Jean-Michel Basquiat Irony of the Negro Policeman 1981

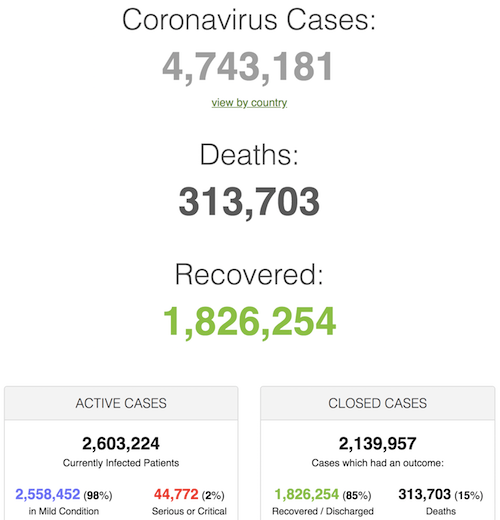

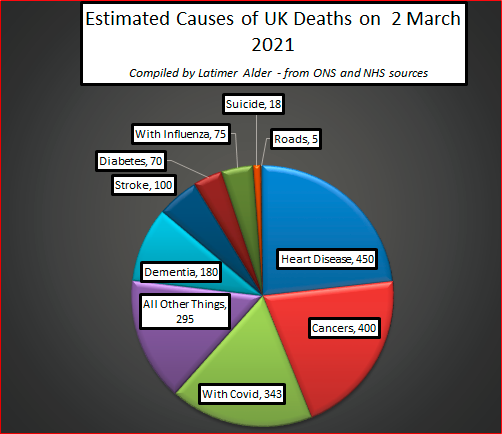

“With” COVID.

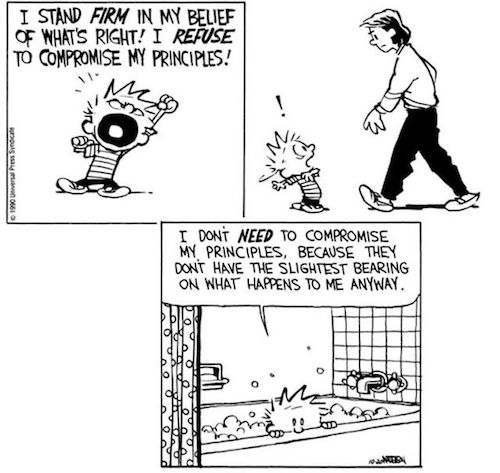

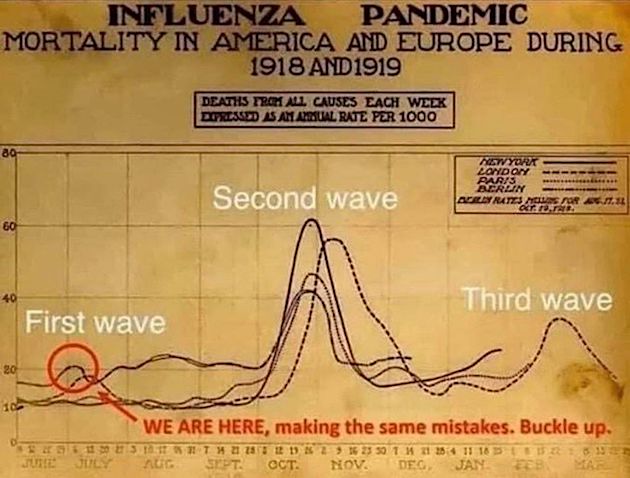

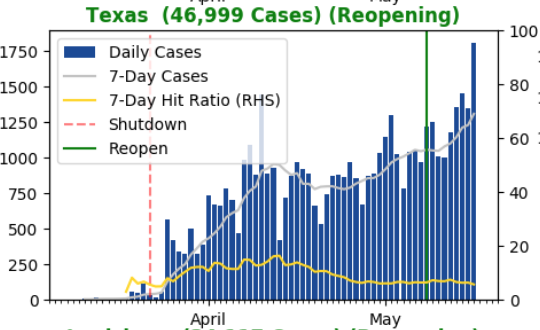

Do we all understand why this is inevitable? Abbott’s biggest critic says he “is doing what he does best: leaving Texans to fend for themselves.”

But isn’t what what Texans want? Florida is open, and doing much better than New York, which is closed. Science as a religion does not work.

• Texas And Mississippi Drop Covid Restrictions – Even Mask Mandates (F.)

Texas and Mississippi are both dropping their Covid-19 restrictions on businesses and ending their mask mandates, the states’ governors announced Tuesday, the latest in a string of states that have relaxed or dropped restrictions as cases have fallen nationwide despite public health officials strongly urging against it. “It is time to open Texas 100%,” Texas Gov. Greg Abbott said at a press conference Tuesday, saying “all businesses, of any type” can fully open as of next Wednesday. Abbott said increased Covid-19 testing, personal protective equipment and vaccines put the state in a “far better position” than when orders were first issued, and “Texans have mastered the daily habits to avoid getting Covid.”

County judges can impose local restrictions if hospitalizations raise to more than 15% of the region’s hospital bed capacity for seven days straight, Abbott said, but they cannot impose occupancy restrictions of less than 50% and cannot impose penalties against people who don’t wear masks. Gov. Tate Reeves announced Mississippi will also rescind a mask mandate that required them only in certain counties—the state already dropped a statewide mask order in September—and will lift all business restrictions except in schools and a 50% capacity limit for indoor arenas. Though less stringent than some other states, Texas does have social distancing restrictions in place for now for many businesses, such as a 75% capacity limit on indoor dining and gyms and a 50% capacity limit on bars, as well as an order for them to stop serving alcohol at 11 p.m.

