James F. Gibson Tent of A. Foulke, Horse Artillery, Brandy Station, Virginia 1864

Got to love it when Stockman gets mad.

• Sell The Bonds, Sell The Stocks, Sell The House – Dread The Fed! (Stockman)

There is going to be carnage in the casino, and the proof lies in the transcript of Janet Yellen’s press conference. She did not say one word about the real world; it was all about the hypothecated world embedded in the Fed’s tinker toy model of the US economy. Yes, tinker toys are what kids used to play with back in the 1950s and 1960s, and that’s when Janet acquired her school-girl model of the nation’s economy. But since that model is so frightfully primitive, mechanical, incomplete, stylized and obsolete, it tells almost nothing of relevance about where the markets and economy now stand; or what forces are driving them; or where they are headed in the period just ahead. In fact, Yellen’s tinker toy model is so deficient as to confirm that she and her posse are essentially flying blind.

That alone should give investors pause – especially because Yellen confessed explicitly that “monetary policy is an exercise in forecasting”. Accordingly, her answers were riddled with ritualistic reminders about all the dashboards, incoming data and economic system telemetry that the Fed is vigilantly monitoring. But all that minding of everybody else’s business is not a virtue – its proof that Yellen is the ultimate Keynesian catechumen. This stupendously naïve old school marm still believes the received Keynesian scriptures as penned by the 1960s-era apostles James (Tobin), John (Galbraith), Paul (Samuelson) and Walter (Heller). But c’mon.Those ancient texts have no relevance to the debt-saturated, state-dominated, hideously over-capacitated global economy of 2015.

They just convey a stupid little paint-by-the-numbers simulacrum of what a purportedly closed domestic economy looked like even back then. That is, before Richard Nixon had finally destroyed Bretton Woods and turned over the Fed’s printing presses to power aggrandizing PhDs; and before Mr. Deng had thrown out Mao’s little red book in favor of a central bank based credit Ponzi. As you listened to Yellen babble on about the purported cyclical “slack” remaining in the US economy, the current unusually low “natural rate” of federal funds, all the numerous and sundry “transient” factors affecting the outlook, and the Fed’s fetishly literal quest for 2.00% inflation (yes, these fools apparently think the can hit their inflation target to the second decimal place), only one conclusion was possible. To wit, sell the bonds, sell the stocks, sell the house, dread the Fed!

“Crude stockpiles surged to 490.7 million barrels, the highest for this time of year since 1930..”

• Oil Below $35, Set For Third Weekly Loss As Supply Glut Seen Relentless (BBG)

Oil traded below $35 a barrel and headed for a third weekly decline amid a worsening U.S. supply glut and the first interest rate increase by the Federal Reserve in almost a decade. Futures held losses in New York after closing Thursday at the lowest in almost seven years, and were down 2.2% this week. Crude stockpiles surged to 490.7 million barrels, the highest for this time of year since 1930, according to the Energy Information Administration. Goldman Sachs warned of “high risks” that prices may sink further as supplies swell. The Fed decision bolstered the dollar, diminishing the investment appeal of commodities.

Oil is trading near levels last seen during the global financial crisis on signs the surplus will be exacerbated. OPEC abandoned output limits at a Dec. 4 meeting while the White House announced its support Wednesday for a deal reached by congressional leaders that would end the nation’s 40-year restrictions on crude exports. “The major driver this week has been U.S. dollar strength against a backdrop of ongoing refusal to respond rationally to the current market surplus on the supply side,” Michael McCarthy, a chief markets strategist at CMC Markets in Sydney, said by phone. “We’re just not seeing the normal production cuts we’d expect given the plummet in prices.”

Blame it on the weather.

