DPC Country store, Venezuela 1905

Saw that coming from miles away.

• China Intervenes in Stock Markets Ahead of Annual Policy Meeting (BBG)

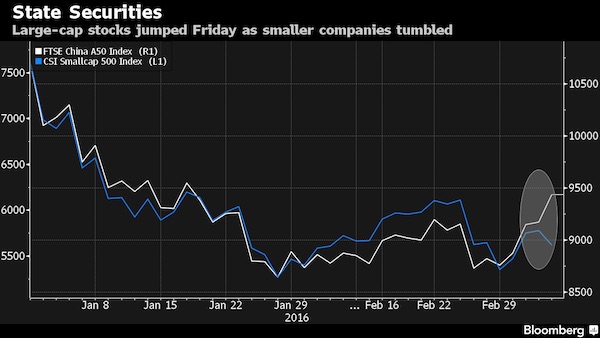

China intervened to support its stock market on Friday, helping the benchmark index cap its best weekly gain of 2016 before policy makers meet to approve a five-year road map for the economy, according to two people with direct knowledge of the situation. State-backed funds bought primarily bank shares, while some local branches of the securities regulator asked listed companies, mutual funds and brokerages to stabilize the market during the National People’s Congress and the Chinese People’s Political Consultative Conference, said the people, who asked not to be named because the matter isn’t public. China’s biggest banks, seen as prime targets for state support because of their large weightings in benchmark indexes, paced gains in the $5.5 trillion market on Friday even as small-capitalization shares tumbled.

Authorities have been known to intervene in markets before key national events, with government funds stepping in to boost share prices last August before a military parade celebrating the 70th anniversary of the World War II victory over Japan. “It looks like the national team has been buying as large caps of the Shanghai index jumped, while small caps fell,” said Steve Wang at Reorient Financial Markets in Hong Kong. China’s stock market has become one of the most visible symbols of anxiety toward Asia’s largest economy after a $5 trillion crash last summer rattled global investors. By publicly intervening to support equity prices in 2015, President Xi Jinping’s government has staked some of its credibility as a steward of the economy on the state’s ability to stabilize one of the world’s most volatile markets.

It’s just word, really: “..by helping keep afloat those state-owned zombie companies in order to boost GDP, Chinese banks are further delaying the process of rebalancing.”

• China’s Rebalancing Is Overrated (Balding)

The optimists’ case for China is fairly straightforward. Yes, the world’s second-largest economy is grinding to its slowest pace in decades. But as investment and manufacturing – traditionally the key drivers of Chinese growth – decline in importance, domestic consumption and services are playing a bigger role: For the first time, services accounted for just over 50% of GDP last year. This much-desired rebalancing should move China toward a far more sustainable growth model. New economy companies in technology, health-care, finance and retail are more productive and less polluting than smokestack industries. Robust consumption – rail traffic is growing at 10% as Chinese spend more on leisure travel, while mobile Internet traffic has doubled – is key to weaning the economy off its addiction to investment.

As unproductive coal mines and steel factories shed workers, labor-intensive services should pick up the slack. A closer look at the data, however, paints a different and decidedly gloomier picture. Take travel. While overall rail traffic is up, total passenger turnover, which accounts for the number of kilometers traveled, grew only 3.1% in 2015. Moreover, it’s important to remember that only 11% of trips are done by rail. (International air travel, which grew 34% last year, only covers 0.2% of trips.) The vast majority of travel takes place by road and highway traffic actually declined last year. If so many more Chinese are going on pleasure trips, why is hotel revenue flat? Similarly, sales at the 100 biggest retailers in China, which one would expect to be thriving if the economy were rebalancing, were down 0.1% in 2015.

Luxury brands have been hit particularly hard (in part because of the ongoing anti-corruption campaign) and sales of even basic consumer durables such as TVs, refrigerators, audio equipment and washing machines are flat or declining. Services are certainly growing faster than manufacturing and real estate. But much of that growth comes from two sectors. The first, financial services, got a major boost in 2015 from the stock-market boom in the first half of the year and from the continuing flood of lending encouraged by the government. If one strips out the contribution made by the sector, consumption continued to slow last year. The bursting of the equity bubble is sure to crimp growth, as may a souring of loans, many of which are going to loss-making heavy industries. Indeed, by helping keep afloat those state-owned zombie companies in order to boost GDP, Chinese banks are further delaying the process of rebalancing.

