NPC L.E. White Coal Co. yards, Washington 1922

Everyone’s betting on the helicopter arriving soon.

• Asian Shares Rally As Wall Street Strikes New Record High (R.)

Asian stocks rose to a 2-1/2-month peak on Tuesday, a day after Wall Street shares hit a record high thanks to a combination of upbeat U.S. data and expectations of more stimulus from global policymakers. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6% to hit its highest level since late April. Japan’s Nikkei jumped 2.5% as investors bet the country’s government may inject $100 billion in fiscal spending to boost the economy, possibly financed by the central bank’s money-printing, a policy mix that is often dubbed “helicopter money”. European shares are seen opening flat to slightly lower, with spread-betters expecting Britain’s FTSE 100 and Germany’s DAX to fall 0.1% and France’s CAC 40 to be flat.

On Wall Street, the S&P 500 index on Monday broke a new record high, its first in more than a year, extending its gain after Friday’s bumper job figures reduced worries about slowdown in employment. The benchmark closed at a record 2,137.16, overtaking the previous high of 2,130.82 hit on May 21, 2015. Globally low interest rates from central bank stimulus in both Japan and Europe are supporting risk assets. Bond yields in the U.S., Japan, Germany, France and the U.K all hit record lows last week as investors bet on more stimulus following the Brexit shock.

Follow the strong leader no matter what he says or does. A culture fraught with danger.

• Abe Orders New Stimulus Package To Water ‘Seeds Of Growth’ (R.)

Japanese Prime Minister Shinzo Abe ordered a new round of fiscal stimulus spending after a crushing election victory over the weekend as evidence mounted the corporate sector is floundering due to weak demand. Abe did not give details on the size of the package, but Japanese stocks jumped nearly 4 percent and the yen weakened over perceptions a landslide victory in upper house elections now gives him a free hand to draft economic policy. An unexpected decline in machinery orders shows the economy needs something to overcome consistently weak corporate investment. Economists worry, however, that Abe’s focus on public works spending will not tackle the structural issues around a declining population and workforce.

More public works also increases pressure on the Bank of Japan to keep interest rates low and the yen weak to make sure stimulus spending will gain traction. The government was ready to spend more than 10 trillion yen ($100 billion), ruling party sources told Reuters before the election. “We are going to make bold investment into seeds of future growth,” Abe told a news conference on Monday at the headquarters for his ruling Liberal Democratic Party (LDP). [..] Abe said he wanted to strengthen agriculture exports from rural areas and improve infrastructure, such as trains and ports, to welcome more tourists and cruise ships from overseas. “We have promised through this election campaign that we will sell the world the agricultural products and tourism resources each region is proud of,” he said.

Abe has no more ideas.

• Japan Turns Again to Bernanke, as Fruits of Abenomics Wither (BBG)

Less than three weeks before the Bank of Japan’s next scheduled policy meeting, Governor Haruhiko Kuroda met with former Federal Reserve Chairman Ben S. Bernanke over lunch on Monday. The BOJ issued no statement on the substance of the talks, which come as the central bank confronts a fresh strengthening in the yen this year that risks undermining inflation and weakening the appetite for investment and wage increases. Prime Minister Shinzo Abe will meet Bernanke at 3 p.m. local time on Tuesday, according to Abe’s office. For Bernanke, offering views on Japan’s challenges and policy options would be nothing new. He delivered a famous 2003 speech calling for greater cooperation between monetary and fiscal policy makers to defeat deflation and spur the economy.

In the room during Bernanke’s meetings with Japanese officials 13 years ago in Tokyo: Abe and Kuroda, who a decade hence unleashed an unprecedented stimulus to revive Japan. Now, that project is increasingly at risk with inflation moving away from the BOJ’s target, and GDP growth far from Abe’s goals. Bernanke’s 2003 visit, when he was a Federal Reserve Board member, and his message at the time is still discussed by BOJ officials. Japan has a tradition of seeking the advice of overseas experts, something that’s been taken to a new level under Abe, who consulted with Nobel laureates Paul Krugman and Joseph Stiglitz prior to his decision in June to delay a sales-tax hike. Unlike with this week’s Bernanke visit, the meetings with Krugman and Stiglitz were well-publicized.

Stockman uses strange definitions of inflation and deflation. Nobody should use CPI.

