William Henry Jackson Camp wagon on a Texas roundup 1901

Not a smart thing to say.

• Chinese PM Li Keqiang Says It Is ‘Impossible’ to Miss Economic Targets (WSJ)

Chinese Premier Li Keqiang said it would be “impossible” for China to fall short in meeting its relatively high economic-growth targets even as it pushes ahead with structural reforms. Speaking to reporters at the conclusion of China’s annual legislative session, Mr. Li said China won’t suffer a “hard landing,” or sharp downturn, and can achieve growth and reform simultaneously. “Reform and development aren’t contradictory,” he said. “We should be able to stimulate market vitality and support economic development via structural reforms.” At the opening of the National People’s Congress earlier this month, China set growth targets of 6.5% to 7% for this year and an average benchmark of at least 6.5% from now until 2020.

Economists say this relatively high growth target at a time when the economy is losing momentum suggests China is favoring growth over structural reform, which could prevent massive job losses and social instability but set back the shift of China’s economy from investment and manufacturing to consumption and services. The real test will be in whether tough restructuring steps are implemented, Commerzbank economist Zhou Hao said in a report following Mr. Li’s comments. “China needs to proceed with the deleveraging more decisively, and should prevent the leverage ratio from soaring again,” he wrote. “At the end of the day, policy execution is crucial to restore the market confidence.”

Mr. Li said capital-adequacy ratios at China’s financial institutions are sound, bad loans are well covered by reserves and the nation is making progress in cutting corporate debt using debt-for-equity swaps. Mr. Li signaled that China will do what it takes to maintain its growth targets and that it has a “good reserve” of policy instruments in the event that growth falls outside an acceptable range, He said China will employ “innovative measures” to ensure steady economic progress.

What could go wrong?

• Chinese Buying In US Rekindles Memories Of Japan’s 1980s Merger Mania (Forbes)

Nearly three decades ago, Japanese corporations flooded the United States with a boom of takeover deals, much of it focused on prime U.S. real estate. They snapped up properties like Rockefeller Center and The Plaza Hotel, in addition to Columbia Pictures, causing consternation among those in the U.S. who wondered when, or if, the buying boom would ever end. “If you don’t want Japan to buy it.. don’t sell it,” Akio Morita, founder of Sony , famously said when bidding for Columbia. The buying stopped when a 1980s stock market bubble in Japan popped, depleting the dealmaking currency and animal spirits of overseas acquirers. Within years, targets like Rock Center and The Plaza were in the hands of new ownership and a quarter century later, Japanese corporations are still trying to dig out from under the bubble.

Now, it appears there’s a new foreign buyer rushing into U.S. markets and exhibiting similarities to the heady, 1980s Japanese M&A binge. Chinese corporations have opened 2016 with an unprecedented surge in overseas dealmaking and this frenzy of activity is no coincidence. It comes as China’s currency is in the process of readjusting to account for it slowing economic growth, causing hundreds of billions of dollars in capital outflows. Roughly half a trillion dollars poured out of China in 2015 according to the Institute for International Finance and that pace continues this year. Capital leaving China has found its way into single and multifamily real estate properties in North America – in addition to financial assets like stocks, bonds and currencies.

Now, the money is rushing directly towards large domestic corporations through takeover deals. Just two and a half months into the year, Chinese overseas corporate M&A activity is roughly in line with the $108 billion in outbound M&A conducted all of last year, according to Dealogic. If Chinese corporates are beginning to exhibit similar symptoms to the Japanese merger mania, a set of deals in the works this weekend cements the comparison. Anbang Insurance Group, which is run by Deng Xiaoping’s grandson-in-law, is trying to negotiate what looks to be an unprecedented bonanza of real estate acquisitions, targeted at famous U.S. properties. Anbang ponied up $2 billion to buy the Waldorf-Astoria Hotel from Blackstone-controlled Hilton Hotels in late 2014, and the group is back at it with two deals that would increase its buying by many multiples.

The insurer is reportedly offering to buy Strategic Hotels and Resorts (SH&R) — the owner of properties including Essex House and Hotel del Coronado — from Blackstone. That offer comes just months after the ink dried on the PE giant’s $4 billion takeover of SH&R in September. And Anbang is leading a consortium of investors who are challenging Marriott International’s $12 billion takeover of Starwood Hotels, operator of upscale hotel brands including Westin, W Hotels and Le Meridien.

