DPC R.H. Macy & Co, Herald Square, Broadway at 34th Street, NYC 1908

They could have given any other number, and it would have been just as believable and relevant. How does $5.6 trillion sound? Bit heavy, let’s do $3.8 trillion. Adjust your models accordingly. And then let’s play a round of golf.

• The IMF’s $3.8 Trillion Warning To The Fed (MarketWatch)

A rocky exit from low interest rates by the Federal Reserve risks $3.8 trillion of losses to global bond portfolios, the International Monetary Fund warned Wednesday in its latest global financial stability report. The IMF was at pains to emphasize that it’s not forecasting such losses, but it did point out that tightening in the past has been a key trigger for declines in fixed-income markets. The IMF came up with the $3.8 trillion figure by assuming a rapid adjustment that causes term premiums to go back to historic norms and credit risk premiums to normalize, with moves of 100 basis points each. That would trigger losses by more than 8%, which could “trigger significant disruption in global markets.”

The IMF also pointed to the low volatility term structure for the S&P 500, suggesting equities also may be underpricing the risk of higher volatility in the future. It’s these concerns that have led the Federal Reserve to increase their communication to the public, through quarterly press conferences as well as interest-rate and economic forecasts. Observers both inside and outside the Fed expect the first rate hike to occur in the middle of 2015. But there remains considerable debate over the pace of subsequent hikes. Meanwhile, while the IMF warned about the Fed lifting interest rates, they also note the risks of the Fed and other central banks keeping rates low for so long. The IMF pointed out that asset price appreciation, spread compression and record low volatility have occurred simultaneously across broad asset classes and countries.

Put ’em up, Calamity Janet.

• IMF Warns Ultra-Low Interest Rates Pose Fresh Crisis Threat (Guardian)

A prolonged period of ultra-low interest rates poses the threat of a fresh financial crisis by encouraging excessive risk taking on global markets, the International Monetary Fund has said. The Washington-based IMF said that more than half a decade in which official borrowing costs have been close to zero had encouraged speculation rather than the hoped-for pick up in investment. In its half-yearly global financial stability report, it said the risks to stability no longer came from the traditional banks but from the so-called shadow banking system – institutions such as hedge funds, money market funds and investment banks that do not take deposits from the public.

José Viñals, the IMF’s financial counsellor, said: “Policymakers are facing a new global imbalance: not enough economic risk-taking in support of growth, but increasing excesses in financial risk-taking posing stability challenges.” He added that traditional banks were safer after the injection of additional capital but not strong enough to support economic recovery. Viñals said the IMF had analysed 300 large banks in advanced economies, making up the bulk of their banking system. It found that institutions representing almost 40% of total assets lacked the financial muscle to supply adequate credit in support of the recovery. In the eurozone, this proportion rose to about 70%. “And risks are shifting to the shadow banking system in the form of rising market and liquidity risks,” Viñals said. “If left unaddressed, these risks could compromise global financial stability.”

At last. Let’s get some real prices.

• US Home Prices Headed For A Triple Dip (CNBC)

The headline for much of this year has been that home price gains are easing. Prices are still higher compared to last year, but not nearly as much as they had been. Now, suddenly, it looks as if home values could actually go negative on a national level. “That will be the first time collectively, as a nation, we’ve seen prices drop since the low point or the trough of the housing crisis,” said Alex Villacorta, vice president of research and analytics at data firm Clear Capital. Villacorta points to a 1% quarterly home price gain from the second to the third quarter of this year. Last year that quarterly gain was 3%. “The discouraging thing about that is, yes, we’re still in the positive, but that 1% has been waning from that three%, and this comes after what should have been the most active buying season in the housing market for the summer that just ended,” he added.

The West, which has some of the largest metropolitan markets in the nation, has seen a huge drop in distressed sales, as fewer properties go to foreclosure. At their peak in 2009, just over half of all sales in the West were of distressed properties; today that share is just over 12%, according to Clear Capital. Investors, consequently, are moving on to other markets in the South and Midwest, where there are still bargains to be had. The West is therefore seeing sharper drops in home price appreciation. “And that is why the West is really that leading indicator, the canary in the coal mine, because as the West goes, both on the downturn and in the recovery,we’ve seen the rest of the country go as well,” said Villacorta.

