Man Ray Departure of summer 1914

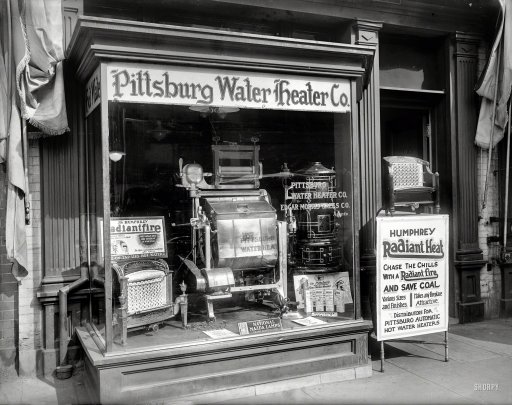

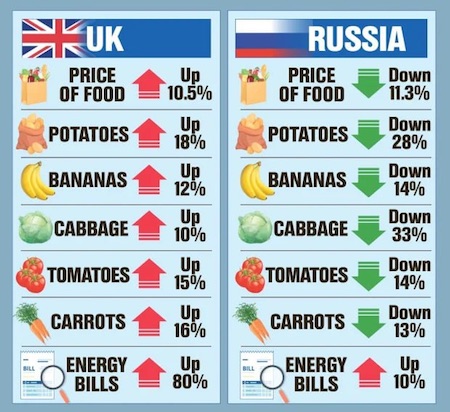

According to Bloomberg Europe has reserved $375 Billion in heating bill relief. UK’s Truss has set aside £130 billion.

Think of all the gas you could have bought with that money. Now you get nothing.

Winter will be big

https://twitter.com/i/status/1566832570775621632

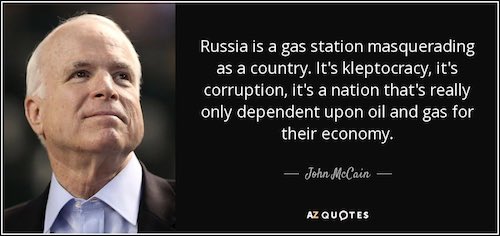

The Russians have been accused for many years. Wonder how that feels?!

Here is ten straight minutes of Democrats denying election results.pic.twitter.com/bJRbzEcIO2

— RNC Research (@RNCResearch) September 4, 2022

Take it down and tear it up

Really fun tune.pic.twitter.com/QRjqHc26MD

— Gonzalo Lira (@GonzaloLira1968) September 5, 2022

They’ve done it. War is peace.

• Australian Artist Removes Ukraine And Russia Mural After Backlash (BBC)

An Australian artist has painted over a street mural showing Ukrainian and Russian soldiers hugging, after a community backlash. The Melbourne artwork advocated a “peaceful resolution” between the two countries, creator Peter Seaton says. But some have likened the three-storey mural to Russian propaganda. Seaton – known as CTO – has apologised for his work, saying it was “clumsy” and he “didn’t think it would be so badly received”. Thousands of Ukrainians have been killed and Russian forces have been accused of war crimes since they invaded in February. Critics said the work – titled Peace Before Pieces – drew a false moral equivalence between the two sides.

“What would people think if a mural featured a rapist and a victim hugging?” co-chair of the Australian Federation of Ukrainian Organisations, Stefan Romaniw, said in a statement. “Trying to be ‘even-handed’ and accepting a false narrative that ‘all we need is peace’ in this case supports evil.” Ukraine’s ambassador to Australia Vasyl Myroshnychenko said it was “utterly offensive to all Ukrainians”. An art organisation, called Art4Ukraine Australia, said it had raised concerns about the artwork before it was started, and was shocked to see it completed. Seaton said he had stayed up until 03:00 local time on Monday to paint over the mural. “The mural cost me $2,000 to $3,000… I wouldn’t do that and spend 10 days doing it if I had thought it was going to hurt people,” he told the Australian Broadcasting Corporation later on Monday.

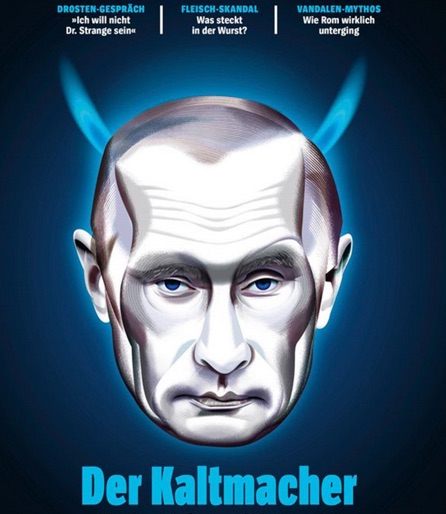

“Annalena Baerbock, promised last week to keep demonizing Russia to support Ukraine’s black hole of racketeering “no matter what my German voters think or how hard their life gets.”

