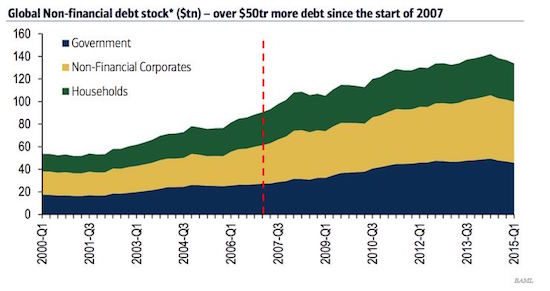

Gottscho-Schleisner Plaza buildings from Central Park, NY 1933

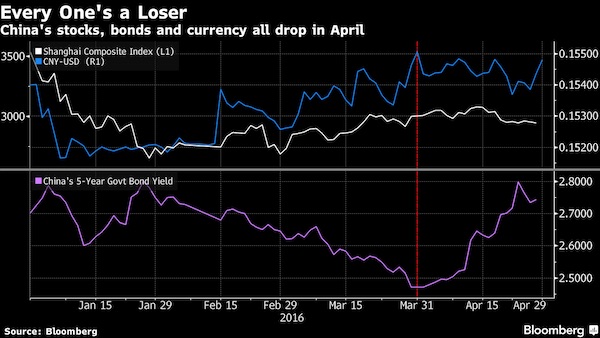

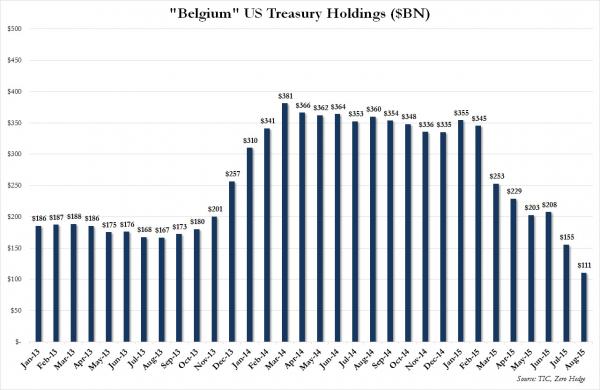

Let that graph sink in.

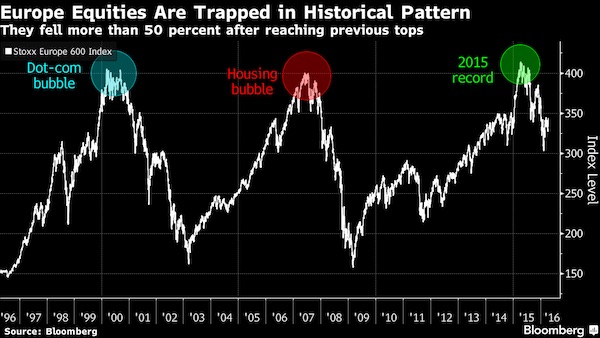

• A Year After European Stocks Hit Record, Crash Angst Hits Traders (BBG)

A year ago today, European equities hit their highest levels ever. But the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% since its record, and investors who piled in last year are now unwinding bets at the fastest rate since 2013 as analysts predict an earnings contraction. The trading pattern looks familiar: a fast run to just over 400 on the gauge, then disaster. Optimism has turned to doubt with ECB President Draghi’s bond-buying program doing little to bolster the economy while sowing concerns about bank profitability. To Benedict Goette of Crossbow Partners, the odds of another crisis are higher than a rally to fresh records.

“The 2009-2015 rally originated from two main drivers: a massive stimulus, and credit expansion in China,” said Goette. “European earnings have not followed suit so far. Skepticism regarding central-bank operations has started to emerge.” Even with a recent rebound, the Stoxx 600 remains 6% lower for the year, and strategists are predicting the gauge will end 2016 at about the same level where it started. Analysts, who in January called for earnings growth, are now expecting declines of 2.8%. Investors have withdrawn money from funds tracking the region’s equities for nine straight weeks, the longest streak since May 2013, according to a Bank of America note dated April 7 that cited EPFR Global data.

Since last year’s peak, all industry groups in the Stoxx 600 have fallen, with lenders, miners and automakers down more than 25%. Traders have had to contend with a rebound in the euro despite additional ECB stimulus, persistently low inflation and slowing growth from China. Fewer than one in five fund managers are confident Draghi’s easing will be a major source of growth for Europe, a Bank of America survey showed April 12.

Read more …

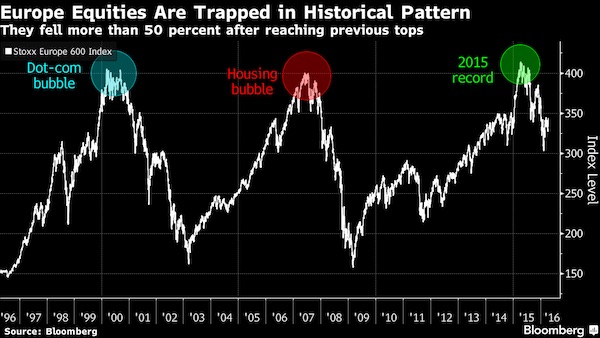

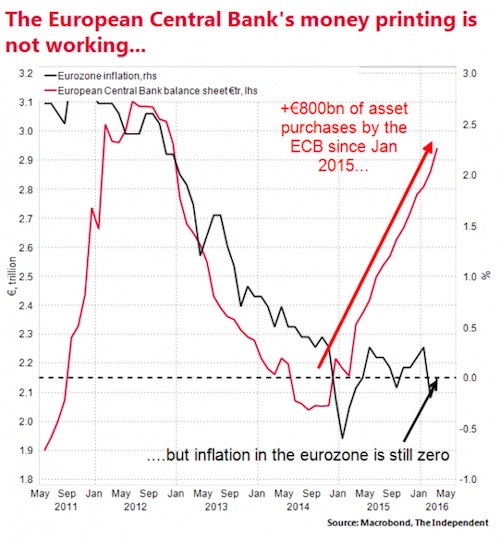

In case that wasn’t clear yet.

