DPC El Paso, Texas 1903

Lowball spin of the day: “..an increasing willingness among individuals to hold foreign currencies..”

• China’s Yuan Positions Fall by a Record, Signaling More Outflows (Bloomberg)

Yuan positions at China’s central bank and financial institutions fell by the most on record in July, a sign capital outflows picked up and the central bank stepped up intervention to support the yuan. Yuan positions on the balance sheet of the People’s Bank of China totaled 26.4 trillion yuan ($4.13 trillion) at the end of July, according to data on the authority’s website. That’s a drop of 308 billion yuan from a month earlier, based on Bloomberg calculations. Yuan positions at Chinese financial institutions accumulated from foreign-exchange purchases fell by 249.1 billion yuan to 28.9 trillion yuan. “The drop was both due to a trend of diversifying assets and market expectations of a Federal Reserve interest-rate rise,” said Hu Yuexiao at Shanghai Securities.

“The combination of a current-account surplus and a capital-account deficit won’t change for a long time.” The 58.9 billion yuan difference in the size of the declines were due to an increasing willingness among individuals to hold foreign currencies, Hu added. The data come days after the People’s Bank of China devalued the yuan, triggering the currency’s steepest slide in two decades, and announced a shift to a more market-driven exchange-rate mechanism. The changes follow interventions to prop up the yuan that contributed to a decline of almost $300 billion in the nation’s foreign-exchange reserves over the last four quarters. The central bank has lowered banks’ reserve-ratio requirements this year in moves economists said were designed to compensate for such losses in liquidity.

Global corporations across the board have bet on years of huge growth in China. The amount of overcapacity will be found out to be stunning, and to cause tons of bankruptcies.

• Eight Reasons Why China’s Currency Crisis Matters To Us All (Guardian)

After China unexpectedly devalued its currency last week, one City economist shrugged despairingly and said: “It’s August.” While it’s meant to be a time for heading for the beach or kicking back in the sunshine with the kids, August has often witnessed the first cracks that presaged what later became profound shifts in the tectonic plates of the global economy – from the Russian debt default in 1998, to what Northern Rock boss Adam Applegarth called “the day the world changed,” when the first ripples of the credit crunch were felt in 2007; to August 2011, when ratings agency Standard and Poor’s sent shockwaves through financial markets by stripping America of its triple-AAA credit rating.

Taking the long view, last week’s devaluation by China, which left the yuan about 3% weaker against the dollar, was relatively modest — sterling had lost 16% of its value in 1967 when Harold Wilson sought to reassure the British public about the “pound in your pocket”. But China’s decision represented the largest yuan depreciation for 20 years; and the ripples may yet be felt thousands of miles away. So what difference will it make to the rest of the world?

1. It could be serious China’s devaluation may be best seen as a distress signal from Beijing policymakers – in which case the world’s second-largest economy may be far weaker than the 7% a year growth that official figures suggests. China has been trying to engineer a shift from export-led growth to an expansion based on consumer spending – while simultaneously trying to deflate a property bubble. Last week’s move, which loosened the yuan’s link to the value of the dollar, suggested some policymakers may be losing patience with that strategy, and reaching for the familiar prop of a cheap currency. Nobel prize-winning economist Paul Krugman described the decision as “the first bite of the cherry,” suggesting more could follow, and in a reference to Chinese premier Xi Jinping, warned that such a modest move gave the impression that, “when it comes to economic policy Xi-who-must-be-obeyed has no idea what he’s doing”.

If its economy really is much weaker than Beijing has let on, it would be alarming for any company hoping to export to China — something firms in Britain have been encouraged to do in recent years, to lessen reliance on the stodgy European economies. China was the sixth-largest destination for British exports last year. China will remain a vast market; but it may not be quite such a one-way bet as some analysts have suggested. And when it comes to the challenges facing Chinese policymakers, Russell Jones, of consultancy Llewellyn Consulting says: “The potential for getting this wrong is quite high.”

Krugman agrees with me that China’s leadership has no control where it thought it did. The result of hubris.

• Bungling Beijing’s Stock Markets (Paul Krugman)

China is ruled by a party that calls itself Communist, but its economic reality is one of rapacious crony capitalism. And everyone has been assuming that the nation’s leaders are in on the joke, that they know better than to take their occasional socialist rhetoric seriously. Yet their zigzagging policies over the past few months have been worrying. Is it possible that after all these years Beijing still doesn’t get how this “markets” thing works? The background: China’s economy is wildly unbalanced, with a very low share of gross domestic product devoted to consumption and a very high share devoted to investment. This was sustainable while the country was able to maintain extremely rapid growth; but growth is, inevitably, slowing as China runs out of surplus labor.

As a result, returns on investment are dropping fast. The solution is to invest less and consume more. But getting there will take reforms that distribute the fruits of growth more widely and provide families with greater security. And while China has taken some steps in that direction, there’s still a long way to go. Meanwhile, the problem is how to sustain spending during the transition. And that’s where things have gotten weird. At first, the Chinese government supported the economy in part through infrastructure spending, which is the standard remedy for economic weakness. But it also did so by funneling cheap credit to state-owned enterprises. The result was a run-up in these enterprises’ debt, which by last year was high enough to raise worries about financial stability.

