DPC The Mammoth Oak at Pass Christian, Mississippi 1900

The Fed, the debt ceiling and the Dutch election. All this Wednesday, March 15.

The Ides of March (Latin: Idus Martiae, Late Latin: Idus Martii) is a day on the Roman calendar that corresponds to 15 March. It was marked by several religious observances and became notorious as the date of the assassination of Julius Caesar in 44 BC..

• The Ides of March Could Be A Critical Turning Point For The Stock Market (MW)

As much as Julius Caesar’s assassination on the Ides of March signaled an inflection point in Roman history, March 15 may also mark a watershed moment for the U.S. stock market with the Federal Reserve poised to seek closure to its loose monetary policy regime. “The coming week has the potential to be huge for trading opportunities,” said Colin Cieszynski, chief market strategist at CMC Markets, in a note. “Everything centers around the Ides of March…with a number of key developments coming out both on [March] 15 and 16.” The Fed’s monetary policy decision on Wednesday will take center stage with markets nearly 100% certain of a rate increase following solid February jobs data. The focus will be on the Fed’s statement rather than the decision itself.

“The commentary will help determine how many more hikes the market has to get used to and then when it has to start preparing,” said Bob Pavlik at Boston Private Wealth. If the central bank strikes a hawkish tone, it could trigger a selloff in the market although Pavlik expects Fed Chairwoman Janet Yellen to keep her comments positive to avoid upsetting the market. Still, investors should keep in mind is that this is the third hike in the current tightening cycle, and history is working against the market. Since 1971, stocks have fallen an average of 2.2% on the third hike over the following three months, said Tom Lee at Fundstrat Global Advisors. To be sure, there are always exceptions. Stocks rose sharply in the following three months after the Fed hiked for a third time in both June 1984 and September 2004, he said.

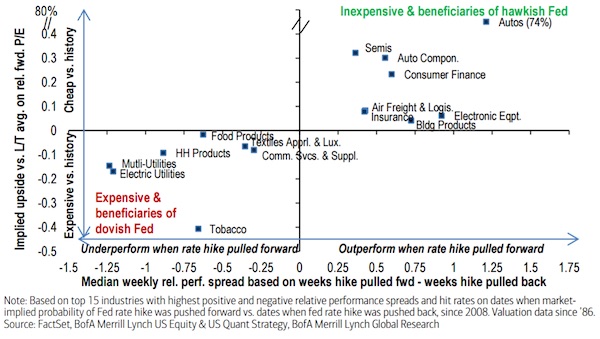

Most analysts agree that stocks have largely priced in a rate hike of 25 basis points. But there are still bargains to be found in automobile, semiconductors, consumer finance and insurance sectors, which are cheap but benefit from a hawkish Fed, according to Bank of America Merrill Lynch. Aside from the Fed, eight other central banks are scheduled to meet next week, including the Bank of Japan and the Bank of England, providing a quick insight into whether other countries will adjust their policies in response to the Fed. Meanwhile, Trump is expected to present his preliminary budget request to the Congress on Thursday, outlining his administration’s priorities. It will serve as a critical test for whether the euphoria that propelled stocks to record territory in anticipation of tax reforms and ramped up fiscal spending under President Donald Trump is warranted.

The S&P 500 has risen 4.5% and the Dow Jones Industrial Average DJIA has gained 5.3% in the first 50 days since Trump took office, the best ever for a GOP president. However, if Trump’s budget proposal fails to meet the market’s expectations, it could spark a major unwinding in positions, leading to a sharp drop in prices. “Thursday could be the day the instant speed of markets crashes into the glacial speed of government,” said Cieszynski.

Boy, what a bubble this is turning into.

