NPC Pennsylvania Avenue storefront view, Washington DC 1921

Apparently not at all worried about credibility, then.

• ECB Sees No Evidence Of Asset Bubbles: Draghi (Reuters)

The ECB will continue to do what is necessary to boost inflation and has not seen evidence so far that exceptionally loose monetary policies are creating asset bubbles, ECB President Mario Draghi said on Friday. Draghi added that the economic outlook for the euro zone faces uncertainty due to risks to growth prospects in emerging market economies, a clouded outlook for oil prices and geopolitical risks. “While accommodative monetary policies over an extended horizon may have unintended consequences for certain sectors in the form of excessive risk-taking and misaligned asset prices, we do not currently see any broad-based evidence of excesses in the behavior of banks and other financial institutions and valuations of euro area asset prices,” Draghi said in a statement. Draghi also repeated the ECB’s forward guidance that the key policy rates will remain at the current or lower levels for an extended period of time, well past the horizon of the net asset purchases.

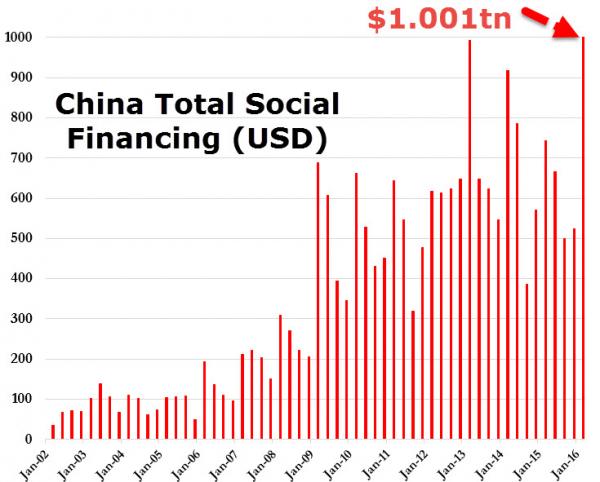

Over $1 trillion in just one quarter. My comment yesterday: “This is such a contradiction in terms it’s crazy the WSJ prints it: “China’s economy may have stabilized for now, thanks to gobs of new debt..”

• China Buys ‘Recovery’ With A Record Amount Of New Debt (ZH)

When China reported its economic data dump last night which was modestly better than expected (one has to marvel at China’s phenomenal ability to calculate its GDP just two weeks after the quarter ended – not even the Bureau of Economic Analysis is that fast), the investing community could finally exhale: after all, the biggest source of “global” instability for the Fed appears to have been neutralized. But what was the reason for this seeming halt to China’s incipient hard landing? The answer was in the secondary data that was reported alongside the primary economic numbers: the March new loan and Total Social Financing report.

As the PBOC reported last night, Chinese banks made 1.37 trillion yuan ($211.23 billion) in new local-currency loans in March, well above analyst expectations, as the central bank scrambled to keep the economy engorged with new loans “to keep policy accomodative to underpin the slowing economy” as Reuters put it. This was up from February’s 726.6 billion yuan but off a record of 2.51 trillion yuan extended in January. Outstanding yuan loans grew 14.7% by month-end on an annual basis, versus expectations of 14.5%. But it wasn’t the total loan tally that is the key figure tracking China’s credit largesse: for that one has to look at the total social financing, which in just the month of March rose to 2.34 trillion yuan, the equivalent of more than a third of a trillion in dollars!

And there is your answer, because if one adds up the Total Social Financing injected in the first quarter, one gets a stunning $1 trillion dollars in new credit, or $1,001,000,000,000 to be precise, shoved down China’s economic throat. As shown on the chart below, this was an all time high in dollar terms, and puts to rest any naive suggestion that China may be pursuing “debt reform.” Quite the contrary, China has once again resorted to the old “growth” model where GDP is to be saved at any cost, even if it means flooding the economy with record amount of debt.

