Toni Frissell Fashion model in dolphin tank, Marineland, Florida 1939

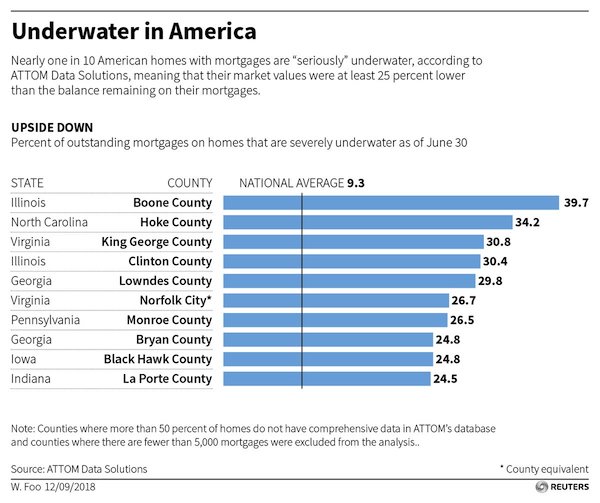

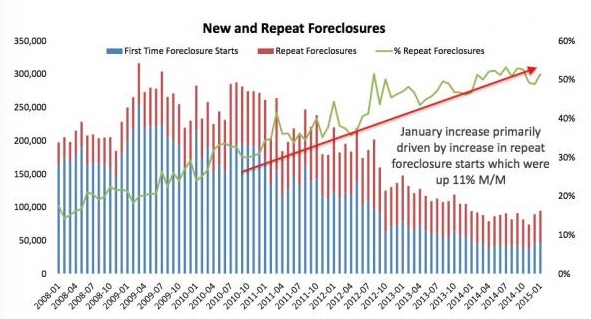

According to a new Zillow report, 40% of all US mortgage holders can’t afford to sell their homes. That is 20 million Americans homeowners, 10 million who are downright underwater and another 10 million who are so close to being there that they don’t have the money to cover the cost of selling. And those are still numbers across the spectrum; things are far towards the bottom. ‘30% of homes in the bottom price tier are in negative equity, while 18.1% of homes in the middle tier and 10.7% in the top tier are underwater’. If we assume that at the bottom, like across the spectrum, as many people are close to being submerged as those who already are, that would mean 60% of bottom tier borrowers are too poor to sell their homes (i.e. have less than 20% equity).

Pretty stunning numbers when you realize that this comes after 7-9 million homes were already foreclosed on (RealtyTrac lists 16.5 million foreclosure filings from 2006 through 2013), and millions more are still stalled in one or another step of the foreclosure process because banks don’t want to be forced to put the losses on their books. It also comes after 6 years in which many trillions of dollars were pumped into the top of the financial system to prevent it from crumbling. The problem is, of course, that those trillions were absorbed by the top. and never reached the bottom. It’s like watering a severely parched parcel of land.

A perhaps unexpected consequence of all this is that – potential – starters, a group already severely hindered by skyrocketing student loans and high levels of unemployment, find the starter home they might be able to afford remains occupied by people the market until recently would have penciled in for a move higher up the ladder. The US housing market is seriously congested. It could be opened with much lower prices, but that would significantly raise the number of underwater owners. As David Stockman writes: “Monetary central banking is an economy wrecker.” Just to make sure the market is eligible for awards in the absurd theater category, median prices have gone up by 11% since 2012. It should be obvious that such a market place in inherently self-defeating. Or should we really say American Dream-defeating?

Here’s what the Wall Street Journal takes away from the report:

Mortgage, Home-Equity Woes Linger

• At the end of the first quarter, some 18.8% of U.S. homeowners with a mortgage – 9.7 million households – were “underwater” on their mortgage, according to a report scheduled for release Tuesday by real-estate information site Zillow Inc. Z -3.19% While that is an improvement from 19.4% at the end of last year and a peak of 31.4% 2012, those figures understate the problem.

• In addition to the homeowners who are underwater, roughly 10 million households have 20% or less equity in their homes, which makes it difficult for them to sell their homes without dipping into their savings. Most move-up homeowners typically use their home equity to cover broker fees, closing costs and a down payment for their next home. Without those funds, many homeowners can’t sell.

• “It’s a sobering appreciation that negative equity is going to be with us for a while to come,” said Stan Humphries, Zillow’s chief economist. “Negative equity is central to understanding a lot of the distortions in the marketplace right now.”

• … prices have risen about 11% over the past two years, and several times that in rebounding markets like Las Vegas, Phoenix and much of California. Rising prices, combined with higher mortgage rates, have given sticker shock to buyers looking for a deal. This has been particularly hard on first-time home buyers who are usually in the market for a lower-priced home.

• Many underwater homeowners have gone into foreclosure or executed a short sale, where they sell the home for a loss. But many aren’t budging. “There are people who still have their jobs and they’re not late on their payment, but they can’t move,” said Vita Deveaux, a real-estate agent at Keller Williams Realty First Atlanta.

