DPC Madison Street east from Fifth Avenue, Chicago Sep 1 1900

“There is no excuse for making this error – except that the error is deliberate, and is intended to lead to failure..”

• ‘Finance Is The New Warfare’ Michael Hudson: Has the IMF Annexed Ukraine? (NC)

Michael, in a recent interview published in The National Interest magazine, you said that most media covers Russia as if it is the greatest threat to Ukraine. History suggests the IMF may be far more dangerous. What did you mean by that?

HUDSON: First of all, the terms on which the IMF make loans require more austerity and a withdrawal of all the public subsidies. The Ukrainian population already is economically devastated. The conditions that the IMF’s program is laying down for making loans to Ukraine is that it must repay the debts. But it doesn’t have the ability to pay. So there’s only one way to do it, and that’s the way that the IMF has told Greece and other countries to do: It has to begin selling off whatever the nation has left of its public domain; or, to have your leading oligarchs take on partnerships with American or European investors, so that they can buy out into the monopolies in the Ukraine and indulge in rent-extraction. This is the IMF’s one-two punch.

Punch number one is: here’s the loan – to pay your bondholders, so that you now owe us, the IMF, to whom you can’t write down debts. The terms of this loan is to believe our Guiding Fiction: that you can pay foreign debt by running a domestic budgetary surplus, by cutting back public spending and causing an even deeper depression. This idea that foreign debts can be paid by squeezing out domestic tax revenues was controverted by Keynes in the 1920s in his discussion of German reparations. There is no excuse for making this error – except that the error is deliberate, and is intended to lead to failure, so that the IMF can then say that to everyone’s surprise and nobody’s blame, their “stabilization program” destabilized rather than stabilized the economy.

The penalty for following this junk economics must be paid by the victim, not by the victimizer. This is part of the IMF’s “blame the victim” strategy. The IMF then throws its Number Two punch. It says, “Oh, you can’t pay us? I’m sorry that our projections were so wrong. But you’ve got to find some way to pay – by forfeiting whatever assets your economy may still have in domestic hands. The IMF has been wrong on Ukraine year after year, almost as much as it’s been wrong on Ireland and on Greece. Its prescriptions are the same as those that devastated Third World economies from the 1970s onward. So now the problem becomes one of just what Ukraine is going to have to sell off to pay the foreign debts – run up increasingly for waging the war that’s devastated its economy.

One asset that foreign investors want is Ukrainian farmland. Monsanto has been buying into Ukraine – or rather, leasing its land, because Ukraine has a law against alienating its farmland and agricultural land to foreigners. And a matter of fact, its law is very much the same as what the Financial Times reports Australia is wanting to do to block Chinese and American purchase of farmland. The IMF also insists that debtor countries dismantle public regulations againstforeign investment, as well as consumer protection and environmental protection regulations. This means that what is in store for Ukraine is a neoliberal policy that’s guaranteed to actually make the situation even worse. In that sense, finance is war. Finance is the new kind of warfare, using finance and forced sell-offs in a new kind of battlefield.

“There will be less of a civil war going on there because they will have to worry about their debt. This is an economic matter too. You have to realize that the country is totally bankrupt.”

• Ron Paul: ‘Get NATO, Foreign Countries Out Of Ukraine To End Civil War’ (RT)

The best thing for Ukraine is to force NATO, the US, and regional players out of the country, former US congressman and presidential candidate Ron Paul said. Without foreign meddling in the civil war, Kiev will focus on the nation’s economic collapse. “Get the foreigners out of there [Ukraine], get the Europeans out, the US out, get NATO out, and get the Russians out,” Paul said at the International Students for Liberty Conference in Washington on Friday. “There will be less of a civil war going on there because they will have to worry about their debt. This is an economic matter too. You have to realize that the country is totally bankrupt.”

Paul’s speech followed the NSA surveillance whistleblower Edward Snowden’s presentation. “I’m not pro-Putin, I’m not pro-Russia, but I’m pro-facts,” Paul stressed when defending his stance. “Crimea is not exactly a foreign country, according to the Russians. But I’m neutral on that,” the former presidential candidate stated. Paul – a 79-year-old retired doctor who spent nearly three decades in the US Congress representing the state of Texas – reiterated his previous statements, noting that what happened in Ukraine last year was a “coup” that was planned by “NATO, EU” and western Ukrainians. “One thing for sure that we do know, is we [US] had the conversations between our State Department and our ambassador before the coup – who will we put in place. And they planned part of the coup.”

“..in the foreseeable future there will be no common security system on the continent of Europe, no commonly agreed-upon norms and no rules of behaviour.”

• In Ukraine, The New World Disorder Enters Europe (Observer)

After the ceasefire negotiated in Minsk, a peace settlement in eastern Ukraine remains distant. Most of the points in the agreement, including Ukraine’s constitutional reform and the resumption of Kiev’s control over the entire Ukrainian-Russian border, will probably never be implemented. The most one can hope for is that the conflict is frozen and people stop dying. Even that, however, cannot be taken for granted, as continued fighting ahead of the ceasefire’s formal entry into force suggests. If the truce sticks, it will be the first negotiated arrangement in a newly divided Europe, leaving Russia almost alone on the east, with much of the rest of Europe supporting Ukraine. This split can grow much worse if the conflict in Donbass continues. But even if it stops, reconciliation is not on the cards.

This means that in the foreseeable future there will be no common security system on the continent of Europe, no commonly agreed-upon norms and no rules of behaviour. The world disorder has entered the recently most stable and best-regulated part of the globe: Europe. The idea that a combination of western sanctions and the low oil price can bring a change in Kremlin policies, or a change in the Kremlin itself, has so far not been borne out by the facts. Putin remains defiant, the elites do not turn against him, and his popularity among the bulk of the Russian people, despite the hardships they have begun to feel, is at record levels.

