Jessie Willcox Smith From The Princess and the Goblin by George MacDonald 1920

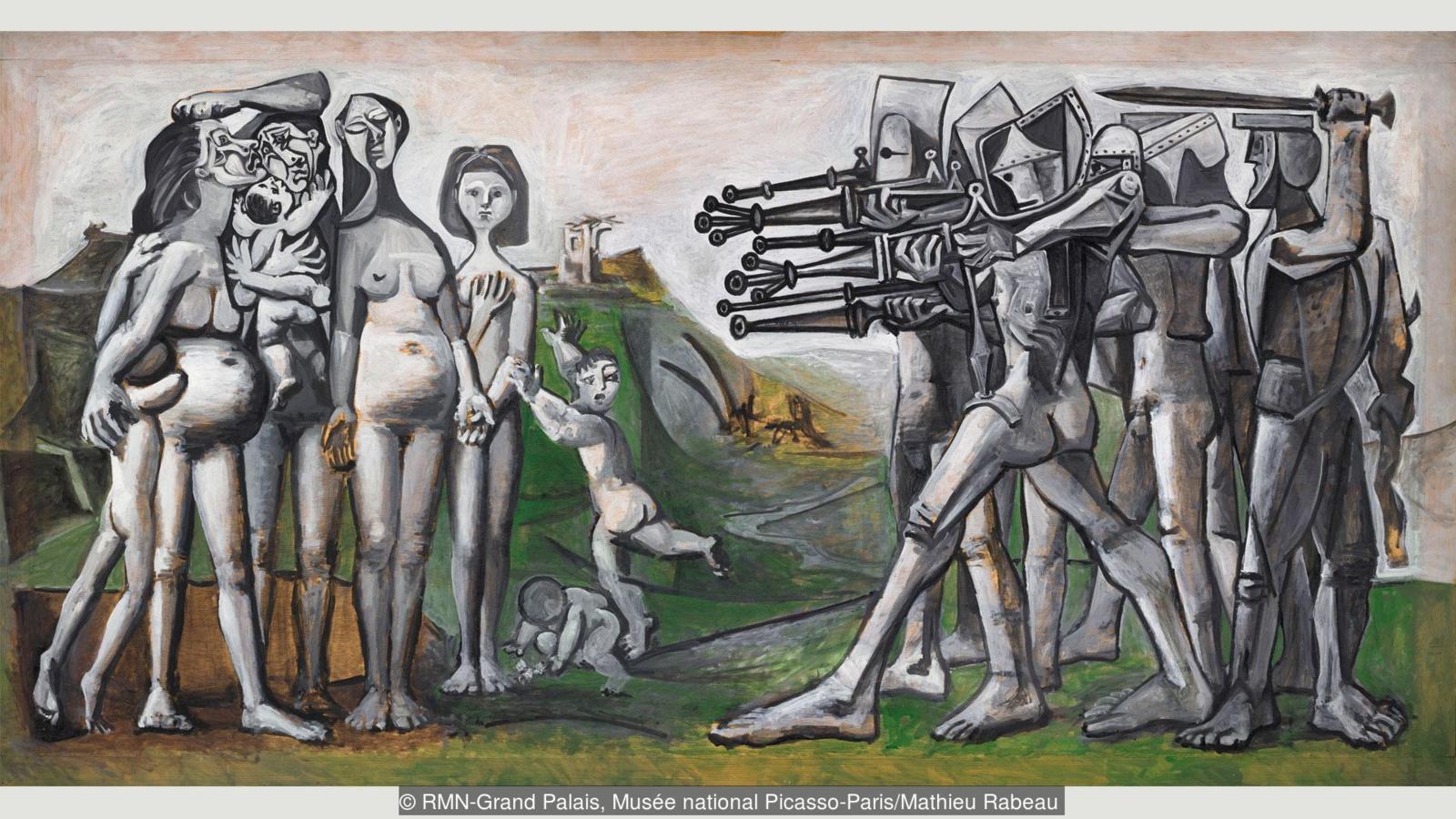

Brink of War

https://twitter.com/i/status/1694143915602182430

Macgregor

Colonel Douglas Macgregor on the economy & the fourth turning. https://t.co/aS0GoAnOza pic.twitter.com/U0HtTG5Xy6

— Financelot (@FinanceLancelot) August 22, 2023

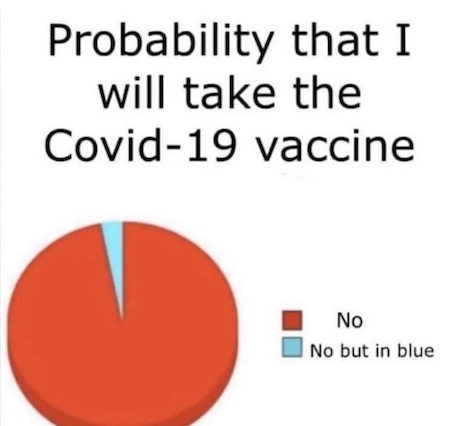

Myocarditis

https://twitter.com/i/status/1693744128314458248

Biological warfare

https://twitter.com/i/status/1693957169786294424

Escobar BRICS

If Trump is not there, nobody watches. If he IS there, nobody pays attention to the others. They can’t win.