That’s essentially still just a bunch of numbers. But it’s not as if they’re some freak result of immaculate conception or spontaneous combustion. Therefore, David Stockman provides a wider perspective:

The Greenspan Housing Bubble Lives On: 20 Million Homeowners Can’t Trade-Up Because They Are Still Underwater

One of the most deplorable aspects of Greenspan’s monetary central planning was the lame proposition that financial bubbles can’t be detected, and that the job of central banks is to wait until they crash and then flood the market with liquidity to contain the damage. In fact, after the giant housing bubble crashed and left millions of Main Street victims holding the bag, Greenspan evacuated the Eccles Building, and then spent nearly a whole chapter in his memoirs explaining how this devastation wasn’t his fault.

Instead, he blamed Chinese peasant girls who came by the millions to the east China export factories where they lived a dozen at a time cramped in tiny dormitory rooms working 14 hour days. According to the Maestro, they “saved” too much, thereby enabling American’s to overdo it on the mortgage borrowing front. Yes, in so many words he said exactly that! Lets see. The Maestro was allegedly a data hound. Did he not notice that housing prices in the US rose for 111 straight months from late 1994 to 2006, and during that period increased by nearly 200% on average across US neighborhoods. How in the world could this giant aberration have escaped the notice of the money printers around Greenspan in the Eccles Building?

How in the world could any adult thinker blame this on factory girls in China – that is, a policy regime that caused excessive savings? In fact, it is plainly evident that the People’s Printing Press of China attempted to protect its exchange rate from appreciating against the flood of dollars emitted from the Eccles Building. It did this in mercantilist fashion by pegging the RMB exchange rate and thereby accumulating a massive hoard of US treasury notes and Fannie/Freddie paper. In short, China didn’t “save ” America into a housing crisis; the Greenspan Fed printed America into a cheap debt binge that ended up impairing the residential housing market for years to come. So the problem with central bank inflation of financial bubbles is that when they burst the damage is extensive, capricious and long-lasting.

It is no great mystery that historically trade-up borrowers have been the motor force that drove the US housing market. Selling their existing home for a better castle, trade-up buyers vacated the bottom-end of the market so that first time buyers could find a foothold. Now thanks to Washington’s eternal conviction that debt it the magic elixir of economic growth, first time buyers are few and far between because they are buried in student debt – about $1.1 trillion to be exact. Each graduating class has more students with loans to carry forward, and in higher and more onerous amounts. Fully 70% of the class of 2014 has student loans, and they average of about $30,000 each. Both figures are triple what they were just a decade ago.

As prices rise, and millions of homeowners and their families are drowning in the American dream, housing is a perfect reflection of what America has become: a nation in which the less affluent working men and women, those who were once known as the middle class, are sinking deeper, albeit slowly for the time being, along with the millions who abandoned the dream of homeownership as time went by.

That makes America already a radically different nation from what it once was, with only one way to go, but how many people fully acknowledge that change? I’m pretty sure most still think their dreams will return, and be fulfilled, at some point in the future. But that’s not going to happen, because all the credit that props up the top tier of society today was largely borrowed from the bottom tier, so things can only get worse when payback time comes. And it will, when interest rates rise. They can’t go any lower, unlike the fast growing contingent of less affluent Americans. Interest rates can only go up from here, and at some point it won’t matter anymore how skilled a swimmer you are.

• 9.7 Million Americans Still Have Underwater Homes, Zillow Says (Forbes)

A total of 9.7 million American households still have “underwater” mortgages, meaning they owe more on the home than it is currently worth. Homes in the lowest price tier are most affected, according to data released today from Zillow. 30% of homes in the bottom price tier are in negative equity, while only 18.1% of homes in the middle tier and 10.7% in top tier are underwater, according to Zillow’s Negative Equity Report. Homes are defined as top, middle, or bottom tier based on their estimated value compared to the median home price for that area. (Nationally, the median price in the top tier is $306,700; middle tier, $163,400; bottom, $98,400.) Overall, 18.8% of homeowners were underwater during the first quarter of 2014. And more than one-third of all homeowners with a mortgage were “effectively” underwater, meaning they have less than 20% equity in their home.

Zillow’s figures for homes with negative equity are higher than other recent reports looking at the same problem. This is in part because the Zillow report captures the current amount a homeowner owes on a mortgage via data from Transunion, while other reports estimate the current loan balance based on public records. But there are also differences in the way various data companies estimate a home’s current value. Different methodologies lead to different findings. For example, CoreLogic’s most recent report shows far fewer homes with negative equity than Zillow’s: nearly 6.5 million homes (13.3% of mortgaged propertes) were in negative equity at the end of 2013, according to CoreLogic. That’s 3 million less than the negative equity homes Zillow is counting.