Pretty useless ‘analysis’. Is Saudi battling America? I wouldn’t be so sure. There might be something else going on.

• Can Saudis Beat North Dakota In An Oil Price War? (MarketWatch)

With oil prices tumbling — and dragging gasoline prices at U.S. pumps further below $4 a gallon — investors wonder if Saudi Arabia will cut production in an effort to stop the slide. Don’t count on it. In a note, commodity strategists led by Seth Kleinman at Citi argue that the Saudis aren’t likely to throttle back output, in part because they apparently “think that they can win any price war” with U.S. shale producers. In other words, Saudi producers are playing a long game, confident that “full cycle” shale production costs are considerably more than their own. As Julian Jessop, head of commodities at Capital Economics points out, there is precedent. Saudi Arabia responded to a glut of non-OPEC oil in the latter half of the 1980s by increasing its own output, successfully eroding the profitability of other producers, including those in the North Sea, he said.

Oil futures remained under pressure Wednesday, with the price of light, sweet crude for November delivery on the New York Mercantile Exchange falling $1.54, or 1.7%, to $87.31 a barrel, hitting the lowest price for a most-active contract since April 2013 after data showed a further rise in U.S. crude supplies. ICE November Brent crude futures fell 58 cents, or 0.6%, to $91.53 a barrel, setting a two-year low. Saudi Arabia earlier this month cut the official selling price for its crude, according to news reports, a move that put additional pressure on oil prices at the time. The Citi analysts say the Saudis might be right to think they can win a price war, but only up to a point.

What if they built a pipeline and nobody came?

• The Keystone Killer the Enviros Didn’t See Coming (Bloomberg)

When it comes to oil, U.S. is king. Discoveries in North Dakota and Texas have pushed American oil production past Saudi Arabia and Russia this year. The new supplies have boosted the economy and dialed down the price of oil everywhere – gasoline at $3 a gallon anyone? The price of oil has fallen so low it’s threatening the feasibility of controversial and expensive drilling projects proposed in the Canadian Oil Sands and the Arctic. West Texas Intermediate, the U.S. benchmark for crude, is going for less than $90 a barrel. That’s approaching the break-even point for profitability at many of the very wells driving the American oil boom.

“If prices go to $80 or lower, which I think is possible, then we are going to see a reduction in drilling activity,” Ralph Eads, vice chairman and global head of energy investment banking at Jefferies LLC, told Bloomberg News reporter Isaac Arnsdorf. “It will be uncharted territory.” At the current price of about $87 a barrel, cheap American crude undercuts many of the most aggressive oil projects under consideration by the oil majors. About $1.1 trillion of capital expenditures have been earmarked through 2025 for projects that require a market price of more than $95 a barrel, according to a May study by the Carbon Tracker Initiative, a London-based think tank and environmental advocacy group.

No, the US will.

• Will China Spark a Currency War? (Bloomberg)

Is China about to devalue? The question seems to pop up everywhere I go – most recently in Frankfurt, Sydney and New York. Economists here in Tokyo, too, are buzzing about the chances of a big decline in the yuan in the next few months. A new report from Lombard Street Research explains why all these folks may have reason for concern. According to London-based Charles Dumas, China’s slowdown will soon drag down gross domestic product growth below 5% (whether Beijing admits it or not). Dumas joins long-time Asia investor Marc Faber in thinking China will find itself in the 4% range by year end. A continued downtrend, Dumas says, would represent “a major, slow-motion shock for the world economy and financial markets” that will slam everything from commodities to growth rates from Japan to Germany.