No-one will watch a debate with Nikki Haley and Chris Christie. At the same time, Trump is on Tucker. A few hours later, he’s in Georgia.

• Trump to Miss Debate as There’s ‘Less to Lose by Not Showing Up’ (Sp.)

Former US President Donald Trump had already planned to miss the first Republican primary debate since he is unquestionably the leading GOP candidate, but his impending arrest in Georgia the following day adds a new layer of volatility to the already-fragile state of US politics, a prominent commentator told Sputnik. The first Republican presidential primary debate for the 2024 US election race is set to air on Wednesday evening on Fox networks. Eight candidates are expected to attend the Milwaukee, Wisconsin, event, but missing will be the clear pack leader, former US President Donald Trump. The candidates expected to appear are Florida Governor Ron DeSantis; North Dakota Governor Dough Burgum; former US ambassador to the United Nations Nikki Haley; former US Vice President Mike Pence; former New Jersey Governor Chris Christie; former Arkansas Governor Asa Hutchinson; US Sen. Tim Scott of South Carolina; and New York-based entrepreneur Vivek Ramaswamy.

Just hours after the debate, Trump is set to surrender himself to authorities in Fulton County, Georgia, in connection with federal charges that he illegally sought to overturn his loss in the Peach State in the 2020 election. Ajamu Baraka, international human rights activist, organizer, political analyst, and the national organizer for the Black Alliance for Peace, told Radio Sputnik on Tuesday that Trump’s absence could potentially be read as good or bad by his supporters, but that it was certainly bad for the legitimacy of the US political system for Trump to be facing such transparently political charges designed to stop his participation in politics. “There could be a backlash from either supporters of Trump if they believe this represents a certain kind of arrogance or it could be the opposite, that people believe that what the Republican candidates should do is to rally around the presumptive nominee of their party,” Baraka said.

“For Trump and his campaign, it’s understandable that he would not want to subject himself to the possibility of having to deal with some aggressive responses or comments coming from some of his opponents,” he noted. “There’s really a lot to lose in doing that and so they may have calculated that there’s less to lose by not even showing up.” Baraka said it was clearly “the predominant thinking within the Republican Party” that the nomination was Trump’s to refuse at this point, leaving little room for the other candidates to make a separate name for themselves at the Wednesday night debate. Indeed, the Iowa Poll, widely seen as the most reliable early poll for the primary race, found that Trump has by far the most solid support of any candidate: 68% said they won’t vote for anyone else.“What the Democrats seem not to understand is – the perception is that these prosecutions are politicized,” he explained.

“This is an attempt on the part of Democrats and Democratically-connected institutions and structures to undermine the ability of Donald Trump to run again. “I think that narrative is extending beyond the hardcore Trump supporters. People are raising questions around what appears to be a sort of piling-on, and indictments that have such a political character to them. We know they’re being framed as just some objective legal issues. And we know that the judge in Georgia, for example, claimed that she’s going to try this case without the politics. But very few people are in fact buying that. And it’s really a very dangerous situation because that perception is really helping to continue to undermine the legitimacy of US institutions.” “It’s a very dangerous strategy, but one in which Democrats believe that, in some kind of way, they’re going to create a condition or situation where someone, one of the Republican candidates, will then break from the pack,” he said. “That seems to be the thinking of many of the Democratic Party strategists.”

Baraka said that the Democratic officials in Georgia had displayed a “political inclination to make” Trump’s prosecution “into a spectacle” by treating him as if he is a flight risk and imposing limitations on his speech. “The main thing is: they want to degrade” Trump, he said. “They want those pictures, for example,” of Trump surrendering to authorities. “They have this belief that this is going to somehow undermine Trump. I think it’s going to have the opposite effect,” Baraka asserted. He accused them of having a kind of one-sided moral “blindness” that would inevitably lead to “political errors” on par with the second attempt to impeach Trump following the January 6, 2021, insurrection by his supporters at the US Capitol. “It’s all part of the process of the degeneration of politics in the US. It is incredibly dangerous because of the deepening economic crisis that we are facing. When you have the delegitimization of all of the US institutions then there’s no telling what may happen in terms of the politics here in this country. It’s very, very dangerous.”

Trump racism

What if they lied to you about President Trump?pic.twitter.com/cvAmq70hwT

— Brenden Dilley (@WarlordDilley) August 21, 2023

“President Trump’s only crime was to humiliate the lot of you, at every level and in both parties.”

