Pierre-Auguste Renoir The Return of the Boating Party 1862

McCullough

https://twitter.com/i/status/1702277639191310734

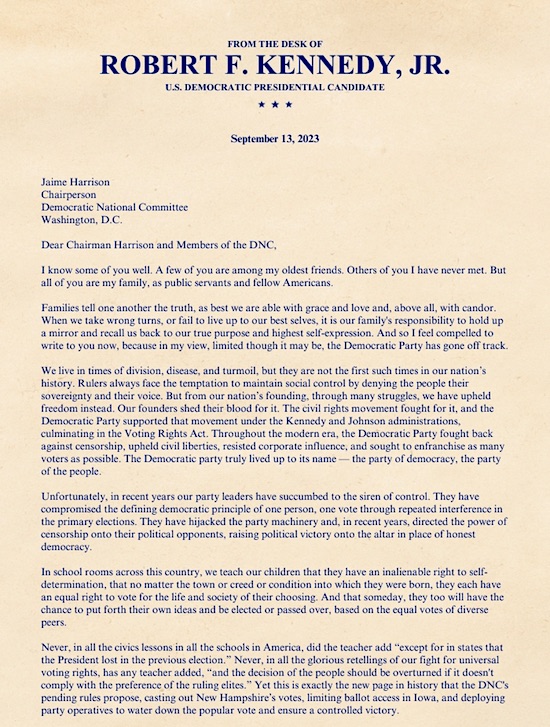

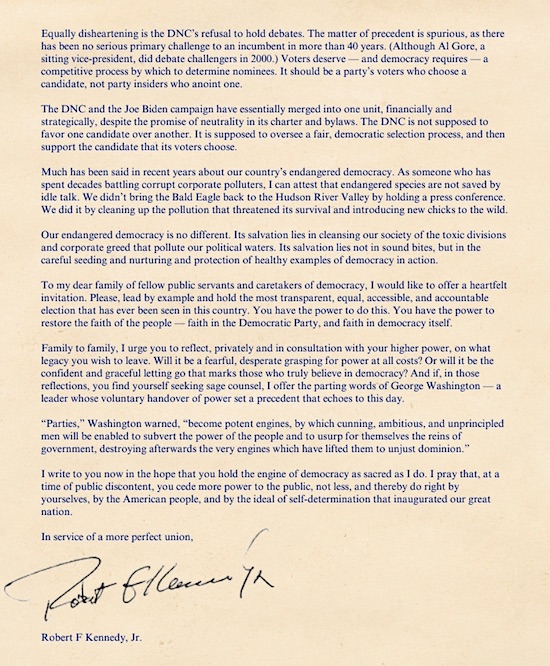

RFK

https://twitter.com/i/status/1702361950540226619

Macgregor

Ukraine's counter offensive has been a total failure.

General Mark Milley is the ultimate political puppet.

Milley is a fraud. pic.twitter.com/SVo2n5dLAk

— Douglas Macgregor (@DougAMacgregor) September 15, 2023

Fulton County

Fulton County Prosecutors Accused of Hiding Key Documents in Trump RICO Case

"I heard squat from the state."

"They have it, your Honor. I have a reason to believe they have it and they don't even respond. I have a motion. I'm going to file it. I'm going to ask for this relief,… pic.twitter.com/qiPcp1GXfZ

— Kyle Becker (@kylenabecker) September 14, 2023

David Weiss headed the investigation into Hunter and is now the Special Counsel. Just reading this makes you realize why that is against the law. Weiss was in on the plea deal that the judge laughed out of court but Hunter’s lawyers keep insisting is valid regardless.

Stretching out the gun case can silence Hunter about all other cases. Oh, and the gun case keeps Joe out of sight, and all the information about him: he has no link to the gun. It’s the only thing he’s not linked to.

• Hunter Biden Indicted On Federal Firearms Charge (ZH)

Hunter Biden has been indicted on three counts related to the possession of a gun while using narcotics, court documents show. The move, a “historic indictment against the son of a sitting president,” comes after an absurd plea deal fell apart, and days after House Republicans launched an impeachment inquiry which seeks bank records and other documents on the Biden family’s business dealings. “The case is being overseen by special counsel David Weiss, who also headed the investigation. Weiss is a Trump appointee who was kept on as U.S. attorney for Delaware because of the sensitive and unique nature of the investigation into a president’s son by the Justice Department, a part of the executive branch headed by the president. U.S. Attorney General Merrick Garland named Weiss special counsel in August, as negotiations over the tax and gun charges collapsed.”

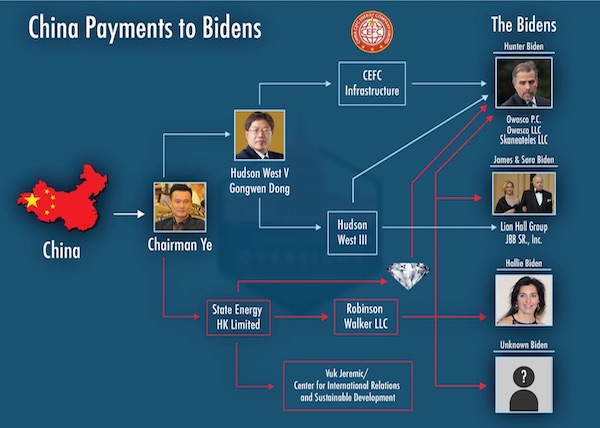

Of course, none of this has to do with perhaps the biggest grift in the US history – as the Biden family raked in more than $20 million from foreign sources – including figures in China, Ukraine, Russia and Romania, all funneled through a complex arrangement of corporations, according to House GOP investigators and whistleblowers who are currently seeking Biden bank records. For example, in 2017, Hunter pulled in over $2.3 million – with $1 million of that coming from a company he formed with the CEO of a Chinese conglomerate. He also took in $664,000 from a Chinese infrastructure investment firm, $500,000 from a Ukrainian energy company (we assume to be Burisma), $70,000 from a Romanian business, $48,000 from an international law firm, and $666,000 from domestic business interests.