Growth significantly below Beijing’s 7.5% target also complicates President Xi Jinping’s efforts to shift China to a services-based economy from an export-and-investment-led one. The obvious solution: a weaker exchange rate that boosts exports and thus buys Xi time to recalibrate growth drivers. While Chinese leaders aren’t dropping clear hints of a devaluation, it’s a logical next step. Even before the 2008 global crisis, Lombard Street says, capital spending in China had already reached an unsustainable 42% of GDP. Then the regime responded to the crisis with an unprecedented investment surge, beginning with a $651 billion stimulus package in 2009. By the end of that year, capital spending had jumped to 48% – where it remained until last year. It’s simply not possible for an economy that carries a consumer-spending ratio of about 36% to thrive long-term with an investment ratio on the cusp of 50%.

Since the crisis, Chinese corporate debt has also reached $14.2 trillion, topping that of the U.S., according to Standard & Poor’s. Recently, China’s central bank set out to measure activity in China’s $6 trillion shadow banking industry, implying that officials worry it’s even bigger than we know. And while estimates of the true size of liabilities facing local governments differ widely, roughly $1.65 trillion of their debt is already held by major banks, including Industrial and Commercial Bank of China and China Construction Bank. Borrowing more to gin up growth isn’t an option for a highly-indebted developing nation. Debt must be reduced.

Ambrose wants you to spend! He also says France will overtake Germany soon because of the birthrate.

• German Model Is Ruinous For Germany, And Deadly For Europe (AEP)

The German economy has already stalled. Output contracted in the second quarter. Factory orders fell 5.7pc in August. Germany’s “Five Wise Men” council of economic experts will slash the country’s growth forecast to 1.2pc next year in a report on Friday. Prof Fratzscher accuses Germany’s elites of losing the plot in every important respect. Investment has fallen from 23pc to 17pc of GDP since the early 1990s. Net public investment has been negative for 12 years. Growth has averaged 1.1pc since the beginning of the decade, placing Germany 13th out of 18 in the eurozone (or 156th out of 166 countries worldwide over the past 20 years). This chronic weakness been masked by slightly better growth since the Lehman crisis, and by the creditor-debtor dynamics of the EMU debt crisis. German looks healthy only because half of Europe looks deathly. The Hartz IV reforms – so widely praised as the foundation of German competitiveness, and now being foisted on southern Europe – did not raise productivity, the proper measure of labour reform.

Data from the OECD show that German productivity growth slumped to 0.3pc a year in the period from 2007 to 2012, compared with 0.5pc in Denmark, 0.7pc in Austria, 0.9pc in Japan, 1.3pc in Australia, 1.5pc in the US and 3.2pc in Korea. Britain has been negative, of course, but that is no benchmark. Prof Fratzscher says the chief effect was to let companies compress wages through labour arbitrage. Real pay has fallen back to the levels of the late 1990s. The legacy of Hartz IV is a lumpen-proletariat of 7.4m people on “mini-jobs”, part-time work that is tax-free up to €450. This flatters the jobless rate, but Germany has become a split society, more unequal than at any time in its modern history. A fifth of German children are raised in poverty. Philippe Legrain, a former top economist at the European Commission, says Germany’s “beggar-thy-neighbour economic model” works by suppressing wages to subsidise exports, to the benefit of corporate elites. This is “dysfunctional”, and the more that EU officials try to extend the model across the eurozone, the more dangerous it becomes.

The numbers keep coming in bad.

• German Exports Plunge 5.8%, Most Since 2009, as Economy Stumbles (Bloomberg)

German exports slumped the most since January 2009 in the latest sign Europe’s largest economy is struggling to rebound from its second-quarter contraction. Exports dropped 5.8% in August, after a 4.8% increase in July, the Federal Statistics Office in Wiesbaden said today. Economists surveyed by Bloomberg News predicted a decline of 4%. While the typically volatile data was influenced by the timing of German school holidays in late summer, it still depicts an economy that is stumbling as the euro-area recovery grinds to a halt. The European Central Bank has added unprecedented stimulus to try to revive inflation and economic growth in the 18-nation currency bloc.