Next, China adopted an official policy of boosting stock prices, combining a stock-buying propaganda campaign with relaxed margin requirements, making it easier to buy stocks with borrowed money. The goal may have been to help out those state-owned enterprises, which could pay down debt by selling stock. But the consequence was an obvious bubble, which began deflating earlier this year. The response of the Chinese authorities was remarkable: They pulled out all the stops to support the market — suspending trading in many stocks, banning short-selling, pushing large investors to buy, and instructing graduating economics students to chant “Revive A-shares, benefit the people.” All of this has stabilized the market for the time being. But it is at the cost of tying China’s credibility to its ability to keep stock prices from ever falling. And the Chinese economy still needs more support.

Why there are 30% discounts on car purchases in China.

• China Mess, Yuan Devaluation Spread to the US, Carmakers (WolfStreet)

China’s auto market, which had been the single most important element in the convoluted growth story of GM and other global automakers, was getting battered even before the yuan devaluation. But now elements coagulate into a toxic mix. Sales of passenger vehicles in July dropped 6.6% from a year ago, to 1.27 million, according to the China Association of Automobile Manufacturers, a 17-month low, after they’d already fallen 3.4% in June, and after they’d relentlessly trended down since late last year. This debacle happened even though automakers had cut prices and heaped incentives on the market to stem the decline. GM and VW started it, and it has now turned into a price war. GM’s sales through its joint ventures fell 4% in July year-over-year, to 229,175 vehicles.

Despite falling sales and ballooning price cuts, GM remains, at least in its press release, optimistic about sales and profit margins in China, its second largest market, and simply blamed “model changeovers and the phasing out of older Chevrolet vehicles.” So no biggie. Ford’s sales through its Chinese joint ventures plunged 6% year-over-year, its third monthly decline in a row, to 77,100 vehicles. Unlike GM, it’s publically worried: “Longer term, we’re still very bullish on China,” Hau Thai-Tang, head of Ford’s global purchasing, told an industry conference in New York. But the company would move to lower output in China if there is a “prolonged period of recessions.” While some automakers booked gains, like Daimler whose sales surged 42%, others got clobbered, like Nissan whose sales plunged 14%.

And VW said today that its Audi sales in July had plummeted 12.5% in China, Audi’s largest market. It sells about a third of its cars there. Unlike the folks at GM, Audi sales chief Luca de Meo fretted today: “The market situation in China has remained challenging as expected, exacerbated by the stock market turmoil.” Global automakers assemble in China most of the vehicles they sell in China. In the first half of the year, imports – mostly luxury brands – dropped 24% to 531,900 as a consequence of the corruption crackdown. They made up only about 5% of the 10.1 million passenger vehicles sold in the first half. The remaining 95% were assembled in China.

“If there is no firm commitment from the IMF to participate in the third aid package, then we have a new situation..”

• Germany, IMF Far Apart On Greek Debt Relief (Observer)

[..] Lagarde also said she will not commit the IMF to joining the latest bailout until the board has reviewed the agreement, probably in the autumn. Officials said they want to see more details about reforms, particularly to pensions, but the delay will also give European leaders time to consider their stance on debt relief. Germany holds more Greek debt than any other eurozone country and has repeatedly rejected any “haircut” on what Athens owes, but is also keen to keep the IMF involved in the bailout. German finance minister Wolfgang Schäuble reiterated his opposition to an outright writedown of the face value of Greek debt in an interview with Deutsche Welle published on Saturday.

He also said the scope for milder forms of debt relief, like extending debt maturities, was “not very big”. But the IMF has taken an equally hard line, warning last month that, without an “explicit and concrete agreement” on debt relief, the fund will not participate in a new bailout. According to analysis by the EC, ECB and the eurozone bailout fund, Greece’s debts will peak at 201% of GDP in 2016, but still be 160% in 2022. The IMF views a debt-to-GDP ratio above 120% as unsustainable. The IMF is a key part of Europe’s bailout plans because it can provide both funds that spare European countries some financial pain and a reputation for rigour that helps eurozone leaders convince financial markets and domestic parliaments that Greece will keep its commitments.

A parliamentary vote on the bailout package in Berlin on Wednesday is likely to expose fractures in Angela Merkel’s conservative ranks. A key ally described IMF involvement as a “condition” for the support of his party, Reuters reported, although Green and Social Democrat support is expected to get the deal through. “If there is no firm commitment from the IMF to participate in the third aid package, then we have a new situation,” said Wolfgang Bosbach, a high-profile rebel on Greece from Merkel’s CDU party.

Headline is better than content.

• Europe Has Taken Charge Of Greece Like A Television Nanny (Guardian)

Many measures are not objectionable in themselves: they are couched in the language of “best practice” and will be carried out with the “technical assistance” of external institutions, including the Organisation of Economic Co-operation and Development and the World Bank. Not even the most radical Syriza hardliner would argue that Greece’s economy is not in need of reform. And there are narrative passages, whose inclusion was presumably insisted on by the Greeks, that represent the tattered remnants of eurozone solidarity: “The correction of extreme imbalances in public finances in recent years has required an unprecedented adjustment and sacrifices from Greece and its citizens,” the document acknowledges.

