Pablo Picasso Femmes d’Alger -Women of Algiers (after Delacroix) 1955

Pelosi Schumer

It would be a real shame if everybody watched and shared this right now.

A REAL shame… pic.twitter.com/bYKhb5QvlN

— Gain of Fauci (@DschlopesIsBack) March 9, 2024

Obama

This wasn't 30 years ago. This was President Obama in 2009 on immigration.

"We can't have half a million people pouring over the border…"

About 7 years later these same positions were considered racist and xenophobic by Democrats. pic.twitter.com/X41Qk0Qe2x

— MAZE (@mazemoore) March 11, 2024

Zhirinovsky

On March 17th, 2006, Russian Politician Vladimir Zhirinovsky made a remarkably prophetic prediction about Ukraines future to the panel of a Ukrainain TV show.

Listening to him is the far right leader of Ukraines ultra nationalist "Right Sector" Oleg Tyahnybok.

Tyahnybok, a… pic.twitter.com/CEtnhiznXZ

— Chay Bowes (@BowesChay) March 10, 2024

Tucker Steve Kirsch

Tucker Jordan Peterson, Conrad Black

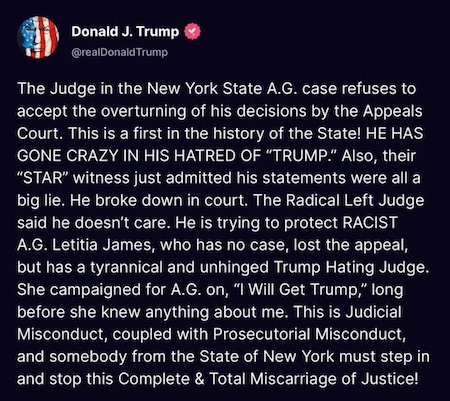

“..Smith insisted that the oft-cited Justice Department policy to avoid such proceedings within 60 days of an election would not be applied in Trump’s case..”

• A Trump Criminal Trial Could Run Right Through 2024 Election (Turley)

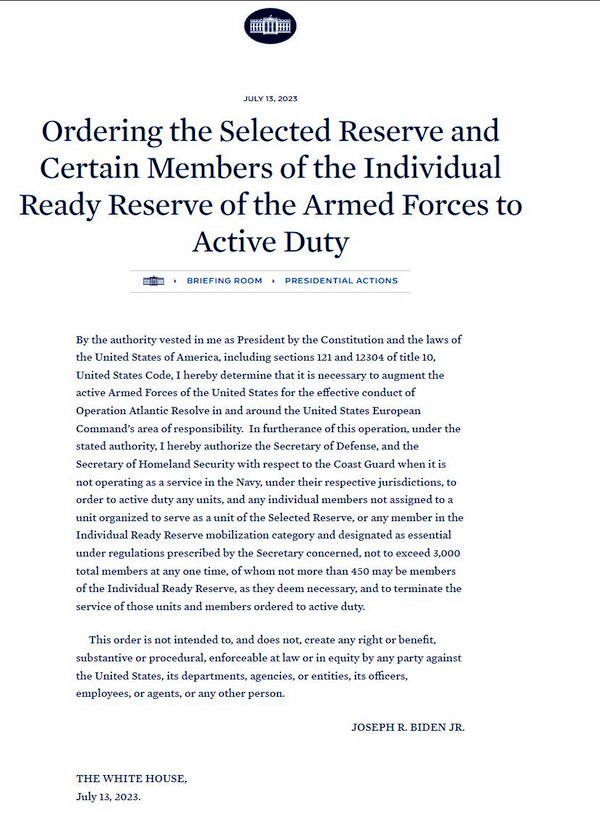

“This trial will not yield to the election cycle.” Those words of U.S. District Judge Tanya Chutkan last year made clear that she will not consider that Donald Trump will likely be the 2024 Republican presidential nominee in setting the schedule for his federal trial in Washington, D.C. Most recently, in the federal prosecution in Florida, Special Counsel Jack Smith declared that he will not consider himself bound by the Justice Department’s longstanding policy of not bringing charges or holding trials of candidates close to an election. With the Supreme Court reviewing the immunity question (and a decision not expected until June), a nightmare scenario is unfolding in which Trump could be tried not just before the general election, but actually through November’s election. Chutkan has insisted that her refusal to consider Trump’s candidacy is simply denying special treatment to the former president.

But there is nothing typical about how she and others have handled the case. The fact that Chutkan was pushing for a March trial date shows just how extraordinary her handling has been. In the D.C. courts, with thousands of stacked up cases, that would be a rocket docket for a complex case of this kind. There are roughly 770,000 pending cases in roughly 100 district courts around the country. The backlog of pending criminal cases in the federal court system increased by more than a quarter in the last five years. Even when defendants plead guilty, criminal cases average 10 months. If a trial is needed, it runs on average to two years, absent serious complications over classified or privileged material. Smith indicted Trump less than a year ago. At every juncture, Smith has tried to expedite and spur the case along. This has included an attempt to cut off standard appellate options for Trump. It seems as if the entire point is to try Trump before the election. Smith has offered no reason, other than that he wants voters to consider the outcome of the trial.

It is a rare acknowledgement of a desire for a trial to become a factor in an election. Chutkan has shown the same determination. The judge was criticized for comments she made before any charges were brought that strongly suggested she thought Trump should be criminally charged. Chutkan told one defendant that he showed “blind loyalty to one person who, by the way, remains free to this day.” In another case, Chutkan told the defendant that it was unfair that he might go to prison but “the architects of that horrific event will likely never be charged.” When asked to recuse herself, Chutkan denied the clear implication of her own words. She stated that she has not expressly stated that “’President Trump should be prosecuted’ and imprisoned… And the defense does not cite any instance of the court ever uttering those words or anything similar.” Of course, neither the court nor the prosecutors seem willing to apply a similarly deferential view of the meaning of Trump’s words within the context of the case.