• Natural Gas Falls to All-Time Inflation-Adjusted Low (WSJ)

Natural-gas fell to the lowest ever inflation-adjusted price in its history of Nymex trading on Wednesday as extremely warm weather continues to limit demand. Prices for the front-month January contract settled down 3.2 cents, or 1.8%, at $1.79 a million British thermal units on the New York Mercantile Exchange. That is the lowest settlement since March 24, 1999. Gas prices have been falling precipitously in recent weeks because of the combination of record-high stockpiles and a December that could be the worst for heating demand in history. Prices have fallen 25% in just one month and have dropped 39% from their high in August. Wednesday settlement put gas below the inflation-adjusted low of $1.801 that had been in place since January 1992.

Gas did make a move up to small gains in after-hours trading, but many traders and brokers had little explanation for that rebound. The trader Marc Kerrest said he noticed prices and spreads moving higher for months far away, a sign front-month prices could follow. He closed out some of his bearish bets before settlement, he said. “But in no way would I consider going [bullish on] gas just because of what it’s done,” in recent weeks, said Mr. Kerrest, who manages his own gas-focused fund, Cornice Trading. Warm weather in the U.S. caused by the El Niño weather phenomenon has sharply limited demand for the heating fuel this year. The natural-gas market is oversupplied, and some traders and analysts say the industry could run out of storage space for gas by mid-2016.

Production was so high and demand was so soft that storage levels likely shrank by just 41 billion cubic feet last week, according to the average forecast of 17 analysts, brokers and traders surveyed by The Wall Street Journal. That is only a third of their five-year average drawdown for the week. If the forecast is correct, stockpiles on Dec. 11 would have been 16% above levels from a year ago and 8.9% above the five-year average for the same week.

We’re just getting started.

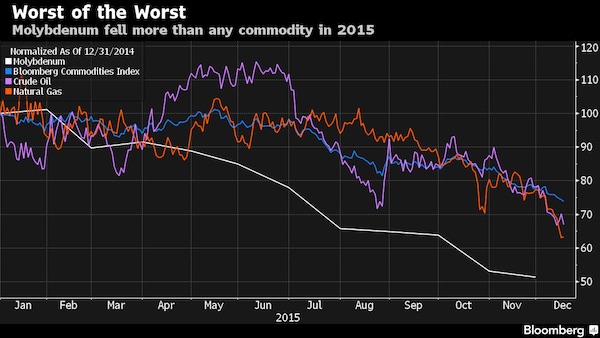

• This Year’s Worst Commodity Is One You Probably Can’t Pronounce (BBG)

An obscure metal used to make steel has become this year’s worst-performing commodity, after China’s stumbling economy and a collapse in the energy industry drove outsized losses. Molybdenum – that’s mo.lyb.de.num for the uninitiated – is used in many steel building materials and to help harden the drills used to extract oil and natural gas from deep underground. Prices plunged 49%, the most among 79 raw materials tracked by Bloomberg, as the white metal was undermined by the flagging demand and oversupply that plagued global commodity markets throughout 2015. Use of the metal tumbled 5.1% this year, the biggest contraction since 2009, driven by a slowdown in China, the world’s biggest metals and energy consumer, according to Macquarie.

Prices have dropped for eight straight months, the longest slump since 2011, weighing on returns for mining companies including Freeport-McMoRan Inc., the world’s top producer. “It’s like a poster child for the commodity bear market,” said Paul Christopher atWells Fargo Investment Institute. “We don’t have a positive outlook on metals, including molybdenum, because they’ve been overproduced. They will continue to do the worst, not just because China’s demand is slipping still, but also because there’s not been enough supply adjustment.” Prices for molybdenum oxide tumbled to a 12-year low of $4.616 a pound in November, according to monthly data from Metal Bulletin. The drop exceeded the 34% decline for crude oil and the 27% slide in the Bloomberg Commodity Index, a gauge of returns from 22 items that is headed for its biggest annual decline since the recession in 2008.

