Pablo Picasso Two naked figures 1908

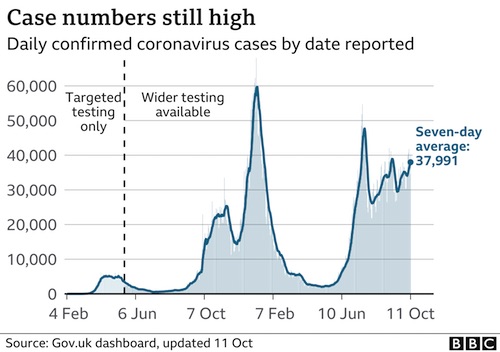

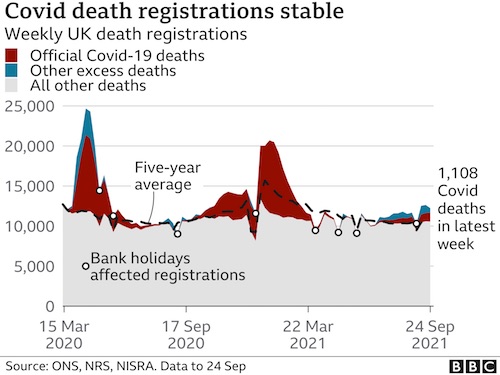

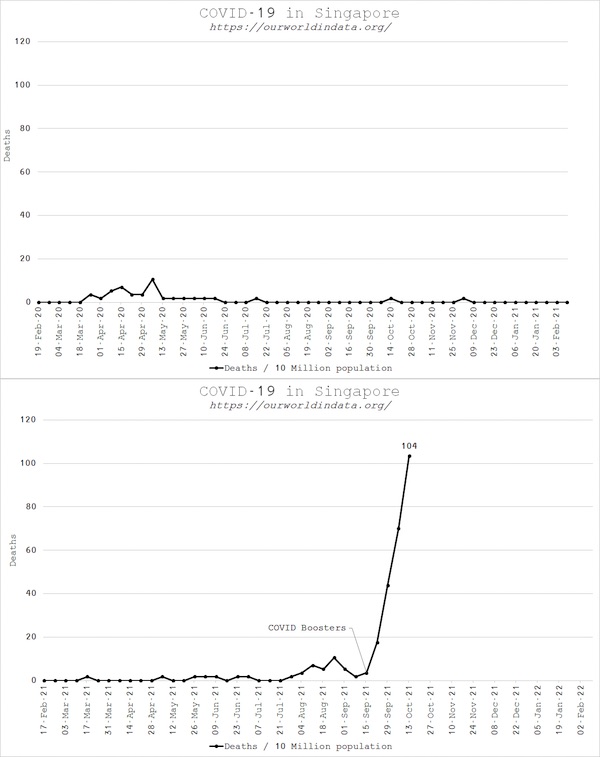

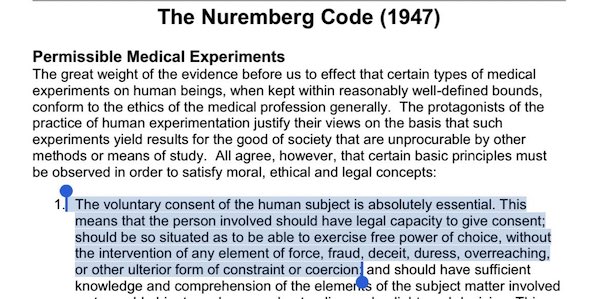

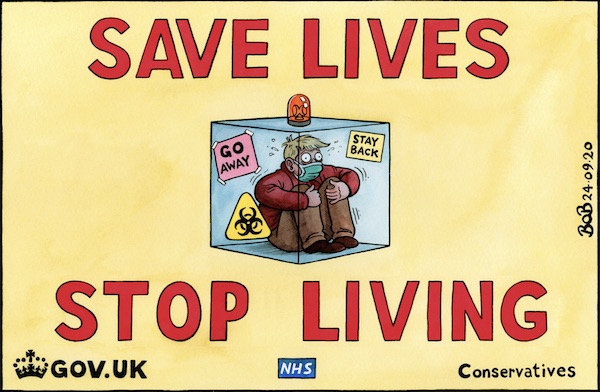

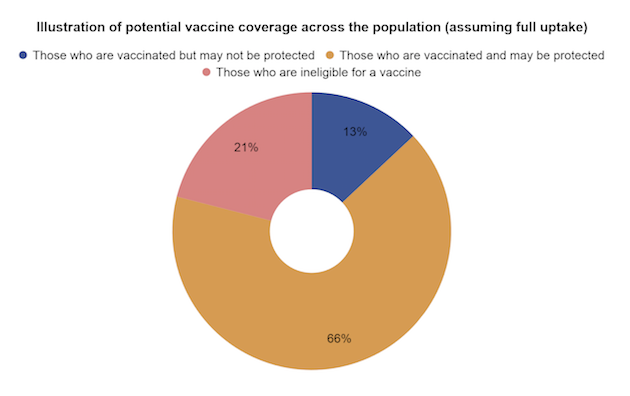

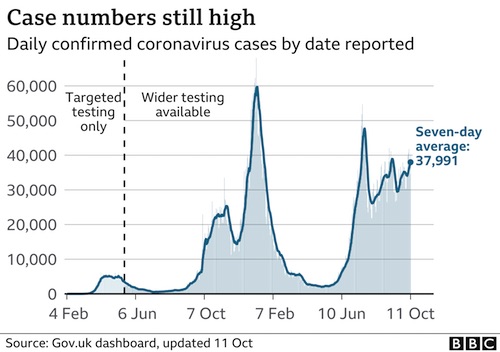

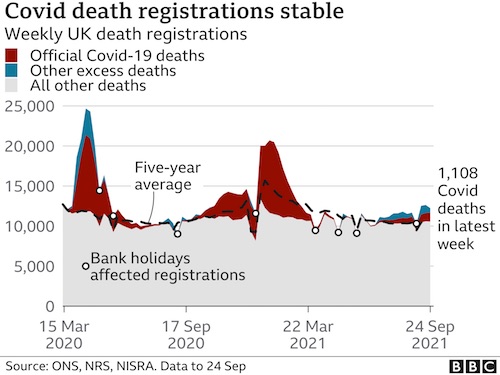

The report itself is as big a failure. What went wrong? Lockdowns came too late.. But the vaccines are a resounding success. Yeah, sure. Just look at all the new cases. Oh, and in the 2nd graph, what are all those recent excess deaths? Where do they come from? Couldn’t be the vaccines, could it?

Not one word on early treatment or prophylaxis. Not one.

• Covid Response ‘One Of UK’s Worst Ever Public Health Failures’ (G.)

Britain’s early handling of the coronavirus pandemic was one of the worst public health failures in UK history, with ministers and scientists taking a “fatalistic” approach that exacerbated the death toll, a landmark inquiry has found. “Groupthink”, evidence of British exceptionalism and a deliberately “slow and gradualist” approach meant the UK fared “significantly worse” than other countries, according to the 151-page “Coronavirus: lessons learned to date” report led by two former Conservative ministers. The crisis exposed “major deficiencies in the machinery of government”, with public bodies unable to share vital information and scientific advice impaired by a lack of transparency, input from international experts and meaningful challenge.