In 2018, Hunter made over $2.1 million according to the unraveled plea deal – which came as his drug addiction went critical. According to Biden’s memoir, cited by the document, that year saw “a spring and summer of nonstop debauchery.” “According to the agreement, Biden was well aware of his tax liabilities from an accountant he hired. The accountant prepared Biden’s returns and sent them to him for review and signature. Despite repeated encouragement by his accountant, Biden never signed or submitted his returns. According to the agreement, Biden failed to pay his taxes despite having the money to do so. By May 2019, he had spent money he could have used for that purpose “on personal expenses, including large cash withdrawals, payments to or on behalf of his children, credit card balances, and car payments for his Porsche.” -Bloomberg. By October 2021, Biden’s tax liabilities for 2017 and 2018 had grown to $955,800 and $956,632 respectively – and were paid for by an unidentified third party.

That person also covered $45,661 and $197,372 to resolve outstanding tax issues from 2016 and 2019. Earlier this year, the NYT reported that Hollywood entertainment lawyer Kevin ‘bong rip’ Morris lent over $2 million to Biden to help with his taxes. Of note, an IRS whistleblower from the agency’s criminal investigations unit told the House Ways and Means Committee in June that Hunter Biden illegally deducted tens of thousands of dollars spent on prostitutes and a sex club from his taxes, according to testimony from June 1 which was released by House Republicans. “So some of the items that he deducted were personal no-show employees. He deducted payments that were made to who he called his West Coast assistant, but she was essentially a prostitute,” said the whistleblower, who worked directly on the IRS’s investigation into Hunter’s tax issues, speaking of the younger Biden’s 2018 return.

Another whistleblower, IRS supervisory agent Gary Shapely , told the committee on May 26 that he found several instances of Hunter expensing flights for prostitutes. “There were multiple examples of prostitutes that were ordered basically, and we have all the communications between that where he would pay for these prostitutes, would book them a flight where even the flight ticket showed their name. And then he expensed those,” said Shapely , who noted that they were expensed to Biden’s consulting firm, Owasco, PC. What’s more, Hunter expensed a deposit for an elite Los Angeles sex club (which he was kicked out of for ‘grabbing women’s asses’ and ‘acting like a spoiled child’). But hey, he also owned a gun while being a junkie. Get ’em boys.

Rep Andy Biggs: This is just China. We also have evidence from Romania, Ukraine, Kazakhstan, and Russia.

s

Mace

https://twitter.com/i/status/1702477644858834964

“..tensions have been rising in the Republican House Caucus over the looming government shutdown, which lawmakers have until September 30 to avoid..”

• Go F**ing Ahead: McCarthy Dares Republicans to Boot Him From Speakership (Sp.)

A motion to vacate would remove Kevin McCarthy (R-CA) from his position as House speaker, a leadership post he fought hard for in early January. In fact, it took 15 voting sessions before McCarthy was confirmed by the House to serve. US House Speaker Kevin McCarthy (R-CA) reportedly dared the House Freedom Caucus and other hard-right members of the Republican House to try and oust him from his leadership position amid growing threats from the fractured lower chamber. “You guys think I’m scared of a motion to vacate. Go f***ing ahead and do it. I’m not scared,” McCarthy said during a closed caucus meeting early Thursday, according to a lawmaker who spoke to US media on the condition of anonymity.

The majority of Republicans still support McCarthy, but the GOP as a whole holds only a slim majority in the House. A vote to remove the Republican would require a majority from the House overall. If House Democrats joined with even a few hardliners in the Republican party, McCarthy could lose a potential vote to vacate. However, there have been no indications from Democrats they plan to join the Republican hardliners in removing McCarthy. It is unclear if doing so would even be advantageous to them outside of making Republicans look chaotic. A new speaker would also require a majority vote in the House. Democrats would either have to agree on a new speaker with the hardline Republicans – something that is unlikely given their political differences, or join with other elements of the GOP to choose a speaker after just voting to remove one they support.

Failing both options would leave it up to House Republicans to come to a deal; however, ultraconservative Republicans have made it clear they will not vote for a House speaker more palatable to Democrats than McCarthy. Despite how messy it could be for both parties to remove McCarthy, tensions have been rising in the Republican House Caucus over the looming government shutdown, which lawmakers have until September 30 to avoid. On Wednesday, House Republicans failed to pass a procedural vote on funding the Defense Department, normally one of the least controversial spending bills in Congress. Officials also failed to pass an agricultural bill in July, another provision that usually passes little resistance.