• Labor Day Assessment (Jim Kunstler)

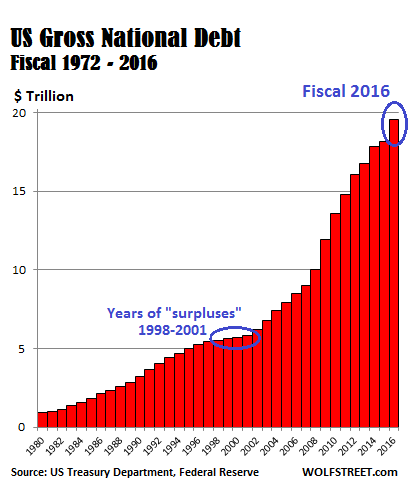

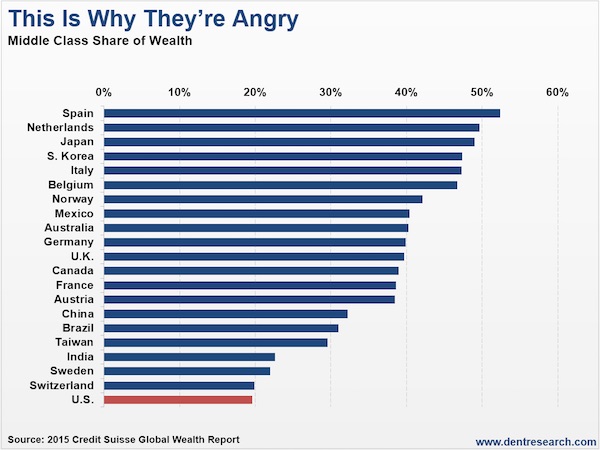

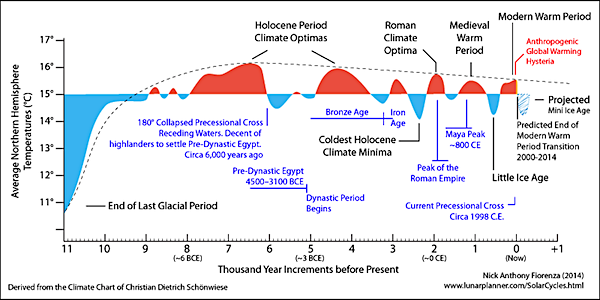

The Great Re-Set is an emergent phenomenon. It unspools naturally out of circumstances that reality presents. It goes its own way and we have to adapt to it, like it or not. Is our climate changing? Maybe. But so what? The climate has changed many times since the Bronze Age. If preventing that is actually out of the question, which it is, then what else are you going to do? The answer is: adapt intelligently to new conditions. When you clear away all the mental resistance to that — which amounts to a titanic struggle to keep things just the way they are — you’re going to have to make changes anyway. America was, for a time, the greatest industrial society and now that appears to be over. The disorder in all the moving parts of it is probably too gross to arrest at this point.

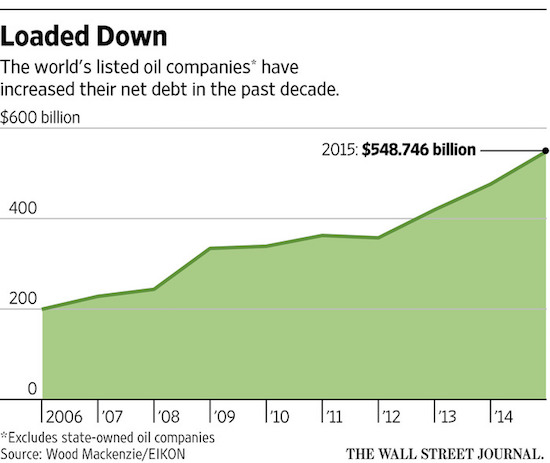

We shoved it into disorder by making some very bad choices, like getting rid of our factories and squandering our wealth on an absurd suburban living arrangement. Shale oil was a financial stunt to keep our set-up going a little longer. It was part of the colossal debt roll-up — the steering function of finance — that was used to compensate for our actual loss of mojo, and now that gambit has hit the wall. You can’t pretend to issue more debt when everyone knows it can never be paid back. Europe, the old home-base of Western Civ, never got around to shale oil, and its financial structure was such — reckless bond issuance with no fiscal accountability whatsoever — that now it is collapsing faster and worse than America. Europe’s leadership is clearly insane and it will likely be overthrown before long.