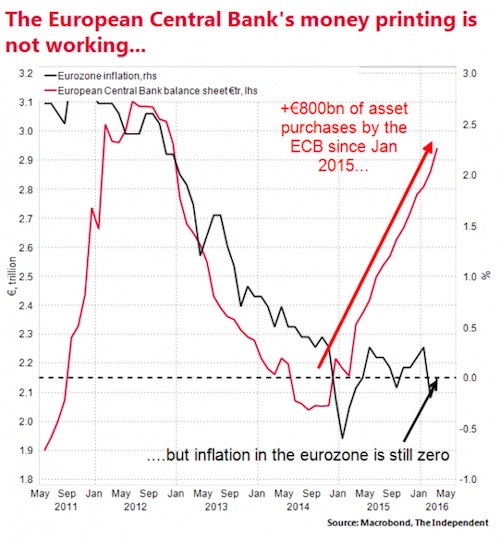

• The One Chart That Shows ECB Money Printing Is Failing (Ind.)

Good news: prices are no longer falling in the eurozone. But don’t break out the champagne. According to the European number crunchers Eurostat consumer prices across the 19 nation bloc were flat on a year earlier in March. The inflation rate was zero. This means the eurozone remains very much within the deflationary danger zone. The ECB has been trying to break the grip of deflation – which can be lethal for economic growth – on the bloc for more than a year now. To this end the ECB’s president Mario Draghi announced a major programme to buy up eurozone government bonds and company debt in January 2015.

The central bank has been buying €60bn of these assets a month in the hope that that flood of money entering the continent’s financial system would lift inflation into positive territory. The trouble is, as the chart below shows, is that all that money printing doesn’t seem to be working in pushing up prices. But the ECB is not giving up. In December it announced that it would continue its programme until March 2017 “or beyond”. The programme was originally supposed to end in September 2016. And in March it upped the size of the monthly bond purchases to €80bn. In other words, the ECB will continue printing money until inflation rises to the central bank’s target of (just below) 2% a year.

Read more …

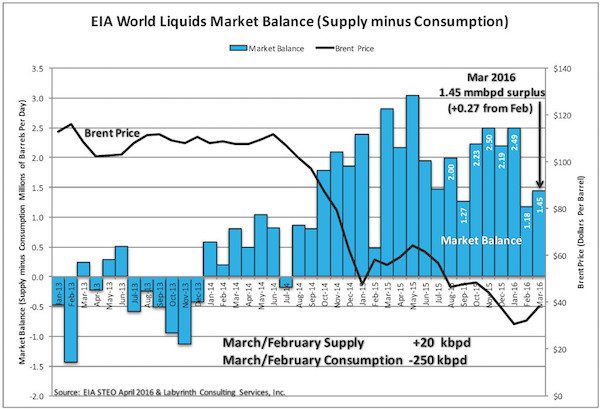

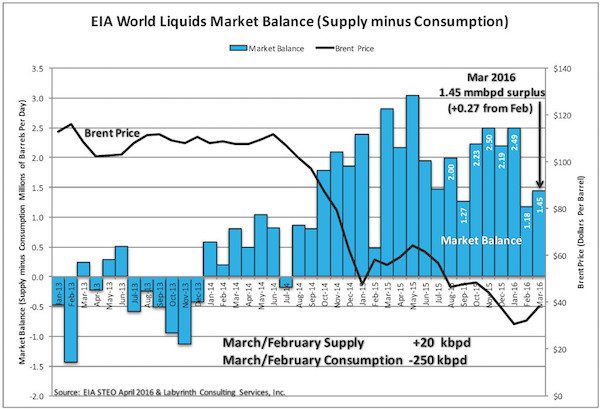

“Supply increased only 20,000 barrels per day in March. Consumption, however, decreased by 250,000 barrels per day.”

• Oil Demand Falls Much Faster Than Supply (Berman)

Oil prices have increased 60% since late January. Is this an oil-price recovery? Two previous price rallies ended badly because they had little basis in market-balance fundamentals. The current rally will probably fail for the same reason. Although oil prices reached the highest levels so far in 2016 during the past few days, the global over-supply of oil worsened in March. EIA data released this week shows that the net surplus (supply minus consumption) increased to 1.45 million barrels per day (Figure 1). Compared to February, the surplus increased 270,000 barrels per day. That’s a bad sign for the durable price recovery that some believe is already underway.

The production freeze that OPEC plus Russia will discuss this weekend has already arrived. Supply increased only 20,000 barrels per day in March. Consumption, however, decreased by 250,000 barrels per day. That’s not good news for the world economy although first quarter consumption is commonly lower than levels during the second half of the year. Meanwhile on Wednesday, April 12, Brent futures closed at almost $45 and WTI futures at more than $42 per barrel, the highest oil prices since early December 2015.

Figure 1. EIA world liquids market balance (supply minus consumption). Source: EIA STEO April 2016 Labyrinth Consulting Services, Inc.