Molybdenum for immediate delivery traded on the London Metal Exchange slumped 43% this year to $11,628 a metric ton ($5.27 a pound). About half of molybdenum is produced as a byproduct of extracting other metals, mainly copper. Because it makes up a small portion of revenue for mining companies, suppliers are slower to respond with output cuts when prices tumble, said Mu Li at CPM Group in New York. Production topped demand by 40.9 million pounds in 2015, the biggest surplus since at least 2002, according to Bank of America. The market will remain oversupplied through 2020, the bank estimates.

No hurries, mate.

• Slowing Boats From China Provide Clue to Health of World Trade (BBG)

If you want to know how China’s economy is doing, take a slow boat from one of its ports. Even with fuel at its cheapest price in almost a decade, the ships that carry goods around the world have been reducing speed in line with the slowdown in China, the biggest exporter. Shipping companies have been “slow steaming” since the global financial crisis in 2008, as a way to save costs and keep as many ships active as possible. Vessels are now operating at an average of 9.69 knots, compared with 13.06 knots seven years ago, according to data compiled by Bloomberg. That means Nike sneakers and Barbie dolls made in China can now take two weeks to arrive in Los Angeles and a month to reach Le Havre, France – a week longer than if the ships were moving at full speed.

And there’s scope for ships to go even slower, according to A.P. Moeller-Maersk. “This is the new norm,” said Rahul Kapoor at Drewry Maritime Services. “The overall speed of the industry has gone down and there’s no going back.” In the boom years before the 2008 financial crisis, shipping lines expanded fleets and ran ships as fast as they could to keep up with the surging demand for goods manufactured half a world away. As demand dropped, the lines were left with too many vessels, and customers eager to reduce inventory, who would rather pay a lower rate to receive goods than guarantee quick delivery. “In 2003, if you were on a tanker, container ships would zoom past and in a matter of a few minutes you couldn’t see them on the horizon,” Kapoor said.

“Since 2008, it’s been a different story.” Fuel costs are the biggest expense for shipping lines and the drop in oil has given them some relief from plunging freight rates driven lower by overcapacity and sluggish global growth. Reducing a ship’s speed by 10% can cut fuel consumption by as much as 30%, according to ship assessor Det Norske Veritas.

Lots of things will go wrong.

• Fed Will Have To Reverse Gears Fast If Anything Goes Wrong (AEP)

The global policy graveyard is littered with central bankers who raised interest rates too soon, only to retreat after tipping their economies back into recession or after having misjudged the powerful deflationary forces in the post-Lehman world. The European Central Bank raised rates twice in 2011, before the economy had achieved “escape velocity” and just as the Club Med states embarked on drastic fiscal austerity. The result was the near-collapse of monetary union. Sweden, Denmark, Korea, Canada, Australia, New Zealand, Israel and Chile, among others, were all forced to reverse course, and some have since swung into negative territory to compensate for the damage. The US Federal Reserve has waited longer before pulling the trigger, and circumstances are, in many ways, more propitious.

Four years of budget cuts and fiscal drag are finally over. State and local spending will add stimulus worth 0.5pc of GDP this year. The unemployment rate has dropped to 5pc. Payrolls have risen by 509,000 over the past two months. The rate of job openings is the highest since the peak of the dotcom boom in 2000. The M1 and M2 money supply figures have switched from green to amber but are not flashing the sort of stress warnings so clearly visible in mid-2008. Yet it is a very murky picture. This is the first time the Fed has ever embarked on tightening cycle when the ISM gauge of manufacturing is below the boom-bust line of 50. Nominal GDP growth in the US has been trending down from 5pc in mid-2014 to barely 3pc. Danny Blanchflower, a Dartmouth professor and a former UK rate-setter, said the US labour market is not as tight as it looks.