Despite being one of the first countries to develop a test for Covid in January 2020, the UK “squandered” its lead and “converted it into one of permanent crisis”. The consequences were profound, the report says. “For a country with a world-class expertise in data analysis, to face the biggest health crisis in 100 years with virtually no data to analyse was an almost unimaginable setback.” Boris Johnson did not order a complete lockdown until 23 March 2020, two months after the government’s Sage committee of scientific advisers first met to discuss the crisis. “This slow and gradualist approach was not inadvertent, nor did it reflect bureaucratic delay or disagreement between ministers and their advisers. It was a deliberate policy – proposed by official scientific advisers and adopted by the governments of all of the nations of the UK,” the report says.

“It is now clear that this was the wrong policy, and that it led to a higher initial death toll than would have resulted from a more emphatic early policy. In a pandemic spreading rapidly and exponentially, every week counted.”

Read more …

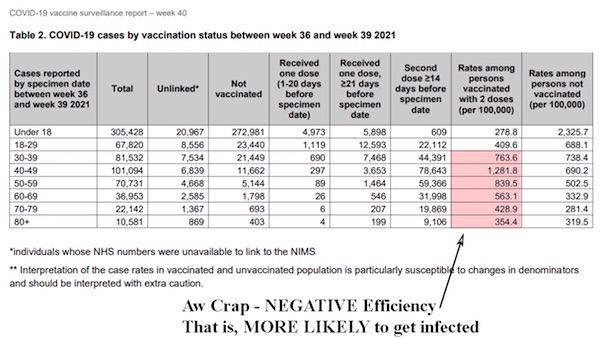

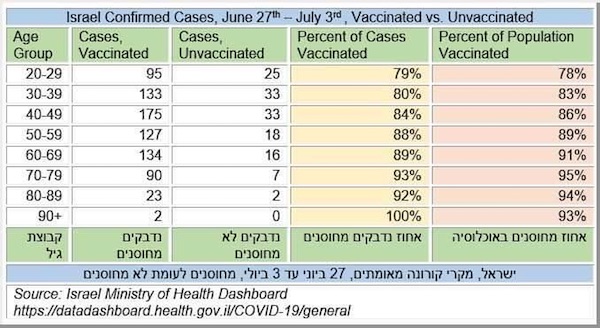

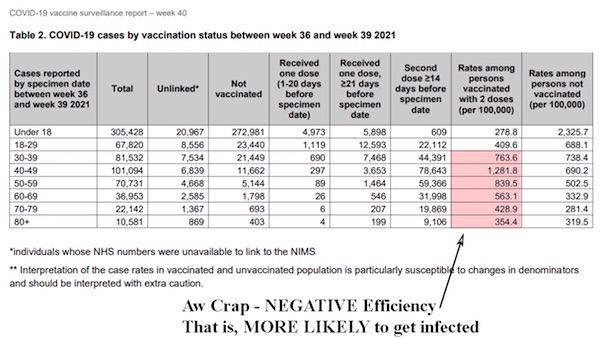

“.. that the vaccine makes you more likely to both get and give to others the virus is now established.”