Read more …

Any agreement willl exist on paper only.

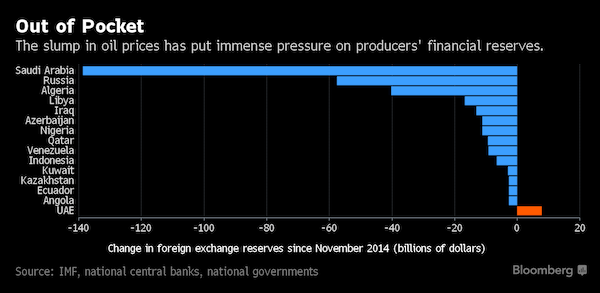

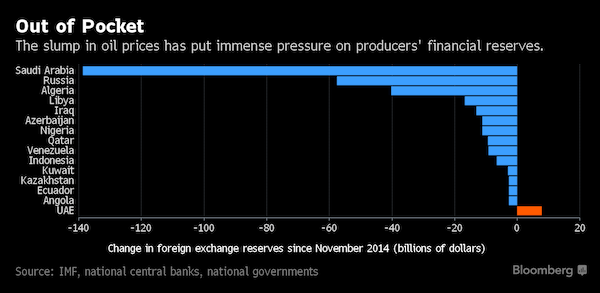

• Oil Producers Head For Doha Counting $315 Billion Cost Of Slump (BBG)

The world’s top oil exporters are burning through their petrodollar assets at an accelerating pace, increasing the pressure to reach a deal to freeze production to bolster prices. The 18 nations set to gather in Doha on Sunday to discuss a production freeze have spent $315 billion of their foreign-exchange reserves – about a fifth of their total – since the oil slump started in November 2014, according to data compiled by Bloomberg. In the last three months of 2015, reserves fell nearly $54 billion, the largest quarterly drop since the crisis started. The petrodollar burn has consequences beyond the oil nations, affecting international fund managers like Aberdeen Asset Management and global currencies markets.

Oil nations have traditionally held their reserves in U.S. Treasuries and other liquid securities. Nonetheless, the impact in credit markets has been muted as central banks continue to buy debt. “We expect 2016 to be yet another painful year for most of the oil states,” said Abhishek Deshpande, oil analyst at Natixis in London. The gathering in Doha will comprise both OPEC and non-OPEC states, though any deal to boost prices will probably be largely cosmetic as countries are already pumping nearly at record levels. In a letter inviting countries to the Doha meeting, Qatar Energy Minister Mohammed Al Sada said oil countries need to stabilize the market in “the interest of a healthier world economy as the present low price is seen to be benefiting no one.”

Saudi Arabia accounts for nearly half of the decline in foreign-exchange reserves among oil producers, with $138 billion – or 23% of its total – followed by Russia, Algeria, Libya and Nigeria. In the final three months of last year, Saudi Arabia burned through $38.1 billion, the biggest quarterly reduction in data going back to 1962.

Read more …

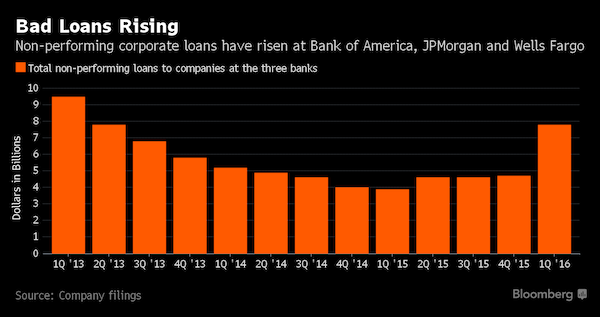

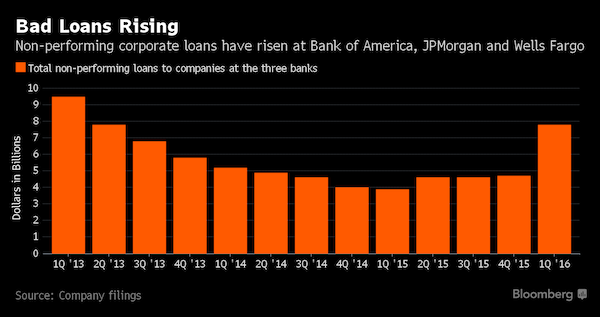

“Soured loans to companies jumped 67% at the three biggest U.S. banks in the first quarter..”

• Soured Corporate Loans Surge at Biggest US Banks on Oil (BBG)

Soured loans to companies jumped 67% at the three biggest U.S. banks in the first quarter, the latest sign that corporate credit quality is eroding after energy prices plunged. At Bank of America, JPMorgan and Wells Fargo, bad loans to companies reached their highest levels since at least 2013. For now, weakness is mainly confined to oil and gas and related industries, executives said. U.S. crude has tumbled more than 60% since June 2014, although they have rallied since February. Troubled loans have broadly been declining at big banks for years, and at JPMorgan and Bank of America, are less than 1% of total assets.

But there are signs that default risk is rising in sectors outside of energy, including health care, James Elder, a director in corporate and financial institutions at Standard & Poor’s, said in a presentation this week. Charles Peabody, a banking analyst at Portales Partners, downgraded JPMorgan to “underperform” from “market perform” in February in part because of concerns about the potential for mounting credit losses. “We’re at the very early stages of an inflection point in corporate credit quality, and it’s getting worse from here,” Peabody said. Pri de Silva, an analyst at CreditSights, is among those who see current credit problems as limited to oil and gas and related industries. “At this point, I don’t see much contagion,” he said.