There, the implications are sufficient for that “one person” described earlier by the court. Chutkan is now reportedly telling parties in other cases that she will be out of the country in August, and that defendants will have to delay any proceedings in light of her plans…unless she can try Trump. She told lawyers that she will stick with her schedule unless “I’m in trial in another matter that has not yet returned to my calendar.” Given the apparent motivation of the trial court to try Trump before the election, the only other source of restraint would be the Justice Department itself. Smith, however, has insisted that he will show no such restraint, even if he tries Trump through the election. In his filings in Florida, Smith insisted that the oft-cited Justice Department policy to avoid such proceedings within 60 days of an election would not be applied in Trump’s case. He insisted that, since everyone knows about the allegations, there would be no harm or foul in holding him for trial for the weeks before the election as his opponent, President Biden, is free to traverse the country campaigning.

“Trump said that if he returns, he will not do this, [he will] not [allocate] a penny. And then this war will end..”

• Orban Says Trump Pledged Not to Provide Financial Aid to Ukraine (Sp.)

Former US President Donald Trump said that he would not provide financial assistance to Ukraine if elected this fall, Hungarian Prime Minister Viktor Orban said. On Friday, Trump met with Orban at his Mar-a-Lago residence in Florida to discuss a wide range of issues of common interest for Hungary and the United States. “If the Americans do not give weapons and money, and the Europeans follow them, then the war will end. If the Americans do not give money, then the Europeans are not able to finance this war themselves, and then it will end.

Trump is not president now, but his party interferes when the Democrats want to send money to the war. Trump said that if he returns, he will not do this, [he will] not [allocate] a penny. And then this war will end,” Orban said in an interview with Hungarian broadcaster M1. Trump and Orban are longtime allies who share conservative political views and have publicly expressed mutual respect and support. Orban has thrown support behind Trump both in the US presidential race and the legal challenges he is facing.

President @realDonaldTrump was a president of peace. He commanded respect in the world, and created the conditions for peace. During his presidency there was peace in the Middle East and peace in Ukraine. We need him back more than ever! Thank you for the invitation, Mr.… pic.twitter.com/4nSqwoYxMV

— Orbán Viktor (@PM_ViktorOrban) March 10, 2024

“These are ideas so old they leave the U.S. in a state of ever more extreme isolation in a world eager to get on with the 21st century..”

• Old Man Shouting, “The American Empire is Doing Great!” (Patrick Lawrence)

Democratic elites and the reporters who clerk for them were effusively approving of Joe Biden’s State of the Union speech last Thursday evening—not so much for what he said, which came nothing new, as for the demeanor of our enfeebled president. Never mind that Biden reduced an occasion intended to address all Americans as to the condition of their nation to a cheap stump speech. He avoided falling down for his hour at the podium while stringing coherent sentences (mostly) together in the cause of his political survival. That is what counted. “This was not Old Man Joe,” Peter Baker fairly ejaculated in Friday morning’s New York Times. “This was Forceful Joe. This was Angry Joe. This was Loud Joe. This was Game–On Joe.” Wow. I seemed to have missed that, Joe.

I saw Joe who trades in hollow appearances. This was Joe urging both houses of Congress and 32 million television viewers to join in making believe we still live in the 20th century. This was Joe pretending America’s global primacy is intact. This was Joe refusing to recognize the emergence of new poles of power and the high cost this refusal exacts. “A nation that stands as a beacon to the world. A nation in a new age of possibilities”: You wouldn’t believe an American public figure, to say nothing of a president, would still trade in this kind of exhausted pabulum. Denial of this kind, we must not fail to remind ourselves, does not come cheap. You have to wonder who is driving the bus after listening to a speech as vapid as Biden’s, and I will attempt an answer to this question in due course. Here is the passage in Biden’s speech that most aroused all the Peter Baker liberals eager to see him reelected in November:

“My fellow Americans, the issue facing our nation isn’t how old we are, it’s how old are our ideas…. [Y]ou can’t lead America with ancient ideas that only take us back. To lead America, the land of possibilities, you need a vision for the future and what can and should be done.” These remarks—Biden rehearsed them severally in preceding days—bring us to some very difficult recognitions, even if Biden’s speechwriters intended them otherwise. No recent president I can think of has proven more abjectly bereft of new ideas than Joe Biden. The reckless support of “the Jewish state,” the proxy war in Ukraine, the obsessive Russophobia, the provocations across the Taiwan Strait, the covert operations in Syria and elsewhere, the sanction regimes imposed on too many nations to count, the vassalization of Europe: There is no new thinking in any of this. These are ideas so old they leave the U.S. in a state of ever more extreme isolation in a world eager to get on with the 21st century. Joseph R. Biden, Jr., is the face of the American imperium as it insists on prolonging itself. This is not a role with any originality or vision to it.

“..the elites could permit Trump to assume the Presidency because they know that they can prevent him from achieving what those who elected him want..”

“.. If all else fails, the bullets that destroyed JFK and RFK are available.”