These people are not ignorant of the dangers a continued conflict over Ukraine can pose to them, but lay the blame for these on Kiev, Washington and the European leaders. Putin, whether as war leader or a peacemaker, is their champion. At Minsk, he has achieved his minimal goal. Kiev has conceded the failure of its efforts to wipe out the Donbass rebels backed by Moscow. If the ceasefire becomes permanent, the “people’s republics” will be physically safe and can start turning themselves into functioning entities on the models of Transnistria. Russia will need to supply them with more than weapons and humanitarian assistance, straining its resources even more, but there’s hardly an alternative. For Putin, and most Russians, these are “our people”.

Yet, in Minsk, Putin reaffirmed Russia’s official position that Donbass should remain part of Ukraine. This is not a concession. Within a formally unified Ukraine, Donetsk and Lugansk are a protected centre of resistance to the political leadership in Kiev. The situation in the rest of the country permitting, they can expand their influence beyond Donbass and link up with those who, a year after the triumph of the Maidan, have become disillusioned with their government, which is woefully unable to tame corruption and improve the lives of ordinary Ukrainians. Indeed, if the truce in the east of the country holds, the future of Ukraine will depend on how it manages reform and popular discontent.

Meanwhile, inside the casino…

• Contrarian US Bond Manager Braces For Big Ukraine Losses (FT)

Ukraine is widely expected to impose a haircut on private sector creditors under the terms of a forthcoming bailout from the International Monetary Fund. If so, then one investor stands to lose more than any other: Michael Hasenstab, the fund manager renowned for taking unpopular bets on government debt. Through vehicles at Franklin Templeton, the big US money manager based in California, Mr Hasenstab owns more than $7bn of Ukrainian debt, making him the country’s biggest private bondholder. He has previously scored big rewards for his contrarian moves, which included a large purchase of Irish debt in the midst of the eurozone crisis and investments in Hungary and Uruguay.

But as the crisis in Ukraine has escalated his position has suffered, leaving his $69bn Templeton Global Bond Fund and others down approximately $3bn on the investment, according to Bloomberg data, encouraging a flood of client money to leave the fund at the end of last year. Alongside Mr Hasenstab, investments in Ukraine’s eurobonds are split between household financial names, including BlackRock, Allianz and Fidelity, most of which hold no more than 2.5% of any individual Ukrainian bond. In addition to its publicly traded bonds, Ukraine also owes $3bn to Russia, which is due to mature in December. But Mr Hasenstab, who began investing in Ukraine in 2010, clearly has the most at stake.

He was originally drawn by the country s relatively low level of debt to gross domestic product, its promising agricultural sector and high yields available on bonds. Over the years he has topped up his position, reiterating his belief in the long-term potential of Ukraine, thanks in part to its strategic position, geographically and geopolitically, at the crossroads of Europe and the east. In an interview with the Financial Times in June, he said the difficulties that the country faced were political, not economic, and he felt comfortable that tensions would be resolved. ‘Ukraine should have linkages with Europe .. but it should also have linkages with Russia and I think the Nato inclusion was probably one of the largest motivations of Putin’s military aggression and now that is taken off the table’, he said.

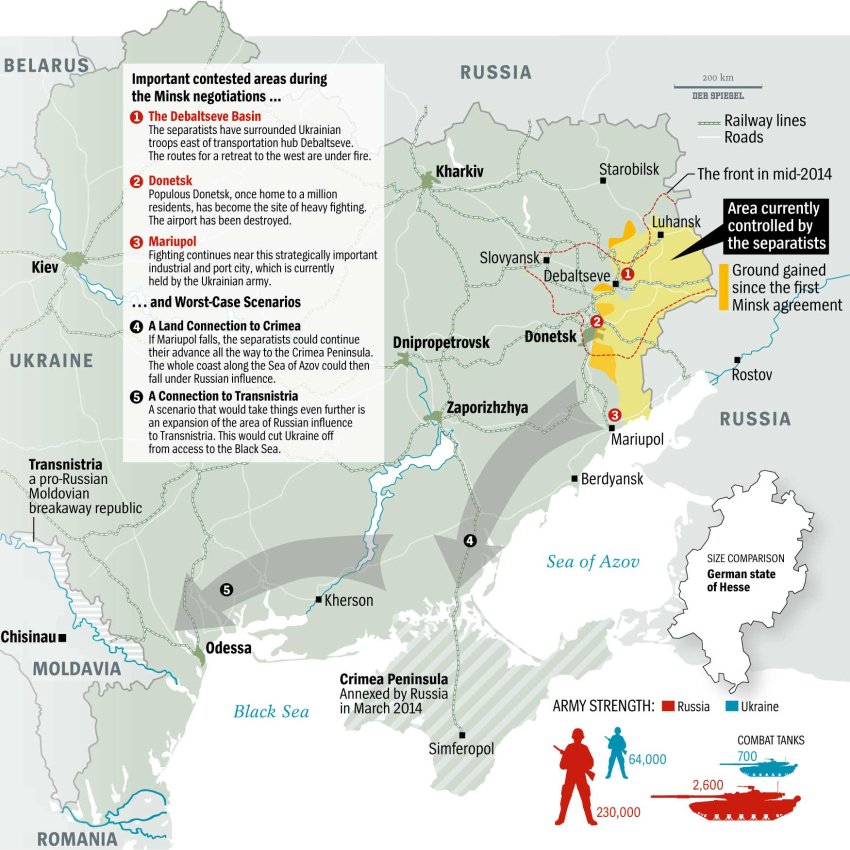

“The situation in Debaltseve plunged the Ukrainian army into a desperate, almost hopeless, position, as the negotiators in Minsk well knew. Indeed, it was the reason the talks were so urgently necessary.” Note that on the map, Der Spiegel pits the Unrainian army vs the Russian one, not the rebels.