But once it gets down to the nitty-gritty, the abrogation of political control signalled by the memorandum is extraordinary. It is littered with milestones and targets the Athens government must meet – month by month, year by year – and pledges to subject any significant policy changes to the scrutiny of its international overseers. At one level, this is understandable: Greece’s creditors are putting their own taxpayers’ money at risk and have democratic mandates of their own to fulfil. But it sits in sharp opposition to the widespread public rejection of austerity revealed in June’s Greek referendum – and it won’t work. The shortcomings of the fiscal arithmetic underlying the new plans have been well-rehearsed. Syriza has won modest concessions on the size of the primary surpluses (that is, surpluses before debt repayments) it will have to aim at in the years ahead.

But the EU’s own institutions joined the IMF in suggesting the country’s debt still looks unsustainable without restructuring – something that is yet to be negotiated. More talks will follow in the autumn, once the Greeks have passed yet more legislation to show their determination (and perhaps after snap elections). All this will take place against the background of a eurozone economy that already appears to have been slowing, amid weak global demand, even before the fresh dose of deflation that will be heading Europe’s way after China devalued its currency last week. That will make it even harder for Greece to generate the growth it needs to rebuild public finances.

While Athens strains to reach its targets, it will be simultaneously attempting to concertina decades of social and political evolution – from stodgy backwater to new-model economy, graft-ridden client state to efficient technocracy – into just three years. Drastic economic reforms imposed by external taskmasters hardly have a glowing history, even when enthusiastically adopted (think of the World Bank’s “shock therapy” in Russia or the IMF’s record during the Asian financial crisis of the late 1990s). The parliament may have passed the package on Friday morning after one of its soul-searching all-nighters, but with the economy still being strangled by capital controls, this was democracy at economic gunpoint.

“I see very little chance that the bailout will succeed — it’s too much like the other ones.”

• The Greek Debt Deal’s Missing Piece (NY Times)

At long last, European creditor nations and Greece have reached an agreement on a third bailout in five years. The bailout, which was approved by Greece’s Parliament on Friday, included familiar details: In return for an infusion of 86 billion euros, or $95 billion, Greece has promised to increase taxes, cut spending and enact measures to make its economy function more efficiently. But there was one glaring omission. As it stands, none of that new money flowing into Greece will come from the agency that has, until now, played a crucial role in virtually every bailout, in Greece and elsewhere around the world: the IMF. That is because the IMF says that Greece was simply incapable of repaying its staggering debt. Yet the accord reached last week makes no effort to reduce that burden.

If you agree with the IMF’s reasoning, you might have to conclude that despite all of the seemingly ironclad provisions of the agreement imposed by eurozone creditors, Greece will be no more able to honor the deal or to repay its new loans than it has been in other bailouts. “I remain firmly of the view that Greece’s debt has become unsustainable and that Greece cannot restore debt sustainability solely through actions on its own,” the IMF’s chief, Christine Lagarde, said on Friday, following the accord’s approval this week. The Greek debt drama has had its share of twists and turns. Alliances have shifted, rivalries have deepened, and the back-room maneuverings have been appropriately Byzantine. But the IMF shift from being Greece’s most persistent scold to its main advocate for a break on its debt has been among the most intriguing developments so far.

[..] The Europeans were pressuring Mr. Varoufakis to agree to an austerity-loaded debt deal that he was resisting. I have a question for Christine, he said. Can the IMF formally state in this meeting that this proposal we are being asked to sign will make the Greek debt sustainable? Back at IMF headquarters in Washington, the decision was unanimous: It would go public with its assessment that Greece’s debt situation was hopeless. The 19 countries of the euro area make up the IMF’s largest shareholder base, but as the world’s financial watchdog, the fund also represents 169 other nations. If the IMF wants to be seen as an international, as opposed to a European, monetary fund, it must prove that it can speak with an independent voice.

And if that means arguing that Europe, its senior partner in these talks, needs to take a loss on its loans — well, so be it. Many have commended the fund for going public with its views. But the release of its debt reports has not yet had any practical effect. The latest bailout is heavy on austerity measures like privatization of power companies and seaports, reduced pensions and tax increases in shipping and tourism, and says nothing about debt relief. “This is old wine in a new bottle,” said Meghan E. Greene, chief economist at Manulife in Boston. “I see very little chance that the bailout will succeed — it’s too much like the other ones.”

Would it have made a difference if the fund had officially broken with Europe in the spring, when it began to conclude that the Greek debt had become unmanageable? Probably not, says Susan Schadler, a former IMF economist and author of a widely read paper on the fund’s Greece saga. But she argues that by not forcing creditors to take a loss back in 2010, the pain has been borne almost exclusively by the Greeks themselves, and not by bond investors. “The fund should have pushed for a restructuring then,” she said. “That, after all, is its job — to assess the risks and say whether or not the debt is sustainable.”

“Every corner and beauty of Greece is being sold..”