• Down To Only One Question Now.. (Denninger)

Unfortunately what this means is that now for anyone over 30 you are more likely to get infected, yes, adjusted for the population that is vaccinated, if you are vaccinated. Indeed in the 40-49 age group you’re close to double as probable on a per-population basis. This means that if your employer mandates the jabs he or she can be sued for putting those who can’t get vaccinated at double the risk, on purpose, by enforcing the mandate. Since there are people who can’t (due to immune compromise, such as cancer patients) be vaccinated this is now intentional risk. In other words this is hard, scientific evidence that these mandates by employers have increased the risk of customers (and other employees) contracting Covid-19. This isn’t a natural risk, it’s a man-made one created by the employer.

That’s actionable. So far this is not translating into higher risk of Covid hospitalization and death on a per-100,000 basis. But that the vaccine makes you more likely to both get and give to others the virus is now established. It is fact. It is in fact true for everyone who is over 30. I have pointed out that preventing infection was never in the cards; it was not part of the EUA, it was not part of the studies, it was never demonstrated. But this is much worse because now we are talking about a direct threat to others The CDC, NIH and Biden almost-certainly know this. This is why the mad rush to demand you get jabbed; they know damn well what this means and that while the manufacturer is immune the employers are not and in fact any such mandate leaves them wide open legally as soon as an unvaccinated person gets infected after being at said firm either as an employee or customer and sues the company on the basis of intentionally and maliciously increasing their risk by forcing their employees to get the jab, which is exactly what they did.

The data from England is conclusive in that regard. I bet that they’ve known this was happening right here in the US for months now. I expected no effective protection. What I did not expect was negative protection, but that’s what we got. This portends the potential for very, very bad things. Specifically, if the impairment is only toward Covid-19; that is, this is some sort of VEI specific to Covid, then the issue ends there. For those with natural (recovered) immunity they don’t care and absolutely should not get the jab; indeed, if you’re recovered and take them you may destroy your protection in part or whole and wind up susceptible to repeat infection you would otherwise not be hit with! If you do that you’re stupid and may well win a stupid prize.

But the 900lb Gorilla is that the impairment may not Covid-19 specific. In other words the impairment may be immune system generalized, in which case those who took the jabs are screwed because that immune damage could be long-lasting or even permanent, yet the protection against serious outcomes is specific to Covid. So yes, you’re “safer” against a serious outcome even while screwing everyone else, but at the same time you are wildly more-susceptible to a severe or fatal outcome due to, for example, influenza.

Read more …

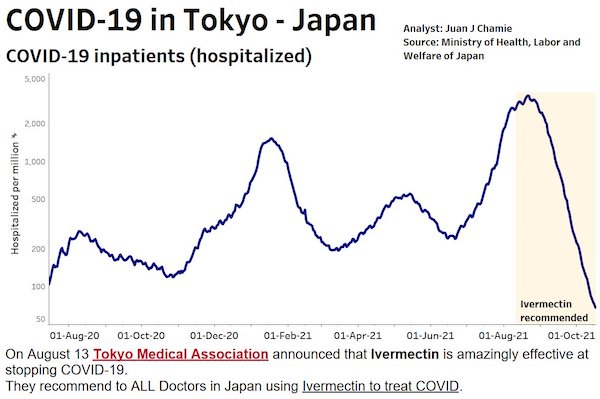

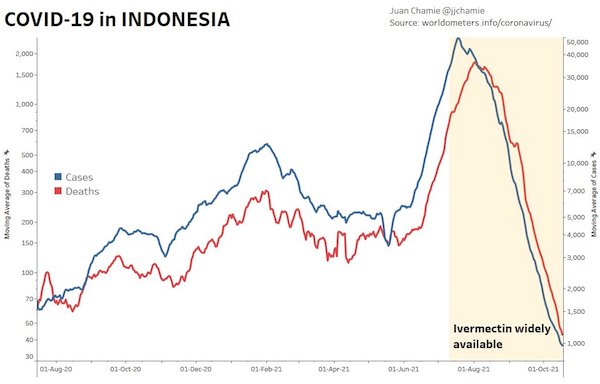

“If you were paranoid, you might suspect that something was up in this attempt to roadblock cheap, safe, and effective treatments..”