What’s particularly significant about the Zillow report is that it underscores a reason for the low prevalence of first-time homebuyers in the market: many owners of less expensive homes can’t afford to sell. “The unfortunate reality is that housing markets look to be swimming with underwater borrowers for years to come,” said Zillow Chief Economist Dr. Stan Humphries via a release. “It’s hard to overstate just how much of a drag on the housing market negative equity really is, especially at the lower end of the market, which represents those homes typically most affordable for first-time buyers. Negative equity constrains inventory, which helps drive home values higher, which in turn makes those homes that are available that much less affordable.”

Read more …

• 20 Million Homeowners Can’t Trade-Up Because They’re Underwater (Stockman)

Here we are 96 months after the housing peak, yet there are still 20 million households which are either underwater on their mortgages or do not have enough embedded equity to cover the transaction costs and down payment needed to move. Since there are only 50 million households with mortgages, that means that as a practical matter 40% of mortgage borrowers are precluded from trading-up. It is no great mystery that historically trade-up borrowers have been the motor force that drove the US housing market. Selling their existing home for a better castle, trade-up buyers vacated the bottom-end of the market so that first time buyers could find a foothold.

Now thanks to Washington’s eternal conviction that debt it the magic elixir of economic growth, first time buyers are few and far between because they are buried in student debt—-about $1.1 trillion to be exact. Each graduating class has more students with loans to carry forward, and in higher and more onerous amounts. Fully 70% of the class of 2014 has student loans, and they average of about $30,000 each. Both figures are triple what they were just a decade ago. In any event, for those Millennials who do manage to accumulate a down payment by the time they are in their early 30s there is precious little starter home inventory available. The Greenspan mortgage debt serfs from the previous generation are blocking the way.

Read more …

• Mortgage, Home-Equity Woes Linger (WSJ)

Nearly 10 million U.S. households remain stuck in homes worth less than their mortgage and a similar number have so little equity they can’t meet the expenses of selling a home, trends that help explain recent sluggishness in the housing recovery. At the end of the first quarter, some 18.8% of U.S. homeowners with a mortgage—9.7 million households—were “underwater” on their mortgage, according to a report scheduled for release Tuesday by real-estate information site Zillow Inc. While that is an improvement from 19.4% at the end of last year and a peak of 31.4% 2012, those figures understate the problem. In addition to the homeowners who are underwater, roughly 10 million households have 20% or less equity in their homes, which makes it difficult for them to sell their homes without dipping into their savings.

Most move-up homeowners typically use their home equity to cover broker fees, closing costs and a down payment for their next home. Without those funds, many homeowners can’t sell. “It’s a sobering appreciation that negative equity is going to be with us for a while to come,” said Stan Humphries, Zillow’s chief economist. “Negative equity is central to understanding a lot of the distortions in the marketplace right now.” Those distortions include the inventory of homes for sale, which, while rising, is low by historical standards. It also helps explain why first-time home buyers are having such a hard time cracking the market. Real estate is in some ways like a ladder, Mr. Humphries notes, so when underwater homeowners don’t trade up it makes it harder for newcomers to get in.

Read more …

• Blackrock CEO Says US Housing “Structurally More Unsound” Now (Bloomberg)

BlackRock CEO Laurence D. Fink said the U.S. housing market is “structurally more unsound” today than before the financial crisis because it depends more on government-backed mortgage companies such as Fannie Mae and Freddie Mac. “We’re more dependent on Fannie and Freddie than we were before the crisis,” Fink said today at a conference held by the Investment Company Institute in Washington, noting that he was one of the first Freddie Mac bond traders on Wall Street. Fink, who has built New York-based BlackRock into a $4.4 trillion money manager, said today that with strong underwriting standards, ownership of affordable homes can again become a foundation for American families.

The U.S. Senate Banking Committee is working to overhaul the housing-finance system, after casting a narrow vote this month to advance a bill that would wind down Fannie Mae and Freddie Mac. Current shareholders of Fannie Mae and Freddie Mac would be in line behind the U.S. for compensation from the wind-down. Restructuring the mortgage market is the largest piece of unfinished U.S. business from the 2008 credit crisis, when regulators seized Fannie Mae and Freddie Mac as they neared insolvency. The companies, which buy mortgages and package them into securities, were bailed out with $187.5 billion from the Treasury and backed a growing share of mortgages as private capital dried up.

Read more …

Traders asleep at the wheel?

• An Incredible Explanation For The Relentless Stock Rally (Yahoo!)

Cal Ripken’s 2,632 consecutive starts. DiMaggio’s 56 straight games with a hit. Those streaks pale in comparison to what’s happening in the market right now. That’s because the S&P has gone 468 days since experiencing a correction of 10% or more. That’s the fourth longest streak on record, according to Newedge. Still not impressed? How about this: The S&P hasn’t closed below its 200-day moving average in over 18 months. Waiting for the correction has become an absurdist activity, the financial equivalent of “Waiting for Godot.” “We’ve been above trend for far too long. It’s been four years since we’ve had a close below the 150-day moving average. We have to go back to 2003 – 2007 to find a similar run,” said Rich Ross of Auerbach Grayson. “The stage is set for a serious 10% correction. Maybe even 20%”.

