Byron Street haberdashery, New York 1900

Very funny. But the one country that has seen its currency gain global advantage of late is the US itself.

• US Puts China, Japan on New Watch List for FX Practices (BBG)

The U.S. put economies including China, Japan and Germany on a new currency watch list, saying their foreign-exchange practices bear close monitoring to gauge whether they provide an unfair trade advantage over America. The inaugural list also includes South Korea and Taiwan, the Treasury Department said Friday in a revamped version of its semi-annual report on the foreign-exchange policies of major U.S. trading partners. The five economies met two of the three criteria used to judge unfair practices under a February law that seeks to enforce U.S. trade interests. Meeting all three would trigger action by the president to enter discussions with the country and seek potential penalties.

The new scrutiny of some of the world’s biggest economies comes amid a bruising presidential campaign in which candidates from both the Democratic and Republican parties have questioned the merits of free trade. Republican front-runner Donald Trump has promised to declare China a currency manipulator, and the latest report may fail to appease critics in Congress who say China’s practices have cost American manufacturing jobs. “We will continue to watch this process closely to ensure that the president squarely addresses currency manipulation and stands up for the American people,” House Ways and Means Chairman Kevin Brady, a Texas Republican, said in a statement on the Treasury report. The Treasury had already been monitoring countries for evidence of currency manipulation under a 1988 law.

In the latest report, the department concluded that no major trading partner qualified as a currency manipulator; the last country it labeled as such was China, in 1994. Under the new law, Treasury officials developed three criteria to decide if countries are being unfair: an economy having a trade surplus with the U.S. above $20 billion; having a current-account surplus amounting to more than 3% of its GDP; and one that repeatedly depreciates its currency by buying foreign assets equivalent to 2% of output over the year. China, Japan, Germany and South Korea were flagged as a result of their trade and current-account surpluses, the department said. Taiwan made the list because of its current-account surplus and persistent intervention to weaken the currency, according to the Treasury. If a country meets all three criteria, it could eventually be cut off from some U.S. development financing and excluded from U.S. government contracts.

But then again, the idea is probably that attack is the best defense…

• US Chides Five Economic Powers Over Policies (WSJ)

The Obama administration delivered a shot across the bow to Asia’s leading exporters and Germany for their economic policies and warned that a number of major economies around the globe could face intense pressure to engage in currency interventions to counter slow growth. The U.S. Treasury Department, in its semiannual currency report to Congress, called out China, Japan, South Korea, Taiwan and Germany for relying on policies it says threaten to damage the U.S. and the global economy. The countries are cited in a new name-and-shame list that can trigger sanctions against offending trade partners under fresh powers Congress granted last year to address economic policies that threaten U.S. industries.

U.S. officials are increasingly concerned other countries aren’t doing enough to boost demand at home, relying too heavily on exports to bolster growth. Counting on cheap currencies as a shortcut to boosting exports can create risks across the global economy, as nations fight to stay ahead of their competitors. Over the past two decades, for example, many U.S. officials have accused China of using an undervalued currency to bolster its manufacturing sector. A cheaper currency makes products cheaper overseas. Although China has moved to address some of those worries, tension over currency policy more broadly has heightened in recent years, amid an unprecedented era of easy-money policies, weak global growth and rising exchange-rate volatility.

The failure of many countries to overhaul their economies after the financial crisis has prompted economists to slash global growth forecasts. Amplifying those worries, a 20% surge in the dollar’s value against a basket of major currencies over the past two years has slowed U.S. growth, as American products became more expensive to international buyers. The Obama administration said in its new report that the economic and currency policies of China, Japan, Korea, Taiwan and Germany are adding to the global economy’s problems. Absent stronger efforts by those countries to boost domestic demand, “global growth has suffered and will continue to suffer,” the Treasury Department said.

This is not good. This is very bad.

• UK Consumers Borrow At Fastest Rate In Over A Decade (R.)

British mortgage approvals fell for the first time in six months in March shortly before a new tax took effect, but consumers borrowed at the fastest rate in over a decade, Bank of England data showed. Mortgage approvals for house purchases numbered 71,357 in March, down from 73,195 in February. Analysts in a Reuters poll had forecast 74,500 mortgage approvals were made in March. British finance minister George Osborne announced in November that he would add a surcharge on the purchase of buy-to-let properties and second homes from April 1, in a move aimed to boost home ownership by first-time buyers. The news spurred an increase in buying of such properties in recent months before March’s slowdown as the deadline approached.

