Arthur Rothstein “Low-cost housing, Saint Louis, Mo.” March 1936

It’s been quite the emerging week in the financial markets, but we shouldn’t let that make us ignore what goes on in the real world. The numbers about US and UK real economies may not have been entirely surprising to those of us who peek behind the veil from time to time, , but they were surely as bad as they were probably confusing. The media and “leaders” never seem to get tired of reminding us what a great recovery we’re in. US GDP growth was supposed to have been 3.2% in Q4 2013. And we see headlines like “Consumer Spending in U.S. Increases More Than Forecast”. But we also saw that Amazon didn’t receive nearly its expected part of that increase, and America’s Shopping Malls Are Dying. So what gives? Well, for one thing, as I suggested yesterday, that 3.2% number is “perhaps” a little exaggerated. But there’s more to think about.

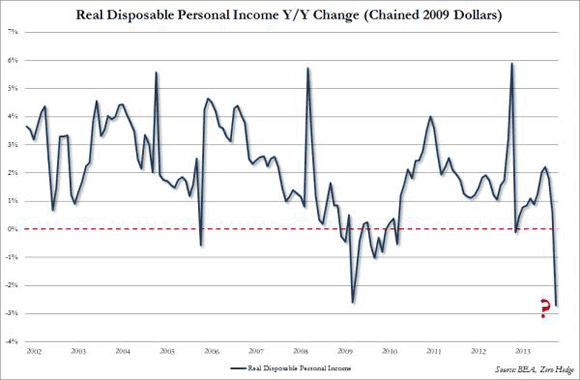

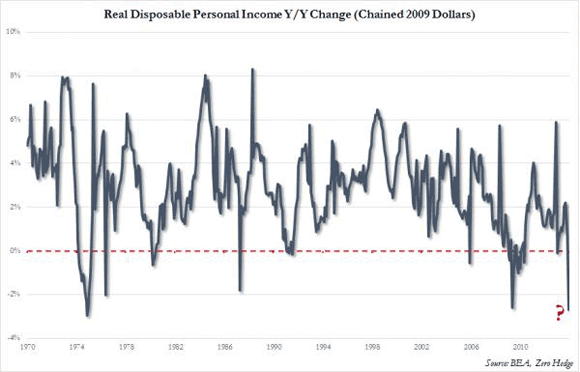

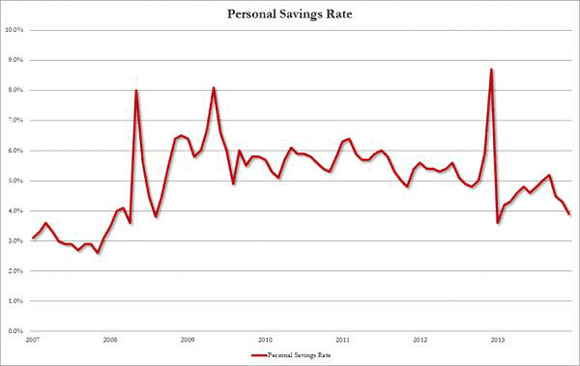

American disposable income fell 0.2% in December, 2.7% over the past 12 months, and if you don’t think that’s a big deal, please note that it’s the largest year-to-year drop since 1974, or 40 years. Still, household purchases were up 0.4% from last December. How is that possible? It’s so obvious you could easily miss it: Americans have cut into their savings to the tune of $46 billion to afford their holiday shopping. So when you see Credit Agricole chief economist Michael Carey claim that “There’s general improvement in households’ financial position; The strengthening labor market will feed back into spending”, you know that the first bit is baloney, and the second bit is about as questionable as claims come. The US is supposed to have created jobs over the past year, or so we’re told, but disposable income has only dropped deeper.

The truth is that the 3.2% US GDP growth number is based, for very close to 100%, on free money for the financial sector, and on borrowed money and diminishing savings for everyone else. Of course it’s utterly insane that such things are seen as positive and counted as growth, but we know by now that’s the model we’re being fed on a daily basis. A model in which it’s entirely acceptable to fight debt with more debt. If the emerging market crisis lasts, in which case it looks set to drag western stock markets down with it, that model will be tested. And so will US GDP numbers.