Banks have been getting ready for loans to deteriorate – the industry added $1.43 billion in the fourth quarter to the total money it has set aside to cover bad loans, according to Federal Deposit Insurance Corp. data compiled by Bloomberg, the first time banks in aggregate added to reserves since 2009. Banks usually classify loans to companies as “nonperforming” after the borrower is delinquent for 90 days. Loans that are unlikely to be repaid are also typically designated as “nonperforming.” Now loans are actually souring. At JPMorgan, bad loans to companies more than doubled to $2.21 billion from $1.02 billion in the fourth quarter, according to company filings. Bank of America said they rose 32% to $1.6 billion. And at Wells Fargo, they rose 64% to $3.97 billion, which includes $343 million from loans it acquired from GE Capital.

Read more …

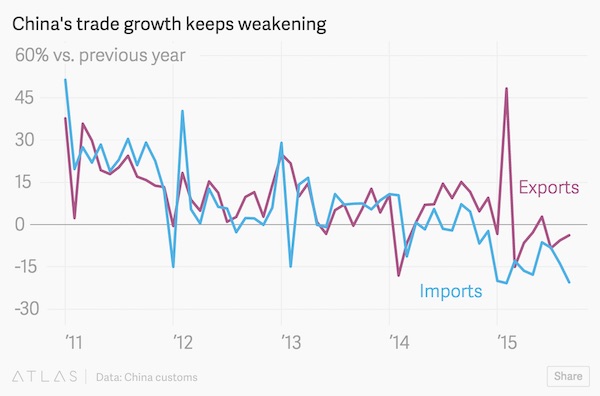

This is such a contradiction in terms it’s crazy the WSJ prints it: “China’s economy may have stabilized for now, thanks to gobs of new debt..”

• China’s Economy Faces Recovery Without Legs (WSJ)

China’s economy may have stabilized for now, thanks to gobs of new debt and a reflating property bubble. Dipping into that old bag of tricks, however, seems likely to dredge up the same old problems. Official data showed China’s GDP slowed to 6.7% in the first quarter from a year earlier. As expected, that is the slowest in years, but underlying data showed activity picked up toward the end of the quarter. Home buyers, for instance, continued to splash out for new property, with residential sales rising 54% in the first quarter from a year earlier. That has emboldened developers to start to build again, with housing starts rising 16% in the first quarter, after falling 15% last year. That augurs well for employment and demand for raw materials. But it is hard to see China’s property market—which in past years generated directly and indirectly up to a third of all economic activity—returning to its past glory.

Much of the recovery in prices and activity has been in China’s so-called tier one cities—the four largest cities—and regulators there are already clamping down to prevent things from getting out of hand. In the rest of China, the property recovery is far more subdued, and inventories of unsold apartments remain substantial. Around 95% of real estate sales occur outside of those top four cities, notes Louis Kuijs of Oxford Economics, so unless the boom spreads, the impact on the broader economy will remain muted. China’s old economy sectors also seem to have awoken somewhat from their slumber. Industrial production grew 6.8% in March, the fastest in nine months. Fixed asset investment, spending on things like factories and infrastructure, grew 11.2%, much faster than the 6.8% low it hit in December.

Driving all this activity: easy money. Real interest rates have fallen. And nominal GDP grew faster than real GDP for the first time in five quarters, which in theory makes servicing debt easier. What should trouble investors is that while China’s economic activity is ticking up, debt is piling up faster. The stock of total financing in the economy, including bond issuance as part of a local government bailout program, rose 15.8% in March from a year ago, the fastest rate since mid-2014. With nominal GDP growing 7.2%, Beijing’s plans to deleverage the economy continue to be overwhelmed by the need to support growth. China bulls will be pleased by the data, hoping that a proper recovery is at hand. Those hopes may prove short lived. The more the recovery is fueled by debt and property, the more concerned Beijing will be that it is pushing the gas too hard and will have to ease off sooner than people think.

Read more …

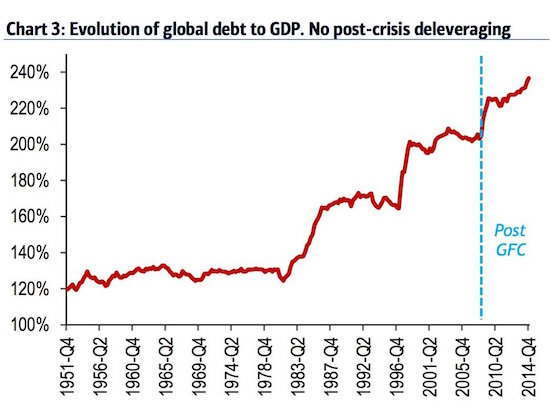

“In a developed economy, Ponzi lending of such an enormous scale would lead to widespread bankruptcies, unemployment and massive losses for investors and lenders. This hasn’t happened yet because Chinese debt has been expanding at an ever-faster rate.”

• China’s Giant Bonfire Of Debt Needs One Spark To Become An Inferno (MW)

China’s debt bonfire has been building for decades, but recent news and data points to it growing faster than ever with a greater risk of becoming an economy-scorching inferno. There are three key components to this analogy: the wood, the accelerant and the matches. First the wood, which is an ever-growing stockpile of debt that cannot be serviced from profits. Macquarie Research found that 23% of bonds issued were by companies that don’t generate enough operating profit to cover their interest. This aligns with a Bloomberg report that the median Chinese listed company generates enough operating profit to cover their interest two times, down from a ratio of six times in 2010. Another report found that 45% of new company debt is raised to pay interest on existing debt.