[..] US Rep. Matt Gaetz (R-FL) is a member of the Freedom Caucus and one of McCarthy’s most vocal critics. He previously said that if McCarthy tried to push forward spending bills without fulfilling the promises he made to hardline Republicans, he would file a motion to vacate. “The path forward for the House of Representatives is to either bring you [McCarthy] forward to immediate and total compliance or remove you,” Gaetz said. “If we have to start the day with the prayer, pledge and the motion to vacate, so be it.” Gaetz dismissed McCarthy’s impeachment inquiry on Tuesday as “baby steps” and accused him of acting like a “valet” to Biden’s agenda.

McCarthy

AP reported that McCarthy's impeachment inquiry was launched "without evidence.” Here’s McCarthy forcing an AP reporter to admit that there was lots of evidence to support an impeachment inquiry. pic.twitter.com/lgzU1BNNlE

— Arthur Schwartz (@ArthurSchwartz) September 14, 2023

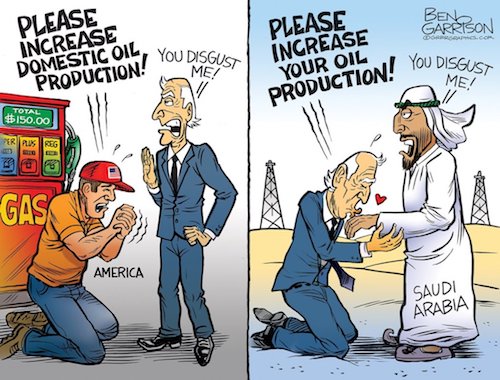

Apt comparison.

• US Political System Frozen by Soviet-Style ‘Aging Crisis’ (Sp.)

Last week, former House Speaker Nancy Pelosi, now 83, announced she would run for reelection again next year, while Senator Diane Feinstein, 90, continues to sit in the Senate with no thought of retirement even though her own daughter took power of attorney to pay her bills. Last week, 81-year-old Senate Minority Leader Mitch McConnell, addressing concerns about his health following episodes of freezing in public, vowed to finish out his term. In addition, a recent CNN poll revealed 75% of Americans are concerned about US President Joe Biden’s age and mental competence, while 67% of Democrats do not want him to run again.

Constitutional historian Dan Lazare suggested these developments are part of a generational illness afflicting an out-of-touch US governing elite that stayed too long in power, not unlike what happened to the Soviet Union during the 1980s, when the Kremlin was plainly at a loss in responding to a declining economy and dysfunctional political system. “Basically, the United States is caught in a Soviet-style age crisis,” Lazare said. “Remember what [former US President] Ronald Reagan said? When asked why he didn’t talk with Soviet leaders, he replied: ‘Because they keep dying on me.’ He was right.” However, while Reagan’s line got a good laugh, Lazare added, the joke is on the United States with elderly lawmakers feebly holding on to Senate seats, not to mention Biden’s “growing senility.”

“After one superpower descended into gerontocracy, how is it that another one is doing the same thing 40 years later? The answer to this question is political gridlock,” Lazare said. “Everyone is terrified of what change might mean.” Deepening gridlock has led to 30 years of trench warfare on Capitol Hill, Lazare pointed out. And thanks to this deadlock, the lineup barely shifts from one year to the next, he added. However, Lazare warned, history has proven this cannot go on forever. In the Soviet Union, he explained, the “ice eventually broke” with the appointment of premier Mikhail Gorbachev in 1985 – but the change came too late. “The ice will eventually break in the United States as well, but the results could be just as explosive,” Lazare said.

Watters

Make no mistake: Ignatius’ column is more than a suggestion- it’s a marching order. When American intelligence wants to put out a hit, they feed it to David Ignatius and today, Ignatius pulled the pin on Joe Biden’s 2024 run. He’s turning Washington’s whispers into a rallying… pic.twitter.com/OZDKmiZaD3

— Jesse Watters (@JesseBWatters) September 14, 2023

“..The Russians are yet to learn that Putin’s idealism exists nowhere else and that they must out-bribe the Americans..”

• The Insouciant Russians (Paul Craig Roberts)

Armenia, despite being a member of Russia’s Collective Security Treaty Organization, began last Monday joint military exercises with the United States that will conclude September 20. This would appear to be Armenia’s finger in Russia’s eye. Clearly, Big Bucks Washington bribed someone in Armenia. The Russians are yet to learn that Putin’s idealism exists nowhere else and that they must out-bribe the Americans. About a year ago Washington organized “Regional Cooperation 2022,” an exercise of the US armed forces with the former Soviet Central Asian Republics of Tajikistan, Kazakhstan, Kryrgyzstan, and Uzbekistan. As Washington’s cover for stirring up new troubles for Russia, Washington’s ambassador to Tajikistan, John Pommersheim, explained Washington’s presence in Central Asia as working on peaceful responses to global challenges.

Just as Putin, the Kremlin, the Russian media sat sitting on their butts for 8 years while Washington built and equipped an Ukrainian Army poised to destroy the Russian peoples in the Donbas breakaway republics, the Kremlin, and the Russians media sit on their butts doing nothing while Washington, motivated by Putin’s failure to bring the Ukrainian war to an end, prepares to present the butt-sitter with another Ukraine in Central Asia. It seems Russians, too, can be insouciant. I sometimes wonder if they realize that they are at war. Russian tourists flock to Europe to have their cars and personal possessions stollen as sanctioned goods. And instead of warning the weak, essentially militarily irrelevant EU countries, the Kremlin warns its own citizens. The persona of irresoluteness, indecision, inability to act that the Kremlin broadcasts to the world encourages Washington to ever more provocations that will eventually go too far.