Inflation is nowhere near its 2pc target and the world economy is still gasping for air. He sees a 50/50 chance that the Fed will have to pirouette and go back to the drawing board. “All it will take is one shock,” said Lars Christensen, from Markets and Money Advisory. “It is really weird that they are raising rates at all. Capacity utilization in industry has been falling for five months.” Mr Christensen said the rate rise in itself is relatively harmless. The real tightening kicked off two years ago when the Fed began to slow its $85bn of bond purchases each month. This squeezed liquidity through the classic quantity of money effect. Fed tapering slowly turned off the spigot for a global financial system running on a “dollar standard”, with an estimated $9 trillion of foreign debt in US currency.

China imported US tightening through its dollar-peg, compounding the slowdown already under way. It was the delayed effect of this crunch that has caused the “broad” dollar index to rocket by 19pc since July 2014, the steepest dollar rise in modern times. It is a key cause of the bloodbath for commodities and emerging markets. Mr Christensen said the saving grace this time is that Fed has given clear assurances – like the Bank of England – that it will roll over its $4.5 trillion balance sheet for a long time to come, rather than winding back quantitative easing and risking monetary contraction.

The big banks will be alright.

• The ‘Rate Hike’ Means More Looting By The 1% (Paul Craig Roberts)

The Federal Reserve raised the interbank borrowing rate today by one quarter of one% or 25 basis points. Readers are asking, “what does that mean?” It means that the Fed has had time to figure out that the effect of the small “rate hike” would essentially be zero. In other words, the small increase in the target rate from a range of 0 to 0.25% to 0.25 to 0.50% is insufficient to set off problems in the interest-rate derivatives market or to send stock and bond prices into decline. Prior to today’s Fed announcement, the interbank borrowing rate was averaging 0.13% over the period since the beginning of Quantitative Easing. In other words, there has not been enough demand from banks for the available liquidity to push the rate up to the 0.25% limit.

Similarly, after today’s announced “rate hike,” the rate might settle at 0.25%, the max of the previous rate and the bottom range of the new rate. However, the fact of the matter is that the available liquidity exceeded demand in the old rate range. The purpose of raising interest rates is to choke off credit demand, but there was no need to choke off credit demand when the demand for credit was only sufficient to keep the average rate in the midpoint of the old range. This “rate hike” is a fraud. It is only for the idiots in the financial media who have been going on about a rate hike forever and the need for the Fed to protect its credibility by raising interest rates.

Look at it this way. The banking system as a whole does not need to borrow as it is sitting on $2.42 trillion in excess reserves. The negative impact of the “rate hike” affects only smaller banks that are lending to businesses and consumers. If these banks find themselves fully loaned up and in need of overnight reserves to meet their reserve requirements, they will need to borrow from a bank with excess reserves. Thus, the rate hike has the effect of making smaller banks pay higher interest expense to the mega-banks favored by the Federal Reserve. A different way of putting it is that the “rate hike” favors banks sitting on excess reserves over banks who are lending to businesses and consumers in their community. In other words, the rate hike just facilitates more looting by the One%.

Their debt is not high enough yet.

• Japan To Craft $27 Billion Extra Stimulus Budget To Spur Growth (Reuters)

Japan’s cabinet is set to approve on Friday an extra budget worth $27 billion to fund stimulus spending for the current fiscal year ending in March to rev up the flagging economy, government sources told Reuters. The 3.3213 trillion yen ($27.14 billion) extra stimulus budget includes spending for steps to support elderly pensioners with cash benefits and farmers seen hit by the Trans-Pacific Partnership (TPP) trade deal, the sources said on condition of anonymity because the plan has not been finalised. In a show of efforts to fix dire public finances, the government will fund the stimulus without resorting to fresh borrowing, while tapping cash reserves left from the previous year’s budget and higher-than-expected tax revenue, they said.

These funding sources will allow the government to reduce its plans to issue new bonds by 444.7 billion yen from the initially planned 36.9 trillion yen, they said. The government revised up the tax revenue estimate for this fiscal year by 1.899 trillion yen to a 24-year high of 56.4 trillion yen, reflecting increase in corporate tax payments on the back of rising profits. Non-tax revenue was cut by 346.6 billion yen from an initial estimate of 4.95 trillion yen, due to expected cuts in the Bank of Japan’s payment into the government’s coffers because of the bank’s plan to replenish its reserves. The extra budget will be sent to parliament for approval early next year, along with an annual budget for the coming fiscal year that starts in April.

