Pietro Lorenzetti Jesus enters Jerusalem 1320 (Basilica of St Francis of Assisi)

“And when he was come into Jerusalem, all the city was stirred, saying, Who is this? And the multitudes said, This is the prophet, Jesus, from Nazareth of Galilee.” – Matthew 21:10-11 #PalmSunday

Coronavirus update, New York City:

– 4,561 new cases in last 24 hours

– 124,652 tests performed

– 60,850 tested positive

– 25,029 under age 45

– 2,254 deaths

– 12,716 hospitalized

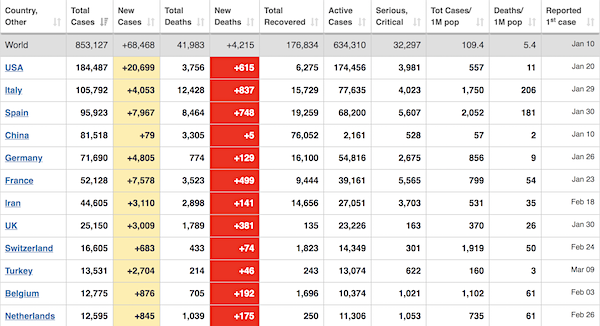

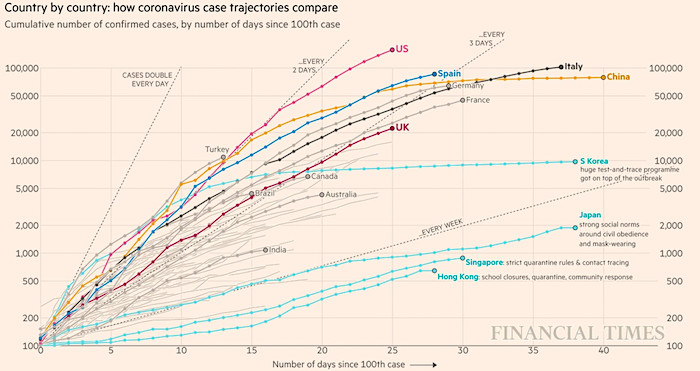

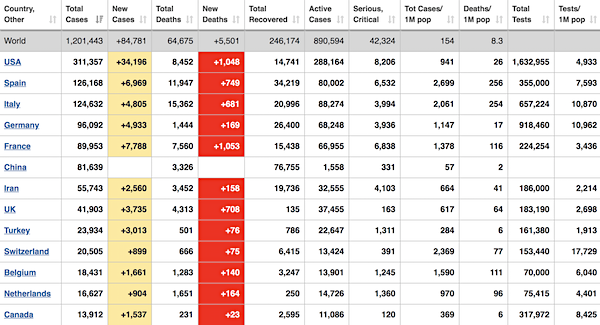

Countries to keep an eye on: France, UK!, Turkey, Belgium,. Portugal, Brazil, Romania, Poland, Saudi Arabia, Indonesia, Mexico.

• Cases 1214487 (+ 83,912 from yesterday’s 1,130,575)

• Deaths 65605 (+ 5,477 from yesterday’s 60,128)

From Worldometer yesterday evening -before their day’s close-

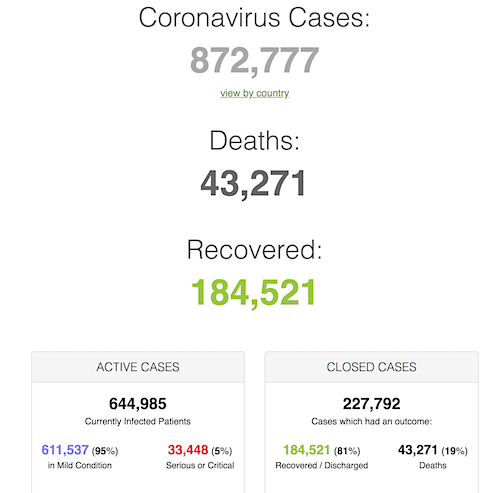

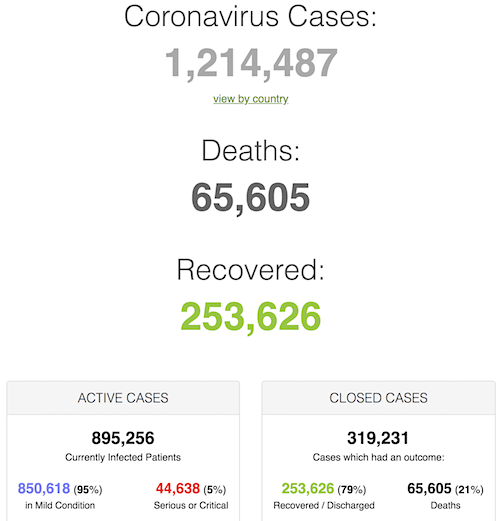

From Worldometer -NOTE: mortality rate for closed cases is at 21% !–

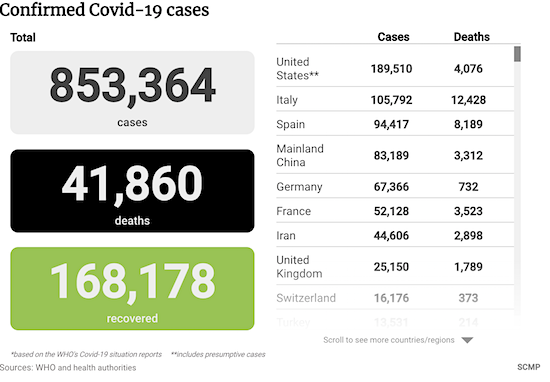

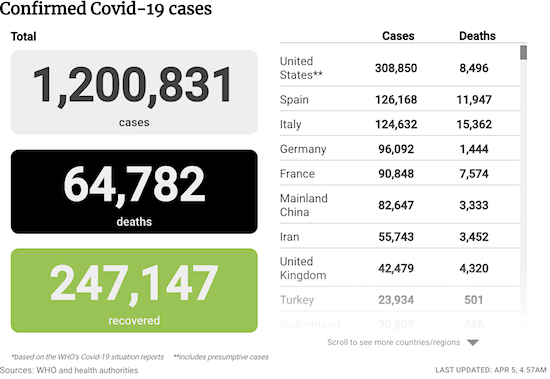

From SCMP:

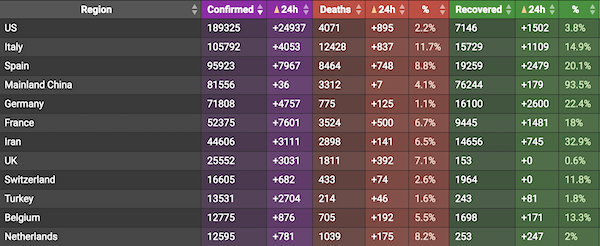

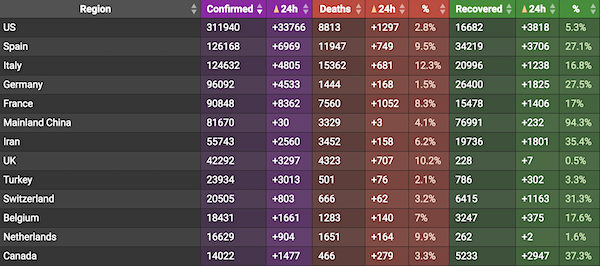

From COVID2019Info.live:

I suspect the lack of understanding of the exponential function may lead to many people saying more people die of normal flu.

• Getting Your Head Around Exponential Growth (Steve Keen)

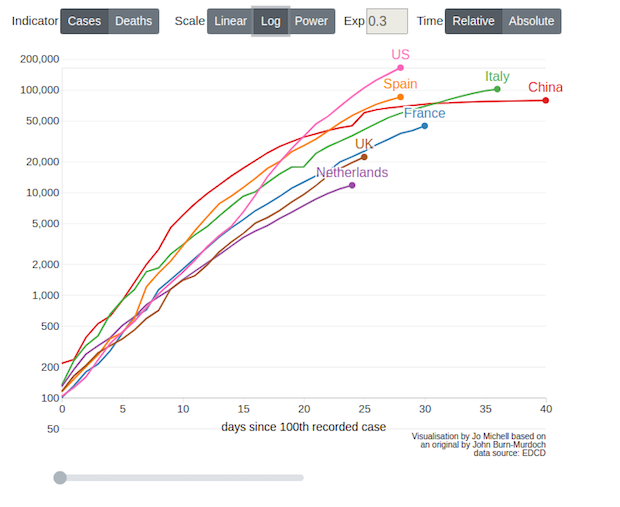

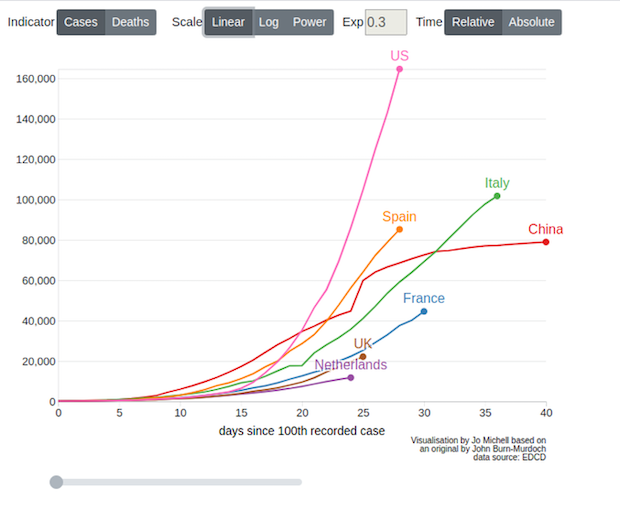

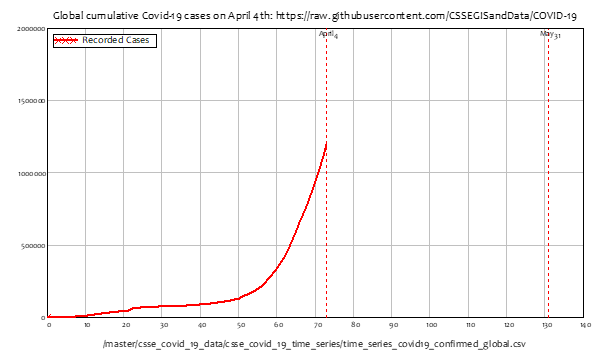

A lot of people still don’t seem to get the concept of exponential growth, even though we’ve had over two months of watching an exponential process unfold with the Coronavirus. I hope some simple illustrations using current data might help. John Hopkins University is doing an excellent job of collating the cumulative number of cases reported around the world with its GIS database Coronavirus COVID-19 Global Cases by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University (JHU). They’ve made the raw time series data available too. Aggregated to the world level, this is what cumulative COVID-19 cases looked like as of late on April 4th:

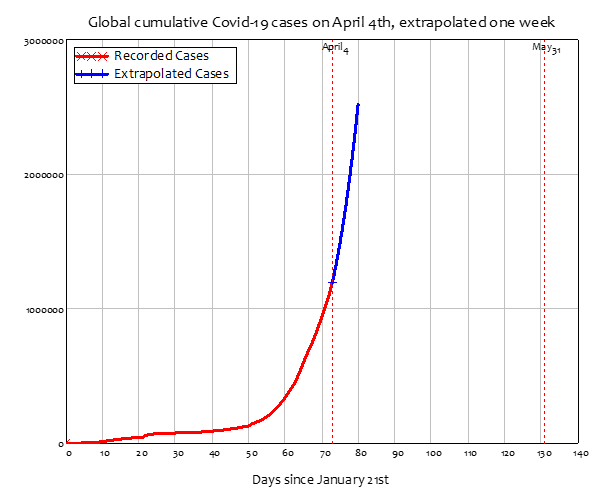

This is simply the total number of recorded cases, which includes tested cases where the carrier has only mild symptoms, people who got the disease way back when it began and have since recovered, those who have died, those who are still in intensive care, etc. The global total was just over 1.2 million on April 4th. A simple regression of this data onto an exponential function yields the prediction that, if the rate of transmission and the rate of doubling of the disease reflects what has happened to date from January 21st, when the JHU time series begins, in a week’s time there will be twice as many cases: 2.5 million compared to today’s 1.2 million.

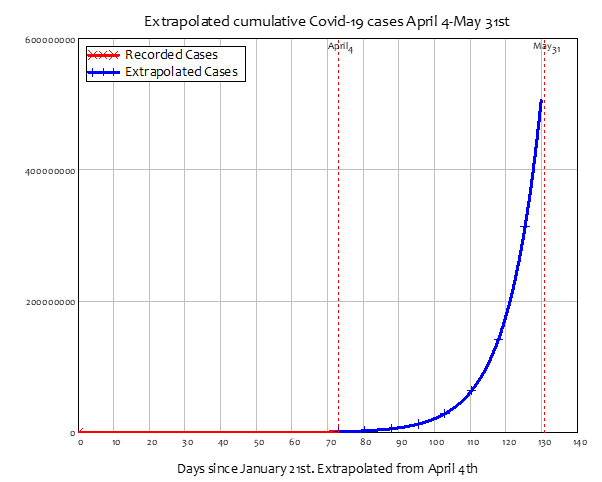

That’s a lot of cases, but it’s still way short of the total world population of about 7.5 billion. It took about ten weeks to go from 555 cases (the number recorded on January 21st at the start of this data series) to over 1 million. How long will it take to get to a significant number compared to the planet’s population—say, half a billion cases? It will take about another 8 weeks.

The red line in each of these graphs is the same red line. Now only a fraction of those infected are going to be current cases—basically, those who were identified in the preceding 2-4 weeks—and only a fraction of those—perhaps about 20%–are going to require hospitalization. But that’s still a huge number of people, far more than can be handled in the world’s emergency medical facilities. This is why this disease is not “just another flu”. It is far more contagious (and we also don’t have any innate resistance to it). We have to “Flatten the curve”, we can’t cope with the number of cases doubling every week, as is the case now.

True at heart, but he does not explain how.

• Reporting Estimated Rather Than Confirmed Infections Might Save Lives (M.)

Day after day we see startling and quickly rising numbers of confirmed COVID-19 infections. They’re scary. But the true scope of the pandemic is almost certainly scarier. Confirmed cases represent only a fraction of the real spread. In most communities, only the sickest patients are being tested so most people with mild symptoms and those that are asymptomatic go untested and unreported. The real number of people who have been infected by the virus almost certainly dwarfs the cases we know about. And the public winds up with a distorted picture of how prevalent the virus is, often tragically. When there is exponential growth, every unreported case matters even more, as a handful cases can quickly grow to thousands within a few weeks.

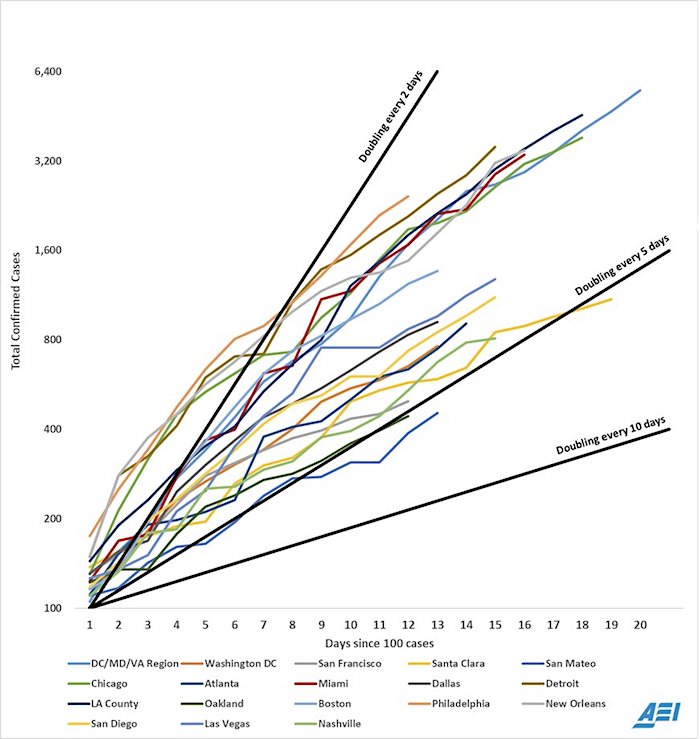

And it’s doubtful that most people recognize how seriously confirmed cases underreport the real situation. Knowing that there are ten confirmed cases in your neighborhood now doesn’t mean there are only ten cases that you can come in contact with. The reality could well be that there are actually a hundred cases, ten that were tested and confirmed, fifty that have not yet shown symptoms and not yet been tested, another forty that have been tested and still are waiting on their results. In just a few days, that total could as much as double, depending on the county you live in, because of the speed at which the disease tends to spread. (Right now, the number of confirmed cases in New York city is doubling every two and a half days).