How China keeps its zombies alive.

• China Mixes Cash, Coercion to Ease Labor Unrest (WSJ)

A protest by Chinese coal workers over unpaid wages drew a swift, expected response: payoffs to get them off the streets and threats of police action if they don’t. The effort underscores the government’s long-standing worries about labor strife and its newly cautious approach to restructuring unprofitable state firms. Unrest in the northeastern city of Shuangyashan appeared to ease as Longmay Mining Holding, a huge employer, started disbursing some back pay on Monday, workers said. Hundreds took to the streets there last week, drawing a large police presence, after the provincial governor said Longmay didn’t owe its miners wages.

The response by Longmay and Heilongjiang province Gov. Lu Hao, who later said he had misspoken about the wage arrears, mirrored past efforts by Chinese officials to ease labor unrest with a mix of cash, coercion and pledges of redress. Chinese call the strategy “buying stability,” part of the government’s well-worn playbook for defusing public anger. Beyond being a troubled coal company, Longmay is a test case for government resolve in carrying out a key economic initiative—the restructuring of uncompetitive state industries whose drain on resources is impeding a transition to an economy driven more by services and consumers. Many Longmay workers in Shuangyashan are among the 1.8 million steel and coal workers Beijing plans to lay off over the next five years.

The retrenchment, and the allocation of 100 billion yuan ($15.4 billion) in restructuring funds to pay for workers’ severance, retraining and relocation, are part of a five-year economic program Chinese lawmakers are set to adopt at the end of their annual session in Beijing on Wednesday. Economists have said China needs deeper cuts to shed excess industrial capacity and divert labor and capital to more productive industries. Instead, the government is encouraging businesses to keep workers on the payrolls, often at reduced hours and pay, avoiding fueling a continuing surge in labor unrest but at the cost of dragging out an economic transition. Some ailing enterprises can expect official support to stay in business, including in Longmay’s case tax cuts and cash incentives that Fitch Ratings says allowed the mining company to avoid defaulting on bonds.

“His property agent offered him a zero-interest loan, funded entirely online by peer-to-peer lenders, that covered almost half his deposit..”

• China To Target Shadow Lending For Housing Down-Payments (BBG)

When Fu Songtao found his ideal home in the suburbs of Shanghai, he faced the typical problem of would-be homebuyers: Coming up with enough cash for a down payment. So Fu turned to an online solution. His property agent offered him a zero-interest loan, funded entirely online by peer-to-peer lenders, that covered almost half his deposit. “Everybody I know took out these loans,” said Fu, a 29-year-old employee of a state-owned enterprise, who borrowed 380,000 yuan ($58,000) a year ago, with interest payments to lenders subsidized by the property agent, for his 3 million yuan apartment, and has seen its value increase to 3.3 million yuan since. “If you can borrow like that, why not?” The lending platform of his real estate agency, E-House China, is one of China’s hundreds of P2P lenders allowing home buyers to seek down-payment loans online.

Total P2P borrowing for home deposits reached 924 million yuan in January, more than three times the level of last July, according to data provider Yingcan. Lending for property down payments, a phenomenon all but unheard of a year ago, has now prompted plans by the government to halt such borrowing. The response underscores the stakes as shadow-banking leverage creeps into China’s housing market – a development similar to the margin financing that fueled last year’s stock market bubble, but with potentially more damaging consequences. “Down-payment financing would definitely cause risks to the financial system, similar to the subprime crisis in the U.S.,” said Hu Xingdou, an economics professor at the Beijing Institute of Technology.

“China has learned a lesson from the U.S. subprime crisis. The Chinese government understands that they have to solve problems like housing and overcapacity. At the same time, they can’t bring further risks to the financial system, as the banks already have a lot of bad debt.” People’s Bank of China Deputy Governor Pan Gongsheng said at a press conference on Saturday that down-payment loans offered by developers, real estate agents, and P2P lenders not only raised leverage of home buyers, they also undermined effectiveness of macroeconomic policies and increased risks to the financial system and property markets. The central bank together with other government departments will soon start a campaign to clean up such activities, he said. New rules being drafted by the central bank, the China Banking Regulatory Commission and other bodies would bar developers, peer-to-peer networks and other non-banks from offering down-payment loans

Casino’s on steroids.