By exercising more state control…

• China Lays Out Its Vision To Become A Tech Power (Reuters)

China aims to become a world leader in advanced industries such as semiconductors and in the next generation of chip materials, robotics, aviation equipment and satellites, the government said in its blueprint for development between 2016 and 2020. In its new draft five-year development plan unveiled on Saturday, Beijing also said it aims to use the internet to bolster a slowing economy and make the country a cyber power. China aims to boost its R&D spending to 2.5% of GDP for the five-year period, compared with 2.1% of GDP in 2011-to-2015. Innovation is the primary driving force for the country’s development, Premier Li Keqiang said in a speech at the start of the annual full session of parliament.

China is hoping to marry its tech sector’s nimbleness and ability to gather and process mountains of data to make other, traditional areas of the economy more advanced and efficient, with an eye to shoring up its slowing economy and helping transition to a growth model that is driven more by services and consumption than by exports and investment. This policy, known as “Internet Plus”, also applies to government, health care and education. As technology has come to permeate every layer of Chinese business and society, controlling technology and using technology to exert control have become key priorities for the government.

China will implement its “cyber power strategy”, the five-year plan said, underscoring the weight Beijing gives to controlling the Internet, both for domestic national security and the aim of becoming a powerful voice in international governance of the web. China aims to increase Internet control capabilities, set up a network security review system, strengthen cyberspace control and promote a multilateral, democratic and transparent international Internet governance system, according to the plan. Since President Xi Jinping came to power in early 2013, the government has increasingly reined in the Internet, seeing the web as a crucial domain for controlling public opinion and eliminating anti-Communist Party sentiment.

“..if markets around the world are crashing, let’s just say that scenario happens, everybody’s going to put their money in the U.S. dollar—it could turn into a bubble.”

• Jim Rogers: There’s a 100% Probability of a US Recession Within a Year (BBG)

Rogers Holdings Chairman Jim Rogers is certain that the U.S. economy will be in recession in the next 12 months. During an interview on Bloomberg TV with Guy Johnson, the famous investor said that there was a 100% probability that the U.S. economy would be in a downturn within one year. “It’s been seven years, eight years since we had the last recession in the U.S., and normally, historically we have them every four to seven years for whatever reason—at least we always have,” he said. “It doesn’t have to happen in four to seven years, but look at the debt, the debt is staggering.” Most Wall Street economists see a much smaller chance of a U.S. recession within this span, with odds typically below 33%.

Rogers was not specific on what could trigger a disorderly deleveraging process and recession but claimed that sluggish or slowing economies in China, Japan, and the euro zone mean that there are many possible channels of contagion. The former partner of George Soros suggested that if investors focus on the right data, there are signs that the U.S. economy is already faltering. “If you look at the … payroll tax figures [in the U.S.], you see they’re already flat,” he concluded. “Don’t pay attention to the government numbers, pay attention to the real numbers.” In light of the economic turmoil envisioned by Rogers, he is long the U.S. dollar.

“It might even turn into a bubble,” he said of the greenback. “I mean, if markets around the world are crashing, let’s just say that scenario happens, everybody’s going to put their money in the U.S. dollar—it could turn into a bubble.” Rogers added that a strengthening U.S. dollar has historically been negative for commodities—the asset class that the investor is best-known for. While the yen is often designated as a risk-off currency, it won’t benefit in the event of a flight to safety due to the massive, continued expansion of the Bank of Japan’s balance sheet, according to Rogers, who said he exited his position in the yen last Friday.

Don’t hold your breath.

• US Watchdog To Probe Fed’s Lax Oversight Of Wall Street (Reuters)

A U.S. watchdog agency is preparing to investigate whether the Federal Reserve and other regulators are too soft on the banks they are meant to police, after a written request from Democratic lawmakers that marks the latest sign of distrust between Congress and the central bank. Ranking representatives Maxine Waters of the House Financial Services Committee and Al Green of the Subcommittee on Oversight and Investigations asked the Government Accountability Office on Oct. 8 to launch a probe of “regulatory capture” and to focus on the New York Fed, according to a letter obtained by Reuters. In an interview, the congressional agency said it has begun planning its approach. The probe, which had not been previously reported or made public, is the first by an outside agency into the perception that government regulators are “captured” by and too deferential toward the bankers they supervise, so that Wall Street benefits at the public’s expense.