Armed with estimates of the actual scope of the problem from expert epidemiologists, far fewer people would engage in unsafe behavior. If this more useful information were being reported, the beaches during spring break might have been emptier. We can’t get past this until we have had stringent lockdowns for long enough for our healthcare workers to catch up. And we can’t expect citizens to respect stringent lockdown orders unless they have clear and accurate information, not just the data that are most conveniently available. That means getting accurate estimates out is critical. We urge governments and epidemiologists to start publishing estimates of current cases, which would include both confirmed and not yet discovered infections, and we urge the media to start asking for them–and reporting them, daily.

Some of the groundwork is already in place in models that project deaths based on factors such as population density, current testing capacities and methodologies, false negative rates, death rates (and criteria for reporting them), and mitigation strategies. By deriving estimates of currentcases from these models and making those estimates more explicit, and widely available, we can help people and governments make better decisions. No one single estimate will be perfect, but without any readily available sources, we are running almost entirely blind.

Japan will rebuild its own medicine industry to move away from China. So will many other countries.

• Japan To Boost Avigan Drug Stockpile As Part Of Coronavirus Stimulus (R.)

Japan is considering increasing the stockpile of Fujifilm Holding Corp’s Avigan anti-flu drug during this fiscal year so it can be used to treat 2 million people, according to a planning document seen by Reuters. Local media reported on Sunday that Japan was hoping to triple the production of the drug from current levels, which is enough to treat 700,000 people if used by coronavirus patients. Avigan, also known as Favipiravir, is manufactured by a subsidiary of Fujifilm, which has a healthcare arm although it is better known for its cameras. The drug was approved for use in Japan in 2014. Avigan is being tested in China as a treatment for COVID-19.

In the emergency stimulus package expected to be rolled out on Tuesday, the government also planned to prioritise the clinical trial process of the drug so it can be formally approved to be used in treating coronavirus patients. According to the document, Japan also plans to boost subsidies to domestic companies that supply masks and disinfectants and will secure enough capacity to supply 700 million masks a month. The Nikkei newspaper reported on Sunday that in efforts to reduce its dependence on China as its manufacturing hub, it will subsidise companies that will move some of their production facilities back to Japan.

They’ll find way to hide them again.

• Mainland China Sees Rise In New Coronavirus Cases (R.)

Mainland China reported 30 new coronavirus cases on Saturday, up from 19 a day earlier as the number of cases involving travellers from abroad as well as local transmissions increased, highlighting the difficulty in stamping out the outbreak. The National Health Commission said in a statement on Sunday that 25 of the latest cases involved people who had entered from abroad, compared with 18 such cases a day earlier. Five new locally transmitted infections were also reported on Saturday, all in the southern coastal province of Guangdong, up from a day earlier. The mainland has now reported a total of 81,669 cases, while the death toll has risen by three to 3,329.

Though daily infections have fallen dramatically from the height of the epidemic in February, when hundreds of new cases were reported daily, Beijing remains unable to completely halt new infections despite imposing some of the most drastic measures to curb the virus’ spread. The so-called imported cases and asymptomatic patients, who have the virus and can give it to others but show no symptoms, have become among China’s chief concerns in recent weeks. The country has closed off its borders to almost all foreigners as the virus spread globally, though most of the imported cases involve Chinese nationals returning from overseas.

Or they may not. No lack of aspiration.

• Researchers May Have Found Coronavirus’ Achilles’ Heel (NYP)

There may be some good news on the coronavirus horizon, as Scripps Research reported it may have found COVID-19’s Achilles heel. The research shows a specific area of the virus could be “targeted with drugs and other therapies, a finding that also could help with the development of a vaccine,” according to the San Diego Tribune. The targeted area, according to biologist Ian Wilson, who led the scientific team, “is crucial to spreading the highly contagious virus, and … its composition suggests that it would be vulnerable to drugs.” The discovery was published Friday in the journal Science and comes as scientists globally are working feverishly to find a vaccine or cure for the pandemic that has devastated global markets and caused more than 63,000 deaths worldwide.

An antibody taken from a SARS patient years earlier was used in the discovery, as researchers realized it had attached itself to a specific part of the virus, and were able to repeat the phenomenon with COVID-19, helping to identify a coronavirus weakness, according to the report. “That high degree of similarity implies that the site has an important function that would be lost if it mutated significantly,” Scripps Research said in a statement Friday. Sadly, the weak spot isn’t easy to find. “We found that this (spot) is usually hidden inside the virus, and only exposed when that part of the virus changes its structure, as it would in natural infection,” Wilson’s colleague, Meng Yuan, said in a statement.

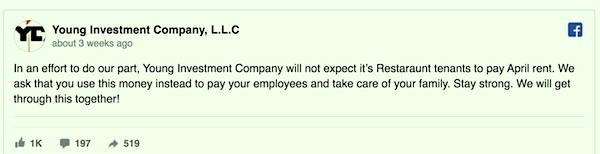

Saw this yesterday but it was in the New York Times, and we don’t cover that rag around here. But good on the landlords, and may many more be inspired.