• A Letter To Our Betters (Lundrum)

To those who rule over us, though not by our own choice; To those who could not care less about this nation we call our home, but instead only care for their own power, glory, and enrichment; To those who consider themselves better than us, and view us with nothing but the utmost contempt: We know exactly who you are. Now, more than ever before, We The People have had the wool pulled from our eyes, due in large part to your own arrogance. You have ended up as our ruling class, through manipulation rather than merit, through deception rather than democracy, and through favoritism rather than free elections. And we know all this through the efforts of one man: The man that you are now attempting to sentence to hundreds of years in one of your gulags, all for the crime of exposing your treachery at the highest levels.

Most simply, Donald J. Trump committed a sin that, in your eyes, is far more egregious than such trivial crimes as bribery, sexual impropriety, abuse of power, or even outright treason. President Trump’s only crime was to humiliate the lot of you, at every level and in both parties. The damage to your ego is a far greater offense than any actual criminal wrongdoing committed by many career politicians of days gone by.That is why you now hunt the man with all the relentlessness of Ahab pursuing his White Whale. And that is why we are now more resolved than ever before to stop you. Quite simply, the fight to save Donald Trump is the fight to save America: His struggle now is unlike any smear, intimidation, and character assassination campaign faced by any other political figure in American history. And it is only so because you have made it so. The more viscerally you react to him, and the more deranged your attacks against him, the more determined his supporters become to stand by him through it all.

But this all goes far beyond President Trump. You dictate to us from your halls of marble, built ages ago by far greater men than you will ever be, and in so doing desecrate the memory of those who came before us. If our Founding Fathers could see the state of their nation today, they would either believe that the Revolution had failed; or, perhaps, they would even regret the Revolution altogether if this was the ultimate end result. You have actively led a widespread and systematic effort to erase our nation’s history, from the legacy of those very Founders to the statues and other monuments meant to stand through all of time as a tribute to their greatness. Whether by mobs of roaming thugs or by official decree, you have sought to tear down the very memory of those who built the nation that you now run.

You speak down to us from your houses of glass, eternally – and perhaps deliberately – oblivious to the two-tiered society you have created for your own benefit and at our expense. You claim to fight for “democracy,” and yet actively obstruct the will of we, the 63 million, from the moment our chosen leader laid his hand on the Bible. Your bureaucrats determined that an archaic “interagency consensus” should override the desires of the American people and their elected commander-in-chief. When he called out the corruption of one of your leading political puppets, and suggested that such corruption should be investigated, you responded by putting him through a nakedly political impeachment trial. You made a crime out of noticing a crime, even after the former Vice President quite literally confessed to committing the corrupt act to which President Trump was referring.

Where does this leave Obama?

• Biden’s Personal Interest in Firing Ukraine Prosecutor Targeting Burisma (Sp.)

New memos indicate that then-Vice President Joe Biden did not act in concert with the US government when he threatened to withhold $1 billion in Ukraine aid unless the Poroshenko government fired the prosecutor general who targeted Hunter Biden’s Ukrainian employer at that time. Joe Biden and Democrats have repeatedly stressed that his insistence on firing Ukrainian then-Prosecutor General Viktor Shokhin back in December 2015 was consistent with the US policy of stamping out corruption in Ukraine. At the time, then-Vice President Joe Biden even went so far as to threaten then-Ukrainian President Petro Poroshenko that Washington would deprive Ukraine of a much-needed $1 billion loan guarantee in case the latter did not fire Shokhin. The conversation reportedly occurred in December 2015.

Biden openly bragged about the incident to the Council on Foreign Relations gathering in January 2018: “I said, ‘You’re not getting the billion.’ I’m going to be leaving here in, I think it was about six hours. I looked at them and said: ‘I’m leaving in six hours. If the prosecutor is not fired, you’re not getting the money.’ Well, son of a bitch, he got fired. And they put in place someone who was solid at the time.” However, memos by Treasury and Justice Department officials obtained by Just the News, an independent US media outlet founded by award-winning investigative journalist John Solomon, indicate that the US government held Shokhin in high regard at the time and concluded that Ukraine had made progress in fighting endemic corruption, thus deserving the loan guarantee.

“Ukraine has made sufficient progress on its reform agenda to justify a third guarantee,” read an October 1, 2015, memo by the Interagency Policy Committee (IPC), a Barack Obama task force. Moreover, Senior State Department officials sent Shokhin a personal note saying they were “impressed” with his office’s work and invited him and his staff to Washington for a January 2016 strategy session prior to his sacking. Remarkably, an audio tape from March 2016 which appeared to record Biden and Poroshenko’s conversation showed that the Ukrainian president pointed out that there was no evidence that Shokhin and his office were anyhow mired in corruption: “Despite the fact that we didn’t have any corruption charges, we don’t have any information about him doing something wrong, I especially asked him … No, it was the day before yesterday. I especially asked him to resign,” Poroshenko allegedly told Biden in a tape released in 2020 by then-parliamentarian Andrii Derkach.