And to put it all together, the PBOC also reported that the broad M2 money supply measure grew 13.4% in March from a year earlier, or precisely double the rate of growth of GDP. This means that it took two dollars in new loans to create one dollar of GDP growth. With China’s debt/GDP already estimate at 350%, how much longer can China sustain this stunning debt (and by definition, deposit) growth continue?

China has too much steel, too much cotton, and too much of lots of other things.

• Flood of Chinese Cotton Exports Sends Global Prices Tumbling (BBG)

China is about to open the floodgates on its huge supplies of cotton, sparking a rout in prices. The country plans to auction about 2 million metric tons from May through August, a government statement showed Friday. That’s almost equal to total shipments expected this season from American growers, the world’s top exporters. The auction sales would represent about 14% of the 13.9-million tons that the U.S Department of Agriculture estimates that China has in its stockpiles. Cotton futures fell the most in six weeks. The price slid more than 7% in the past year in part because the large Chinese inventories curbed overseas purchases from the Asian nation, the biggest consumer of the fiber.

“We knew this was coming, but it’s probably a bit more than what people were expecting” and reduces the country’s import outlook in the near term, Keith Brown, president of brokerage Keith Brown & Co. in Moultrie, Georgia, said in a telephone interview. Adding to the outlook for bigger supplies is favorable growing weather in U.S. cotton areas. Rains in the next few days will boost soil moisture in Texas, the country’s top producer, according to MDA Weather Services in Gaithersburg, Maryland. Drier conditions will aid planting in the U.S. Southeast, the forecaster said. American farmers are expected to increase plantings in the season that starts in August as low prices for competing crops leave farmers with few options, the USDA projects.

“Any increase in production, as well as any volume pushed out of Chinese reserves, will be added to globally available supply in the coming crop year,” industry researcher Cotton Inc. said in a report this week. “High levels of available supply can be expected to keep downward pressure on prices.” Still, the auction sales come as China’s crop is set to shrink this year to the lowest in more than a decade, USDA data show. That’s reducing global output by more than 16%, the biggest annual slide since at least 1961. As the Asian country depletes inventories, in the “long-run it’s positive,” for prices because it means that there will be less supply further down the road, boosting the outlook for eventual imports, Brown said.

Draghi buys anything now.

• Greek Banks’ EFSF Notes Eligible For ECB’s QE Purchases (Reuters)

The ECB has included European Financial Stability Facility (EFSF) notes in its list of eligible securities for purchasing under its so-called quantitative easing program, an ECB spokesperson said on Friday. “Up to 50% of the outstanding amount can be purchased as this is the limit applicable to securities issued by eligible international organizations,” the spokesperson told Reuters. With holdings of more than €30 billion of such notes after rounds of recapitalization, Greek banks stand to make gains on the securities.

Bank shares were rebounding 16.2% on Friday after losses in the previous sessions. “The market jumped on this one-off positive piece of news after days of negativity,” said Eurobank analyst Nick Koskoletos. Banks had not been not allowed to sell the EFSF notes in the market but they repoed them with the ECB to obtain cheap funding. Apart from capital gains, selling a portion of their EFSF notes to the ECB could reduce the amount Greek banks borrow from it.

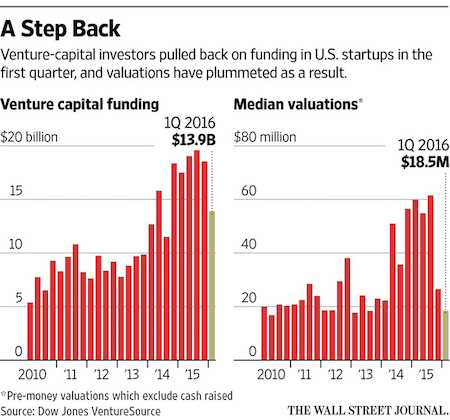

The focus on startups and unicorns smells of despair, a last ditch attempt to deny the demise of the economy.