“We point our fingers at Congress like they’re not just rented mules for the same people who sit on the board for the Rand Corporation.”

• US Imperial ‘Death Cult’ Admits it Provoked Proxy Conflict in Ukraine (Sp.)

US deep state and financial interests openly schemed for years to provoke the conflict in Ukraine, says a media commentator. Webcast host Steve Poikonen told Sputnik he was gratified that NATO leaders were “finally saying that it’s a proxy war now.” That was “delightfully refreshing” after more than a year of “being called a tinfoil hat or Putin apologist for merely suggesting that what we are engaged in is a proxy war,” he said. The media commentator characterized the “permanent unelected state, the neocons and the military industrial complex” in the US as a “death cult.” “It operates like one, against all reason and against their own best interests even,” Poikonen said. “They pursue endless war, and they don’t even bother to care about the people on the ground. It’s all about moving the self-perpetuating money laundering machine, and they do it with impunity… because they’re 100 percent amoral.”

US strategic think-tank the RAND Corporation published a paper in 2019 entitled Overextending and Unbalancing Russia — a blueprint for a campaign of hybrid warfare, including “providing lethal aid to Ukraine” in order to “exploit Russia’s greatest point of external vulnerability.” “For every international conflict in which the U.S. is now overextended, there is a supporting RAND document that outlines exactly how we’re going to get into this mess,” Poikonen said. “This is their sole purpose. The reason the Rand Corporation gets together to figure out how to destabilize nations and how a handful of people in the United States, in the international business community can profit from it.” The RAND report also recommended disrupting Russia’s overseas oil and gas markets.

“Of course, they’re going to go after the oil and gas,” the pundit argued. “And when they see that and the RAND argument, the first thing I think of is the Nord Stream pipeline.” “The RAND Corporation is nothing if not fantastic salesman,” Poikonen observed. “They’ve been able to exist for the last 60, 70 years based solely on their ability to convince at least a handful of Congresscritters that all of our money should go to the military budget.” He argued US politics was nothing but theatre that concealed those pulling the strings behind the scenes. “We’re consistently attacking the wrong people in this country. We’re consistently pointing the finger at the wrong people,” he said. “We point our fingers at Congress like they’re not just rented mules for the same people who sit on the board for the Rand Corporation.”

A 50-year-old transgender American is Kiev’s military spokesperson and threatens to kill anyone who asks questions. What a world.

• Moscow Responds To Ukrainian Official’s ‘Terrorist’ Threat (RT)

Threats aimed at Russian journalists by Ukrainian military spokesperson, Sarah Ashton-Cirillo, will be referred to international organizations as an example of the terrorist nature of the Kiev regime, Moscow’s Foreign Ministry spokeswoman Maria Zakharova has said. On Wednesday, Ashton-Cirillo issued a threat to kill Russian “propagandists” and claimed that “next week, the teeth of the Russian devils will gnash even harder, and their rabid mouths will foam in uncontrollable frenzy as the world will see a favorite Kremlin propagandist pay for their crimes.” “Russia’s war criminal propagandists will all be hunted down, and justice will be served as we in Ukraine are led on this mission by faith in God, liberty and complete liberation,” the transgender military spokesperson pledged.

“A zombie apocalypse,” Zakharova wrote in response to the threat. “We will be sending this further evidence of the terrorist nature of the Kiev regime and its sponsorship by Washington to all international organizations and NGOs,” she said. The first deputy of the Russian State Duma’s culture committee, Elena Drapenko, claimed Ashton-Cirillo’s words were within the logic of the “terrorists and fascists” in Kiev and supported Zakharova’s suggestion that the threat be referred to international institutions. “There are international conventions, there are obligations that Ukraine has assumed. We must demand that they be fulfilled,” Drapenko said.

The head of Russia’s Human Rights Council, Valery Fadeev, has also stated that he would contact the Investigative Committee and the Federal Security Service (FSB) to investigate the threats in light of the “sad experience” of previous assassination attempts on Russian journalists and public opinion leaders. Investigative Committee chairman Alexander Bastrykin has confirmed that he has already instructed his service to investigate and provide a legal assessment of Ashton-Cirillo’s statements. Meanwhile, Russia’s Journalist Union (SJR) has cautioned that Ashton-Cirillo’s threats may be quite real in light of previous terrorist attacks on Russian media representatives.

“It is probably pointless to talk about the moral qualities of representatives of the Kiev leadership. These threats should be taken seriously,” said SJR president Vladimir Solovyov, urging fellow journalists to be careful. He added that he hoped Ashton-Cirillo would be appropriately punished as soon as they fall into the hands of Russian law enforcement agencies. The first deputy chairman of the Duma Defense Committee, Alexei Zhuravlev, also noted that “Ukrainian terrorism is gradually degrading” and taking on an “increasingly uglier face” in the form of Ashton-Cirillo, whom he called a “pervert-satan.”

Ideal moment to tell him it’s over.

