Dante Gabriel Rossetti Monna Vanna 1866

6 days to April 12. May can’t offer Labour anything the Brexiteers don’t want. And vice versa. Thing is, that was obvious 3 years ago.

The problem is not the idea of Brexit, it’s purely the execution.

• Cross-Party Talks Fail As Labour Says May Unable To Compromise (G.)

Theresa May’s prospects of cobbling together a cross-party majority to convince EU leaders to grant a short Brexit delay next week appear to be slipping away after Labour claimed she had failed to offer “real change or compromise” in talks. The prime minister made a dramatic pledge to open the door to talks with Labour on Tuesday after a marathon cabinet meeting. But after two days of negotiations and an exchange of letters on Friday, Labour issued a statement criticising the prime minister for failing to offer “real change or compromise”.= “We urge the prime minister to come forward with genuine changes to her deal in an effort to find an alternative that can win support in parliament and bring the country together,” a spokesperson said.

The pessimistic note came after May wrote to the European council president, Donald Tusk, on Friday morning, asking for Brexit to be delayed until 30 June, while cross-party talks continue. Even before Labour’s statement, EU politicians responded with bemusement to her failure to offer a concrete plan for assembling a coalition behind a workable deal – increasing the risk that they will take a tough line at next Wednesday’s summit. May’s letter suggested that the UK was preparing to field candidates in European parliamentary elections on 23 May if no deal could be reached.

Don’t be surprised if one country just says NO. Or more than one. For a new extension, May will need a new plan. She has none.

• France, Spain and Belgium ‘Ready For No-Deal Brexit Next Week’ (G.)

France has won the support of Spain and Belgium after signalling its readiness for a no-deal Brexit on 12 April if there are no significant new British proposals, according to a note of an EU27 meeting seen by the Guardian. The diplomatic cable reveals that the French ambassador secured the support of Spanish and Belgian colleagues in arguing that there should only be, at most, a short article 50 extension to avoid an instant financial crisis, saying: “We could probably extend for a couple of weeks to prepare ourselves in the markets.” The chances of Theresa May’s proposal of an extension to 30 June succeeding appeared slim as France’s position in the private diplomatic meeting was echoed by an official statement reiterating its opposition to any further Brexit delay without a clear British plan.

May wrote to the president of the European council, Donald Tusk, on Friday to ask for the delay until 30 June while she battles to win cross-party agreement on a way forward. EU states are extremely sceptical that an extension to 30 June will resolve anything in Westminster. Tusk is pushing the EU to offer at a summit next Wednesday what he has described as a “flextension” in which the UK would be given a year-long extension with an option to come out early if the deal is ratified.

“Mr. Mueller produced a brief of arguments pro-and-con about obstruction for others to decide upon. In doing that, he was out of order, and maliciously so.”

Having disgraced themselves with full immersion in the barren RussiaGate “narrative,” the Resistance is now tripling down on RussiaGate’s successor gambit: obstruction of justice where there was no crime in the first place. What exactly was that bit of mischief Robert Mueller inserted in his final report, saying that “…while this report does not conclude that the President committed a crime, it also does not exonerate him?” It’s this simple: prosecutors are charged with finding crimes. If there is insufficient evidence to bring a case, then that is the end of the matter. Prosecutors, special or otherwise, are not authorized to offer hypothetical accounts where they can’t bring a criminal case. But Mr. Mueller produced a brief of arguments pro-and-con about obstruction for others to decide upon.

In doing that, he was out of order, and maliciously so. Of course, Attorney General Barr took up the offer and declared the case closed, as he properly should where the prosecutor could not conclude that a crime was committed. One hopes that the AG also instructed Mr. Mueller and his staff to shut the fuck up vis-à-vis further ex post facto “anonymous source” speculation in the news media. But, of course, the Mueller staff — which inexplicably included lawyers who worked for the Clinton Foundation and the Democratic National Committee — at once started insinuating to New York Times reporters that the full report would contain an arsenal of bombshells reigniting enough suspicion to fuel several congressional committee investigations.