• The War Next Door: Can Merkel’s Diplomacy Save Europe? (Spiegel)

The problem has four syllables: Debaltseve. German Chancellor Angela Merkel can now pronounce it without difficulties, as can French President François Hollande. Debaltseve proved to be one of the thorniest issues during the negotiations in Minsk on Wednesday night and into Thursday. Indeed, the talks almost completely collapsed because of Debaltseve. Ultimately, Debaltseve may end up torpedoing the deal that was worked out in the end. Debaltseve is a small town in eastern Ukraine, held by 6,000 government troops, or perhaps 8,000. Nobody wants to say for sure. It is the heart of an army that can only put 30,000 soldiers into the field, a weak heart. Until Sunday of last week, that heart was largely encircled by pro-Russian separatists and the troops could only be supplied by way of highway M03. Then, Monday came.

Separatist fighters began advancing across snowy fields towards the village of Lohvynove, a tiny settlement of 30 houses hugging the M03. The separatists stormed an army checkpoint and killed a few officers. They then dug in – and the heart of the Ukrainian army was surrounded. The situation in Debaltseve plunged the Ukrainian army into a desperate, almost hopeless, position, as the negotiators in Minsk well knew. Indeed, it was the reason the talks were so urgently necessary. Debaltseve was one of the reasons Merkel and Hollande launched their most recent diplomatic offensive nine days ago. The other reason was the American discussion over the delivery of weapons to the struggling Ukrainian army.

Debaltseve and the weapons debate had pushed Europe to the brink of a dangerous escalation – and the fears of a broader war were growing rapidly. A well-armed proxy war between Russia and the West in Ukraine was becoming a very real possibility. A conflict which began with the failure of the EU-Ukraine Association Agreement and the protests on Maidan Square in Kiev, and one which escalated with Russian President Vladimir Putin’s annexation of the Crimea Peninsula, has long since become the most dangerous stand-off Europe has seen in several decades. It is possible that it could ultimately involve the US and Russia facing each other across a line of demarcation.

Given the intensity of the situation, Germany and France together took the initiative and forced the Wednesday night summit in Minsk, Belarus. The long night of talks, which extended deep into Thursday morning, was the apex of eight days of shuttle diplomacy between Moscow, Kiev, Washington and Munich. With intense focus during dozens of hours of telephone conversations and negotiations across the globe, the German chancellor helped wrest a cease-fire from the belligerents. It is a fragile deal full of question marks, one which can only succeed if all parties dedicate themselves to adhering to it. Whether that will be the case is doubtful. The Minsk deal is brief respite. Nothing more. But it is a success nonetheless.

“It’s no secret to anyone that fakes like this are made by a group of US counselors staying in the Kiev building of the Security Council, led by General Randy Kee..”

• Russia Shrugs Off US Envoy’s ‘Evidence’ Of Russian Troops In Ukraine (RT)

The Russian Ministry of Defense has branded new claims by the US ambassador to Ukraine as “crystal ball gazing.” The ambassador tweeted pictures of what he said were Russian armed forces in Debaltsevo, eastern Ukraine. On Saturday, the US ambassador to Ukraine, Geoffrey Pyatt, posted on Twitter what he says are satellite photos proving there are Russian artillery systems stationed near the town of Lomuvatka, about 20 kilometers northeast of Debaltsevo. The images could not be immediately verified. Under the tweet, he said: “We are confident these are Russia military, not separatist systems.” The photographs were commissioned by the private Digital Globe satellite company.

“We have failed to understand how those grainy dark patches in the photos published by US Ambassador to Ukraine Geoffrey Pyatt on his Twitter feed could prove anything,” Major General Igor Konashenkov, a spokesman for the Russian Defense Ministry, told journalists later in the day. “Unlike the American intelligence services, Russia’s military [has] never considered crystal ball gazing a good way to check and confirm data.” Konashenkov also disregarded an earlier allegation by State Department spokeswoman Jennifer Psaki, saying he has not heard “anything new.” On Friday, Psaki declared that in addition to the artillery systems and multiple rocket launchers, Russia had also deployed air defense systems to the area near the surrounded railway hub.

“This is clearly not in the spirit of this week’s agreement. All parties must show complete restraint in the run up to Sunday,” Psaki told reporters. In late July, the Russian Ministry of Defense spoke out against images posted by Pyatt on his Twitter account, which alleged that Ukraine had been shelled from Russian territory. “These materials were posted to Twitter not by accident, as their authenticity is impossible to prove – due to the absence of the attribution to the exact area, and an extremely low resolution. Let alone using them as ‘photographic evidence,’” Konashenkov said at the time. “It’s no secret to anyone that fakes like this are made by a group of US counselors staying in the Kiev building of the Security Council, led by General Randy Kee,” he noted.

Craziness.

• New Anti-Russia Sanctions to Enter Into Force Monday (Sputnik)

Maja Kocijancic, European Commission’s spokesperson for foreign affairs, confirmed Friday that the EU will add 19 individuals, including five Russians, and nine entities to the list of sanctions over Ukraine on February 16. The statement was made a day after Russian President Vladimir Putin, together with the leaders of Germany, France and Ukraine, brokered a new deal on the crisis reconciliation in Minsk. “The political decision of additional listings has been taken on January 29. The [EU] Foreign Affairs Council on Monday adopted a legal act so it made it fulfilled this political commitment and has set to give the diplomatic efforts a chance that entering into force will happen on February 16, which is this coming Monday,” Kocijancic said.