Such perceptions have dogged the U.S. central bank since it failed to head off the 2007-2009 financial crisis that sparked a global recession. The Fed’s biggest critics have since been Republicans looking to curb its policy independence, but the request by Democrats could cool its somewhat warmer relationship with the left. “We currently do have some ongoing work looking at the concept known as regulatory capture. We’re in initial stages of outlining that engagement,” Lawrance Evans, director of the GAO’s financial markets and community investment division, said in an interview. The agency will conduct “an assessment across all financial regulators, and the Federal Reserve will be one institution,” he said. It was unclear whether the majority Republicans on the House committee, including Chairman Jeb Hensarling, backed the request from the minority Democrats.

This is how simple it is. The NIRP boomerang.

• It Begins: Palace Revolt Against ECB’s NIRP (WS)

The Association of Bavarian Savings Banks, which represents 71 savings banks in the German State of Bavaria, has had it with the ECB’s negative deposit-rate absurdity, and it’s now instigating a palace revolt. In 2014, when negative interest rates first hit Eurozone banks and ricocheted out from there, Germans called it “punishment interest” (Strafzinsen) because these rates were designed to flog banks and savers until their mood improves. But inexplicably, their mood hasn’t improved. Bank stocks have gotten clobbered as their profits have gotten hit by the negative interest rate environment. Stocks of Eurozone companies in general have come down hard, and the Eurozone economy simply hasn’t responded very well though the ECB is flogging it on a daily basis with its punishment interest.

And so Bavarian savings banks have had enough. The Frankfurter Algemeine has obtained a memo by the Association of Bavarian Savings Banks that openly encourages its member banks to stash cash in their own vaults rather than depositing it at the ECB and paying the penalty interest of 0.3% to the ECB on these deposits. The savings banks therefore are asking if it might be more economical for them to keep high cash values in their safes and not -as usual- store them at the ECB, the memo said. To estimate total costs and determine which would be the better deal -hang on to the cash or send it to the ECB- the association analyzed the costs of additional insurance coverage needed for these higher levels of cash-in-vault and further discussed some options concerning this insurance coverage, or as it says, for ECB-cash protection.

According to its analysis, insurance coverage on cash costs 0.15%, plus insurance tax, in total 0.1785%. This is below the ECB’s punishment rate of 0.3%. Each additional €1,000 of cash in its vault would therefore cost the bank €1.785 per year. But if the bank deposited that €1,000 at the ECB, it would cost €3.00 per year. Multiply the difference of €1.21 by tens or hundreds of millions, and pretty soon you’re talking about some real money. Banks have a total of €245 billion deposited at the ECB. At a deposit rate of negative 0.3%, extrapolated over a year, it costs them €735 million in punishment interest. “Punishment interest is already costing real money,” is how a senior central bankers explained it to the Frankfurter Algemeine.

More interest rate manipulation damage.

• What’s Best For UK Savers Who’ve Lost £160 Billion Of Interest In 7 Years? (G.)

Not many experts thought that the “emergency” base rate cut to 0.5% on March 5, 2009 would last for long. But seven years later savers have lost around £160bn in interest, while the prospect of rate rises are slipping further into the distance. In the immediate aftermath of the cut to 0.5%, rates for savers remained relatively high. Our analysis shows how cash Isas were offering 3%, and notice accounts 3.5%, in March 2009, and for the next couple of years they hovered around this level. After all, most banks and building societies were desperate for deposits after the great financial crash, so they were willing to pay far above the Bank of England base rate. The real villain turns out to be the Funding for Lending government programme introduced in July 2012, which effectively provided cheap money for cash-strapped lenders.

The effect was almost instantaneous: banks no longer needed to attract cash from savers, so they cut the rates on offer. Susan Hannums of Savingschampion.co.uk says: “While the base rate hitting the record 0.5% was bad enough, it was Funding for Lending that had one of the biggest impacts. Almost overnight, best-buy rates for savers dropped like a stone, followed by an unprecedented number of reductions on existing rates. “Today we’ve hit over 4,000 rate reductions for existing savers, with little sign of this slowing down. This means all savers would be wise to keep checking the rate they are getting, and to switch to improve returns when they are no longer competitive. “With almost 50% of easy-access accounts paying 0.5% or less, and the best-paying 1.55%, it’s easy to see why so many need to switch.”