• Can Americans Have Hope? (Paul Craig Roberts)

The issue that faces us is: There is no possibility whatever of Biden being reelected. The fool lined up with Israel in the genocide of the Palestinian people. The fool has lost the war in Ukraine that absorbed untold billions of American money. The fool has violated his oath of office and has not only allowed but has actively participated in bringing in during his 4 years 48 cities the size of Pittsburgh full of immigrant-invaders, actually flying in at the expense of US taxpayers 320,000 immigrant-invaders. The fool is signing over to an international bureaucracy, WHO, the determination of your health care, which as of May of this year will be out of your hands. I could go on, but how can a candidate described by his own Department of Justice to be too incompetent to stand trial for his illegal possession of secret national security documents be sufficiently competent to be President of the United States and to have in his incompetent hands, so ruled by his own Justice Department, the nuclear briefcase?

How can the Democrats run a candidate for president who has been ruled incompetent by his own government? How is it that Democrat state judges, attorneys general, and secretaries of state illegitimately rule that Trump cannot be on the Democrat states ballots because he is an “insurrectionist”? Trump has not been convicted as an insurrectionist. Why do these dumbshit Demorats think that their assertion amounts to a conviction? Moreover the 14th Amendment assigns that decision to the US Congress, not to state judges, attorney generals, and secretaries of state. Are the Democrats so utterly stupid and incompetent that they do not understand basic law and cannot understand that they are asserting a power that they do not have? Yes, I believe that is the case. For decades Democrats have been appointing legal and constitutional illiterates to the judiciary, knowing that the only way Democrats can achieve a one-party tyrannical state is by using stupid people to weaponize law.

With polls showing that 90% of the voting population regard Biden as too old or too incapable to serve as president, why are the Democrats running him? Is it because they have no other candidate? Or is it because the Democrats have a plan to move Trump aside and neutralize him? Biden has nonexistent chances of winning. This makes it impossible for the Democrats to steal the third national election in a row. To steal an election the vote count has to be close. Otherwise, it is not believable. Perhaps the Democrats have a plan for derailing Trump? Earlier I suggested that the Democrats would have Biden resign for medical reasons. Kamala would become president. She would be instructed to choose Hillary as her VP and then resign herself. This would leave Hillary and her machine in power prior to the election. Then the border conflict between Washington and Texas would be heated up. There would be talk of civil war, and the prospect would be used by Hillary to declare martial law to put down rebellion and cancel the election.

As much sense as this makes for the Democrats, there is little evidence that they are moving in this direction. So how will they keep Trump out of office? As Trump has declared war on the American ruling elites,they are determined to keep him away from power. Has Trump been re-educated so that he no longer wants normal relations with Russia? We know he is in Israel’s pocket, which is a great gift to the control that the establishment has over Trump. The question before us is: Does Trump want vindication by reelection more than he wants to overthrow the elite and return government to the people as democracy requires? If he hasn’t struck a deal with the elites, why would they allow him, their enemy, be in the Oval Office? Could it be that the elite know how much more powerful they are compared to a mere US president? When it comes down to the question, what can Trump do?

If he is able to understand the situation and to identify people able and willing to help him take power from the ruling elite and to restore power to the people, he still has the problem of getting a bought-and-paid-for US Senate to approve his appointments. Remember, Trump’s appointment of General Flynn lasted two weeks. My updated opinion is that the elites could permit Trump to assume the Presidency because they know that they can prevent him from achieving what those who elected him want, thereby demoralizing the American citizens who had hope that a leader would restore and revitalize their nation. They know that they can orchestrate an economic catastrophe that would destroy Trump’s presidency and keep Republicans out of office for many years. If all else fails, the bullets that destroyed JFK and RFK are available. There is no doubt that the corrupt US media would attribute Trump’s assassination to “a lone gunman.”

“Don’t let the enemies-from-within end America in so despicable a manner. Don’t let this be how America ends..”

• No Borders? No America (Justin Smith)

Former President Donald Trump has promised to start the largest mass deportation of illegal aliens in U.S. history, if he wins the upcoming election, and he plans to use the military to implement it, rightfully so. As reported in the Washington Post [February 21st 2024], Karoline Leavitt, spokeswoman for the Trump campaign, stated: “Americans can expect that immediately upon President Trump’s return to the Oval Office, he will restore all his prior policies, implement brand new crackdowns that will send shock waves to all the world’s criminal smugglers, and marshal every federal and state power necessary to institute the largest deportation operation in American history” as she also added that illegal aliens “should not get comfortable because very soon they will be going home.”

We have the absolute right and a duty as sovereign citizens, living in sovereign states, to defend ourselves and our families, in the wake of a lawless federal government, this lawless Biden regime. The authority rests within the Constitution which has always allowed for the use of the States’ militias or the military to be mobilized for just such circumstances, and although we can be certain that Biden and some state governors will keep refusing to utilize the mechanisms at their disposal to fast-track the removal of these invaders, we have the right to gather ourselves armed with pistols and rifles — those of us able with the time and backbone to do so — to go to the border and tell the Border Patrol to do join us and do their Constitutional duty to stop the millions more who will try to cross between now and January 2025.

I oft suggested in years past, half-jokingly, not so much anymore, that we should put them on a plane, parachutes optional, and shove them out over Mexico. This comment has become so much more full of meaning, now that we know the Biden regime has actively been seeking out these illegal caravans and flying their members into America. No matter how they arrive, by a fast jet, a slow boat or a reliable bus or train, we must send them back on a super-charged bus or jet just as quickly. Set about to deport every last one of them, and then effectively and totally seal the border and place a ten year moratorium on all immigration, legal and illegal, or until we have our nation and our population straightened out in a fashion that puts us back on a path to the same level of exceptionalism that used to be the rule in America and removes or eradicates, with extreme prejudice, those radicals who seek to fundamentally transform America and end our republic.