Net mortgage lending, which lags approvals, rose by £7.435 billion last month, the biggest increase since October 2007, before the global financial crisis hit and above all forecasts in the Reuters poll. Figures released earlier this week by the British Bankers’ Association, which are less comprehensive than those of the BoE, also showed a fall in mortgage approvals in March accompanied by a rise in mortgage lending as previously approved deals were carried out. The BoE said consumer credit grew by £1.883 billion last month, the strongest increase since March 2005 and a long way above the median forecast for an increase of £1.3 billion in the Reuters poll of economists. The rise was not a one-off: in the first quarter as a whole, consumer credit rose by an annualised 11.6%, the strongest increase since the first three months of 2015.

The narrative: “..progress [in China] has been a let-down..”. But a 26% plunge in revenue is not just a ‘let-down’.

• Apple Stock Suffers Worst Week Since 2013 (R.)

Apple on Friday ended its worst week on the stock market since 2013 as worries festered about a slowdown in iPhone sales and after influential shareholder Carl Icahn revealed he sold his entire stake. Shares of Apple, a mainstay of many Wall Street portfolios and the largest component of the Standard & Poor’s 500 index, have dropped 11% in the past five sessions. That shrank the technology behemoth’s market capitalization by $65 billion. Confidence in the company has been shaken since posting its first-ever quarterly decline in iPhone sales and first revenue drop in 13 years on Tuesday, although Apple investors pointed to the stock’s relatively low valuation as a key reason to hold onto the stock. “If you’re going to buy Apple, you have to buy it for the long term, because the next year or two are going to be very tough,” said Michael Yoshikami, chief executive of Destination Wealth Management.

Faced with lackluster sales of smartphones in the United States, Apple has bet on China as a major new growth engine, but progress there has been a let-down. Revenue from China slumped 26% during the March quarter and its iBooks Stores and iTunes Movie service in China were shut down last week after the introduction of new regulations on online publishing. Pointing to concerns that Beijing could make it difficult for Apple to conduct business in China, long-time Apple investor Carl Icahn told CNBC on Thursday that he had sold his stake in the company he previously described as a “no brainer” and undervalued. The selloff has left Apple trading at about 11 times its expected 12-month earnings, cheap compared to its average of 17.5 over the past 10 years. S&P 500 stocks on average are trading at 17 times expected earnings.

China is fast becoming a one-dimensional nation.

• Chinese Cities Dive Back Into Debt To Fuel Growth Even As Defaults Rise (R.)

With a nod from Beijing, China’s local governments have embarked on a massive new round of off-balance sheet debt financing, underpinning a fragile pick up in the economy but raising red flags on financial stability. The increased borrowing for an economy already swimming in debt adds to concerns about growing bubbles in certain major asset classes, such as real estate and commodities, and a bond market seeing a rise in corporate defaults. Economists say increasing public sector investment – most of it financed locally with debt – is behind improvements in China’s economy. First-quarter GDP rose at the weakest pace in seven years, but other data suggested growth was picking up in March. “With new infrastructure projects effectively all funded by debt and more consumer mortgages, the leverage problem and risks on the financial sector are rising,” Credit Suisse analysts wrote in a research report.

Local government financing vehicles (LGFVs), which Chinese cities use to circumvent official spending limits, raised at least 538 billion yuan ($83 billion) in bonds in the first quarter, up 178% from a year earlier and the highest quarterly issuance since June 2014, Everbright Securities said, quoting figures from privately held financial data provider WIND. Issuance in March alone was a monthly record of 287 billion yuan ($44.3 billion). China’s planning agency, the National Development and Reform Commission, declined to comment on the sharp rise in LGFV issuance. Most of the LGFV debt in the first quarter was made up of so-called enterprise bonds, which the NDRC oversees. Beijing had been trying to move LGFV debt on to municipal balance sheets via the 2014 creation of a municipal bond market. But policymakers retreated from this in the middle of 2015, easing borrowing restrictions as economic growth stumbled.

Consequently, LGFV issuance in the first quarter of 2016 was nearly 60% as large as the municipal bond issuance meant to replace it, up from just 37% in the fourth quarter of 2015, central clearinghouse and brokerage data shows. “In the second half of last year, the government raised the%age of project financing that can be funded with debt,” said Yang Zhao, chief China economist at Nomura in Hong Kong, helping spark the flurry of LGFV deals. “If they continue on, the debt-to-GDP ratio could actually go up quite rapidly. I don’t think the policy is sustainable, and you’ll see policymakers slow down the pace of (credit) easing in a quarter or two.”