• Alexis Tsipras Is Down But Far From Out (Guardian)

The result of the parliamentary all-nighter that approved Greece’s latest multibillion-euro bailout on Friday morning means early elections are now a near certainty and could come as soon as next month. The prime minister, Alexis Tsipras, may have secured parliament’s backing by a comfortable margin but he did so thanks to the support of the opposition, not of his own leftist Syriza party, nearly one-third of whose 149 MPs either voted against or abstained. The rebellion by Syriza hardliners, furious at what they see as a betrayal of the party’s anti-austerity principles, left Tsipras short of the 120 votes – two-fifths of the 300-seat assembly – that Greek prime ministers need to show they command a majority and could survive a censure motion.

Government sources told Greek media Tsipras could now well choose to call a confidence vote for soon after 20 August, the day Athens is due to make a crucial €3.2bn payment to the ECB. This time, he would not be able to count on the votes of the conservative New Democracy opposition, which has already said it would not back the government in a confidence vote – although some other pro-European parties might. Win or lose, however, Tsipras is now widely expected to try to shore up his position by going to the polls this autumn. Fresh elections could be held at a month’s notice, making late September or early October likely dates. “The agreement has cost the government its majority,” Nikos Xydakis, the culture minister, told state television. “As things have turned out, the clearest solution would be elections.”

Tsipras told parliament he did not regret his “decision to compromise” with Greece’s international creditors: “We undertook the responsibility to stay alive, over choosing suicide.” However, Tsipras’s party is now almost certain to split, with the leader of its dissident Left Platform, the former energy minister Panagiotis Lafazanis, already announcing his intention to form a new anti-bailout movement and accusing the government of “annulling democracy” and caving in to the “dictatorship of the eurozone”. The depth of the rebels’ bitterness is plain. Zoe Konstantopoulou, the speaker, raised so many procedural questions and objections that the finance minister, Euclid Tsakalotos, missed the 9.30am vote, Reuters reported, as he had to catch a plane to Brussels.

“Every corner and beauty of Greece is being sold,” Konstantopoulou declared. “The government is giving the keys to the troika [of creditors], along with sovereignty and national assets … I am not going to support the prime minister any more.”

“Berlin is keen to keep [the IMF] on board because of the institution’s reputation for rigour.” But they refuse to accept the consequences of that rigor: debt relief.

• German Vote On Greek Bailout Carries Risks For Angela Merkel (Reuters)

In a major test of her authority, Chancellor Angela Merkel will ask sceptical German lawmakers to back an €86 billion bailout for Greece on Wednesday despite uncertainty over whether the IMF will play a role in the rescue. Parliamentary approval is not in doubt because the Social Democrats (SPD) and Greens are expected to back the deal. But the vote could expose a deep divide among Merkel’s conservatives, damaging the German leader and her close ally Volker Kauder, the head of her bloc in parliament.

Kauder, who incensed fellow lawmakers last week with threats of retaliation if they rebelled and voted against a bailout, has described the involvement of the IMF as a “condition” for the support of his party.However under the bailout approved by euro zone finance ministers at a meeting in Brussels late on Friday, it is unclear whether the IMF will end up playing a role. IMF Managing Director Christine Lagarde told the ministers by telephone that she could not commit until her board reviewed the situation in the autumn. She renewed a call for “significant” debt relief for Greece, a demand Merkel’s government has repeatedly pushed back against. German Finance Minister Wolfgang Schaeuble reiterated his opposition to an outright writedown of the face value of Greek debt in an interview with Deutsche Welle published on Saturday. He said the scope for milder forms of debt relief, like extending debt maturities, was “not very big”.

The IMF took part in the first two rescues for Greece, which totalled €240 billion, and Berlin is keen to keep it on board because of the Washington-based institution’s reputation for rigour. Last month, a record 65 lawmakers from Merkel’s conservative camp broke ranks and refused to back negotiations on the bailout. Far more could rebel in Wednesday’s vote, with top-selling German daily Bild estimating that up to 120 members of her Christian Democratic Union (CDU) and its Bavarian sister party, the Christian Social Union (CSU), may refuse to back the government.

There is still time.

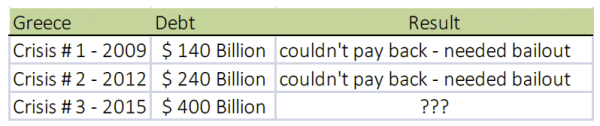

• Guess What Happens Next (Keith Dicker)

[..] considering that economic growth is a function of aggregate spending, how on earth can any sane person expect the Greek economy to recover and grow? The answer: they can’t. For further proof why it doesn’t work and it will never work, you just have to look at Iceland. Iceland was the very first country wiped out by the 2008 global debt crisis. The Icelandic government and the Icelandic banks completely mismanaged everything for which they were financially responsible. And when everything hit the fan – no one come running to save them, in fact, the complete opposite happened. Both Britain and the Netherlands threatened to completely wipe Iceland off the global financial map.

At the time, Icelandic banks offered regular banking accounts in Britain and the Netherlands that paid 6% interest. Considering other global banks offered 3% and less, and also considering that the vast majority of people in the world have no idea how a bank is structured; thousands of British and Dutch savers blindly ploughed their savings into these Icelandic bank accounts. After all, it was a bank deposit, it was guaranteed by the bank and 6% is greater than 3%. Where was the risk with this? Next, when the crisis hit Iceland – all bank accounts were frozen, and the savings of many British and Dutch investors melted away. Suddenly, the risk with 6% was crystal clear. Naturally, the British and Dutch governments both demanded their citizens be repaid for making stupid investment decisions.