McCarthy is the GOP. Trump is not.

• McCarthy Threatens Impeachment Inquiry, Again (Manley)

House Republicans have been calling for impeachment proceedings against US President Joe Biden for months over allegations of financial misconduct during the Obama years. While initial calls were dulled, new reports suggest the initiative may be picked up once Congress comes back in session. US House Speaker Kevin McCarthy (R-CA) threatened, yet again, on Tuesday to launch an impeachment inquiry in September if the Biden administration fails to turn over documents said to be tied to an alleged bribery scheme involving the Biden family. It’s not clear, however, which documents McCarthy is seeking, nor from whom. Additionally, reports have suggested the so-called ‘missing’ files were not exactly requested by lawmakers. “The thing that holds up whether we do impeachment inquiry, provide us the documents we’re asking,” McCarthy said in an interview with Larry Kudlow. “The whole determination here is how the Bidens handled this.”

“If they provide us the documents, there wouldn’t be a need for impeachment inquiry. But if they withhold the documents and fight like they have now to not provide to the American public what they deserve to know, we will move forward with impeachment inquiry when we come back into session,” he added. The House speaker did clarify that they were looking for bank statements, as well as credit card statements. “The bank statements, the credit card statements and others. Show us where the money went, show us were you taking money from outside sources? And that would clear most of this up, but they seem to fight it every step of the way,” he added. Republicans have for months been making calls for an impeachment inquiry against US President Joe Biden over a pay-to-play scheme that is alleged to have taken place when the commander-in-chief served as vice president under the Obama White House. It’s alleged Hunter Biden used his father’s role as a means to get kickbacks at the time.

When asked about the impeachment inquiry into the president, McCarthy reportedly raised several allegations about Biden’s involvement in his son’s business dealings. In addition, he also criticized the decision to appoint a special counsel to oversee the ongoing probe into Hunter Biden. Attorney for the District of Delaware, David Weiss, was earlier appointed by Attorney General Merrick Garland to oversee the Hunter Biden case, a move that has prompted GOP attacks against Weiss as a result. McCarthy is presently claiming that the US House could also push forward an impeachment inquiry into Biden should Weiss refuse to hand over certain information to Congress. It’s worth noting that prior to the appointment announcement, reports indicated that Weiss had initially been blocked from the post.

“If they use this special counsel to say that they can’t provide us the information, then it just shows more politics. And it will not stop us. Then we would move to impeachment inquiry and we would be able to still get the documents that we need as we move forward,” McCarthy explained. McCarthy first floated the idea of an impeachment inquiry against Biden in July, explaining then that the motive was rooted over allegations that the US president was a willing participant in financial misconduct. However, the early summer initiative only came after the House speaker initially opted to shut down earlier impeachment calls that were being encouraged by the hard-right Republicans of the House Freedom caucus.

CNN DOJ Biden

NEW: CNN makes a shocking pivot, says they're 'perplexed' by the corruption coming out of the Department of 'Justice' as they continue to cover up for the Biden Crime Family.

That's something I never thought I would hear.

CNN Senior Legal Analyst Elie Honig blasted the DOJ for… pic.twitter.com/BRkk16SKXZ

— Collin Rugg (@CollinRugg) August 22, 2023

“In 2008, the EU’s economy was somewhat larger than America’s: $16.2tn versus $14.7tn. By 2022, the US economy had grown to $25tn, whereas the EU and the UK together had only reached $19.8tn.”

• The EU Doesn’t Know How To Not Be A Vassal Of The US Anymore (Blankenship)

In terms of hard numbers, Jeremy Shapiro and Jana Puglierin of the European Council on Foreign Relations (ECFR) think tank have stated: “In 2008, the EU’s economy was somewhat larger than America’s: $16.2tn versus $14.7tn. By 2022, the US economy had grown to $25tn, whereas the EU and the UK together had only reached $19.8tn. America’s economy is now nearly one-third bigger. It is more than 50 per cent larger than the EU without the UK.” The article goes on to describe a European Union that is dragging far behind the US and China in terms of quality universities, a less-than-pristine start-up environment, and lacking key benefits from its transatlantic peer – namely cheap energy. The Ukraine conflict has impacted the latter to the point that EU companies are paying three or four times what their American competitors are, with Washington being energy-independent and enjoying great domestic supplies. Meanwhile, energy from Russia is waning, European factories are closing in droves, and industry leaders are worried about the region’s future competitiveness.

