Henri Matisse Antibes 1908

Oh yeah, let’s save the bankers again….

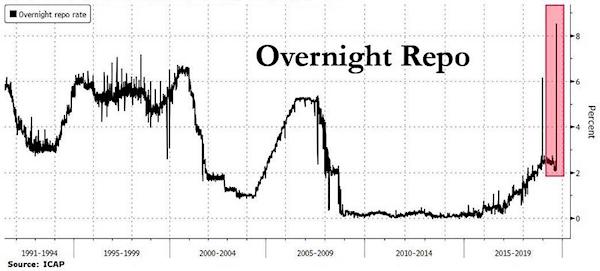

• Fed Concludes First Repo In A Decade Amid Liquidity Panic (ZH)

Update 4: It’s over: after a torrid 30 minutes in which the NY Fed first announced a repo operation, then announced the repo was canceled due to technical difficulties, then mysterious the difficulties went away just minutes later, at precisely 10:10am, the Fed concluded its first repo operation in a decade, which while not topping out at the $75 billion max, was nonetheless a significant $53.15 billion, split as follows: • $40.85BN with TSYs as collateral at a 2.1% stop out rate • $0.6BN with Agencies as collateral at a 3.0% stop out rate • $11.7BN with Mortgage-backed securities as collateral at a 2.1% stop out rate. While the Fed did not disclose how many banks participated in the operation, it is safe to say it was a sizable number.

Worse, the result from today’s unexpected repo operation, we can now conclude that in addition to $1.3 trillion in ‘excess reserves’, a Fed which is now cutting rates and will cut rates by 25bps tomorrow, the US financial system somehow found itself with a liquidity shortfall of $53 billion that almost paralyzed the interbank funding market. Oh, and for those wondering why the Fed did a repo, the answer is simple: it did not want to launch QE just yet. But make no mistake, once repo is insufficient, the Fed will have no choice but to escalate to the next step which is open market purchases. Which brings us to the bigger question of how long such overnight repos will satisfy the market, and how long before the next repo rate spike prompts the Fed to do the inevitable, and restart QE. At least president Trump will be delighted.

And while we’re saving their multi-million bonuses, let’s throw them some more bones,..

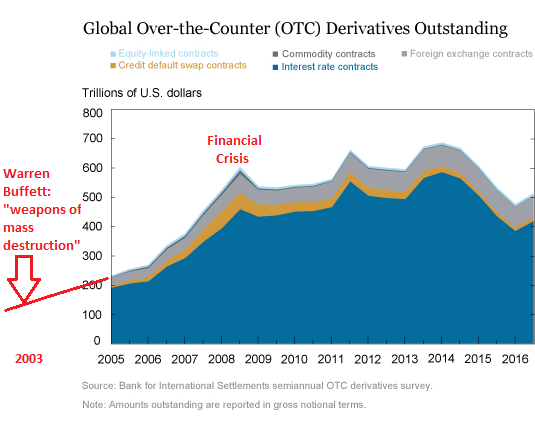

• Big Banks Score Win As FDIC Proposes Easing Post-Crisis Derivatives Rules (R.)

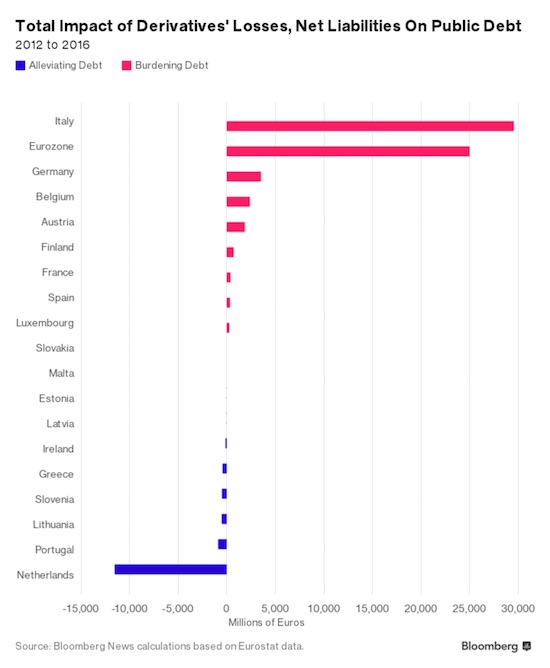

A U.S. banking regulator on Tuesday proposed easing a rule requiring banks to set aside cash to safeguard derivatives trades between affiliates, marking one of the biggest wins for Wall Street lenders under the business-friendly Trump administration. The proposal, by the Federal Deposit Insurance Corporation, could potentially free $40 billion across the nation’s largest banks, according to a 2018 survey by the International Swaps and Derivatives Association (ISDA), the global trade group that has been lobbying for the rule change for years.