The European Union, the United States and other countries have imposed several rounds of sanctions against Russia over its alleged role in the Ukrainian conflict. The restrictions target the country’s defense, energy and finance sectors, as well as a number of individuals. Moscow has repeatedly stressed that it is not militarily involved in Ukraine’s internal affairs. Following the Minsk talks, EU leaders convened for an informal meeting but a new-wave of anti-Russia sanctions was not on the agenda, European Council President Donald Tusk announced. Meanwhile European leaders agreed that the implementation of Thursday’s deal will become a touchstone for further relations with Russia.

“..The EU imposed a ban in the European Court on accepting claims from Russian entities and individuals that have been subjected to sanctions. [This] has severe consequences, including for European democracy. Is there an independent rule of law?“

• Igor Sechin: The Oil Man At The Heart Of Putin’s Kremlin (Independent)

Igor Sechin, the boss of Russian oil behemoth Rosneft and one of the most powerful men in Russia, has declared European sanctions against his giant state-controlled organisation are an illegal affront to democracy. In a rare interview, the man widely seen as being Vladimir Putin’s closest adviser said the world economy faced “severe consequences” as a result of the sanctions, which he said were “absolutely illegal and illegitimate”. He also spoke of how Rosneft – 20% owned by Britain’s BP – will cope with the collapse in the oil price, revealing that the company will be cutting its capital expenditure programme for this year by “approximately 30%”. That will represent a savage reduction on 2014’s spend, said in October to be $14bn-$16bn.

It follows cuts announced recently by other major firms around the world totalling $65bn. Although predicting continued volatility and saying he did not want to get into a “guessing game”, he said the oil price could start to rise again in the final quarter of this year. This was because the current oversupply of oil was insignificant compared with previous oil crises like 1985, so the fundamental supply and demand equation did not justify the current price slump. Moreover, demand is rising, primarily in Asia, and not falling like it was in 1985, he said. He repeatedly expressed his concerns that there could be a global shortage of oil if companies did not return to investing in production and output. If investment levels recovered, next year’s price would be $60-$80 a barrel, he said.

However, if they do not, and the supply-demand equation was not rebalanced, it could bounce back to $100-$110 as the lack of investment in drilling caused a shortfall in production. He talked for the first time of his close bond with the senior management of BP, particularly Bob Dudley, the US-born chief executive who famously fled Russia in fear of his safety during BP’s battle with the oligarch partners of its BP-TNK joint venture. And, speaking after Rosneft’s legal case against EU sanctions was sent from the High Court in London to the European Court of Justice, he declared: “We are fighting: the knot will be untied.” Mr Sechin said Rosneft was prepared for a long haul in its battle to overturn the sanctions, placed on both him and the company by the US and EU authorities in response to the Ukraine conflict.

Asked about the prospects of the time extension of the case’s move from London to the European Court, he said wryly: “Instead of three years, the case may be a year and a half… What can you do? I don’t know if the case will be tried on merit and our claims will be justly reviewed and evaluated.” He attacked the European authorities for the way the sanctions were applied in such a way to ban legal appeals against them: “That is what concerns me most… The EU imposed a ban in the European Court on accepting claims from Russian entities and individuals that have been subjected to sanctions. [This] has severe consequences, including consequences for European democracy. Is there an independent rule of law?”

It doesn’t look good ahaed of tomorrow’s meeting.

• Greece And Creditors Continue Talks Ahead Of Eurogroup Meeting (AFP)

Greek and EU officials met for talks Saturday ahead of a high-stakes show-down over Athens’ demands for a radical restructuring of its massive international bailout programme. “It is not a negotiation but an exchange of views to better understand each other’s position,» an EU official said of the final huddle before next week’s crunch meeting. “The talks are ongoing and the institutions are expected to report at the Eurogroup on Monday,» the official said, without giving further details. No discussions are scheduled for Sunday, with the parties reporting back to their governments to complete preparations for Monday’s meeting of the 19 eurozone finance ministers. The consultations began Friday after new hard-left Greek Prime Minister Alexis Tsipras laid out his plans to his peers, including Europes sceptical paymaster German Chancellor Angela Merkel, at his first EU summit.

Merkel recognised the need for compromise on all sides, but also called for Greece to respect the conditions of the bailout – a position that neatly encapsulated both sides in the stand-off. Dutch Finance Minister and Eurogroup head Jeroen Dijsselbloem said Friday he was «pessimistic» of any quick deal. “The Greeks have sky-high ambitions. The possibilities, given the state of the Greek economy, are limited”, Dijsselbloem said in describing the difficulties in finding common ground. “I don’t know if well get there by Monday,” he added. The EU and the International Monetary Fund bailed Greece out in 2010, and then again in 2012 to the tune of some €240 billion, plus a debt write-down worth more than €100 billion euros.

The rescue may have kept Greece in the eurozone, but it also left Athens with a mountain of debt worth about €315 billion that most analysts do not believe will ever be fully repaid. In return for the bailouts, the then centre-right Greek government agreed to a series of stinging austerity measures, and the much-resented oversight by the EU, IMF and ECB ‘troika to make sure Greece stuck to the terms. Tsipras campaigned and won elections last month on promises to ditch the programme, which he said had wrecked the economy, not helped it, and sent the jobless rate soaring. In a more conciliatory move, however, Athens also said it could live with 70% of the current programme, but that Greece must be allowed leeway on the rest so it can do more to boost the economy, including through additional spending.