In a developed economy, Ponzi lending of such an enormous scale would lead to widespread bankruptcies, unemployment and massive losses for investors and lenders. This hasn’t happened yet because Chinese debt has been expanding at an ever-faster rate. China’s total debt levels grew to about 300% of GDP last year from about 250% of GDP in 2014 and set a new record for a single month in January, growing at roughly 5% of the size of the economy. Problems have been covered over as the Chinese banking regulator is forcing banks to lend to companies that can’t pay their interest and would otherwise default. We know the bonfire is big and the wood is dry. The next step is to figure how quickly a fire could spread once it begins.

The second key component is the accelerant, which is the relatively high proportion of debt borrowed for short periods. Chinese wealth management products are typically sold by banks as an alternative to term deposits that pay much higher interest rates. Borrowers are almost always promised their money back within six months. The underlying investments are typically loans to companies that banks are unwilling to lend to. These borrowers have little prospect of repaying the debt at maturity unless someone else is willing to provide more debt. Another source of short-term funding is peer-to-peer platforms. However, 28% of these are thought to be fraudulent. In the institutional funding market, there’s commercial paper, which is composed of corporate debts of 270 days or less. Outstanding Chinese commercial paper was $1.61 trillion at the end of 2015, far larger than the U.S. equivalent at $1.05 trillion.

As shown by the financial crisis in 2008, short-term debt is an accelerant to fires in credit systems. Within a week of the collapse of Lehman Brothers, 26% of U.S. commercial paper disappeared. Investors were no longer willing to lend without asking questions and borrowers were sent scurrying for other sources of capital. A run on short-term funding sources quickly spreads the fire from one bankrupt borrower to many other borrowers.

Read more …

“Chinese customs officials reported $1.68 trillion in imports last year. Banks, on the other hand, claimed to have paid $2.2 trillion for those same imports. While the official balance-of-payments records a current account surplus of $331 billion in 2015, banks’ payments and receipts show a $122 billion deficit.”

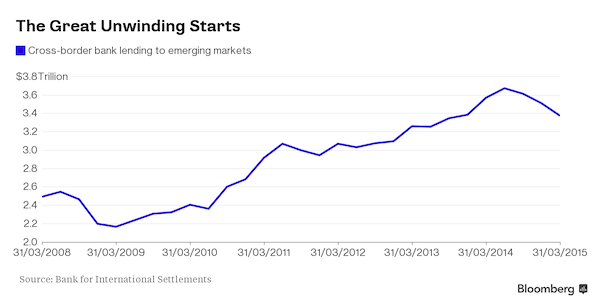

• Funny Numbers Show Money Leaving China (Balding)

News that China’s foreign-exchange reserves rose by $10 billion in March rather than declining has quieted doomsayers. Worries that the reserves could dip to dangerous levels as soon as this summer – after shrinking by an estimated $1 trillion last year – appear to have been premature. Still, questions linger over exactly how much money is leaving China and why. The true picture may not be as rosy as the headline numbers suggest. Before the March upturn, capital had been flooding out of China at a rapid clip – an average of $48 billion per month over the previous six months, according to official bank data. The reasons were several. Fearing further declines in the value of the yuan, several companies paid off their dollar loans; others pursued big acquisitions abroad. Individual investors sought out higher returns as the Fed prepared to raise rates.

The government spent billions to prop up the value of the currency. Some individuals and companies reduced their offshore yuan deposits. Still others looked to spirit money out of the country to safer havens. The question is how much money has been leaving for which reasons. Some analysts, including economists at the Bank for International Settlements, have argued that the bulk of these outflows are healthy, mostly involving companies paying down their foreign debt. However, the BIS study, which estimates that such repayments accounted for nearly a quarter of the $163 billion of non-reserve outflows in the third quarter of 2015, focuses on a very narrow slice of time. Foreign debt obligations grew rapidly in late 2014 and the first half of 2015, then shrunk dramatically in the third quarter.

Moreover, what those official figures miss are hidden outflows, disguised primarily as payments for imports, which appear to have created a $71 billion current account deficit in the same quarter, according to bank payments data. In effect, enterprising Chinese are overpaying massively for the products they’re importing. Chinese customs officials reported $1.68 trillion in imports last year. Banks, on the other hand, claimed to have paid $2.2 trillion for those same imports. While the official balance-of-payments records a current account surplus of $331 billion in 2015, banks’ payments and receipts show a $122 billion deficit. Overpaying for imported goods and services is a clever way for Chinese companies and citizens to move money out of the country surreptitiously.

Let’s say a foreign country exports $1 million worth of goods to China. Chinese customs officials will faithfully record $1 million in imports. But when the importer goes to the bank, he’ll either use fraudulent documentation or bribe a bank official to record a $2 million payment to the foreign counterparty. Presumably, the excess $1 million ends up in a private bank account. While some discrepancies are to be expected in data like this, the size and steady increase in the gap since 2012 implies that something shadier is going on. When Chinese companies pay down debt, or make big acquisitions abroad, they do so openly. These other outflows – which topped half a trillion dollars last year – seem far more likely to be driven by individuals and companies simply seeking to get their money out of the country.