• Bernanke’s Black Helicopters Of Money (David Stockman)

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis. But strip away the pseudo scientific jargon, and it amounts to monetization of the public debt—–the very oldest form of something for nothing economics. Back then, of course, Ben’s jabbering about helicopter money was taken to be some sort of theoretical metaphor about the ultimate powers of central bankers, and especially their ability to forestall the boogey-man of “deflation”.

Indeed, Bernanke was held to be a leading economic scholar of the Great Depression and a disciple of Milton Friedman’s claim that Fed stringency during 1930-1932 had caused it. This is complete poppycock, as I demonstrated in The Great Deformation, but it did give an air of plausibility and even conservative pedigree to a truly stupid and dangerous idea. Right about then, in fact, Bernanke grandly promised during a speech at Friedman’s 90th birthday party that today’s enlightened central bankers – led by himself – would never let it happen again. Presumably Bernanke was speaking of the 25% deflation of the general price level after 1929.

The latter is always good for a big scare among modern audiences because no one seems to remember that the deflation of the 1930’s was nothing more than the partial liquidation of the 100%-300% inflation of the general price level during the Great War. In any event, Bernanke was tilting at windmills when he implied that the collapse of the US wartime and Roaring Twenties boom had anything to do with the conditions of 2002. Even the claim that Japan was suffering from severe deflation at the time was manifestly false. In fact, during the final stages of Japan great export and credit boom, the domestic price level had risen substantially, increasing by nearly 70% between 1976 and 1993. It then simply flattened-out – and appropriately so – after the great credit, real estate and stock market bubble collapse of 1990-1992.

And this is the end result of QE et al.

• The Trillions Spent By Central Banks Has Been A Dud: BofA (MW)

Toasts all around? U.S. stocks charged into record territory on Monday after Friday’s jobs report helped restore confidence in the U.S. economic recovery. But not so fast. The solid data mask a worrisome reality — despite the trillions collectively spent by central banks to breathe life into their economies since the 2008 financial crisis, authorities have been largely shooting blanks, according to Bank of America Merrill Lynch. The S&P 500 climbed to an intraday high of 2,143 Monday, passing the previous intraday record of 2,134.72 set on May 21, 2015. Stocks gained in part because the U.S. economy added 287,000 new jobs last month, far better than the gain of 170,000 projected by economists in a MarketWatch survey.

Yet the same report revealed that the labor participation rate—a metric to measure those who are employed or actively searching for jobs—is hovering at a 38-year low of 62.7%. A weak labor participation rate is an indication that an increasing number of people are leaving the labor force either through retirement or because they’re discouraged by not finding employment. It is also a sign that job growth isn’t tracking as robustly as it should considering that the U.S. economy expanded to $18 trillion in 2015 from $2.4 trillion in 1978. What’s more, the official unemployment rate edged up to 4.9% in June from 4.7% in May as more people entered the labor force looking for jobs. This headline number, however, excludes millions of part-time workers who would really rather work full time, as well as those who have become too discouraged to look for work, period. If this broader group was accounted for, the actual jobless rate would be closer to 10%.

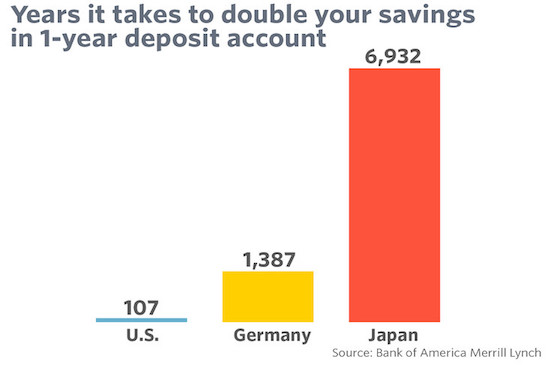

It all suggests that the labor market, and by extension the economy, may not be as healthy as it should be given the prolonged period of accommodative monetary policy in the U.S. and elsewhere. It’s against this backdrop that a team led by Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch, demonstrated how ineffective they believe central banks’ collective quantitative easing has been. Central banks around the world have cut interest rates a combined 659 times since Lehman Brothers filed for bankruptcy on Sept. 15, 2008, resulting in negative rates in many major economies, according to Hartnett. “Incited by the belief that every single interest rate in the world is heading to zero, the mountain of cash on the sidelines has induced fresh ‘irrational upside’ in government and corporate bonds,” said the strategist, in a note.