• Startup Investors Hit the Brakes (WSJ)

Venture-capital investors hit the brakes on investing in the first quarter, following a funding bonanza the past two years that pushed valuations of once-hot technology startups to soaring heights. Funding for U.S. startups fell 25% from the fourth quarter to $13.9 billion, the largest quarterly decline on record since the dot-com bust, according to data from Dow Jones VentureSource. The numbers of deals also hit a four-year low of 884. The drop threatens to hasten a slump rippling through Silicon Valley that is pushing startups to slash marketing budgets, lay off staff and dial back lofty ambitions. Investors such as mutual funds and big banks that pumped money into startups on the promise of big returns have since retrenched, as a punishing market for initial public offerings has spoiled the runaway optimism.

The sky-high valuations of last year have retreated as a result. In the first quarter, the median value of U.S. startups plummeted to $18.5 million after hitting a peak of $61.5 million in last year’s third quarter. “I think investors are nervous, sitting on the sidelines waiting to see what happens,” said Brian Mulvey at PeakSpan Capital, which recently raised a venture fund of $150 million. Investors caution the first-quarter data spans a relatively small period and that capital tends to fluctuate widely throughout the year. VentureSource counts funding rounds for U.S.-based companies with at least one venture-capital firm as an investor. It doesn’t include startups only backed by individuals or majority-owned by corporations or private-equity firms. Several other data providers with varying methodologies show less of a decline.

Commodities break on plunging demand.

• Goodrich Petroleum Files For Chapter 11 Bankruptcy Protection (WSJ)

Goodrich Petroleum filed for chapter 11 bankruptcy Friday with investment firms slated to pick up the pieces, as yet another company sought court protection amid the shakeout in the oil and gas industry. Houston-based Goodrich, an oil and gas producer which struggled to cut its debt as crude prices tumbled, has a deal in place that would erase $400 million in debt from its books through a swap with a group of investors that own bonds the company issued last year. The Goodrich bondholders, who include Franklin Advisors, Penn Capital Management and Jefferies, have agreed to forgive $175 million in debt in exchange for ownership of the company. The deal is part of a larger bankruptcy-exit plan that would pay off or carry over $40 million of higher-ranking senior bank debt and wipe out $224 million in unsecured bonds.

Goodrich’s bankruptcy deal mirrors those proposed recently by other struggling oil producers as the energy slump transforms a U.S. industry once dominated by Texas oil men into one controlled by financial firms from across the nation. Falling oil prices have roiled the industry since the summer of 2014. Since that time, about 60 North American oil and gas companies have filed for bankruptcy, involving nearly $20 billion in debt, according to the law firm Haynes & Boone. On Thursday, Houston’s Energy XXI filed for bankruptcy to complete a debt-for-equity swap with a group of bondholders that includes Oaktree Capital Management.

Denver-based Venoco filed for bankruptcy last month after striking a deal with Apollo Global Management and MAST Capital Management that will erase nearly $1 billion in debt. Energy & Exploration Partners, Magnum Hunter Resources and New Gulf Resourcesare among other energy companies that have brokered similar deals. The rising number of debt-for-equity swaps is due to lenders’ unwillingness to accept the fire-sale prices that potential buyers are offering for oil assets, according to Ian Peck, head of Haynes & Boone’s bankruptcy practice.

Orchestrated theater. Too many producers can’t afford a freeze.

• Saudi Prince Reiterates Oil Freeze Depends on Others Joining (BBG)

Saudi Arabia won’t restrain its oil production unless other producers, including Iran, agree to freeze output at a meeting this weekend in Doha, the kingdom’s deputy crown prince said. The world’s biggest crude exporter would cap its market share at about 10.3 million to 10.4 million barrels a day, if producers agree to the freeze, Prince Mohammed bin Salman said during an interview on Thursday at King Salman’s private farm in Diriyah, the original home of the Al Saud royal family. “If all major producers don’t freeze production, we will not freeze production,” said Prince Mohammed, 30, who has emerged as Saudi Arabia’s leading economic force. “If we don’t freeze, then we will sell at any opportunity we get.”