“..investigating whether officials inside the China Securities Regulatory Commission used their knowledge of the rescue effort to enrich their friends or themselves..”

• Beijing Probes Architects of Stock-Market Rescue (WSJ)

Having already investigated investors and brokerages in connection with a bungled summer stock-market rescue totaling more than $200 billion, Beijing is now probing the rescuers. Communist Party graft busters are investigating whether officials inside the China Securities Regulatory Commission used their knowledge of the rescue effort to enrich their friends or themselves, say agency officials familiar with the probe. In recent weeks, they have been taking officials, one by one, to a hotel close to the agency’s headquarters to press them to come clean or report on others, the officials say. The investigators also have set up shop on the top floor of the agency’s 22-story headquarters in downtown Beijing, banned agency officials from leaving China and set up a hotline and red mailbox in the lobby for anonymous tips, the officials say.

Already two top CSRC officials have been removed from their posts and placed under investigation on suspicion of leaking the government’s moves to private investors who used it to reap profits, according to officials with knowledge of the probe. The officials familiar with the probe told The Wall Street Journal that one focus is suspected chummy ties between the regulators and those they regulate. “They’re trying to determine what went wrong with the action to save the market this summer,” one of the officials said. “Was there anyone who inappropriately profited from the action?” [..]

The investigation was sparked by a stock-market rescue effort that called into question China’s ability to manage a market-driven economy, a stated national goal. That effort included a massive government-led buying binge, with a state lender plowing 1.2 trillion yuan ($188 billion) into the stock market and brokerages vowing to spend 120 billion yuan more, while other state-backed companies spent an undisclosed amount. Chinese officials have said those unprecedented measures were necessary to preventing the stock rout from spreading to other parts of China’s financial system.

The not-official numbers.

• China Beige Book Shows ‘Disturbing’ Economic Deterioration (BBG)

China’s economic conditions deteriorated across the board in the fourth quarter, according to a private survey from a New York-based research group that contrasted with recent official indicators that signaled some stabilization in the country’s slowdown. National sales revenue, volumes, output, prices, profits, hiring, borrowing, and capital expenditure were all weaker than the prior three months, according to the fourth-quarter China Beige Book, published by CBB International. The indicator is modeled on the survey compiled by the Federal Reserve on the U.S. economy, and was first published in 2012. The world’s second-largest economy lacks the kind of comprehensive data available on developed nations, making it harder for investors to get a clear read – particularly as China transitions from reliance on manufacturing and investment toward services and consumption.

Official data on industrial production, retail sales and fixed-asset investment all exceeded forecasts for November, while consumer inflation perked up and a slide in imports moderated. The Beige Book’s profit reading is “particularly disturbing,” with the share of firms reporting earnings gains slipping to the lowest level recorded, CBB President Leland Miller wrote in the release. While retail and real estate held up reasonably well, manufacturing and services performed poorly, with revenues, employment, capital expenditure and profits weakening. The survey shows “pervasive weakness,” Miller wrote in the report. “The popular rush to find a successful manufacturing-to-services transition will have to be put on hold for a bit. Only the part about struggling manufacturing held true.”

After efforts including six interest-rate cuts since late 2014 failed to revive growth, policy makers are switching focus to fix problems like overcapacity on the supply side. President Xi Jinping – seeking to keep growth at a minimum 6.5% a year through 2020 – is juggling short-term stimulus with long-term prescriptions to avoid the middle-income trap that has ensnared developing nations after bouts of rapid growth before they became wealthy. China’s leaders convene their annual economic work meeting Friday, according to the People’s Daily. Officials typically set the growth target for the coming year at the conference, which lasts a few days.