Sure.

• Do Derivatives Make The World Safer? (Guillaume Vuillemey)

The interest rate derivatives market is the largest market in the world, with an aggregate notional exposure of 563 trillion USD as of June 2014. Its fast growth over the past 15 years (shown in Figure 1) has raised concerns from policymakers. Currently, no theory provides guidance regarding the effect of the use of derivatives on other decisions by financial intermediaries. In a recent paper, I develop a framework to show how hedging using interest rate derivatives affects:

• Risk management in banking,

• The response of bank lending (both to interest rate and real shocks), and

• The occurrence of bank defaults.What are interest rate derivatives? Interest rate derivatives are contracts by which two parties commit to exchange future interest rate cash flows, computed as%ages of a given amount – the notional amount. The most popular of these contracts is the interest rate swap, which makes it possible to exchange a fixed rate against a floating rate until the maturity of the contract is reached. Derivative contracts have hedging properties: they make it possible to insure against some future realizations of the short rate, which would otherwise induce losses. One reason why banks are active in the interest rate derivatives market is because most of the cash flows they receive (e.g. loans) or pay (e.g. interbank borrowing) are interest rates whose maturities do not match: they tend to ‘borrow short’ and ‘lend long’. As a consequence of maturity mismatch, changes in interest rates either increase or decrease a bank’s profitability and possibly induce default.

Derivatives and risk management In my framework, hedging is motivated by the existence of financial constraints (as in Froot et al. 1993). Banks aim to manage internal funds so that they have sufficient resources at times profitable lending opportunities arise. A shortage of funds would imply turning to costly external financing sources. Banks optimally engage in risk management either by

• Preserving debt capacity – i.e. by not borrowing up to their collateral constraint and instead keeping cash – or

• Using derivatives to transfer resources to future states where large lending outlays will be optimal.

• My framework features two risks faced by a bank, which give rise to two opposite motives for risk management.On the liability side, the risk is that the cost of debt financing will be high precisely in states where lending opportunities will be large. This risk gives an incentive to transfer resources from future states where the short rate is low to states where it is high. On the asset side, the risk is that for a given cost of debt financing, the bank will be unable to seize lending opportunities arising from a low short rate, as such states are typically associated with greater optimal lending. This risk gives an incentive to transfer resources from future states where the short rate is high to states where it is low. From the existence of these two opposite forces – which I call respectively the ‘financing’ and the ‘investment’ motives for risk management, – it follows that both pay-fixed and pay-float swaps may be used for hedging. In previous discussions, the fact that banks use pay-float positions – i.e. they get exposed to interest rate spikes – was usually considered a puzzle or as evidence of speculation. I show it is also consistent with genuine hedging.

CDS are meant to hide losses and wagers.

• Derivatives No Longer Used For Hedging But For “Alpha Generation” (Zero Hedge)

Maybe the pervasive “this time is always different” meme has been perpetuated to the point that the market actually believes it, or maybe it’s just old fashioned greed, but whatever the case, market participants (and this means central banks, retail investors, and everyone in between) have an extraordinary inclination towards Einsteinian insanity. Never mind, for instance, that the Fed’s attempts to “smooth out the business cycle” (breaking it in the process) have everywhere and always served only to create bigger and bigger bubbles that have led, invariably, to crashes that are ever more spectacular/devastating – what we need is more intervention by central planners bankers. Forget the fact that throughout the course of human history, minting endless amounts of fiat currency always fails – in the words of new BOJ board member Yutaka Harada, “we just need to print more money.”

And certainly pay no attention (despite the tendency for these types of discrepancies to self-correct) to the divergence between the S&P and trivial things like the U.S. macro picture and/or forward earnings estimates… … the U.S. economy is the cleanest dirty shirt and Jeremy Siegel is probably contemplating Dow 40K as we speak, so just hold your nose and buy.

Given this steadfast refusal to learn from yesterday’s mistakes, it isn’t any wonder that when Citi recently surveyed 43 banks, 29 asset managers, and 31 hedge funds regarding their outlook for the credit derivatives market in 2015, the consensus was that “there seems to be plenty of room and enthusiasm to use derivatives to take leveraged risk.” Phew: for a minute there it looked like leveraged risk taking with derivatives might go the way of the Dodo in the post-crisis world, making Bruno Iksil the last great example of how much fun one can have stomping around in off-the-run CDS indices with depositors’ money.

It’s also comforting to know that among those Citi surveyed, the general consensus was that “…there seems to have been a shift from using derivatives as a hedging tool, to using them more for alpha generation [as] most products are now used more for adding risk and directional views.” So investment professionals and sophisticated market participants are quite eager to take leveraged risk with derivatives with an eye not towards “hedging” (i.e. mitigating risk), but towards “alpha generation” and expressing “directional views” (i.e. gambling). In fact, nearly two-thirds of those surveyed listed either “alpha generation” or “adding risk” as the primary reason for trading single-name and index CDS

Supply shock.

• Goldman Warns Over-Supply Means Oil Prices Will Be Much Lower (Zero Hedge)

Via Goldman Sachs’ Sven Jari Stehn: US Daily: Oil Supply versus Demand: A Market Perspective:

• We use statistical techniques to explore the drivers of the sharp drop in oil prices since last summer. The idea behind our approach is to use the behavior of oil and equity prices to disentangle demand from supply shifts. Intuitively, we would expect that positive demand shocks should push both equity and oil prices up, while positive supply shocks should push equities up and oil prices down.• Our model suggests that the vast majority of the decline in oil prices until November 2014 was driven by perceptions of improved supply. The continued sell-off in December and January was driven by perceptions of both improving supply and slowing demand. The latest rebound in oil–which started in late January–appears to be driven by a mix of demand and supply.