At least 15 nations including Saudi Arabia and Russia, the world’s two largest crude oil producers, will gather in Doha on April 17 to discuss freezing output to stabilize an oversupplied market. Prince Mohammed has said Saudi Arabia’s commitment to a production cap would depend on Iran’s participation. Iran’s oil minister has dismissed the prospect of joining the deal as “ridiculous” for now. A Russian official said it was possible to reach a deal in Doha to freeze oil output, regardless of Iran whose crude shipments have risen by more than 600,000 barrels a day this month. That increase has added to the pressure on producer nations to reach an agreement to prop up prices as economies from Venezuela to Nigeria reel from the market rout. The meeting in Doha is only relevant if no deal is reached, prompting a sharp selloff in the markets, according to Ed Morse at Citigroup.

Promising, but incomplete.

• Neoliberalism – The Ideology At The Root Of All Our Problems (Monbiot)

[..] It may seem strange that a doctrine promising choice and freedom should have been promoted with the slogan “there is no alternative”. But, as Hayek remarked on a visit to Pinochet’s Chile – one of the first nations in which the programme was comprehensively applied – “my personal preference leans toward a liberal dictatorship rather than toward a democratic government devoid of liberalism”. The freedom that neoliberalism offers, which sounds so beguiling when expressed in general terms, turns out to mean freedom for the pike, not for the minnows. Freedom from trade unions and collective bargaining means the freedom to suppress wages. Freedom from regulation means the freedom to poison rivers, endanger workers, charge iniquitous rates of interest and design exotic financial instruments.

Freedom from tax means freedom from the distribution of wealth that lifts people out of poverty. As Naomi Klein documents in The Shock Doctrine, neoliberal theorists advocated the use of crises to impose unpopular policies while people were distracted: for example, in the aftermath of Pinochet’s coup, the Iraq war and Hurricane Katrina, which Friedman described as “an opportunity to radically reform the educational system” in New Orleans. Where neoliberal policies cannot be imposed domestically, they are imposed internationally, through trade treaties incorporating “investor-state dispute settlement”: offshore tribunals in which corporations can press for the removal of social and environmental protections. When parliaments have voted to restrict sales of cigarettes, protect water supplies from mining companies, freeze energy bills or prevent pharmaceutical firms from ripping off the state, corporations have sued, often successfully. Democracy is reduced to theatre.

Another paradox of neoliberalism is that universal competition relies upon universal quantification and comparison. The result is that workers, job-seekers and public services of every kind are subject to a pettifogging, stifling regime of assessment and monitoring, designed to identify the winners and punish the losers. The doctrine that Von Mises proposed would free us from the bureaucratic nightmare of central planning has instead created one. Neoliberalism was not conceived as a self-serving racket, but it rapidly became one. Economic growth has been markedly slower in the neoliberal era (since 1980 in Britain and the US) than it was in the preceding decades; but not for the very rich. Inequality in the distribution of both income and wealth, after 60 years of decline, rose rapidly in this era, due to the smashing of trade unions, tax reductions, rising rents, privatisation and deregulation.

Lots of criticism of Merkel for this, not sure that’s justified. She must be careful when it comes to trumping the law. Let the courts decide. It’s not as if they’ll lock the guy up. Many EU nations have similar antiquated ‘insult to foreign leaders’ laws, by the way.

