & 70% fall” but all people hear is 2017 & 70%..”

• Australia Headed For Recession As Early As Next Year – Steve Keen (ABC.au)

Australia’s credit binge will lead to a bust as soon as next year, with house prices to fall between 40 and 70% and unemployment to rise sharply, Professor Steve Keen says. The professor famously lost a bet when he predicted a catastrophic crash in Australian house prices following the GFC and had to walk from Canberra to Mount Kosciusko as a result. But he says, this time, he is right and does not have his hiking boots at the ready. “We have borrowed ourselves so much to the hilt that we are now dependent on that continuing to rise over time and it simply won’t,” he told the ABC’s The Business.

Many believe the Reserve Bank has been a steady guiding hand to the Australian economy in the years since the GFC, but Professor Keen believes it has guided the economy “straight toward the shoals” by encouraging households to borrow with low rates which has led to asset bubbles. “They don’t know what they’re doing,” he said. “Our debt level according to the Bank of International Settlements, private debt level, has gone from 150% of GDP to 210% of GDP.” He argued that means a large part of the growth that Australia has enjoyed since the GFC, while many other countries plunged into recession, has been fuelled by a 60% rise in household debt. “Ireland did the same thing when they called themselves the Celtic Tiger and they don’t call themselves that anymore,” he said.

“Spain was doing the same thing during its housing bubble and we’ve replicated the same mistakes. He believes the Reserve Bank will be forced to take rates down to zero from their current level of 1.75% as the economy continues to slow, but that will not stop the collapse of the credit binge that has kept the country afloat until now. “[Lower rates] will suck more people in, it will suck more people in for a while and the [Reserve Bank] can delay this for a while by cutting the rates,” he said. He said the catalysts for the recession were the declining terms of trade, the continued fall in investment into the economy and the Federal Government’s “stupid” pursuit of a budget surplus. “The Government is frankly stupid about the economy and is obsessed about running surpluses when it is bad economics.”

“The stock markets should be down massively but investors seem to have been hypnotized that nothing can go wrong.”

• ‘Sell The House, Sell The Car, Sell The Kids’ – Gundlach (R.)

Jeffrey Gundlach, the chief executive of DoubleLine Capital, said on Friday that many asset classes look frothy and his firm continues to hold gold, a traditional safe-haven, along with gold miner stocks. Noting the recent run-up in the benchmark Standard & Poor’s 500 index while economic growth remains weak and corporate earnings are stagnant, Gundlach said stock investors have entered a “world of uber complacency.” The S&P 500 on Friday touched an all-time high of 2,177.09, while the government reported that U.S. GDP in the second quarter grew at a meager 1.2% rate. “The artist Christopher Wool has a word painting, ‘Sell the house, sell the car, sell the kids.’ That’s exactly how I feel – sell everything. Nothing here looks good,” Gundlach said in a telephone interview.

“The stock markets should be down massively but investors seem to have been hypnotized that nothing can go wrong.” Gundlach, who oversees more than $100 billion at Los Angeles-based DoubleLine, said the firm went “maximum negative” on Treasuries on July 6 when the yield on the benchmark 10-year Treasury note hit 1.32%. “We never short in our mainline strategies. We also never go to zero Treasuries. We went to lower weightings and change the duration,” Gundlach said. Currently, the yield on the 10-year Treasury note is 1.45%, which has translated into some profits so far for DoubleLine. “The yield on the 10-year yield may reverse and go lower again but I am not interested. You don’t make any money. The risk-reward is horrific,” Gundlach said. “There is no upside” in Treasury prices.

The perks of trade agreements.

• British Columbia Violates NAFTA With Its Foreign Property Tax (FP)

The British Columbia government has suddenly introduced a penalty tax forcing non-Canadian purchasers of residential real estate in the Greater Vancouver Regional District to pay a 15% tax on all purchases registered from Aug. 2, 2016. This penalty tax discriminates by definition against foreign investors buying residential real estate in the Greater Vancouver Area: Canadian citizens buying residential real estate are exempt; foreign buyers must pay the tax. That discrimination is a glaring violation of our trade treaties. The North American Free Trade Agreement (NAFTA) and other Canadian trade agreements prohibit governments from imposing discriminatory policies that punish foreigners while exempting locals.

NAFTA’s national treatment obligation requires that citizens from other NAFTA partners investing in B.C. receive the same treatment from the government as the very best treatment received by Canadian investors. Americans and Mexicans forced to pay the 15% penalty tax would be able to pursue direct compensation for B.C.’s discriminatory tax from an independent international tribunal. [..] While the vast majority of Vancouver’s foreign property buyers might be Chinese, who were apparently the provincial government’s main target, enough investors from our dozens of treaty partners, comprising of hundreds of affected foreigners with trade rights, could be caught up in this tax, leading to mass claims. Those claims would be against the Canadian government, the signatory to NAFTA and the other international trade treaties, not B.C. Canadian taxpayers could be on the hook for hundreds of millions, or even billions, of dollars.

Big kahuna remains: the classified mails on Hillay’s server(s).