The objective apparently is to keep Mr. Trump burdened, hobbled, and disabled for the remainder of his term, and especially in preparation for the 2020 election against whoever emerges from the crowd of lightweights and geriatric cases now roistering through the primary states. It also leaves the door open for the Resistance to prosecute an impeachment case, since that is a political matter, not a law enforcement action. This blog is not associated with any court other than public opinion, and I am free to hypothesize on the meaning of Mr. Mueller’s curious gambit, so here goes: Mr. Barr, long before being considered for his current job, published his opinion that there was no case for obstruction of justice in the RussiaGate affair. By punting the decision to Mr. Barr, Mr. Mueller sets up the AG for being accused of prejudice in the matter — and, more to the point, has managed to generate a new brushfire in the press.

Investigate the road the Steele dossier traveled. Might be all you need.

• The Russian Collusion Hoax Meets An Unbelievable End (Nunes)

It is astonishing that intelligence leaders did not immediately recognize they were being manipulated in an information operation or understand the danger that the dossier could contain deliberate disinformation from Steele’s Russian sources. In fact, it is impossible to believe in light of everything we now know about the FBI’s conduct of this investigation, including the astounding level of anti-Trump animus shown by high-level FBI figures like Peter Strzok and Lisa Page, as well as the inspector general’s discovery of a shocking number of leaks by FBI officials.

It’s now clear that top intelligence officials were perfectly well aware of the dubiousness of the dossier, but they embraced it anyway because it justified actions they wanted to take – turning the full force of our intelligence agencies first against a political candidate and then against a sitting president. The hoax itself was a gift to our nation’s adversaries, most notably Russia. The abuse of intelligence for political purposes is insidious in any democracy. It undermines trust in democratic institutions, and it damages the reputation of the brave men and women who are working to keep us safe. This unethical conduct has had major repercussions on America’s body politic, creating a yearslong political crisis whose full effects remain to be seen.

Having extensively investigated this abuse, House Intelligence Committee Republicans will soon be submitting criminal referrals on numerous individuals involved in these matters. These people must be held to account to prevent similar abuses from occurring in the future. The men and women of our intelligence community perform an essential service defending American national security, and their ability to carry out their mission cannot be compromised by biased actors who seek to transform the intelligence agencies into weapons of political warfare.

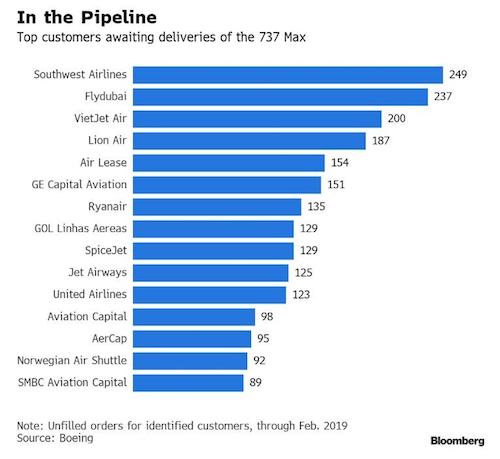

The only thing they talk about is software. But if anything goes wrong, these people will be guillotined.

• Boeing Slashes 737 Production By 20% (ZH)

Just a few hours after Ethiopian Airlines warned of a “stigma” associated with the 737 Max that may make them choose not to take delivery of the planes they ordered, Boeing has released a statement after-hours that the company will slash production of the 737 plane from 52 to 42 airplanes per month. Bloomberg reports that Boeing plans to coordinate with customers and suppliers to blunt the financial impact of the slowdown, and for now it doesn’t plan to lay off workers from the 737 program. “When the Max returns to the skies, we’ve promised our airline customers and their passengers and crews that it will be as safe as any airplane ever to fly,” Boeing Chief Executive Officer Dennis Muilenburg said in a statement Friday after the market close.

Boeing had planned to hike output of the 737, a workhorse for budget carriers, about 10 percent by midyear, to meet the backlogs. [..] if the issues are not resolved in a timely manner and production of the 737 MAX needs to be halted for an extended period of time, it would take about 0.15% off the level of GDP, or about 0.6%-point off the quarterly annualized growth rate of GDP in the quarter in which production is stopped. [..] the value of total shipments of aircraft by domestic producers in the US totaled $129 billion in 2016. Extrapolating that figure using monthly shipments data by the aircraft and parts industry implies a similar figure for 2018, around $130 billion.