Texas is the largest state so far to entirely drop its Covid-19 restrictions, but the state and Mississippi follow Florida and other Republican-led states that have taken similar measures. “Personal vigilance to follow the safe standards is still needed to contain Covid. It’s just that now, state mandates are no longer needed,” Abbott said. “At this time, people and businesses don’t need the state telling them how to operate.” “Abbott removing a statewide mandate while preaching personal responsibility to prevent the spread of COVID is an abdication of his own personal and professional responsibility to keep Texans safe,” Texas Democratic Party Chair Gilberto Hinojosa said in a statement Tuesday. “By removing all previous state mandates and opening the state to 100 percent, Governor Abbott, who has never taken this pandemic seriously, is doing what he does best: leaving Texans to fend for themselves.”

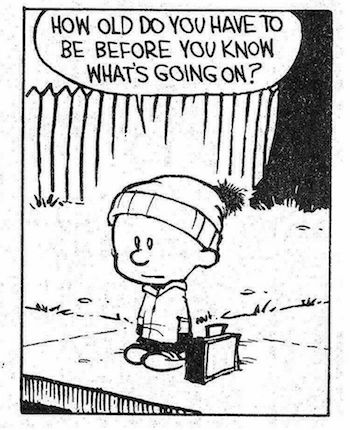

I’m still a bit amazed at how the meaning of “herd immunity” seamlessly came to include vaccines.

• Russian Deputy PM Golikova Predicts ‘Herd Immunity’ By End Of Summer (RT)

If the current Covid-19 vaccination rates are maintained, there will be collective immunity in Russia by August, Deputy Prime Minister Tatyana Golikova has predicted, while making it clear the pandemic is still “quite serious.” Speaking in an interview with news network TASS, published Tuesday, Golikova revealed that the government is planning to reach 60 percent collective immunity – one of the prerequisites for removing all pandemic-related restrictions. “In order to determine the final date of achieving collective immunity, we have developed an epidemiological and mathematical model,” Golikova said. “If vaccination is carried out at the same pace as it is now, and the number of vaccination points remains the same, then the country will achieve collective immunity in August 2021.”

The deputy prime minister also noted that the number of detected cases is slowly declining, after a peak in late December. On Tuesday, the official Covid-19 HQ reported 10,565 new daily instances of coronavirus – a steep drop from the 29,935 figure of just over two months ago. “The numbers of new cases of coronavirus infection are still quite serious, although reassuringly decreasing,” she said. “You will remember that we decided to ease measures last May, when we were at just around this point in terms of the number of new cases.” However, Golikova was also careful to note that viral infections spread more in winter and at the beginning of spring, meaning precautions still need to be taken. She also refused to name a date when life in Russia would get back to normal.

“Neither we nor the world has yet accumulated enough experience to understand how long the immune defense lasts,” she explained. “Of course, everyone is now relaxed and believes that Covid is going away. The situation is better now, but the virus is still not going anywhere. You need to take care of yourself and your loved ones.”

Wow, this is scary: “School staff members dedicated to be ‘Welcomers’ will be at every site to scan the QR code and take your temperature at the entrance.”

• Microsoft, LA School District Develop COVID ‘Daily Pass’ App (DC)

The Los Angeles Unified School District (LAUSD) has worked with Microsoft to develop the “Daily Pass” app to monitor coronavirus the vaccination status, health symptoms and temperatures of its students. “Sort of like the golden ticket in ‘Willy Wonka,’ everyone with this pass can easily get into a school building,” LAUSD Superintendent Austin Beutner said during his weekly update on Sunday, according to Fox News. “Los Angeles Unified has launched a one-stop shop web app built specifically for the District to ensure that we get students, faculty and administrators back to schools and district offices as safely as possible,” read a statement on the school’s website, which included an animated clip about the app.

In the video, a student uses the app in order to gain their “daily pass” to go back to school. The pass includes a daily health check, details about their “weekly” coronavirus test and scheduling for their vaccination once it becomes available. “Students, parents and visitors will access the Daily Pass on any computer, tablet or mobile device at dailypass.lausd.net. Answer the daily health check questions (not more than a two-minute process!),” the LAUSD website reads, describing the process for students. “If the individual has recently tested negative for COVID-19 and completes the online health check, a QR code will be generated for that day and specific site location,” it continues. “School staff members dedicated to be ‘Welcomers’ will be at every site to scan the QR code and take your temperature at the entrance.”

And so is this. It definitely looks like the opposite of freedom.

• Israel Launches Covid-Tracking ‘Freedom Bracelet’ (RT)

Israel has unveiled a coronavirus-tracking bracelet as an alternative to a two-week quarantine for incoming travelers, sparking privacy concerns as a top court moved to curb the Shin Bet spy agency’s role in contact tracing. A pilot program for the tracking bracelet kicked off at Ben Gurion Airport on Monday, where 100 devices were doled out to arriving travelers as a way to avoid a stay at a military-administered quarantine hotel. Instead, those opting for the bracelet system – which features the electronic wristband, a smartphone app and a wall-mounted tracking device – will be free to return home to wait out the two-week isolation period.