“She shares the prosecutors’ view that there is no basis for any charge against her.”

• IMF’s Lagarde to Face Trial for ‘Negligence’ in Tapie Case (BBG)

IMF Managing Director Christine Lagarde will be tried for “negligence” in relation to a settlement the French government reached with businessman Bernard Tapie during her time as finance minister, a French court said Thursday. Lagarde, 59, has repeatedly denied wrongdoing and will appeal the decision to put her on trial, her lawyer said. The decision was made by a special commission of the court against the advice of the prosecutor, a court official said. The trial concerns Lagarde’s 2008 decision to allow an arbitration process to end a dispute between Tapie, a supporter of then-French President Nicolas Sarkozy, and former state-owned bank Credit Lyonnais. The court has been looking into whether she erred in agreeing to the arbitration, which resulted in the tycoon being awarded about €403 million.

Having to face trial in France could have serious implications for Lagarde’s future at the helm of the IMF, though her job may not be in any immediate danger. Her five-year term as managing director expires in July. At the fund’s annual meeting in Lima in October, Lagarde said she’d be open to serving another term. “I assume this would probably go quickly, if only to remove the cloud of suspicion over her,” said Christopher Mesnooh, a Paris-based lawyer at Field Fisher Waterhouse, who isn’t involved in the Lagarde case. “Everyone knows the importance of Christine Lagarde to the world economy. They won’t want to leave this unresolved.”

Lagarde reaffirms that she “acted in the best interest of the French State and in full compliance with the law,” according to an e-mailed statement from her attorney Yves Repiquet. “She shares the prosecutors’ view that there is no basis for any charge against her.” The IMF board said Thursday that it sees Lagarde as still able to do her job. “The Executive Board continues to express its confidence in the managing director’s ability to effectively carry out her duties,” IMF spokesman Gerry Rice said in an e-mailed statement. “The board will continue to be briefed on this matter.”

Banks are more important than countries.

• IMF Admits Mistakes Over Greece’s Bailout Program (GR)

The IMF acknowledged that it made mistakes and omissions in the Greek bailout program approved in May 2010, as it did not include debt restructuring. The IMF Board of Directors approved the evaluation report on the programs during the economic crisis. An independent committee will examine the issue, especially on debt restructuring, which, as highlighted on the report, multiplied difficulties in Greece. According to a Mega television report, the Board expects the report of the Independent Office Fund Evaluation on the role played by its members on the Eurozone crisis. However, the report will be delayed at the request of Poul Thomsen, on the grounds that “the program is still running.”

Regarding the restructuring of the Greek debt, the report states that there was no restructuring because of the fear that the crisis would spread to other Eurozone countries. There was also the fear of exposure of European banks to the Greek debt. Only when the ECB intervened to protect the Eurozone and two years of uncertainty passed, then the Eurozone was secure, the report says. When it was decided to restructure private debt (PSI) the “haircut” was great for the creditors compared to others, but at the same time chances that it would prove insufficient to restore debt sustainability were increased, the report says, according to Mega.

Regarding restructuring of the Greek debt, it is implicitly admitted in the report that it was absolutely necessary in 2010. It is also admitted that for the 2010 and 2012 programs, internal devaluation through reforms in labor and product markets was the main goal. To this end, they decided measures such as reducing nominal wages and benefits in the public sector, reducing minimum wages, the reform of the collective bargaining system, promoting privatization, reducing bureaucracy and promoting competition.

This can not end well. A revolt is building.

