NPC Balloon at Shriners convention, Washington DC 1923

Recovery in all its glory.

• Less Than Half Of US 22-26-Year-Olds Pay Their Own Rent, Health Insurance (F.)

According to a new survey, people in their 20s and 30s are having trouble “adulting,” or achieving financial independence. Conducted by Bank of America and USA Today, the report says less than half of the 22-26-year-olds surveyed pay their own rent (47%), health insurance (41%), or contribute to a retirement account (27%). One thing they learned from the survey of Millennials (born in the early 1980s to mid ‘90s) and Generation Z’ers (born in the mid-1990s to early 2000s) said Andrew Plepler, the bank’s Enterprise, Social and Governance executive, was that “adulthood” defined by people in their 20s isn’t about age or milestones such as getting married or buying a home. “Instead, the majority said that adulthood really begins when you’re financially independent – when you can find a job, pay your own bills, cover your own rent and stop relying on mom and dad for financial support,” he said.

Indeed, the respondents who did report feeling like adults said it’s because they had help preparing from their parents (60%), because they have a job (60%) or they had a role model to guide the way (49%). They’re also thinking ahead about the economy in the wake of the presidential election : • 65% say economic issues are more important to them than social issues (34%) • Most would choose a candidate that’s best for the country (79%) over one who would improve just their own financial situation (21%) • Job growth/unemployment (27%), health care costs (25%) and college affordability/student debt (24%) rose to the top as young voters’ top campaign issues in this election. • Among those with student debt, nearly 25% say it will impact the way they vote “a great deal”

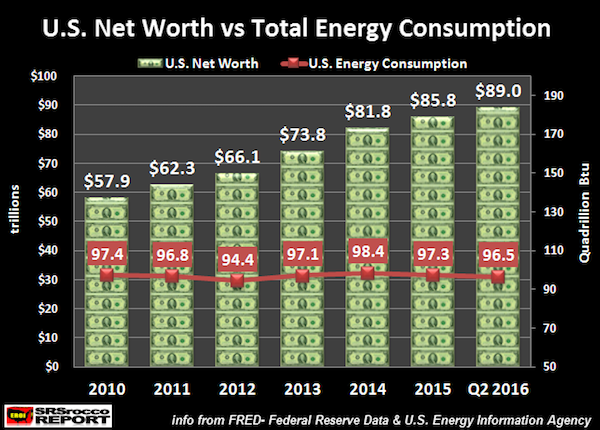

Yeah, maybe net worth vs energy use is a good way to measure reality.

• The Coming Collapse Of US Net Worth Will Wipe Out Millions Of Americans (SRSr)

As the Financial Circus continues today, pushing down the precious metals prices, millions of Americans are going to get wiped out when the collapse of U.S. net worth begins in earnest. Anyone with a tad bit of common sense realizes these financial markets today are totally disconnected from reality. With new stories of 40 million Russians to take part in “Nuclear Disaster” drill, the Philippine President telling President Obama “To Go To Hell”, he’s buying weapons from Russia, U.S. Suspends Diplomatic Relations With Russia on Syria, U.S. Ends Fiscal 2014 With $1.4 Trillion Debt Increase: Third Largest In History, Deutsche Bank Troubles Raise Fear of Global Shock, it’s completely hilarious that the gold and silver prices are selling off big time today.

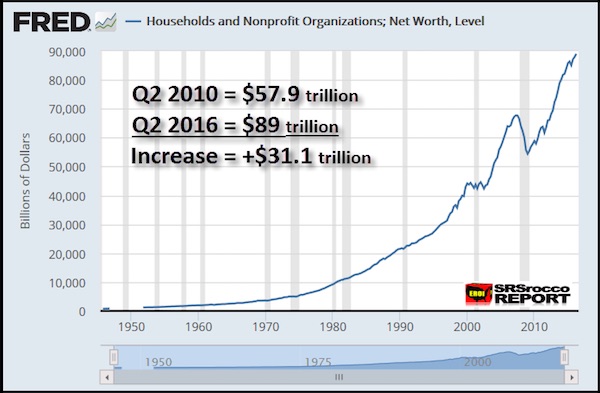

With 90% of the U.S. media now in control by six large mega-corporations, Americans have no idea just how bad the U.S. financial system has become. News stories today that would have caused a stock market crash and a spike in the precious metals years ago… no longer are a realistic barometer of the market today. Instead, the broader Stock, Bond and Real Estate Markets where 99% of Americans are invested, continue to be propped up. How propped up? Well, let’s say by a staggering $31 trillion in the past six years. According to the wonderful folks at the Federal Reserve, U.S. net worth increased from $57.9 trillion Q2 2010, to a stunning $89 trillion Q2 2016:

I would imagine a lot of wealthy Americans believe they are living life “High On The Hog” today. However, that $31 trillion in additional wealth is a nothing more than a “Digital Mirage.” For wealth to grow, more energy must be burned and positive economic activity must be generated. This is the foundation of all economic principles. Unfortunately, Americans did not burn more energy to create this additional $31 trillion in U.S. net worth. Matter-a-fact, total U.S. energy consumption in 2016 will likely turn out to be less than it was in 2010. This chart is very simple to understand. The left axis shows U.S. net worth in trillions of dollars while the right axis indicates total U.S. energy consumption in quadrillion Btu’s (that’s one hell of a lot of energy). As we can see, total U.S. energy consumption has fluctuated a bit, but has been relatively flat for the past six years.

[..] How the U.S. GDP increased nearly 25% in six years while its energy consumption remained flat is one for the record books. Now, this wasn’t always the case. U.S. energy consumption nearly tripled from 34 quad Btu’s in 1950 to 98 quad Btu’s in 2000. Thus, U.S. GDP increased as total energy consumption increased.

Obsolete.

• World Leaders Vow To Boost Growth Despite Brexit, Anti-Globalization (CNBC)

World finance leaders pledged Saturday to use more resources to try to bolster economic gains as they confront stubbornly slow growth and a rising backlash against globalization. The policy committee for the 189-nation IMF said the world has “benefited tremendously from globalization” but that protectionism is a threat. Increasing anger over globalization dominated the annual meetings of the IMF and its sister lending agency, the World Bank. The unhappiness is evident in Britain’s vote in June to leave the EU and in the U.S. presidential campaign of Republican Donald Trump. Trump has said millions of Americans have lost jobs or seen wages stagnate because of unfair trade practices of countries such as China and Mexico. He is vowing to impose penalty tariffs if those practices are not halted.

The British vote sent shockwaves through financial markets this summer, and there were further troubles Friday when the British pound plunged by 6% against the dollar before recovering. Investors worry whether there will be more turbulence if the British exit proves to be messy and prolonged. IMF Managing Director Christine Lagarde said “growth has been too low for too long, benefiting too few,” and that’s what officials need to address. In their statement, IMF officials committed to designing and putting in place policies “to address the concerns of those who have been left behind and to ensure that everyone has the opportunity to benefit from globalization and technological change.”

Raising more debt to pay for legal costs….

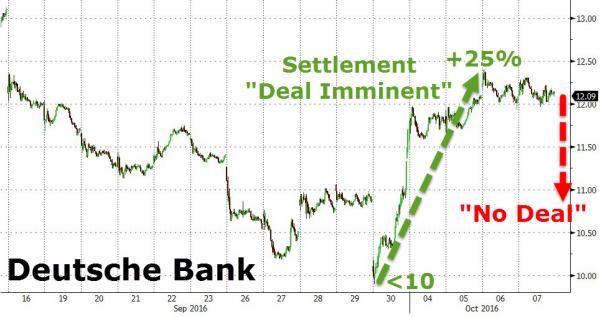

• Deutsche Bank CEO Cryan Doesn’t Reach Accord With US (BBG)

Deutsche Bank CEO John Cryan failed to reach an agreement with the U.S. Justice Department to resolve a years-long investigation into its mortgage-bond dealings during a meeting in Washington Friday, Germany’s Bild newspaper reported. The meeting was meant to negotiate the multi-billion-dollar settlement the bank will have to pay to resolve alleged misconduct arising from its dealings in residential-mortgage backed securities that led to the 2008 financial crisis, according to a Bild am Sonntag report. The German lender is still considering seeking damages against Anshu Jain and Josef Ackermann, who are both former CEOs of the bank, the newspaper reported. Bild said the bank froze part of the millions in bonus payments to Jain and other former top managers.

Concerns about Deutsche Bank’s ability to pay the $14 billion opening settlement bid from the Justice Department sent the lender’s stock to a record low last month. The bank, which set aside €5.5 billion ($6.2 billion) for litigation at the end of June, may face additional penalties to wrap up other outstanding investigations, including one into a money-laundering probe tied to its Russia operations. Analysts at Barclays speculate that could cost the bank as much as €2 billion. Cryan, a Briton who speaks fluent German, has sought for the last three weeks to reassure investors that Deutsche Bank can weather the formidable obstacles to its financial health.

The bank is holding informal talks with Wall Street firms about options to deal with legal costs, including a stock sale that could raise €5 billion, people with knowledge of the matter said this week. Qatar’s royal family is also considering increasing its stake in Deutsche Bank to as much as 25%, according to people with knowledge of the matter. Cryan has said the lender may fail to be profitable this year after posting the first annual loss since 2008 last year. With plans to eliminate thousands of jobs and cut risky assets, he called 2016 a peak restructuring year.