German imports declined 1.3% in August, after dropping 1.4% in July, today’s report showed. The country’s trade surplus narrowed to €14.1 billion ($18 billion) from a record €23.5 billion. The current account surplus shrank to €10.3 billion from €20.1 billion. German gross domestic product fell 0.2% in the three months through June. Data earlier this week showed factory orders and industrial production each declined by the most since January 2009 in August.

Power battle between France and Germany.

• Hollande Falls Into Line as Merkel Fends Off EU Spending (Bloomberg)

German Chancellor Angela Merkel sidestepped French President Francois Hollande’s call to use stimulus measures to counter Europe’s faltering recovery, saying investments need to be carefully considered. With Germany’s economy slowing, France barely growing and Italy in its third recession since 2008, Hollande arrived at a jobs summit in Milan yesterday saying Germany should “do more to support demand” and that the European Union as a whole should provide €20 billion ($25 billion) to support joblessness over six years. Barely four hours later Merkel shied away from any commitment and Hollande fell into line. “We need to invest, yes, but we need to know where to invest, we need to know where the jobs are,” Merkel said. “We need to know what the professions of the future are. In the whole digital area I see the opportunities for the future. That’s where we should train people.”

Hollande and Italian Prime Minister Matteo Renzi want the European Union to use flexibility in its budget rules in the face of slowing growth and are pushing for the bloc to spend more creating jobs for the one in five young people who are out of work. Currently €6 billion has been set aside for the issue in 2014 and 2015. “I’d like to see more by 2020,” Hollande said. “If Europe can’t provide opportunities for the young, then people will turn away from Europe,” he said. France and Italy are also under pressure as lack of growth distances them from deficit-cutting commitments made earlier in the year. France now expects its budget deficit to rise this year for the first time in half a decade and doesn’t see the shortfall shrinking to the EU limit of 3% of gross domestic product before 2017. Italy has pushed back its plan to achieve a structural balance to next year from this year.

After lobbying for more EU spending on job creation on the way into yesterday’s meeting, Hollande echoed Merkel’s view that existing funds must spent first as he sat alongside her at the press conference afterward. “I’d like to see more by 2020, I’ve spoken of €20 billion, but before we must see these sums are spent,” he said. “We need simplification and speeding up of this disbursement.” Euro-area countries including France and Italy have until Oct. 15 to submit their 2015 budgets to the European Commission under the region’s fiscal rules. The commission will have to then judge their plans and decide whether governments have made sufficient efforts or need to be prodded to do more. The 3% limit was “conceived more than 20 years ago, in a different world,” Renzi said. “I respect the decisions of other countries such as France today or Germany in the past with a different government to breach the limit,” adding that Italy will meet its target all the same to bolster its credibility.

Better leave now, Mario.

• Draghi Policies Blunted in Berlin as German Protests Grow (Bloomberg)

Mario Draghi’s policy tools are being blunted in Berlin. The European Central Bank president has stopped short of large-scale sovereign-bond purchases as efforts to mollify Germany’s political elite do little to silence criticism of his ever-more expansionary measures. Support for anti-euro groups such as Alternative for Germany has risen and the ECB’s latest plan to buy assets sparked an outcry within all major parties. “German public opinion matters an awful lot,” said Anatoli Annenkov, senior economist at Societe Generale SA in London. “Draghi wants the ECB to be a central bank like any other, one that can go and buy government debt. But he’s perfectly aware of Germany’s opposition, and the storm now is a clear signal that it’ll be much more difficult.” Draghi may be pressured at the International Monetary Fund meetings in Washington this week to take further measures to revive the 18-nation currency bloc’s recovery.

That won’t be easy in the face of a German aversion to quantitative easing that is rooted in the 1920s, when money-printing laid the foundation for a society that still fears rising prices more than deflation. The debate over sovereign-debt purchases will be raised again on Oct. 14 when the European Union’s highest court hears arguments about the ECB’s still-unused OMT program. Germany’s Federal Constitutional Court has already expressed doubts about the legality of the two-year-old pledge to buy bonds of stressed countries after a challenge by a German lawmaker and a group of academics.