“..Your return is too low for your risk in China.”

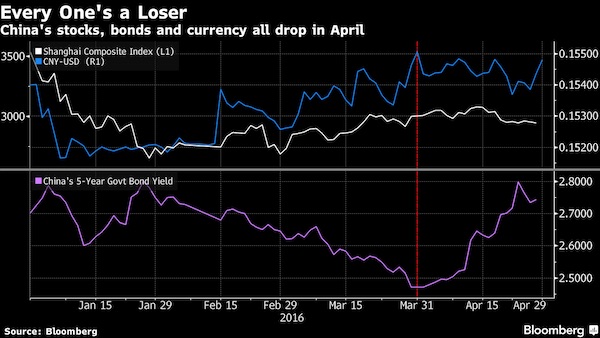

• China’s Stocks, Bonds, Yuan Are a Triple Losing Bet This Month (BBG)

For the first time in two years, China’s stocks, bonds and currency are all a losing proposition. The Shanghai Composite dropped 2.2% in April, the yuan fell 0.6% versus the dollar, while government and corporate bonds tumbled, with the five-year sovereign yield rising 27 basis points. Even a sudden revival in the nation’s commodities markets is looking fragile after frenzied speculation prompted exchanges to take measures to cool trading. The declines mark a reversal from March, when the benchmark equities gauge jumped 12% and the yuan rallied the most since 2010 as new credit surged. Improving data from industrial output to retail sales have led traders to pare back bets for more stimulus, while rising credit defaults are fueling the biggest selloff in junk debt since the data became available in 2014.

Deutsche Bank is one bull looking to reduce holdings of Chinese stocks on bets the economy will fail to reach the government’s growth targets and yuan declines will accelerate. “Clearly there was a turn in China,” said Sean Taylor, CIO for Asia Pacific for Deutsche Bank’s wealth-management unit in Hong Kong. “You’ve seen money in the A-share market going to property and commodities. We’ve been adding risk in the last few months and coming into the summer, we will take it away and wait for opportunities to add again. We are not yet ready for China’s structural story because earnings haven’t come through.” Investor interest in the world’s second-largest equity market is waning, with turnover on the Shanghai Stock Exchange falling to levels last seen regularly in 2014 and a gauge of volatility dropping to a 12-month low. Investments in stock-market funds fell by 89 billion yuan ($13.7 billion) in April.

[..] Government bonds are coming under pressure as inflation increased to the highest since mid-2014, while corporate notes are slumping amid a spate of defaults and a surprise move by state-owned China Railway Materials to halt its bond trading this month because of what the company called “repayment issues.” “We will definitely see more defaults and difficulties for corporates in issuing new bonds,” said David Gaud at Edmond de Rothschild Asset Management in Hong Kong. “Credit costs will go up and credit spreads will widen. Your return is too low for your risk in China.”

Small potatoes for now, but at the same time there’s nothing in sight that could reverse the trend.

• Hong Kong Underwater Mortgages Jump 15-Fold in Q1 as Prices Drop (BBG)

The number of Hong Kong homeowners with apartments worth less than their mortgages surged 15 times in the first quarter, according to the Hong Kong Monetary Authority. The number of negative-equity mortgages rose to 1,432, with a total value of HK$4.9 billion ($634 million), for the three months ended March, from 95 such home loans worth HK$418 million in the previous quarter, the city’s de facto central bank said on its website Friday.

Property prices in Hong Kong, which reached a record last year, have been sliding and sales tumbled to a 25-year low in February amid economic uncertainty. Home prices in the city slumped 13% from September to March, according to data compiled by Centaline Property Agency. The government is determined to tackle the housing problem and maintain a healthy development of the market, the city’s Rating and Valuation Department said in a report on Friday, while maintaining that it has no intention to withdraw demand-side property curbs.

The one word that comes to mind: incestuous: “..The switch has been made possible by clearing houses’ designation as systemically-important utilities..”