• Although our approach is subject to a number of caveats, the main conclusion is consistent with our commodities team’s views, who have argued that the decline in oil has been driven by an oversupplied global oil market.

Oil prices have fallen substantially since last summer. Crude West Texas Intermediate (WTI), for example, fell by about 60% between June and January, before starting to rebound somewhat in February. In today’s comment we use statistical techniques to explore the drivers of these changes in the oil price. The idea behind our approach is to use the behavior of oil and equity prices to disentangle demand from supply shifts. Intuitively, we would expect that positive demand shocks should push both equity and oil prices up, while positive supply shocks should push equities up and oil prices down. We therefore call anything that pushes oil and equities in the same direction a “demand” shock and anything that pushes them in opposite directions a “supply” shock.

“Libya’s state-run oil company warned that it would shut production at all fields..” No it won’t.

• Libya Warns of Complete Oil Shutdown as Attacks Escalate (Bloomberg)

Libya’s state-run oil company warned that it would shut production at all fields if authorities in the divided nation fail to contain an escalation of attacks on facilities that has cut crude output to a year-low. “If these incidents continue, National Oil Corp. will regrettably be forced to stop all operations at all fields in order to preserve the lives” of employees, the company said in a statement on its website. “National Oil Corp. urges the Ministry of Defense and the Petroleum Facilities Guard to take the appropriate measures to protect oil sites.” The North African nation’s oil production was reduced by 180,000 barrels a day after a fire at a pipeline that carries crude to the eastern Hariga port, National Oil spokesman Mohamed Elharari said by phone in Tripoli.

Hariga, near Tobruk, has oil left in storage for exports and the last ship to load there was the Greek-flagged Minerva Zoe, he said. Libya, holder of Africa’s largest oil reserves, was producing 350,000 barrels a day in January, Elharari said at the time. The nation may be producing less than 200,000 barrels a day after the pipeline fire. The previous lowest daily average was in March 2014, at 150,000 barrels. A member of OPEC, Libya was producing 1.6 million barrels a day before the 2011 rebellion that ended Muammar Qaddafi’s 23-year rule. National Oil Corp., or NOC as the company is known, has a majority stake in all of Libya’s oil and gas producing ventures. It has a 59% stake in the company that operates Bahi, an oil field that came under attack on Friday, with Marathon Oil, ConocoPhillips and Hess holding the remaining 41%, according to an NOC statement about the attack.

NOC has said it was neutral in the conflict, which is pitting the Islamist-backed government that captured Tripoli last year against the internationally-recognized government that fled to the eastern region. The Petroleum Facilities Guard is loyal to the internationally-recognized administration of Abdullah al-Thinni. The bombing of the pipeline followed attacks on fields in central Libya that Ali al-Hasy, a spokesman for the guards, blames on a local branch of Islamic State, the militants that have proclaimed a caliphate in parts of Iraq and Syria and is being fought by a U.S.-led coalition of Arab and Western nations.

“Americans will have to rely more heavily on the piggy bank.” Whatever that means. And that’s still provided they have one.

• Start Saving Those Pennies Now, Robert Shiller Warns Investors (CNBC)

Nobel Prize-winning economist Robert Shiller has a grim message for investors: Save up, because in the years ahead, assets aren’t going to give you the type of returns that you’ve become accustomed to. In his third edition of “Irrational Exuberance,” which will drop later this month, the Yale professor of economics warns about high prices for stocks and bonds alike. “Don’t use your usual assumptions about returns going forward.” Shiller recommended to investors in a Thursday interview on CNBC’s “Futures Now.” He says that stock valuations look rich.

In fact, Shiller’s favorite valuation measure, the cyclically adjusted price-earnings ratio (which compares current prices to the prior 10 years’ worth of earnings) is “higher than ever before except for the times around 1929, 2000, and 2008, all major market peaks,” he writes in his new preface to the third edition. “It’s very hard to predict turning points in markets,” Shiller said on Thursday. His CAPE measure of the S&P 500 “could keep going up. … But it’s definitely high. By historical standards, it’s up there.” Meanwhile, Shiller said that bond yields, which move inversely to prices, “can’t keep trending down” and “could [reach] a major turning point in coming years.” It’s no surprise, then, that Shiller expects little in the way of asset returns—meaning Americans will have to rely more heavily on the piggy bank.

That’ll be the day.

• UK Tories Told To Shun Wealthy Donors To Avoid Scandal (Guardian)

The Conservative party needs to break its dependence on millionaires, the former Tory chancellor Ken Clarke has told the Observer, amid a growing furore over the tax affairs of the party’s donors. After a week of some of the most intense fighting between the parties in recent years, Clarke said the Conservatives would be strengthened by loosening the hold of rich men on their financial survival. He called on David Cameron to cap political donations and increase state funding of political parties to put an end to damaging scandals and rows. The Conservatives have been rocked in the past week by a potentially toxic combination of allegations of tax evasion by clients of the HSBC bank, whose chairman, Lord Green, became a Tory minister; tax avoidance by party donors; and leaked details of the secretive black and white fundraising ball.

On Saturday, Green stepped down from a financial services lobby group, TheCityUK’s advisory council, in order to avoid “damaging the effectiveness” of its efforts “in promoting good governance”. Clarke said that while he believed the current row over donors and tax avoidance was “artificial and bogus”, such episodic rows over the funding of political parties were feeding into the growing cynicism and distrust of the British political system. He defended Cameron’s decision to attend the fundraising black and white ball in Mayfair, where guests included a series of controversial donors, but said the time had come for the prime minister “to put on his tin hat” and secure further state funding of parties, whatever the short-term public outcry.