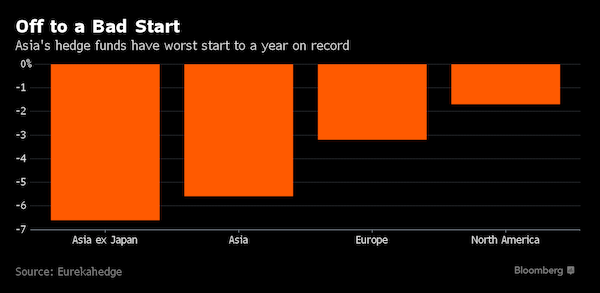

• Asia Hedge Funds Had Worst-Ever Start to Year (BBG)

Hedge funds in Asia, which beat counterparts in the U.S. and Europe in 2015, are off to their worst annual start on record this year, as the region’s stock markets have plunged amid a dimming outlook for growth. Asia hedge funds, excluding those that invest in Japan, fell 1.5% in February, bringing their loss for the first two months of 2016 to 6.6%, according to Singapore-based data provider Eurekahedge. Apart from being the biggest drop ever for the first two months of the year, that’s also the worst start among the world’s major regions, Eurekahedge said. Hedge funds including those from Greenwoods Asset Management and Zeal Asset Management extended declines they suffered in January.

After successfully navigating turbulent markets in 2015, hedge funds in Asia are seeing a reversal this year as worries about a global slowdown have deepened. The Shanghai Composite Index has tumbled 19% this year to rank among the worst-performing equity markets in the world, and most of the region’s benchmarks have been whipsawed by volatility amid scant signs of global growth. “Hedge fund managers in the region, especially those focusing on long-short strategies, had been stung by volatility in underlying markets,” said Mohammad Hassan at Eurekahedge. As it becomes more difficult to post consistent returns, investors are increasingly shifting their money to the largest or most promising managers, prompting many smaller-scale firms to exit the business or return money to investors.

That’s creating a bifurcation in Asia’s hedge fund industry. The losses for hedge funds investing in Asia ex-Japan compares with a decline of 3.2% in Europe through the end of February and a decrease of 1.7% in North America, according to the Eurekahedge website. Last year, Asia ex-Japan hedge funds rose 7.5%, beating rivals in other parts of the world. Greenwoods Asset’s Golden China Fund fell 3.7% in February, bringing its losses to 14.4% so far this year, according to Joseph Zeng, a Hong Kong-based partner at the hedge fund firm. The fund, which managed $1.7 billion as of January, was one of the top performers last year, posting gains of almost 22%.

“This situation would wreak havoc on every pension fund—but that’s not even the worst part.”

• Retirement Is Impossible With Negative Rates (Mauldin)

Since 2008, the Fed has relied on near-zero interest rates to stimulate economic growth, and they still sincerely believe that low interest rates will do the job they’re supposed to. However, the hard evidence of the past few years is that ultra-low rates, combined with quantitative easing, haven’t stimulated much growth. Unemployment has fallen, which is good—but probably not as good as the numbers suggest because people have gone back to work for lower pay and are now even deeper in debt. Personal income growth has stagnated, too. Are we better off now than we were five years ago? The answer is a qualified yes. But it is not entirely clear, at least to your humble analyst, that the halting economic recovery is the result of low interest rates and not other less manipulable factors such as entrepreneurial initiative and good old muddling through.

In fact, an ultra-easy monetary policy may be part of the reason we’ve been stuck with low growth. Witness Japan and Europe. Just saying… Seriously, no one fully understands how all the moving parts influence each other. Years of ZIRP did help businesses and consumers reduce their debt burdens. ZIRP and multiple rounds of QE have also done wonders for stock prices… but not much for the kind of business expansion that creates jobs and GDP growth. If year upon year of ultra-low rates were enough to create an economic boom, Japan would be the world’s strongest economy right now. It obviously isn’t—which says something about ZIRP’s efficacy as a stimulus tool. What isn’t a mystery, however, is that ZIRP has created a massive problem for retirement savers and pension fund managers.