• Derivatives Houses To Open Accounts With Federal Reserve (FT)

Derivatives brokers choosing where to park their margin money will now have the option of the world’s most powerful central bank. The Federal Reserve Bank of Chicago has authorised three of the US’s largest clearing houses, run by CME Group and Intercontinental Exchange, and the Options Clearing Corporation, to open an account at the central bank. ICE’s permit is for its US credit derivatives clearing house. The change at the CME applies only to house cash belonging to brokers, its executives said on a conference call on Thursday. Margin posted by their customers will continue to be walled off and held by commercial banks or in US Treasury bonds, they confirmed.

The switch has been made possible by clearing houses’ designation as systemically-important utilities, which recognised the dangers to the financial system if they failed and gave them access to the Fed’s cash in an emergency. Tougher regulation of markets means they must now handle billions of dollars of futures and swaps trades every day. Traders who use derivatives must safeguard their deals against defaults with margin and collateral. For clearing brokers whose business has been damaged by years of low interest rates, keeping cash at the Fed could yield better returns. New market rules also authorised a regional Fed bank to maintain an account for designated clearing houses and pay earnings on any balance, as it already does for US banks subject to Fed oversight.

“When effective, we expect to pass a higher rate to clearing members for their house positions than we do today,” John Pietrowicz, CME’s chief financial officer, told analysts. Mr Pietrowicz said the accounts would open in the “next month or so”. While the majority of the returns would be passed back to clearing members, CME would also be able to “earn more” as cash balances increased. CME applied for access to a Fed account in 2014, a spokeswoman said, and would direct funds into an omnibus account for collateral and settlement services. The derivatives industry and its regulator have argued in recent years that tougher banking laws have hurt the brokerage business by making clearing uneconomical. “The resulting industry consolidation would increase systemic risk by concentrating derivatives clearing activities in fewer clearing member banks,” Walt Lukken, chief executive of the FIA industry association, testified to a US House agriculture subcommittee on Thursday.

It might be best to ignore these numbers. Whatever BBG’s economist panel predicts is always wrong. Growth numbers are always manipulated. One good thing to take away is that consumer prices do not equal inflation.

• Draghi Challenge Seen As Consumer Prices Fall More Than Forecast (BBG)

Mario Draghi’s policy challenge was highlighted once again on Friday, with the fastest economic growth in a year overshadowed by a renewed drop in consumer prices. The euro-area inflation rate fell to minus 0.2% in April, a worse out-turn than the 0.1% decline forecast by economists in a Bloomberg survey. It wasn’t all bad news for the ECB president however, with the economy expanding 0.6% in the first quarter and unemployment declining in March to the lowest since 2011. Draghi has said the situation in the 19-nation region is slowly improving, but that hasn’t assuaged his concerns about the inflation outlook. Policy makers cut interest rates and ramped up other stimulus last month, and the ECB president has signaled he’s willing to do even more to revive price growth. “Draghi has to be on alert – despite the solid growth momentum, inflation is not picking up,” said Michael Schubert at Commerzbank.

“The ECB will have to do more in the future, an extension of QE being most likely, but for the time being we’ll have to be patient.” Eurostat released the euro-area growth data about two weeks earlier than usual as it tries to make figures on output more timely, which could help inform the ECB’s policy-making. The new timing brings the region into line with the U.S. and U.K., which also publish first estimates within about a month of the end of the quarter. Based on the latest data, the euro area grew faster than both countries in the January-March period, with the U.K. expanding 0.4% and the U.S. by 0.5% on an annualized basis. National euro-zone data on Friday also provided some positive news, with both the French and Spanish economies expanding faster than expected. Growth in France accelerated to 0.5% from 0.3%, helped by investment and consumer spending, while Spain shrugged off a political deadlock that’s left it facing new elections to grow 0.8%.

More economists entirely clueless on the link between debt and deflation. There’s tons of them, and they’re on ‘both sides of the debate’. And it doesn’t matter one iota how many ‘equations’ from their school books they can quote. Suggesting that increasing VAT rates -in incremental steps- will make people spend more ignores the reason why they don’t spend now: debt. In fact, VAT increases will make things more expensive, and that will result in less spending, not more. That’s what Japan has been showing us for 20 years.

• Fighting Deflation With Unconventional Fiscal Policy (VoxEu)

In his Marjolin lecture on 4 February 2016, Mario Draghi asserted that “there are forces in the global economy that are conspiring to hold inflation down” (Draghi 2016). Eurostat confirmed that in February 2016 the annual inflation rate for the Eurozone was -0.2% (Eurostat 2016). On 10 March 2016, the ECB board agreed upon a set of largely unexpected monetary policy measures, with the aim of boosting inflation and growth in the Eurozone. These measures were inspired, among others, by thoughts in Bernanke (2010) and Blanchard et al. (2010).