• The Waiting Is The Hardest Part (Kunstler)

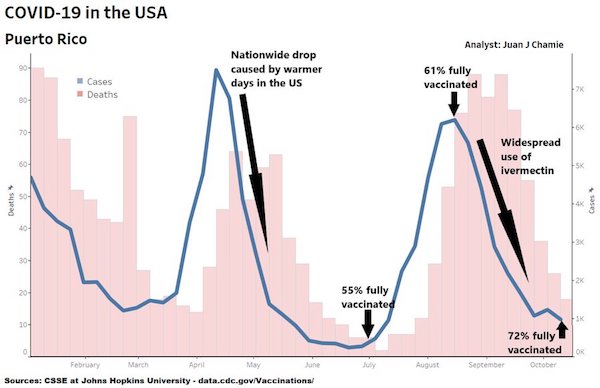

Meanwhile, we have the arrival on-the-scene of another joker: Merck’s new anti-Covid-19 drug molnupiravir, said to reduce the risk of hospitalization and death from Covid by 50 percent. Merck and its partner, Ridgeback Biotherapeutics, have applied for an emergency use authorization (EUA) from the FDC for this new drug, the same legal loophole that Pfizer and Moderna got for their mRNA vaxes. “Joe Biden” promised to spend $1.2 billion procuring a big batch of the new drug, so bringing it on must be a done deal. The catch is, molnupiravir is in the same order of nucleoside analogue drugs as remdesivir, a clinically-proven failure in the treatment of Covid 19. The stuff killed patients left and right. Molnupiravir’s mutagenic mechanism is supposed to mess with the DNA of Covid-19 viruses, incrementally disabling them and killing them off.

The trouble is, mutagenic drugs are notorious for broad spectrum action, so Molnupiravir might do the same thing to the various cells in your body, too: instant cancer. I guess we’ll have to stand-by and see how that works out. It pays to remember, though, that the EUA didn’t work out so well for the Covid-19 vaccines, did it? The waiting is the hardest part. Molnupiravir was shoved out onstage after two years of the public health authorities (Drs. Fauci, Collins, et al.) and the corporate news media casting curses on the existing suite of cheap drugs that proved clinically effective in the early treatment of Covid-19, namely ivermectin (a.k.a. “horse paste”), hydroxychloroquine, fluvoxamine, prednisone, etc. If you were paranoid, you might suspect that something was up in this attempt to roadblock cheap, safe, and effective treatments in favor of untested novelties that would just happen to be another multibillion-dollar boon for drug companies.

Read more …

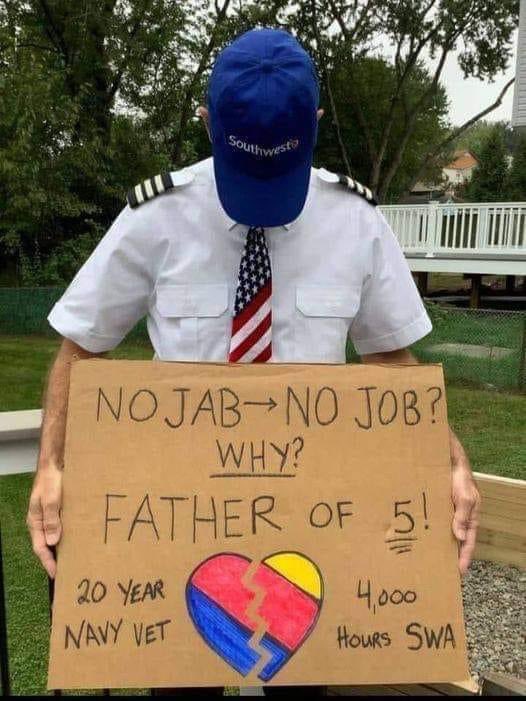

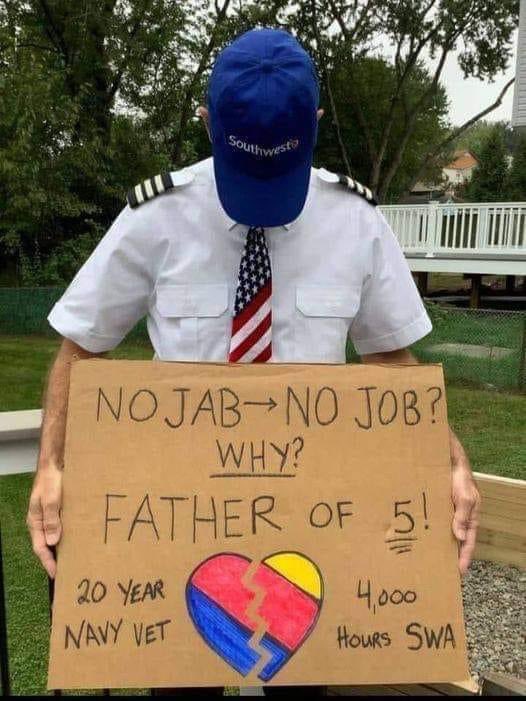

How many of these “leaders” will give in before Christmas?