Of course, identifying the catalyst for said correction has been a near impossible task for most market participants. But some are starting to point to the composition of the recent leg of the run as a warning sign. “We’ve had a defensive rally all year long,” said Chantico Global’s Gina Sanchez. “Defensive stocks continue to be the better bets, and the rotation continues into value. I don’t know what will be the straw that breaks the camel’s back, but the pace of earnings can’t continue to be stronger than the pace of the economic recovery.” Still, just because history or logic says something should happen doesn’t mean it will. And to some investors, there could be a simpler explanation for this decade’s unstoppable rally.

“As more portfolios become passive in nature, less attention is paid to the daily ups and downs for the news cycle for a given asset class. Suppression of volatility is a symptom of this,” wrote Josh Brown, CEO of Ritholtz Wealth Management. “People who attribute this purely to the Fed probably have it half wrong.” According to Brown, assets under fee-based accounts have swelled to $1.3 trillion in 2013 from $200 billion in 2005. Most of this money is not being actively managed and is being put to work in a methodical, passive fashion each month. This provides a constant bid to the market as wealth managers become less incentivized to jump in and out of stocks and more rewarded to buy, and buy more. “This means a bias toward buying equities every day and almost never selling,” wrote Brown. “It means adding to stocks sheepishly on up days and voraciously on the (rarely occurring) down ones.”

Read more …

No, really?

• Bank of England’s Bean Says Stimulus Exit May Be Difficult (Bloomberg)

Bank of England Deputy Governor Charlie Bean said policy makers face potential “potholes” when it comes to exiting the extraordinary stimulus measures they implemented during the recession, many of which put central banks into uncharted territory. “I do not expect central banks’ collective management of the exit from the present exceptionally stimulatory monetary stance will be easy,” Bean said in a speech in London yesterday. “Market interest rates are bound to become more volatile along the exit path, however well central banks communicate their intentions.”

The challenge of how and when to remove stimulus is one that Bean won’t have to face, as he retires at the end of next month after a 14-year career at the BOE. Governor Mark Carney said last week that while the U.K. is moving closer to a point that it will need tighter policy, the inflation outlook and the need to use up more spare capacity in the economy weigh against an immediate increase in the key interest rate. With the benchmark at record-low 0.5% and the recovery strengthening, U.K. policy makers are battling rate-increase expectations. Bean echoed language the BOE used in its Inflation Report last week, saying that when it comes time to begin rate increases, the Monetary Policy Committee will move “gradually.”

Read more …

Zzzzz.

• Germany Finance Watchdog Finds Evidence Of Forex Manipulation (Reuters)

Germany’s financial watchdog has discovered clear evidence that market participants attempted to manipulate reference currency rates, widening the probe to include many more banks and saying international investigations into the matter were far from over. Regulators globally are looking at traders’ behaviour on key benchmarks, spanning interest rates, foreign exchange and commodities. Eight financial firms have been fined billions of dollars for manipulating reference interest rates, and the probe into the largely unregulated $5.3 tn-a-day foreign exchange market could prove even costlier. The head of banking supervision at German watchdog Bafin, Raimund Roeseler, said the latest discoveries in the forex probe were worrying and it was “much, much bigger” than the investigation into benchmark interest rates, such as Libor.

“There were clearly attempts to manipulate prices, that’s what was disturbing,” Roeseler said on Tuesday at the regulator’s annual news conference. Market participants had attempted to manipulate daily fixing rates for a number of different currencies, he said without specifying what evidence had been gleaned. “It’s not the really big currencies, not the dollar/euro, but several currencies were involved,” he said, noting the Mexican peso was one of the currencies involved. More than 30 foreign exchange traders at many of the world’s biggest banks have already been put on leave, suspended or fired as forex probes in various countries expand.

Read more …

The Germans are not entirely blinded yet. But they have 27 other nations they must lead.

• Bundesbank Warns Market Calm Hides Risks Of Low Interest Rates (Bloomberg)

New risks to financial stability could emerge from the combination of generous central bank policies and investors’ search for yield in a low-interest rate environment, Bundesbank board member Andreas Dombret said. “We do see risks, despite the fact that the markets are calm,” Dombret said in an interview in Frankfurt yesterday. “Real-estate markets in some European countries are pretty high, corporate bond valuations seem stretched and high. The low volatility leads to market participants thinking that they don’t need to hedge.”

Record-low yields on debt from Spain to Ireland are adding to evidence that investors are leaving the euro area’s debt crisis behind them, and Germany’s DAX Index of stocks is near an all-time high. Even so, consumer prices are proving slow to pick up, prompting the European Central Bank to consider adding yet more stimulus as soon as next month. A risk measure that that uses options to forecast fluctuations in equities, currencies, commodities and bonds fell to its lowest level in almost seven years last week. Bank of America Corp.’s Market Risk Index dropped to minus 1.22 on May 14, the lowest level since June 2007. The measure was at minus 1.19 yesterday.