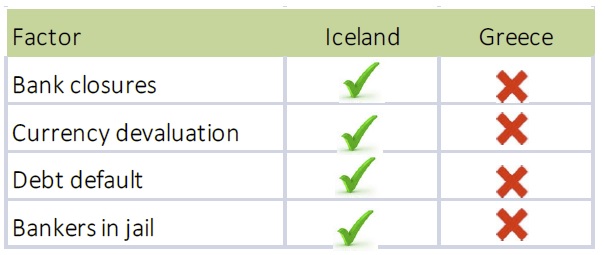

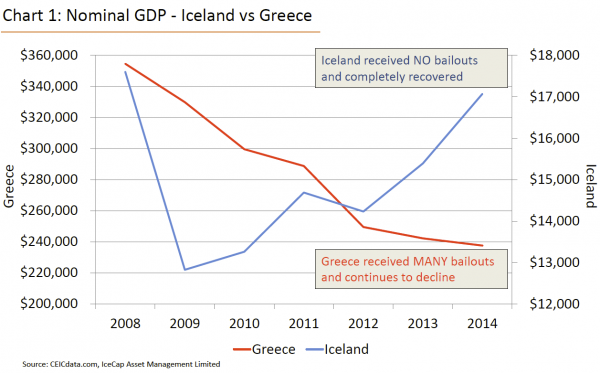

The Icelandic government meanwhile, finally woke from their frozen state and assessed the situation. Not only did the government not have enough money to repay bank depositors, it didn’t have enough money to pay themselves. And since no one would lend Iceland any money – the country was officially broke. The rivers would stop running, the glaciers would stop flowing, and the thermal baths would stop steaming – or so we were told. Instead, Iceland allowed its banks to collapse, allowed its currency to drop by over 70%, decided not to pay back all of the money it owed, and finally – it actually imprisoned certain bank executives for putting the country into such a financially toxic position. A comparison between the Icelandic approach and the European approach forced upon Greece is as follows:

And as for the outcome, the chart below clearly shows the economic recovery experienced by both countries, over the exact same time frame, and using completely opposite solutions.

No, we’re in it.

• Approaching a Global Deflationary Crisis? (Brian Davey)

The desire to make the crisis understandable can convert into a temptation to make it seem simpler than it is. At its most banal we have the explanations that neo liberal German politicians are prone to – like the idea that the crisis is because of a lack of confidence and trust and that this can be resolved (in Europe) purely and simply by countries following the Eurozone rules. If the confidence and trust are restored then all will be well and the market will restore prosperity. A more adequate story is needed than this – and it is one that needs to focus on global trends not just in Europe but in the USA, the so-called developing world and above all in China. This story has a number of different plots and sub plots, not one. We need to understand how the sub plots interweave.

The story is one of debt, competitive imbalances and an energy crisis and all need to be told. To make the story even more complicated we need to keep in mind too that an even more important story, that of climate change, has to be held in our minds too. If and when humanity has any chance of resolving these crises it will have to resolve that one at the same time. Will this be possible? I don’t know – what I do know is that there is a theory, by archeologist Joseph Tainter, that humanities’ problem solving capacities are limited by complexity. A friend is currently trying to get me to use twitter. However I am daunted by reducing complex situations to short simple messages.

Understanding the global economy is like entering a labyrinth. As I get older I notice that some people become famous because of the clarity in the way that they write. What may not be noticed is that the apparent clarity in a political economic message is often the result of simplification. The popularity of neo-liberal economcs is like that. So lets look at the ways of describing the crisis. In summary this can be described as the interrelationship between 4 processes.

(1) Structural policy stupidity – policy governance cannot cope with the complexity of the crisis. Politicians cannot cope with communicating complex messages to their peoples nor find the mechanisms to cope with the complexity of the issues.

(2) Problems are also caused by uneven development between countries and sectors which cannot be sustained without methods for recycling purchasing power from the more competitive countries to the less competitive ones. These imbalances become most problematic when capital export from surplus to deficit countries slows which happens when growth slows in the deficit countries.

(3) The crisis is both cause and effect of a rising amount of debt – personal, corporate, state and financial sector – which has acted as a drag on growth. As growth falls all kinds of debt become more difficult to service so the monetary authorities have tried to push interest rates down. Nevertheless the finance sector has tended to become both more speculative and more predatory as there is a “hunt for yield”. Interest rates rise when risk premiums are imposed on distressed borrowers (including states), money making occurs through financing arrangements based on “passing the risk parcel” exploiting the naivety of lenders about complex financial arrangements and by the promotion of asset price bubbles. The bigger players are rescued during crises but the smaller players (including tax payers and those who lose their state benefits) are made to pay.

(4) The crisis is the result of reaching “the limits of economic growth” and, in particular, because of resource depletion in the energy sector. This is less obvious because of currently low and falling energy and commodity prices but we need to study the experience of the energy sector over last few years, not just the immediate situation. The immediate fall in commodity and energy prices is a result of the onset of the crisis – a crisis which very high and rising energy prices up until recently helped bring on. The high energy prices have been compatible with a high level of debt only because interest rates have been so low and because there has been a “hunt for yield”, something that would pay more than leaving money on deposit paying very little.