While the device will alert authorities if participants venture too far from the wall-mounted tracker, Ordan Trabelsi, the CEO of SuperCom, the company behind the bracelet, said it does not collect any other information, insisting the tech is minimally intrusive. “Nobody is forced to do it, but for those who are interested, it gives them another option: more flexibility,” he said. The pilot project – which Trabelsi has already called to expand to “thousands of units” for “wide-scale use” – may trigger further anxiety given SuperCom’s past work with a number of governments around the world to provide “offender monitoring” services, using its tracking tech to surveil prisoners and detainees. The firm signed a contract last year with a government agency in Wisconsin to offer the same service, and also sells technology used for electronic IDs, voter biometrics and cybersecurity.

As the rollout of the tracking bracelets got underway on Monday, Israel’s top court ruled that the country’s domestic spying agency, the Shin Bet, must rein in its Covid-19 contact-tracing efforts, calling the surveillance “draconian” and a threat to Israeli democracy. While the government has employed the Shin Bet for tracing since last March, the court has repeatedly challenged the practice, finally ruling that the agency may only be used under special circumstances beginning on March 14. “From [that] day on, the use of the Shin Bet will be limited to cases in which a confirmed coronavirus patient was not cooperating in his [epidemiological] investigation, whether intentionally or not, or gave no report of his encounters,” the court said.

“..all we know about the vaccines is that they will very effectively reduce your risk of severe disease. We haven’t seen any evidence yet indicating whether or not they stop transmission.”

• Is Europe Open For Summer? All Bets Are Off For US Travelers (F.)

There is some optimism in the U.S. that increased vaccination rates, decreasing Covid-19 rates and the rise of health passport schemes could open international travel up for the summer. At a time when EU countries are raising borders, however, all the signs in Europe point to the fact that summer 2021 is still incredibly uncertain for anyone wishing to travel from outside the region. There are extremely conflicting views about summer. On one side, the optimists. Intelligencer gave 9 Reasons To Believe The Worst Of The Pandemic Is Over and The Atlantic quoted Anthony Fauci’s prediction that herd immunity might be reached by August and that Covid-19 cases across the U.S. are declining much more sharply than anticipated, declaring that “the summer of 2021 is shaping up to be historic.”

On the other side are reports that the summer might indeed be historic but for entirely different reasons. The United Nations World Tourism Organization called 2020 the worst year on record for tourism but recently stated that 2021’s prospects had worsened. As reported by The Wall Street Journal, tourist destinations had been hoping for a sorely needed rebound but “with vaccine rollouts delayed in some places and new virus strains appearing, it is looking more likely that international travel could be stalled for years.” Worse still, 41% of experts polled by the UN didn’t think that pre-pandemic levels of tourism would be reached until 2024. It’s a view supported by the International Air Transport Association which said that air travel might only improve by 13% this year and industry insiders who said that it may be that long haul travel doesn’t properly resume until 2023 or 2024.

Many people are pinning hopes on the idea of vaccination passports, coupled with increased vaccination rates, to open up borders by the summer. But as reported by Bloomberg, this is far from sure. As stated by the World Health Organization, no one yet knows how vaccines will stop the spread of Covid-19, nor is it clear how the vaccines will hold up against variant strains. Digital health cards or vaccination/immunity passports are fraught with political and social obstacles, raising issues of equality and discrimination, never mind logistics. Margaret Harris, a WHO spokesperson in Geneva told Bloomberg, “it’s very important for people to understand that at the moment, all we know about the vaccines is that they will very effectively reduce your risk of severe disease. We haven’t seen any evidence yet indicating whether or not they stop transmission.”

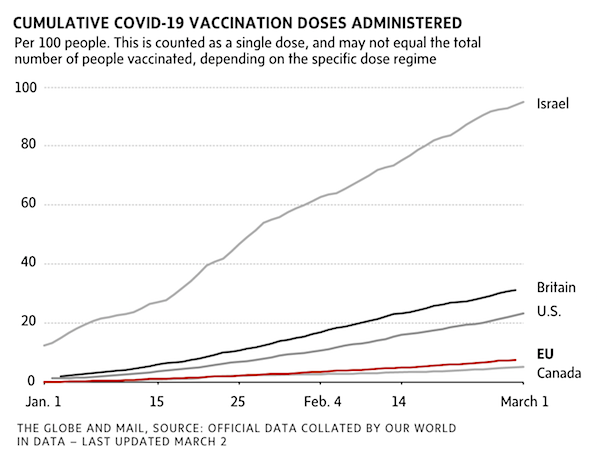

The EU doing what it does best. Be useless.

• EU’s Faltering COVID-19 Vaccine Rollout Triggers Rebellion (G&M)

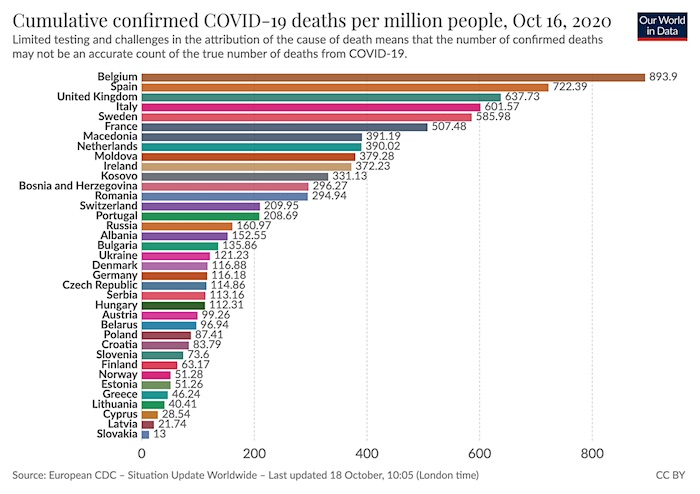

The European Union’s vaccine unity has shattered as shortages push a few desperate countries to seek outside supplies and create foreign partnerships. Frustrated by the vaccine shortages, at least four EU countries – Slovakia, Czech Republic, Hungary and Poland – have struck deals to buy Russia’s Sputnik V vaccine, or are considering doing so. The Chinese vaccine is also a contender. The Russian and Chinese products have not been approved by the European Medicines Agency (EMA). The EU’s vaccine rollout remains stubbornly slow, although the pace has picked up somewhat in recent days. By Tuesday, the 27-country EU – population 450 million – had administered only 33.5 million doses, equivalent to 7.5 per 100 citizens.