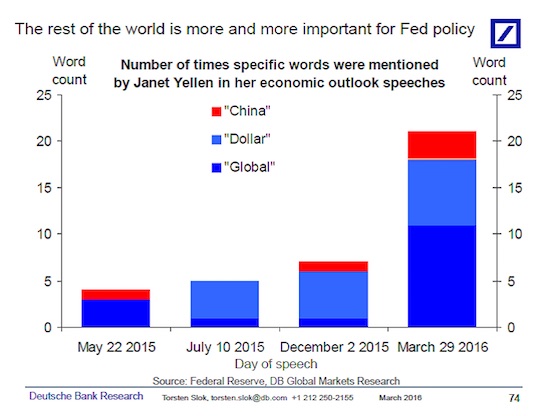

The foreign minister of Germany, the winsome Annalena Baerbock, promised last week to keep demonizing Russia to support Ukraine’s black hole of racketeering “no matter what my German voters think or how hard their life gets.” Stand by to see how that goes over.The angst around these circumstances is expressing itself in a generalized political nervous breakdown featuring the sort of tragi-comic behavior previously confined in lunatic asylums. Have you ever seen anything more patently insane than the sexual confusion acted out in American schools? Drag Queen story hours? Litter boxes in the bathrooms for students who identify as “furries”? That was the funny part. The Covid-19 event is no joke — rather a psychopathic mass murder.

Obviously, it was no accident. We have a pretty good idea who made it, and set it loose into the world. And the “vaccine” response looks plainly malevolent at this point. Yet the Covid episode is shot through with mystery. How did all those sedulously trained doctors get so mind-fucked as to persist in saying the “vaccines” were safe-and-effective, when the vaxxes were obviously killing and maiming people? They’re still stuck in that disgraceful posture, busy punishing their colleagues who demur, and dishonoring medicine — not to mention the thousands of public health officials still pushing vaxxes and boosters to this day. We can attribute that to mass formation psychosis, but even that reeks of mystery. Maybe, as the old American hymn goes, farther along we’ll understand why….

Problems in [gas] deliveries arose due to sanctions that have been imposed on our country and a number of companies by Western countries, including Germany and the UK. There are no other reasons behind supply issues..”

• Main Gas Pipeline To EU Will Be Closed Until Sanctions Lifted – Kremlin (RT)

The technical issues with gas deliveries to Europe via the Nord Stream 1 gas pipeline will persist until the West lifts sanctions it has slapped on Russia over the ongoing Ukraine conflict, Kremlin spokesman Dmitry Peskov said on Monday. On August 31, Gazprom completely shut down gas deliveries via the pipeline. Although initially Nord Stream 1 was slated to resume gas transit on Friday, Gazprom announced that it would remain closed indefinitely due to technical issues. “Problems in [gas] deliveries arose due to sanctions that have been imposed on our country and a number of companies by Western countries, including Germany and the UK. There are no other reasons behind supply issues,” Peskov noted.

The Kremlin spokesman also claimed that it is not Gazprom’s fault that “the Europeans absolutely absurdly make a decision to refuse to service their equipment,” which they are contractually obligated to do. Peskov stressed that all Nord Stream 1 operations hinge on “one piece of equipment that needs serious maintenance.” On Sunday, his comments were echoed by Alexander Novak, Russian Deputy Prime Minister, who blamed the European Union for the problems that have prevented the resumption of gas supplies via the pipeline. “The entire problem lies precisely on [the EU’s] side, because all the conditions of the repair contract have been completely violated, along with the terms of shipping of the equipment,” he said.

On Friday, Gazprom canceled the restart of Nord Stream 1 citing an oil leak in the turbine, which was detected during a joint inspection with manufacturer Siemens Energy at the Portovaya compressor station near St. Petersburg. At the same time, the malfunction could be remedied only in Canada, which has imposed sanctions against Moscow. Despite the maintenance issues, Europe has accused Russia of weaponizing energy supplies, with European Commission President Ursula von der Leyen describing Moscow as “not a reliable partner” in terms of gas supplies.

Not if there is no oil. Not a problem at all.

• Enforcing Russian Oil Price Cap Is Problematic – Washington Post (RT)

The latest initiative to set a price ceiling for Russian crude announced by the Group of Seven nations last week may encounter significant difficulties, the Washington Post reported on Friday. The scheme pushed by the G7 (the US, Canada, the UK, Germany, France, Italy, and Japan) is aimed at solving several problems simultaneously. It aims to undercut the revenue Moscow receives from selling crude to the global market, while maintaining energy flows to the West, and also keeping global oil prices in check. The plan, which is seen as a top priority of US Treasury Secretary Janet Yellen, includes banning services such as insurance and financing to ships transporting Russian crude above an agreed price level.