Clarke, who was a cabinet minister until last July, said: “I think the Conservative party will be strengthened if it is less dependent on having to raise money from wealthy individuals. But there is no way any leader can avoid raising funds from large gatherings of that kind. “What happens is that the Conservatives attack the Labour party for being ever more dependent on rather unrepresentative leftwing trade union leaders, and the Labour party spends all its time attacking the Conservative party for being dependent on rather unrepresentative wealthy businessmen. In a way both criticisms are true. And the media sends both up. “The solution is for the party leaders to get together to agree, put on their tin hats and move to a more sensible and ultimately more defensible system.”

Remarkable.

• New York’s Streets Are Suddenly Safer. Why? (Guardian)

It is 15 below zero – using what US meteorologists call RealFeel temperature – in Brooklyn’s notorious Marcy Projects. The cold has driven the drug dealers off the streets; police, who have taken to patrolling in fours since two officers were gunned down in a police car last December, are scarce; and at the Ponce Funeral Home the trade is all of the natural-causes kind. Although there was an attempted murder in Queens on Friday that left a man on life-support, New York has enjoyed an almost unprecedented 12-day streak without a homicide. While many pointed to the weather, the embattled New York mayor, Bill de Blasio, sought to improve his strained relationship with the police department, attributing the lull to its hard work.

After months dominated by allegations that US law enforcement is reckless in the use of deadly force, especially when it comes to African-American men, there’s a new criminal-justice narrative: US crime rates are falling, often dramatically, even as incarceration rates begin to level off. The changes are apparent even in Marcy Projects, the neighborhood made famous by homeboy Shawn Carter, aka Jay-Z, who used to describe it in songs such as Murda Marcyville. “Thirty-some odd years ago I’d find dead people on my corner when I came to work,” recalls a community guard who gave her name only as Deborah. In 1990 there were 71 murders here; in 2012 there was just one. “It’s calmed down a lot. Mostly that’s ’cause of the police. They’re more present now.”

The fall in crime in this part of the Bedford-Stuyvesant district is mirrored across the metropolis. In 2014 there were 333 murders in New York City, half the number committed in 2000 and a quarter of the 1,384 recorded in 1985. While crime statistics are difficult to interpret – violent crimes such as rape and assault have not reduced so markedly – the trend overall is repeated across the US. From its peak in 1991, violent crime is down 51%; property crime 4% lower; and murder down 54%. During that same time, incarceration nearly doubled. The US prison population now stands at 2.4 million – up 800% since 1980 – or roughly a quarter of the world’s total. The cost? About $80bn a year. The overall cost of the US criminal justice system is placed at $240bn, or about half of the federal deficit.

But according to What Caused the Crime Decline?, a study published last week by the Brennan centre for justice at New York University school of law, there is no definitive link between falling crime and mass incarceration. The finding runs counter to previous studies claiming that incarceration accounts for as much as a third of the fall in crime. Once violent criminals were taken off the streets in the 1990s, the study claims, an additional 1.1 million low-level or non-violent offenders were jailed without any further benefit. “The rate of incarceration has passed even the point of diminishing returns and now makes no effective difference,” said Oliver Roeder, one of the study’s three authors.

“This whole thing is just another big experiment on humans for no good reason..”

• GMO Apples Win Approval For Sale In US (Reuters)

US regulators have approved what would be the first commercialised biotech apples, rejecting efforts by the organic industry and other GMO critics to block the new fruit. The US Department of Agriculture’s animal and plant health authority, Aphis, approved two genetically engineered apple varieties designed to resist browning that have been developed by the Canadian company Okanagan Specialty Fruits. Okanagan plans to market the apples as Arctic Granny and Arctic Golden, and says the apples are identical to their conventional counterparts except the flesh of the fruit will retain a fresh appearance after it is sliced or bruised. The company’s president, Neal Carter, called the USDA approval “a monumental occasion”.

“It is the biggest milestone yet for us and we can’t wait until they’re available for consumers,” he said. Arctic apples would first be available in late 2016 in small quantities but not widely distributed for some years, Carter said. The new Okanagan apples have drawn broad opposition. The Organic Consumers Association (OCA), which petitioned the USDA to deny approval, says the genetic changes that prevent browning could be harmful to human health and pesticide levels on the apples could be excessive. The OCA would pressure food companies and retail outlets not to use the fruit, said its Director Ronnie Cummins. “This whole thing is just another big experiment on humans for no good reason,” he said.

Those pesky green Germans do it again…

• Germany Moves To Legalise Fracking (Guardian)

Germany has proposed a draft law that would allow commercial shale gas fracking at depths of over 3,000 metres, overturning a de facto moratorium that has been in place since the start of the decade. A new six-person expert panel would also be empowered to allow fracks at shallower levels Shale gas industry groups welcomed the proposal for its potential to crack open the German shale gas market, but it has sparked outrage among environmentalists who view it as the thin edge of a fossil fuel wedge. Senior German officials say that the proposal, first mooted in July, is an environmental protection measure, wholly unrelated to energy security concerns which have been intensified by the conflict in Ukraine. “It is important to have a legal framework for hydraulic fracturing as until now there has been no legislation on the subject,” Maria Krautzberger, president of Germany’s federal environment agency (UBA), told the Guardian.