[..] In a blow to the EC vaccine strategy, which is overseen by EC president Ursula von der Leyen, Slovakia and Hungary granted emergency approval of the Sputnik vaccine. Slovakia, which currently has the highest number of pandemic deaths per capita over a seven-day period, is to receive two million doses of the Sputnik vaccine. The question is whether one of the EU’s big countries will also break ranks and order outside vaccine supplies. Francesco Galietti, chief executive of the Rome political consultancy Policy Sonar, said that Mario Draghi, Italy’s new prime minister, might be forced to buy the Russian vaccine if Italy’s campaign doesn’t pick up momentum soon. “Draghi will have to carefully assess whether the Western vaccines are enough,” he said in an interview. “He seems to have realized that Italy cannot survive economically if the vaccine is not rolled out before the summer. He knows the importance of tourism to Italy.”

The larger picture.

• The Age of Social Murder (Chris Hedges)

The two million deaths that have resulted from the ruling elite’s mishandling of the global pandemic will be dwarfed by what is to follow. The global catastrophe that awaits us, already baked into the ecosystem from the failure to curb the use of fossil fuels and animal agriculture, presage new, deadlier pandemics, mass migrations of billions of desperate people, plummeting crop yields, mass starvation, and systems collapse. The science that elucidates this social death is known to the ruling elites. The science that warned us of this pandemic, and others that will follow, is known to the ruling elites. The science that shows that a failure to halt carbon emissions will lead to a climate crisis and ultimately the extinction of the human species and most other species is known to the ruling elites. They cannot claim ignorance. Only indifference.

The facts are incontrovertible. Each of the last four decades have been hotter than the last. In 2018, the UN International Panel on Climate Change released a special report on the systemic effects of a 1.5 degrees Celsius (2.7 degrees Fahrenheit) rise in temperatures. It makes for very grim reading. Soaring temperature rises — we are already at a 1.2 degrees Celsius (2.16 degrees Fahrenheit) above preindustrial levels — are already baked into the system, meaning that even if we stopped all carbon emission today, we still face catastrophe. Anything above a temperature rise of 1.5 degrees Celsius will render the earth unhabitable. The Arctic ice along with the Greenland ice sheet are now expected to melt regardless of how much we reduce carbon emissions. A seven-meter (23-foot) rise in sea level, which is what will take place once the ice is gone, means every town and city on a coast at sea level will have to be evacuated.

[..] As the climate crisis worsens, the political constrictions will tighten, making public resistance difficult. We do not live, yet, in the brutal Orwellian state that appears on the horizon, one where all dissidents will suffer the fate of Julian Assange. But this Orwellian state is not far away. This makes it imperative that we act now. The ruling elites, despite the accelerating and tangible ecological collapse, mollify us, either by meaningless gestures or denial. They are the architects of social murder. Social murder, as Friedrich Engels noted in his 1845 book “The Condition of the Working-Class in England,” one of the most important works of social history, is built into the capitalist system. The ruling elites, Engels writes, those that hold “social and political control,” were aware that the harsh working and living conditions during the industrial revolution doomed workers to “an early and unnatural death:”

Something tells me they can afford it.

• Warren’s Wealth Tax Would Cost 100 Richest Americans $78 Billion (Hill)

A new wealth tax proposed by Sen. Elizabeth Warren (D-Mass.) and other progressives on Monday would result in the 100 richest Americans paying over $78 billion in taxes annually, according to analysis by Bloomberg News. The bill, called the Ultra-Millionaire Tax Act, would require households with a net worth of more than $50 million to pay 2 percent of their wealth every year. A 1 percent surtax would be added for those with a net worth in excess of $1 billion. That would mean Amazon founder Jeff Bezos, the richest person in the world, would face an additional $5.4 billion in taxes if the bill were signed into law this year, according to Bloomberg News. Tesla CEO Elon Musk would pay an additional $5.2 billion, Bill Gates would pay $4 billion more and Facebook CEO Mark Zuckerberg would see his tax bill increase by about $3 billion.

The legislation, which is unlikely to pass Congress, would affect tax payments starting in 2023. “As Congress develops additional plans to help our economy, the wealth tax should be at the top of the list to help pay for these plans because of the huge amounts of revenue it would generate,” Warren said on Monday when unveiling the new proposal. “This is money that should be invested in child care and early education, K-12, infrastructure, all of which are priorities of President Biden and Democrats in Congress,” she added. “I’m confident lawmakers will catch up to the overwhelming majority of Americans who are demanding more fairness, more change, and who believe it’s time for a wealth tax.” According to Bloomberg News, the 100 richest Americans added $598 billion to their fortunes last year. Warren’s proposed tax would take 13 percent of that added wealth.

Your daily drip drip.