• Mr. Zelensky Goes To Washington, Again (ZH)

Ukraine’s Present Volodymyr Zelensky is again expected to pay homage to the hands that feed him, as Bloomberg is reporting that another trip to the White House is imminent. “President Joe Biden will host Ukrainian President Volodymyr Zelenskiy at the White House next week, according to a person familiar with the plans,” the fresh Thursday report indicates. The Ukrainian leader’s first official visit to Washington had occurred in December 2022, and also had marked his first known trip outside his war-ravaged country since Russia invaded. But things have changed since he gave that “Christmas season” address in Congress, where then House speaker Pelosi treated him like a rockstar as she and VP Kamala Harris excitedly waived the Ukrainian flag around, hugging Zelensky in the process.

Not only is the much-anticipated counteroffensive not going well, or even failing, but his personal ‘star status’ is waning too. Bloomberg notes the new context, namely that Republicans are less likely to sign off on massive new aid packages in the federal budget: For the US president, it also coincides with an upcoming showdown over federal funding. Biden has asked Congress to provide $24 billion for the Ukraine war and related costs, but conservatives in the House are threatening to shut down the US government if they consider any funding bill a “blank check” for Ukraine. Current funding for government operations runs through Sept. 20.

Next week’s meeting was first reported by Reuters. And a fresh photo op with Zelensky is perhaps what Biden thinks he needs for a boost in domestic approval ratings, given not only is the mainstream media turning on him……but he’s also newly focused his campaign going into 2024 on being the “tough” commander-in-chief who “protects” democracy around the world: “He entered Ukraine under the cover of night. And in the morning, Joe Biden walked shoulder to shoulder with our allies in the war-torn streets,” the narrator of a new one-minute Biden campaign ad begins. “Standing up for democracy in a place where a tyrant is waging war to take it away.”

On the Ukrainian side, Zelensky could be coming also to bolster support and enthusiasm among GOP hawks and conservative supporters in order to get their fellow Republicans in line. Kiev has also expressed increased impatience and frustration of late when it comes to F-16 delivery timeline, and related to getting more advanced US weapons like long-range missiles. There’s currently talk within the administration of Ukraine getting approval for the MGM-140 Army Tactical Missile System (ATACMS), which has a max range of 190 miles. Certainly Zelensky is going to press for this and more. Will Biden make this the focus of a “big” announcement when he greets Zelensky in the White House next week?

“DIA’s intelligence on Russia does not get to relevant hands in the White House because it is being ignored for political expediency..”

• Sy Hersh: Overly Optimistic US Intel Reports on Ukraine to Lead to Disaster (Sp.)

The Defense Intelligence Agency (DIA) withheld documents from the White House on anti-government extremist groups in Syria producing sarin gas and has been providing “insanely” optimistic assessments on the conflict in Ukraine, investigative journalist Seymour Hersh stated on his Substack blog on Wednesday. DIA’s intelligence on Russia does not get to relevant hands in the White House because it is being ignored for political expediency, just like CIA reports on the current failed Ukrainian counteroffensive are being ignored by Blinken, Hersh said. The journalist pointed out that he chose to publish a series of documents on his Substack because what the US Intelligence community did regarding Syria, it is doing once again regarding the Ukraine crisis.

If the same situation is allowed to persist regarding Ukraine, the conflict with Russia can scale up and that is an outcome that nobody wants, Hersh added. “[Secretary of State Anthony] Blinken’s wrong-headed confidence… could be based on insanely optimistic assessments supplied by the Defense Intelligence Agency. The DIA’s assessments, as I have reported, are now the intelligence of choice inside the White House,” the journalist said. Hersh noted that amid calls for the United States to intervene in the Syrian conflict ten years ago, the White House was not provided with crucial intelligence because of its alleged “politically inconvenient” nature. Such was the case of a detailed yet DIA-redacted five-page report from intercepts by the National Security Agency (NSA) that anti-government Islamist groups possessed the nerve agent sarin gas, the journalist stressed.

“It revealed the kind of truth that presidents then and now viewed as political poison,” Hersh emphasized. The much-touted counteroffensive attempt by the Kiev regime in early June has evidently been a failure, with massive losses and non-existent gains. A number of NATO generals, as well as Western military analysts, have already admitted the catastrophic situation of the Ukrainian forces. Nevertheless, Ukrainian officials – following their Western masters – refuse to acknowledge the reality: Ukraine has lost virtually all of its strategic reserves together with an enormous amount of NATO-supplied military equipment in a futile effort to breach the Russian defenses.

“..the ATACMS has been the beneficiary of a Service Life Extension Program designed to keep the missile from failing once launched due to old age..”s

• ATACMS – The Latest American Poison Pill for Ukraine (Scott Ritter)

Back in July 2022, US National Security Advisor Jake Sullivan, pushing back against increasing demands from Ukraine and its American backers in Congress, the State Department, and the Pentagon that the Biden administration provide Ukraine with the Army Tactical Missile System, or ATACMS, declared that providing Ukraine with this weapon would risk putting the US and Russia on “the road towards a third world war.” Ukraine had been demanding that the ATACMS, a 300-kilometer range solid-fuel guided missile, be included in the list of weapons Ukraine claimed it needed to successfully execute its much-touted “counteroffensive.”