• Erdogan and the Satirist: Inside Merkel’s Comedy Conundrum (Spiegel)

Jan Böhmermann has disappeared. He’s not giving interviews; he’s not answering his phone. Since Monday, he has also gone silent on Twitter, where he is normally extremely active. He has hardly left his home in Cologne in the last few days and he is also now under police protection. He had his Thursday show on the German public broadcaster ZDF cancelled and his Sunday radio show on RBB will likewise not be broadcast this week. It was cancelled last Sunday as well. Böhmermann was already in his home studio ready to record when he realized that he was in no mood to be funny. So he called it off. Friends and acquaintances who have had contact with him in the last few days are worried that he won’t be able to withstand the pressure.

The ZDF satirist is a sensitive person, even if that hasn’t always been part of his public persona. The scandal surrounding the disparaging poem he wrote about Turkish President Recep Tayyip Erdogan has affected him more deeply than many have realized. Perhaps one has to be vulnerable to emotional pain in order to know how to inflict such pain on others. Two weeks ago, when he was still active on social media, he tweeted out the Beatles hit “The Fool on the Hill.” The song is about a simpleton sitting alone on a hill with a silly grin on his face – and everyone can see that he is a half-wit. It is essentially how people see Böhmermann, and it is how he wanted to be seen: The misunderstood fool. The tweet went out two days after his insulting Erdogan poem was broadcast on his ZDF show “Neo Magazin Royale” and one day after the broadcaster deleted the show from its video hub and distanced itself from Böhmermann’s verses.

And that was just the beginning. Prior to the scandal, Böhmermann had led a niche existence in Germany’s media landscape, but now everybody in the country knows who he is. The 35-year-old has triggered an affair of state, one which has served to demonstrate just how limited Chancellor Angela Merkel’s power really is. And how absurd German law can be. If Böhmermann intended to show just how powerful satire can be, he has been incredibly successful. The Böhmermann scandal is now entering its third week, and only now is it becoming clear just what the five-minute clip has set in motion. It didn’t just shine the spotlight on the Turkish president’s sensitivity and the limits of chancellor’s steadfastness, it has also unsettled all of Germany – a country which normally doesn’t spend much time thinking about satire and art and the freedoms associated with them.

On Friday, the need for doing so became even more apparent. Chancellor Merkel announced that the federal government had granted permission for criminal proceedings to go ahead against Jan Böhmermann under the controversial Paragraph 103 of the German Criminal Code. The law makes it illegal to insult the representatives of foreign countries. The federal government must approve the initiation of Paragraph 103 proceedings.

These things take much longer to sink in then they do to happen.

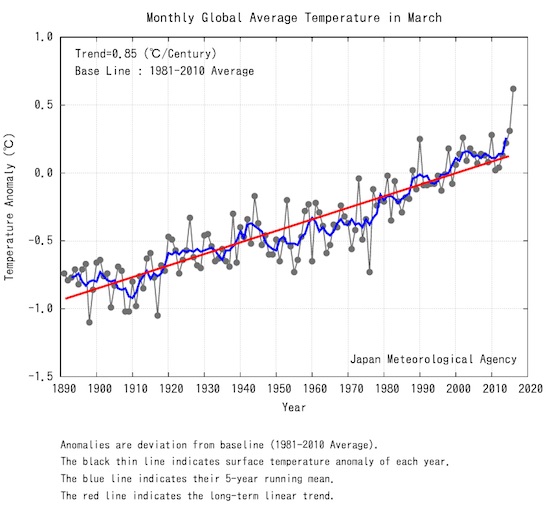

• March Global Temperature Smashes 100-Year Record (G.)

The global temperature in March has shattered a century-long record and by the greatest margin yet seen for any month. February was far above the long-term average globally, driven largely by climate change, and was described by scientists as a “shocker” and signalling “a kind of climate emergency”. But data released by the Japan Meteorological Agency (JMA) shows that March was even hotter. Compared with the 20th-century average, March was 1.07C hotter across the globe, according to the JMA figures, while February was 1.04C higher. The JMA measurements go back to 1891 and show that every one of the past 11 months has been the hottest ever recorded for that month.