The ECFR issued its own report on the matter in April, which is far blunter in describing the situation as a kind of “vassalization.” The summary of that report notes that the Ukraine war has exposed the EU’s key dependencies on the US, that over the course of a decade, the bloc has fallen behind the US in virtually every key metric, that it is deadlocked in disagreement and is looking to Washington for leadership. The ECFR noted two causes for this situation. Firstly, despite the widely understood decline of the US compared to the rise of China, the transatlantic relationship has been unbalanced in Washington’s favor over the last 15 years since the 2008 financial crisis. The Biden administration is keen to exploit this and assert itself in the face of a disjointed Europe. Secondly, no one in the EU knows what greater strategic autonomy could look like – let alone agree on it if they did. There exists no process to decide the EU’s future in an autonomous way given the current status quo, which means US leadership is necessary.

This paints quite an interesting picture. Many commentators, including myself, have long documented the decline of the US and attributed it to a number of factors: less of an attractive environment for foreign direct investment (FDI), financial instability, corruption, and internal political turmoil. This is, of course, relativized to China, which has seen immense economic growth since the founding of the People’s Republic and particularly over the past four decades. But under the smoke screen of a fumbling America and a growing China, the EU has likewise fallen in stature. As for the two causes noted by the ECFR, they seem to be intertwined. Many of the key issues that have faced the EU, from migration to the banking crisis to Covid-19, have stemmed directly from the non-federal nature of the EU.

And the current political crises are a result of Euroskepticism, i.e. a backlash against what is perceived as an overreach from Brussels by some political organizations within the bloc. The EU is a complicated and sometimes cumbersome bureaucracy that is cherished by some, reviled by others, and, under these assumptions, is an impediment to strategic autonomy. The ECFR essentially argues for the EU and Western European capitals to lean into the transatlantic partnership, but on terms favorable to themselves. This includes creating an independent security architecture within and complimentary to NATO, creating an economic NATO of sorts and even pursuing a European nuclear weapons program. At least the former two are acceptable, as abandoning the US outright would be politically foolish for the EU at this juncture. It certainly needs to develop a transatlantic free-trade agreement that puts an end to American trade protectionism.

“even the most experienced units have been reconstituted a number of times after taking heavy casualties.”

• West ‘Perplexed’ By Ukraine’s Strategy – NYT (RT)

Ukraine’s counteroffensive is struggling because some of Kiev’s best troops are “in the wrong places,” the New York Times reported on Tuesday, citing senior US and UK officials speaking on condition of anonymity. The offensive’s main objective is to reach the Sea of Azov, cutting off Crimea from the Russian mainland, but Ukraine currently has more troops on the eastern front – facing Artyomovsk, also known as Bakhmut – than in the “far more strategically significant” south, according to the Times. “American planners have advised Ukraine to concentrate on the front driving toward Melitopol… and on punching through Russian minefields and other defenses, even if the Ukrainians lose more soldiers and equipment in the process,” the newspaper said.

The Russian Defense Ministry has estimated Ukraine had lost 45,000 dead and over 5,000 vehicles in the past two months of fighting, without going past the Russian screening line. “Only with a change of tactics and a dramatic move can the tempo of the counteroffensive change,” a US official told the newspaper, though others argued that even that may be too little, too late. Kiev’s insistence on keeping a large force in the east is particularly “perplexing” to American and British officials, as Western doctrine calls for commitment to a clear main effort. They argue that a smaller force could serve to pin down the Russian defenders, and while Ukraine theoretically has enough troops to retake Artyomovsk, doing so would “lead to large numbers of losses for little strategic gain.”

General Mark Milley, chairman of the US Joint Chiefs of Staff, his British counterpart Admiral Sir Tony Radakin, and NATO’s Supreme Allied Commander Europe Christopher Cavoli all urged Ukraine’s top general Valery Zaluzhny to focus on the southern front in the August 10 call, the Times said. Zaluzhny supposedly agreed. Just five days later, however, President Vladimir Zelensky was touring the “Soledar sector” near Artyomovsk, visiting the neo-Nazi ‘Azov’ unit and speaking about the importance of that front. According to the Times, Ukraine has started to redeploy some units to the south, but “even the most experienced units have been reconstituted a number of times after taking heavy casualties.”

Kiev is currently “tapping into its last strategic reserves,” and unnamed Western analysts worry that Ukrainian forces “may run out of steam” by mid-September, even before a change in weather turns the ground into impassable mud. The Times itself noted that US criticism comes from the perspective of officers “who have never experienced a war of this scale and intensity,” and that the US war doctrine “has never been tested in an environment like Ukraine’s, where Russian electronic warfare jams communications and GPS,” and there is no air superiority. Ukraine launched its much-hyped offensive in early June, but has so far failed to gain any significant ground, losing many Western-supplied tanks and armored vehicles in the process.