A picture of the real China.

• Ground Zero of China’s Slowdown Leaves Locals Looking for Exit (BBG)

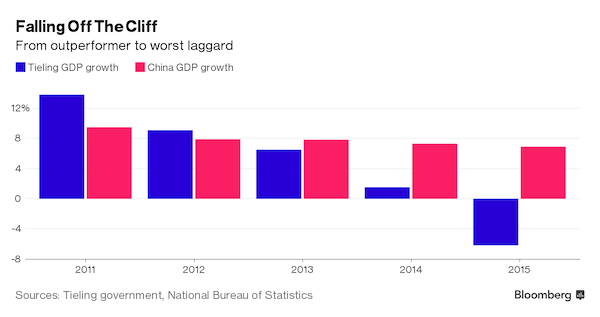

Tea-shop manager Zhang Yue is so desperate about her home city of Tieling’s future that she’s borrowed about five times her annual income to buy a work visa to leave for Japan – an economy that’s flat-lined for a generation. “Two years ago, everything was fine and I bought whatever I wanted,” said Zhang, 29, whose husband’s wages have since halved and her own have stalled. “Then, suddenly, the slump started. The economy went straight down. It’s in free fall.” The home to about 3 million people in the northeast rust-belt province of Liaoning is ground zero in China’s slowdown – the worst-performing city in the worst-performing province. Ads offering work visas abroad are peppered across hoardings, and billboards offer loans for people in “urgent need.”

Shuttered car-parts factories flank the highway to the high-speed train station. In the center, a closed wedding-photograph studio has a notice in the window that reads: “Owner is going overseas. Shop for sale.” Tieling is among the places hardest hit by a slowdown across the nation of 1.4 billion people triggered in recent years by a commodity-price slump, housing correction and campaign to rein in wasteful investment. The city has seen a triple whammy from the three dynamics, which left the local economy contracting 6.2% last year – compared with national growth of near 7%. Fixed-asset investment in Tieling – largely property and infrastructure investment – plummeted 39%, steel output plunged 89%, industrial output dropped 18% and coal production was down almost 8%.

Keep this up and tar and feathers are your part.

• HSBC Avoided US Money Laundering Charges Because Of ‘Market Risk’ Fears (BBC)

US officials refused to prosecute HSBC for money laundering in 2012 because of concerns within the Department of Justice that it would cause a “global financial disaster”, a report says. A US Congressional report revealed UK officials, including Chancellor George Osborne, added to pressure by warning the US it could lead to market turmoil. The report alleges the UK “hampered” the probe and “influenced” the outcome. HSBC was accused of letting drug cartels use US banks to launder funds. The bank, which has its headquarters in London, paid a $1.92bn settlement but did not face criminal charges . No top officials at HSBC faced any charges. The report says: “George Osborne, the UK’s chief financial minister, intervened in the HSBC matter by sending a letter to Federal Reserve Chairman Ben Bernanke… to express the UK’s concerns regarding US enforcement actions against British banks.”

The letter said that prosecuting HSBC could have “very serious implications for financial and economic stability, particularly in Europe and Asia”. Justice Department spokesman Peter Carr said a series of factors were considered when deciding how to resolve a case, including whether there may be “adverse consequences for innocent third parties, such as employees, customers, investors, pension holders and the public”. The report also accuses former US Attorney General Eric Holder of misleading Congress about the decision. The report says Mr Holder ignored the recommendations of more junior staff to prosecute HSBC because of the bank’s “systemic importance” to the financial markets.

Nonsensical article. If any of this were valid, US banks were so weak pre-Brexit, lower profits were cast in stone no matter what.