The proposal is subject to public comment and will likely face resistance from Democratic lawmakers and consumer groups, who have warned that chipping away at regulations put in place following the 2007-2009 financial crisis could sew the seeds of the next one. Countries across the globe introduced a slew of rules to rein in the global over-the-counter derivatives market after big bets on credit swaps brought firms including Lehman Brothers and AIG to their knees.

Was there any damage at all? Didn’t I read that they hit a bunch of empty tanks?

• Oil Steadies After Saudi Pledges To Restore Output Lost In Attacks (R.)

Oil prices were little changed on Wednesday, steadying after Saudi Arabia said it will restore by the end of the month production lost in weekend attacks on its facilities. Prices plummeted 6% on Tuesday after Saudi Arabia’s energy minister said the country had managed to restore oil supplies to customers to where they stood before the attacks on its facilities that shut 5% of global oil output by drawing from its huge inventories. But tension in the region remained elevated after the United States said it believed the attacks on the world’s top oil exporter originated in southwestern Iran. Iran has denied involvement in the strikes.

Brent crude oil futures were flat at $64.55 a barrel by 0732 GMT. U.S. West Texas Intermediate (WTI) crude CLc1 futures were down 15 cents, or 0.1%, to $59.19 a barrel, after sinking 5.7% on Tuesday. “Considering limited spare (production) capacity outside Saudi Arabia and risks of renewed attacks on Saudi energy infrastructure, a risk premium is likely to stay on oil prices in the foreseeable future,” UBS analysts said in a note. Energy Minister Prince Abdulaziz bin Salman said on Tuesday that average oil production in September and October would be 9.89 million barrels per day and that the world’s top oil exporter would ensure full oil supply commitments to its customers this month.

Not sure Bill Barr is your man.

• Without Accountability, There Can Never Be Trust in Our Government (Cates)

The Watergate scandal, at its heart, was about political operatives working on behalf of the Nixon administration (informally known as “The Plumbers”) attempting to plant bugs in the phones of the Democratic National Committee (DNC) headquarters at the Watergate Hotel, so they could spy on key Democratic campaign communications. A little-remembered fact is that bugs had been successfully planted earlier; the burglars were returning to plant a new set in the phones because the first set never worked properly. It was during this second foray into DNC headquarters in the middle of the night that they were caught by an observant security guard.

So the Watergate scandal was based on an attempt to spy on political opponents, but no evidence ever surfaced that any successful spying was actually done. The first set of listening devices never functioned, and the operatives were caught while trying to replace them. That won’t be the case in the Spygate scandal, because this wasn’t an off-the-books dirty tricks group like The Plumbers running an operation against the Trump campaign. This was the federal government itself, making use of the official engines of its intelligence and law enforcement agencies and surveillance courts to spy on a political campaign and, then, a presidency. And it’s because this scandal is so much worse than Watergate that the persons responsible for it must be held accountable for their actions.

[..] The crimes here amount to a deliberate attempt to subvert the federal intelligence and law enforcement agencies and turn them into political engines of partisan policy to shield political friends and destroy political enemies. After covering up serious crimes committed by their political friends, these key government officials used their offices to manufacture crimes to use as a pretext to investigate and punish their political enemies. Unless this behavior is punished with the utmost severity, no one will ever be able to place trust in the federal government. The ball of accountability will soon end up in the court of U.S. Attorney General William Barr.

I for one have little faith in Congress in this case. Not that I have much faith in Congress in general.

• House Panel Asks Boeing CEO To Testify October 30 on 737 MAX (R.)

The U.S. House Transportation and Infrastructure Committee formally asked Boeing CEO Dennis Muilenburg on Tuesday to testify on the now grounded 737 MAX that has been involved in two deadly crashes since October 2018 that killed 346 people. The panel’s chair, Representative Peter DeFazio, also asked John Hamilton, the chief engineer of Boeing’s Commercial Airplanes division, to appear. Both executives have been asked to testify on Oct. 30. Last week, DeFazio asked Muilenburg to make several employees available for interviews as part of a congressional probe into the design, development and certification of 737 MAX aircraft. “Boeing has received the Committee’s invitation and is reviewing it now. We will continue to cooperate with Congress and regulatory authorities as we focus on safely returning the MAX to service,” a Boeing representative said in a statement.