Dombret, 54, will this month take charge of banking and financial supervision at Germany’s Bundesbank, after previously leading the financial stability department. His new role gives him a seat on the ECB’s Supervisory Board, which will be responsible from November for overseeing about 130 euro-area banks. A challenge facing the ECB is bringing order to the array of models for assessing risk deployed by the region’s lenders. Dombret said regulators shouldn’t attempt completely to harmonize those models. “If we unify risk models this could lead to herd behavior, with all those negative effects, and would also exclude the institute-specific measures, which are important for diversity,” he said. “I am a big believer in continuing to use risk models, and counter-checking them with leverage ratios.”

Read more …

Europe’s faking it all the way.

• Europe’s Debt Time Bomb (Bloomberg)

One of the consequences of the European debt crisis is that some of the region’s biggest borrowers will face big debt repayments sooner than they might have otherwise. In simple terms, Spain and Italy found it easier and cheaper to take out short-term loans, rather than longer-term funding. The result, though, is a repayment hump in 2015 that will need to be financed with fresh debt sales. Here’s a chart of the how the average length of time until Italy’s debts come due has changed year by year:

In the first quarter of 2011, Italy had an average of 7.25 years to repay its debts. As it sold more debt with shorter maturities, that average has dropped to 6.27 years.

Here’s the same chart for Spain:

In the first quarter of 2010, Spain had an average of 6.51 years to repay its debts. That figure is down to 5.76 years.

Read more …

Could get nice if the elections this week turn sour.

• Are European Bonds Signaling Trouble? (CNBC)

The quick move higher in the yields of Europe’s weakest sovereigns from historic lows may be just the beginning and on the edges it could start to affect other low-rated credits where investors have hunted for yield—such as U.S. junk bonds. Driven by speculation about the European Central Bank and selling by major investors, the prices of peripheral European bonds have been weakening since last week. As a result, the yields of sovereigns—Spain, Italy, Greece, Portugal and Ireland—have all moved higher, while the core German bund yield has edged just slightly higher. The 10-year Spanish bond, for instance, was yielding 3.008% Tuesday, after reaching a low of 2.832% last Thursday, its lowest level in 20 years. As investors sell, Greece’s 10-year yield is creeping back toward 7%, after making a four-year low of 5.85% in April.

“I think this has more room to go. It’s been about a year in the making. We’ve barely seen much of it yet,” said Marc Chandler, chief currency strategist at Brown Brothers Harriman. “Some large funds like BlackRock have indicated they are beginning to take profits on it. Then the EU and IMF expressed concern that those bond market rallies were not going to be sustainable.” Trader chatter has increased about the fact the selloff in Europe could lead to more caution about risk exposure in other areas of global fixed-income markets. “While there’s not been wholesale selling and aggregate index performance has turned in solid results, underlying trends suggest a consolidation in risk exposure,” said Adrian Miller, director fixed-income strategy at GMP Securities.

Read more …

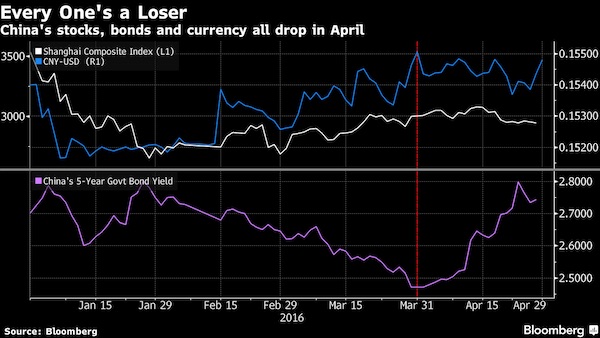

• Moody’s Turns Negative On China Property (CNBC)

Moody’s joined the drumbeat of pessimism on China’s property industry, cutting its outlook to negative from stable, but it still expects most rated developers’ finances will remain on an even keel. “We expect a significant slowdown in residential property sales growth, high inventory levels and weakening liquidity over the coming 12 months,” Moody’s said in a report Wednesday. “A differentiation in the credit quality of developers will become more apparent.” Concerns that China’s property market is a popping bubble recently moved to the front burner, with home sales in the four months ended April down 9.9%, after slumping 7.7% in the first quarter. Property is estimated to account for around 20% of the mainland’s gross domestic product (GDP).

Read more …

• Money Won’t Come Cheap For China Banks’ $120 Billion Funding Spree (Reuters)

Chinese banks are poised to raise a record $120 billion in the next two years to shore up their balance sheets in the face of slowing growth and rising bad debts, but the funds could prove expensive and hurt earnings as investors demand a premium. For the first time, banks will raise capital by issuing preference shares and other so-called hybrid securities, a funding technique that avoids the need for issuing ordinary shares into a badly hit stock market. Just in the past two weeks, Agricultural Bank of China and Bank of China announced plans to raise about $29 billion in preferred shares between them. As growth slows and bad debts build up, the banks are rushing to replenish their balance sheets to meet new global capital rules known as Basel III.