The conundrum the Eurozone faces is finding a recipe to support inflation and ultimately consumption and economic growth in a setting in which traditional monetary policy measures are not viable, and governments cannot support growth with fiscal spending because of their large debt-to-GDP ratios. In this column, we discuss an alternative to monetary interventions, which we call unconventional fiscal policy. • Unconventional fiscal policy aims to increase growth and inflation in a budget neutral fashion, while keeping constant the tax burden on households.

Feldstein (2002) introduced the notion of unconventional fiscal policy measures at times of liquidity traps. Among several possible interventions Feldstein proposed: “A series of pre-announced increases in the value-added tax (VAT) to generate consumer price inflation, and hence increase private spending via intertemporal substitution.” In his words: “This [VAT] tax-induced inflation would give households an incentive to spend sooner rather than waiting until prices are substantially higher.” The intuition for this proposal is based on a simple logic: announcing higher prices in the future will increase current inflation expectations. Higher inflation expectations at times of fixed nominal interest rates should reduce real interest rates (Fisher equation), and lower real interest rates should increase households’ incentives to consume rather than save (Euler equation).

Because imposing higher VAT reduces households’ wealth – especially poorer households’ wealth – and might affect households’ labour supply, lower income taxes (or transfers for those households that do not pay any income tax) should accompany the increase in VAT. Designed this way, the policy measure would be budget-neutral for the government, as well as for households. It would incentivise households to consume immediately, jump-start the economy, and hence help the economy exit the slump. In his presidential address to the 2011 American Economic Association Annual Meeting, Bob Hall (2011) reiterated Feldstein’s ideas, and encouraged further research to understand the viability and effects of unconventional fiscal policy, both theoretically and empirically.

Clueless: “..the current recovery could boost industry activity and slow the decline..”

• Oil Market Deja Vu Triggers Predictions of a Return to $30 (BBG)

Oil’s climb above $45 a barrel is reassuring influential figures from BP to the IEA that the industry is finally recovering from the worst slump in a generation. Others say the market is about to fall into the same trap as last year. There’s a sense of deja vu at Commerzbank, BNP Paribas and UBS, who say crude’s gain of about 70% from a 12-year low in January resembles the recovery that took hold this time last year – only to sputter out by May as the supply glut endured. Prices will sink back towards $30 a barrel in the coming weeks, BNP and UBS warn. “There are dangerous parallels to 2015,” said Eugen Weinberg at Commerzbank. “The market already appears overheated and a correction is overdue.”

Last year, Brent crude rose 45% from January to almost $68 in May as traders anticipated a rapid decrease in U.S. output as drilling rigs were idled. The rally reversed when production kept rising, peaking at 9.61 million barrels a day in June 2015, a year after the price slump began. While drilling cutbacks eventually took their toll and the nation’s output slipped to 8.9 million barrels a day last week, the current recovery could boost industry activity and slow the decline.

At least something’s trickling down…

• Pipelines: The Next Devastating Phase Of The Oil Bust (Forbes)

When oil and natural gas prices began their swan dive in 2014 and continued their descent in 2015, the casualties seemed obvious. Exploration and production companies would need to file for bankruptcy protection and restructure en masse. Banks that financed these companies would need to write down bad loans and noteholders that invested in their high yield debt would be left holding the bag, or at least, the equity securities of the reorganized producers. The damage would also extend to the so-called “midstream” companies that transport oil and gas from wells to processing facilities and end-users downstream. It was thought that the damage to such midstream companies would be substantial, but manageable.

However, an ongoing legal tussle in the Sabine Oil and Gas bankruptcy proceeding in New York threatens to devastate an important corner of the $500 billion midstream industry and set off a new and entirely unexpected phase of the energy crisis. The dispute started in September 2015, when Sabine filed a motion in its bankruptcy case seeking authority to reject contracts it had entered into with two separate midstream operators that provided gas gathering and other services. Rejecting contracts and walking away from pre-bankruptcy obligations is commonplace for bankrupt debtors, but in the oil and gas industry many midstream companies thought their arrangements were protected from this risk.