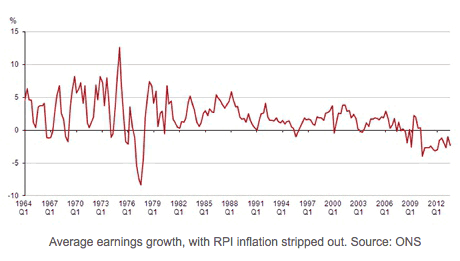

In the UK, both real wages and living standards have kept on falling ever since 2010, the longest period in at least 50 years. The numbers spell a disturbing picture: Real wage growth averaged 2.9% in the 1970s and 1980s, 1.5% in the 1990s, 1.2% in 2000s, but has fallen to minus 2.2% since the first quarter of 2010. Not that this has kept the government from claiming wages are rising. They’ll think twice before making that claim again.

Overall, whatever growth there might be is not reaching the real economy, and once you start using “real” methods to measure it you will see contraction, not growth. The thumbscrews are being tightened as you’re waiting for the recovery to knock on your door too. Come to think of it, the recovery is a lot like Santa Claus: a made up feel good story for which you get to pay the bill once the party’s over and you realize you’ll have to wait another year for it to come back.

• Real Disposable Income Plummets Most In 40 Years (Zero Hedge)

We may not know much about “Keynesian economics” (and neither does anyone else: they just plug and pray, literally), but we know one thing: when real disposable personal income drops by 0.2% from a month earlier, and plummets by 2.7% from a year ago, the biggest collapse since the semi-depression in 1974, something is wrong with the US consumer.

And longer term:

• Consumer Spending in U.S. Increases More Than Forecast (Bloomberg)

Consumer spending in the U.S. climbed more than forecast in December even as incomes stagnated, showing the economy needs to generate bigger gains in employment to boost the expansion. Household purchases, which account for about 70% of the economy, rose 0.4%, after a 0.6% gain the prior month that was larger than previously estimated, Commerce Department figures showed today in Washington

“We are seeing a pretty solid pickup in consumer spending,” Michael Carey, chief economist for North America at Credit Agricole CIB in New York, said before the report. “There’s general improvement in households’ financial position. The strengthening labor market will feed back into spending.” [..]

Disposable income, or the money left over after taxes, dropped 0.2% in December after adjusting for inflation from the prior month, the biggest decrease since January. Over the past 12 months, it decreased 2.7%,the largest year- to-year drop since November 1974, reflecting the impact of the expiration of the payroll tax break, the increase in some income taxes earlier in the year and weak wage gains.

The saving rate decreased to 3.9%, the lowest level since January, from 4.3%. Wages and salaries were unchanged in December from the prior month.

Gross domestic product grew at a 3.2% annualized rate in the final three months of 2013, following a 4.1% pace from July through September, a Commerce Department report showed yesterday. Consumer spending climbed at a 3.3% pace, the best quarterly performance since the end of 2010.

• Americans Burned Through $46 Billion In Savings To Fund December Purchases (Zero Hedge)

If there was any confusion where the funding for that little shopping spree Americans engaged in during December came from, it should all go away now. While the street was expecting a 0.2% increase in both personal income and personal spending in the month of December, what it got instead was a flat print in income (i.e. unchanged from November) while spending (mostly for non-durable goods) spiked by 0.4% meaning there was a 0.4% funding hold that had to be filled somehow. That somehow we now know is personal savings, which tumbled from a revised 4.3% to 3.9% – the lowest since January 2013, only back then incomes would rise for the rest of the year driven by the 30% increase in the S&P “wealth effect.” This time, with the Fed now tapering QE, the only way is down for both the “wealth effect” and Personal Incomes… and thus Personal spending, that majority component of US GDP.