Now, with the “counteroffensive”, which has been underway for more than three months, floundering in the face of a Russian defense that had proven more capable than originally thought by the NATO military planners who helped the Ukrainians craft it, US Secretary of State, Antony Blinken, suddenly announced that the Biden administration was considering reversing course on the issue of providing Ukraine with ATACMS. Left unsaid was to what extent, if any, the Biden administration had addressed the issue of a third world war with Russia, and whether the ATACMS was still considered to be a likely trigger for its initiation.

One theory that is making its way around Washington, DC, is that the Biden administration, after successive arms procurement decisions (HIMARS, the M-1 Abrams, and the F-16) appeared to cross so-called Russian “red lines” without generating any appreciable Russian reaction, believed that the Russians would likewise allow the introduction of the ATACMS to take place without provoking a crisis akin to a third world war. The underlying analysis for this assessment is that Russian President Vladimir Putin is bluffing when it comes to the so-called “red lines”, and that the US can provide Ukraine the weapons it needs to successfully prosecute its stalled counteroffensive.

There are two major problems with this assessment. First, it makes certain assumptions about Russia’s so-called “red lines”, and the consequences which would accrue to Ukraine and its Western partners if these lines were crossed. Russia has, to date, only articulated two definitive “red lines” when it comes to the ongoing Special Military Operation against Ukraine. The first is the direct involvement of US and/or NATO forces in the conflict, whether by putting boots on the ground in Ukraine, or intervening in Belarus. The second was any military situation which threatened the existential survival of the Russian nation. In both circumstances, the President of Russia, Vladimir Putin, has decreed that Russia would use all the means at its disposal to respond to the threat, up to and including nuclear weapons. All other so-called “red lines” are speculative in nature, made by persons other than the President. Second, it assumes that the ATACMS is a game-changing technology whose presence on the battlefield will have a meaningful and telling impact on the ability of the Ukrainian armed forces to prevail in combat against their Russia foes.

The ATACMS is a 50-year-old system which the US Army stopped buying in 2007. While the ATACMS has been the beneficiary of a Service Life Extension Program designed to keep the missile from failing once launched due to old age, it remains an aging system with limited capabilities. If employed by Ukraine, the ATACMS will find itself targeted by Russian anti-missile weapons that will intercept the rocket prior to reaching its target and jam the guidance systems using electronic-warfare capabilities considered to be among the most effective in the world. There is no doubt that an ATACMS missile is capable of inflicting considerable harm and damage on any target it can strike. But the reality is that most of the ATACMS missiles will be shot down before they reach their target, a fact the military planners in the Pentagon are only too aware of. In short, ATACMS is the antithesis of a “magic” weapon designed to strengthen Ukrainian military capacity.

“Brussels “should have isolated this war, but instead of that the EU has globalized” it..”

• EU Gave ‘Bad Answer’ To Ukraine Crisis – Hungary (RT)

The European response to the Ukraine crisis is causing the world to fragment, Hungarian Foreign Minister Peter Szijjarto has claimed, adding that Budapest wants to see unifying action, like China’s Belt and Road Initiative (BRI). “Europe has given a very bad answer to the war in Ukraine that unfortunately seems to be ending up in a world being divided into blocs again,” the Hungarian diplomat told CNBC on the sidelines of the Belt and Road summit in Hong Kong. Brussels “should have isolated this war, but instead of that the EU has globalized” it, he said in the interview broadcast on Wednesday.

Szijjarto argued that a lack of communication between opposing countries has led to them giving up on achieving peace, while states that benefit from good East-West relations – such as Hungary – have been hurt economically. The minister contrasted this to how the BRI aims to bring the world together for mutual prosperity and security, which is why Hungary welcomes China’s presence. He criticized rich Western European nations who are now talking about decoupling from the Chinese economy or “derisking” due to political concerns. Quietly, they seek Chinese investment just like small nations, Szijjarto said.

“They can be hypocritical, they can afford [it],” he argued. Unlike those countries, Budapest states its foreign policy openly, the diplomat said, warning that if ‘decoupling’ with China were to succeed, it would “kill the European economy.” The Hungarian government has been a vocal critic of the Western response to the Ukrainian conflict since its outset. It has called for peace talks, while speaking out against sanctioning Russia and arming Ukraine. Most EU nations, following in the US lead, have pledged to support Kiev for “as long as it takes” to defeat Moscow.

“It’s clear that the West overall has been surprised by the pretty widespread reluctance by many of the countries in the so-called Global South… to come on board..”

• Global South Won’t Back Kiev As West Demands – WSJ (RT)

Western officials have overestimated the willingness of neutral nations to join anti-Russia policies in support of Ukraine, according to The Wall Street Journal. “It’s clear that the West overall has been surprised by the pretty widespread reluctance by many of the countries in the so-called Global South… to come on board,” Jan Techau of the consulting firm Eurasia Group told the newspaper, as quoted on Thursday. He cited “animosity toward the US and Europe” in some parts of the world and the desire of rising powers, such as Brazil and South Africa, to “assert their independence”, the article said. The WSJ detailed purported successes and failures of Western diplomacy to rally the support of neutral nations for what it called “a fair peace settlement for Ukraine” ahead of next week’s gathering of world leaders at the UN General Assembly.