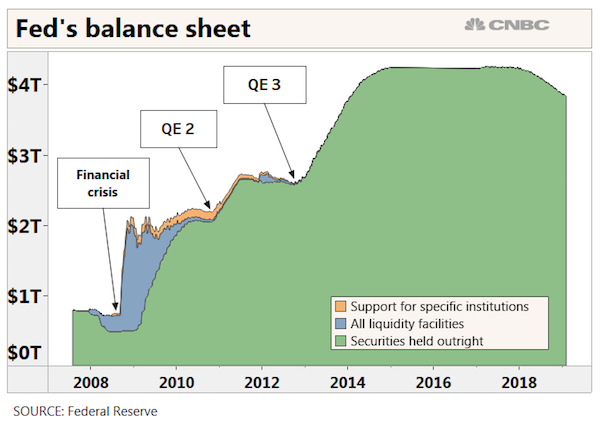

End the Fed.

• Trump Says Economy Would Take Off Like ‘A Rocket Ship’ If Fed Cut Rates (CNBC)

President Donald Trump said Friday the U.S. economy would climb like “a rocket ship” if the Federal Reserve cut interest rates. Commenting after a strong jobs report for March, Trump said the Fed “really slowed us down” in terms of economic growth, and that “there’s no inflation.” “I think they should drop rates and get rid of quantitative tightening,” Trump told reporters, referring to the Fed’s policy of selling securities to unwind its balance sheet, a stimulus put in place during the financial crisis. “You would see a rocket ship. Despite that we’re doing very well.” White House aides have called for the Fed to cut interests rates by as much as 50 basis points. Following the Fed’s most recent meeting in March, the central bank decided to maintain interest rates and hold off on any further increases this year.

As Trump’s chief economic adviser Larry Kudlow did on Friday, Federal Reserve Chairman Jerome Powell highlighted the slowing global economy. “We’re facing a worldwide slowdown [as] Europe is not doing well,” Kudlow said on Bloomberg TV. But unlike the White House, the Fed did not conclude in March that slowing global growth means the bank should begin cutting rates. Trump has been heavily critical of Powell’s decisions at the Fed, going as far as to say that “the Fed has gone crazy” with raising rates. Trump has blamed Powell’s decision-making for drops in the stock market, calling him “loco” for steadily raising rates in 2018 and saying choosing Powell for Fed chairman was the worst mistake of his presidency,

Capitalism needs capitalism first of all. For that to happen, the Fed will have to be dismantled. You can’t have capitalism without functioning markets. Ergo: America doesn’t appear to like capitalism, or it would make sure it exists.

• Ray Dalio Says Capitalism Needs Urgent Reform (MW)

Ray Dalio, founder of Bridgewater Associates LP, the world’s biggest hedge fund, says capitalism has developed into a system that is promoting an ever-wider wealth gap that puts the very existence of the United States at risk. In a two-part series published on LinkedIn, the noted investor argues that capitalism is now in need of reform — and offered ways to accomplish it: ‘I have also seen capitalism evolve in a way that it is not working well for the majority of Americans because it’s producing self-reinforcing spirals up for the haves and down for the have-nots. This is creating widening income/wealth/opportunity gaps that pose existential threats to the United States because these gaps are bringing about damaging domestic and international conflicts and weakening America’s condition.’

[..] Today, however, the system has produced little or no real income growth for most people for decades, according to the Dalio essay on LinkedIn. Prime-age workers in the bottom 60% have had no real (inflation-adjusted) income growth since 1980, and the percentage of children who grow up to earn more than their parents has fallen to 50% from 90% in 1970. The wealth gap is at its widest point since the late 1930s, with the top 1% owning more than the bottom 90% combined, “which,” Dalio notes, “is the same sort of wealth gap that existed during the 1935-40 period (a period that brought in an era of great internal and external conflicts for most countries).”

Most people in the bottom 60% “are poor,” he writes. About 40% of all Americans would struggle to raise $400 in the event of an emergency, he says, citing a recent Federal Reserve study. The childhood poverty rate stands at 17.5% and has not shown meaningful improvement in decades. That, in turn, leads to poor academic achievement, low productivity and low incomes.