That is because such gathering contracts “dedicate” the relevant oil and gas mineral interests and surrounding acreage to the midstream companies, which is intended to create a property interest known as a “real covenant” that “runs with the land.” Under longstanding bankruptcy principles, conveyances of real property—and certain associated rights—are not contracts that can be “rejected.” If the midstream companies prevailed in the argument that contractual dedications could create real covenants, then if a producer filed for bankruptcy protection or if its mineral rights were transferred to a new owner, the midstream company would retain its exclusive property right to gather oil and gas produced from the land and receive a fee for such services.

This argument seemed a strong one. However, after examining the applicable Texas property law at issue, on March 8, 2016, Judge Chapman issued a non-binding bench ruling holding that the legal requirements for treating these arrangements as real property interests were not satisfied and that they could be invalidated in bankruptcy through the contract rejection process. This ruling rocked the midstream world. It also came when similar attempts to reject gathering agreements were underway in the Quicksilver Resources and Magnum Hunter Resources bankruptcy cases in Delaware, leading to a sense that the midstream industry was under assault.

We’re fast losing the conditions that gave us life. But we lack the intelligence to understand this. Which makes it only fitting. If you’re not smart enough to survive, then you won’t.

• More Tigers Poached In India So Far This Year Than In All Of 2015 (AFP)

More tigers have been killed in India already this year than in the whole of 2015, a census showed Friday, raising doubts about the country’s anti-poaching efforts. The Wildlife Protection Society of India, a conservation charity, said 28 of the endangered beasts had been poached by April 26, three more than last year. Tiger meat and bones are used in traditional Chinese medicine and fetch high prices. “The stats are worrying indeed,” said Tito Joseph, programme manager at the group. “Poaching can only be stopped when we have coordinated, intelligence-led enforcement operations, because citizens of many countries are involved in illegal wildlife trade. It’s a transnational organised crime.”

Poachers use guns, poison and even steel traps and electrocution to kill their prey. India is home to more than half of the world’s tiger population with 2,226 in its reserves according to the last count in 2014. The figures come after a report by the WWF and the Global Tiger Forum said the number of wild tigers in the world had increased for the first time in more than a century to an estimated 3,890. The report cited improved conservation efforts, although its authors cautioned that the rise could be partly attributed to improved data gathering.

“Nor are the problems exclusive to the LHC: In 2006, raccoons conducted a “coordinated” attack on a particle accelerator in Illinois. It is unclear whether the animals are trying to stop humanity from unlocking the secrets of the universe. Of course, small mammals cause problems in all sorts of organizations. Yesterday, a group of children took National Public Radio off the air for over a minute before engineers could restore the broadcast.”

• Small Mammal Shuts Down World’s Most Powerful Machine (NPR)

A small mammal has sabotaged the world’s most powerful scientific instrument. The Large Hadron Collider, a 17-mile superconducting machine designed to smash protons together at close to the speed of light, went offline overnight. Engineers investigating the mishap found the charred remains of a furry creature near a gnawed-through power cable. “We had electrical problems, and we are pretty sure this was caused by a small animal,” says Arnaud Marsollier, head of press for CERN, the organization that runs the $7 billion particle collider in Switzerland. Although they had not conducted a thorough analysis of the remains, Marsollier says they believe the creature was “a weasel, probably.” (Update: An official briefing document from CERN indicates the creature may have been a marten.)

The shutdown comes as the LHC was preparing to collect new data on the Higgs Boson, a fundamental particle it discovered in 2012. The Higgs is believed to endow other particles with mass, and it is considered to be a cornerstone of the modern theory of particle physics. Researchers have seen some hints in recent data that other, yet-undiscovered particles might also be generated inside the LHC. If those other particles exist, they could revolutionize researcher’s understanding of everything from the laws of gravity, to quantum mechanics. Unfortunately, Marsollier says, scientists will have to wait while workers bring the machine back online. Repairs will take a few days, but getting the machine fully ready to smash might take another week or two. “It may be mid-May,” he says.

These sorts of mishaps are not unheard of, says Marsollier. The LHC is located outside of Geneva. “We are in the countryside, and of course we have wild animals everywhere.” There have been previous incidents, including one in 2009, when a bird is believed to have dropped a baguette onto critical electrical systems. Nor are the problems exclusive to the LHC: In 2006, raccoons conducted a “coordinated” attack on a particle accelerator in Illinois. It is unclear whether the animals are trying to stop humanity from unlocking the secrets of the universe. Of course, small mammals cause problems in all sorts of organizations. Yesterday, a group of children took National Public Radio off the air for over a minute before engineers could restore the broadcast.