• Andrew Cuomo Is Living To Regret The Deal He Pushed On Letitia James (IC)

In 2003, Letitia “Tish” James shook the New York Democratic political establishment, becoming the first City Council candidate to win office solely as a nominee of the Working Families Party. James spent the next 15 years as an outspoken, independent-minded progressive and a leading voice for the city’s social movements. In 2013, despite being vastly outspent, she won a tight race for New York City public advocate, a stepping stone to mayor. Her close alliance with the city’s grassroots was considered by political observers to be both a benefit and an obstacle. She had people behind her, but she didn’t have money — and moving to the next level required lots of it. When New York Attorney General Eric Schneiderman was forced to resign amid a #MeToo scandal in 2018, James was quickly discussed as a potential successor. But could she raise the funds?

That’s where Andrew Cuomo came in. The state’s governor, who was seeking his third term, was in the midst of a long-running feud with the organization that was so intimately linked with James’s rise, the WFP. Under pressure from Cuomo, local unions had left the party, taking their clout and financing with them. In April 2018, the WFP came for the king, endorsing activist and actor Cynthia Nixon for the Democratic primary over Cuomo, who vowed to destroy the organization. Cuomo had long treated figures in New York politics — his playground — like kids to be bullied. He turned his attention to James. In May, Cuomo made James an excruciating offer: He would endorse her and open his donor network to her, but it would come at a price. Not only would she have to endorse him, she would have to publicly refuse the support of the WFP.

Ripped from the pages of a cliched mafia screenplay, James would have to prove her loyalty by executing her longtime ally. James was left with two bad options: Accepting Cuomo’s offer was the most likely route to winning the election, but it would come with accusations that she had traded in her trademark independence and social justice values. Rejecting it could cost her the election and make Cuomo into a fatal enemy. James took the deal. The WFP endorsed her anyway, against her public will, while jointly endorsing Zephyr Teachout. The bulk of their spending went toward opposing the most right-leaning candidate, Sean Patrick Maloney, who represents a congressional district upstate.

In the fictional version of these parables, a deal with the devil always ends the same way: The devil always gets his due. But New York politics is not a parable. The story’s new plot twist conforms more closely to a Disney version: Cuomo is getting his due of a different kind, with scrutiny over his failed coronavirus response and an investigation into sexual harassment claims. His fate now rests with Tish James.

She’s just one of a large group. And she’ll be in the administration anyway.

• Tanden Withdraws Nomination As Biden Budget Chief (Hill)

Neera Tanden has withdrawn her nomination to head President Biden’s White House budget office after her prospects of Senate confirmation flamed out.The White House made the announcement on Tuesday evening, capping a tumultuous few weeks surrounding the fight over her nomination. Tanden, who would have been the first woman of color to lead the Office of Management and Budget (OMB), faced scrutiny over mean tweets she had written about Republicans and progressive Democrats alike in her previous role heading the Center for American Progress think tank.“I have accepted Neera Tanden’s request to withdraw her name from nomination for Director of the Office of Management and Budget,” Biden said in a statement.

“I have the utmost respect for her record of accomplishment, her experience and her counsel, and I look forward to having her serve in a role in my Administration. She will bring valuable perspective and insight to our work.”Tanden is Biden’s first Cabinet nominee to be withdrawn from consideration, making this an early blow for the president. The White House spent the past two weeks insisting there was a path to confirmation for Tanden and vowed to fight for her, even as her prospects dimmed.Tanden is expected to be appointed to an administration role that does not require Senate confirmation.A handful of names have circulated as potential replacements for Tanden. Shalanda Young, who on Wednesday underwent a confirmation hearing to be the deputy OMB director, is seen as the most likely nominee.

In her controversial tweets, many of which were deleted in recent months, Tanden compared Sen. Mitch McConnell (R-Ky.) to Voldemort and Sen. Ted Cruz (R-Texas) to a vampire and insinuated that Sen. Bernie Sanders (I-Vt.) benefited from Russian hacking in the 2016 election.In two confirmation hearings, she repeatedly apologized for the tweets and promised to strike a more collegial tone as a member of the administration.Her nomination began to unravel when Sen. Joe Manchin (D-W.V.) pulled his support, citing the need for comity. In the evenly divided Senate, that left Tanden reliant on support from centrist Republicans such as Sen. Susan Collins (Maine), who also was a target of Tanden’s tweets. That support was not forthcoming.

As I’ve said 1000 times: Our economies run on waste.

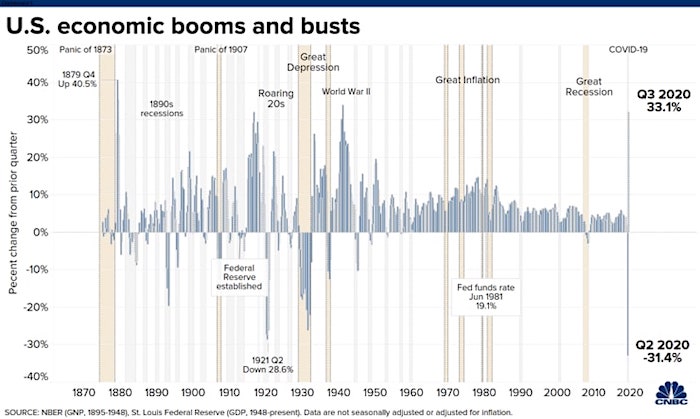

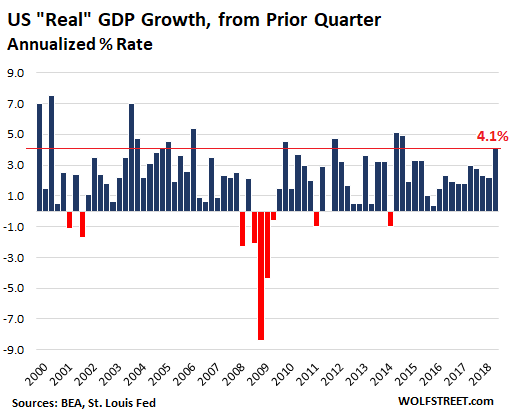

• Remember That GDP = Waste (CHS)