• Seattle PD May Lose 40% Of Officers Over Covid-19 Vaccine Mandate (ZH)

It was inevitable – as vaccine mandates across the country approach their deadlines, vast swaths of American workers, service members and atheletes face termination or disciplinary action for refusing to take the Covid-19 jab. In Los Angeles, nearly 1,000 firefighters are about to sue the city over the mandate. Southwest Airlines’ pilot union sued the company last week, before staffing shortages led to the cancellation of more than 2,000 flights over the weekend (and more on Monday). Meanwhile, doctors and nurses across the country have begun suing their employers. Interestingly, after a group of officers from the Los Angeles Police Department sued over the mandate, Sheriff Alex Villanueva announced that he would not ‘force anyone’ to take the jab.

But not Seattle – which stands to lose 40% of its 1,000 person force for failing to get vaccinated as an Oct. 18 deadline approaches. “The environment has been pretty toxic and negative,” one officer anonymously told Fox 13. “Not just from this whole mandate, but prior to that as well. I’m not sure this would be a good place for me to work long-term for my mental health. It has been very stressful.” Recall that this is on the heels of the city losing around 300 officers amid Black Lives Matter riots and the “defund the police” movement. By the numbers, as of Oct. 6, 292 sworn personnel had yet to provide proof of a COVID-19 vaccination per the report, down from 354 on Tuesday. An additional 111 officers are awaiting the results of exemption requests, meaning the total number of potentially fired Seattle cops is as high as 403.

Read more …

The hide and seek game continues.

• Southwest Says Staffing Shortages Contributed To Flight Snarls (Y!)

After initially blaming air traffic control issues and weather for thousands of flight cancelations, Southwest Airlines on Monday acknowledged that staffing shortages also played a role in the service disruption. The carrier cancelled 1,124 flights on Sunday — by far the highest rate of any airline — 800 the day before and another 326 on Monday, according to airline tracker FlightAware. “On Friday evening, the airline ended the day with numerous cancellations, primarily created by weather and other external constraints, which left aircraft and crews out of pre-planned positions to operate our schedule on Saturday,” the low-cost carrier said in a statement. “Unfortunately, the out-of-place aircraft and continued strain on our crew resources created additional cancelations across our point-to-point network that cascaded throughout the weekend and into Monday.”

CNBC reported Southwest Chief Operating Officer Mike Van de Ven acknowledged to employees that the company “is still not where we need to be on staffing, and in particular with flight crews.” Like most airlines, Southwest let employees go when air traffic collapsed as the Covid-19 pandemic began, but has seen business surge this year as vaccinations spur people to travel again. The weekend’s snarls caused speculation that some pilots or other Southwest staff were participating in a work slowdown as a way to express opposition to the company’s decision to require its employees to be vaccinated against Covid-19. In their statement, Southwest said “the operational challenges were not a result of Southwest employee demonstrations” and they hope to restore normal operations “as soon as possible.”

Read more …

The value of freedom.

• Texas Gov. Abbott Issues Order Banning Covid Vaccination Mandates (NBC)

Texas Gov. Greg Abbott issued an executive order Monday prohibiting any entity, including private businesses, from imposing Covid-19 vaccination requirements on employees or customers. “The COVID-19 vaccine is safe, effective, and our best defense against the virus, but should remain voluntary and never forced,” Abbott said in a statement. Abbott, a Republican, said in his order that it was prompted by the Biden administration’s vaccination mandate, which he said was federal overreach. President Joe Biden announced a mandate last month requiring companies with 100 or more employees to ensure that their workforces are vaccinated or regularly tested. The Labor Department has yet to release details of the emergency rule, but Biden last week called on companies to act now and not to wait for the requirement to go into effect.

Abbott, who tested positive for Covid in August, has also resisted mask mandates and requiring proof of vaccination. Texas has continued to experience a rise in cases and crowded hospitals, prompting Abbott to invest in monoclonal antibody infusion centers. Abbott issued executive orders over the summer banning local governments and school districts from requiring either masks or vaccinations, issuing $1,000 fines to those who failed to comply. School districts in San Antonio and Dallas have challenged the order in court. The Legislature also passed a bill in June banning private businesses from requiring proof of vaccination from customers.

Read more …

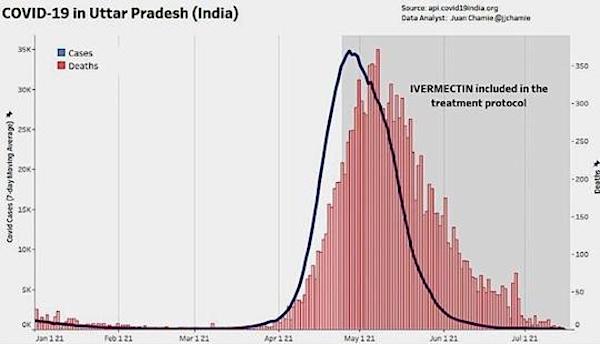

From the NIH: ” Ivermectin is a drug that has been shown to be active against coronavirus disease 19 (COVID-19) in previous studies”.

Any further questions?