• Beijing Grinds To Halt As Second Ever ‘Red Smog Alert’ Issued (Reuters)

China’s capital city issued a “red alert” for pollution on Friday, hard on the heels of its first-ever such warning earlier in December, as Beijing’s leadership vowed to crack down on often hazardous levels of smog. Authorities in the Chinese capital warned the city would be shrouded by heavy pollution from Saturday until next Tuesday, prompting the highest-level warning that leads to emergency responses such as limiting car use and closing schools. After decades of unbridled economic growth, China’s leadership has vowed to tackle heavy air, water and soil pollution, including the thick smog that often blankets major cities. Beijing’s second red alert comes after a landmark climate agreement was reached in Paris in December, setting a course to move away from a fossil fuel-driven economy within decades in a bid to arrest global warming.

The city’s first red alert was issued on 7 December, restricting traffic and halting outdoor construction. The Beijing Meteorological Service said in a statement vehicle use would be severely restricted, and that fireworks and outdoor barbecues would be banned. It also recommended schools cancel classes. City residents have previously criticised authorities for being too slow to issue red alerts for heavy smog, which often exceeds hazardous levels on pollution indices. The environmental protection minister, Chen Jining, vowed in December to punish agencies and officials for any failure to implement a pollution emergency response plan quickly, the state-run Global Times tabloid said. Many cities around China suffer high levels of pollution, with Shanghai schools banning outdoor activities and authorities limiting work at construction sites and factories earlier this week.

In the eyes of the richer Europeans, they are the victims, not the refugees or Greece.

• EU Puts Blame On Greece, Turkey At Refugee Summit (Kath.)

EU leaders meeting in Brussels on Thursday pressed Turkey to curb the flow of migrants entering the bloc via Greece and urged Athens to speed up its efforts to accommodate and repatriate migrants. Prime Minister Alexis Tsipras met his Turkish counterpart Ahmet Davutoglu on the sidelines of the mini-summit in Brussels which brought together 11 EU leaders and Davutoglu. According to sources, Tsipras urged European officials to ensure that a recent agreement between the EU and Turkey to stem migrant flows is being observed. Tsipras repeated Greece’s position that refugees should be transferred directly from Turkey to other EU member-states. But, according to sources, several EU leaders made it clear to Davutoglu that refugee relocations from Turkey would not begun until Ankara makes good on commitments to the EU to curb the flow of migrants to the EU via Greece.

Turkey was not the only country to come under pressure at the summit, which is to continue on Friday. Greece was criticized, chiefly by German Chancellor Angela Merkel, for delays in completing a series of screening centers for migrants on Aegean islands, dubbed hot spots. Merkel also complained about the slow rate of repatriations of migrants from Greece. Tsipras countered that Greek authorities face problems in returning migrants to countries such as Pakistan where authorities are not always cooperative. As for a proposal for the creation of an EU border force with stronger powers, the majority of leaders present, including Tsipras, backed the idea in principle. The leaders of Hungary, Malta and Poland were the most cautious while Tsipras insisted that any upgraded border force should not compromise national sovereignty. Meanwhile back in Athens, Greek authorities continued their efforts to accommodate hundreds of migrants in temporary accommodation centers.

But many appeared reluctant to stay in the designated facilities. Of some 1,300 migrants who have been staying in the Tae Kwo Do Stadium in Palaio Faliro, only 235 were at the old Olympic hockey venue in nearby Elliniko following a relocation on Thursday night. It is unclear where the rest of the migrants went though large numbers have been gathering in squares in central Athens since the Former Yugoslav Republic of Macedonia tightened its border with Greece. Athens Mayor Giorgos Kaminis on Thursday expressed concern at the presence of thousands of migrants who do not merit refugee status, from countries such as Morocco, Algeria and Pakistan, stuck in the capital and other Greek cities. “We do not want these people to be wandering around unable to survive, with no prospects,” he said, adding that he had called on authorities to make use of abandoned military facilities as temporary accommodation.

This can only end badly. Someone get a good lawyer before this mess gets any bigger.