• Landlords Cancel Rent for Tenants So They Can Buy Food, Pay Employees (AN)

In the United States, many people who live paycheck to paycheck are worried that they won’t be able to afford housing or basic necessities during the shutdown. There has been a freeze on mortgages in most places, but these conditions overlook renters, who are often-times the most vulnerable. Many renters and activists across the country have called for a rent strike for the month of April, but some landlords have taken it upon themselves to help out their tenants. Mario Salerno, of Brooklyn, New York, owns 18 apartment buildings, and has told his renters to not worry about paying rent during the shutdown, but to instead make sure that all of their other needs are covered. Salerno told the New York Times that his main concern is the health of his tenants.

He said he had about 200 to 300 tenants in total, and estimates that he will lose hundreds of thousands of dollars in income during the month of April. Salerno isn’t the only one, this type of rent forgiveness is happening across the country. A landlord in Jonesboro, Arkansas, made a post on social media last month saying that his company would not expect its restaurants to pay rent during the shutdown, and suggested that they continue to pay their employees instead. Young Investment Company owns properties that are home to some of the area’s most popular restaurants, including Eleanor’s Pizzeria, Roots, Main Street Coffee, The Parsonage, and City Wok. Property owner Clay Young said that all small businesses are suffering right now and he did not want to put more pressure on them during this difficult time.

If this doesn’t signal the end of the health care for profit model, nothing will.

“All hospitals are going to need some economic relief very, very soon.”

• Tucson Hospital On The Brink Of Closure Because Of COVID19 Costs (AZC)

Leaders of a small, regional hospital south of Tucson say they are on the brink of closing because of costs associated with the COVID-19 pandemic. “We need economic relief to keep functioning,” Kelly Adams, CEO of the 49-bed Santa Cruz Valley Regional Hospital, told The Arizona Republic. “There’s a revenue problem. … All hospitals are going to need some economic relief very, very soon.” One of the problems, Adams explained, is that elective surgeries have been canceled as a result of an executive order by Arizona Gov. Doug Ducey in anticipation of a surge of patients ill with COVID-19, the disease caused by the new coronavirus.

The cancellation of surgeries means less revenue coming in from patients at a time when the hospital is trying to comply with another executive order from Ducey — that all Arizona hospitals by April 24 increase their number of patient beds by 50 percent. Increasing bed capacity is adding additional expenses at a time when the hospital has very little revenue, Adams explained. Overall hospital volume is down by about 40% not only because of halting surgeries, leaders say, but also because members of the community fear visiting a hospital where they could potentially be in proximity to COVID-19.

Leaders say the hospital is pursuing various funding sources to get relief. But the need is urgent, said Patrick Feeney, a managing director with California-based Lateral Investment Management, which owns the hospital. “This isn’t just about our hospital. Hospitals cannot function profitably in this environment, which is why we’re all awaiting money from the government,” he said. “If you want me to increase our bed capacity by 50%, how am I going to do that? It’s going to cause me to shut our doors.”

On February 2, over two months ago, which is an eternity especially in virustime, I described all this in The Party and the Virus.

But holding the CCP accountable? With 100,000s of lives and $10 trillion in damages? Don’t think so. Whether it was intentional or not.

“After living and working in China for over 10 years and speaking fluent Chinese, you get to know a society pretty well… and let me tell you this – if you’re applauding or admiring the political leadership of China, you’re all deluded beyond belief.” That is how “laowhy86” begins this succinct video exploring the ‘facts’ – not conspiracies – behind the source of the coronavirus that is ravaging the earth. “China doesn’t operate like ‘your’ country,” he warns, “the Chinese government is a face- and greed-driven government that relies on lies and bullying to maintain leadership.” [..] laowhy86 notes that another job opening appeared on December 24th (remember this is before any news broke of the virus publicly), which basically says ‘we’ve discovered a new and terrible virus and would like to recruit people to come deal with it’…[..]

So, he decided to dig a little bit more into the staff… and that’s where it gets interesting… as he discovers silenced scientists, disappeared doctors, and constant propaganda… “…it’s quite clear that the Chinese government needs to close its mouth and acknowledge that this virus did in fact come from Wuhan, Hubei, China.” [..] this is all public information on the Chinese internet published by researchers, scientists, and doctors.” [..] “Despite the CCP’s all-powerful ability to hide everything it can, the truth usually finds its way out – the Chinese government should cover their tracks better next time if they’re going to blame this on Italy or the US or whatever is convenient to your narrative.”

“…the CCP’s incompetence and its understanding of the danger of the virus on a pure scientific level – and then going on to silence those who wanted to warn the public… and letting the virus spread for months… is the reason the Chinese government must be held accountable!”

Oh well, as I said yesterday: dependence on China is no longer acceptable.

• China Floods Europe With Defective Medical Equipment (Kern)

[..] In Spain, the Ministry of Health revealed that 640,000 coronavirus tests that it had purchased from a Chinese supplier were defective. In addition, a further million coronavirus tests delivered to Spain on March 30 by another Chinese manufacturer were also defective. The Czech news site iRozhlas reported that 300,000 coronavirus test kits delivered by China had an error rate of 80%. The Czech Ministry of Interior had paid $2.1 million for the kits. A spokesperson for a hospital in Dutch city of Eindhoven said that Chinese suppliers were selling “a lot of junk… at high prices.” “No. 10 [the residence of the British prime minister] believes China is seeking to build its economic power during the pandemic with ‘predatory offers of help’ to countries around the world.” — The Daily Mail, March 28, 2020.