Finally, this data means that according to the BEA in December US consumers funded some $46 billion in spending through burning down their savings. As of December 31, 2013 total personal savings left are down to $495 billion.

• UK real wages falling for longest period for at least 50 years (Guardian)

Real wages have been falling consistently since 2010, the longest period for 50 years, according to the Office for National Statistics, adding that low productivity growth seems to be pushing wages down. Real wage growth averaged 2.9% in the 1970s and 1980s, 1.5% in the 1990s, 1.2% in 2000s, but has fallen to minus 2.2% since the first quarter of 2010, the ONS figures showed.

TUC general secretary Frances O’Grady said: “Over the last four years British workers have suffered an unprecedented real wage squeeze. “Worryingly, average pay rises have been getter weaker in every decade since the 1980s, despite increases in productivity, growth and profits. Unless things change, the 2010s could be the first ever decade of falling wages.”

I’ve written about developments in emerging markets the entire week, and not one issue involved has been resolved. One might have thought the return of money invested in these markets, to the US, would by now have lifted the Dow and S&P, but there’s too much risk and fear. Bonds? Less risk, but no returns. No doubt Wall Street is working hard on financial innovations, but they won’t necessarily lift stock markets. A substantial correction looks increasingly likely.

• Contagion fears heighten as emerging markets selloff resumes (Reuters)

Emerging market stocks and currencies extended their slide on Friday on fears of a protracted capital flight, while a gauge of global equities fell, on track to close its worst month in two years. European and U.S. stock markets gave back the previous day’s gains, setting up MSCI’s global index for its largest monthly decline since May 2012. Emerging market stocks were down nearly 7% for the month, the worst start to a year since 2008.

Adding to pressure in emerging market currencies from Turkey to South Africa in previous sessions, the Russian rouble and Polish zloty slid against the U.S. dollar. Government borrowing costs jumped across weaker economies despite local policymakers’ efforts to staunch the bleeding.

Concern about growth in China and other emerging markets triggered the selling in developing economies late last week, with focus on countries with internal political and economic issues, like Ukraine and Argentina. The U.S. Federal Reserve’s decision this week to continue to withdraw its monetary stimulus – one of the reasons for the flow of cash into emerging markets in recent years – compounded the problems in emerging economies.

“Pressure has now returned to haunt the key emerging market currencies whose central banks have so far raised the cost of borrowing, but pressure valves are also now being tested elsewhere,” said Andrew Wilkinson, chief market analyst at Interactive Brokers LLC in Greenwich, Connecticut. He noted that interest rate increases from Turkey, India and South Africa this week helped reverse the trend in trading on Thursday. “The week is ending on a bad note as investors reflect on the earlier catalyst indicating potential sluggish growth for the world’s No. 2 two economy, China.”

“I have been saying that the U.S. should worry about the effects of its policies on the rest of the world,” Reserve Bank of India Governor Raghuram Rajan said on Friday, a day after slamming what he said was a breakdown in global monetary coordination. Poland delayed publication of its monthly debt supply plan until next week due to market turbulence and an overhaul of its pension scheme, a day after Hungary scrapped a bond sale because of a sudden spike in rates.

Euro zone consumer price inflation dropped in January, bucking market expectations and putting downward pressure on the single currency. Inflation slowed back to 0.7%, the same level as when the ECB, which meets next Thursday, caught markets off guard with a rate cut in November. Unemployment remained at a record high. “It’s now more likely than ever that Draghi is going to have to step in with some extraordinary measure to stave off deflation,” said Aberdeen Asset Management fixed income investment analyst Luke Bartholomew, referring to ECB President Mario Draghi.

Fund investors worldwide pulled $6.4 billion from emerging market stock funds in the week ended January 29, marking their biggest outflows since August 2011 , data from a Bank of America Merrill Lynch Global Research report showed.

The grab for safer assets meant the dollar .DXY had the upper hand in the currency market, pressuring commodities already weakened by the prospects of slower growth. Gold was caught between the run to safety and the greenback’s surge, and spot prices were little changed. The precious metal was down for the week but on track to post its first monthly gain since last August.