• Brexit Seen Biting Profit for Years at US Banks (BBG)

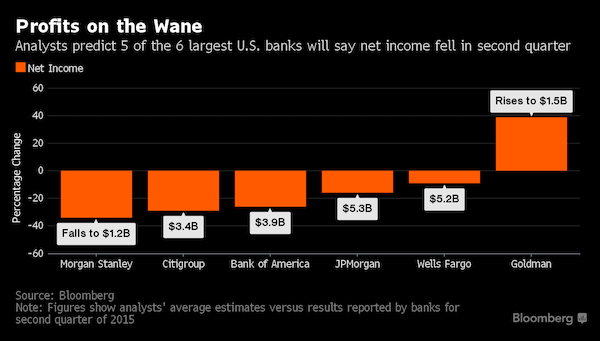

When U.S. banks post second-quarter results in days, it’ll boil down to this: Bonus cuts are coming for just about everyone this year, says Wall Street recruiter Richard Lipstein. “If you are break-even, it’s an achievement.” That’s the picture taking shape as analysts trim estimates for the quarter and overhaul long-term projections for banks’ main businesses after the U.K.’s vote to leave the European Union. Starting this week, JPMorgan Chase, Citigroup and Goldman Sachs probably will say they saw a quick bump in trading after the June 23 referendum, but that deals are stalling and years of pain lie ahead. Combined net income at the six biggest U.S. banks is estimated to fall 18% in the second quarter from a year earlier, according to analysts surveyed by Bloomberg.

Fred Cannon, global research director at Keefe, Bruyette & Woods, said many analysts are just starting to rework projections for future periods to account for Brexit’s fallout, such as the prolonging of low interest rates. “We went from lower for longer into what seems like lower forever,” he said. That will erode interest from lending. Market turmoil and economic drags linked to Brexit will hurt investment banking revenue as companies reconsider acquisitions and selling new securities. And that’s after trading units suffered their worst first quarter since 2009.

For the full year, analysts predict combined earnings at the six U.S. banks – which also include Bank of America, Wells Fargo and Morgan Stanley – will drop 14%. It may only partially recover in 2017, the estimates show. The projections for both years tumbled after markets swung earlier this year, and then slipped further after the U.K. vote as analysts began updating research. “Up until June 24, everybody thought the second quarter was building a nice recovery, and now you have to question that,” said Chris Kotowski, a bank analyst at Oppenheimer & Co., referencing the day ballots were tallied. “I’m more cautious than I was.”

As long as the country stays in the eurozone, yes.

• Italy ‘Facing 20 Years Of Economic Woe’: IMF (BBC)

The IMF has warned that Italy faces two decades of stagnant economic growth. Its latest report on the country puts growth this year at under 1%, down from its previous 1.1% estimate, and forecasts growth in 2017 of about 1% – down from a 1.25% estimate. The IMF says Italy will not reach pre-crisis levels until 2025, by which time its neighbours will have economies 20-25% above 2008 levels. Italy is the third largest eurozone country. It has 11% unemployment and a banking sector in crisis, with government debt second only to that of Greece. The country’s banks are under pressure because the long-standing poor economic performance has depressed tax revenue and increased the chances of businesses getting into difficulty and being unable to maintain their loan payments.

Italian banks are weighed down by massive bad debts, and may need a significant injection of funds. The IMF says any recovery is likely to be prolonged and subject to risks. Among those risks are the UK’s withdrawal from the European Union, which it said last week had prompted it to downgrade its forecasts for growth for the entire eurozone. Other problem areas include “the refugee surge, and headwinds from the slowdown in global trade”.

Just in case it wasn’t clear yet just how crazy our times are.

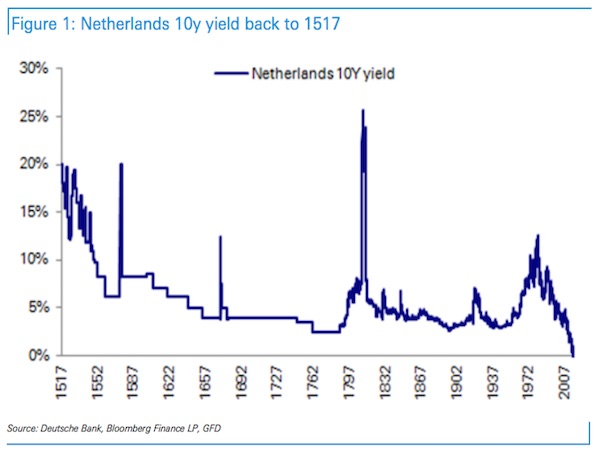

• Dutch Bonds Just Did Something That We Haven’t Seen In 499 Years (BI)

Dutch 10-year government bond yields dropped below zero for the first time ever on Monday, making them the latest to join the negative yield club. The Netherlands’ 10-year dipped by 0.08 %age points to as low as -0.007%. It has fallen by about 30 basis points since the June Brexit vote. There’s roughly $13 trillion of global negative-yielding debt now, according to data from Bank of America Merrill Lynch, cited by the Wall Street Journal on Sunday. By comparison, there was about $11 trillion ahead of the UK’s vote on EU referendum.