Analysts polled by the media are raising concerns that the ban could be easily circumvented if countries outside the G7, such as China and India, were to keep purchasing Russian oil above the capped price before selling it back to world markets at a premium. “The devil is in the details, and few details appeared today,” Bob McNally, a former energy official in the George W. Bush administration told the Post. “This was a process announcement, moving from exploring a price cap to implementing one.” According to Simon Johnson, a professor at the Massachusetts Institute of Technology, the price cap plan, which would allow Russia to trade oil at a discount, would be less disruptive to world markets than Europe’s previous idea of severing all imports of Russian oil. Experts have also warned that Russia could retaliate by slashing shipments of natural gas to Europe more sharply, saying such a scenario would exacerbate the economic crisis already gripping many Western countries.

Preparing the people. How about a lockdown in homes they can’t heat?

• Deterioration Of Living Standard Inevitable – Greece Gov’t Spokesman (KTG)

“Deterioration of living standard for quite some time is inevitable,” government spokesman Giannis Oikonomou warned Greeks on Sunday. “Citizens’ quality of life is threatened with sharp deterioration,” the spokesman said in an interview with Skai TV and an article he published at the Sunday edition of the newspaper tovima . His warning comes a day after the Development Minister warned of “the worse winter than the one in 1942 [Greece under German Nazi occupation].despite the government cheers of a flourishing economy and tourism revenues breaking all records. Referring to “the upcoming difficult winter”, Oikonomou said that the government is fully aware that this winter the people’s strength will be tested.

“The crises imported from Europe are threatening our every day life and the standard of living of all the society and even more that of the most vulnerable groups. So we should seek for ways and answers in order to stand by the citizens” he said.He noted that the government is examining ways to support the citizens without blowing up the economy.“The energy crisis has similar characteristics with the pandemic. It is external, it is imported and was not produced here, it has significant economic repercussions as the pandemic did, so it needs economic measures and support as it happened with the pandemic”.

Oikonomou’s warnings come one day after the Development Minister urged Greeks to seek alternative ways for heating, while the government has been reassuring all summer long that it was well “shielded” against the energy crisis cheering a flourishing economy and tourism revenues breaking all records.. Inflation stood at 11.1% in August and price hikes of 7%-10% for goods of basic needs are coming in supermarkets in September as companies have already announced.

Truss is mad enough to send in police against her own people.

• Leaked Paper Shows UK Cops Preparing For Greater Civil Unrest This Winter (ZH)

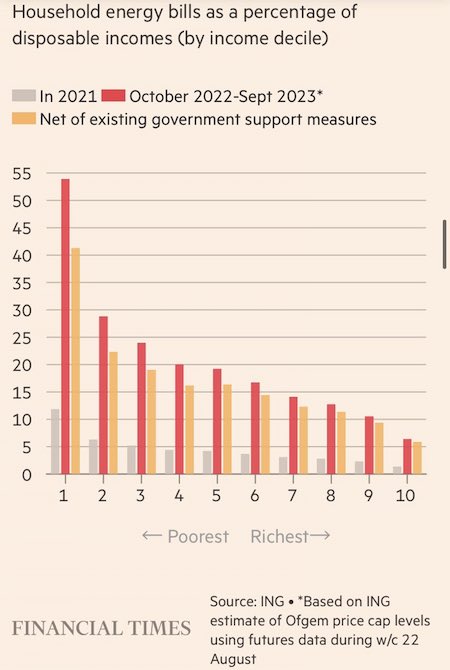

New Prime Minister Liz Truss may have only weeks to deliver a confidence turnaround in the UK economy or face a surge in violent crime and breakdown in public order caused by a cost-of-living crisis. The Times revealed police chiefs fear “economic turmoil and financial instability” has the “potential to drive increases in particular crime types,” such as shoplifting, burglary, vehicle theft, and online fraud and blackmail, as Brits face one of the worst collapses in living standards in a century amid energy hyperinflation. “Prolonged and painful economic pressure” could spark “greater civil unrest,” similar to the 2011 London riots, the leaked national strategy paper read. One police chief noticed increased violent crime as inflation is stuck at multi-decade highs.