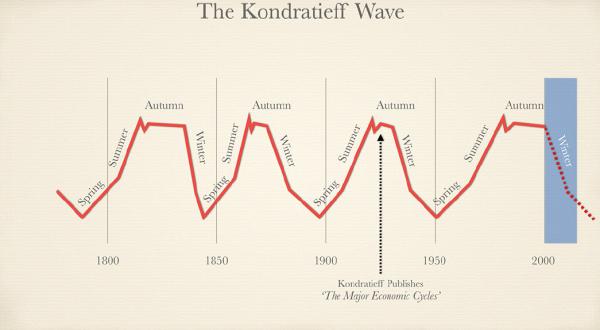

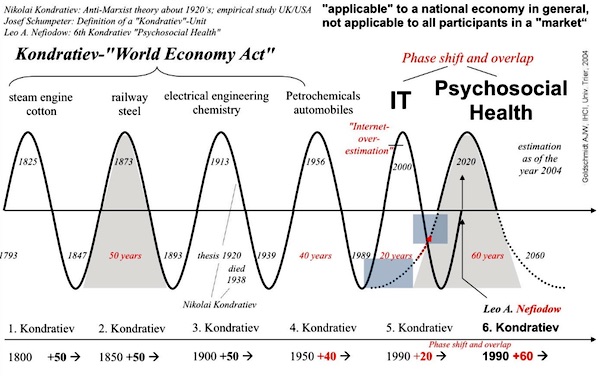

It’s good when people who are not familar with it learn about Kondratieff (though I’ve seen better write-ups), but again: the Fed has become the economy, so what is real anymore?

• Kondratiev – Riding the Economic Wave (Kerevan)

There is a rich literature trying to identify the cause, in particular the work of the Belgian economist, the late, great Ernest Mandel. Crudely, it works like this. Social and economic conditions mature to spark a runaway investment boom in the latest cluster of new technologies. After a period, excess investment and increased competition lower rates of profitability, curbing the boom. At the same time – because this is as much a sociological as an economic process – growth expands the global workforce, both in numbers and geographically. The new, militant workforce launches social struggles to capture some of the wealth created in the boom.

This, in turn, adds to the squeeze on profits. The peak and early down wave are characterised by violent social conflicts, whose outcome determines the length of the contraction. To date each K-wave has seen a crushing of social protest and a halt to wage growth, if not a fall in real incomes for the working class. Thus conditions accumulate for a fresh investment boom, as profitability recovers. The ultimate trigger for the new upcycle is investment in the next bunch of new technologies, which simultaneously provide monopoly profits and a new set of markets.

Where precisely are we in the Kondratiev cycle? There is a dispute about this. Economists convinced by the Kondratiev theory largely agree there was a strong up-phase following the Second World War, lasting till the early 1970s. This was driven by the collapse in European wages imposed earlier by the Nazis and by the universal adoption of Fordist, mass production techniques. This expansion turned into a downswing in the 1970s and early 1980s, as profitability declined and the revived European economies (linked through the early Common Market) eroded American competitiveness.

The dispute concerns what happened next – the era of Reagan, Thatcher, neoliberalism and globalisation, running up to the present. In 1998, the American economic historian Robert Brenner published a hugely influential account of global capitalism which claimed to identify a super downswing running from circa 1970 to the turn of the millennium. Brenner rejected the notion global capitalism had (or was likely) to regain profitability, citing excess capacity rather than working class resistance as the primary driver. He pointed to the sudden stagnation in the Japanese economy, in the 1990s, as a precursor for the West’s future.

Youi’re going to have to go after individuals, not allow them to hide behind corporations.

• EU Charges BMW, Daimler and VW With Collusion Over Emissions (G.)

The European commission has charged BMW, Daimler and Volkswagen with colluding to limit the introduction of clean emissions technology, in the preliminary findings of an antitrust investigation. The car manufacturers have 10 weeks to respond and could face fines of billions of euros – up to 10% of their global annual turnover – if their explanations are rejected. A similar cartel case the commission took out in 2014 against MAN, Volvo/Renault, Daimler, Iveco and DAF ended with €2.93bn (£2.53bn) of penalties being levied. The EU’s competition commissioner, Margrethe Vestager, said: “Companies can cooperate in many ways to improve the quality of their products. However, EU competition rules do not allow them to collude on exactly the opposite: not to improve their products, not to compete on quality.”

She added: “Daimler, VW and BMW may have broken EU competition rules. As a result, European consumers may have been denied the opportunity to buy cars with the best available technology.” The EU announcement follows raids on the auto manufacturers in July 2017 after allegations in Der Spiegel that they had met in secret working groups in the 1990s to coordinate a response to diesel emissions limits. Between 2006 and 2014, the commission suspects that the “circle of five” carmakers – including VW’s Audi and Porsche divisions – colluded to limit, delay or avoid the introduction of selective catalytic reduction systems (SCRs) and “Otto” particle filters.