“The brutal truth is that China seems to flout the normal rules of behavior in every area of life — from healthcare to trade and from currency manipulation to internal repression. For too long, nations have lamely kowtowed to China in the desperate hope of winning trade deals. But once we get clear of this terrible pandemic, it is imperative that we all rethink that relationship and put it on a much more balanced and honest basis.” — Former UK Conservative Party leader Iain Duncan Smith.

[..] On March 28, the Netherlands was forced to recall 1.3 million face masks produced in China because they did not meet the minimum safety standards for medical personnel. The so-called KN95 masks are a less expensive Chinese alternative to the American-standard N95 mask, which currently is in short supply around the world. The KN95 does not fit on the face as tightly as the N95, thus potentially exposing medical personnel to the coronavirus. More than 500,000 of the KN95 masks had already been distributed to Dutch hospitals before the recall was enacted. “When the masks were delivered to our hospital, I immediately rejected them,” a hospital worker told the Dutch public broadcaster NOS. “If those masks do not seal properly, the virus particles can simply pass through. We cannot use them. They are unsafe for our people.”

In a written statement, the Dutch Ministry of Health explained: “A first shipment from a Chinese manufacturer was partly delivered last Saturday. These are masks with a KN95 quality certificate. During an inspection this shipment was found not to meet our quality standard. Part of this shipment had already been delivered to healthcare providers; the rest of the cargo was immediately withheld and not further distributed. “A second test also showed that the masks did not meet our quality standard. It has now been decided that this entire shipment will not be used. New shipments will undergo additional tests.”

Everybody’s anxious to make friends.

• Turkey Seizes Hundreds Of Ventilators Paid For By Spain (Ind.)

Turkey was accused of seizing hundreds of ventilators and sanitary equipment destined for Spain amid the escalating coronavirus pandemic. Spanish officials said Ankara was holding the ventilators for “the treatment of their own patients”, despite local governments in Spain having already paid millions for them. In a press conference on Friday, Spain’s foreign affairs minister, Arancha Gonzalez Laya, appeared to admit defeat in her attempts to convince her Turkish counterpart to release the ventilators in the coming days. “Turkey has imposed restrictions on the export of medical devices, motivated by the need for medical supplies,” she said, according to Spanish national media. Late on Saturday, however, Ms Laya announced Turkey would allow the shipment to make its way to Spain.

Thanking Turkey’s foreign minister, Mevlut Cavusoglu, Ms Laya tweeted: “We appreciate the gesture of a friendly and allied country.” Spanish newspaper El Mundo on Friday reported the ventilators were manufactured in Turkey on behalf of a Spanish firm that bought the components from China. Three Spanish regions, Castilla-La Mancha, Navarre and Catalonia, had bought the ventilators, the newspaper reported, while the shipment also featured sanitary materials paid for by the country’s health ministry. But before the equipment could be flown out, Turkish customs intervened. Emiliano Garcia-Page, Castilla-La Mancha’s president, said Turkey has “unilaterally decided to requisition” 150 ventilators it had already paid €3m for. He added he expected the national government to issue a diplomatic complaint about the issue, which he said was “bordering on criminality”.

Cuba has sent doctors to 14 different countries in the corona fight. The problem with the blockades and sanctions at this point, whether it’s Iran, Venezuela or Cuba, is that people won’t forget.

• US Blockade Prevents Medical Supplies From Reaching Cuba (TeleSur)

Cuba was unable to receive a plane with medical supplies and aid from China on March 31 because of the U.S. blockade. The resources were sent by the Chinese entrepreneur and philanthropist Jack Ma. According to the official Twitter profile of the Cuban President, Cuba announced that the donation of medical supplies from the Alibaba Foundation to the Island-Nation to combat the COVID19 has not been able to arrive due to the regulations of the criminal blockade of the United States government against our people. The President of Cuba, Miguel Díaz-Canel Bermúdez, also said this fact is an aggression against the human rights of the Cuban people. Jack Ma, a Chinese entrepreneur and founder of Alibaba, allocated a donation of masks, rapid diagnostic kits, and ventilators.

This aid was intended for the patients affected by COVID-19 and the medical staff on the island. On March 22, the businessman announced this shipment, which was to arrive at its destination on the 30th. “One world, one fight! We will donate emergency supplies – 2 million masks, 400K test kits, 104 ventilators – to 24 Latin American countries including Argentina, Brazil, Chile, Cuba, Ecuador, Dominican Republic, and Peru. We will ship long-distance, and we will hurry! WE ARE ONE!” Ma also announced extra supplies in the donative, like ventilators, disposable gloves, and medical gowns. However, due to Helms-Burton Law, the airship with the donatives was unable to arrive in Cuba under the argument that “the regulations of the economic, commercial and financial blockade imposed against the country of destination.

[..] Cuba is facing the COVID-19 threat on its territory, with 186 confirmed positive cases and 2,837 suspected patients. Besides, the Caribbean island provides medical assistance to more than 14 countries.

“The FBI and DOJ made up this ‘case,’ threatened to indict his son the next day if he did not plead guilty, hid–and are still hiding–the evidence that shows he is innocent, and they knew that all along..”

• Prosecutors Want Delay In Michael Flynn Case, Defense Seeks Dismissal (SAC)

Justice Department prosecutors in the case against former National Security Advisor Michael Flynn are asking the court for an additional three weeks continuance on the case, citing the review of “voluminous” documents submitted by Flynn’s former legal team that represented him for a span [of]30 months. The status report was filed by prosecutors Friday in anticipation of a scheduled hearing on April 3. Justice Department prosecutors stated in the status report that the documents provided by Flynn’s former legal counsel with Covington and Burling “are voluminous, span numerous topics that arose during Covington’s 30-month representation of Mr. Flynn, and include many pages of sometimes difficult-to-decipher handwritten notes.”