Though they have every right to defend themselves, something makes me wish Tyler Durden had counted to 10 before writing this. They could have limited it to: “Zero Hedge admits to having hired an unstable writer”, and left it at that. That’s all the Bloomberg attempt at smut warrants. As is, Zero Hedge poebably killed the secrecy as much as Bloomberg did.

• The Full Story Behind Bloomberg’s Attempt To “Unmask” Zero Hedge (ZH)

Over the years, Zero Hedge has proven to be a magnet for media attention. It started years ago with a NY Magazine article published in September 2009 which first “unmasked” the people behind Zero Hedge with the “The Dow Zero Insurgency: The nothing-can-be-believed chaos of the financial crisis created a golden opportunity for a blog run by a mysterious ex-hedge-funder with a dodgy past and conspiracy theories to burn” in which we were presented as a bunch of “conspiracy theory” tin foil hat paranoid loons. We are ok with being typecast as “conspiracy theorists” as these “theories” tend to become “conspiracy fact” months to years later.

Others, such as “academics who defend Wall Street to reap rewards” had taken on a different approach, accusing the website of being a “Russian information operation”, supporting pro-Russian interests, which allegedly involved KGB and even Putin ties, simply because we refused to follow the pro-US script. We are certainly ok with being the object of other’s conspiracy theories, in this case completely false ones since we have never been in contact with anyone in Russia, or the US, or any government for that matter. We have also never accepted a dollar of outside funding from either public or private organization – we have prided ourselves in our financial independence because we have been profitable since inception. Which brings us to the latest “outing” of Zero Hedge, this time from none other than Bloomberg which this morning leads with “Unmasking the Men Behind Zero Hedge, Wall Street’s Renegade Blog” in which it makes the tacit admission that “Bloomberg LP competes with Zero Hedge in providing financial news and information.”

To an extent we were surprised, because while much of the “information” Bloomberg claims it reveals could have been discovered by anyone with a cursory 30 second google search, this time the accusation lobbed at Zero Hedge by Bloomberg was a new one: that we are capitalists who seek to generate profits and who have expectations from our employees. This comes from a media organization which caters to Wall Street and is run by one of the wealthiest people in the world. Underlying the entire Bloomberg article is disclosure based on a former employee at Zero Hedge. Traditionally we don’t reply to such media stories but in this case we’ll make an exception as there is a substantial amount of information Bloomberg has purposefully failed to add.

Brussels will never be able to push through visa-free travel for nearly 80 million Turks. It’s simply not going to happen, not in a democratic way. Greece should be very afraid.

• Turkey PM: Denying Visa-Free Travel Means Collapse Of EU Refugee Deal (DS)

Prime Minister Ahmet Davutoglu said on Thursday evening that there are disappointments and the EU has un-kept promises in recent Turkish-EU relations and that Turkey will stop implementing the recent readmission agreement if the EU does not keep its word and grant visa-free travel to Turkish citizens. Speaking to a group of journalist who accompanied his visit to Qatar on Thursday, Davutoglu said that Turkey is successfully implementing the EU-Turkey deal from March 18 and that the deal has ended illegal migration to Europe.

“Last October there were 6,800 illegal migrants passing over to Europe from Turkey every day. This figure went down to 3,000 in January after we started to implement the terms of the November deal with EU. We made a game changing move with the March 18 deal and this figure is now about 25 per day. Moreover, in April there have been some days on which no migrant passed to Europe,” Davutoglu said, and asked: “Have you heard about the death of a migrant in the Aegean Sea since April 4?” Asserting that Turkey will fulfill all EU criteria for visa-free travel on Monday, Davutoglu said that Ankara will stop implementing the readmission agreement if the EU does not grant visa-free travel.

“These two issues are linked to each other and are part of the deal with the EU. This is a test for everyone. We think that we have passed our test,” Davutoglu said, and added that it is now time for the EU to fulfill its obligations. “[The EU] promised to invest €1 billion for refuges until end of July. We will see whether they keep their promise or not. We have experienced disappointment in the past. We will react negatively if these experiences reoccur,” Davutoglu said, adding that in 2004 the EU had promised to lift restrictions on Turkish Cypriots if they vote for the Annan Plan, but it did not keep its promise afterward.

Home › Forums › Debt Rattle April 30 2016