The German ‘Strongman’ went home. And he’s going to stay there.

• Where Did The German ‘Strongman’ Go? (CNBC)

This week’s disappointing German manufacturing data are the latest sign the “strongman” of Europe is weakening, in what could mark a worrying turn for the rest of Europe. Tuesday’s industrial output numbers for Germany missed forecasts, with production slowing by 4% month-on-month in August. German factory orders, out on Monday, also showed a steep—and unexpected—decline. “The data from Germany is persistently dreadful,” said Societe Generale’s Kit Juckes in a note on Wednesday. The warning comes after the International Monetary Fund (IMF) cut Germany’s growth outlook for this year and next on Tuesday. It now sees the economy growing by 1.4% in 2014 and 1.5% in 2015. This is better than the euro zone average, but below peers like the U.K., where the economy is expected to expand by 3.2% this year and 2.7% next.

Here we take a look at some of the reasons why Germany could be losing its economic clout: France has criticized Germany for hoarding cash rather than using it to stimulate domestic demand, which could help boost growth throughout the euro zone. “Germany must fulfil its responsibilities,” French Prime Minister Manuel Valls declared at a policy meeting last month. Now, some economists say the zealous fiscal prudence exercised by Chancellor Angela Merkel and colleagues is harming Germany, as well as its neighbors. “The figures should provide something of a wake-up call to those in the German government still resisting calls to loosen the fiscal reins and provide the euro zone’s biggest economy with more support,” said Jonathan Loynes, chief European economist at Capital Economics, in a note on Wednesday.

Sure, let’s turn to the rich to solve our problems.

• ‘Bad Choices’ Have Put French Economy Under Pressure, Says EDF Boss (TiM)

One of France’s leading businessmen has admitted the economy is ‘under pressure’ and lashed out against high taxes. Henri Proglio is the chairman and chief executive of EDF, the French energy giant with more than 150,000 employees worldwide. He was speaking as EDF received approval from the EU for its nuclear power plants at Hinkley Point in Somerset. Brussels revealed the price of the work has risen to £24.5billion from the projected £16billion once debt financing is included. It could rise to as high as £34billion in a worst-case scenario. Proglio’s comments on the French economy come only days after John Lewis boss Andy Street said that France was ‘finished’ because it is ‘sclerotic, hopeless and downbeat’.

The French Prime Minister Manuel Valls, on an official trip to Britain, subsequently responded to the comments by suggesting that the John Lewis chief had ‘drunk too much beer’. Speaking yesterday, Proglio said: ‘France today is in a poor situation. It’s a country under pressure.’ He admitted that France ‘made some bad choices for a few years’ that have led to ‘overtaxation’. He added: ‘It’s not a brilliant situation.’ He said the country should be ‘forced’ to slash government spending – currently at more than 50 per cent of GDP – and ‘drive more investment’.He said: ‘It’s too easy to say today France is doing bad, because it’s obvious. ‘How can you make it better? This is the point.’

I’m bad, but you’re worse.

• ‘France Is Doing Badly, But German Energy Sector Is A Disaster’ (Telegraph)

France’s economy may be doing badly but Germany’s energy sector is a “disaster”, the head of French state-owned energy company EDF has said. Henri Proglio, EDF chief executive, acknowledged his country was “in a poor situation” and “under pressure”. But he said different industries should be considered in their own right, highlighting the German energy sector, where the country’s phase-out of nuclear power and drive for renewables has severely damaged its two biggest companies. “When it comes to energy they are in a disaster. Their two major companies – E.On and RWE – are under huge pressure. One is more or less dead, the other one is in a very difficult situation,” he said. By contrast, he said EDF was doing “quite well” and the French aerospace industry was “number one in the world”.