• The US As The “Cleanest Dirty Shirt” (Snider)

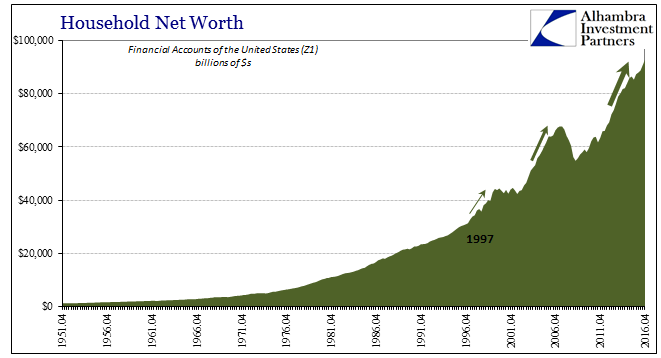

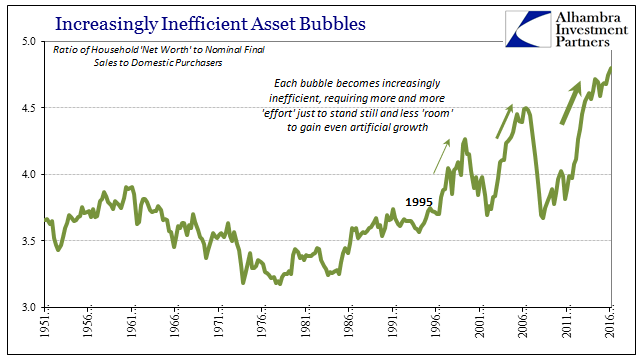

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression. Weakness might be more easily believed as some overseas problem, leading to only ideas of decoupling or the US as the “cleanest dirty shirt” – the US economy has problems, but how bad can they be? Yet, despite asset price levels and even record debt, all those prove is just how disconnected those places have become from what used to be an efficient way to redistribute financial resources.

According to the Fed’s Z1 report, Household net worth climbed by $2 trillion in Q4 alone to $92.8 trillion. That is a 69% increase from the low in Q1 2009, even though Final Sales to Domestic Purchasers have grown by just 30% in that same time. The wealth effect is dead, or, more specifically, it never was.

From the view of net worth, the increase to record debt levels seems manageable. From the more appropriate view of income and economy, it does not, even though US debt levels have grown more slowly post-crisis. That would mean debt is partway between assets and economy, sort of splitting the difference of what monetary policy believes and what it, at best, “achieved.”

The Great Volatility.

• A Third Of American Families Have ‘Roller Coaster’ Finances (MW)

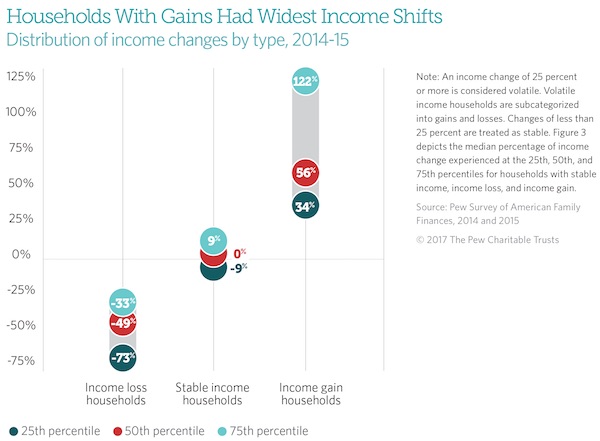

When it comes to making money, consistency may be almost as important as quantity. Families that had large fluctuations in their incomes — even when it was a 25% gain — were more likely than those with stable incomes to say they wouldn’t be able to come up with $2,000 for an unexpected need, according to a study by Pew Charitable Trusts released this week. The study looked at “income volatility” among more than 5,600 families the term for a year-over-year change in annual income of 25% or more, between 2014 and 2015. “Volatility in general, regardless of the direction, is very disruptive to families,” said Erin Currier, the director of Pew’s financial security and mobility project, who called that volatility “a roller coaster” for many Americans. “It makes it harder for them to plan.”