Bizarro.

• Argentina To Issue $11.68 Billion In Bonds To Pay For Defaulted Bonds (Reuters)

Argentina plans to return to international credit markets in April with three bonds sales totaling $11.68 billion under U.S. law if Congress swiftly approves a debt deal for holdout creditors, top finance ministry officials told Congress on Friday. Finance Minister Alfonso Prat-Gay said the bonds, which will be used to finance the payouts to investors holding unpaid debt stemming from the country’s 2002 default, would carry maturities of five, ten and thirty years. Prat-Gay and his deputy, Luis Caputo, on Friday presented a package of debt agreements brokered with creditors, including a $4.65 billion cash payout to the main holdouts suing in a Manhattan court led by billionaire Paul Singer. Argentina has now reached provisional settlements with about 85% of bondholders and says negotiations continue with the rest.

“If the deal extends to all holdout investors, the bond issue will be for $11.684 billion. That’s what we need to close this chapter definitively,” Prat-Gay said. The debate in Congress is the first major political test of President Mauricio Macri’s ability to garner cross-party support for his economic reform package, the success of which hinges on ending the festering 14-year debt battle. Legislators will also be asked to repeal two laws blocking settlement of the debt case. Macri’s government is confident it can corral the votes needed to win approval even though the opposition holds a majority in the Senate and Macri holds only the largest minority in the lower chamber. Caputo told legislators the bonds would carry an interest rate of about 7.5%. While debt brokers see healthy appetite for Argentine debt after its prolonged absence from global debt markets, the gloomy global context may weigh.

“News of Lula’s brief detention sparked a rally in Brazilian assets as traders bet that the political upheaval could empower a more market-friendly coalition.”

• Brazil Ex-President Lula Detained In Corruption Probe (Reuters)

Former Brazilian President Luiz Inacio Lula da Silva was briefly detained for questioning on Friday in a federal investigation of a vast corruption scheme, fanning a political crisis that threatens to topple his successor, President Dilma Rousseff. Lula’s questioning in police custody was the highest profile development in a two-year-old graft probe centered on the state oil company Petrobras, which has rocked Brazil’s political and business establishment and deepened the worst recession in decades in Latin America’s biggest economy. The investigation threatens to tarnish the legacy of Brazil’s most powerful politician, whose humble roots and anti-poverty programs made him a folk hero, by putting a legal spotlight on how his left-leaning Workers’ Party consolidated its position since rising to power 13 years ago.

Police picked up Lula at his home on the outskirts of Sao Paulo and released him after three hours of questioning. They said evidence suggested Lula had received illicit benefits from kickbacks at the oil company, Petrobras, in the form of payments and luxury real estate. The evidence against the former president brought the graft investigation closer to his protege Rousseff. She is already fighting off impeachment for allegedly breaking budget rules, weakening her efforts to pull the economy out of recession. Rousseff expressed her disagreement with the police taking her mentor into custody, saying it was “unnecessary” after his voluntary testimony. But she repeated her backing for institutions investigating corruption and said the probe must continue until those responsible were punished. News of Lula’s brief detention sparked a rally in Brazilian assets as traders bet that the political upheaval could empower a more market-friendly coalition.

Yeah, do fear for the Olympics.

• Brazil’s Ruling Party To Tap FX Reserves As Policy Fight Escalates (AEP)

The ruling party in Brazil has drawn up crisis plans to tap the country’s foreign exchange reserves to fight recession and prevent a surge in unemployment, heightening fears of a populist lurch as the economic crisis deepens. Any such move by Brazil would mark an escalation in the emerging market crisis, leading to intense scrutiny of other countries across the world facing similar difficulties following the collapse of the commodity boom and the end of cheap dollar liquidity from the US Federal Reserve. The plan is in direct conflict with the policies of president Dilma Rousseff and implies a head-on clash between the government and its own political base in the Workers Party (PT), with serious implications for the stability of the currency and Brazil’s debt markets.