The state of the German economy: selling off assets.

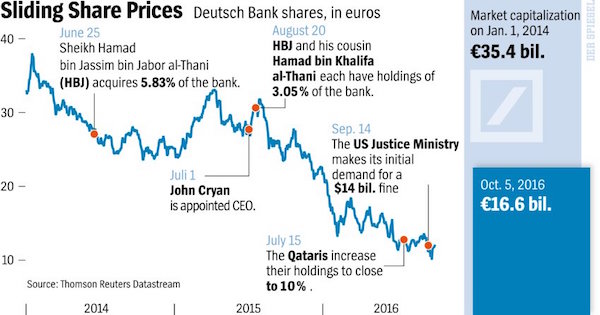

• Qatari Investors Eyeing Control of Deutsche Bank (Spiegel)

On September 15, the Justice Department in the United States ordered the company to pay a $14 billion fine to settle accusations of fraud in Deutsche Bank’s packaging and sale of mortgage-backed securities in the free-wheeling days that led to the global financial crisis. Speculators and politicians have been in a state of near panic since the announcement, with open speculation about the possibility of a government bailout for the prestigious bank. An atmosphere of frustration and depression is currently prevailing inside the bank and Cryan is trying to combat it with messages of perseverance. For a time, Deutsche Bank’s market value plummeted below €15 billion, down from €35 billion a year ago.

Large-scale investor HBJ and his cousin – the former Emir of Qatar, Sheik Hamad bin Khalifa al-Thani, who he has since brought in as an investor as well – are believed to have lost more than a billion euros – on paper, at least. This summer, the two increased their holdings to just under 10% of the company, but Deutsche Bank’s market capital has since continued to slide. And yet, it appears that the low share price is encouraging the sheikhs to invest even more now that it wouldn’t take more than a few billion for them to gain control of Deutsche Bank. Information obtained by SPIEGEL indicates that the al-Thani cousins are considering propping up the bank with a fresh capital infusion and purchasing a blocking stake of 25% together with other investors.

To do this, they could partner with sovereign wealth funds, some of which are apparently willing to invest in the company. But the information obtained by SPIEGEL also suggests that HBJ and the former emir would only be willing to take that risk if they could have a strong say in business decisions at Deutsche Bank. They are said to be deeply frustrated over the fact that the bank has been unable to maneuver itself out of its defensive position. The Qataris are said to be increasingly unhappy with Cryan’s current management team and believe the company’s present course is dangerous. The problems can’t be fixed through cost saving measures alone, they believe, particularly with eroding revenues and profits could. This displeasure manifested itself through the appointment in July of attorney Stefan Simon to the supervisory board. He represents the Qataris’ interests inside the company.

Might as well have said 2029. Useless and hollow.

• Draghi Points to 2019 as Time for Inflation Mission Accomplished (BBG)

Inflation in the euro area should return to the European Central Bank’s target by early 2019 at the latest, ECB President Mario Draghi said. “Our inflation rate will pick up during the course of 2017, and then will continue moving in 2018 toward the objective which is close but below 2%,” Draghi said on Saturday at a press conference during the annual meeting of the IMF in Washington. “This is predicated on maintaining the extraordinary support of our monetary policy.” While the ECB hasn’t met its own definition of its mandate on inflation since early 2013, an unprecedented wave of stimulus measures during Draghi’s tenure including the current asset-purchase pace of €80 billion per month has helped keep the currency bloc away from outright deflation.

Draghi’s comments imply that fresh staff forecasts due in December – which build-in the impact of current stimulus – will show a 2019 inflation rate in line with the goal. Achieving that target would mark the end of Draghi’s fight against the euro area’s stubbornly low inflation after more than six years. The ECB has deployed negative rates, asset purchases and cheap long-term loans to banks to rein in inflation. The December round of staff forecasts may serve as the basis for a decision on whether the ECB intends to continue its quantitative easing program at the current rate beyond the end date in March 2017, whether the program will be wound down gradually after that, or if it could be stopped completely.

Update. No escape. No velocity.