More than a third of those households surveyed experienced these large changes in their incomes from 2014 to 2015, Pew found. That number has been fairly consistent over time, Currier said. Households of various incomes see major dips and drops, but since volatility is measured as a percentage change in income, those with lower incomes had the lowest threshold for qualifying as having volatile incomes, Pew’s report says. In fact, there were more households in the years Pew studied that saw a gain in their incomes than those who saw dips, which is probably less surprising given that the economy was growing in those years and many families were finally getting back on their feet after the Great Recession.

Roller coaster finances are more common than many people realize. A quarter of people saw their incomes rise or drop by 30% or more, according to an analysis of 27 million Chase bank accounts between 2013 and 2014 by the J.P. Morgan Chase Institute JPM, -0.32% a J.P. Morgan Chase think tank. Those fluctuations were about the same, regardless of account holders’ incomes. One problem: Although income and spending both change, they don’t always change in the same direction, which can create budgeting problems. Put bluntly, some people keep spending even when they and their families experience a reversal of fortune.

Been warning about this for a long time. It could get completely out of hand. Much of it is private debt.

• US Interest Rate Rise To Deepen Developing Countries’ Debt Crisis (G.)

Developing countries are struggling with steep rises in their debt payments after being hit by a double whammy of lower commodity prices and a stronger dollar, with more pain to come once the US central bank raises interest rates this week, campaigners warn. The Jubilee Debt Campaign said that some of the world’s poorest countries have seen the cost of repaying their debts – as a proportion of government revenue – hit the highest level for a decade. Government coffers have been depleted by lower revenues from commodity exports and the size of dollar-denominated debts has risen as the US currency has strengthened.

The dollar has risen more than 6% against a basket of other big currencies over the past six months as investors anticipate that big spending plans by President Donald Trump will boost US growth and that the US Federal Reserve will follow up December’s interest rate rise with more increases this year. After the latest US jobs numbers on Friday beat expectations, a rate rise from the Fed’s policymakers when they meet this Wednesday is seen as imminent among investors. That would further increase the cost of debt payments for poor countries, which have taken out big loans in recent years from western countries where interest rates have been low, said the Jubilee Debt Campaign.

Tim Jones, economist at the campaign group, warned the rising cost of debt payments was putting developing countries under extra strain just when they needed to be spending more money at home to meet the UN sustainable development targets – a series of goals for human development intended to be achieved by 2030. “The rapid increase in debt payments in many countries comes after a boom in lending, a fall in commodity prices, the rising value of the US dollar and now increasing dollar interest rates,” said Jones. He warned there was a danger that loans from the IMF and other lenders would be used to bail out “reckless lenders” who were at risk of not getting repayments from crisis-hit countries. That would lead to year of economic stagnation, just as in debt-laden Greece, Jones added. “Instead, reckless lenders should be made to shoulder some of the costs of recent economic shocks by accepting lower payments,” he said.

Has been for may years.

• The Issue Is The Leverage And Instability Of The System (Rickards)

[..] expectations of a Fed rate hike March 15 are now near 100% based on surveys of economists and fed funds futures contracts. Markets are looking at things like business cycle indicators, but that’s not what the Fed is watching these days. The Fed is desperate to raise rates before the next recession (so they can cut them again) and will take every opportunity to do so. But as I’ve said before, the Fed is getting ready to raise into weakness. It may soon have to reverse course. My view is that the Fed will raise rates 0.25% every other meeting (March, June, September and December) until 2019 unless one of three events happens — a stock market crash, job losses or deflation. But right now the stock market is booming, job creation is strong and inflation is emerging. So none of the usual speed bumps is in place. The coast is clear for a rate hike this Wednesday.