[..] In February, Attorney General William Barr ordered a re-examination of several high-profile cases, including Flynns. The re-examination of Flynn’s case will be headed by U.S. Attorney Jeffrey Jensen of St. Louis. According to sources familiar with the matter, Jensen will be working with Brandon Van Grack, who is the former prosecutor that pursued the case against Flynn during Robert Mueller’s Special Counsel investigation. In March, President Donald Trump tweeted he was ‘strongly considering’ a pardon Flynn. He said “after destroying his life & that of his wonderful family (and many others also) the FBI, working in conjunction with the Department of Justice has lost” his records.

Flynn’s defense attorney Sidney Powell told this reporter that Flynn “would wear a pardon like a badge of honor.” She cautioned, however, that the DOJ should intervene before a pardon is even necessary. Powell filed a supplemental motion to withdraw his guilty plea in January. In it, she cited the failure of his previous counsel, Covington and Burling, to timely, fully and correctly advise him of the firm’s ‘conflict of interest in his case’ regarding the Foreign Agents Registration Act form it filed on his behalf. Moreover, she argues that the conflict was so severe the firm was required to withdraw from the matter. He could not consent.

In fact, in Powell’s supplemental motion filed in January, she argued that Flynn’s former counsel “betrayed” him. Powell filed the motion to withdraw his plea just days after Flynn’s prosecutors made a major reversal asking the court to put Flynn in jail for up to six months. Shortly after, prosecutors reversed the jail time recommendation. [..] Powell told SaraACarter.com Friday that “as the government seeks an additional three weeks to work with Covington and Burling LLP against General Flynn, we are reminded again of this egregious injustice against an American hero.”

“The FBI and DOJ made up this ‘case,’ threatened to indict his son the next day if he did not plead guilty, hid–and are still hiding–the evidence that shows he is innocent, and they knew that all along,” she added. “Clapper and Brennan and others knew that Flynn intended to audit and clean out the corrupt intelligence agencies. They and the FBI targeted him to destroy with this false prosecution. Every day the government delays in dismissing this persecution is a disgrace for anything called “Justice” and an enormous waste of taxpayer dollars.”

She means the resolve to keep both Prince Andrew and Julian Assange from facing justice. From a symbol to a useless old woman. Who’s doing terribly damage to her entire family in the process. You can no longer take yourself serious AND support these inbreeds anymore. She’s a accomplice to her son’s crimes; she’s denying his victims even just their day in court.

• Show Typical British Resolve, Queen To Tell Nation (R.)

Queen Elizabeth will call on Britons to show the same resolve as their forebears and take on the challenge and disruption caused by the coronavirus outbreak with good-humoured resolve when she makes an extremely rare address to rally the nation on Sunday. In what will only be her fifth special televised message to the country during her 68 years on the throne, the queen will also thank healthcare workers on the front line and recognise the pain already suffered by some families. “I hope in the years to come everyone will be able to take pride in how they responded to this challenge. And those who come after us will say that the Britons of this generation were as strong as any,” the 93-year-old monarch will say, according to extracts released by Buckingham Palace.

“That the attributes of self-discipline, of quiet good-humoured resolve and of fellow-feeling still characterise this country.” On Saturday, the government said the death toll of those who had tested positive for the virus rose by 708 in 24 hours to 4,313, with a 5-year-old among the dead, along with at least 40 who had no known previous health conditions. Health officials have cautioned that high fatalities were expected for at least another week or two even if people complied with strict isolation measures.

It’s not about the documentary, it’s about the Law. In the days of #MeToo, the Queen of England decides to hide a sexual predator in her home. Signaling that the law does not apply to her family.

• Prince Andrew Will Reportedly Not Be Interviewed In Epstein Documentary (G.)

Prince Andrew will reportedly not agree to be interviewed for a forthcoming documentary about the financier and sex offender Jeffrey Epstein. The Duke of York has been repeatedly criticized for associating with Epstein, who died in custody in New York following his July 2019 arrest on sex trafficking charges. According to the Daily Mirror, Andrew was “formally asked” to appear in Surviving Jeffrey Epstein, a four-hour Lifetime production slated for release this summer to follow the channel’s similarly titled films about the singer R Kelly. The British paper quoted an unidentified Los Angeles-based source as saying: “Andrew has been asked to appear to discuss his friendship, but there has been no formal response.”

The reports come some four months after Andrew’s own disastrous BBC Newsnight interview, which was followed by his withdrawal from public duties and patronages. An Epstein accuser, Virginia Roberts Giuffre, alleges that Epstein directed her to have sex with Andrew when she was 17. Andrew has categorically denied all claims of wrongdoing and maintains that he has “no recollection” of meeting Roberts Giuffre, although he was photographed with his arm around her. [..] The Mirror quoted its source as saying Andrew’s “legal team have told him to conduct no more interviews after he spoke to the BBC”. “There is a concern anything he says on tape or camera becomes potential legal material for the many civil cases facing Epstein, and FBI questions regarding Andrew. Essentially all allegations that mention Andrew within the context of Epstein will be dealt with by his lawyers.”