It came as official data showed Brazil’s economy contracted sharply in 2015 as businesses slashed investment plans and laid off more than 1.5 million workers, setting the stage for what could be the country’s deepest recession on record. Brazil’s gross domestic product shrank 3.8pc in 2015, capped by another steep contraction in the fourth quarter. It was the steepest annual drop for the country’s GDP since 1990, when hyperinflation and debt default blighted the country’s recent return to democracy. Rui Falcão, the PT’s president, personally drafted the crisis document known as the National Emergency Plan. He reportedly has the backing of former president Lula, Luiz Inacio da Silva. It calls for a draw-down on the country’s $371bn foreign reserves to finance a development and jobs fund, as well as demanding a sharp cut in interest rates, a move that would effectively strip the central bank of its independence.

The 16 proposals together mark a dramatic shift back to the party’s Marxist roots and a rejection of its free-market concordat over recent years. While investors might be willing to accept use of the reserves to back up a stabilisation policy and radical reform, they would be horrified if it was used to finance a last-ditch populist agenda. “If the PT taps the reserves, they risk setting off a run on the currency. This is very dangerous,” said one economist, dismissing the scheme as complete madness. While the reserves are large, they are also opaque since the central bank has taken out $115bn in currency swaps, partly in order to support companies struggling to cope with dollar debts that have suddenly doubled in local terms due to the devaluation of the Brazilian real.

Lisa Schineller, a director of sovereign ratings at Standard & Poor’s, said Brazil’s safety margin on external debt is weaker than it looks, a key reason why the agency downgraded the country deeper into junk status in late February. Total external debt is $470bn, but on top of this there are $200bn of inter-company loans that have a “debt-like” character. “This is a very large order of magnitude. Brazil’s situation is not as strong as some people suggest,” she told The Daily Telegraph. “Their external assets do not exceed their external debts. They are much lower than they have been historically.”

“There’s lots of precedent in the U.S., but I don’t think the precedent is anywhere near as well established in Germany,” he said. “It’s going to be interesting to watch where this goes.”

• Giant California Pension Funds To Sue VW Over Diesel Scandal (LA Times)

Two giant California pension funds plan to sue Volkswagen in a German court, joining other institutional investors who argue the automaker should pay for losses they experienced since the revelation last year that VW cheated on emissions tests. The California State Teachers’ Retirement System, or CalSTRS, on Friday announced plans to join in a securities case against VW. A spokesman for the California Public Employees’ Retirement System, or CalPERS, confirmed that fund is separately pursuing a similar action. CalSTRS owned about 354,000 common and preferred shares of VW as of Dec. 31. Common shares fell by as much as 37%, and preferreds by as much as 43%, in the first weeks of the mushrooming scandal that began in September. Shares have since recovered somewhat.

CalSTRS said its holdings are now worth $52 million, though the pension fund has not said how much it believes it has lost. Its VW investment is a tiny fraction of the fund’s roughly $180 billion portfolio. “The emissions cheating scandal has badly hurt [VW’s] value,” CalSTRS Chief Executive Jack Ehnes said in a statement Friday. “Volkswagen’s actions are particularly heinous since the company marketed itself as a forward-thinking steward of the environment.” Ehnes said the pension fund hopes to recover money, as well as send a message to VW and the auto industry “that we will not tolerate these illegal actions.” CalPERS, the nation’s largest pension fund, with assets of $279 billion, also holds VW shares, though it has not publicly reported the number of shares since the summer of 2014.

It is not clear whether either pension fund has sold or acquired shares since the emissions scandal. It’s relatively common in the United States for investors to sue public companies following scandal-driven stock slumps, but such suits are less common in Europe, said Bruce Simon, a partner at law firm Pearson Simon & Warshaw, which specializes in class-action and securities litigation. He said the big question for the pension funds and other U.S. investors in VW is how much they’ll be able to recover under German securities law. “There’s lots of precedent in the U.S., but I don’t think the precedent is anywhere near as well established in Germany,” he said. “It’s going to be interesting to watch where this goes.”

“The oil price is outside BP’s control, but executives performed strongly in managing the things they could control and for which they are accountable..”

• BP CEO Gets 20% Pay Rise Despite 2015 Record Loss, 1000s of Jobs Lost (Ind.)