But will they get them? Boeing will just claim they would reveal company secrets.

• Ethiopian Crash Victims Want 737 MAX Documents From Boeing, FAA (R.)

A lawyer for victims of Ethiopian Airlines Flight 302 said on Tuesday he wants Boeing Co and the U.S. Federal Aviation Administration to hand over documents about the decision to keep the Boeing 737 MAX in the air after a deadly Lion Air crash last October. A week after Lion Air Flight 610 nose-dived into the Java Sea, killing all 189 aboard, the FAA warned airlines that erroneous inputs from an automated flight control system’s sensors could lead the jet to automatically pitch its nose down, but the agency allowed the jets to continue flying. Five months later, the same system was blamed for playing a role when ET302 crashed on March 10, killing all 157 passengers and crew and prompting a worldwide grounding of the 737 MAX that remains in place.

“The decisions to keep those planes in service are key,” Robert Clifford of Clifford Law Offices, which represents families of the Ethiopian crash victims, said at a status hearing before U.S. Judge Jorge Alonso in Chicago. Nearly 100 lawsuits have been filed against Boeing by at least a dozen law firms representing families of the Ethiopian Airlines crash victims, who came from 35 different countries, including nine U.S. citizens and 19 Canadians. Families of about 60 victims have yet to file lawsuits but plaintiffs’ lawyers said they anticipate more to come. Most of the lawsuits do not make a specific dollar claim, though Ribbeck Law Chartered has said its clients are seeking more than $1 billion.

The entire Kavanaugh thing is empty, just two women trying to sell a book. Trump said he should sue them. But as a Supreme Court judge, perhaps he shouldn’t.

• Editorial Mistake My Ass (Mish)

As details emerge in the New York Times Kavanaugh scandal, it’s very clear the NYT repeatedly made serious errors On September 14, the New York Times resurrected unsubstantiated and graphic rumors about Supreme Court Justice Brett Kavanaugh in a purposeful smear article Brett Kavanaugh Fit In With the Privileged Kids. She Did Not. The article was by disgraced NYT authors Robin Pogrebin and Kate Kelly to promote their upcoming book “The Education of Brett Kavanaugh: An Investigation.” I do not normally report on sleaze but to understand what the NYT did, I have to. Here is one controversial paragraph: “We also uncovered a previously unreported story about Mr. Kavanaugh in his freshman year that echoes Ms. Ramirez’s allegation. A classmate, Max Stier, saw Mr. Kavanaugh with his pants down at a different drunken dorm party, where friends pushed his penis into the hand of a female student.”

The NYT later added this correction. “The book reports that the female student declined to be interviewed and friends say that she does not recall the incident. That information has been added to the article.” Making matters worse for itself, the NYT came out and blamed it all on an “editing error”. Reporters Robin Pogrebin and Kate Kelly said in an interview on MSNBC that they wrote in the draft of their Sunday Review piece that a woman who Kavanaugh was said to have exposed himself to while a student at Yale had told others she had no recollection of the alleged incident. Their editors, they say, removed the reference. “It was just sort of. . . in the haste of the editing process,” said Pogrebin.

But this is where the non-story leads to. Kamala seeks a way to reinvent her campaign, the rest just follows.

• Democrats Urge New Probe Of Kavanaugh, Impeachment Inquiry (R.)

U.S. Senator Kamala Harris on Tuesday urged a House of Representatives panel to investigate Supreme Court Justice Brett Kavanaugh, while a Democratic lawmaker filed an impeachment resolution in the wake of new allegations of sexual misconduct by the conservative judge when he was in college in the 1980s. The moves by Harris, one of 20 Democratic presidential candidates, and Representative Ayanna Pressley, a progressive on the left of the party, signaled impatience among some Democrats with congressional leaders unenthusiastic about pursuing Kavanaugh’s impeachment, though their efforts appeared unlikely to spur action.

Harris said in a letter to House Judiciary Committee Chairman Jerrold Nadler that the panel should “hold Mr. Kavanaugh accountable for his prior conduct and testimony.” Nadler on Monday faulted the FBI’s probe of prior sexual misconduct allegations against Kavanaugh ahead of his narrow confirmation by the Senate in October 2018, saying in a radio interview it “apparently was a sham.” But Nadler also said his panel had its “hands full” with investigating Republican President Donald Trump. In her letter to Nadler, Harris suggested the House Judiciary Committee could create a task force and retain outside counsel if it did not have the time or resources to pursue an inquiry of Kavanaugh now.