[..] In November, Andrew said he was “willing to help any appropriate law enforcement agency with their investigations if required”. But he has been accused of refusing to cooperate with US authorities investigating Epstein, who in 2008 pleaded guilty to soliciting a minor for prostitution. “Contrary to Prince Andrew’s very public offer to cooperate with our investigation into Epstein’s co-conspirators, an offer that was conveyed via press release, Prince Andrew has now completely shut the door on voluntary cooperation and our office is considering its options,” Manhattan US attorney Geoffrey Berman told reporters in March, revisiting a claim made in January. Buckingham Palace said then it would not comment and said “the issue is being dealt with by the Duke of York’s legal team”.

The land of utter stinking weasels has found another loophole: “Julian Assange is not eligible for an early Covid-19 release because he is not serving a criminal sentence.”

• Julian Assange “Not Eligible” For Early COVID19 Release – UK (CN)

Imprisoned WikiLeaks publisher Julian Assange is not eligible for an early Covid-19 release from prison with other inmates because he is not serving a criminal sentence, the Australian Associated Press has reported. British Justice Secretary Robert Buckland said Saturday that some low-risk inmates, weeks from release, will be let go with monitoring devices to help avoid a further outbreak of Covid-19 in the nations’ prisons. So far 88 prisoners and 15 staff have tested positive for the virus in British prisons. More than 25 percent of the nations’ prison staff are quarantining themselves. “This government is committed to ensuring that justice is served to those who break the law,” Buckland said in a statement.

“But this is an unprecedented situation because if coronavirus takes hold in our prisons, the NHS could be overwhelmed and more lives put at risk.” The Ministry of Justice told the AAP that Assange won’t be among those released because he isn’t serving a custodial sentence. In other words, because he has not been convicted of a crime, and is instead only being held on remand pending the outcome of the U.S. extradition request, he must remain in Belmarsh prison with high-risk inmates–the most serious and hardened criminals. The Daily Maverick reported this week that there is one other prisoner on remand in Belmarsh, who would presumably also be left to rot in the jail as the virus spreads throughout the British prison system.

The days that are over.

My stepfather, the man who raised me, was an interesting specimen of that gen. Fresh out of college in Boston, he joined the army, became a lieutenant, and by-and-by found himself trapped in the German offensive through the Ardennes Forest, known as the Battle of the Bulge. Unlike some WW2 vets, he was willing to talk about his experiences. His most vivid memory was the difference between the sound of American and German machine guns. Ours went rat-a-tat-tat, theirs went zzzzzzzap, he said, like you couldn’t even detect the interval between the bullets coming at you. It scared the piss out of his men, not a few of whom were cut to pieces. My stepfather merely caught several chunks of shrapnel in his arm and thigh, and was still on the scene when Germany finally surrendered in May, 1945.

He was awarded a silver star for valor, but never bragged on it. (My mother barely participated in my upbringing, but that’s another story.) He went straight to New York City when it was over. His gen’s victory dance was to get straight to work in the economic bonanza just revving up — because the war had happened elsewhere and all our stuff was intact, ready to re-start, to make and sell anything under the sun to the shattered rest-of-the-world, and lend them money to buy it — quite an opportunity for young men highly disciplined and regimented from their recent travails of war.

My stepfather became a classic Mad Man, as in the TV series, working in media, publishing, and PR, a hard-drinking cohort of mostly military vets who would knock down three martinis over lunch with clients (a nearly inconceivable feat, actually, when you think about it), but that showed what the war had done to the soldiers who survived. He died from it at barely sixty, and from smoking two packs of Camel straights a day, another habit of battle. We Boomer boys had his war as movies and comic books: Sergeant Rock and John Wayne on the beach at Iwo! We had all the fruits of that postwar bonanza. We had Disneyland, the 1964 World’s Fair, the Carousel-of-Progress, and Rock Around the Clock. We eventually had a war of our own, Vietnam, but it was optional for college kids. I declined to go get my ass shot off, of course.

It must be possible to run the Automatic Earth on people’s kind donations. These are no longer the times when ads pay for all you read, your donations have become an integral part of it. It has become a two-way street; and isn’t that liberating, when you think about it?

Thanks everyone for your wonderfully generous donations over the past days.

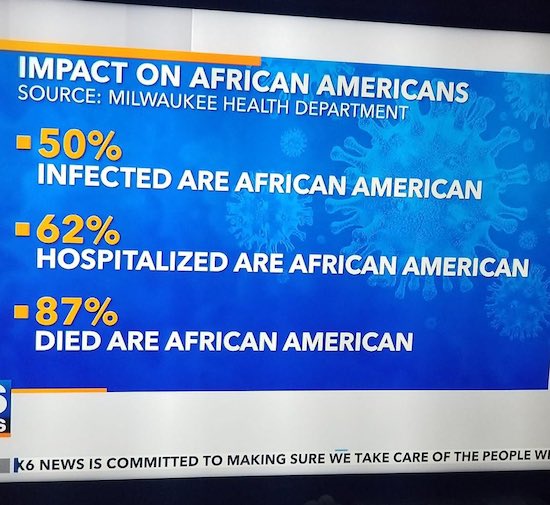

26% of the population of Milwaukee is black:

In the event you haven’t seen this, trust me when I say the language barrier is no problem. Watch to the end. As my mom said upon seeing, necessity is the mother of invention. Clearly that’s the case in my grandparents’ home.

Thanks to my dear friend Maryanne Waldman for sharing pic.twitter.com/GXhYIRVz9l

— Danielle DiMartino Booth (@DiMartinoBooth) April 5, 2020

The EU and its hardest stricken member countries:

Support us in virustime. Help the Automatic Earth survive. It’s good for you.