We’re told the gross domestic product (GDP) measures growth, but what it really measures is waste: capital, labor and resources that are squandered and then mislabeled “growth” for PR purposes. If we only manage what we measure, then we’re mismanaging our economy by promoting waste as the only metric we measure and incentivize. Forecasts now predict a rousing 6.8% “growth” in 2021 GDP. In other words, the amount of resources and capital being squandered is going parabolic and we love it! 50 million autos and trucks stuck in traffic, burning millions of gallons of fuel while going nowhere? Growth! All that wasted fuel adds to GDP. Everyone who works from home detracts from “growth” since they didn’t waste fuel sitting in traffic jams. That’s bad! Wasting millions of gallons of gasoline is “growth”!

Repaving a little-used road: growth! Never mind the money could have been invested in repairing a heavily traveled road, or adding safe bikeways, etc.–in the current neo-Keynesian system, building bridges to nowhere is “infrastructure growth.” GDP has no mechanism to measure the opportunity costs of squandering capital, labor and resources on investments with marginal or even negative returns. Buying a new refrigerator to replace a broken one that could have been fixed by replacing a $10 sensor: growth! GDP has no mechanism for calculating the utility still remaining in roads, vehicles, buildings, etc. that are replaced–throwing away all the fixed-investment’s remaining utility to buy a new replacement is strongly encouraged because it adds to “growth.”

Planned obsolescence that sends everything on a conveyor belt to the landfill is “growth”– we love the Landfill Economy because all that incredibly needless waste is “growth”! Building and maintaining extraordinarily costly weapons systems that are already obsolete: growth! The gargantuan future costs of interest paid by taxpayers on the debt borrowed to pay for failed weapons systems like the trillion-dollar rathole known as the F-35 aircraft program is not calculated by GDP. The staggering costs of indebting future taxpayers is ignored by GDP– the only thing that counts in GDP is “growth” in spending, no matter how useless. [..] GDP has no mechanism to measure the value of alternatives that use less capital, labor and resources to get the same results.

How to get it just right.

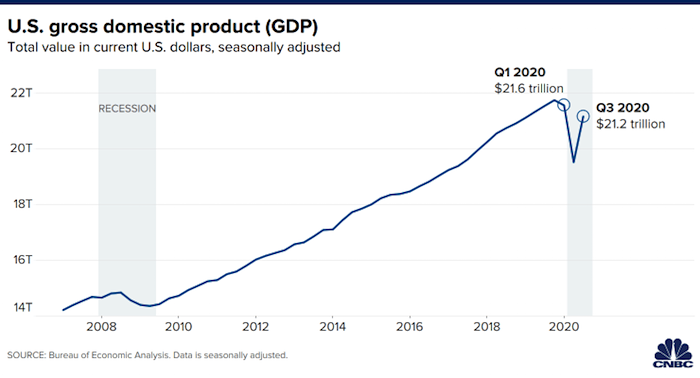

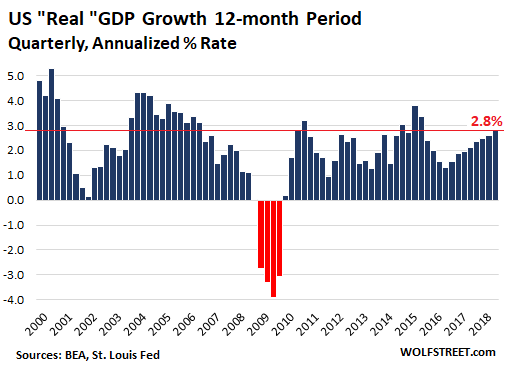

• The Goldilocks Stimulus Myth (Varoufakis)

To see why there can be no “Goldilocks” stimulus that gets the amount “just right,” it helps to engage the critics who argue that the administration’s proposal would overheat the economy and hand the Republicans the midterms. Central to their prediction is their tacit assumption that there is also a Goldilocks interest rate and a corresponding stimulus size that will deliver it. What would render any rate of interest “just right”? First, it would achieve the right balance between available savings and productive investment. Second, it would not unleash a cascade of corporate bankruptcies, bad loans, and a fresh banking crisis. And there’s the rub: It is not at all clear that there is a single interest rate that can do both.

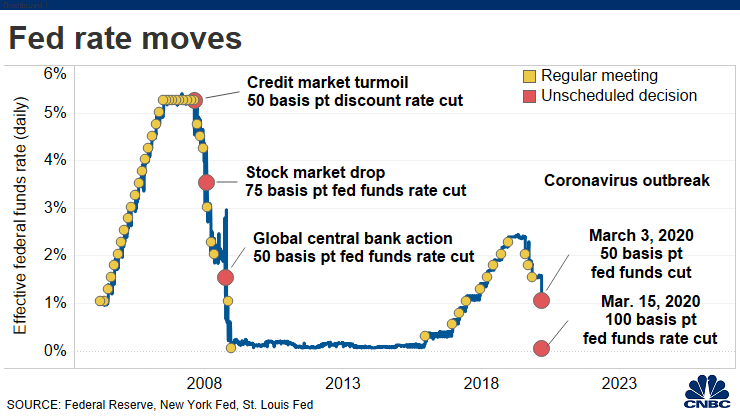

Once upon a time, there was. In the 1950s and early 1960s, under the Bretton Woods system, an interest rate of around 4% did the trick of balancing savings and investment while keeping bank profitability at a level that allowed credit to reproduce itself sustainably. Back then, if investment fell below available savings for too long, and failed to recover despite a reduction in the interest rate, a well-designed government stimulus raised investment back to the level of savings, the rate of interest picked up, and balance was restored. Alas, we no longer live in that kind of world. The reason capitalism no longer works like that is the manner in which the Obama administration, aided and abetted by the Federal Reserve, re-floated the sinking Western banks. The 2008 crisis was as deep and terrible as that of 1929.