“The groups exist throughout Ukraine and some have as many as 100,000 members..”

• Ukrainian Draft Dodgers Aggravating Troop Shortages – BBC (RT)

Ukraine is struggling to reinforce its troop numbers due to “constant” heavy casualties suffered in the conflict with Russia and the population’s unwillingness to replace those no longer able to serve, the BBC reported on Tuesday. “The country constantly needs to replace the tens of thousands who’ve been killed or injured,” the British state broadcaster said, adding that many Ukrainian troops are exhausted following 18 months of hostilities with Moscow. According to the broadcaster, Ukrainians have formed mass chat groups on social media to share ways of dodging conscription, including providing tip-offs on Telegram of draft patrol officers’ routes. The groups exist throughout Ukraine and some have as many as 100,000 members, the BBC added.

Thousands have already fled Ukraine in an attempt to avoid the draft, while others are planning to do so, the BBC claimed. It said that those fleeing often bribe officials, including recruitment officers, to ensure safe passage abroad. Earlier this month, Ukrainian President Vladimir Zelensky dismissed every single regional military official responsible for conscription following a series of corruption scandals. The Ukrainian authorities had previously opened 112 criminal cases against territorial draft center officials, Zelensky revealed at the time. Ukrainian defense officials have described the alleged offenses committed by those responsible for the draft campaign as “shameful and unacceptable.” Fired personnel will be replaced by combat veterans unfit for active duty, Zelensky said in early August, claiming that they had “no cynicism” and could be trusted.

According to the BBC, officers involved in the recruitment campaign stand accused of employing increasingly heavy-handed tactics. People have allegedly been summoned to recruitment centers for registration, often only to be seized on the spot and deprived of the chance to return home, the broadcaster claimed. Draft officials are also accused of using “harsh or intimidating tactics,” the British broadcaster said, while fresh recruits can reportedly find themselves on the front lines “with just a month of training.” The report comes as Kiev struggles with the much-hyped counteroffensive against Russian forces launched in early June. According to Moscow, Ukrainian troops have failed to make any significant progress, often only reaching the first line of Russian defenses.

They find that out now?

• F-16’s For Ukraine Can’t Carry Storm Shadows (Sp.)

According to reports in US media, the plan to supply Ukraine with US-made F-16 Falcon fighter jets has hit a snag, since the aircraft are not presently compatible with the British-made Storm Shadow cruise missiles previously given to Ukraine to enhance its long-range aerial strike capability. That has raised a new question among politicos: should the US send compatible cruise missiles to Kiev alongside the F-16, such as the AGM-158 Joint Air-to-Surface Standoff Missile (JASSM) with its 575-mile range? Alexander Mikhailov, head of the Bureau of Military-Political Analysis, told Sputnik on Tuesday that the situation exposes the unplanned and haphazard way in which NATO is scrambling to send Kiev any weapons they can find, but especially older ones.

“It seems to me that both the British and aviation armaments [industries] will find a technical opportunity to place their missiles on the F-16,” he said. “I think the issue here is quite technically solvable. It seems to me that, in general, we need to wait for the delivery of aircraft.” “We are again dealing with promises to assist in the supply of weapons, promises to establish training for pilots. But we don’t see specific products,” he said. “This story is very similar to the story of American tanks, which started in November of last year, when the Americans first promised their Abrams tanks and simultaneously dragged European partners into these promises, then they themselves stalled the supply of tanks, citing a lack of a structural base, a lack of a repair base, a shortage of all this in Poland or on the territory of Ukraine,” Mikhailov noted.

“And at this time, the German Leopard tanks were already burning and the image of the German defense industry was burning and a lot of other troubles that Europe received which, as it were, followed the lead of the Americans with their eternal divorce.” “Now it’s a very similar story. The Americans would very much like European planes to fly to Ukraine. Moreover, the same Germans have third-generation Tornado aircraft, Europeans have Typhoons, Mirages, Rafales, and Gripens. And in principle, there is plenty to choose from, especially if the Europeans are more loyal. But the Europeans are no longer fooled by these American promises. Because after the story with the Abrams, when even the Challenger tanks arrived in Ukraine and several Leopards were sent to Ukraine and even participated in the hostilities, the Abrams did not appear in Ukraine.”

PPP.

• Putin: Russia Among World’s Top Five Economies, Overtakes Germany (Sp.)

Despite pessimistic forecasts, Russia is among the five largest economies in the world and has overtaken the Federal Republic of Germany, Russian President Vladimir Putin said at the Council on Strategic Development and National Projects. According to the World Bank, the Russian Federation “has moved ahead of the Federal Republic of Germany in terms of purchasing power parity, in terms of the size of the economy,” Putin added. The president highlighted that this is one of the most important indicators. The president stressed that the growth rates are steady, including in industry, while the current budget situation is stable and risk-free. “The current budgetary situation is generally stable and does not carry risks for macroeconomic stability. In the second quarter, the federal budget deficit decreased almost eight times compared to the first quarter and totaled 264 billion rubles. In July, the budget balance was 458 billion rubles better than a year ago,” Putin clarified.