When a bond is negative yielding, it means investors get less back when the debt is due than what they pay for it today. The Dutch bond yields are the lowest the country has ever seen. Amazingly, there’s nearly half a millennium of records to compare that against, as record keeping began in 1517. As a historical reference point, that’s the same year that Martin Luther published his 95 Theses. You can see the history of the Dutch 10-year going back to 1517 in the chart below, which was shared by Deutsche Bank’s Jim Reid in his Monday note to clients.

America wants revenge.

• Citibank To Close Key Venezuela Payment Account: Maduro (AFP)

Citibank plans to close the account Venezuela uses to make international payments, President Nicolas Maduro said Monday, accusing the US-based bank of a “financial blockade.” “Citibank, with no warning or communication, says that it is going to close the Central Bank and Bank Of Venezuela account. That is what you call a financial blockade,” the embattled president said in televised remarks. He said the move amounted to an “inquisition” by US President Barack Obama’s administration. Maduro said his South American nation, a major oil producer, uses the account to make payments “within 24 hours, to other accounts in the United States and worldwide.” Maduro’s socialist government has often claimed that US interests and local business elites were trying to blockade his state-led economy and prevent Venezuela’s access to international credit.

“Do you think they are going to stop us by putting in place a financial blockade? No, ladies and gentlemen, nobody stops Venezuela! With Citibank or without it, we are moving forward. With Kimberly or without, we are moving.” Venezuela’s government said just hours earlier that it would take over operations at facilities where US consumer goods giant Kimberly-Clark recently shut down, citing unworkable economic conditions. The American company announced on Saturday it would cease production, saying that it was impossible to get enough hard currency to buy raw materials, and that inflation was surging. “We are going to sign, at the workers’ request… to authorize immediate occupation of the workplace known as Kimberly-Clark de Venezuela… by its workers,” Labor Minister Oswaldo Vera said at the facility’s plant in the central city of Maracay.

Look, they just don’t care. That’s what Britain has a unique oppottunity to step away from. It doesn’t mean there’s no corruption in Britain, but inside the EU it would be guaranteed. Note: it’s quite an achievement to get France’s socialists and Marine le Pen on the same page. But Barroso gets it done. AND he’ll remain eligible for his (very rich) EU benefits and pension …

• European Commission Under Fire Over Barroso’s Goldman Sachs Job (EuO)

[..] “Barroso’s decision … is morally and politically deplorable”, said Gianni Pittella, leader of the Socialist and Democrats group in the European Parliament. “After 10 years of mediocre governance of the EU, now the former EU Commission president will serve those who aim to undermine our rules and values,” he added. The Brussels-based lobby watchdog, Corporate Europe Observatory’s (CEO), said the commission’s line – that Barroso acted within the rules – was “pathetic”. “Major loopholes exist in both the rules and the way in which they are implemented … there should be a mandatory cooling-off period of at least five years for former commission presidents regarding direct and indirect corporate lobbying activities,” the NGO’s Nina Holland said. She noted that nine of Barroso’s former commissioners had gone to work for big business after their terms ended in 2014.

Meanwhile, the timing of Barroso’s move could hardly have been worse for the commission. Eurosceptic movements around Europe have long accused EU officials of trampling on ordinary people’s welfare to serve the interests of elites in developments that came to a head in the Brexit vote. France’s far-right Marine Le Pen tweeted that the Barrose move was “not a surprise for people who know that the EU does not serve people but high finance”. French socialist MEPs called on Goldman Sachs to let him go. In a statement on Monday they called the appointment “outrageous and shameful”. They said that he breached the EU treaty and should be stripped of his EU benefits and pension.

They cited article 245 of the EU treaty, which says that commissioners should respect the “obligations arising therefrom and in particular their duty to behave with integrity and discretion as regards the acceptance, after they have ceased to hold office, of certain appointments or benefits.” Barroso led the commission through the tumultuous years of the euro crisis and related bailouts. Under his tenure, the EU set up financial rescue funds to help troubled countries and their banks, but at the cost of severe austerity in Greece, Ireland and Portugal. Goldman Sachs was one of the US investment banks at the heart of the 2008 financial crisis that triggered the events when lenders traded failing mortgages as parts of complex financial instruments.