“The absence of the Chinese market for the next week means that we may see some further downside on commodities, especially if we do see the dollar gaining ground,” said Tim Radford, of Sydney-based metals adviser Rivkin. Chinese markets were closed for the New Year holiday and will remained closed into next week.

Most, if not all of the emerging market economies are quite simply too weak to withstand the jitters and pressure that come with capital outflows. They’re essentially subprime investments, and they could cause the same sort of damage. Only question is how bad will it get. What makes it extra dangerous is that the main banks don’t care, because, unlike in the run-up to the subprime housing crisis, they now know for a fact that they’re considered too big to fail, and they can basically do whatever they please and see their losses scooped up by the real economy. How did we ever get here?

• The Dark Side of Capital in Emerging Markets (NY Times)

The widespread worry about emerging markets — investors are also nervous about Brazil, India, Indonesia, Thailand, Taiwan and Malaysia, to name a few — can in some ways be traced to the fact that they did remarkably well during the credit crisis that began in 2008. Many of them had hefty foreign currency reserves, and their growth attracted foreign investment.

That investment helped to push up local asset prices, which intensified the boom and brought in more capital. Eventually, money flowed in from investors chasing performance, a sort of “What goes up must keep going up” attitude. The currencies appreciated, and countries began to buy more things from abroad while their industries were losing competitiveness. Current-account deficits began to soar, but that did not immediately matter because the capital was still coming in.

When the cycle turns, as it eventually must, investors who were clamoring to invest can suddenly demand to get out. How much a country is hurt may depend on what form that capital infusion took. Foreign direct investment, like building plants or buying local companies, cannot be quickly or easily reversed. But bank loans can fade away, and those who bought stocks on the local market can sell quickly. The worst problem can come from short-term debt to foreigners, who can get cold feet at the worst possible time. That is why capital controls can make sense when times are good. Countries that have easy access to loans may be better off not taking them. [..]

David A. Rosenberg, the chief economist at Gluskin Sheff, a Canadian research firm, looked at six indicators — large current-account deficits, large capital inflows from 2010 to 2012, relatively high levels of fixed investment, slowing economic growth, rising inflation and weak productivity growth.

He found eight countries that he considered vulnerable on at least four of those measures: Brazil, India, Indonesia, Turkey, Thailand, Taiwan, Russia and Malaysia. What, he asked, happened to all that capital that poured in? “One can reasonably draw the conclusion that, as we have seen time and again, the foreign capital inflow was squandered either on conspicuous consumption or noncompetitive investments,” he wrote.

The oil industry has a number of problems these days. The business model for Big Oil is essentially dead, due first of all to changes in energy return on investments – which crush profit margins – , and second to its own internal inertia. Once investors start clueing in on the problems, share prices could be hit badly. A number of large investors, such as foundations, are already withdrawing their money, under the motto “Either coal, oil and gas deposits become stranded assets, or we do.” While this may look good to the environment crew, be careful what you wish for. If we can’t manage to withdraw from oil, gas, coal in an orderly fashion, the ensuing brawls and battles may turn out to be extremely polluting. Just think back, once more, to the recent numbers on increasing German brown coal consumption.

• Big Oil Has Big Problems (Bloomberg)

In a way, the world’s major oil companies all suffer from some version of the same problem: They’re spending more money to produce less oil. The world’s cheap, easy-to-find reserves are basically gone; the low-hanging fruit was picked decades ago. Not only is the new stuff harder to find, but the older stuff is running out faster and faster.

Just to maintain production rates, oil companies have to race to find new reserves faster than the old ones dry up. That essentially puts them on a treadmill at which they must run faster just to keep pace—a horrible problem in any business. “It’s like feeding an elephant,” says Fadel Gheit, an energy analyst at Oppenheimer. “You can’t just give him a couple bags of peanuts. You have to find a truck load every day, just to keep him happy.”