If ZIRP is bad, NIRP will be far worse for retirement planning. Bond-return assumptions will have to be even lower and potentially below zero. This situation would wreak havoc on every pension fund—but that’s not even the worst part. Most asset allocations are generally in the ballpark of 60% equities and 40% bonds, so that is the standard portfolio we will be discussing. Other allocations will make some differences, but not change the general direction. In other words, “your mileage may vary,” but probably not by much. In an ideal world—which is the world that pension consultants live in—equities will return 10% nominal and bonds will return 5%. A 60/40 portfolio blend will then yield an 8% overall return after fees, expenses, and management costs.

“J.P. Morgan is using the Federal Deposit Insurance Corp.’s safe harbor, which isolates them from the assets and protects investors if the mortgages go bad.”

• JP Morgan Brings Back Mortgage-Backed Securities (WSJ)

J.P. Morgan Chase & Co. is trying to sell new securities that would pass along most of the credit risk on $1.9 billion in mortgages, in an attempt to revive a debt market that has been largely left to the government since the financial crisis. The largest U.S. bank by assets is expected to price the residential mortgage-backed deal over the next two weeks. J.P. Morgan would hold 90% of the deal by keeping the safest parts, or the most senior tranches, and plans to sell off the riskier pieces to investors. Government-sponsored entities Fannie Mae and Freddie Mac have dominated the market in their absence. The two companies have recently been selling new securities that use derivatives to unload the risk of default on the mortgages they guarantee.

The new deal is J.P. Morgan’s first “house transaction” since the financial crisis, meaning it is entirely backed by mortgages the bank owns. The pool includes a mix of more than 6,000 mortgages, both newer and refinancings, around 75% of them conforming with the underwriting standards set by Fannie and Freddie. J.P. Morgan could have sold those loans directly to Fannie and Freddie, so the deal indicates it thinks it can get a better deal with private investors or holding parts on its balance sheet.

The New York bank hopes this new method could offer more competitive pricing and help broaden the market for such deals, people familiar with the matter said. J.P. Morgan is using the Federal Deposit Insurance Corp.’s safe harbor, which isolates them from the assets and protects investors if the mortgages go bad. The deal is the first of its kind to be issued by a major bank, according to Fitch Ratings, which gave the securities mostly investment-grade credit ratings. “This is an important step to bring private capital back into the mortgage market,” J.P. Morgan Chief Operating Officer Matt Zames said.

“.. the historical defeat and humiliation of the British working classes is now the island’s primary export product.”

In the United Kingdom, “finance” is based above all in real estate, and the real estate bubble that sustains the City is itself sustained by the fact that pretty much every billionaire in the world feels they have to maintain at least a flat, and more often a townhouse, in a fashionable part of London. Why? There are plenty of other well-appointed modern cities in the world, most of which have a decidedly more appealing climate. Yet even more than, say, New York or San Francisco, London real estate has become something like U.S. treasury bonds, a basic currency of the international rich. It’s when one asks questions like these that economics and politics become indistinguishable. Those who have investigated the situation find that London’s appeal—and by extension, Britain’s—rests on two factors.

First of all, Russian oligarchs or Saudi princesses know they can get pretty much anything they want in London, from antique candelabras and high-tech spy devices, to Mary Poppins–style nannies for their children, fresh lobsters delivered by bicycle in the wee hours, and every conceivable variety of exotic sexual service, music, and food. What’s more, the boodles will be delivered by a cheerful, creative, and subservient working-class population who, drawing on centuries of tradition, know exactly how to be butlers. The second factor is security. If one is a nouveau riche construction magnate or diamond trader from Hong Kong, Delhi, or Bahrain, one is keenly aware that at home, something could still go terribly wrong: revolution, a sudden U-turn of government policy, expropriation, violent unrest. None of this could possibly happen in Notting Hill or Chelsea.

Any political change that would significantly affect the most wealthy was effectively taken off the table with the Glorious Revolution of 1688. In other words, the historical defeat and humiliation of the British working classes is now the island’s primary export product. By organizing the entire economy around the resultant housing bubble, the Tories have ensured that the bulk of the British population is aware, at least on some tacit level, that it is precisely the global appeal of the English class system, up to and including the contemptuous sneer of the Oxbridge graduates in Parliament chuckling over the impending removal of housing benefits, that is also keeping affordable track shoes, beer, and consumer electronics flowing into the country. It’s an impossible dilemma.