• Ivermectin as Covid Pre-Exposure Prophylaxis Method in Healthcare Workers (NIH)

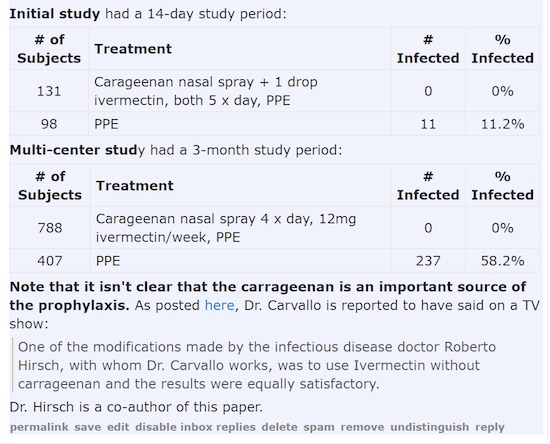

Background: Ivermectin is a drug that has been shown to be active against coronavirus disease 19 (COVID-19) in previous studies. Healthcare personnel are highly exposed to severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) infection. Therefore, we decided to offer them ivermectin as a pre-exposure prophylaxis (PrEP) method.

Purpose: Primary outcome was to measure the number of healthcare workers with symptomatic SARS-CoV-2 infection and a positive reverse transcription polymerase chain reaction (RT-PCR) COVID-19 test in the ivermectin group and in the control group. Secondary outcome was to measure the number of sick healthcare workers with a positive RT-PCR COVID-19 test whose condition deteriorated and required hospitalization and/or an Intensive Care Unit (ICU), or who died, in the ivermectin group and in the control group.

Material and methods: This observational and retrospective cohort study was carried out in two medical centers, Centro Medico Bournigal (CMBO) in Puerto Plata and Centro Medico Punta Cana (CMPC) in Punta Cana, Dominican Republic. The study began on June 29, 2020, and ended on July 26, 2020. A Statistical Package for Social Sciences (SPSS) Propensity Score Matching procedure was applied in a 1:1 ratio to homogeneously evaluate 271 healthcare personnel that adhered to a PrEP program with ivermectin at a weekly oral (PO) dose of 0.2 mg/kg, and 271 healthcare personnel who did not adhere to the program were assigned as a control group.

Results: In 28 days of follow-up, significant protection of ivermectin preventing the infection from SARS-CoV-2 was observed: 1.8% compared to those who did not take it (6.6%; p-value = 0.006), with a risk reduction of 74% (HR 0.26, 95% CI [0.10,0.71]). Conclusions: These results suggest that compassionate use of weekly ivermectin could be an option as a preventive method in healthcare workers and as an adjunct to immunizations, while further well-designed randomized controlled trials are developed to facilitate scientific consensus.

Read more …

Promising, but…

• Russian Drug To Calm Cytokine Storm (RT)

A group of Russian scientists have created a drug that may potentially revolutionize the treatment of Covid-19 by defusing the most catastrophic reaction the disease causes in patients, while not destroying their immune response. The drug, called Leitragin, was developed by the Biomedical Technology Research Center of the Russian Federal Medical and Biology Agency (FMBA), and is currently undergoing clinical trials in Russia. Although its base substance was previously known and used in ulcer treatment medicine by Soviet and Russian doctors, it was the FMBA team that discovered how to apply it for the treatment of severe cases of Covid-19 and, potentially, other deadly diseases that cause life-threatening lung inflammation.

The Russian scientists had tasked themselves with finding a substance that would act as an ‘off switch’ for the chain reaction that, after being triggered by the invading SARS-CoV-2 virus, actually causes potential organ failure and death. This reaction of the immune system, dubbed the “cytokine storm,” has been variously described as our body’s overreaction to the virus or a “suicide attack” against the invading pathogen, and even as an evolutionary mechanism to stop the spread of deadly infections with the death of the host. Trying to stop this uncontrolled immune response while still preserving the body’s ability to fight the virus without causing more damage is what scientists and medics in intensive care units across the world have been wrestling with during the Covid-19 pandemic. In that regard, Leitragin is being touted as a game-changer, since its novel mechanism acts in a targeted way, and is said to be completely safe for one’s health.

Read more …

Wait, so Iceland ditches Moderna because it has enough Pfizer… which it says has the same effects as Moderna.

• FDA Responds To Nordic Countries Suspending Moderna COVID Vaccine Usage (ET)

The Food and Drug Administration (FDA) responded to Nordic countries limiting the use of Moderna’s COVID-19 vaccine last week, saying the shot’s benefits outweigh the risks. Health officials in Finland, Norway, Sweden, and Iceland suspended the use of the Moderna vaccine for younger people due to a risk of side effects including myocarditis. Sweden said it would pause the vaccine for people under the age of 30, and Denmark did the same for those under 18. Finland said that males under the age 30 shouldn’t receive the jab, while Icelandic officials added over the weekend that they would suspend use of the shot.