• EU To Fast-Track Border Control Plans (RTE)

EU leaders have pledged to fast-track the establishment of an EU border and coast guard force. At a summit in Brussels, they last night urged each other to implement measures agreed this year to curb migration across the Mediterranean. By the middle of next year, they decided, they would agree the details of the new border force which was proposed by the EU executive earlier this week. Some leaders, including Greek PM Alexis Tsipras, made clear, however, that they wanted to strike out a controversial element of the proposal which would give Brussels power to send in EU border guards without a country’s consent. Summing up the three-hour discussion, European Council President Donald Tusk, said leaders had agreed there was a “delivery deficit” in making good on a series of measures agreed over recent months to stem chaotic movements that have put Europe’s Schengen open-borders area in jeopardy.

“Over the past months, the European Council has developed a strategy aimed at stemming the unprecedented migratory flows Europe is facing,” the final agreement read. “However, implementation is insufficient and has to be speeded up. “For the integrity of Schengen to be safeguarded it is indispensable to regain control over the external borders.” Greece and Italy are under pressure to do more to manage and identify those arriving, a million or more so far this year, while governments in general have yet to make good on promises to help take in asylum seekers and deport unwanted migrants. There are only two fully operational “hotspots” for screening of migrants arriving to Italy and Greece from 11 that are supposed to be set up.

Exactly what Berlin and brussels hope to achieve.

• Greece Risks Becoming A ‘Black Box’ For Stranded Migrants (FT)

Greece risks becoming a vast holding pen for tens of thousands of migrants arriving by boat from Turkey as neighbouring countries close their borders, prime minister Alexis Tsipras has warned. Mr Tsipras also expressed frustration with plans to create a new EU border force that could be deployed to the bloc’s external borders even against the objections of the relevant national government. “Greece stands accused of not being able to protect its border but they [other EU countries] don’t tell us what they expect us to do,” Mr Tsipras told the FT. “We have to rescue people in danger of losing their lives [at sea crossing from Turkey]. If they want us to carry out pushbacks, they must say so,” he added.

He was speaking as the European Commission unveiled its proposal for the new border force, which is widely viewed as a means to address a porous Greek frontier that has become an entry point for hundreds of thousands of migrants seeking to reach Germany and other, more prosperous parts of the EU. Greece only reluctantly accepted 400 officials from the EU’s current border agency, Frontex, to help police its frontier with Macedonia, and the issue of sovereignty cuts deep in a nation that has lost control of much of its economic policymaking as a consequence of its international bailouts. Crossings to Greece’s eastern islands have slowed somewhat of late – possibly because of bad weather – but still averaged about 3,400 per day this month.

According to a EU report on Turkey’s efforts to stem the flow, sent to national capitals on Wednesday, Brussels remains unconvinced the reduction was owing to any new efforts by Ankara following a pledge last month to crack down in exchange for €3bn in EU aid. The report comes ahead of a meeting between Turkey’s prime minister and a group of EU prime ministers on the sidelines of a two-day Brussels summit. That meeting, hosted by Austria and including Mr Tsipras and Angela Merkel, the German chancellor, concerns a voluntary programme in which refugees currently in Turkey would be resettled among willing member states. While Berlin had hoped the scheme would total as many as 500,000 refugees, it is likely to include only about 50,000, according to estimates from officials involved in the talks. They also made clear the scheme will not go ahead unless Turkey manages to cut the number of people entering Europe.

Athens has become increasingly concerned that it will be stuck in the middle – with Ankara failing to stop the influx and countries to the north blocking those migrants they believe are motivated by economic despair and therefore would not qualify as war refugees. For the past four weeks, only migrants fleeing wars and violence in Syria, Iraq and Afghanistan have been allowed to cross Greece’s northern border into Macedonia and continue the journey to central Europe. “Greece is in danger of becoming a black box [for refugees] if these flows don’t decrease,” Mr Tsipras said. “Slovenia, Croatia, the former Yugoslav Republic of Macedonia, all took the decision to filter people by nationality, for example, not accepting those from north African countries and Iran. This is not correct,” he added.

Home › Forums › Debt Rattle December 18 2015