It’s hardly surprising, then, that so many turn to cynical right-wing populists like UKIP, who manipulate the resulting indignation by fomenting rage against Polish construction workers instead of Russian oligarchs, Bangladeshi drivers instead of Qatari princes, and West Indian porters instead of Brazilian steel tycoons. This marketing of class subservience is the essence of Tory economic strategy. Industry may be trounced and the university system turned (back) into a playground for the rich, but even if this leads to a collapse of technology and the knowledge economy, the end result will only seal in more firmly the class system that produces Tory politicians: England will literally have nothing else to sell.

Lest we forget. Good read, lots of details.

• Disaster Capitalists Fan Flames Of War In Syria (II)

If Naomi Klein were to rewrite The Shock Doctrine now, I hope she d agree that the situation in Syria is playing out as a textbook example of her terrifying concept because I believe that’s what we are witnessing. To understand the actions of each nation involved in Syria, you first have to recognise their motivation. It is, as always, fossil fuels and the dollar with human life at a lowly position down the pecking order. The crux of the matter is that Bashar al-Assad put paid to the construction of an oil and gas pipeline, which would have ended Europe s reliance on Russia for its natural gas, by refusing to sign an agreement with Qatar. Instead, he opted for a partnership with Iran (after which the civil war in Syria intensified). While the construction of the pipeline had previously been put on hold, it was quietly announced last July that Iran was forging ahead with a trunkline (IGAT6) to supply Iraq with natural gas; in theory, this could be the beginning of an Iran-Iraq-Syria pipeline or one that goes direct to Turkey.

The Iranian pipeline would be unacceptable to both Washington and Brussels, as it would mean energy co-ordination from Iran, Iraq, Syria and Russia (putting pressure on their Sunni-led cohorts in the region), and also because the product from such would be traded in a basket of currencies not exclusively the petrodollar. Moreover, with Iran now emerging from sanctions (and forecast to produce 3.1mbpd), its gas fields, the second largest reserves on the planet, are up for grabs to exporters. There is, in Syria and across the spectrum of corporate interests of the countries involved, everything to play for and the disaster capitalists are piling into the game, full throttle.

The refugee crisis ostensibly splintering the governments of the EU is set to balloon. Already this year, 133,549 people have reached Europe by sea up more than 10 fold from 2015. The demographic has altered drastically as well: whereas last year, the breakdown of migrants/refugees by gender was 62% male, 16% women and 22% children, so far this year it has been 47%, 20% and 34% respectively. The chaotic propaganda surrounding the refugee crisis continues unabated, each country pointing fingers at the other, for instance, when a NATO general accused Russia and Syria of weaponising the refugee crisis (while simultaneously characterising the people fleeing war as a hotbed of ISIS recruits).

Meanwhile, Greece, in the midst of its own economic turmoil, is left to accommodate 122,000 souls under the UNHCR’s warning of an ‘imminent humanitarian disaster’ unless other EU countries begin to take in these refugees. In effect, the intentional bottleneck in Greece functions as yet another form of shock inflicted by the EU and Troika on an already flailing Syriza administration and its embattled leader Tsipras. With its third bailout looking unsteady amidst mutterings of the IMF pulling out of the deal, the Greek administration has no chips to bargain with, and holds minimal leverage within the EU.

More disgrace. Greece spends €600 million alone, EU ‘approves’ €300 million in support of the entire ‘refugee effort’.

• EU Approves Refugee Support Mechanism For Greece (Kath.)

The presidency of the European Council on Tuesday announced that it has approved a new support mechanism for Greece and other European countries struggling with the bloc’s biggest immigration crisis since World War II. “This Council decision shows that the EU stands by Greece at this difficult time. The Netherlands presidency will do all it can to ensure that the necessary EU funds are mobilized as quickly as possible,” said Dutch Foreign Minister Bert Koenders, whose country holds the six-month rotating presidency of the EU. The European Commission estimates that the refugee effort will require €300 million this year and an additional €200 million each in 2017 and 2018.