Data released released later on Friday by Nasa confirmed last month was the hottest March on record, but the US agency’s data indicated February had seen the biggest margin. The Nasa data recorded March as 1.65C above the average from 1951-1980, while February was 1.71C higher. The World Meteorological Organisation, the UN body for climate and weather, said the March data had “smashed” previous records.

Let’s see if this is more than just a show.

• Pope Francis Flies To Lesbos To Highlight Humanitarian Crisis In Europe (G.)

Pope Francis, widely regarded as one of the world’s greatest defender of refugees, flies into Lesbos on Saturday to highlight the humanitarian crisis unfolding in Europe. The Roman Catholic leader will spend five hours on the island with the Ecumenical head of world Orthodoxy, Patriarch Bartholomew I, and Archbishop of Athens and All Greece, Ieronymos II. Imbued with added urgency on the frontline of the EU’s migrant emergency, the meeting is also being seen as a further warming of ties between the western and eastern branches of Christianity, almost 10 centuries after their bitter split in 1054. The pontiff, who has publicly criticised Europe’s “anaesthetised conscience” on refugees, will go straight to the menacing detention centre above the hilltop village of Moria where more than 3,000 men, women and children are held.

On Friday, just hours before Francis’ scheduled visit, detainees chanted “freedom, freedom” as demonstrators denounced their incarceration. Standing under the razor wire-topped fence, Sham Jutt, a young Pakistani, spoke of the refugees’ plight, saying he hoped the pope could intervene. “We expected a life of hope and now he is our only hope,” said the 21-year-old, adding that he had seen the camp change from being a registration centre to a prison following the controversial pact the EU signed with Turkey to stem the flows. “Now, with this agreement, we are very afraid they will deport us.” Greece’s leftist-led government described Saturday’s visit of religious leaders as “extremely significant”. Lesbos has borne the brunt of the refugee influx with over 850,000 of the 1.1 million Syrians, Afghans and Iraqis who streamed into Europe last year, coming through the island.

Prime minister Alexis Tsipras, also due to fly in, was expected to underline Greece’s increasingly fragile situation in talks with Francis. More than 50,000 migrants and refugees have been trapped in the country since Macedonia and other Balkan states cut off the migrant trail by closing borders. Greece has been struggling to house refugees in makeshift facilities even if arrivals have dropped dramatically since the deal came into effect on 20 March. For detainees who have arrived since then, conditions have deteriorated dramatically. Human rights organisations have withdrawn from Moria and other detention centres for fear of being associated with mass expulsions.

Before the church leaders’ visit, authorities had gone out of their way to clean up the camp, whitewashing graffiti-splattered walls, replacing tents with containers, installing air conditioning and taking families out of the overcrowded facility to an open-air holding centre nearby. “In every sense of the word, they have given it a whitewash,” said Jakob Mamzzak, a volunteer from California. “Today we even heard they had given [inmates] clean clothes, let them have their first shower in 25 days and brought them good food when the truth is conditions are inhumane.”

Taking 10 refugees with him on his way back.

• Pope Francis Visits Lesbos, Frontline Of Europe’s Refugee Crisis (Reuters)

Pope Francis arrived on the Greek island of Lesbos on Saturday, turning the world’s attention to the frontline of Europe’s migrant crisis which has claimed hundreds of lives in the past year. Francis, leader of the world’s 1.2 billion Roman Catholics, was scheduled to spend about six hours on the small Aegean island. Based on his schedule, he was to meet 250 refugees and have lunch with eight of them. Hundreds of people have died making the short but precarious crossing from Turkey to the Lesbos shores in inflatable dinghies in the past year, and the island is full of unmarked graves. “This is a trip that is a bit different than the others … this is a trip marked by sadness,” Francis told reporters on the airplane taking him to Lesbos.