Mr Proglio was speaking after his company was granted EU state aid approval to build Britain’s first new nuclear plant in a generation at Hinkley Point in Somerset. “It’s too easy to say today France is doing bad, because it’s obvious,” he said, adding attention should focus on “how can you make it better”. “On the fiscal point of view, France, in my view, made some bad choices for a few years. Over-taxation is very negative for the country,” he said. “On the other hand, we have some very good companies.” Mr Proglio said it was “very important to consider industry as a key driver for growth”. “You have to force a country to make some improvements in overheads, public overheads and to drive more investment.” Earlier this week French Prime Minister Manuel Valls admitted the country’s economic growth had been in “long breakdown” but insisted that his government was “pro-business”.

Paul Massara, the head of RWE’s UK supply business npower, did attack the Hinkley Point subsidy deal, suggesting it was poor value for consumers. “We recognise the need for Britain to have modern, efficient energy infrastructure with a diverse mix of technologies, but this must happen at the lowest possible cost to the consumer. “We are concerned that today’s decision around guaranteed revenue from new nuclear power stations in return for their delivery could force the next three generations of British consumers to pay unnecessarily high energy bills,” he said.

“We have already lost, under the euro, one decade because of these enormous capital flows into users in southern Europe which were not so productive and we will lose another decade if we don’t act … ”

• Europe In Danger Of Another ‘Lost Decade’: Ifo’s Sinn (CNBC)

If euro zone countries like France do not complete vital structural reforms, the currency union faces another “lost decade,” Hans-Werner Sinn, president of the Munich-based Ifo Institute, told CNBC. Rather than the breakup of the single currency, Sinn warned that the euro zone will see another prolonged period of stagnation with weak growth unless countries can boost productivity and complete tough rebalancing programs. “We have already lost, under the euro, one decade because of these enormous capital flows into users in southern Europe which were not so productive and we will lose another decade if we don’t act,” he told CNBC on Thursday.

The euro zone’s main problem over the last decade has been that savings have been shifted into southern European nations that have “eaten up” that capital rather than using it to increase productivity in their economies, he said. He now believes that struggling southern European nations should undergo painful devaluation in order for them to grow again. So, instead of continuing to borrow at low interest rates through the current period of low growth and low inflation, Sinn says that painful reforms need to be implemented. “If you take the pain anyway it won’t happen,” he said.

With unemployment numbers like Greece has, this sounds like nonsense.

• Samaras ‘Fully Comfortable’ Seeking Early Exit for Greece (Bloomberg)

Prime Minister Antonis Samaras said he aims to sever the international lifeline that has kept Greece afloat since 2010 by forgoing disbursements of emergency loans scheduled over the next two years. “We feel fully comfortable” that Greece can cover its financing needs from the bond markets in the coming years, Samaras, 63, said in an interview in Milan yesterday after a European Union summit. An improvement in public finances and low interest rates have emboldened Samaras, who said the Greek parliament will discuss the end of aid from the euro area and International Monetary Fund, which have granted the country €240 billion ($306 billion) in bailout loans, in a confidence-vote debate scheduled to run through tomorrow. Greek bonds are the best-performing securities in the Bloomberg indexes this year, having earned 20% through yesterday.

The yield on 10-year debt fell as low 5.52% on Sept. 8, the lowest since early 2010. Even after a sell off in the past month, that compares to a record high of 44% in March 2012, on the eve of the world’s biggest-ever debt restructuring. Samaras’s confidence contrasts with fellow euro-area and IMF officials, who insist Greece should retain access to bailout funds next year. The prevailing view among those officials is that Greece’s market access remains fragile, according to two people directly involved in the negotiations. European Central Bank President Mario Draghi weighed into the debate last week, saying the country needs to remain in some kind of program for Greek banks’ junk-rated asset-backed securities to be eligible for the ECB’s ABS purchase program. The bailout loans came with belt-tightening conditions that exacerbated a six-year Greek recession, left more than a quarter of the workforce jobless and triggered a social backlash. Aid next year would also come with strings attached.

“A plan by the Swedish Bankers’ Association to require borrowers to pay down new loans to 50% of property values may be enough”. Sounds like trouble for borrowers.