As in 1929, sequential bankruptcies, unemployment, and falling prices meant no one was willing to borrow. Interest rates nosedived to zero and capitalism fell into what John Maynard Keynes referred to as the “liquidity trap.” Once at zero, the interest rate could not go much lower without destroying what was left of the banking sector, insurance companies, pension funds, and other financial institutions. The great difference between 1929 and 2008 was that in 2008 the banks were not allowed to fail. One way to save them was a large enough fiscal stimulus. Direct injections of freshly minted money to consumers and firms – to pay off debts and to increase consumption and investment – would have re-floated Main Street and, indirectly, Wall Street. This was the road not taken by the Obama administration.

Instead, the Fed printed trillions of dollars, and the failing banks were re-floated directly. But while the banks were saved, the economy was not freed from the liquidity trap. The banks lent the new money to corporations, but, because their customers were not re-floated, managers were unwilling to risk plowing the money into good jobs, buildings, or machines. Instead, they took it to the stock market, causing the largest-ever disconnect between share prices and the real economy.

The warnings of inflation are getting louder.

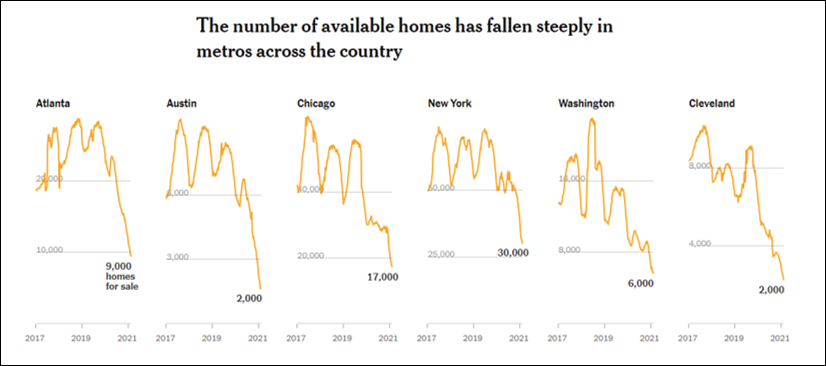

• The Opposite of 2008 (Ben Hunt)

In late 2007 I started counting the For Sale signs on the 20 minute drive to work through the neighborhoods of Weston and Westport, CT. I’m not exactly sure why it made my risk antenna start quivering in the first place … honestly, I just like to count things – anything – when I’m doing a repetitive task. Coming into 2008 there were a mid-teen number of For Sale signs on my regular route, up from high single-digits in 2007. By May of 2008 there were 35+ For Sale signs. If there’s a better real-world signal of financial system distress than everyone who takes Metro North from Westport to Grand Central trying to sell their homes all at the same time and finding no buyers … I don’t know what that signal is. The insane amount of housing supply in Wall Street bedroom communities in early 2008 was a crucial datapoint in my figuring out the systemic risks and market ramifications of the Great Financial Crisis.

Last week, for the first time in years, I made the old drive to count the number of For Sale signs. Know how many there were?Zero. And then on Friday I saw this article from the NY Times – Where Have All the Houses Gone? – with these two graphics:I mean … my god.Here’s where I am right now as I try to piece together what the Opposite of 2008 means for markets and real-world.

1) Home price appreciation will not show up in official inflation stats. In fact, given that a) rents are flat to declining, and b) the Fed uses “rent equivalents” as their modeled proxy for housing inputs to cost of living calculations, it’s entirely possible that soaring home prices will end up being a negative contribution to official inflation statistics. This is, of course, absolutely insane, but it’s why we will continue to hear Jay Powell talk about “transitory” inflation that the Fed “just doesn’t see”.

2) Cash-out mortgage refis and HELOCs are going to explode. On Friday, I saw that Rocket Mortgage reported on their quarterly call that refi applications were coming in at their fastest rate ever. As the kids would say, I’m old enough to remember the tailwind that home equity withdrawals provided for … everything … in 2005-2007. This will also “surprise” the Fed.

3) Middle class (ie, home-owning) blue collar labor mobility is dead. If you need to move to find a new job, you’re a renter. You’re not going to be able to buy a home in your new metro area. That really doesn’t matter for white collar labor mobility, because you can work remotely. You don’t have to move to find a new job if you’re a white collar worker. Or if you want to put this in terms of demographics rather than class, this is great for boomers and awful for millennials and Gen Z’ers who want to buy a house and start a family.

4) As for markets … I think it is impossible for the Fed NOT to fall way behind the curve here. I think it is impossible for the Fed NOT to be caught flat-footed here. I think it is impossible for the Fed NOT to underreact for months and then find themselves in a position where they must overreact just to avoid a serious melt-up in real-world prices and pockets of market-world. Could a Covid variant surge tap the deflationary brakes on all this? Absolutely. But let’s hope that doesn’t happen! And even if it does happen, that’s only going to constrict housing supply still more, which is the real driver of these inflationary pressures.