As a result, oil majors are throwing massive amounts of cash at super-expensive mega-projects such as Shell’s LNG-producing “Monster ship” the Prelude, estimated to cost upwards of $12 billion. It takes years, if not a decade, for these kinds of projects to start producing, which leaves billions of dollars of invested capital not producing a return. The alternative is not investing at all and having the pipeline dry up—along with current production.

• Chevron follows Shell, Exxon Mobil profit slide. Is Big Oil in trouble? (CS Monitor)

Oil and gas production is booming in much of the world, but it’s not boosting Big Oil’s bottom line. As supplies of easily obtainable oil dwindle and prices remain flat, the world’s oil majors are getting less in return for the vast sums they invest on big, risky projects that don’t always pan out. Royal Dutch Shell and Exxon Mobil announced drops in fourth quarter profits Thursday. Chevron announced similar results Friday. [..]

More than a dozen major foundations announced Thursday they would join a small but growing fossil-fuels divestment movement. The Park Foundation, the Schmidt Family Foundation, and the Wallace Global Fund are among 17 foundations who said Thursday they would pull their combined $1.8 billion in assets out of oil, gas, and coal companies.

“The financial risks of staying invested in fossil fuels are high because two-thirds of proven fossil fuel reserves simply cannot be burned, yet the markets treat this basic physics like it is science fiction,” Tom Van Dyck, financial adviser at RBC US Wealth Management, said in a statement.“ Either coal, oil and gas deposits become stranded assets, or we do,” said Mr. Van Dyck, who advised several of the signatories to the initiative.

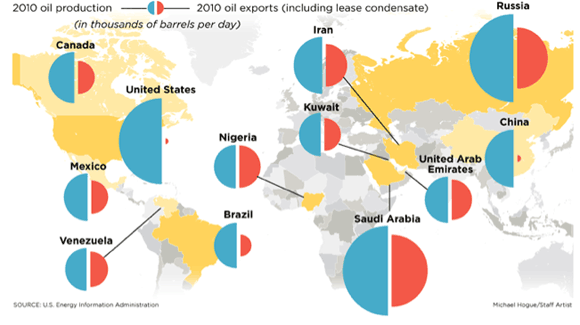

An almost comical battle in the oil industry is developing in the US, where Big – International – Oil fights for the same ideals as the green movement: lifting the 1970s ban on US oil exports. On the other side of the fence are SmallOil and the right wing. All of the above will soon find out that all of their assumptions have been way off, because US shale oil production is not even going to make it to 2020, but in the meantime at least it gives them something to do and makes them feel they’re being useful.

• A battle roils in US oil industry (Dallas News)

American crude now sells at a discount because of a massive surge in production in Texas and North Dakota. And if the export ban were lifted and drillers could sell on the global market, American crude prices would rise, many believe. A number of oil refiners in Texas and beyond, including Valero in San Antonio and Dallas-based HollyFrontier, are pushing back against lifting the ban on the grounds it will drive up not just their costs but motorists’ as well.

“It’s one piece of a much larger U.S. energy policy,” said HollyFrontier CEO Mike Jennings. “Our company understands the need for open commerce in creating wealth. We believe in free trade. But let’s not make one piece free and still have heavy regulation on other facets.”

Lining up against Texas refiners are the giants of the oil sector. Late last year, Exxon Mobil and the American Petroleum Institute, a trade group for the oil industry, came out in support of lifting the ban on the grounds that drillers in the U.S. were at a disadvantage to those operating in foreign countries. Even the trade group American Fuel and Petrochemical Manufacturers, which represents refineries, said it does not oppose opening up crude exports.

Michael Webber, deputy director of the University of Texas Energy Institute, points to a similar argument waged by the petrochemical industry over the export of liquefied natural gas. “I like to call it a four-way cage match. Producers on one side and consumers, like the chemical companies and refiners and we the public, on the other. It’s tough for the environmentalists. They do want energy prices to go higher, but do they want to be in bed with the oil companies? And then there’s the hawks. They want to keep the supply domestic. But depressing world oil prices would hurt Middle East countries,” he said. “No one really knows what to make of this whole new world.”