The pay package for BP chief executive Bob Dudley jumped by $3.2m (£2.1m) last year, despite profits plunging at the oil giant and thousands more staff facing the axe. His total package rose by 20% from $16.4m to $19.6m and was condemned by critics for being the latest example of a company losing “contact with reality” – after BP said a further 3,000 workers would lose their jobs on top of 4,000 gone in January. A further 4,000 went last year, with BP predicting that the oil price downturn would be long-lasting. About 250,000 jobs have been cut in the sector in 18 months. Mr Dudley’s base salary was unchanged at $1.85m but his annual cash bonus rose by $300,000 to $1.3m. Pension contributions soared from $3m to $6.5m.

But the biggest contributor to his package was $7.1m worth of vested performance shares, which he will receive during the current year. BP said one third of this award was based on total shareholder returns, one third on “strategic imperatives”, including safety and operational risk, and the final third on operating cashflow. The company added that the executive directors had “responded early and decisively to the lower oil price environment” – and said Mr Dudley deserved his extra cash because of his performance in a difficult period. “Despite the very challenging environment,” it stated, “BP delivered strong operating and safety performance throughout 2015.

“The oil price is outside BP’s control, but executives performed strongly in managing the things they could control and for which they are accountable. BP surpassed expectations on most measures ,and directors’ remuneration reflects this.” The pay boost came as the falling oil price and continuing liabilities related to the Gulf of Mexico oil spill in 2010 led BP to report a record 2015 deficit of $6.5bn.

As talks with EU are ongoing. Too much.

• Turkey Seizes Control Of Anti-Erdogan Daily In Midnight Raid (AFP)

Turkish police on Friday raided the premises of a daily newspaper staunchly opposed to President Recep Tayyip Erdogan, using tear gas and water cannon to disperse supporters and enter the building to impose a court order placing the media business under administration. Police fired the tear gas and water cannon to move away a hundreds-strong crowd that had formed outside the headquarters of the Zaman newspaper in Istanbul following the court order that was issued earlier in the day, an AFP photographer said. Zaman, closely linked to Erdogan’s arch-foe the US-based preacher Fethullah Gulen, was ordered into administration by the court on the request of Istanbul prosecutors, the state-run Anatolia news agency said.

There was no immediate official explanation for the court’s decision. The move means the court will appoint new managers to run the newspaper, who will be expected to transform its editorial line. Hundreds of supporters had gathered outside the paper’s headquarters in Istanbul awaiting the arrival of bailiffs and security forces after the court order. “We will fight for a free press,” and “We will not remain silent” said placards held by protestors, according to live images broadcast on the pro-Gulen Samanyolu TV. “Democracy will continue and free media will not be silent,” Zaman’s editor-in-chief Abdulhamit Bilici was quoted as saying by the Cihan news agency outside its headquarters. “I believe that free media will continue even if we have to write on the walls. I don’t think it is possible to silence media in the digital age,” he told Cihan, part of the Zaman media group.

[..] The court order had already aroused the concern of the United States, which said it was “the latest in a series of troubling judicial and law enforcement actions taken by the Turkish government targeting media outlets and others critical of it.” “We urge Turkish authorities to ensure their actions uphold the universal democratic values enshrined in their own constitution, including freedom of speech and especially freedom of the press,” State Department spokesman John Kirby said.

Somehow it’s hard to believe this still continues.

• What The NY Times Won’t Tell You About The US Adventure In Ukraine (Salon)

This column has cheered for an American failure in Ukraine since first forecasting one in the spring of 2014. Brilliant that it is upon us at last. Forcing a nation to live under a neoliberal economic regime so that American corporations can exploit it freely, as the Obama administration proposed when it designated Arseniy Yatsenyuk as prime minister in 2014, is never to be cheered. Turning a nation of 46 million into a bare-toothed front line in America’s obsessive campaign against Russia is never to be cheered. Forcing the Russian-speaking half of the country to live under a government that would ban Russian as a national language if it could is never to be cheered. The only regret, a great regret of mind and heart, is that American failures almost always prove so costly in consequence of the blindness and arrogance of the policy cliques.