• Banks in Sweden Beat Regulator With Plan to Cut Record Debt Load (Bloomberg)

Sweden’s financial regulator may not push ahead with formal rules on amortization after the country’s banks presented a proposal targeting a reduction in mortgage debt. A plan by the Swedish Bankers’ Association to require borrowers to pay down new loans to 50% of property values may be enough, Martin Andersson, head of the Swedish Financial Supervisory Authority, said yesterday in a phone interview. If banks “present a proposal that’s very similar to what we ourselves think is a very good proposal it’s absolutely a conceivable alternative,” he said. Banks can implement such a plan quicker and it provides “the flexibility needed for particularly vulnerable households that for a period of time are unemployed, or sick, or whatever it may be that makes it hard to amortize,” Andersson said.

Sweden is trying to stem an increase in private debt that has soared to record levels while protecting the most vulnerable households from new requirements. Finance Minister Magdalena Andersson, Riksbank Deputy Governor Cecilia Skingsley and Klas Danielsson, chief executive officer of state-owned bank SBAB, have urged policy makers to exempt some demographic groups from amortization requirements. The Bankers’ Association this week proposed new guidelines that would force homeowners to pay down their mortgage debt to 50% of property values after lowering it to 70% from 75% in March. The group said it hopes the measure aimed at fostering a better amortization culture will prevent the regulator from introducing formal legislation.

Let’s cheer?!

• Brussels Backs New UK Nuclear Plant As Cost Forecasts Soar (FT)

Britain won EU approval for a new nuclear power plant in Somerset on Wednesday, allowing the government to commit to 35 years of financial support for Europe’s biggest and most controversial infrastructure project. Hinkley Point C will cost £24.5bn to build, EU officials revealed – a much higher figure than the £16bn disclosed last year by EDF, the French utility running the project. The lower figure was in 2012 prices and excluded interest payments made during construction and other pre-building costs, said EDF. Joaquín Almunia, the EU competition commissioner, said the project’s total costs would be about £34bn, including cash the developers had to show they could come up with in the event of problems during construction.

Formal state aid approval from the European Commission, on the condition of some minimal revisions, came after a deeply divided debate that led to four EU commissioners voting against the decision. Mr Almunia said the final decision had been taken, despite initial doubts, because the UK had shown there was a “genuine market failure” which meant that “without public support this investment could not take place”. “This decision will not create any kind of precedent,” he added, describing Hinkley Point as a project of “unprecedented nature and scale”.

Another baseload issue.

• Japan Solar Boom Fizzling as Utilities Limit Grid Access (Bloomberg)

Japan’s solar energy boom is starting to fizzle after two years of rapid expansion left utilities saying they’re unable to accept electricity from so many new sources that generate power only when the sun shines. At least five of the nation’s biggest utilities are restricting the access of new solar farms to their grids. Struggling to compensate for nuclear shutdowns after the Fukushima reactor meltdowns, the government of Prime Minister Shinzo Abe offers some of the highest incentives for solar in the world. That’s helped make Japan the second-biggest market for photovoltaic panels, providing an alternative to downturns in Germany and Spain, nations that once led the industry. “Everyone was entering the solar market because it was lucrative, and that has strained the market,” said Yutaka Miki, who studies clean energy at the Japan Research Institute.

Japan’s trade ministry has approved plans for about 72 gigawatts of renewable energy projects since July 2012. The country installed almost 7.1 gigawatts of solar capacity last year, more than currently exists in all of Spain, according to Bloomberg New Energy Finance. A gigawatt is about the size of a nuclear reactor. Japan’s investment in the technology more than tripled to $29.6 billion in 2013 from 2010 levels, data from London-based BNEF show. Kyushu Electric Power, which supplies power to the southern island of Kyushu, said in late September that it will suspend giving new grid access to clean-energy producers while examining how much more capacity it can take on. The question is whether Japan’s grid can handle intermittent power deliveries from solar systems that only generate when the sun is shining.

What good is this going to do?