This comes as energy regulator Ofgem increased the cap on power bills to a record £3,549 ($4,189) beginning Oct. 1 from £1,971 ($2,330). That cap is expected to rise to £5,439 ($6,427) by January and £7,272 ($8,594) by spring. Besides police, energy executives warned that mass civil unrest looms as people cannot afford their heating and electricity bills this winter. About 160,000 Brits have joined a movement against skyrocketing electricity bills, vowing not to pay come Oct. 1. Last Friday, Russia’s energy giant Gazprom PJSC halted flows via Nord Stream 1 to Europe, sending EU natural gas and electricity prices soaring on Monday. This means Truss hardly has any time to deliver a coherent strategy to save households from energy poverty and businesses from failing.

The massive protest in Prague this past weekend, where tens of thousands of Czechs flooded the streets, offers a glimpse of the impending social unrest that could hit the street of the UK if power bills continue rising without government intervention. Published last week was a new report via Verisk Maplecroft, a UK-based risk consulting and intelligence firm, warning there’s a high risk of social unrest in Europe later this year due to rising inflation. Europeans are finally waking up to how bad Western sanctions on Russia have backfired, as their governments sacrificed ordinary people over NATO’s proxy fight against Russia in Ukraine. These protests could spread like wildfire across Europe, and it appears the UK is preparing for the worst-case scenario.

The Guardian should detest Truss, but guess what?!

• Kremlin Scathing Over Truss But Kyiv Praises Britain’s New PM (G.)

Liz Truss’s imminent arrival in Downing Street as British prime minister has been greeted with scorn and scarcely veiled condescension from the Kremlin, but an outpouring of praise in Ukraine. Vladimir Putin’s chief spokesperson, Dmitry Peskov, expressed concerns that relations might deteriorate in comments to reporters shortly before Truss was announced as the winner of the Tory leadership race. “I wouldn’t like to say that things can change for the worse, because it’s hard to imagine anything worse,” Peskov said when asked if Moscow expected any shift in relations with Britain. “But unfortunately, this cannot be ruled out.”

The Kremlin has openly mocked and belittled Truss since she went to Moscow in February for talks with the Russian foreign minister, Sergei Lavrov. In the meeting, a fortnight before the Russian invasion, Truss challenged Lavrov on the buildup of 100,000 troops on Ukraine’s border, which Moscow denied was preparation for an attack. Lavrov complained that her interventions were “just slogans shouted from the tribunes”. Russian government spokespeople sneered after a Russian newspaper reported that Truss had confused Russian regions with Ukrainian territory and had to be corrected by the British ambassador. The British government said she had simply misheard a question from Lavrov.

Reacting to Truss’s victory in typically bombastic style, one host on Russian state TV declared: “Stupidity has triumphed: Liz Truss has become the new prime minister … If Boris Johnson achieved Brexit, she wants to achieve something entirely different – the end of the world.” Ukrainian politicians, however, offered an exuberant welcome. The country’s president, Volodymyr Zelenskiy, said British-Ukraine ties were already “ an unprecedentedly high level”, adding: “We in Ukraine know her well – she has always been on the bright side of European politics. And I believe that together we will be able to do a lot more to protect our nations and to thwart all Russian destructive efforts. The main thing is to preserve our unity, and this will definitely be the case.”

“In Liz, we Truss” tweeted Ukrainian deputy Rustem Umerov. “Mrs Truss is a solid supporter of Ukraine. Hope for a fruitful ongoing partnership between the UK and Ukraine.” Ukraine’s former president Petro Poroshenko congratulated Truss, writing on Facebook: “I am glad that the alliance between our nations will remain strong and powerful, which is crucial for our common victory over the Russian aggressor and Putin’s regime.” Ukrainian media reported that Truss’s first call would be to the country’s president, Volodymyr Zelenskiy. Some bloggers were said to have christened Truss “the iron lady”, an epithet bound to delight the new prime minister, who has styled herself on Margaret Thatcher.

Belgium could get very bad.

• Belgium Warns Citizens Of Ten ‘Difficult Winters’ Ahead (RT)

Belgium is facing up to ten “difficult winters” but is about to leap “20 years forward” by getting rid of its dependency on fossil fuels, Prime Minister Alexander De Croo said on Sunday. He was commenting on the looming energy crisis, exacerbated by sanctions on Moscow over the Ukraine conflict and a decrease in Russian natural gas supplies. Speaking to VRT TV, De Croo claimed that the conflict in Ukraine had affected the European economy much more than the Covid pandemic “could ever have had.” However, he said that the hardships are worth it, because “this is about the stability and security of the European continent.” “When we get it under control, it will be five difficult years, it will be ten difficult years with bad policy, but I also said that we as a country and European continent can handle this if we get all noses in the same direction,” De Croo pointed out.