The help that will be provided under the new mechanism includes food, shelter, water, medicine and other basic necessities. It will be delivered by the Commission itself or by partner organizations selected in cooperation with Greek authorities. Tuesday’s statement put the number of migrants and refugees currently trapped in Greece due to border closures at 35,000. Government sources estimate that number to be closer to 44,000. The Bank of Greece, meanwhile, on Monday said the cost of the handling the refugee crisis for Greece alone will likely exceed a previous estimate of €600 million.

Sour and bitter relations. The Greeks say ‘Skopje’. Rumors say accidentally calling the country Macedonia forced the Greek migration minister to resign today.

• FYROM Accuses Greece Over the “Exodus” of Refugees (PP)

The Minister of foreign affairs of FYROM, Nikola Poposki, stated that Greece is responsible for the “organised push” of several hundreds of migrants who attempted to cross over yesterday In a series of tweets, Poposki claimed that the growing numbers of migrants at the borders between Greece and FYROM intensifies smuggling while it worsens the human treatment of those living in the refugee camps. He claims that only a united and humane EU reaction will be able to provide a solution for both migrants as well as the involved countries. Those statements came after the effort, on Monday, of almost a thousand refugees to cross the river of Axios and attempt to get into FYROM via an opening in the fence separating the two countries.

While three people were drowned, the rest managed to enter FYROM where they were intercepted by FYROM army and were captured. The refugees decided to make that desperate “exodus” towards FYROM after a flyer was distributed between them, describing in English and Arabic where, and how they could pass over to FYROM. The incident creates further confusion and difficulties in what is already a complex situation between the countries involved. In any case it is not a development which aids Greece, or in fact the efforts of the refugees as it allows those countries which have decided to seal their borders to claim that Greece is not able to control the waves of migrants.

The Greek chief of the Administration for the migrant problem stated that, should FYROM make a petition for the re-entrance of the refugees back to Greece, the Greek side will evaluate and decide on it. It should be noted that there is no formal agreement between FYROM and Greece for the re-acceptance of migrants. At the same time, the Greek government is beckoning to NGOs as well as volunteering organizations to be in close contact with the authorities in order to avoid cases of misinformation. On Monday afternoon the Prime Minister presided over a meeting with all concerned authorities regarding those latest developments.

That is illegal.

• FYROM Dumps Refugees Back In Greece As EU-Turkey Deal Falters (Reuters)

Macedonia dumped about 1,500 migrants and refugees back into Greece overnight after they forced their way across the border, as European nations continued to pass the buck in a migration crisis that risks tearing the European Union apart. The police action was part of a drive by Western Balkans states to shut down a migration route from Greece to Germany used by nearly a million people fleeing war and poverty in the Middle East and Asia over the last year in Europe’s biggest refugee influx since World War Two. EU efforts to conclude a deal with Turkey to halt the human tide in return for political and economic rewards hit a setback on Tuesday when EU member Cyprus vowed to block efforts to speed up Ankara’s EU accession talks unless Turkey meets its obligations to recognize its nationhood.

European Council President Donald Tusk, who will chair an EU summit with Turkey on Thursday and Friday, was flying on to Ankara to discuss the fraying pact with Turkish leaders after tough talks with Cypriot President Nicos Anastasiades. Tusk acknowledged to reporters that the tentative deal put together last week by German Chancellor Angela Merkel and Dutch Prime Minister Mark Rutte with Turkish Prime Minister Ahmet Davutoglu raised legal problems and needed to be “rebalanced” to win acceptance from all 28 EU members. The European Commission meanwhile postponed proposals to reform the bloc’s flawed asylum system, which puts the onus on the state where migrants first arrive, in an attempt to avoid further controversy before the Turkey deal is finalised. Some 43,000 migrants are bottled up in Greece, overstraining the economically shattered euro zone country’s capacity to cope, and more continue to cross the Aegean daily from Turkey despite new NATO sea patrols.

An estimated 1,500 people marched out of a squalid transit camp near the northern Greek town of Idomeni on Monday, hiked for hours along muddy paths and forded a rain-swollen river to get around the border fence. Most were picked up by Macedonian security forces, put into trucks and driven back over the border into Greece late Monday or overnight, a Macedonian police official said. Greek authorities said they could not confirm the return as there had been no official contact from the Macedonian side. Ties between the two neighbors are fraught because of Greece’s long-standing refusal to recognize Macedonia’s name, which is the same as that of a northern Greek province. A second group of about 600 migrants was prevented from crossing into Macedonia and many of them spent the night camping in the Greek mountains.