For July-September the budget will be reported with a surplus, and by the end of the year the excess of expenditures over revenues will amount to the planned 2% of GDP, Putin noted. According to the president, in a year and a half, the ruble’s share of payments for Russian exports has more than tripled, from 12% to 42%, and “if we count it together with the currencies of friendly countries, this share reaches 70%”. Domestic manufacturers are quickly filling the niches of foreign companies that have left, and Russia will continue to do the same, the president emphasized. On August 4, Sputnik calculated using data from the World Bank that Russia’s GDP by purchasing power parity (PPP) in 2022 for the first time ever exceeded $5 trillion, allowing the country to remain the world’s fifth-largest economy.

Earllier Russian Prime Minister Mikhail Mishustin said that the Russian economy had adapted to Western sanctions and was growing steadily, adding that, despite all attempts to cut it off from global production chains, logistics routes and financial systems, interest for the country’s economy was increasing. In early August, an American newspaper reported that the West’s strategy of imposing sanctions on Russian businessmen and their families proved to be ineffective. Russia’s ability to withstand the sanctions will be a subject for analysis in the future, according to the report.

More PPP.

• De-Dollarization Is Irreversible – Putin (RT)

The US dollar is losing its global role in an “objective and irreversible” process, the Russian president told participants at the BRICS Summit in South Africa on Tuesday. Vladimir Putin spoke by via videolink, after choosing not to attend the event in person.De-dollarization is “gaining momentum” he said, adding that members of the group of major emerging economies are seeking to reduce their reliance on the greenback in mutual transactions. The Russian leader said the five nations – Russia, China, India, Brazil and South Africa – are becoming the new world economic leaders, and that their cumulative share of global GDP has reached 26%. He noted that if measured by purchasing power parity, BRICS has already surpassed the Group of Seven leading industrialised nations – accounting for 31% of the global economy, compared to 30% for the G7.

Over the past 10 years, mutual investment between the BRICS member states has increased by six times. Their total investments in the world economy have doubled, while cumulative exports account for 20% of the global total, Putin said. Moscow is focusing on re-orienting its transport and logistics routes towards “reliable foreign partners,” including BRICS members, to ensure an uninterrupted supply of energy and food to the international market. Russia’s primary goals include developing the Northern Sea Route and the ‘North-South’ transport corridor, Putin stated. The first, passing through the Arctic Ocean, along Russia’s northern coastline, will ensure faster goods deliveries between Europe and the Far East. The second will connect Russia’s northern and Baltic ports to the Persian Gulf and the Indian Ocean, facilitating cargo movement between Eurasian and African nations.

“We are consistently increasing fuel, food and fertilizer supplies to the states of the Global South,” and actively contributing to global food and energy security, the Russian leader said. He blamed the current international food crisis on the West’s unilateral sanctions, describing them as “unlawful.” “Illegitimate sanctions… seriously weigh on the international economic situation,” and the “unlawful freezing of sovereign states’ assets” constitutes a violation of free trade and economic cooperation rules. The resource deficit and growing inequality worldwide are a “direct result” of such policies, the Russian president argued. He highlighted skyrocketing grain and food prices as the latest manifestation of this process, primarily affecting the most vulnerable nations.

Moscow is represented at the Johannesburg summit, which runs from August 22 to 24, by Russian Foreign Minister Sergey Lavrov. Putin opted not to attend the event after a decision by the International Criminal Court (ICC) to issue a warrant for his arrest in March. The court based the order on Ukraine’s allegation that the Russian evacuation of children from the conflict zone amid hostilities between the two nations amounted to “unlawful population transfers.”South Africa is a signatory of the Rome Statute of the ICC, and the US and its allies had pressured it to detain Putin should he travel to the country. Moscow has repeatedly denied the ICC’s allegations and stressed that it does not recognize the court’s authority, declaring the warrant legally null and void. Although South African President Cyril Ramaphosa repeatedly stated that he would not carry out the order, claiming it would amount to a “declaration of war,” Moscow ultimately decided to send Foreign Minister Sergey Lavrov to the BRICS summit to represent Russia.

https://twitter.com/i/status/1694133636101001423

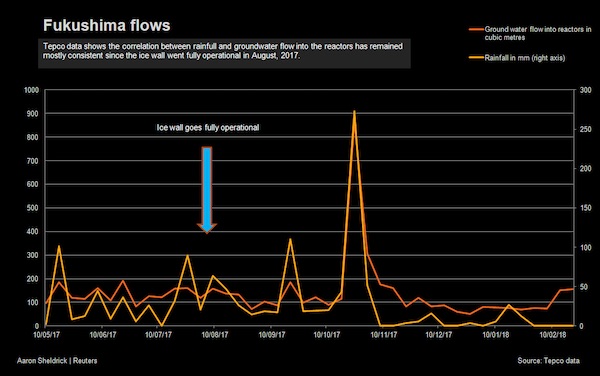

“IAEA Director General Rafael Grossi recently claimed the wastewater was safe enough for drinking and swimming. He did not respond to Beijing’s request to drink it himself, however.”