The timing is also telling. The discrepancy began to grow rapidly in 2012, just as growth peaked and concerns began to rise among affluent Chinese about the economy and a political transition. Since then, fake import payments have grown from $140 billion to $524 billion in 2015. During that period, growth in China has slowed, rates of return on investment have declined and surplus capacity has exploded. Investment opportunities have shrunk, while state-owned enterprises have crowded out private investors. Certainly the latter have good reason to seek better returns elsewhere.

Read more …

“Corporate debt now amounts to 160% of China’s GDP… That is up from 98% in 2008 and compares with a current U.S. level of 70%.”

• China Is Set to Allow Banks to Swap Bad Loans for Equity in Borrowers (WSJ)

China is planning a debt-for-equity swap program that could provide large companies mired in overcapacity a way to reduce their debt burdens, the country’s top central banker said on Thursday. The deepening slowdown in the world’s second-largest economy has heightened the need for Chinese authorities to come up with ways to help the country’s heavily-indebted corporate sector deleverage. A plan in the works involves enabling banks to exchange bad loans for equity in companies they lend to. Speaking at a small-business financing event hosted by the OECD on Thursday, Zhou Xiaochuan, Gov. of the People’s Bank of China, said the planned debt-for-equity swap program would mainly help large companies plagued with excessive industrial capacity cut bank debt.

The event was held on the sidelines of a Group of 20 finance-chief meeting this week. Small Chinese companies, Mr. Zhou said, aren’t expected to benefit significantly from this program as they’re less indebted than their bigger brethren. He pointed to a persistent challenge faced by China’s policy makers: Despite a relative high leverage ratio in China’s economy, small businesses “still have difficulty in accessing bank loans.” In the past couple of years, the central bank has taken a number of steps—such as targeted credit-easing measures—to encourage banks to lend to small and private companies. But so far progress has been slow as large state banks, which dominate corporate lending in China, still prefer to lend to large state-owned corporate clients.

“We don’t have enough community banks to lend to small- and medium-sized enterprises,” Mr. Zhou said. The planned debt-for-equity swap program is a potentially controversial step that many Chinese bankers say could saddle banks with near-worthless stock and squeeze their liquidity. Analysts also say the move could risk keeping “zombie” companies afloat while making lenders even more strapped for capital. [..] Corporate debt now amounts to 160% of China’s GDP, according to Standard & Poor’s Ratings Services. That is up from 98% in 2008 and compares with a current U.S. level of 70%.

Read more …

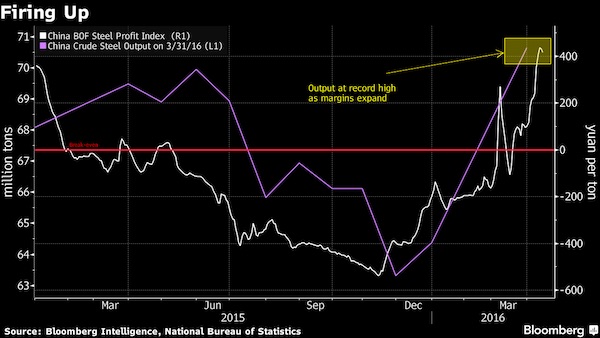

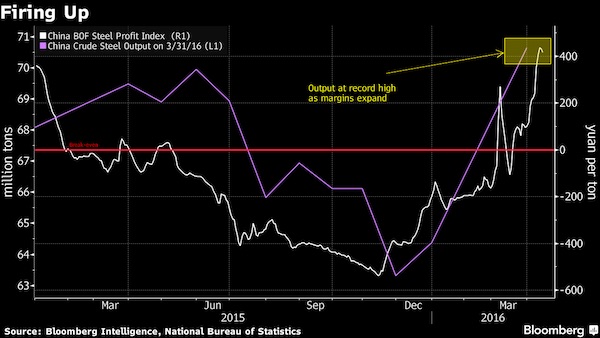

Steel exports are Beijing’s only window to avert widespread job losses and hence unrest.

• China’s Giant Steel Industry Just Churned Out Record Supply (BBG)

The world’s biggest steel producer pushed output to a record in March as mills in China fired up plants to take advantage of a price surge since the start of the year that’s rescued profit margins. Output rose 2.9% to 70.65 million metric tons from a year earlier, the National Bureau of Statistics said on Friday. That’s the highest ever, according to data from state-owned researcher Beijing Antaike Information. Still, for the first quarter, supply fell 3.2% to 192 million tons. The country’s steelmakers are ramping up output after cuts at the end of 2015 fueled a major price surge that has rippled out to world markets. The mills’ busiest-ever month came as figures showed that China’s economy stabilized, aided by a rebound in the property market.

Last year, the country’s steel output shrank for the first time since 1981 as demand contracted and mills battled surging losses and too much capacity, and forecasters including Australia’s government expect a further decline in 2016. “It’s normal to see higher output in March but this is a significant increase,” said Kevin Bai, a Beijing-based researcher at consultancy CRU Group. “Right now, the mills are making money. The market is still relatively tight and this has encouraged some producers to return.”

Read more …

They mean price discovery is dead for the moment. But it will be back. And what will central banks do then?

• What Negative Interest Rates Mean for the World (WSJ)

Central bankers around the world are pushing deeper into the once-unthinkable world of negative interest rates — essentially charging customers to hold their cash. Denmark set negative interest rates as early as 2012, followed by the ECB in 2014. Since then, they’ve been joined by Switzerland and Sweden. In Asia, the Bank of Japan announced a negative interest rate policy in January this year. Hungary became the first emerging market to experiment with negative rates, taking the plunge in March. With more of the world’s central banks joining in, and rates pushing further below zero, The Wall Street Journal this week explores how negative rates appear to be working in various settings and what they mean for policymakers and markets.