He argued that the current situation has a bright side. “We can also jump 20 years forward, in terms of detaching from fossil fuels and breaking away from countries that we don’t like to trade with…,” the prime minister noted. Last week, the Belgian government published a plan to combat soaring energy prices. It set out measures to decrease energy consumption, such as lowering the temperature in government buildings to 19 degrees, limiting use of air conditioning to a maximum of 27 degrees and ordering to switch off lighting in federal properties and monuments between 7pm and 6am. According to the paper, the country “should be able to get through the winter without any major problems” and might even be able to help its neighbors.

“..the active de-occupation.”

• Kiev Urges Crimeans To Prepare Shelters (RT)

Kiev has issued a warning to people living in what it called “occupied territories,” including the Crimean peninsula, to prepare shelter and stock up on supplies. The appeal was shared to Twitter on Monday by an adviser to Ukrainian President Vladimir Zelensky. Mikhail Podolyak urged “residents of the occupied territories, including the Crimean peninsula, to follow the officials’ recommendations during de-occupation measures.” Furthermore, people should “prepare a bomb shelter, stock up on a sufficient amount of water and charge power banks right now.” Podolyak concluded his warning with the line “Everything will be Ukraine.” The warning comes after Podolyak announced last week that Ukrainian authorities are developing evacuation routes for Ukrainians living in Crimea “who want to leave the island during the active de-occupation.”

Kiev has repeatedly insisted that it considers Crimea, which became part of Russia following a referendum in 2014, to be an “occupied territory” and has vowed to seize the peninsula “by any means necessary.” The US-led NATO alliance also considers Crimea to be “illegally annexed” Ukrainian territory, and has demanded that Moscow return the region to Ukrainian control. A US official told Politico last month that Washington had given Ukraine its blessing to strike targets of its choosing in Crimea. Kiev’s warning to Crimeans comes as the Ukrainian government has been talking about a counteroffensive in the south of the country for several months now, vowing to reclaim the whole of Donbass, parts of the Zaporozhye and Kharkov regions currently held by Russian forces, as well as Crimea.

“Hungarian Foreign Minister Peter Szijjarto argued that each state should be allowed to make its own decision on the issue..”

• EU Arms Stocks Drastically Depleted – Borrell (RT)

Stocks of weapons within the European Union are greatly depleted as member states continue to supply arms and ammunition to Ukraine for use in its conflict with Russia, EU foreign policy chief Josep Borrell said on Monday.“The military stocks of most member states have been, I wouldn’t say exhausted, but depleted in a high proportion, because we have been providing a lot of capacity to the Ukrainians,” Borrell said during a debate with lawmakers in the European Parliament, adding that the arsenal will “have to be refilled.”The top diplomat said EU member states must start coordinating their military spending to avoid too many duplications and a waste of money.

If countries don’t coordinate properly, “the result will be a big waste of money, because this is not a way of canceling our duplications – there are a lot of them – or filling our gaps.”EU countries have been sending weapons to Ukraine since Russia launched its military operation in the neighboring country in February – and Borrell has since discussed launching a bloc-wide training mission for Ukrainian troops.On Monday, the chief diplomat said Brussels should have responded more quickly to requests for training Ukrainian troops a year ago.“Unhappily we didn’t, and today we regret it. We regret that last August we were not following this request, fulfilling this request,” he said, adding that “we would be in a better situation” if the EU had acted at the time.

The US and UK are already training Ukrainian troops in urban combat and instructing them on how to use Western-supplied weapons.Some EU nations are also already hosting training for Ukrainian troops, but no coordinated bloc-wide, EU-level program has yet been implemented – and some countries have voiced concerns over the idea. Luxembourg Defense Minister Francois Bausch told AFP last week that he was “not convinced” this would be the best way to help Kiev. Meanwhile, Hungarian Foreign Minister Peter Szijjarto argued that each state should be allowed to make its own decision on the issue, telling Politico that it “should not be done at a European Union level.”

“..the German military is “quite critical” of the idea of handing over its equipment to Ukraine..”

• NATO Struggling To Supply Winter Uniforms To Ukraine – Der Spiegel (RT)

NATO members have been scraping the barrel in their efforts to supply Ukraine with sufficient winter uniforms and field camp equipment, Germany’s Der Spiegel magazine reported on Monday. Kiev has apparently called on the bloc to urgently provide the necessary equipment before the cold weather sets in. According to Der Spiegel, Ukrainian Defense Minister Aleksey Reznikov wrote a letter to NATO Secretary General Jens Stoltenberg back in late July, calling on the military alliance to provide cold-proof field tents along with clothing for as many as 200,000 Ukrainian soldiers. The uniforms and equipment should be delivered as quickly as possible, the minister added, according to the magazine.