Don’t let the enemies-from-within end America in so despicable a manner. Don’t let this be how America ends. Fight back like hell, and when the time is right, make the bastards who have committed this treason against America pay with their own lives.

“..France and Poland have no right to speak on behalf of NATO, and the alliance’s intervention in the conflict would “erase the path to diplomacy.”

• NATO Can No Longer Hide Its Military Presence in Ukraine – Zakharova (Sp.)

Spokeswoman of the Russian Foreign Ministry Maria Zakharova commented on the statement by Polish Foreign Minister Radoslaw Sikorski about the presence of soldiers NATO countries in Ukraine, telling Sputnik: “They couldn’t hide it any longer.” Earlier in the day, Polish Foreign Minister Radoslaw Sikorski said during a panel discussion at an event dedicated to the 25th anniversary of the country’s accession to the alliance that some NATO countries have already sent their military to Ukraine. The event was broadcasted on the Sejm RP YouTube channel. “NATO soldiers are already present in Ukraine,” Sikorski said. Sikorski added that he is not going to disclose which states sent their military there, “unlike some politicians.” Earlier, the diplomat Sikorski said that the presence of NATO forces in Ukraine “was not unthinkable,” adding that he appreciated Macron’s initiative on the possibility of sending Western troops to Ukraine.

Polish President Andrzej Duda, in turn, expressed his opinion that Warsaw needs to build a large airport to transport NATO troops. At the end of February, Macron said that France would do everything to prevent Russia “from winning this war.” According to him, the leaders of Western countries have discussed the possibility of sending troops to Ukraine and, although no consensus had been reached in this regard, nothing could be ruled out. Later, the French president, who was sharply criticized for his statements, noted that all his words were carefully considered. He also emphasized that Paris “has no limits or red lines” on the issue of assistance to Kiev. At the same time, the authorities of many European countries stated that there is no talk of transferring military personnel to Ukraine. In particular, German Chancellor Olaf Scholz and Defense Minister Boris Pistorius emphasized that Germany would not send its military personnel to the republic.

In addition, the head of the German government clarified that NATO countries as a whole are not going to do this. Italian Defense Minister Guido Crosetto likewise said that France and Poland have no right to speak on behalf of NATO, and the alliance’s intervention in the conflict would “erase the path to diplomacy.” Commenting on Sikorski’s revelation, Russia’s Foreign Ministry spokeswoman Maria Zakharova told Sputnik that the alliance’s members could no longer hide it. In his annual address to the Russian Federal Assembly in late February, President Vladimir Putin warned that the consequences of a possible NATO intervention in Ukraine would be tragic for the alliance’s deployed troops.

“It is not for Russia to tell us how we should help Ukraine in the coming months or years..”

• France Just Can’t Calm Down, Itching to Start World War III (Sp.)

France is forming a coalition of nations that are willing to consider the possibility of deploying Western forces to Ukraine, Politico reports. On Friday, French Foreign Minister Stéphane Séjourné travelled to Lithuania to hold a meeting with his Baltic and Ukrainian counterparts to promote the idea that foreign forces might assist Ukraine in tasks such as de-mining. Séjourné repeatedly mentioned mine clearance operations as a potential area of assistance, stating it “might mean having some personnel, [but] not to fight.” “It is not for Russia to tell us how we should help Ukraine in the coming months or years,” Séjourné said at a meeting chaired by Lithuanian Foreign Minister Gabrielius Landsbergis and attended by his Ukrainian counterpart, Dmytro Kuleba.

The newspaper recalled French President Emmanuel Macron’s remarks about the possibility of sending servicemen from Western countries to Ukraine. Subsequently most EU members, including Germany, the Czech Republic, and Poland, clarified they had no such plans. However, as Politico writes, Estonia, Latvia, and Lithuania appeared “much more open to the idea.” Commenting on Macron’s statements, Kremlin spokesman Dmitry Peskov stressed that NATO troops’ potential boots on the ground in Ukraine will lead to an inevitable conflict between Russia and the alliance. Russia has repeatedly warned NATO countries that arms supplies to Ukraine would be considered legitimate targets. Moscow has accused NATO countries of “playing with fire” by arming Ukraine, emphasizing that such actions hinder the possibility of Russia-Ukraine negotiations.

“The current trend is toward total militarization and a five-fold build-up in all respects..”

• West Is Conducting ‘All-Out Militarization’ To Defeat Russia – Vucic (ZH)

Last week we detailed that during Ukrainian President Zelensky’s visit to Albania where he appealed for more weapons from Balkan countries, he pushed the idea that all Western-friendly Balkan states should have a pathway to the EU and NATO. And at the same time French President Emmanuel Macron has been busy floating the possibility of Western troops deploying to Ukraine. Albania is of course a chief regional rival to Moscow’s close ally and friend Serbia. Jahja Muhasilovic, a political analyst on the Balkans, had commented of Zelensky’s rare Balkan trip that “Albania is known to be one of the staunchest supporters of limiting Russia’s influence here in the region.” “In a way, Zelensky’s visit in Albania is having that geopolitical connotation. He is probably counting on the Western Balkan countries not to help them militarily because they are limited, but through their lobbying part that they can play in continuing the armament of the Ukrainian troops,” he explained.