In Denmark: Some mortgage holders are the envy of home owners around the world. With negative interest rates, they’re actually receiving interest payments from the banks they initially borrowed from.

In Switzerland: Few banks are dealing with negative interest rates by passing them on to their customers, but Alternative Bank Schweiz in Switzerland is bucking the trend, and charging clients to hold their deposits.

In Germany: Life insurance companies with long term liabilities are feeling the squeeze of negative interest rates. Some groups require an annual yield of more than 5% to sustain their businesses, driving a typically low risk industry into increasingly risky assets.

In Japan: The announcement of negative interest rates spurred a massive rise in prices on the government’s 40 year bond, gains only usually seen on bonds in emerging markets like Venezuela. But even in Japanese government bonds, investors are taking on a new risk: duration. Money market trading is also withering in Japan, as the new interest rates set into place. The trading confirmation system used by domestic banks wasn’t fully updated until a month after the Bank of Japan’s rate cut.

In the U.S: policymakers are weighing up whether the policy could work for them. The U.S. economy is preparing for higher rather than lower rates, but even the Federal Reserve is investigating whether going negative might work in the event of another downturn.

And for monetary policy: What comes after negative rates? Helicopter money is one answer, according to James Mackintosh, as perverse effects of negative rate policies begin to crop up. Around the world, it looks like negative interest rates are here to stay. And like it or not, so are their effects.

Read more …

“The ECB and the Bank of Japan, grappling with stagnant economies, are using subzero rates to stimulate growth.” Which clearly doesn’t work.

• Negative Rates: Danish Couple Gets Paid Interest on Their Mortgage (WSJ)

Hans Peter Christensen got some unusual news when he opened his most recent mortgage statement. His quarterly interest payment was negative 249 Danish kroner. Instead of paying interest on the loan he got a decade ago to buy a house in [Aalborg] , his bank paid him the equivalent of $38 in interest for the quarter. As of Dec. 31, his mortgage rate, excluding fees, stood at negative 0.0562%. It has been nearly four years since Denmark entered the world of negative monetary policy, and borrowers and lenders alike are still trying to make sense of the upside-down world it has brought. “My parents said I should frame it, to prove to coming generations that this ever happened,” said Mr. Christensen, a 35-year-old financial consultant, about his bank statement.

Denmark isn’t the only place where central bankers are experimenting with negative rates. The ECB and the Bank of Japan, grappling with stagnant economies, are using subzero rates to stimulate growth. Switzerland and Sweden, like Denmark, are trying negative rates to keep their currencies in line with the struggling euro. Denmark, where the central bank’s benchmark rate stands at minus 0.65%, has lived in negative territory longer than any other country. Neighboring Sweden has been below zero for 14 months, and its central bank has said it would go lower than the current benchmark of negative 0.5% if it needs to. In Norway, the central bank still has positive rates, but it is considering resorting to negative ones to prop up an economy hit hard by the prolonged spell of low oil prices.

Scandinavia’s experience has given economists a chance to study what happens when rates drop below zero—long considered an inviolable floor on rates. Already, there are concerns about undesirable side effects. Consumer savings accounts pay no interest, and there is pressure on bank profitability. A boom in real-estate borrowing has kindled fears that problems will arise if rates bounce back up. “If you had said this would happen a few years ago, you would have been considered out of your mind,” said Torben Andersen, a professor at Denmark’s Aarhus University who serves on the government’s economic-advisory council.

Read more …

Watch derivatives.

• Deutsche Bank Settles Silver, Gold Price-Manipulation Suits (BBG)

Deutsche Bank has reached settlements in lawsuits over allegations it manipulated gold and silver prices, lawyers for traders of the commodities said in court filings. Attorneys for futures contract traders in two private lawsuits said in letters filed Wednesday and Thursday in Manhattan federal court that the bank has executed term sheets and is negotiating final details for the accords. The German financial firm also agreed to help the plaintiffs pursue similar claims against other banks as part of the settlements, according to the letters. Vincent Briganti and Robert Eisler, attorneys for traders in the silver-fixing lawsuit, said Deutsche Bank will turn over instant messages and other communications to help further their case. Financial terms of the settlements weren’t disclosed.

“In addition to valuable monetary consideration to be paid into a settlement fund, the term sheet also provides for other valuable consideration such as provisions requiring Deutsche Bank’s cooperation in pursuing claims against the remaining defendants,” attorneys Daniel Brockett and Merrill Davidoff said in their letter Thursday in the gold-fixing lawsuit. Silver and gold futures traders sued groups of banks in 2014 alleging they rigged prices for the precious metals and their derivatives. Silver traders brought claims against Deutsche Bank, HSBC, Bank of Nova Scotia and UBS. Gold traders additionally sued Barclays and Societe Generale.

The traders alleged the banks abused their positions of controlling daily silver and gold fixes to reap illegitimate profits from trading and hurting other investors in those markets who use the benchmark in billions of dollars of transactions, according to versions of the complaints filed in 2015. Of those banks, only Deutsche Bank has reached a settlement.

Read more …

This discussion is sinking to Forrest Gump levels.