The Kempsons are fabulous. But where’s the rest of Britain?

• Refugees On Lesbos Offered Sanctuary Thanks To Brit Couple (Mirror)

Many British couples dream of leaving Blighty behind and opening a hotel on an island in the sun. It was no different for Eric and Philippa Kempson when they thought about their future together. But it was the global refugee crisis which pushed them to buy their seafront guest house on the Greek island of Lesbos. And rather than welcoming British tourists, they have opened their doors to the hundreds of fleeing refugees who land on its shores each month. Now, as Turkey and the EU agree their “one in, one out” policy in response to the migrant crisis, Philippa says: “I’m absolutely speechless about these latest measures -they’re farcical. Labels like “irregular migration” are meaningless.” “We need to remember these are human beings fleeing horrific circumstances.

Hotel Elpis, on tranquil Eftalou Beach, gives desperate refugees shelter, somewhere to wash and a meal when they land on Lesbos. The 20-room hotel welcomed its first 110 residents two weeks ago. “In Greek Elpis is the goddess of hope, so it seemed fitting that we called the hotel the Hope Centre“ says Philippa, 43. First and foremost that’s what we provide these people with: hope. We are trying to give the families a few hours of dignity and somewhere where they are treated as people, not as refugees. We hadn’t planned to open our doors so early, as we are still waiting for our health and safety licenses. But last week one of the aid agencies begged us to help 110 people who had just arrived on boats. Every facility on the island was full. Philippa and Eric, 60, got involved in the crisis last summer, when they started handing out water to refugees.

Philippa explains: “We thought bigger agencies would come to help, but when none did, we thought, we have to help these people ourselves”. It was then that they decided to open the hotel. “We ve used our own savings and are working on the project 24/7”, she says. Tourists have been kind enough to leave money at supermarkets so we can buy supplies to hand out. The couple have also been given help with the hotel’s rent by Glasgow housing charity PAIH. Philippa adds: “Eric is an artist and makes oak products we sell. But last summer he didn’t have the time to do that because of our work with refugees. So I don t know how we are going to survive ourselves financially this year, but we will deal with those issues when they come.”

Good luck.

• UNHCR To Ask World To Take In 400,000 Syrian Refugees (A.)

The United Nations High Commissioner for Refugees said on Tuesday he will ask countries to step forward and agree to take in another 400,000 Syrian refugees. On his first visit to Washington since being appointed to head the UN refugee effort, Filippo Grandi said the world must do more to end the crisis. “On March 30, I’m going to chair a meeting in Geneva at which I ask the international community to take 10% of all the Syrian refugees,” he said. “10% is a lot of people. It’s more than 400,000 people,” he told reporters on the fifth anniversary of Syria’s bloody civil war. More than four million Syrians have fled their war-torn country since the conflict erupted, and more than six million are displaced within its borders. Neighboring Turkey, Lebanon and Jordan are struggling to cope with the exodus and the onward flow has created a political and humanitarian crisis in Europe.

Canada and Germany have been praised for stepping up to welcome tens of thousands as refugees, but others, including the United States have been criticized. Historically the United States has been by far the world’s leading host of refugees and it still is for those fleeing many other conflicts around the world. But amid a bitter atmosphere in the run up to November’s presidential election, Washington has struggled to offer new homes to desperate Syrians. US President Barack Obama ordered that 10,000 be admitted during the 2016 fiscal year, but half-way through the period only 1,115 have been processed. Grandi was careful not to criticize his hosts in Washington, praising the leading US role in hosting refugees of other nationalities.

But he lamented the tone of the debate in both the US and Europe, where anti-immigration politicians have claimed that terrorists hide among Muslim refugees. Grandi complained that on a visit to the European parliament he had heard “language we haven’t heard since the 30s” from opponents of resettlement. But he added that the new 400,000 target figure could be met in part by means short of the full resettlement package that the United States offers. Rather than providing Syrian refugees with new lives and permanent residence, some countries may offer temporary jobs, scholarships or humanitarian visas. For this, he said, his office would work with private firms and universities in partnership with states, to try to reduce the pressure on Syria’s neighbors.

Home › Forums › Debt Rattle March 16 2016