In fresh comments this weekend, Serbian President Aleksandar Vucic has weighed in and responded to ongoing calls from Western officials to urgently send more weapons to Kiev. Vucic has accused the West of pursuing a policy of “total militarization” toward defeating Russian, which puts the region and the world on the brink of disaster and stumbling to WW3. “What is happening now is madness,” he was cited in regional media as saying. “They all thought that Putin would be easily defeated. Now they see that this is not so.” “The current trend is toward total militarization and a five-fold build-up in all respects,” the Serbian president said further during a visit to the Belgrade Military Technical Institute. Vucic has also warned against European countries sending their troops to Ukraine to confront Russian forces, saying this would immediately and unpredictably escalate the war.

“He didn’t mix it up. He can no longer retain to himself what everyone understands – the US have disgraced themselves in the bloodiest manner with the whole Ukrainian project..”

• ‘We Shouldn’t Have Gone Into Ukraine’ – Biden (RT)

In another of his gaffes, Joe Biden has said that Washington made a mistake by going into Ukraine. The US president was actually talking about a different country in another part of the world. In the course of an interview with MSNBC on Saturday, Biden was criticizing Israeli Prime Minister Benjamin Netanyahu, saying that by ignoring civilian casualties during the IDF’s military operation in Gaza, he was “hurting Israel more than he’s helping Israel.” According to the latest data from the Gaza health ministry, 31,045 people have been killed and 72,654 others wounded since October 7, after which the IDF began its attacks on the Palestinian enclave in response to the Hamas incursion into Israel, in which an estimated 1,200 people lost their lives and over 200 were taken hostage. Biden recalled how, during his visit to Israel early in the conflict, he had warned Netanyahu against making a “mistake” that the US made after 9/11.

“America made a mistake. We went after Osama bin Laden until we got him, but we shouldn’t have gone into Ukraine…” the 81-year-old said. The president quickly corrected himself, saying: “We shouldn’t have gone into the whole thing in Iraq and Afghanistan.” Those military campaigns by the US “caused more problems than they cured,” he added. Russian Foreign Ministry spokeswoman Maria Zakharova infused the subject with a little sarcasm and said Moscow actually disagreed with the reporting in the media, that Biden had simply confused Ukraine with Iraq and Afghanistan. “He didn’t mix it up. He can no longer retain to himself what everyone understands – the US have disgraced themselves in the bloodiest manner with the whole Ukrainian project,” she wrote on Telegram on Sunday.

After repelling Ukraine’s counteroffensive last year, Russian forces have been steadily improving frontline positions, capturing the strategic stronghold of Adveevka in Russia’s People’s Republic of Donetsk last month, and several other settlements. Washington has been Ukraine’s primary backer since the escalation to armed confrontation in February 2022 of long-simmering conflicts between Moscow and Kiev, and has provided over $111 billion in military and financial assistance. However, in recent months, US aid has subsided drastically as the Biden administration struggles to overcome Republicans’ resistance to its efforts at pushing through another $60-billion in aid for Ukraine. It’s not the first time that Biden has confused countries and places. In June, he said that “Putin is losing the war in Iraq.” In a more recent blunder, he said a week ago that the US and partners were discussing “airdrops of food and supplies into Ukraine,” while actually meaning proposed airdrops into Gaza.

They left it all to the Houthis.

• Islamic World Has Let Palestinians Down – Erdogan (RT)

Muslim-majority countries did not do enough to stop Israeli forces from killing Palestinian civilians in Gaza, Turkish President Recep Tayyip Erdogan has said. He made his comment as the war between Israel and Hamas entered its sixth month. “We have all witnessed together how the Universal Declaration of Human Rights became just a piece of paper when it comes to the right to live for Palestinian children, women and innocent civilians,” the Turkish leader said at an event in Istanbul on Saturday. Erdogan went on to argue that the war in the Middle East “has shown us that the Islamic world still has very significant shortcomings, especially in terms of acting in unity” when attempting to pressure Israel to end its operation in Gaza. Unfortunately, the Islamic world, with its population of nearly 2 billion people, has failed to properly fulfil its brotherly duty to the Palestinians.

The president said that, despite the “hard work and many efforts in the diplomatic field,” the Muslim-majority countries ultimately “could not prevent the deaths of innocent children of Gaza from hunger, bullets and bombs.” Ankara has delivered some 40,000 tons of humanitarian aid to Gaza by air and sea, Erdogan said. The remarks came after Israeli Prime Minister Benjamin Netanyahu vowed to continue the offensive on Rafah, a major city near Gaza’s border with Egypt. The city and its surroundings became crowded with refugees after the Israel Defense Forces instructed Palestinians to flee the northern part of the enclave. Netanyahu has rejected international calls for a ceasefire, arguing that the IDF must clear out “the last Hamas stronghold” in Rafah. Israel declared war on Hamas after the militant group unexpectedly attacked southern Israeli cities on October 7, killing some 1,200 people and taking more than 200 hostages. More than 30,000 Palestinians have been killed in Gaza since the fighting began last year, according to local authorities.

“Netanyahu and his hateful administration have added their names to the list of ‘today’s Nazis’ alongside Hitler, Mussolini, Stalin, Pol Pot, Franco and other assassins of the modern era..”

• Erdogan Among ‘Greatest Anti-Semites In History’ – Israeli FM (RT)

Turkish President Recep Tayyip Erdogan ranks among the worst anti-Semites in history because of his stance on the Gaza conflict, Israeli Foreign Minister Israel Katz has claimed.In a speech on Saturday, Erdogan compared Israeli Prime Minister Benjamin Netanyahu to Nazi German dictator Adolf Hitler, referring to the relentless IDF attacks on Gaza, which have killed at least 30,960 people and wounded 72,524 others, according to the health ministry in the Palestinian enclave. He also again refused to label Hamas a terrorist organization, saying Ankara “firmly backs” the leadership of the Palestinian armed group. Katz, a member of Netanyahu’s Likud Party, responded to the Turkish president’s remarks a few hours later on X (formerly Twitter), in both Hebrew and Turkish.