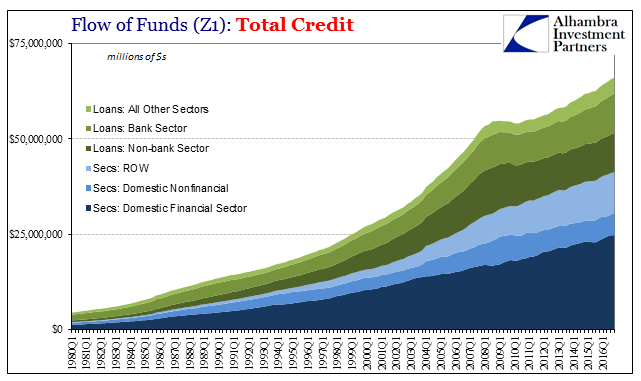

But growth is being financed with debt, which has now reached epic proportions. A lot of money has been printed since 2007, but debt has expanded much faster. The debt bubble can be seen at the personal, corporate and sovereign levels. If the debt bubble bursts, things can get very messy. In a liquidity crisis, investors who think they have “money” (in the form of stocks, bonds, real estate, etc.) suddenly realize that those investments are not money at all — they’re just assets. When investors all sell their assets at once to get their money back, markets crash and the panic feeds on itself. What would it take to set off this kind of panic? In a super-highly leveraged system, the answer is: Not much. It could be anything: a high-profile bankruptcy, a failed deal, a bad headline, a geopolitical crisis, a natural disaster and so on. This issue is not the catalyst; the issue is the leverage and instability of the system.

Bit curious coming from a judge, but good title.

• Who Bleeds When the Wolves Bite? (CNBC)

The question posed was, “Who Bleeds When the Wolves Bite?” It’s the title of an evocative paper written by Leo Strine, the chief justice of the Delaware Supreme Court. By wolves, he means hedge funds, and his answer, found within a 113-page paper set to be published next month in the Yale Law Review, is that average American investors are the ones getting bit by the existing corporate-governance system. While little known in circles outside the highest ranks of corporate America, Strine’s voice is among one of the most powerful in the business community. That’s because two-thirds of American companies are legally based in Delaware, meaning corporate litigation often takes place in that state, so his opinions on such topics can hold tremendous sway.

Strine’s paper is one of the strongest repudiations to date of hedge-fund activism — or what critics of the industry describe as the practice of investors with major stock holdings aggressively forcing companies into changes that will quickly pump up stock prices, often without regard for those same companies’ long-term health. Strine looks at what he calls a “flesh and blood” perspective on how hedge funds, and specifically hedge-fund activists, are harmful to typical American investors. He calls regular Americans “human investors,” distinguishing from the “wolf packs” of hedge funds. Human investors are those who invest in the capital markets and save for events like retirement or college for their children, according to Strine. Strine’s main argument is that the “current corporate governance system … gives the most voice and the most power to those whose perspectives and incentives are least aligned with that of ordinary Americans.”

Strine’s critics — largely hedge funds and hedge fund advisers — privately criticized the paper, arguing that a justice should not be on the record condemning a group of people who tend to litigate in his court and the lower Delaware courts. Additionally, they say his paper does not offer much in the way of prescriptions for how to fix what he sees as a flawed system. They declined to be quoted, fearing retribution from Strine.

A history lesson.

• When It Comes to Wall Street, Preet Bharara Is No Hero (PP)

After his election in 1968, President Richard Nixon asked Robert Morgenthau, the US Attorney for the Southern District of New York, to resign. Morgenthau refused to leave voluntarily, saying it degraded the office to treat it as a patronage position. Nixon’s move precipitated a political crisis. The president named a replacement. Powerful politicians lined up to support Morgenthau. Morgenthau had taken on mobsters and power brokers. He had repeatedly prosecuted Roy Cohn, the sleazy New York lawyer who had been Senator Joe McCarthy’s right-hand man. (One of Cohn’s clients and protégés was a young New York City real estate developer named Donald Trump.) When Cohn complained that Morgenthau had a vendetta against him, Morgenthau replied, “A man is not immune from prosecution merely because a United States Attorney happens not to like him.”