This list could be much longer still.

• The Crisis Is Spreading: China, Australia, Brazil, Canada, Sweden… (Keith Dicker)

We’ve written before that governments all around the world have borrowed too much money and the weight of these debts are choking economic growth. And to make matters worse – these very same governments and their central banks have implemented various plans that have only made matters worse. Our view has not changed – the global debt crisis has escalated to a point where the government bond bubble has inflated itself to become the mother of all bubbles. It’s going to burst, and when it does it wont be pretty. Further evidence to support our view is as follows:

Canada – the collapse in oil and commodity markets has pushed the country into recession and the Canadian Dollar to decline to levels lower than that reached during the 2008 crisis. Oil dependent provinces Alberta and Newfoundland remain in deep denial. Since everyone in these provinces have only ever experienced a booming oil market, many naively believe things will bounce back – and quickly. Meanwhile, both Toronto and Vancouver housing markets also remain in denial as they continue to go gangbusters. Buyers today are likely buying at all-time highs.

Australia – Over the last 20 years, China has been viewed as the growth engine of the world, and justifiably so. With annual growth rates between 8% to 15%, China’s economy was literally eating every rock, stalk and barrel of practically every commodity in the world. And naturally, any country or company that produced these commodities made a tonne of money – including Australia. Today, China’s growth rate has slowed to about 3% which is a dramatic slow down compared to what it achieved in the past. This slowdown and China’s effort to even maintain these rates, will have significant repercussions around the world.

Brazil – Like Australia, Brazil has benefitted immensely from China’s growth. And now, also like Australia, it too is feeling the affects of the dramatic Chinese slowdown. The economy has now declined for 12 consecutive months making it both the longest and deepest recession in 25 years. But wait – it gets worse. Despite declining growth, inflation continues to soar higher causing interest rates to rise as well. And if that wasn’t bad, also know that the Brazilian currency has fell off the cliff at -53%.

Sweden – Unlike Australia and Brazil, Sweden relies very little on China as a buyer of last resort. Yet, the Swedish economy is also not very hot these days. In fact, instead of spectacular and dramatic declines in anything, it is doing the exact opposite – it just isn’t moving. While Sweden isn’t in the Eurozone, it is smack dab next to it and that in itself is reason enough for the lack of growth. We’ve written before how the debt crisis in the Eurozone is acting like a giant, slow moving tornado that is sucking the life out of the economy and everything near by. And unfortunately for Sweden, it is very near by.

A story intended to hide US links, not reveal them.

• Brazil Authorities Detail US Link in Petrobras Corruption Case (WSJ)

Brazilian authorities leading an investigation into a massive corruption scandal at the state-run oil firm Petróleo Brasileiro SA have for the first time detailed suspected wrongdoing on U.S. soil. The authorities had previously shown evidence that some suspects in the case laundered money through U.S. bank accounts. But new evidence purports to show two suspects working out the details of a bribe-for-contracts deal at a Manhattan hotel, adding to the international scope of an investigation that already spans four continents. The U.S. Justice Department and the Securities and Exchange Commission opened investigations last year into Petrobras, whose shares are traded in New York.

“It is certainly significant. Having somebody in the U.S.—where there was some action that furthered the conspiracy—would be a very good jurisdictional hook” for the Justice Department, said Bill Michael, a Chicago-based lawyer with firm Mayer Brown LLP. According to Brazilian prosecutors, a Chinese shipping executive named Hsin Chi Su and a Brazilian named Hamylton Padilha, who was working on behalf of the Houston-based oil-services company Vantage Drilling Co., met at the Four Seasons Hotel in New York in November 2008. Mr. Su, also known as Nobu Su, was the chief executive of a privately held Taiwanese company called Taiwan Maritime Transportation, or TMT. His mother was a major shareholder in Vantage Drilling, prosecutors said.

TMT and Vantage co-owned a deep-water drilling ship named the Titanium Explorer, and were working together to win a lucrative contract to lease the ship to Petrobras. After Vantage had been left off a final list of companies in the running for the contract, the two men agreed at the New York meeting and a subsequent Rio de Janeiro meeting to bribe key Petrobras executives and politicians with $31 million sifted through a series of shell companies and bank accounts in Switzerland, Panama and Monaco, according to prosecutors. A few weeks later, Vantage was placed at the top of the list of potential bidders for the contract, prosecutors said. In January 2009, Petrobras’s board of directors approved the deal. At the time, Vantage said that it expected to see revenues of $1.6 billion over the course of the eight-year deal.

What other than a revolution can cleanse Brazil?

• Brazil Sees Massive Protests Calling For President Rousseff’s Impeachment (SMH)

Hundreds of thousands of angry of citizens are expected to take to the streets of more than 114 Brazilian cities on Sunday as allegations of corruption and incompetence swamp the government, and plummeting commodity prices sap its economy, posing a key test for President Dilma Rousseff. This will be the year’s third mass protest against Ms Rousseff, who is facing growing calls for her impeachment. A strong showing could help support her ouster. The Free Brazil Movement, one of the groups organising the demonstrations, says rallies are confirmed in at least 114 cities. Congress is watching the turnout both to judge the support for impeachment proceedings and to measure the level of discontent in their home districts.