Ukrainian President Vladimir Zelensky has been internationally promoting his “peace formula” with Western backing. It includes Ukraine regaining control over all former territories, war reparations from Russia, and a tribunal for the Russian leadership. Moscow has dismissed the Zelensky plan as being detached from reality. The newspaper noted that many “emerging countries” have resisted demands for reparations and a tribunal, while “the international willingness to call out Russia publicly has diminished.” In particular, the final statement of the G20 leaders after the summit in India last week did not condemn Russia or even call the conflict a war “against Ukraine.”

The newspaper asserted that the G20 meeting was a “success for the West too,” because Russian President Vladimir Putin and Chinese President Xi Jinping did not attend the event in person. “Factually, Russia is much more isolated than before,” a senior European official told The WSJ. At the upcoming UN General Assembly meeting, non-Western participants are likely “to shift the global focus onto their priorities: global inequality and debt relief,” the report predicted. Moscow has described the Ukraine crisis as part of a Western proxy war against Russia. It has also accused the US of mismanaging the global economy for selfish goals, while trying to preserve its dominance and resisting the emergence of a multipolar world.

Twelvefold. And much more expensive. Very smart.

• Germany Hugely Increases Imports Of Russian Oil – Der Spiegel (RT)

Germany has continued importing large volumes of Russian oil, turning to India as a substitute supplier after the EU banned almost all crude imports from Moscow in early December. According to a Der Spiegel report on Tuesday, Berlin’s imports of petroleum products from India jumped more than twelvefold in January-July 2023 year-on-year. The value of those imports soared from €37 million ($39 million) in the first seven months of 2022 to $484 million during the same period of 2023, the outlet’s analysis of official data reportedly showed. The imports from India “were mainly gas oils that are used to produce diesel or heating oil,” the report said, noting that New Delhi has recently been producing a significant proportion of those gas oils from Russian crude oil.

Germany, which has historically been the largest EU buyer of Russian oil, stopped imports via pipelines on January 1, despite the fact that the latest EU embargo exempts piped deliveries to the bloc from the sanctioned country. Official data by German statistical office Destatis shows that Berlin’s imports of Russian crude oil have ceased almost entirely amid the sanctions. Statistics, however, do not count crude of Russian origin purchased indirectly from global traders through ship-to-ship transfers. According to Der Spiegel, citing data, some volumes of Russian oil bought by India later end up in Germany in some form.

Poland won’t break the union. But Hungary may.

• Polish Minister Warns Of Threat From Ukraine (RT)

If Ukraine were to become a member of the EU it would have to be under certain conditions, particularly in light of the threat posed by its agriculture, Poland’s Agriculture and Rural Development Minister Robert Telus has said, in an interview with polish news station PAP on Thursday. Telus was asked if Warsaw would take any steps to oppose Kiev’s accession to the EU, given that Poland has placed an embargo on Ukrainian grain. The minister replied that although the Polish government was generally in favor of Ukraine’s admission to the bloc, certain issues would first have to be addressed before that can become a reality. “Ukraine cannot join the EU without conditions. We had conditions and the same must apply to Ukraine,” Telus said.

He noted that agriculture is a particularly important point in relations with Kiev as Ukraine’s agriculture sector is structured completely differently than Poland’s and the EU’s. “We need to take a closer look at this, because Ukrainian agriculture is a threat to the agriculture of the frontline countries, but also to the whole of Europe,” he told PAP. Earlier this week, Polish PM Mateusz Morawiecki stressed that Warsaw will not allow cheap Ukrainian grain to “flood” the Polish market and disrupt the country’s agricultural industry. He added that regardless of what the EU says, Poland will keep its border closed to Ukrainian grain in order to protect the interests of Polish farmers.

Back in May, five Eastern European members of the EU, namely Poland, Hungary, Romania, Bulgaria and Slovakia, placed a sweeping ban on the import of Ukrainian grain. That was after Brussels lifted quotas and tariffs from Ukrainian grain exports in a bid to support Zelensky’s government in the early months of the Russia-Ukraine conflict. However, the policy ultimately backfired on Eastern European nations, which have faced mass protests from local farmers. The EU then closed off the markets of the five nations to Ukrainian wheat, corn, sunflower seeds and rapeseed, but still allowed the transit of the goods to continue. On Friday, the European Parliament is set to debate on the extension of the embargo.

Commenting on Brussels’ possible decision to lift the ban, Telus suggested that such a move would bear political undertones and that “there are forces in Europe that want to further destabilize” Poland’s market. Kiev, meanwhile, has opposed the grain ban, with Ukrainian President Vladimir Zelensky calling the embargo a betrayal of “European values.” The president has since threatened to go to an international arbitration court if Brussels decides to prolong the ban beyond September 15.

“Although western economies are well-developed, they are already “too heavily invested and sluggish,” says Titov: “In the East, on the other hand, everything is booming, moving forward rapidly, developing rapidly…”

• In Vladivostok, The Russian Far East Rises (Pepe Escobar)

Russian President Vladimir Putin opened and closed his quite detailed address to the Eastern Economic Forum in Vladivostok with a resounding message: “The Far East is Russia’s strategic priority for the entire 21st century.” And that’s exactly the feeling one would have prior to the address, interacting with business executives mingling across the stunning forum grounds at the Far Eastern Federal University (opened only 11 years ago), with the backdrop of the more than four kilometer-long suspension bridge to Russky Island across the Eastern Bosphorus strait. The development possibilities of what is in effect Russian Asia, and one of the key nodes of Asia-Pacific, are literally mind-boggling.