Readers may remember when, with a defense authorization bill in debate last June, two congressmen advanced an amendment banning military assistance to “openly neo-Nazi” and “fascist” militias waging war against Ukraine’s eastern regions. John Conyers and Ted Yoho got two things done in a stroke: They forced public acknowledgment that “the repulsive neo-Nazi Azov battalion,” as Conyers put it, was active, and they shamed the (also repulsive) Republican House to pass their legislative amendment unanimously. Obama signed the defense bill then at issue into law just before Thanksgiving. The Conyers-Yoho amendment was deleted but for a single phrase. The bill thus authorizes, among much, much else, $300 million in aid this year to “the military and national security forces in Ukraine.” In a land ruled by euphemisms, the latter category designates the Azov battalion and the numerous other fascist militias on which the Poroshenko government is wholly dependent for its existence.

An omnibus spending bill Obama signed a month later included an additional $250 million for the Ukraine army and its rightist adjuncts. This is your money, taxpayers, should you need reminding. As Obama signed these bills, the White House expressed its satisfaction that “ideological riders” had been stripped out of them. No, you read next to nothing of this in any American newspaper. Yes, you now know what the often-lethal combination of blindness and arrogance looks like in action. Yes, you can now see why American policy in Ukraine must fail if this crisis is ever to come to a rational, humane resolution.

The funds just noted are in addition to a $1 billion loan guarantee—in essence another form of aid—that Secretary of State Kerry announced with fanfare last year. And that is in addition to the International Monetary Fund’s $40 billion bailout program, a $17.5 billion tranche of which is now pending. Since the I.M.F. is the external-relations arm of the U.S. Treasury (and Managing Director Christine Lagarde thus the Treasury’s public-relations face) this is a big commitment on the Obama administration’s part (which is to say yours and mine).

“Then something happened. Ramadan looks up. He seems 70 but is 54. “We lost track of where the children were,” Ramadan says.”

• The Syrian Exodus: Epic In Scale, Inconceivable Till You Witness It (Flanagan)

“Yesterday was the funeral,” Ramadan says. “It was very cold. We make sure Yasmin always has family around her.” Yasmin wears a red scarf, maroon jumper and blue jeans. She is small and slight. Her face seems unable to assemble itself into any form of meaning. Nothing shapes it. Her eyes are terrible to behold. Blank and pitiless. Yet, in the bare backstreet apartment in Mytilini on the Greek island of Lesbos in which we meet on a sub-zero winter’s night, she is the centre of the room, physically, emotionally, spiritually. The large extended family gathered around Yasmin – a dozen or more brothers, sisters, cousins, nephews, nieces, her mother and her father, Ramadan, an aged carpenter – seem to spin around her. And in this strange vortex nothing holds.

Yasmin’s family has come from Bassouta, an ancient Kurdish town in Afrin, near Aleppo, and joined the great exodus of our age, that of 5 million Syrians fleeing their country to anywhere they can find sanctuary. Old Testament in its stories, epic in scale, inconceivable until you witness it, that great river of refugees spills into neighbouring countries such as Lebanon, Jordan and Turkey, and the overflow – to date more than a million people – washes into Europe across the fatal waters of the Aegean Sea. “We were three hours in a black rubber boat,” Ramadan says. “There were 50 people. We were all on top of each other.” The family show me. They entwine limbs and contort torsos in strange and terrible poses. Yasmin’s nine months pregnant sister, Hanna, says that people were lying on top of her.

I am told how Yasmin was on her knees holding her four-year-old son, Ramo, above her. The air temperature just above freezing, the boat was soon half sunk, and Yasmin wet through. But if she didn’t continue holding Ramo up he might have been crushed to death or drowned beneath the compressed mass of desperate people. Then something happened. Ramadan looks up. He seems 70 but is 54. “We lost track of where the children were,” Ramadan says.

But how do they see this? How is this not as hollow as can be?

• Athens Given Deadlines For Schengen Requirements (Kath.)

Greece was handed Friday a timeline for the improvements it has to make in its border controls by May, as the European Commission presented a step-by-step plan to implement measures, including a new EU border and coast guard, to curb the influx of refugees and migrants to Europe. “We cannot have free movement internally if we cannot manage our external borders effectively,” Migration Commissioner Dimitris Avramopoulos said, as he presented the report ahead of Monday’s summit between the EU and Turkey. According to the Commission’s document, Greece has by March 12 to present its action plan to address concerns about its border controls and explain what action it is taking to correct failings discovered during an inspection in November.