“Representatives in the lower house are paying close attention to the protests on Sunday to see if they have a national impact,” said Leonardo Picciani the leader of the Democratic Movement Party in the lower house, which remains in uneasy alliance with Ms Rousseff’s Workers’ Party. Mr Picciani’s party, known as the PMDB, has the largest representation in Congress. Speaker Eduardo Cunha declared his personal opposition to the government after he was accused of soliciting and accepting a $US 5 million bribe, which he denied. While his party has not formally broken from the Workers’ Party, some of its representatives say they’ll vote for impeachment, an aim shared by large segments of the population.

But Brazilians are divided. Women farmers marched through Brazil’s capital on Wednesday in a show of support for Ms Rousseff. The “March of the Daisies” organised by leftist groups linked to Ms Rousseff’s Workers Party, attracted about 35,000 farmers to Brasilia’s downtown area, according to official estimates. Opinion polls show seven out of 10 Brazilians want Ms Rousseff to be impeached, holding her responsible the downturn in Latin America’s largest economy and a massive corruption scandal at state-run oil company Petrobras.

As Greeks go hungry and refugees drown: “..neutral factual information is needed of course, but it is not enough on its own..”

• EU ‘Self-Promotion’ Budget Reaches €664 Million In 2014 (RT)

The European Union spent €664 million on promoting its values among grown-ups and children last year, a report by the Business for Britain campaign said. The paper, entitled “How much does the EU spend on promoting itself?” (https://forbritain.org/propagandapaper.pdf), was put together after a line-by-line check of EU budgets for 2014. The report by the Eurosceptic campaign describes thousands of publications, videos and information campaigns produced by the Union in order to improve its image. The key PR expenditures in 2014 went to such projects as “Enhancing public awareness of the Common Agricultural Policy” (€11 million), “Fostering European Citizenship” (€24.8 million), and the “House of European History” museum (€9.6 million), which is to open in Brussels in 2016.

“Money assigned to communications in EU budgets is for much more than just ‘public information’, and instead presents a highly biased account of both the EU and its political objectives,” the reports said. The document cited the European Commission strategy, which stated that “neutral factual information is needed of course, but it is not enough on its own”. The EU materials targeted not only grownups, but also children, with over 100 publications, 1,000 videos, cartoons and coloring books issued for distribution in schools, the reports said. Among them was an animated film describing how the EU “came to the rescue” of farmers, an interactive game teaching youngsters to recycle, and a book about one of the stars on the EU flag, entitled “The little star of Europe.”

“Indoctrinating children in classrooms and funding EU-friendly NGOs is a completely inappropriate use of taxpayers’ money when budgets are being cut at home,” Matthew Elliott, Business for Britain chief executive, told the Telegraph newspaper. The EU promotional activities aren’t limited to the sum of €664 million, as they are also included in larger budgets where they aren’t specifically detailed in the documentation, the report said. “More widely, the EU committed €3.9 billion to budgets that contained provisions for EU promotional spending and ‘corporate communication of the political priorities of the Union.’ This is a substantial rise on the €2.4 billion that was available to the EU for self-promotion in 2008,” the Eurosceptics’ report said.

I have to agree with NY Times ed. staff?!

• Ugly Attacks on Refugees in Europe (NY Times Ed.)

It is one of the tragedies of the European refugee crisis that the country with the fewest means, Greece, is the one coping with the greatest number of migrants fleeing tumult and poverty in the Middle East and Africa. It was inevitable that something would go wrong, as it did recently when about 1,000 refugees on the island of Kos, one of several Greek islands overrun this summer by the biggest flow of migrants since World War II, were temporarily packed into a sports stadium in stifling heat, without food, water or toilets. The refugees were eventually moved, but the crisis continues, with about 7,000 refugees on Kos, and more arriving daily. Meanwhile, Europe to the north has failed to agree on an equitable, humane and properly funded response.

If the disproportionate burden borne by Greece, Italy and Spain is not reason enough to inspire joint and urgent action, the human suffering and relentless movement of desperate, illegal and moneyless migrants all across the continent, coupled with an ugly increase in racist attacks, should be. Germany, which has accepted more asylum seekers than any other European country, is witnessing a spate of violent attacks. In the first half of this year, Germany reported more than 179,000 applications for asylum — and 202 attacks on the housing of asylum applicants by far-right and neo-Nazi bands. To its credit, the German government has condemned the attacks and has pledged to continue accepting asylum seekers, who are expected to exceed 450,000 this year.

In Hungary, by contrast, anti-migrant talk has been coupled with official policies intended to keep migrants out, most notably a high fence under construction along the 109-mile border with Serbia. Austria, France and Switzerland have turned back migrants from Italy, and Britain is up in arms over migrants who are clustered in squalid camps in northern France and trying to sneak into England through the Eurotunnel. The EU addressed the crisis at a summit meeting in June. But member states blocked any efforts at setting country quotas for migrants. The best it could do was a pledge to relocate 40,000 refugees over two years — less than a third of those who have already arrived in Italy and Greece this year.