Data from the Ministry for the Development of the Russian Far East and the Arctic – confirmed by several of the most eye-catching panels during the Forum – list a whopping 2,800 investment projects underway, 646 of which are already up and running, complete with the creation of several international Advanced Special Economic Zones (ASEZ) and the expansion of the Free Port of Vladivostok, home to several hundred small and midsize enterprises (SMEs). All that goes way beyond Russia’s “pivot to the East” which was announced by Putin in 2012, two years before the Maidan events in Kiev. For the rest of the planet, not to mention the collective west, it is impossible to understand the Russian Far East magic without being on the spot – starting with Vladivostok, the charming, unofficial capital of the Far East, with its gorgeous hills, striking architecture, verdant islands, sandy bays and of course the terminal of the legendary Trans-Siberian Railway.

What Global South visitors did experience – the collective west was virtually absent from the Forum – was a work in progress in sustainable development: a sovereign state setting the tone in terms of integrating large swathes of its territory to the new, emerging, polycentric geoeconomic era. Delegations from ASEAN (Laos, Myanmar, Philippines) and the Arab world, not to mention India and China, totally understood the picture. In his speech, Putin stressed how the rate of investment in the Far East is three times the Russian region average; how the Far East is only 35 percent explored, with unlimited potential for natural resource industries; how the Power of Siberia and Sakhalin-Khabarovsk-Vladivostok gas pipelines will be connected; and how by 2030, liquified natural gas (LNG) production in the Russian Arctic will triple.

In a broader context, Putin made clear that “the global economy has changed and continues to change; the west, with its own hands, is destroying the system of trade and finance that it itself created.” It is no wonder then that Russia’s trade turnover with Asia-Pacific grew by 13.7 percent in 2022, and by another 18.3 percent in just the first half of 2023. Cue to Presidential Business Rights Commissioner Boris Titov showing how this reorientation away from the “static” west is inevitable. Although western economies are well-developed, they are already “too heavily invested and sluggish,” says Titov: “In the East, on the other hand, everything is booming, moving forward rapidly, developing rapidly. And this applies not only to China, India, and Indonesia, but also to many other countries. They are the center of development today, not Europe, our main consumers of energy are there, finally.”

“The State does not create wealth, the State destroys it. The State can give you nothing, because it produces nothing.”

• “Never Embrace Socialism… Or The Siren Song Of Social Justice” – Milei (ZH)

Argentina’s leading presidential candidate Javier Milei – a self-described anarcho-capitalist who won the primaries with 30% of the vote – sat down with Tucker Carlson this week in Buenos Aires for a wide-ranging discussion. Carlson and Milei talked about why the citizens of Argentina are fed up with the relentless lack of change and the relentless economic decline, echoing many similar patterns taking place in America, with the one-time congressman explaining his platform of radical change which would include the dissolution of numerous socialist institutions and the very central bank which has led Argentina into multiple fiscal crisis events. Milei’s advice to Americans is simple: “Never embrace the ideas of socialism.”

Tucker Milei

Ep. 24 Argentina’s next president could be Javier Milei. Who is he? We traveled to Buenos Aires to speak with him and find out. pic.twitter.com/4WwTZYoWHs

— Tucker Carlson (@TuckerCarlson) September 14, 2023

“Never allow yourselves to be seduced by the siren song of social justice. Don’t get caught up in that terrible concept that where there is a need, there is a right. But that can’t happen on its own. We have to be prepared for this, and wage a cultural war every single day and we have to be careful because they have no problem with getting inside the State and employing Gramsci’s techniques: seducing the artists, seducing the culture, seducing the media or meddling in educational content.” Reflecting in the slippery slope of American leftist politics, Carlson noted that Argentina has adopted many left-wing social issues. “I didn’t fully appreciate the degree to which the Argentinian government had embraced fringe academic, American-style social justice,” Carlson told Milei, adding that “a businessman told me at lunch today that people who identify as transgender pay lower taxes, and that in 2019 you had a Ministry of Women and Diversity created in this country for the first time. What does that ministry do?”

“In theory, it is supposed to deal with women’s issues,” Milei said. “But when you look at the results, you find there aren’t any. Just writing songs…” “Are women happier here?” Carlson asked. “No,” Milei said. “Because there are no real results.” And added, “why isn’t there a Ministry of Men?” Then, Milei really touched the third rail… by supporting President Trump, and offering him some advice: “[Trump] should continue his fight against socialism. Because he is one of the few who truly understood that we are fighting socialism, that we are fighting the statists. He understood perfectly that the generation of wealth comes from the private sector.

The State does not create wealth, the State destroys it. The State can give you nothing, because it produces nothing. And when it attempts it, it does so poorly.” “So I’d say, if I could humbly offer advice, all I could say would be to double down on his efforts in the same direction: defending the ideals of freedom and refusing to give an inch to the socialists,” he continued. The discussion included Milei’s controversial denouncement of the Pope, his views on abortion, and his belief that climate change is a “socialist lie.”

Hermit Crab

https://twitter.com/i/status/1702225669961195845

Ribbon eel

https://twitter.com/i/status/1702369755338768762

Colosseum

Who knows what happened here in ancient times.pic.twitter.com/f5B1uJP92g

— Enezator (@Enezator) September 14, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.