“The FDA is aware of these data. At this time, FDA continues to find that the known and potential benefits of vaccination outweigh the known and potential risks for the Moderna COVID-19 Vaccine,” an FDA official said in a statement to news outlets over the weekend in response to the Nordic nations’ decision to suspend the vaccine for certain age groups. Moderna, meanwhile, said in a statement after the countries’ decision that it was “aware of the very rare occurrence of myocarditis and/or pericarditis following administration of mRNA vaccines against COVID-19.” “These are typically mild cases and individuals tend to recover within a short time following standard treatment and rest. The risk of myocarditis is substantially increased for those who contract COVID-19, and vaccination is the best way to protect against this,” the company’s statement continued.

Moderna’s vaccine is still being administered under the Food and Drug Administration’s emergency use authorization. The company’s application for full approval is still pending. On Oct. 10, Iceland’s Health Directorate said the Moderna vaccine would be entirely suspended due to the risk of cardiac inflammation. “As the supply of Pfizer vaccine is sufficient in the territory … the chief epidemiologist has decided not to use the Moderna vaccine in Iceland,” according to a statement published on the Health Directorate website. The move was handed down due to “the increased incidence of myocarditis and pericarditis after vaccination with the Moderna vaccine, as well as with vaccination using Pfizer/BioNTech,” its statement continued.

Read more …

Sep 24. yeah, we have no idea what kills all those people…

• Thousands More People Than Usual Are Dying … But It’s Not From Covid (Tel.)

While focus remains firmly fixed on Covid-19, a second health crisis is quietly emerging in Britain. Since the beginning of July, there have been thousands of excess deaths that were not caused by coronavirus. According to health experts, this is highly unusual for the summer. Although excess deaths are expected during the winter months, when cold weather and seasonal infections combine to place pressure on the NHS, summer generally sees a lull. This year is a worrying outlier. According to the Office for National Statistics (ONS), since July 2 there have been 9,619 excess deaths in England and Wales, of which 48 per cent (4,635) were not caused by Covid-19. So if all these extra people are not dying from coronavirus, what is killing them?

Data from Public Health England (PHE) shows that during that period there were 2,103 extra death registrations with ischemic heart disease, 1,552 with heart failure, as well as an extra 760 deaths with cerebrovascular diseases such as stroke and aneurysm and 3,915 with other circulatory diseases. Acute and chronic respiratory infections were also up with 3,416 more mentions on death certificates than expected since the start of July, while there have been 1,234 extra urinary system disease deaths, 324 with cirrhosis and liver disease and 1,905 with diabetes. Alarmingly, many of these conditions saw the biggest drops in diagnosis in 2020, as the NHS struggled to cope with the pandemic.

A report released last week by the Government detailing the direct and indirect health impacts of the pandemic reported that there were an estimated 23 million fewer GP consultations – both in-person and online, in 2020 compared with 2019. Diagnosis of Chronic Obstructive Pulmonary Disease (COPD) fell by 51 per cent, atrial fibrillation 26 per cent, heart failure 20 per cent, diabetes 19 per cent, coronary heart disease, 17 per cent and stroke and transient ischemic attack by 16 per cent.

Read more …

“I make my choices, and you make yours. Except with COVID. Then Joe Biden makes my choices, trying to protect me from myself.”

• Live Free Or Die: Why Medical Autonomy Matters (Miele)

I think vaccines have done the world a world of good. I remember getting my smallpox vaccine and waiting eagerly to get the scar on my arm that my mother’s arm showed off like a badge of courage, but it never appeared for me. Then when the oral polio vaccine was developed, I remember lining up in the gym at North Garnerville Elementary School in New York to get my first dose on a sugar cube. Yum. So yes, I’m pro-vaccine. I also generally get the flu vaccine every year. I even got a shot last year, although for some peculiar reason, influenza vanished last winter while COVID was enjoying its greatest reign of terror. And naturally, my three children have all been vaccinated against the usual childhood diseases and taken whatever was recommended to keep them safe.

But one thing I never thought of doing was forcing my neighbors to get vaccinated against the flu. Did you know that influenza kills as many as 50,000 Americans a year? That’s approaching the number of U.S. soldiers killed in the entire length of the Vietnam War. On average, flu kills as many Americans every year as car crashes. Yet did anyone — even St. Anthony Fauci — ever dare to suggest that vaccination for flu should be mandatory because it would save lives? Hell, no, and even though many vaccinations are required of school children for good reasons, we also have allowed religious and medical exemptions for families that needed them. Because we aren’t supposed to be a nation of slaves, but a nation of citizens. If someone had a personal reason why they rejected vaccines, we didn’t put them through an inquisition or try to burn them at the stake of public opinion. This was America — land of the free.

I also never thought of celebrating when a person who opted not to get the flu vaccine died of influenza. But vaccine mandate supporters seem to get giddy when a vaccine refusenik falls ill from COVID and dies on a ventilator or worse. This isn’t science; it’s scientific imperialism — and the CDC centurions are ruthless in their application of power to the masses. Obey or die. So why might a reasonable person decide not to be vaccinated against COVID-19 in such a hysterical climate? Maybe because it’s an experimental and untested drug using a technology (mRNA) that has the power to tamper with the very genetic makeup of the cells in my body. Maybe because I’m more worried about herd instinct than herd immunity. Maybe because I’ve heard wonky scientists gloating about the power they wield over everyday Americans.