Morgenthau carried that confrontational attitude to the world of business. He pioneered the Southern District’s approach to corporate crime. When his prosecutors took on corporate fraud, they did not reach settlements that called for fines, the current fashion these days. They filed criminal charges against the executives responsible. Before Morgenthau, the Department of Justice focused on two-bit corporate misdeeds—Ponzi schemes and boiler room operations. Morgenthau changed that. His prosecutors went after CEOs and their enablers—the accountants and lawyers who abetted the frauds or looked the other way. “How do you justify prosecuting a nineteen-year old who sells drugs on a street corner when you say it’s too complicated to go after the people who move the money?” he once asked. Morgenthau’s years as United States Attorney were followed by political success. He was elected New York County District Attorney in 1974, the first of seven consecutive terms for that office.

There are parallels between Morgenthau, and Preet Bharara, the U.S. attorney for the Southern District who was fired by President Trump this weekend. Like Morgenthau, the 48-year old Bharara leaves the office of US Attorney for the Southern District celebrated for taking on corrupt and powerful politicians. Bharara prosecuted two of the infamous “three men in a room” who ran New York state: Sheldon Silver, the Democratic speaker of the assembly and Dean Skelos, the Republican Senate majority leader. He won convictions of a startling array of local politicians, carrying on the work of the Moreland Commission, an ethics inquiry created and then dismissed by New York’s Gov. Andrew Cuomo. (This weekend, Bharara cryptically tweeted that “I know what the Moreland Commission must have felt like,” a suggestion that he was fired as he was pursuing cases pointed at Trump or his allies.)

But the record shows that Bharara was much less aggressive when it came to confronting Wall Street’s misdeeds. President Obama appointed Bharara in 2009, amid the wreckage of the worst financial crisis since the Great Depression. He inherited ongoing investigations into the collapse, including a probe against Lehman Brothers. He also inherited something he and his young charges found more alluring: insider-trading cases against hedge fund managers. His office focused obsessively on those. At one point, the Southern District racked up a record of 85-0 in those cases. (Appeals courts would later throw out two prominent convictions, infuriating him and dealing blows to several other cases.)

I know it’s George Friedman, but he’s right.

• China’s Economic Miracle Is Over (Friedman)

Sustained double-digit economic growth is possible when you begin with a wrecked economy. In Japan’s case, the country was recovering from World War II. China was recovering from Mao Zedong’s policies. Simply by getting back to work an economy will surge. If the damage from which the economy is recovering is great enough, that surge can last a generation. But extrapolating growth rates by a society that is merely fixing the obvious results of national catastrophes is irrational. The more mature an economy, the more the damage has been repaired and the harder it is to sustain extraordinary growth rates. The idea that China was going to economically dominate the world was as dubious as the idea in the 1980s that Japan would. Japan, however, could have dominated if its growth rate had continued. Since that was impossible, the fantasy evaporates — and with it, the overheated expectations of the world.

In 2008, China was hit by a double tsunami. First, the financial crisis plunged its customers into a recession followed by extended stagnation, and the appetite for Chinese goods contracted. Second, China’s competitive advantage was cost, and they now had lower-cost competitors. China’s deepest fear was unemployment, and the country’s interior remained impoverished. If exports plunged and unemployment rose, the Chinese would face both a social and political threat of massive inequality. It would face an army of the unemployed on the coast. This combination is precisely what gave rise to the Communist Party in the 1920s, which the Party today fully understands. So, a solution was proposed that entailed massive lending to keep non-competitive businesses operating and wages paid. That resulted in even greater inefficiency and made Chinese exports even less competitive.

The Chinese surge had another result. China’s success with boosting low-cost goods in advanced economies resulted in an investment boom by Westerners in China. Investors prospered during the surge, but it was at the cost of damaging the economies of China’s customers in two ways. First, low-cost goods undermined businesses in the consuming country. Second, investment capital flowed out of the consuming countries and into China. That inevitably had political repercussions. The combination of post-2008 stagnation and China’s urgent attempts to maintain exports by keeping its currency low and utilize irrational banking created a political backlash when China could least endure it — which is now.