Earlier this year, the Wall Street firm agreed to a civil settlement of up to $5 billion with federal prosecutors and regulators to resolve claims resulting from the marketing and selling of faulty mortgage securities to investors. Goldman Sachs also helped Greece to hide part of its deficit in the early 2000s, by using so called currency swaps. But the currency trades end up doubling the Greek deficit and leading to the edge of ruin. Barroso himself had been a student leader in an underground Maoist group during his university years. The 60 year-old served as prime minister of Portugal between 2002 and 2004 before heading the EU’s executive for 10 years.

Accountants, unaccountable.

• Oligarchs of the Treasure Islands (MWest)

The “Big Four” global accounting firms – PwC, Deloitte, KPMG and Ernst & Young – are the masterminds of multinational tax avoidance, the architects of tax schemes which cost governments and their taxpayers more than $US1 trillion a year. Although presenting as “the guardians of commerce” they are unregulated and unaccountable; they have infiltrated governments at every level and should be broken up. This is the view of George Rozvany, Australia’s most published expert on transfer pricing, which is one of the principal ways large corporations pursue cross-border tax avoidance. Rozvany stepped down last year as head of tax in Australia for the world’s biggest insurance company, Allianz. Formerly, he was an insider at Ernst & Young, PwC and Arthur Andersen.

“The Big Four have, under a Rasputin-like cloak of illusion strayed from their original and critical role of verifying the accuracy of financial accounts for all stakeholders, to be “accountants of fortune” merely representing the accounting position for multinationals and developing aggressive international tax avoidance practices,” he told michaelwest.com.au. Rozvany is writing a series of books on corporate tax ethics. “This is not a victimless crime,” he says. “While Western governments have been cutting back their aid to the most underprivileged in society, from the homeless to orphaned children in Africa, multinational companies have been diverting ever larger profits into tax havens”.

“The global community must also recognise the links between aggressive taxation behaviour, money laundering, corruption, organised crime and terrorism, of which the Brussels bombings and 9/11 are chilling reminders. This, unquestionably, is the financial sewer of humanity where the purpose for such money, no matter how malevolent, is simply hidden until used”, Rozvany says. [..] “Their signage adorns the skyline in every major city in the world. They have meticulously manicured their public image. They are spectacularly profitable but beyond the law. They are trusted but not trustworthy. They have become too big, too big to fail, so they must be broken up. Break up is hardly radical. It has been done in many industries including banking, oil and communications”.

He’ll get stronger in the face of adversity.

• Trump Wins -Even If He Loses- (Nomi Prins)

Once upon a time not so long ago, making America great again involved a bankroll untainted by the Republican political establishment and its billionaire backers. There would, The Donald swore, be no favors to repay after he was elected, no one to tell him what to do or how to do it just because they had chipped in a few million bucks. But for a man who prides himself on executing only “the best” of deals (trust him) this election has become too expensive to leave to self-reliance. One thing is guaranteed: Donald Trump will not pony up a few hundred million dollars from his own stash. As a result, despite claims that he would never do so, he’s finally taken a Super PAC or two on board and is now pursuing more financial aid even from people who don’t like him.

Robert Mercer and his daughter Rebekah, erstwhile influential billionaire backers of Ted Cruz, have, for instance, decided to turn their Make America Number 1 Super PAC into an anti-Hillary source of funds – this evidently at the encouragement of Ivanka Trump. In the big money context of post-Citizens United presidential politics, however, these are modest developments indeed (particularly compared to Hillary’s campaign). To grasp what Trump has failed to do when it comes to funding his presidential run, note that the Our Principles Super PAC, supported in part by Chicago Cubs owners Marlene Ricketts and her husband, billionaire T.D. Ameritrade founder J.

Joe Ricketts, has already raised more than $18.4 million for anti-Trump TV ads, meetings, and fundraising activities. (On the other hand, their son, Pete, Republican Governor of Nebraska, has given stump speeches supporting Trump.) To put this in context, that $18.4 million is more than the approximately $17 million that all of Trump’s individual supporters, the “little people,” have contributed to his campaign.

Home › Forums › Debt Rattle July 12 2016