It’s just like 2008, except … the opposite.In 2008, the US housing market – together with a Fed that thought the subprime crisis was “contained” – delivered the mother of all deflationary shocks to the global economy.In 2021, the US housing market – together with a Fed that thinks inflationary pressures are “transitory” – risks delivering the mother of all inflationary shocks.It’s the only question that long-term investors MUST get right. You don’t have to get it right immediately. You don’t have to track and turn with every small movement of its path. But you MUST get this question roughly right: Am I in an inflationary world or a deflationary world? And yes, there’s an ET note on this. Because the Fourth Horseman is inflation.

Louis-Ferdinand Céline certainly did. But his work is still great literature.

• Dr. Seuss Didn’t Have ‘A Racist Bone’ In His Body – Stepdaughter (NYP)

One of Dr. Seuss’ stepdaughters insisted to The Post on Tuesday that the world-famous children’s author was no racist — and that she hopes his six controversial kiddie books yanked from publication will be back. “There wasn’t a racist bone in that man’s body — he was so acutely aware of the world around him and cared so much,’’ Lark Grey Dimond-Cates said of her late, now-embattled stepdad, whose real name was Theodor Seuss Geisel. The company overseeing the legacy of the Dr. Seuss books, Dr. Seuss Enterprises, announced Tuesday that it will stop selling six of his titles because they “portray people in ways that are hurtful and wrong.”

Dimond-Cates said DSE, which works with publisher Penguin Random House, informed her Monday about its decision to not continue printing “If I Ran the Zoo,” “And to Think That I Saw It on Mulberry Street,” “McElligot’s Pool,” “On Beyond Zebra!,” “Scrambled Eggs Super!” and “The Cat’s Quizzer.” “I think in this day and age it’s a wise decision,” she told The Post of the move.“I think this is a world that right now is in pain, and we’ve all got to be very gentle and thoughtful and kind with each other.“This is just very difficult, painful times that we live in,” said Dimond-Cates, a California sculptor, who added that Geisel came into her life when she was in grade school.

“We’re taking that into account and being thoughtful. We don’t want to upset anybody.’’Dimond-Cates’ mother was Geisel’s second wife, Audrey Geisel, and the sculptor also has a sister, another of the author’s stepdaughters, Leagrey Dimond. Dr. Seuss did not have any children of his own. Still, Dimond-Cates said she hopes the six pulled books will eventually go back into print “because his body of work is unique.”

“The real antiracists will stand up and oppose this nonsense.”

• There Is No Such Thing as “White” Math (Klainerman)

In my position as a professor of mathematics at Princeton, I have witnessed the decline of universities and cultural institutions as they have embraced political ideology at the expense of rigorous scholarship. Until recently — this past summer, really — I had naively thought that the STEM disciplines would be spared from this ideological takeover. I was wrong. Attempts to “deconstruct” mathematics, deny its objectivity, accuse it of racial bias, and infuse it with political ideology have become more and more common — perhaps, even, at your child’s elementary school. This phenomenon is part of what has been dubbed “The Great Awokening.” As others have explained powerfully, the ideology incubated in academia, where it indoctrinated plenty of bright minds. It then migrated, through those true believers, into our important cultural, religious and political institutions. Now it is affecting some of the country’s most prominent businesses.

[..] For historical reasons, we often discuss contributions to the field of mathematics from the Egyptians, Babylonians, Greeks, Chinese, Indians and Arabs and refer to them as distinct entities. They have all contributed through a unique cultural dialogue to the creation of a truly magnificent edifice accessible today to every man and woman on the planet. Though we pay tribute to great historical figures who inform the practice of mathematics, the subject can be taught — and often is — with no reference to the individuals who have contributed to it. In that sense it is uniquely universal. Schools throughout the world teach the same basic body of mathematics. They differ only by the methodology and intensity with which they instruct students.

It is precisely this universality of math — together with the extraordinary ability of American universities to reward hard work and talent — that allowed me, and so many other young scientists and mathematicians, to come to this country and achieve success beyond our wildest dreams. The idea that focusing on getting the “right answer” is now considered among some self-described progressives a form of bias or racism is offensive and extraordinarily dangerous. The entire study of mathematics is based on clearly formulated definitions and statements of fact. If this were not so, bridges would collapse, planes would fall from the sky, and bank transactions would be impossible. The ability of mathematics to provide right answers to well-formulated problems is not something specific to one culture or another; it is really the essence of mathematics.

To claim otherwise is to argue that somehow the math taught in places like Iran, China, India or Nigeria is not genuinely theirs but borrowed or forged from “white supremacy culture.” It is hard to imagine a more ignorant and offensive statement. Finally, and most importantly, the woke approach to mathematics is particularly poisonous to those it pretends to want to help. Let’s start with the reasonable assumption that mathematical talent is equally distributed at birth to children from all socio-economic backgrounds, independent of ethnicity, sex and race. Those born in poor, uneducated families have clear educational disadvantages relative to others. But mathematics can act as a powerful equalizer. Through its set of well-defined, culturally unbiased, unambiguous set of rules, mathematics gives smart kids the potential to be, at least in this respect, on equal footing with all others. They can stand out by simply finding the right answers to questions with objective results.

There is no such thing as “white” mathematics. There is no reason to assume, as the activists do, that minority kids are not capable of mathematics or of finding the “right answers.” And there can be no justification for, in the name of “equity” or anything else, depriving students of the rigorous education that they need to succeed. The real antiracists will stand up and oppose this nonsense.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.