The Chinese government has been rigorously enforcing these regulations in its efforts to ward off a financial crisis following a huge run-up in debt since 2008 and a marked slowdown in the economy. Analysts say the flood of regulatory capital will help investors diversify their portfolio, but they are expected to drive a hard bargain given the concerns about transparency in China’s opaque financial system and the worrying rise of toxic debt in recent years. “Given the size of the proposed capital issues and the concerns about transparency in the Chinese banking system, it may be hard to price aggressively versus the western structures currently out there,” said Ivan Vatchkov, chief investment officer of Algebris Investments (Asia).

The first few deals should give banks an idea of returns that investors will demand on hybrid capital securities. China CITIC Bank International, a Hong Kong-based affiliate of China CITIC Bank , in April sold capital securities in the offshore market at an interest rate about 100 basis points over the same bank’s subordinate bonds. Benchmark five-year subordinate debt from China’s top-rated banks currently trades at a yield of 5.25%, suggesting banks will have to price yields at around 6.3% for preferred shares to lure investors – a side effect of an economy growing at its slowest pace in decades. Some analysts warn that forcing banks to pay hefty yields on new hybrid capital instruments would not only pressure their profitability, but also threaten their ability to continue lending aggressively as bad loans rise in a slowing economy. Chinese banks’ non-performing loan figures rose to a two-year high at the end of 2013, according to official data.

Read more …

The amount means nothing. Trading restrictions are the clincher.

• BNP Falls as US Probe Said to Cost More Than $5 Billion (Bloomberg)

BNP Paribas fell to a seven-month low in Paris on concern U.S. authorities will seek more than $5 billion from the bank to settle a probe into alleged violations of U.S. sanctions. The stock fell as much as 3% and was down 2.7% at 50.39 euros as of 9:03 a.m., the lowest since Oct. 1. U.S. authorities are seeking the penalty to settle federal and state investigations into the lender’s dealings with countries including Sudan and Iran, according to a person with knowledge of the matter. The amount sought has escalated and now far exceeds the $2.6 billion that Credit Suisse agreed to pay in a settlement with the U.S. for helping Americans evade taxes. Discussions are continuing and the final number could change, the person said.

Last week, four people with knowledge of the matter told Bloomberg News that U.S. authorities were asking for at least $3.5 billion to settle the BNP case. As they did with Credit Suisse, U.S. prosecutors are seeking a guilty plea from BNP, which said last month it may need more than the $1.1 billion it has set aside to settle the case. The settlement, which would be the largest penalty for sanctions violations, could be announced as soon as next month, said the person, who asked not to be identified because a final decision hasn’t been made.

Read more …

Wall Street getting rid of the competition?

• BNP Paribas Risks Client Flight as Ban on Transfers Looms (Bloomberg)

Credit Suisse Group emerged from a guilty plea this week relatively unscathed. The punishment that prosecutors are now holding over BNP Paribas’s head could have more severe consequences. A temporary ban on transferring money into and out of the U.S., floated by New York’s Superintendent of Financial Services Benjamin Lawsky, would be in addition to more than $5 billion in fines and a guilty plea to criminal charges for violating U.S. sanctions, according a person with knowledge of the talks. No similar punishment targeting a business was imposed when Credit Suisse’s main bank subsidiary admitted helping U.S. citizens evade taxes.

Regulators haven’t determined how harsh the BNP Paribas prohibition would be, according to one of the people who asked not to be identified because the negotiations are private. If the French lender isn’t allowed to pay another bank to provide the service, it could push some customers to competitors. “When your client has to go to a rival bank to get the most basic banking service, even for a few months, you’ll lose them,” said Fred Cannon, New York-based head of research at Keefe, Bruyette & Woods Inc. “Not all, but some will take their business completely to that rival and not come back.”

Read more …

• German Unease With ECB Simmers as Anti-Euro Party Gains (Bloomberg)

Lawmakers from Chancellor Angela Merkel’s party are criticizing European Central Bank policies as a German anti-euro party gains support before elections across Europe this week. Misgivings by Finance Minister Wolfgang Schaeuble about the ECB’s threat of unlimited bond-buying and Merkel’s warning of “deceptive calm” in financial markets are the latest signs that German policy makers and economists don’t want to discount the lingering risk to taxpayers from the debt crisis.

As polls suggest the anti-euro Alternative for Germany may win as much as 7% of the German vote for the European Parliament on May 25, members of Merkel’s Christian Democratic Union in the Bundestag, or lower house, questioned the underpinnings of ECB President Mario Draghi’s pledge in July 2012 to do “whatever it takes” to save the euro. “The Bundestag would certainly have major concerns to clear the way for unlimited bond purchases by the ECB,” Norbert Barthle, the budget spokesman for the Christian Democrats in parliament, said by phone. “I said back then that the ECB is making itself strongly dependent on political decisions” because lawmakers in Berlin would have a say in the process if the central bank ever decided it wants to buy a euro-area country’s bonds as part of an aid package, he said.