• Another “Smoking Gun” Looms As Hillary Campaign Admits Server Hacked (ZH)

In the third cyberattack on Democratic Party-related servers, Reuters reports that the computer network used by Democratic presidential candidate Hillary Clinton’s campaign was hacked. This follows hacks of the DNC and the DCCC (the party’s fund-raising committee) in the past week. Who to blame this time? Well with US intelligence head Jim Clapper having exclaimed that he was “somewhat taken aback by the hyperventilation [blaming Russia]” by Democratic surrogates, we suspect another scapegoat will need to be found. The latest attack, which was disclosed to Reuters on Friday, follows reports of two other hacks on the Democratic National Committee and the party’s fundraising committee for candidates for the U.S. House of Representatives.

“The U.S. Department of Justice national security division is investigating whether cyber hacking attacks on Democratic political organizations threatened U.S. security, sources familiar with the matter said on Friday. The involvement of the Justice Department’s national security division is a sign that the Obama administration has concluded that the hacking was state sponsored, individuals with knowledge of the investigation said. The Clinton campaign, based in Brooklyn, had no immediate comment and referred Reuters to a comment from earlier this week by campaign senior policy adviser Jake Sullivan criticizing Republican presidential candidate Donald Trump and calling the hacking “a national security issue.”

It was not immediately clear what information on the Clinton campaign’s computer system hackers would have been able to access, but the possibility of more ‘smoking guns’ only rises with each hack. Of course the finger will inevitably be pointed at Vladimir Putin (and his media-designated puppet Trump) but even The Director of Nation Intelligence has urged that an end be put to the “reactionary mode” blaming it all on Russia…

“We don’t know enough to ascribe motivation regardless of who it might have been,” Director of National Intelligence James Clapper said speaking at Aspen’s Security Forum in Colorado, when asked if the media was getting ahead of themselves in fingering the perpetrator of the hack. Speaking on Thursday, Clapper said that Americans need to stop blaming Russia for the hack, telling the crowd that the US has been running in “reactionary mode” when it comes to the numerous cyber-attacks the nation is continuously facing. “I’m somewhat taken aback by the hyperventilation on this,” Clapper said, as cited by the Washington Examiner. “I’m shocked someone did some hacking,” he added sarcastically, “[as if] that’s never happened before.”

Of course that won’t stop the endless distraction and guilt-mongering to avoid any accountability for actual content of anything that is released. Finally, does it not seem a little “reckless” that so many Democratic servers have been hacked so easily?

It’s starting to increase again.

• Greek Islands Appeal For Measures To Deal With Influx Of Refugees (Kath.)

As the influx of migrants from neighboring Turkey continues – with a slight but noticable increase – regional authorities and tourism professionals are calling for measures to support communities on the Aegean islands. Over the past two weeks, following a failed coup in Turkey on July 15, the influx of migrants has increased, according to government figures. Overall, more than 1,000 migrants landed on the five so-called hot spots: Lesvos, Chios, Kos, Samos and Leros since the failed coup. Those islands are now accommodating 9,313 migrants in camps, many of whom have been there for several months awaiting the outcome of asylum applications or deportation.

In a letter to Migration Policy Minister Yiannis Mouzalas and Alternate Defense Minister Dimitris Vitsas, the governor of the northern Aegean region, Christiana Kalogirou, asked for immediate steps to decongest the islands. “We are seeing a constant and apparently increasing flow of migrants and refugees toward the islands of the northern Aegean,” she wrote, noting that the maximum capacity of state reception centers has been exceeded on all the islands. A representative of an aid agency working on Lesvos said that the increase in migrant arrivals on the island has not yet fuelled tensions in the camps. “But if they keep arriving at the same rate, we’ll have a problem soon,” according to the worker who asked not to be identified.

That’s how hard that is. 5p.

• England’s Plastic Bag Usage Drops 85% Since 5p Charge Introduced (G.)

The number of single-use plastic bags used by shoppers in England has plummeted by more than 85% after the introduction of a 5p charge last October, early figures suggest. More than 7bn bags were handed out by seven main supermarkets in the year before the charge, but this figure plummeted to slightly more than 500m in the first six months after the charge was introduced, the Department for Environment, Food and Rural Affairs (Defra) said. The data is the government’s first official assessment of the impact of the charge, which was introduced to help reduce litter and protect wildlife – and the expected full-year drop of 6bn bags was hailed by ministers as a sign that it is working.

The charge has also triggered donations of more than £29m from retailers towards good causes including charities and community groups, according to Defra. England was the last part of the UK to adopt the 5p levy, after successful schemes in Scotland, Wales and Northern Ireland. Retailers with 250 or more full-time equivalent employees have to charge a minimum of 5p for the bags they provide for shopping in stores and for deliveries, but smaller shops and paper bags are not included. There are also exemptions for some goods, such as raw meat and fish, prescription medicines, seeds and flowers and live fish. Around 8m tonnes of plastic makes its way into the world’s oceans each year, posing a serious threat to the marine environment. Experts estimate that plastic is eaten by 31 species of marine mammals and more than 100 species of sea birds.

Home › Forums › Debt Rattle July 30 2016