There was a time when Americans met in town squares and diners. Then they moved to malls. Now those are dying off. What will be left? Meeting on your phones?

• America’s Shopping Malls Are Dying A Slow, Ugly Death (BI)

All across America, once-vibrant shopping malls are boarded up and decaying. Traffic-driving anchors like Sears and JCPenney are shutting down stores, and mall owners are having a hard time finding retailers large enough to replace them. With a fresh wave of closures on the horizon, the problem is set to accelerate, according to retail and real estate analysts.

About 15% of U.S. malls will fail or be converted into non-retail space within the next 10 years, according to Green Street Advisors, a real estate and REIT analytics firm. That’s an increase from less than two years ago, when the firm predicted 10% of malls would fail or be converted. [..]

Within 15 to 20 years, retail consultant Howard Davidowitz expects as many as half of America’s shopping malls to fail. He predicts that only upscale shopping centers with anchors like Saks Fifth Avenue and Neiman Marcus will survive. “Middle-level stores in middle-level malls are going to be extinct because they don’t make sense,” said Davidowitz, chairman of Davidowitz & Associates, Inc. “That’s why we haven’t built a major enclosed mall since 2006.”

Big Ag, Monsanto and their ilk, has rewritten the US farm bill. Congratulations.

• A Farm Bill Only a Lobbyist Could Love (BusinessWeek)

On Jan. 27, House and Senate leaders announced what just a few months ago seemed impossible—a deal on a five-year, almost half-trillion-dollar farm bill. The legislation had languished for more than a year as Democrats and Republicans haggled over food stamps and crop subsidies. Two things broke the impasse: an unusual urban-rural alliance that hung together to preserve threatened programs; and lots (and lots) of money from lobbyists.

The legislation cuts food stamp spending by $8.6 billion over 10 years—a fifth of the $40 billion that Republicans wanted and that Democrats and food retailers fought to protect. Crop growers will lose $50 billion in subsidies over the next decade, including an end to the controversial direct payments program, which gave checks to some farmers regardless of financial need. Growers will get back about two-thirds of that lost spending in the form of enhanced crop insurance and other benefits.

“The great thing the ag coalition did was include inner-city and suburban food stamp recipients in addition to the more conservative farmers,” says Steve Bell, a former top Republican Senate budget aide and now senior director of economic policy at the Bipartisan Policy Center in Washington. “The combination of strong Republican advocates and Democratic food stamp advocates is unbeatable.” If the bill is signed into law (which seems likely by early February), it will conclude one of the toughest spending fights in almost two decades.

In all, groups pressing for the bill spent $150 million on lobbying in 2013, according to the Center for Responsive Politics, which tracks political spending. At least 350 companies and organizations, including Monsanto, PepsiCo, and Dean Foods, hired lobbyists in 2013 to work on the Senate’s farm bill. Only debates over the federal budget, immigration, and defense spending attracted more lobbying muscle, according to the center.

And this is just a nice story, a glimmer of common sense in world ruled by regulations shaped according profit principles instead of human interest.

• California Legalized Selling Home-Made Food, Created Over 1000 Local Businesses (Forbes)

Under the California Homemade Food Act, local governments cannot ban cottage food businesses based in private homes. Instead, home-based entrepreneurs can sell their goods after passing a “food processor course” (which can be done online), properly labeling their goods and practicing common-sense sanitation when cooking and baking. Those who want to start their own cottage food business legally need only register or obtain a permit, as either a Class A or Class B operation.

The two permits distinguish between the types of cottage food business an entrepreneur may want to run. Class A businesses are exempt from routine inspections, but can only engage in “direct sales,” i.e., straight to the customer. That includes farmers’ markets, bake sales and from the home business itself. Meanwhile, Class B operations require inspections, but also allow “indirect sales” to third-party retailers, like restaurants, bakeries, delis, groceries and food trucks.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 1 2014: Meanwhile Back Home The Thumbscrews Are Tightened