Read more …

This is presented as a good sign?!

• Lower Consumer Spending, Imports Shrink Japan Trade Deficit (Bloomberg)

Japan’s trade deficit shrank in April as imports rose the least in 16 months after the first sales-tax increase in 17 years crimped consumer spending. Inbound shipments rose 3.4% from a year earlier, the Ministry of Finance said today in Tokyo. Exports increased 5.1%, leaving a deficit of 808.9 billion yen ($8 billion), down 7.8% from a year earlier. Reductions in the nation’s trade deficits, which extended their record run to 22 months, would help Prime Minister Shinzo Abe’s efforts to drive a sustained economic recovery and an exit from deflation. So far, the nation’s export gains have been limited, even with a 17% slide in the yen against the dollar since he took office in December 2012.

“Imports boosted by front-loaded demand before the sales-tax hike dropped off in April,” Yoshiki Shinke, chief economist at Dai-ichi Life Research Institute in Tokyo, said before the report. “We have to wait for exports to recover strongly before we will see a real drop in the trade deficit and that situation is still way out of sight,” said Shinke, the most accurate forecaster of Japan’s economy for two years running in data compiled by Bloomberg. [..] Abe increased the sales levy to 8% in April from 5%, as he tries to contain the world’s biggest debt burden. An environmental tax on energy, which also took effect from April 1, undercut imports of oil and coal, according to Nomura Holdings Inc. economists led by Minoru Nogimori, writing in a research report before the data.

Read more …

What if Chinese demand plunges?

• Russia, China Sign Long Awaited $400 Billion Mega Gas Deal (Reuters)

Russia’s state-controlled Gazprom signed a long-awaited gas supply agreement with energy-hungry China today. There were no pricing details on the deal, which is believed to involve Russia supplying 38 billion cubic metres of gas per year to China via a new eastern pipeline linking the countries. It has been unofficially valued at over US$400 billion. Alexey Miller, chief executive officer of OAO Gazprom, Russia’s biggest company, signed the contract with Chinese officials in Shanghai during a two-day visit to China by President Vladimir Putin, according to a Bloomberg report. The move comes as Moscow diversifies away from the European market – but the price for the deal has been a sticking point. In return, it would help to ease Chinese gas shortages and heavy reliance on coal.

Talks on the proposed 30-year contract between Gazprom and state-owned China National Petroleum Corporation began more than a decade ago. A tentative agreement signed in March last year calls for Gazprom to deliver the 38 billion cubic metres per year of gas beginning in 2018, with an option to increase that to 60 billion cubic metres. Analysts have previously said the agreement would give advantages for both sides and tie the two countries closer together. The gas deal would mean China would be in a “de facto alliance with Russia”, according to Vasily Kashin, a China expert at the Centre for Analysis of Strategies and Technologies in Moscow. In exchange, Moscow might lift restrictions on Chinese investment in Russia and on exports of military technology, Kashin said. “In the more distant future, full military alliance cannot be excluded.”

Read more …

As I said. 1000 times.

• Green Cars Won’t Save the Planet(Bloomberg)

A massive polar ice cap seems to be melting. What are we going to do to stop it? The answer, as I’ve often posited in this space, is “likely nothing.” Oh, I don’t mean literally “nothing”; I’m sure people will continue to write angry editorials and buy “green” consumer products. But I don’t think we’re likely to do much in the way of actually reducing greenhouse-gas emissions, which contribute to the climate change that is melting the ice caps. A few weeks back, this drew a censorious e-mail from a longtime commenter who noted that he was making a serious commitment to emissions reduction by, among other things, buying a Chevrolet Volt. My response to him is that “buying a Volt” does not constitute getting serious about carbon emissions. The idea that we can save the planet while barely changing our consumption patterns is one of the reasons that we are not going to actually “get serious” about global warming.

Read more …

Shell’s desperate defense from reality. Well, it’s a cover up mostly. Climate rules don’t matter, they’re simply running out of reserves.

• Shell Hits Back At ‘Carbon Bubble’ Claims (Guardian)

Shell has hit back at claims that its multi-billion dollar investments in tar sands, fracking and other unconventional oil and gas exploration will create a “carbon bubble” which may backfire catastrophically because of expected global climate change legislation. Previous research by economists, campaigners, and MPs has suggested that the majority of coal, oil and gas reserves of publicly listed companies, including Shell, are “unburnable” if the world is to have a chance of not exceeding global warming of 2C, the level governments have agreed to limit rises to. That is leading to a so-called carbon bubble, an overvaluation of oil companies’ financial value, they have said. But in a 20 page response to its shareholders who are meeting on Tuesday in The Hague, Netherlands, for the company’s annual meeting, Shell strongly refutes the criticism that it is vulnerable to such a bubble.