The drought comes one drop at a time.

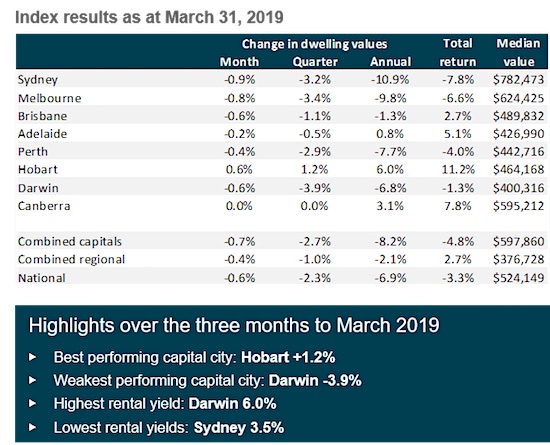

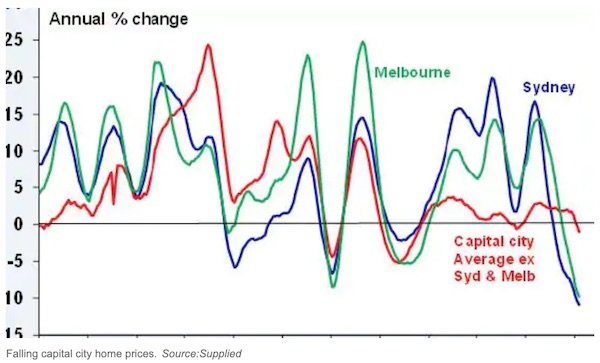

• Australian Housing Downturn Becomes Widespread |(ZH)

After a three-decade boom, the Australian economy is finally facing a recession. The outlook for the economy is exceptionally bleak this year, as the decline in housing prices is more widespread than thought, according to a new report from CoreLogic. National home prices recorded a month-on-month decline of 0.60% in March, which CoreLogic noted was the smallest rate of monthly decline since October. “While the pace of falls has slowed in March, the scope of the downturn has become more geographically widespread,” CoreLogic head of research Tim Lawless said. All eight capital cities in Australia posted declines, with Sydney recording the most significant price drop of .90% month-on-month.

Quarterly, the value of single-family homes and condos declined 3.9%, followed by Melbourne (3.4%), Sydney (3.2%), Perth (2.9%), and Brisbane (1.1%). Prices in Canberra were unchanged. Sydney recorded the most significant annual decline of 10.9%. Melbourne followed with 9.8%. Australia’s regional housing markets have also deteriorated. Regional areas outside Sydney declined by 3.6% over the past year while regional Queensland saw a 1.6% decline. Regional Western Australia experienced a 9.5% decline over the past year, and for the past five years, values in the region have collapsed by 25.8%

It’s not entirely Fake News, but it’s certainly No News. There’s one competitor for the USD, and that’s the renminbi, which nobody wants because it’s not traded freely. End of story.

• Saudi Arabia Threatens To Ditch Petrodollar (R.)

Saudi Arabia is threatening to sell its oil in currencies other than the dollar if Washington passes a bill exposing OPEC members to U.S. antitrust lawsuits, three sources familiar with Saudi energy policy said. They said the option had been discussed internally by senior Saudi energy officials in recent months. Two of the sources said the plan had been discussed with OPEC members and one source briefed on Saudi oil policy said Riyadh had also communicated the threat to senior U.S. energy officials.

The chances of the U.S. bill known as NOPEC coming into force are slim and Saudi Arabia would be unlikely to follow through, but the fact Riyadh is considering such a drastic step is a sign of the kingdom’s annoyance about potential U.S. legal challenges to OPEC. In the unlikely event Riyadh were to ditch the dollar, it would undermine the its status as the world’s main reserve currency, reduce Washington’s clout in global trade and weaken its ability to enforce sanctions on nation states. “The Saudis know they have the dollar as the nuclear option,” one of the sources familiar with the matter said. “The Saudis say: let the Americans pass NOPEC and it would be the U.S. economy that would fall apart,” another source said.