Hamas committed “murders and sexual assaults” during its incursion into Israel on October 7, in which more than 1,100 people were killed and some 240 taken hostage, he said, claiming that Erdogan’s support for the group makes him one “of the greatest oppressors and anti-Semites in history. ”Türkiye has become “the largest supporter of terrorism in the world, along with Iran,” which brings “shame” on the country, the diplomat insisted. In his address in Istanbul, Erdogan, who has been among the harshest critics of Israel in recent months, said the leadership of the Jewish state was responsible for “crimes against humanity” in Gaza. “Netanyahu and his hateful administration have added their names to the list of ‘today’s Nazis’ alongside Hitler, Mussolini, Stalin, Pol Pot, Franco and other assassins of the modern era,” he argued.

What is happening in Gaza has “already surpassed the limits of tolerance,” the Turkish leader insisted. “Backed by the unlimited military and diplomatic support of Western powers, Israel, which is a state of terror, is carrying out an all-out policy of genocide against our Palestinian brothers and sisters.” Erdogan noted that Türkiye has already provided some 40,000 tons of humanitarian aid to the people of Gaza by air and sea. He urged the Muslim world to do more to end the hostilities, saying it has so far “failed to properly fulfill its brotherly duty to the Palestinians.” Netanyahu insisted earlier this week that the mounting international pressure for a truce will not make Israel give up on its goal of achieving “total victory in war” against Hamas.

“..Harvard is devoid of intelligence and of integrity. The reason is that Harvard is flush with Big Pharma research money..”

“..What do we make of a country where money is the only value, where even universities, allegedly centers of learning, prefer money to truth?”

• Harvard University, Formerly Great, now Corrupted by Money (Paul Craig Roberts)

Harvard University has just announced that the university has dropped its Covid “vaccine” mandate that the university has coerced students to accept. It would be interesting to know how many Harvard students the mandate murdered and how many whose health has been ruined by the stupid and irresponsible Harvard administrators’ mandate. It also raises the question of how smart Harvard students really are that they would risk an untested “vaccine.” Harvard says, nevertheless, “We strongly recommend that all members of the Harvard community stay up-to-date on COVID-19 vaccines, including boosters. Additionally, we continue to emphasize the benefits of wearing a high-quality face mask in crowded indoor settings.” The university says it still requires that all students supply evidence that they had the initial jab. The university goes on to say in responding to COVID-19 that “we will continue to monitor public health data and will periodically review requirements.”

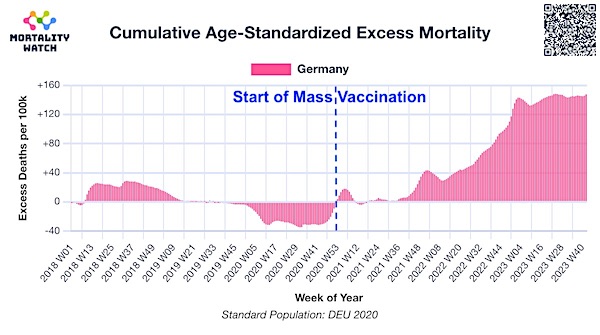

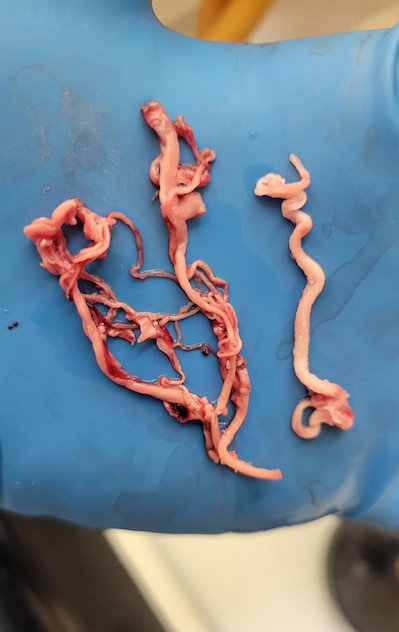

Harvard is allegedly an intelligent institution with a medical school and allegedly has a faculty and administrators capable of assessing facts and making intelligent decisions. Yet we see no sign of any intelligence in the university’s much belated dropping of the vax mandate. We have know for a long time that the mRNA “vaccines” do not prevent a Covid vaccinated person from getting infected with Covid and do not prevent transmission of the virus. Big Pharma Covid vaccine makers themselves now admit this, as do medical authorities. Indeed, the evidence is piling up that the vax makes it more likely for a person to catch Covid. We also know and it has now been admitted–that the mRNA “vaccines” have all of the deadly and health damaging effects that the independent medical scientists said they had. These scientists who told the truth were persecuted by the corrupt US medical establishment.

The evidence is in. There is no longer any question that the “vaccine,” which is not really a vaccine, is not only totally ineffective but very dangerous. Evidence mounts that the “vaccine” is a far greater killer than the lab created virus itself. So why is Harvard still “strongly recommending” more jabs that are ineffective and dangerous? Is this a conclusion from evidence that shows any signs of intelligence? With athletes in the prime of life dropping dead on playing fields all over the world, why is an allegedly intelligent university still requiring students to have had the initial “vaccination”?