“Shell believes that the risks from climate change will continue to rise up the public and political agenda. We are already taking steps to minimise our emissions and we are preparing the company for when legislation and markets will support a more significant action to mitigate CO2,” said JJ Traynor, vice president of investor relations at Royal Dutch Shell. “We do not believe that any of our proven reserves will become stranded. While the ‘stranded asset’ notion may appear to be strong and thought-through, it does have some fundamental flaws and there is a danger that some interest groups use it to trivialise the important societal issue of rising levels of CO2 in the atmosphere,” he wrote.

Shell claimed that the methodology used by its critics was wrong because it failed to acknowledge that global energy demand was likely to increase with population growth and with increasing global prosperity. “As GDP rises in China and India… energy demand will increase on this journey,” said Traynor. “Energy demand growth, in our view, will lead to fossil fuels continuing to play a major role in the energy system – accounting for 40-50% of energy supply in 2050 and beyond. The huge investment required to provide energy is expected to require high energy prices and not the drastic price drop envisaged for hydro carbons in the carbon bubble concept”.

Read more …

Nice piece.

• Just Imagine… If Russia Had Toppled The Canadian Government (RT)

Just imagine if the democratically-elected government of Canada had been toppled in a Russian-financed coup, in which far-right extremists and neo-Nazis played a prominent role. That the new unelected ‘government’ in Ottawa cancelled the law giving the French language official status, appointed a billionaire oligarch to run Quebec and signed an association agreement with a Russian-led trade bloc. Just imagine… If Russia had spent $5 billion on regime change in Canada and then a leading Canadian energy firm had appointed to its board of directors the son of a top Russian government politician.

Just imagine… If the Syrian government had hosted a meeting in Damascus of the ‘Friends of Britain’- a group of countries who supported the violent overthrow of David Cameron’s government. That the Syrian government and its allies gave the anti-government ‘rebels’ in Britain millions of pounds and other support, and failed to condemn ‘rebel’ groups when they killed British civilians and bombed schools, hospitals and universities. That the Syrian Foreign Minister dismissed next year’s scheduled general election in the UK as a ‘parody of democracy’ and said that Cameron must stand down before any elections are held.

Just imagine… If in 2003, Russia and its closest allies had launched a full-scale military invasion of an oil-rich country in the Middle East, having claimed that that country possessed WMDs which threatened the world and that afterwards no WMDs were ever found. That up to 1 million people had been killed in the bloodshed that followed the invasion and that the country was still in turmoil over 10 years later. That Russian companies had come in to benefit from the reconstruction and rebuilding work following the ‘regime change’.

Read more …

Cool!

• Santa Cruz Becomes First California County To Ban Fracking (RT)

Santa Cruz County has become the first county in California to implement a “permanent” ban on hydraulic fracturing, or fracking, in addition to all other onshore oil and gas development. The county’s Board of Supervisors voted 5 to 0 on Tuesday to pre-emptively outlaw fracking in the county. “Some would say this is a symbolic gesture,” said Supervisor Bruce McPherson, according to KQED. “But I think it’s a message that needs to be sent out and listened to, especially on our quality of life and particularly about the impact it might have on our water supply, whether it occurs inside this county or in adjacent counties.”

Injection wells used to dispose of highly-toxic fracking wastewater have contributed to heightened earthquake activity across the nation. The wastewater – riddled with hazardous and often undisclosed chemicals and contaminants – has been linked to a host of human and environmental health concerns. A recent study found that some of the most drought-ravaged areas of the US are also heavily targeted for oil and gas development using fracking, which exacerbates water shortages. In California, 96 percent of new fracking wells were found to be located in areas where competition for water is high. A drought emergency for the entire state – which has traditionally dealt with water-sharing and access problems – was declared in January. The city of Santa Cruz instituted mandatory water rationing for residents last month.

Read more …

Oh mother …

• French Rail Company Orders 2,000 Trains Too Wide For Platforms (Reuters)

France’s national rail company SNCF said on Tuesday it had ordered 2,000 trains for an expanded regional network that are too wide for many station platforms, entailing costly repairs. A spokesman for the RFF national rail operator confirmed the error, first reported by satirical weekly Canard Enchaine in its Wednesday edition. “We discovered the problem a bit late, we recognize that and we accept responsibility on that score,” Christophe Piednoel told France Info radio. Construction work has already begun to reconfigure station platforms to give the new trains room to pass through, but hundreds more remain to be fixed, he added.

The mix-up arose when the RFF transmitted faulty dimensions for its train platforms to the SNCF, which was in charge of ordering trains as part of a broad modernization effort, the Canard Enchaine reported. The RFF only gave the dimensions of platforms built less than 30 years ago, but most of France’s 1,200 platforms were built more than 50 years ago. Repair work has already cost €80 million ($110 million). Transport Minister Frederic Cuvillier blamed an “absurd rail system” for the problem, referring to changes made by a previous government in 1997. “When you separate the rail operator (RFF) from the user, SNCF, it doesn’t work,” he told BFMTV.

Read more …