Harris and several other Democratic presidential candidates called for Kavanaugh’s impeachment after the New York Times published an essay over the weekend detailing what it described as a previously unreported incident of sexual misconduct by Kavanaugh. Others include former U.S. Housing and Urban Development Secretary Julian Castro; U.S. Senators Elizabeth Warren and Cory Booker; South Bend, Indiana Mayor Pete Buttigieg; and former U.S. Representative Beto O’Rourke.

Only a Five Eyes spy chief. And whaddaya know, there’s Bill Browder again. See from yesteday: The Magnitskiy Myth Exploded.

• Trudeau Reassures Allies Amid Alleged Spying Case (BBC)

Canadian Prime Minister Justin Trudeau has moved to reassure allies in the wake of an alleged spying case with possible international implications. A senior intelligence official was charged last week with violating national security laws. Cameron Ortis had access to information coming from Canada’s global allies, the RCMP national police force said. Canada is in close contact with its intelligence partners over the case, Mr Trudeau says. “We are in direct communications with our allies on security,” the prime minister said while campaigning in Newfoundland on Tuesday. “We are also working with them to reassure them, but we want to ensure that everyone understands that we are taking this situation very seriously.” Canada is a member of the Five Eyes – the intelligence alliance that also includes the US, UK, Australia and New Zealand.

Mr Ortis, who was a director general with the police force’s intelligence unit, is accused of breaching the Security of Information Act and the Criminal Code. The charges filed against him include the “unauthorised communication of special operational information”, possessing a device or software “useful for concealing the content of information or for surreptitiously communicating, obtaining or retaining information”, and breach of trust by a public officer. [..] Mr Ortis was looking into allegations that Russian tax fraudsters had laundered millions of dollars through Canada, a US financier told Reuters. Bill Browder, a high-profile critic of Russian President Vladimir Putin, said he had met Mr Ortis twice in Canada in 2017 after alerting the RCMP to the matter.

What exactly would you say is Facebook’s role in our society? How about in your life?

• Catastrophic Effects Of Working As A Facebook Moderator (G.)

They describe being ground down by the volume of the work, numbed by the graphic violence, nudity and bullying they have to view for eight hours a day, working nights and weekends, for “practically minimum pay”. A little-discussed aspect of Facebook’s moderation was particularly distressing to the contractors: vetting private conversations between adults and minors that have been flagged by algorithms as likely sexual exploitation. Such private chats, of which “90% are sexual”, were “violating and creepy”, one moderator said. “You understand something more about this sort of dystopic society we are building every day,” he added. “We have rich white men from Europe, from the US, writing to children from the Philippines … they try to get sexual photos in exchange for $10 or $20.”

Gina, a contractor, said: “I think it’s a breach of human rights. You cannot ask someone to work fast, to work well and to see graphic content. The things that we saw are just not right.” The workers, whose names have been changed, were speaking on condition of anonymity because they had signed non-disclosure agreements with Facebook. Daniel, a former moderator, said: “We are a sort of vanguard in this field … It’s a completely new job, and everything about it is basically an experiment.” John, his former colleague, said: “I’m here today because I would like to avoid other people falling into this hole. As a contemporary society, we are running into this new thing – the internet – and we have to find some rules to deal with it.

Pay him in Bitcoin.

• US Government Is Suing Edward Snowden For His Book Profits (Verge)

The Justice Department has filed a civil lawsuit against Edward Snowden that would recover all proceeds of his recently released memoir, the department announced on Tuesday. The charges coincide with the official publication of the book, which is titled Permanent Record. Snowden’s memoir was allegedly not submitted to the CIA or NSA for pre-publication review, a required practice among former employees of intelligence agencies. As such, the department considers the book a breach of Snowden’s fiduciary obligations, and names the publishers as co-defendants in the suit.

Given the still-classified programs and materials discussed in the memoir, it is unlikely that the book would have been approved for publication by the agencies. Snowden remains a de facto fugitive from the US government, and would likely face charges under the Espionage Act if he returned to the country. But the new civil case could nonetheless cause problems for Snowden, potentially enjoining his publishers from releasing any of the proceeds from the book. Crucially, the suit does not seek to block the release of Snowden’s memoir, as doing so would be illegal under the First Amendment.

From Notes on the Next War, 1935