Why does an allegedly intelligent university, which I am beginning to think Harvard most certainly is not, requiring students to have taken a vaccine known to be ineffective and dangerous? How can such a non-intelligent, non-rational decision be associated with intelligence? My conclusion is that Harvard is devoid of intelligence and of integrity. The reason is that Harvard is flush with Big Pharma research money, and just as Congress and the President have to vote in keeping with the special interests that fund their campaigns, Harvard votes with Big Pharma. What do we make of a country where money is the only value, where even universities, allegedly centers of learning, prefer money to truth?

The same David Weiss who’s taken 5 years investigating Hunter. Looks like he’s had enough.

• Special Counsel Files Blistering Reply to Hunter Motion to Dismiss (Turley)

Special Counsel David Weiss has filed a blistering opposition to the motion to dismiss by Hunter Biden in California that cites his own book and conflicting statements as creating “nothing more than a house of cards.” The filing (below) shows how Hunter’s claims (repeated by many in the media) collapse under even cursory review in court. Weiss’s filing bulldozes through arguments of selective prosecution and political influence in the case. He specifically notes that Biden repeatedly makes statements without any proof or support in his filings. The filing begins by outright accusing Hunter Biden and his counsel of lying to the court about what occurred after the earlier plea agreement fell apart in court after the judge in Delaware asked about a sweeping immunity clause in paragraph 14. Notably, Weiss said that it was Hunter Biden’s legal team that inexplicably shut down negotiations by playing hardball in seeking to preserve the original agreement:

“The government proposed changes to the agreements that addressed only the issues identified during the hearing. Exh. 3. The defendant rejected these counterproposals on August 7, 2023. Id. Instead, the defendant began insisting that the proposed Diversion Agreement had bound both parties, even though it had not been approved by the Chief U.S. Probation Officer, a condition precedent to formation that would have brought it into effect. Moreover, by taking this position, he chose to shut down any further negotiations that could address the issues raised at the hearing.” It then accuses Biden and his counsel as outright lying to the court:

“In his motion, in multiple places, the defendant falsely states that DOJ ‘inexplicably demanded Mr. Biden plead guilty to felonies with jail time.’ He cites nothing in support of his false claims, which is a consistent theme across his motions. The government attaches as Exhibit 3 a redacted letter from the defendant’s counsel which confirms the defendant understood that the government had proposed changes to only those paragraphs that were at issue during the hearing, not paragraphs regarding the charges the defendant must plead to or any “jail time” the defendant must serve. As shown in Exhibit 3, the government proposed changes to Paragraphs 14, 15 and 17 of the Diversion Agreement, and Paragraph 5(b) of the Plea Agreement. The government proposed no changes to Paragraph 1 of the Plea Agreement, which required the defendant to plead guilty to two misdemeanors. Nor did the government propose any changes to Paragraph 6 of the Plea Agreement, in which the United States had agreed to recommend a sentence of probation. The defendant rejected these counterproposals and refused further negotiations…His newly invented claim in his motion that the government “inexplicably demanded Mr. Biden plead guilty to felonies with jail time” is patently false, unsupported by evidence, and belied by his own letter and representations in his filings in the Delaware case.”

The rest of the filing is equally devastating. Weiss notes that Biden repeatedly misrepresents facts or claims authority that does not exist. He notes that Biden does not cite any cases of similarly situated individuals who were not prosecuted. For example, it notes: “The only attempt the defendant makes to link animus directly to prosecutors is his claim that “reports indicate Mr. Weiss himself admitted [the charges] would not have been brought against the average American.” Motion at 13. However, his citation does not include a reference to reports (plural), rather it includes a single New York Times citation, which includes a denial immediately after the quoted excerpt: “A senior law enforcement official forcefully denied the account.” An anonymous account that is “forcefully denied” is not evidence that can satisfy the defendant’s burden of producing “clear evidence” of discriminatory intent and animus by prosecutors.”

In rejecting the two cases that he references, Weiss takes a swipe at Hunter’s book. When he published the book, some of us noted that he was making statements against his own interest in possible prosecutions. Weiss just made that a reality: “The defendant compares himself to only two individuals: Robert Shaughnessy and Roger Stone, both of whom resolved their tax cases civilly for failing to pay taxes. Shaughnessy failed to file and pay his taxes, but he was not alleged to have committed tax evasion. By contrast, the defendant chose to file false returns years later, failed to pay when those returns were filed, and lied to his accountants repeatedly, claiming personal expenses as business expenses. Stone failed to pay his taxes but did timely file his returns, unlike the defendant. Neither Shaughnessy nor Stone illegally purchased a firearm and lied on background check paperwork. And neither of them wrote a memoir in which they made countless statements proving their crimes and drawing further attention to their criminal conduct. These two individuals are not suitable comparators, and since the defendant fails to identify anyone else, his claim fails.”

“In Switzerland, such drastic changes to national health legislation would require changes in the nation’s Constitution. According to the very Swiss Constitution, such changes would require approval by the Swiss people by referendum..”

• Open Letter to the People of Switzerland, Federal Council, Parliament (GR)

We, the Swiss, have the Constitutional Right of Initiatives or Referenda. It is high time that We, the People, make use of this opportunity requesting the Swiss Federal Council and Parliament to renounce its membership in the WHO, the organization at the verge of becoming the world’s dictator on issues of health, more brutal and radical than humanity has ever known before. The Covid-mandates imposed by the WHO were just a precursor to what may come. For the last several years, the WHO was preparing mostly behind closed doors what they call a “Pandemic Treaty”, or “Pandemic Agreement”, which would become part of the 2005 established and now being drastically revised “International Health Regulations” (IHR). If these two new “rules-based orders” are approved by the World Health Assembly (WHA – 27 May to 1 June 2024 in Geneva), the WHO’s health dictate would be above every nation’s sovereignty, and would make health self-determination a thing of the past.