Several NATO nations have since been searching their warehouses for the needed supplies. The organization confirmed to Der Spiegel that it is in contact with member states on the issue. According to reports cited by Der Spiegel, so far the US and Canada, as well as Sweden and Finland, which are yet to join the military grouping, have together promised deliveries that could cover up to 50% of Ukraine’s demands.Military officials from various NATO members argue, though, that most of their nations’ stocks are reserved for the national armies, Der Spiegel says. The defense alliance has reportedly offered to replace the uniforms and equipment member states hand over to Kiev, using the so-called NATO trust fund, amounting to $40 million.

Germany also reportedly plans to join the effort, although it had earlier struggled to equip its own troops with the necessary gear, Der Spiegel says. By sending winter clothing and field camp equipment, Berlin could make “an important contribution” to Ukraine’s defense ahead of the approaching winter, Defense Minister Christine Lambrecht said. According to Der Spiegel, the German military is “quite critical” of the idea of handing over its equipment to Ukraine. Lambrecht herself repeatedly stated earlier that the German Armed Forces – the Bundeswehr – are about to reach the limits of what they can give away when it comes to weapons.

Because you end up burning everything else.

• Ditching Russian Gas No Way To Reach Climate Goals – Putin (RT)

Europe’s decision to slash natural gas imports while trying to reach climate goals was a mistake, President Vladimir Putin said on Monday during an environmental forum in Kamchatka in Russia’s Far East. “First, they (EU) jumped ahead, and then, after cutting off Russian gas supplies, returned everything that was reviled,” Putin stated. He emphasized that all nations are in favor of reducing emissions into the atmosphere, noting however that everything should be done in a timely manner. “And if you jump ahead, get cheap Russian gas, and then cut off the supply of this gas yourself and immediately switch back to everything that was previously condemned, including coal-fired generation, this, of course, is not the best option for solving global problems,” the Russian president said.

Under the REPowerEU plan, published in May, the European Union plans to phase out Russian fossil fuels by 2027 and boost its renewable energy production. However, skyrocketing gas prices in Europe, which some analysts believe could lead to an energy catastrophe this winter, have forced some states to fire up coal plants and expand nuclear power use.

Putin history

Putin speaks to schoolchildren on the importance of history and Russia’s military operation in Ukraine. pic.twitter.com/M96ilOq6rt

— Putin Direct (@PutinDirect) September 5, 2022

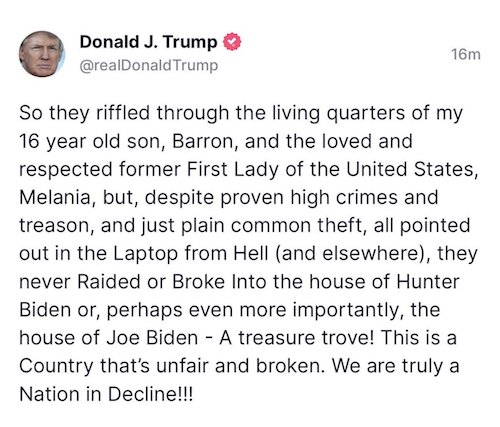

“It is also not clear why investigators seized items labeled “Article of Clothing/Gift Item.”

• Trump Medical Records, Tax Documents Seized In FBI Raid: Judge (Fox)

A federal judge revealed Monday that former President Trump’s medical records and documents related to his accounting information and taxes were seized during the FBI’s raid of his Mar-a-Lago home. U.S. District Judge from the Southern District of Florida Judge Aileen M. Cannon ordered Monday that an independent special master be appointed to review Trump’s records for attorney-client and executive privilege. The judge also ordered the Justice Department stop its own review of the material for investigative purposes. In the order, Cannon revealed the types of documents that had been seized during the raid. “According to the Privilege Review Team’s Report, the seized materials include medical documents, correspondence related to taxes, and accounting information,” Cannon wrote.

A source familiar told Fox News that the FBI seized 40 years of Trump’s medical records from Mar-a-Lago during the search. Congressional Democrats have been seeking Trump’s tax returns since 2019. Last month, a federal appeals court paved the way for the House Ways and Means Committee to finally obtain Trump’s tax returns from the Internal Revenue Service, under a law that permits the disclosure of an individual’s tax returns to the congressional committee. Trump may seek emergency intervention measures from the Supreme Court in an attempt to temporarily block any release of those tax records to the committee. [..] Last week, the Justice Department—after Cannon’s order—filed a more detailed list of documents taken in its raid of Mar-a-Lago, including dozens of classified documents and folders with classified markings.