• U.S. to Check Temperatures of West Africa Passengers at Five Airports (WSJ)

\The U.S. plans to start checking the temperatures of passengers arriving at major airports from West African countries with high rates of Ebola, federal officials said Wednesday. The measure is part of a growing list of steps aimed at detecting travelers infected with the disease to stop it from spreading inside the U.S. Authorities plan to start the new screenings at John F. Kennedy International in New York on Saturday. Next week, they’ll add it at O’Hare International in Chicago, Hartsfield-Jackson International in Atlanta, Washington Dulles International near Washington, D.C., and Newark Liberty International in Newark, N.J. Authorities said more airports may follow.

After their passports are reviewed, passengers arriving from Liberia, Guinea and Sierra Leone will be pulled aside to a separate screening area where U.S. Customs and Border Protection staff will question them about their health and exposure to Ebola, take their temperature with an infrared thermometer and collect their contact information in the U.S. If that screening suggests exposure to the disease, an officer from the Centers for Disease Control and Prevention will evaluate the traveler more, take his temperature again and decide whether the person needs to be taken to a hospital or be monitored by local health authorities. Coast Guard medical staff could also be involved in the screenings, according to a person briefed on the plans. “These measures are really just belt-and-suspenders,” President Barack Obama said in a conference call with state and local officials. “It’s an added layer of protection on top of the procedures already in place at several airports.”

Real economics. And real scary too.

• Kondratieff Winter: The Consequences of the Economic Peace (Grant Williams)

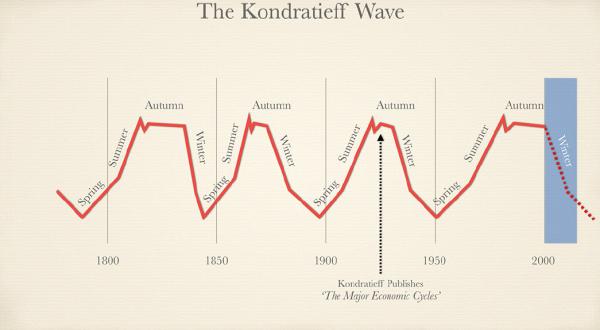

In 1920, a year AFTER the Treaty of Versailles, a Russian economist called Nikolai Kondratieff founded something he named The Institute of Conjuncture, at which he and a team of fellow economists studied, yes, conjuncture — or business cycles, with a particular focus on the long waves they identified within those cycles. Over the years since Kondratieff first laid out his theory on long-wave cycles, a tremendous debate has ensued as to the usefulness of such long-term prognostication; but there is one very good reason why I (and many others) believe there to be a significant advantage gained through the study of long-wave cycles… (Wikipedia: Long-wave theory is not accepted by most academic economists.)

Kondratieff, being a Russian, of course took the long view. He took Schumpeter’s four stages (expansion, crisis, recession, and recovery) and equated them to the four seasons in a year. Once he had identified what he felt to be the length of each “Spring,” “Summer,” “Autumn,” and “Winter,” Kondratieff had his “Wave;” and, as it turned out, that Wave ran for approximately 53 years. In 1925, when he published his book The Major Economic Cycles, using existing data, Kondratieff overlaid his wave on world history and projected it forward — meaning that everything for the 89 years that followed was conjecture on his part… How’d he do? Well, as it turns out, surprisingly well. Kondratieff nailed far too many major turns to have his work simply dismissed, and his most recent turn into Winter occurred in 2000 or, for those of you who measure the passing of time by such things, precisely at the bursting of the tech bubble.

The blue shaded area shows how far into the current Kondratieff downwave we are and — far more importantly — how much farther we have to go before things are supposed to turn around. But what do the inner workings of a Kondratieff Winter look like? And are we in the middle of one, as a nearly 90-year-old forecast would have us believe? Like Schumpeter’s cycles, the four seasons in a Kondratieff Wave are broken down and characterised by the phenomena usually seen during each specific phase of the full cycle. I won’t go through all four seasons now, as we don’t have time, but rather we’ll focus on the longest phase — Winter — as it’s the one we find ourselves mired in.

Home › Forums › Debt Rattle October 9 2014