If the WHO declares a disease, artificially made or not, as a pandemic, orders would have to be followed. If the WHO decides on general vaccination, orders must be followed. In Switzerland, such drastic changes to national health legislation would require changes in the nation’s Constitution. According to the very Swiss Constitution, such changes would require approval by the Swiss people by referendum – with good chances of a popular rejection. To forego a people’s vote, the Swiss Government – Federal Council and Parliament – are currently working on advance-amending the national Swiss health legislation, so that it would meet the requirements of a potentially impending WHO Pandemic Agreement and the new IHR. A Constitutional amendment may then not be necessary, as the new Swiss health standards would blend in with the potentially new WHO dictate.

This is happening semi-clandestinely. Not known to most citizens. Switzerland is supposed to be – constitutionally – a democracy and a country of political neutrality; a country with self-determination and sovereignty in decision making, and where people’s voice and active participation counts. Those were the days. * This call also goes to the Swiss Federal Council and Parliament. Are you not ashamed after the criminal covid and vaxx-fraud you imposed on the very people that pay your salaries and pensions – to betray Us, the People again – with the behind-our-backs anticipatory acceptance of the new WHO oppressive rules? How is health defined? Under the WHO definition, health includes the “climate change” scam, which is already blamed for causing excess dengue fever in Brazil and malaria in Africa – prompting the WHO and Bill Gates releasing billions of genetically modified (GMO) “vaccinating” mosquitoes. They have so far brought a 400% increase in dengue fever in Brazil, and in Africa, malaria is rampant despite, or because of the GMO-Mosquitos. Any “climate-related health issues”, defined by the WHO, would also fall under the WHO health tyranny.

“The Dominican Republic topped the list as the world’s happiest country, followed by Sri Lanka in second place and Tanzania in third. All of the top ten countries were African, Asian, or Latin American nations.”

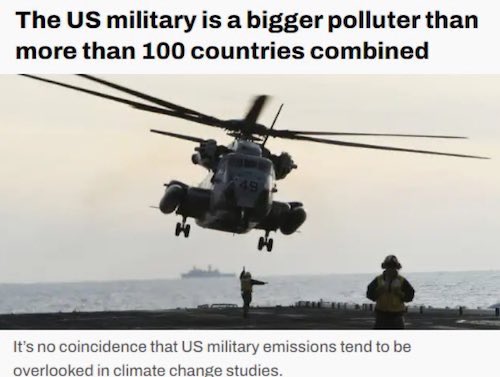

• UK Ranked Second-Most Miserable Country In The World (RT)

Published last week, Sapien Labs’ fourth annual ‘Mental State of the World’ report assessed the mental wellbeing of 419,175 Internet-enabled participants across 71 countries. The results painted a grim picture of the English-speaking world. Out of 71 countries surveyed, the Anglophone nations of the UK, Ireland, Australia and New Zealand sit in the bottom quartile, with residents of the UK happier only than those of Uzbekistan. The survey ranks the UK eight places behind Yemen and 12 places behind Ukraine in terms of its population’s overall mental health. Some 35% of Britons told Sapine Labs that they were either “distressed or struggling,” a figure down by only 0.7% since last year, when Britain came in last place in the rankings.

To determine each nation’s overall mental health, the foundation asked individuals 47 questions about their “mood and outlook,” “social self,” “drive and motivation,” and “adaptability and resilience,” among other categories. While Sapien Labs noted that answers to these questions are inherently subjective, other reports have come to similar conclusions. Amid a historic decline in living standards, the UK’s Office of National Statistics found in November that Britons experienced a drop in happiness and personal satisfaction in the year ending last March. According to a report published in The Lancet medical journal last month, some 1.8 million people in the UK are currently awaiting mental health treatment.

Sapien Labs noted that levels of mental well-being across the English-speaking world plummeted during the coronavirus pandemic, and that this decline “continues to persist with no sign of recovery.” Furthermore, the report found that mental well-being was lower in countries where processed food was commonly eaten, children were given smartphones at a younger age, and relations between family members were more distant. Wealthy, English-speaking countries scored least favorably across all of these three metrics. The Dominican Republic topped the list as the world’s happiest country, followed by Sri Lanka in second place and Tanzania in third. All of the top ten countries were African, Asian, or Latin American nations.

Spring

https://twitter.com/i/status/1766784410450333832

Quoll

Have you ever seen a wild eastern spotted quoll?

They went extinct in Australia mainland 50 years ago but they're still populating Tasmania.pic.twitter.com/pypoYpcgRS

— Massimo (@Rainmaker1973) March 10, 2024

I love you

https://twitter.com/i/status/1766876241078964424

Dog

— Doglover (@puppiesDoglover) March 9, 2024

Ginger cat

This human leaves food, so the ginger cat eats. But they find the cat carries it to her baby instead. Eyes are the windows through souls. They show happiness or need for care, & kindness changes the look of the eyes for the better. pic.twitter.com/G4NBHq6Dcm

— Hakan Kapucu (@1hakankapucu) March 10, 2024

Gull

She didn’t realise it was there…

pic.twitter.com/WO3yn8Qt6Q— Science girl (@gunsnrosesgirl3) March 9, 2024

Neurogenesis

https://twitter.com/i/status/1766453575616487680

Eyesight

STRENGTHEN

YOUR

EYE SIGHT!-BARBARA O'NEILL pic.twitter.com/dpoxAjHq7B

— DR. Kek (@Thekeksociety) March 9, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.