• IMF Says Greek Debt Numbers Don’t Add Up as EU Defends Its Plan (BBG)

The IMF raised doubts about Greece’s ability to keep up repayments under a plan being negotiated with its European creditors, who insisted they’ve already provided plenty of debt relief. “Currently, as envisaged, the debt is not sustainable and what is required is a debt operation,” IMF Managing Director Christine Lagarde said Thursday in Washington, where finance ministers and central bankers are attending the fund’s spring meetings. Lagarde said she’s skeptical about Greece’s ability to meet the budget surplus target set under an €86 billion bailout by euro-area governments, who are reviewing whether to release the loan’s second installment. Under the EU program, Greece is committed to posting a fiscal surplus before interest payments of 3.5% of gross domestic product within two years.

The IMF has said it might be willing to pitch in a new loan itself, but Lagarde said the fund wants the country’s recovery plan to be based on “realism and sustainability.” “We cannot have far-fetched fantasy hypotheticals concerning the future of the Greek economy,” said the IMF chief, who was reappointed in February for a second five-year term. She said debt relief by euro-area countries doesn’t necessarily have to involve a “haircut” on principal, and could take the form of maturity extensions, interest reductions or a “debt holiday.” The more Greece cuts spending through reforms, the less debt restructuring will be required, Lagarde said. “Bottom line, it needs to all add up,” she said. The EU line has been that the numbers already add up.

On Thursday, a spokesman for euro-area finance ministers rejected the notion that Greece’s debt is unsustainable. “We did already a lot to make it more sustainable – lowering the interest rates, lengthening the maturities,” said Jeroen Dijsselbloem of the Netherlands, president of the Eurogroup, made up of the currency zone’s finance ministers. “So for the coming five to 10 years, I don’t think there is a big debt-service issue. I think the Greeks can pay on an annual basis.”

Read more …

What you find in the dictionary under both ‘Useless’ and ‘Lip service’. Nothing happened for years and years, and one leak later they’re all knights of justice?!

• UK and European Allies Plan To Deal ‘Hammer Blow’ To Tax Evasion (G.)

Britain and its European allies have announced new “hammer blow” rules against tax evasion in direct response to the Panama Papers leak that exposed how the world’s richest and most powerful people hide their wealth from the taxman. George Osborne announced on Thursday, in partnership with his counterparts from France, Germany, Spain and Italy, new rules that will lead to the automatic sharing of information about the true owners of complex shell companies and overseas trusts. The chancellor said the new rules, agreed this week in direct response to the Panama Papers leak, were “a hammer blow against those that would illegally evade taxes and hide their wealth in the dark corners of the financial system.

“Britain will work with our major European partners to find out who really owns the secretive shell companies and trusts that have been used as conduits for evading tax, laundering money and benefiting from corruption. “Strong words of condemnation are not enough, populist outrage doesn’t by itself collect a single extra pound or dollar in tax or put a single criminal in jail,” Osborne said at the spring meetings of the IMF in Washington. “What we need is international action now, and that’s precisely what we are doing today with real concrete action in the war against tax evasion.” He said the transparency rules on beneficial ownership showed that Britain and other governments are working to shine a spotlight on “those hiding spaces, those dark corners of the global financial system”.

He said he hoped the rules, which will come into effect in January 2017, would be followed up by other countries. Ángel Gurría, the secretary general of the OECD, said the release of the Panama Papers showed that there was no room for complacency in the international effort to crack down on tax evasion. He said it was no surprise that the rich and the powerful were using Panama to evade tax as “it is one of the few jurisdictions that has pushed against” international measures to improve tax and ownership transparency. “We have to crack down on the professional enablers – lawyers, accountants, financial institutions – that play a key role in maintaining the veil of secrecy,” he said.

Read more …

Whackamole.

• Spanish Industry Minister Resigns After Panama Papers Revelations (AFP)

Spain’s industry minister resigned Friday after he was named in the Panama Papers and other media revelations that claimed he had links to offshore firms, the latest political victim from the global scandal. Jose Manuel Soria said in a statement that he had tendered his resignation “in light of the succession of mistakes committed along the past few days, relating to my explanations over my business activities… and considering the obvious harm that this situation is doing to the Spanish government.” Soria’s troubles began on Monday when Spanish online daily El Confidencial, which has had access to the Panama Papers – files leaked from law firm Mossack Fonseca – said he had was an administrator of an offshore firm for two months in 1992.

Soria called a news conference to deny any link to any Panamanian company, but as the week went by, more allegations emerged from other media outlets, revealing further alleged connections to offshore havens. It is unclear as yet whether any of his alleged actions were illegal. Soria is the latest political victim of the Panama Papers, which resulted from what the law firm blamed on a computer hack launched from abroad, and revealed how the world’s wealthy stashed assets in offshore companies. Iceland’s Prime Minister Sigmundur David Gunnlaugsson was also forced to resign over the leaks.

Read more …

We keep thinking it’s not possible, but Europe keeps finding ways to sink deeper in its moral morass. It’s almost an achievement.

• Ten European Nations Want Military Planes For Refugee Deportations (AP)

Austria and nine East European and Balkan states are calling for an EU declaration endorsing the use of military aircraft for the deportation of migrants who have no chance for asylum, or whose request for that status have been rejected. The Austria Press Agency says the request is being made in a letter to EU foreign policy chief Federica Mogherini, signed by Austrian Defense Minister Hans Peter Doskozil on behalf of Austria and the other countries. APA on Thursday quoted the letter as saying the use of military aircraft should be “seen as an integral and decisive element of a full repatriation program.” The agency said the letter asked for the issue to be on the agenda of the next EU foreign ministers’ meeting in Luxembourg on April 19.

Read more …