“..if the [..] water is truly safe, Japan wouldn’t have to dump it into the sea—and certainly shouldn’t if it’s not..”

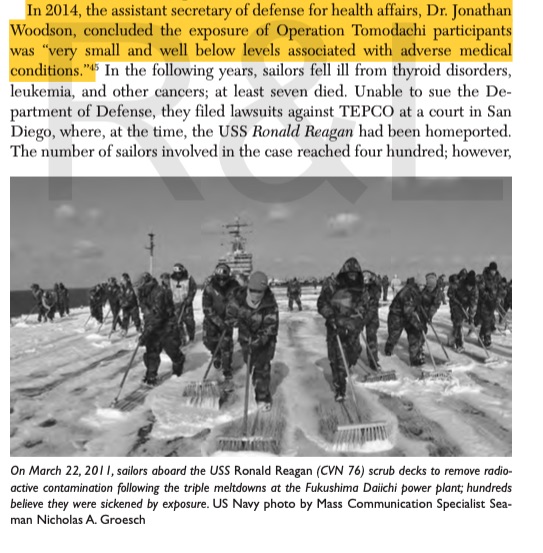

• Fukushima Water Discharge ‘Irresponsible’ – China (RT)

The Japanese government’s plan to discharge water from the stricken Fukushima nuclear power plant into the ocean is “extremely selfish and irresponsible,” Chinese Foreign Ministry spokesman Wang Wenbin said on Tuesday. “The ocean sustains humanity. It is not a sewer for Japan’s nuclear-contaminated water,” Wang told reporters at the daily press briefing, calling the Japanese plan “unjustified, unreasonable and unnecessary.” “Japan is putting its selfish interests above the long-term wellbeing of the entire humanity,” the spokesman added. “China is gravely concerned and strongly opposed to this.” Beijing intends to take all the necessary steps to “protect the marine environment, ensure food safety and safeguard people’s life and health,” Wang added, without adding specifics.

Earlier on Tuesday, Japanese Prime Minister Fumio Kishida announced that the dumping of waste water into the Pacific Ocean would begin on August 24, “weather conditions permitting.” For the past two years, the Tokyo Electric Power Company (TEPCO) has sought approval to start dumping the water from the Fukushima Dai-Ichi nuclear power plant, crippled by the 2011 earthquake and tsunami. The plant produces 100 cubic meters of radioactive water every day, to keep its reactors from melting down, and TEPCO is running out of storage on site. The company intends to release a total of one million metric tons of water, starting with around 7,800 cubic meters over 17 days.

Tokyo insists that the wastewater has been treated and poses no danger to humanity or marine life, but Japan’s neighbors disagree. The ocean dump proposal has been endorsed by the International Atomic Energy Agency (IAEA), which said its impact on the environment would be “negligible.” According to the UN nuclear watchdog, the wastewater contains about 190 becquerels of tritium per liter, well below the 10,000 becquerel limit set by the World Health Organization. IAEA Director General Rafael Grossi recently claimed the wastewater was safe enough for drinking and swimming. He did not respond to Beijing’s request to drink it himself, however.

“China and other stakeholders have pointed out on multiple occasions that if the Fukushima nuclear-contaminated water is truly safe, Japan wouldn’t have to dump it into the sea—and certainly shouldn’t if it’s not,” Wang told reporters on Tuesday. While Beijing did not specify measures it intends to undertake in response, China’s special administrative regions of Hong Kong and Macao have already said they would “immediately activate” import controls on Japanese seafood, covering live, frozen, refrigerated, and dried fish, as well as sea salt and seaweed.

Mantis

https://twitter.com/i/status/1693928738835100023

Baby hippo

Pygmy hippos have a four-chambered stomach. However, they are not true ruminants & hence ferment food & use microbes in a different way than true ruminants. Additionally, they never chew their cud but one can consume as much as 70 kg of grass per nightpic.twitter.com/h6E6yvNl32

— Massimo (@Rainmaker1973) August 22, 2023

Monitor

https://twitter.com/i/status/1693897176311529493

Inca tern

https://twitter.com/i/status/1693973402183258421

Blue

Strange about the blue anomalies… pic.twitter.com/dH6i52IOz9

— PaulsCorner21 (@TNTJohn1717) August 22, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.