“We are going to encounter the greatest humanitarian catastrophe since World War Two. We will see many people who are suffering, who don’t know where to go, who had to flee. We are also going to a cemetery, the sea. So many people died there … this is what is in my heart as I make this trip.” With Ecumenical Patriarch Bartholomew, leader of the world’s Orthodox Christians, and Greek Prime Minister Alexis Tsipras, Francis will visit Moria, a sprawling, fenced complex holding more than 3,000 refugees. “This is an island which has lifted all the weight of Europe upon its shoulders,” Tsipras told Francis at Lesbos airport, where a red carpet was rolled out for the pontiff’s arrival. Greek state TV reported Francis was planning to take ten refugees back with him to the Vatican, eight of them Syrians.

Aid organizations have described conditions at Moria, a disused army camp, as appalling. Journalists have no access to the facility on a hillside just outside Lesbos’s main town of Mytiline, but aid workers said walls were whitewashed, a sewer system fixed and several dozen migrants at the overcrowded facility were transferred to another camp, which the pope will not visit. . Aid organizations say queues for food are long, and people often wait for an hour or more. Saturday’s encounter with refugees would be ‘no frills’ and the religious leaders would eat the same food as everyone else at the camp, an official at the camp told Reuters.

The Pope should speak out a lot louder and clearer. Meeting a few preselected refugees won’t cut it.

• Lesbos Refugee Detention Centre Whitewashed For Pope’s Visit (Ind.)

A detention centre for asylum seekers in Greece is being urgently spruced up ahead of a visit by the Pope as thousands of people remain trapped inside, waiting to find out if they will be sent back to Turkey. Workers were dispatched to whitewash the wall surrounding Moria, a former refugee camp on the island of Lesbos, while others painted fences, cleared litter and moved stray tents. The last-minute efforts on Friday came ahead of Pope Francis’ arrival tomorrow with a delegation of Catholic and Orthodox leaders. Sacha Myers, who is working inside Moria with Save the Children, told The Independent that the now “very white” wall was not a priority for the families living inside Moria. “We hope the improvements continue but they don’t change the fact that we have still got thousands of people locked inside this detention centre with no idea how long they will be here,” she said.

“The camp was built to hold 2,000 people and now there are 2,900. Families are living on top of each other, there is absolutely no privacy. “We’re seeing a real deterioration in conditions.” Ms Myers, a communications and media manager for the charity, said she had met Iraqi and Syrian mothers whose babies were ill with diarrhoea and fever amid declining hygiene. “Some people are aware of the Pope’s visit,” she added. “They really want him to help them and understand their issues.” Save the Children is warning that child refugees are being held in appalling conditions at the centre, where they report illness, fights and theft. Charity workers described dirty rooms without enough beds, where children are denied legal services and basic support despite concerns for their mental and physical wellbeing.

High-profile visits by Angelina Jolie, Greek Prime Minister Alexis Tsipras and Labour MP Yvette Cooper, among others, have done little to improve the situation in Moris. It was set up last year as one of two refugee camps in Lesbos, but on 20 March the gates were locked as it was turned into a detention centre as part of the controversial EU-Turkey deal. The Pope will be joined by leaders of the Catholic and Orthodox churches as he tours Lesbos, which has seen the highest number of refugees arrive out of any island in Europe. After visiting Moria, they will have lunch with refugee representatives and make a joint declaration, before heading to the island’s capital for a prayer service in memory of the many asylum seekers who have drowned attempting to reach Europe.

The Vatican said the five-hour visit to Lesbos was purely humanitarian and religious in nature, not political, and wasn’t meant as a criticism of the deportation programme seeing some asylum seekers sent back to Turkey. Pope Francis said he intended “to express closeness and solidarity both to the refugees and to the Lesbos citizens and all the Greek people who are so generous in welcoming (refugees)”. The pontiff has been outspoken in calls for greater compassion and international co-operation in the refugee crisis, denouncing the “globalisation of indifference” during a trip to Lampedusa – another migrant hotspot.

Home › Forums › Debt Rattle April 16 2016