China has a massive industrial system linked to the appetites of the United States and Europe. It is losing competitive advantage at the same time that political systems in some of these countries are generating new barriers to Chinese exports. There is talk of increasing China’s domestic demand, but China is a vast and poor country, and iPads are expensive. It will be a long time before the Chinese economy generates enough demand to consume what its industrial system can produce.

Greece has had capital controls for only 18 months or so.

• Iceland Exits Capital Controls Eight Years After Banking Crash (BBG)

Iceland is back. The government at a hastily called press conference on Sunday in Reykjavik announced that effective Tuesday it will lift almost all of the remaining capital controls, allowing its citizens, corporations and pension funds full access to the global capital markets. The move ends an eight-year struggle to clean up after the 2008 banking collapse, which triggered the worst recession in more than six decades and enveloped the north Atlantic island of 340,000 people in political turmoil. Prime Minister Bjarni Benediktsson said this final step will “create more trust in the Icelandic economy,” with the most significant move being the removal of a requirement for businesses to return foreign exchange. “That will make direct foreign investment easier,” he said in an interview after the press conference.

The controls are being lifted as Iceland is booming, helped by a record surge in tourism. The economy is even at risk of overheating with money flowing back into the economy as the controls have been eased in steps. The economy last year surged 7.2%, driven by household spending and investments. Unemployment is down at about 3% and inflation is under control. The krona has rallied about 18% against the euro over the past year, in part as traders have been attracted to the nation’s higher interest rates. The government hopes these next moves will ease pressure on the currency to appreciate, according to Benediktsson. “We don’t have any exact hints as to what comes next,” he said. While pension funds have taken full use of exemptions that were granted in the past years, the public hasn’t rushed to invest abroad after other controls were eased, he said.

In Britain, at least Steve gets invited. What good it will do is another matter.

• Steve Keen Is In The House (YT)

This talk on whether we can avoid another financial crisis, and what caused the last one, was arranged by New City Agenda and held in a committee room of the House of Commons. I cover what caused the crisis (credit), why mainstream economics erroneously ignores credit, and the empirical data showing which countries face continued stagnation, and which countries face a future private debt crisis.

Alcohol and politics?!

• We Will All Need A Stiff Drink To Swallow Hammond’s Austerity (G.)

Yes, the Conservative party that for a long time believed the state had no role to play in industrial policy is now rediscovering the wheel – but has dismissed Michael Heseltine, who did not need to rediscover it. And the Treasury is placing great emphasis on the importance of “productivity” – ie the supply side of the economy – to provide the future growth on which higher living standards and tax revenues ultimately depend.

For the uncomfortable truth, underlined by the Office for Budgetary Responsibility, the Institute for Fiscal Studies and the Resolution Foundation last week, is that, after a splurge of consumer spending largely financed by borrowing, the outlook for real incomes is pretty bleak – indeed, there are already signs of a slowdown, and the OECD is forecasting economic growth this year of a mere 1.6%. And the OBR’s post-Brexit forecasts are frightening. But austerity in the public sector is set to continue. Let no one be in doubt: this was a policy choice on the part of George Osborne in 2010, and it is a policy choice now. Underlying it all is the Conservative party’s obsession with shrinking the size of the state and minimising the so called “tax burden” – a “burden” which helps to ensure we have decent hospitals, schools and infrastructure generally.

There can be little doubt that, on his own terms, the decision of Chancellor Lawson in the 1988 budget to bring the top rate of income tax down from 60% to 40%, and the basic rate from 27% to 25%, was what is known in the trade as a “game changer”. Total taxation as a proportion of national income has been around 34% in recent years. But when the economy is operating close to capacity, as the OBR believes it now is, in a decent society the ratio of taxation to national income should be considerably higher – even close to 40% – in order to provide decent public services. For all their conciliatory talk, May and Hammond are pursuing Osborne’s austerity policies. Meanwhile, although for all his efforts Osborne failed to achieve anything like a budget surplus for the nation, he has managed – while capitalising on the lecture circuit upon his experience in office – to achieve a healthy budget surplus for himself. Some people are shameless.