Also included was a wide assortment of other items, including over 1,000 documents that did not have classified markings, several “Article of Clothing/Gift Item” entries and hundreds of printed news articles. It is also not clear why investigators seized items labeled “Article of Clothing/Gift Item.” In all, the DOJ said it took 18 such items. Meanwhile, Cannon’s order Monday halted the Justice Department’s “taint” or “filter” team’s review of seized records. “Furthermore, in natural conjunction with that appointment, and consistent with the value and sequence of special master procedures, the Court also temporarily enjoins the Government from reviewing and using the seized materials for investigative purposes pending completion of the special master’s review or further Court order.”

In the WSJ, no less. Mr. Morrow is a senior fellow at the Ethics and Public Policy Center. His latest book is “The Noise of Typewriters: Remembering Journalism,” forthcoming in January.

• Biden’s Speech Had It All Backwards (Lance Morrow)

Donald Trump isn’t a fascist, or even a semi-fascist, in President Biden’s term. Mr. Trump is an opportunist. His ideology is coextensive with his temperament: In both, he is an anarcho-narcissist. He is Elmer Gantry, or the Music Man, if Harold Hill had been trained in the black arts by Roy Cohn. He is what you might get by crossing the Wizard of Oz with Willie Sutton, who explained that he robbed banks because “that’s where the money is.” As for Mr. Trump’s followers, they belong to the Church of American Nostalgia. They are Norman Rockwellians, or Eisenhowerites. They regard themselves, not without reason, as the last sane Americans. You might think of them as American masculinity in exile; like James Fenimore Cooper’s Natty Bumppo, living in the forest has made their manners rough.

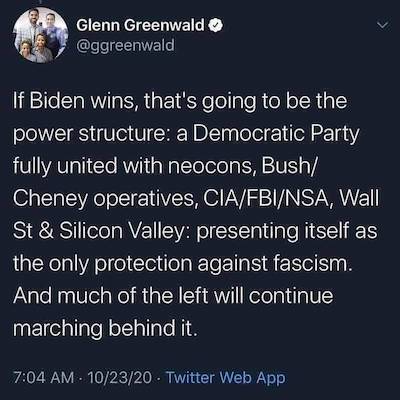

If there are fascists in America these days, they are apt to be found among the tribes of the left. They are Mr. Biden and his people (including the lion’s share of the media), whose opinions have, since Jan. 6, 2021, hardened into absolute faith that any party or political belief system except their own is illegitimate—impermissible, inhuman, monstrous and (a nice touch) a threat to democracy. The evolution of their overprivileged emotions—their sentimentality gone fanatic—has led them, in 2022, to embrace Mussolini’s formula: “All within the state, nothing outside the state, nothing against the state.” Or against the party. (People forget, if they ever knew it, that both Hitler and Mussolini began as socialists). The state and the Democratic Party must speak and act as one, suppressing all dissent.

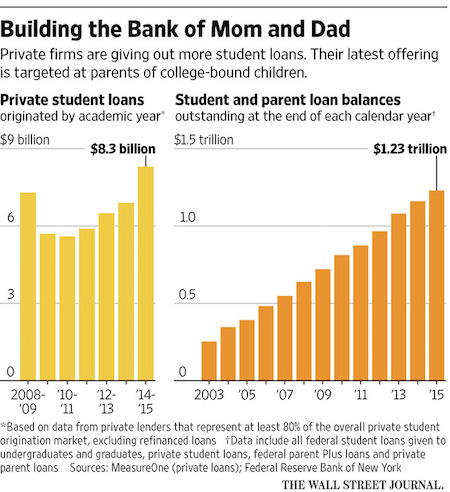

America must conform to the orthodoxy—to the Chinese finger-traps of diversity-or-else and open borders—and rejoice in mandatory drag shows and all such theater of “gender.” Meantime, their man in the White House invokes emergency powers to forgive student debt and their thinkers wonder whether the Constitution and the separation of powers are all they’re cracked up to be. Mr. Trump and his followers, believe it or not, are essentially antifascists: They want the state to stand aside, to impose the least possible interference and allow market forces and entrepreneurial energies to work. Freedom isn’t fascism. Mr. Biden and his vast tribe are essentially enemies of freedom, although most of them haven’t thought the matter through. Freedom, the essential American value, isn’t on their minds. They desire maximum—that is, total—state or party control of all aspects of American life, including what people say and think.

Paris

This is HUGE.

People all over Europe are starting to resist the NATO proxy war.

"Let's get out of NATO!" shout tens of thousands of French people in the streets of Paris yesterday. pic.twitter.com/d45pXPgAQs

— Sarah Abdallah (@sahouraxo) September 4, 2022

What is man’s influence?

A storm is brewing – Adam Kyle Jackson

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.