“We have had a voluntary agreement with the big companies that there would be no fracking but if a company like Exxon wanted, they might do it anyway as there is no way to forbid it,” she said. “This is a progressive step forward.” The draft law would only affect hydraulic fracturing for shale oil and tight gas in water protection and spring healing zones. The tight gas industry made up around 3% of German gas production before the moratorium, and, under the new proposals, could resume fracking in the Lower Saxony region where it is concentrated. Commercial fracking for shale gas and coal bed methane would be banned at levels below 3,000 metres, but allowed for exploration purposes at shallower levels, subject to the assessment of the expert panel.

Environmentalists, however, were alarmed that half of the experts belong to institutions that signed the Hanover Declaration, calling for increased exploration of shale gas in Germany as a way of increasing energy security. “It is clear what these people are going to say,” José Bové, the French Green MEP, told the Guardian. “The panel is not going to be independent, but exactly what the companies are looking for. You don’t need a panel to tell you that shale gas is dangerous. We can see the problems with water pollution, earthquakes and methane emissions. We need people to protest about it before the exploration begins.”

Nobody should ever be allowed to own land in a foreign country. The land belongs to the people.

• South Africa Bars Foreigners From Owning Land (Reuters)

Foreigners will be barred from owning land in South Africa and no individual will be able to own more than 12,000 hectares, the equivalent of two farms, under legislation currently in the works, President Jacob Zuma said on Saturday. Giving more details of a Land Holdings Bill announced this week in a State of the Nation address, Zuma said foreign individuals and companies would be restricted to long-term leases of between 30 and 50 years. If any South Africans owned more than 12,000 hectares, the excess would be liable for seizure by the state, Zuma said, in comments that are likely to upset the large – and still predominantly white-owned – commercial farming sector. “If any single individual owns above that limit, the government would buy the excess land and redistribute it,” he said in a statement.

However, the law will not be applied retroactively for fear of falling foul of the constitution. The legislation would be sent to cabinet for approval soon, after which it will be opened for public consultation and then submitted parliament, Zuma added. Land remains a highly emotive issue in South Africa, where 300 years of colonial rule and white-minority government have left the vast majority of farmland in the hands of a tiny, mainly white, minority. Since the end of apartheid in 1994, the ruling African National Congress has tried to redress the balance through a ‘willing seller, willing buyer’ scheme, but has fallen well short of its target of transferring a third of farmland to blacks by last year.

“The Koch Empire’s already pledged $889 million to win 2016 election for GOP lobbyists, backed by “No Climate Tax Pledges” that GOP members in Congress must sign to get Koch campaign cash in 2016..”

• Planet Earth Is The Titanic, Climate Change The Iceberg (Paul B. Farrell)

Yes, the world is sinking. And the band keeps playing: On the Titanic, first violinist, Big Oil’s Koch Empire. For them capitalism is the solution to everything. Second chair, world’s moral authority, Pope Francis warning that capitalism is the “root cause of the world’s problems.” No harmony. And playing a mean solo flute, Mother Nature, she doesn’t care what the Kochs do, nor what Francis says. Abandon ship? Surrender to the Koch-GOP siren song? Maybe. Pope Francis’s tune is not persuasive enough to win the fight for climate change. True, the pope is the world’s moral authority. But morality — doing what’s right — will never trump the Koch Bros $100 billion bankroll in time to avoid the icebergs we’re all denying. The Koch Empire’s already pledged $889 million to win 2016 election for GOP lobbyists, backed by “No Climate Tax Pledges” that GOP members in Congress must sign to get Koch campaign cash in 2016. They’ve got a winning hand.

Yes, money always trumps morality in today’s raging capitalist society. Yes, your democracy really is for sale to the highest bidder. And yes, everyone has a price … especially senators. But can’t Pope Francis, the world’s moral conscience, lead a resistance movement against Big Oil and the Koch Empire? Save the world? True, he does lead a powerful army of 1.2 billion Catholics worldwide … and, yes, he will soon issue a historic warning in his papal encyclical, making official his position that climate change and global warming are indeed manmade … that capitalism is the root cause of all the world’s deteriorating physical and social environment … that humans are killing their planet.

In recent months the pope has travelled the world warning us capitalism is the enemy of Planet Earth: In capitalism the “worship of the ancient golden calf has returned in a new and ruthless guise in the idolatry of money … lacking a truly human purpose” … our “constant assaults on the natural environment” are “the result of unbridled consumerism” … having “serious consequences for the world economy” … capitalism is morally destructive of the world’s soul and your soul … capitalism will eventually self-destruct the planet and itself.

“He told several people that Winter would last 6 more weeks, however he failed to disclose that it would consist of mountains of snow!”

• Punxsutawney Phil Wanted By Police, Offered Asylum At Ski Resort (ExpressTimes)

Pennsylvania’s most famous forecaster appears to be a controversial figure in New Hampshire, but his supporters are stepping up. The tongue-in-cheek drama appears to have started with a Facebook post Tuesday from police in Merrimack, N.H., saying there is a warrant out for Punxsutawney Phil’s arrest. “We have received several complaints from the public that this little varmint is held up in a hole, warm and toasty,” says the post, which has been shared more than 9,000 times. “He told several people that Winter would last 6 more weeks, however he failed to disclose that it would consist of mountains of snow!”

Merrimack Police Chief Mark Doyle said the joke campaign to get Phil was an attempt to lighten the mood after a series of snowstorms that have buried New England, according to The Associated Press. Others are playing along. Gunstock Mountain Resort in Gilford, N.H., issued a news release Saturday offering asylum to Phil, saying the resort is “thrilled” with snowy conditions it describes as “some of the best snow New Hampshire has seen in years.” “We are concerned with the sensationalist attack on one of America’s true winter heroes,” the release says, adding the resort will work with local authorities to secure the groundhog’s safe passage.

Home › Forums › Debt Rattle February 15 2015