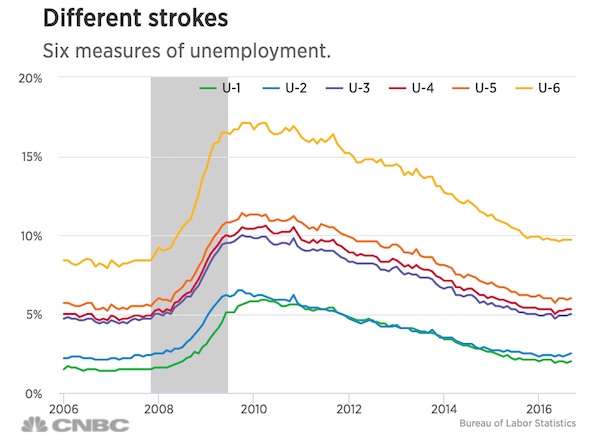

• US Unemployment Rate Shows At 5% But More Realistic Rate Is Higher (CNBC)

The national unemployment rate rose slightly to 5% in September, the Labor Department reported Friday. But relying on that one headline number as an indicator of the economy’s direction leaves a lot of important information below the surface. Every month on “Big Jobs Friday,” the Bureau of Labor Statistics releases a boatload of data, each point of which provides its own unique perspective on a facet of the nation’s employment situation. Economists look past the official unemployment rate — that 5% figure, which is known as the “U-3” rate — to other metrics that provide their own nuanced views of the state of jobs. One of those figures is called the U-6 rate, which has a broader definition of what unemployment means. That figure remained unchanged at 9.7% in September.

The official unemployment rate is composed of “total unemployed, as a% of the civilian labor force,” but doesn’t include a number of employment situations in which workers might find themselves. The U-6 rate is defined as all unemployed, plus “persons marginally attached to the labor force, plus total employed part time for economic reasons, as a% of the labor force.” In other words: That’s the unemployed, the underemployed and the discouraged. The U-3 rate has in the past few months returned to the prerecession levels that economists consider full employment. The U-6 rate has remained above precession levels, though it has seen significant improvement in the past few years. Economists expected 176,000 jobs to be added in September, according to a late Reuters estimate. The report showed that the market added 156,000 jobs.

I see busy lawyers in your future…

• UK MPs Demand Vote On Hard Brexit Plans (G.)

Theresa May is under massive cross-party pressure to grant MPs a vote on any decision to leave or limit UK involvement in the European single market, amid growing outrage at the prospect that parliament could be bypassed over the biggest economic decision in decades. Tory MPs joined forces with former leaders of Labour and the Liberal Democrats, the SNP and Greens to insist that parliament have a say and a vote, pointing out that, while the British people had backed leaving the EU, they had not chosen to leave the biggest trading market in the western world. Former Labour leader Ed Miliband held discussions with pro-EU Tory MPs on Saturday, and was said to be considering tabling an urgent question in the Commons, demanding that May appear before parliament to explain its future role in Brexit decisions, when MPs return on Monday.

The SNP and pro-EU Tory MPs Nicky Morgan and Anna Soubry were also considering tabling questions, while former Lib Dem leader Nick Clegg, now the party’s Brexit spokesman, said it would be appalling if detailed terms of Brexit, including the UK’s future relations with the single market, were not voted on by MPs. Miliband told the Observer: “Having claimed that the referendum was about returning sovereignty to Britain, it would be a complete outrage if May were to determine the terms of Brexit without a mandate from parliament. “There is no mandate for hard Brexit, and I don’t believe there is a majority in parliament for [it] either. Given the importance of these decisions for the UK economy … it has to be a matter for MPs.”

Clegg said: “My great worry is that while there will be a vote on repealing the 1972 European Communities Act, which is about the decision to leave the EU, it will be left to the executive alone to decide the terms of Brexit. That would not be remotely acceptable.”

It’s becoming a lovely nation.

• Britain ‘Ignored Plea By France’ To Aid Stranded Calais Child Refugees (G.)

The Home Office has refused to respond to official requests from the French authorities to accept unaccompanied child refugees stranded in Calais who are eligible to come to Britain, the British Red Cross has said. With the planned demolition of Calais’s refugee camp only weeks away, the Red Cross says the Home Office is turning down “take charge” requests by the French on often pedantic grounds. Once such a request has been accepted by the UK government it is in effect responsible for a child who is seeking asylum. In some cases British officials claim to have “misplaced” requests from the French to help children, raising questions over Britain’s approach to what humanitarian experts call an urgent child protection issue.

The camp is scheduled to be demolished this month, with no provision agreed by the British and French for most of the 1,000 unaccompanied minors there, of whom at least 400 are eligible to enter the UK. A new report damningly articulates the Home Office’s intransigence, with research by the Red Cross revealing it takes up to 11 months on average to bring a child to the UK under an EU scheme to reunite families. Lawyers say there is no reason why the process should take more than several weeks. The report also identifies “problems ranging from basic administrative errors causing severe delays to a shortage of human resources on the French side”. It accuses the Home Office of unnecessarily forcing vulnerable children to stay in the camp for months after their case is rejected because of a basic administrative error or lack of documents. “Insufficient discretion or consideration is made for the child’s vulnerability and circumstances,” says the report, No Place For Children, released on Sunday.

Home › Forums › Debt Rattle October 9 2016