There is no easy answer to the mass migration. The Syrian civil war alone has displaced millions, many of whom will continue trying to reach safe European havens, as will countless other displaced and threatened people in the Middle East and North Africa. What is clear is that no European country alone, and certainly not Greece or Italy, can cope with the flood, or block it. At the very least, the E.U. must allocate far greater resources for humanitarian and administrative work, and it must seek far better ways to share the burden.

I’ll repeat what I said yesterday: they should sail it to a British port.

• Syrians Begin Boarding Refugee Ship On Greek Island (Reuters)

Hundreds of Syrian migrants on the Greek island of Kos on Sunday began boarding a passenger ship that is to house and process them, in a bid to ease sometimes chaotic conditions onshore. Greek officials had delayed the embarkation at the quayside in Kos for more than a day, working on plans to avoid disorder among the increasingly desperate migrants who have arrived on the island in dinghies and small boats from nearby Turkey. The boarding of the car ferry Eleftherios Venizelos, which arrived in Kos on Friday, began in the cooler night hours in an organized and orderly fashion. After some minor disagreements among the migrants over who would go first, they queued up on the quayside and boarded in groups of 20.

The ship, chartered by the Greek government, is to provide accommodation for around 2,500 Syrians in its cabins and an area for processing paperwork. As the Syrians are fleeing their country’s civil war, they are treated as refugees. This gives them greater rights under international law than those from other countries regarded as economic migrants who have also crossed the narrow sea channel separating Kos from the Turkish coast. Nearly a quarter of a million migrants have crossed the Mediterranean to Europe this year, according to the International Organisation for Migration. About half have come to the Greek islands, with numbers surging in the summer when calmer weather makes the voyage marginally less risky.

The Greek government chartered the vessel – which belongs to a company which ships tourists, cars and trucks to the Greek islands and across the Adriatic to Italy – to take some of the pressure off Kos. Several thousand migrants are staying in hotels on the island if they can afford it, but more often sleep in tents, abandoned buildings or in the open. On Saturday, about 50 migrants from Afghanistan, Pakistan and Iran fought each other outside the island’s main police station, throwing stones and exchanging blows as tempers boiled over in the intense mid-summer heat. They have little chance of getting aboard the ship as they have not established themselves as refugees like the Syrians, who have priority.

On Tuesday, local police used fire extinguishers and batons against migrants after violence broke out in a sports stadium where hundreds of people, including young children, were waiting for immigration papers. About 40 riot police were subsequently sent to the island to keep order.

“.. it is hard to ignore a man who was elected with almost 94% of the vote in 2011, and for an eight-year term.”

• Get Rid Of Immigrants? No, We Can’t Get Enough Of Them: German Mayor (Guardian)

Goslar is a gem of a town in central Germany, nestled in the slopes of the Harz mountains. It is popular with tourists, some of whom come to enjoy its cobbled streets and half-timbered architecture, others to ski or mountain bike, or to trace the footsteps of William Wordsworth who penned the beginnings of the Prelude here while homesick during a visit in the freezing winter of 1798. Now it is becoming famous for another reason. Behind the rich culture is a town with huge problems. It is in one of the weakest economic areas of western Germany, and – like much of the country, which for years has had one of the lowest birthrates in the world – it is facing a demographic crisis. Goslar, a town of 50,000, has shrunk by 4,000 in the last decade and is currently losing as many as 1,500 to 2,000 people a year.

In some parts of the town, which once thrived on silver mining and smelting as well as a spa, whole housing blocks stand empty while others have been torn down. Its problems were only exacerbated by the end of the cold war, when it lost its status as a major garrison town close to the border with East Germany. Oliver Junk is determined to reverse the trend. The mayor of Goslar has sparked a debate that has spread across Germany by saying he wants more immigrants to settle in the town. While other parts of Europe are shunning refugees, sometimes with great brutality, Junk is delivering an alternative message: bring on the immigrants. There cannot be enough of them, he says.

At a recent gathering in Jürgenohl, a suburb of Goslar, Junk tapped his feet to a song-and-dance routine being performed for him in Russian by immigrants dressed in the colourful costumes of the former Soviet bloc countries they arrived from around two decades ago. Praising their efforts at integration and thanking them for their contribution to his city, Junk recalled how Jürgenohl only exists thanks to refugees who built it up after the war. The 39-year-old lawyer, a member of Angela Merkel’s Christian Democrats, has triggered controversy across Germany by insisting that an influx of immigrants is the best thing that could happen to his shrinking town, which took only 48 refugees last year and, so far this year, 41. “We have plenty of empty housing, and rather than see it decay we could give new homes to immigrants, helping them, and so give our town a future,” Junk said.

Some German commentators say he is a self-publicist, others that he is naive. But it is hard to ignore a man who was elected with almost 94% of the vote in 2011, and for an eight-year term. Junk says he is merely being pragmatic. This, after all, is a man who was nicknamed “Duke of Darkness” for ordering street lamps to be turned off after midnight to save money. The far right is furious and plans to descend on Goslar on 29 August, for an anti-Junk rally under the slogan “Perspectives, not mass immigration.”

Home › Forums › Debt Rattle August 16 2015