Lame and empty.

• No Proof Russia Disrupts UK Democracy, But They Can – Boris Johnson (RT)

Russia is planning to use “all sorts of dirty tricks” to meddle in the political life of European countries, British Foreign Secretary Boris Johnson warned, though he admitted there is “no evidence” that Moscow is actually involved in anything of the kind. “We have no evidence the Russians are actually involved in trying to undermine our democratic processes,” Johnson told British ITV’s Peston on Sunday show. “But what we do have is plenty of evidence that the Russians are capable of doing that,” he insisted adding that Russians “have been up to all sorts of dirty tricks.” Remarkably, Johnson made these statements just weeks before his visit to Russia, during which he will meet with his Russian counterpart, Sergey Lavrov. His visit would be the first made to Moscow by a British Foreign Minister in five years.

When asked what the UK’s approach to Russia should be now, he said that Britain needs to take “a twin-track approach” towards Russia. “As the prime minister has said, we’ve got to engage but we have to beware,” Johnson stated. Despite constantly saying there was solid proof that Russia had meddled in the affairs of other countries, such as by bringing down French TV stations and interfering in US elections, he failed to provide any concrete evidence to back his accusations. Johnson also implicated that Russia was involved in the situation in Montenegro, where a group of Serbian nationalists was arrested in October of 2016 suspected of planning to carry out armed attacks on the day of the country’s parliamentary elections.

The British Telegraph newspaper later reported that the group was sponsored and controlled by the Russian intelligence officers and had actually tried to stage a coup targeting its Prime Minister Milo Djukanovic with “the support and blessing” of Moscow. However, the paper’s report turned out to be based mostly on the assumptions of unidentified sources and Montenegrin Special Prosecutor for Organized Crime, Milivoje Katnic, confirmed that, despite the participation of several suspected “nationalists from Russia,” there was no “evidence that the state of Russia is involved in any sense.”

Democracy, Transparency, EU.

• Brussels Keeping 2015 Emergency Grexit Plan Locked Away (K.)

European Economic and Monetary Affairs Commissioner Pierre Moscovici has turned down a request from former Greek minister Anna Diamantopoulou for Brussels to make public the emergency plan it drafted in the summer of 2015 for the possibility of a Greek exit from the eurozone. Diamantopoulou, who also served as a European commissioner between 1999 and 2004, wrote to Moscovici earlier this year following a revival of Grexit speculation and asked for the plan to be published so Greeks could be aware of the dangers involved. However, Moscovici suggested in his response, which Diamantopoulou received a few days ago, that publishing the draft would simply fuel damaging speculation and would not be in the public interest as it would endanger financial, monetary and economic stability in Greece.

He also said that the document contains some highly sensitive issues. Parts of the plan, which is said to include emergency humanitarian aid for Greece, were discussed at the College of Commissioners in Brussels a few days before the July 5 referendum in 2015. “In our view, the public interest is best served when citizens know the whole truth about issues that affect their future,” Diamantopoulou, who now heads the Diktyo think tank, told Kathimerini. “When knowledge is absent, speculation, fear and populism flourish and we are left to watch the support for the euro wane day by day, while that for the drachma rises.”

Japan’s leaders don’t admit failure easily.

• Fukushima Evacuees Face ‘Forced’ Return As Subsidies Withdrawn (G.)

Thousands of people who fled the meltdown at the Fukushima Daiichi nuclear power plant six years ago will soon lose their housing subsidies, forcing some to consider returning despite lingering concerns over radiation in their former neighbourhoods. The measure, condemned by campaigners as a violation of the evacuees’ right to live in a safe environment, will affect an estimated 27,000 people who were not living inside the mandatory evacuation zone imposed after Fukushima became the scene of the worst nuclear accident in Japanese history. The meltdown in three reactors occurred after a magnitude-9 earthquake on 11 March 2011 triggered a powerful tsunami that killed almost 19,000 people along Japan’s north-east coast and knocked out the plant’s backup cooling system.