Exactly a month later, Brussels will deliver its assessment on the Greek action plan. A new Schengen evaluation will be carried out by EU experts, who will inspect Greece’s land and sea borders, from April 11-17. Finally, Athens will have to report to the European Council by May 12 on the steps it has taken to meet its recommendations. The report presented Friday estimates that the collapse of passport-free travel in the 26-nation Schengen zone could cost the European economy up to €18 billionß a year.

10,000 kilometers of coastline.

• Tsipras Says Greece Can’t Stop Migrants Headed For Northern Europe (AFP)

Greek Prime Minister Alexis Tsipras said Friday his country can’t stop migrants who want to head to northern Europe, and sharply criticized Balkan countries for shutting their borders. “How can we stop people if they want to keep going?” Tsipras, whose country has faced a major refugee influx via Turkey, told Germany’s top-selling Bild daily. “We cannot imprison people, that would contravene international agreements. We can only help to rescue these people at sea, to supply and register them. Then they all want to move on. That’s why a resettlement process is the only solution.” “They have been bombed in their homes, have risked their lives to escape to come to Greece, the gateway to Europe. But the refugees’ ‘Mecca’ lies to the north.”

Tsipras’s comments came a day after Austria’s foreign minister urged Greece to stop migrants from pursuing their journey to northern Europe, saying Athens should hold new arrivals at registration “hot spots.” Sebastian Kurz told the Sueddeutsche Zeitung in an interview that “those who manage to arrive in Greece should not be allowed to continue on their journey.” But Tsipras retorted that while Greece, as Europe’s main gateway for refugees, had “met more than 100% of our obligations, others haven’t even met 10% and love to criticize us”. “What some countries have agreed and decided goes against all the rules, against the whole of Europe, and we consider it an unfriendly act.” “These countries are destroying Europe!” he charged, according to the German translation.

Athens has been seething over a series of border restrictions along the migrant trail, from Austria to the Former Yugoslav Republic of Macedonia, that has caused a bottleneck in Greece. “Greece is the only country that is fulfilling its obligations,” the leftist leader said, adding that it was now hosting 30,000 refugees. While Greece can protect its land borders, it can’t do the same for some 10,000 kilometers (6,000 miles) of coastline, he said. Tsipras said that “in the end those who are now putting up barbed wire, expelling refugees by force and turning their countries into fortresses, will be isolated in Europe. “We, however, are in an alliance with the countries showing solidarity,” he added, in an apparent reference to Germany, Europe’s top destination for migrants. “And these are the countries with which we had very big problems during the financial crisis,” he said, hinting at Berlin’s tough austerity demands from Greece in return for international bail-out loans.

Somone better stop Tusk. “..if you insist that these people are refugees then you have a duty to welcome them under all EU constitutions.” By contrast, “if you refer to them as migrants then you have no duty towards them..”

• Europe Yanks Welcome Mat Out From Under Its War Refugees (Sputnik)

On Thursday, European Council President Donald Tusk, dismissing refugees fleeing war-torn Syria as “economic migrants,” stated, “Do not come to Europe.” Middle East analyst Hafsa Kara-Mustapha sat down with Sputnik’s Brian Becker to discuss the dire status of Middle Eastern refugees in Europe. What will be the impact of European Council President Tusk’s Statements? “First of all, I have to talk about the wording he used,” Kara-Mustapha told Loud & Clear. “He insisted on using the word migrant and specifically using the phrase ‘economic migrant’ when all the people presently coming into Europe are actually war refugees fleeing conflict.” Kara-Mustapha expressed concern that by rebranding the refugees as economic migrants, the EU aims to alter the requirements of member states to provide asylum.

“In effect, when he says that Europe should stop welcoming economic migrants he is actually changing the whole subject and making the issue about economy and migration when simply it is about refugees,” she noted, adding that, “if you insist that these people are refugees then you have a duty to welcome them under all EU constitutions.” By contrast, “if you refer to them as migrants then you have no duty towards them because these people are just coming for financial gain and nobody owes them anything,” observed Kara-Mustapha. In reality, however, “these people are coming to Europe for safety and to avoid the horrors of war.” She also noted that the current aim of European leadership appears to be to fundamentally change public opinion toward refugees by referring to them as “migrants.” The wording, she said, “makes the topic less acceptable to ensure people turn against these refugees… the underlying meaning is that they are coming here for the benefits, to raid the welfare system, and to make money.”

Home › Forums › Debt Rattle March 5 2016