Maybe because Big Pharma’s getting rich by inventing reasons why you just might need to get a new shot every year. Maybe because I want to decide for myself what’s best for me. Think of it this way. You are afraid of dying of COVID-19. So am I. But that doesn’t mean I am going to die from COVID. In fact, there is what I would characterize as an acceptably small chance I will die of COVID, and I’m 66 years old, right smack in the realm of the supposedly at-risk elderly population. According to data from the CDC reported at RationalGround.com, from Jan. 1, 2020 until Sept. 11, 2021, there were 12,702 U.S. deaths from COVID for my age cohort out of an estimated population of 3,618,069. That’s a death rate of 0.365%.

Meanwhile, 100,449 people my age died during the same period of all causes, suggesting I have about a 12% chance of dying of something this year, a much scarier possibility than dying of COVID-19. Think of it! If I’m going to die this year, I’m 33 times more likely to die of anything else besides COVID. Based on the propaganda we are inundated with every day about the virus, I should be terrified! There are way worse things out there trying to kill me than COVID. But I’m not terrified, not even slightly, because life is always a risk. I can temper my risks by avoiding downhill skiing, ATVs, booze, surfing, and motorsports. Those are my choices, but heaven forbid I should dictate that you have to avoid those activities because they are not 100% safe. Your behavior is none of my business. I make my choices, and you make yours. Except with COVID. Then Joe Biden makes my choices, trying to protect me from myself.

Read more …

Wouldn’t he be circling Biden then?

• Is Durham Circling Jake Sullivan? (Turley)

As soon as the conspiracy theory was packaged and delivered the FBI and the media by Sussman, the indictment recounts an exchange between some of those “VIPs”: “… on or about September 15, 2016, Campaign Lawyer-1 exchanged emails with the Clinton Campaign’s campaign manager, communications director, and foreign policy advisor concerning the Russian Bank-1 allegations that SUSSMANN had recently shared with Reporter-1.” The campaign lawyer reportedly was Elias, and the “foreign policy advisor” reportedly was Sullivan. Sullivan was quoted in an official campaign press statement as stating that the Alfa Bank allegation “could be the most direct link yet between Donald Trump and Moscow.”

In the statement, Sullivan said: “Computer scientists have apparently uncovered a covert server linking the Trump Organization to a Russian-based bank. This secret hotline may be the key to unlocking the mystery of Trump’s ties to Russia … This line of communication may help explain Trump’s bizarre adoration of Vladimir Putin.” The U.S. intelligence community ultimately rejected the Alfa Bank conspiracy. It also concluded that the Steele dossier not only relied on a suspected Russian agent but likely was used by Russian intelligence to spread disinformation through the Clinton campaign. Yet, when Sullivan was later questioned by Congress, he went full Sergeant Schultz, claiming he basically did not have a clue about the basis or origins of the Alfa Bank controversy or other campaign-orchestrated scandals.

Sullivan was adept at laying qualifiers upon qualifiers to render statements useless: “broadly speaking, at some point in the summer, and I don’t remember exactly when it was, around the convention, I learned that there was an effort to do some research into the ties between Trump and Russia.” That will make any false statement claim difficult absent direct involvement in the planning of these “campaign efforts.” Sullivan denied knowing that Elias or Sussman were working for the Clinton campaign, despite numerous news articles identifying Elias as the campaign’s general counsel. Sullivan just shrugged and said: “To be honest with you, Marc wears a tremendous number of hats, so I wasn’t sure who he was representing. I sort of thought he was, you know, just talking to us as, you know, a fellow traveler in this — in this campaign effort.”

Read more …

“..other skills that were not required, but beneficial: Experience calming herds of rabid, sleepless passengers, expertise in flying through mysterious, invisible weather events, and the ability to land the plane.”

• Southwest Offers Free Flights To Anyone Vaccinated Who Can Fly A Plane (BBee)

A spokesperson for Southwest Airlines has announced delays in flights due to strange weather that seems to pass over competitors’ planes, only affecting their own signature blue and orange aircraft. The airline has stated these delays have no connection to their pilots protesting vaccine mandates. The spokesperson then announced a new Southwest Airlines incentive program for potential passengers: All flights, domestic or international, are free to any passenger who is vaccinated and can also fly a plane.

“The requirements to take advantage of these incredible savings are simple,” said Southwest CEO Bob Southwest to a crowd of customers who have been stuck at the airport all weekend and were frothing at the mouth in anger. “Show us proof of vaccination against COVID-19 and promise us you know how fly commercial airliners, and your flight is on us.” The CEO then mentioned other skills that were not required, but beneficial: Experience calming herds of rabid, sleepless passengers, expertise in flying through mysterious, invisible weather events, and the ability to land the plane.

Read more …

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.