As a “voluntary” evacuee, Noriko Matsumoto is among those who will have their subsidies withdrawn at the end of this month, forcing them to make a near-impossible choice: move back to homes they believe are unsafe, or face financial hardship as they struggle on living in nuclear limbo. “Many of the other evacuees I know are in the same position,” Matsumoto said at the launch of Unequal Impact, a Greenpeace Japan report on human rights abuses affecting women and children among the 160,000 people who initially fled from areas near the plant. As of last month, almost 80,000 were still displaced. Matsumoto said: “They would still have to contend with high radiation if they returned, but the government is forcing them to go back by withdrawing housing assistance – that’s tantamount to a crime.”

At the time of the incident, Matsumoto was living with her husband and their two daughters in the city of Koriyama, 43 miles (70km) west of the stricken facility, well outside the area where tens of thousands of people were ordered to leave. Matsumoto initially stayed put, but three months later, with her youngest daughter, then aged 12, having nosebleeds, stomach ache and diarrhoea, she left her husband behind and took their children to Kanagawa prefecture, more than 150 miles south of Fukushima. She said: “The government is playing down the effects of radiation exposure … Yet people who don’t return to places like Koriyama after this month will be left to fend for themselves. They will become internally displaced people. We feel like we’ve been abandoned by our government.”

They should help them, not detain. For what purpose, send them to Turkey?

• Police Raid Athens Squats, Detain Dozens Of Refugees (K.)

Police raided squats in central Athens early on Monday, reclaiming properties and detaining dozens of undocumented migrants. In the first raid, officers entered a building on Alkiviadou Street which has been occupied since February. They transferred 120 migrants from the premises to the Aliens Bureau on Petrou Ralli Street. Police subsequently raided a building in Zografou which has been occupied by members of anti-establishment groups since 2012. Noone was in the building at the time of the raid but they started returning while police were on the premises and seven people were taken to the Athens police headquarters. Riot police units were stationed outside the squat buildings to prevent their reoccupation.

Refugee issues will keep growing until we help rebuild their countries, and work for stability instead of collateral damage control.

• What Would You Do To Keep Your Children Alive? (I’Cept)

Women and children from Central America began arriving at the U.S.-Mexico border in unprecedented numbers during the summer of 2014. Referring to the “urgent humanitarian situation,” President Barack Obama called on Congress to build new detention centers, hire new immigration judges, and increase border surveillance as tens of thousands of unaccompanied children were detained by U.S. immigration officials. At the same time, the United States backed a Mexican government initiative to increase patrols, detentions, and deportations along Mexico’s southern border. The idea was to stop Central Americans from getting into Mexico, let alone the United States. But the gang violence, kidnappings, and extortion sending families fleeing from the “Northern Triangle” comprising El Salvador, Honduras, and Guatemala hasn’t stopped.

People illegally cross the Suchiate River on the Mexico-Guatemala border – Alice Proujansky

The area has the highest murder rate in the world outside a war zone, and people are still coming to Mexico. Only now, as photographer Alice Proujansky documents, they are taking new routes and facing new dangers. “Entire families arrive with little more than backpacks,” Proujansky said. “Women and children are particularly vulnerable: increased enforcement on freight trains has driven migrants to ride buses and walk on isolated routes where they face robbery, assault, and sexual violence.”

Proujansky spent time with families who were hoping to receive asylum from Mexico. There are no reliable figures on how many people cross the border with Guatemala each year, which is still porous despite increased patrols. But between 2014 and the summer of 2016, Mexico detained 425,000 migrants, according to an analysis of government statistics by the Washington Office on Latin America, or WOLA, a human rights advocacy group. In that same time, only 2,900 people received asylum. Last year, there were some 8,700 applicants, of whom 2,800 have so far received protection. (In 2014, Mexico’s refugee agency had just 15 people to screen thousands of applications.)

Alice Proujansky

Home › Forums › Debt Rattle March 13 2017