René Magritte The secret player 1927

Moving the yardsticks.

• Harder To Attribute Mortality To Vaccine Than To Covid? (JTN)

Stephanie Dubois, a British model aged 39, and Lisa Shaw, a BBC radio presenter aged 44, died within a day of each other due to serious thrombotic episodes after receiving the Oxford-AstraZeneca COVID-19 vaccine. Neither had underlying health conditions. Dubois’ case has now been referred to the European Medicines Agency (EMA), as she lived in Cyprus, but she left her own account of her tragic decline on her Facebook page: May 6: “So I had the vaccination today! I hate needles, today was no exception … And now I feel horrendous … pizza and bed for me.” May 14: “Woke up feeling fine and then within an hour I had full body shakes, all my joints seized, and I was struggling to breathe and was cold to the bone with a persistent headache and dizziness … Mum and dad came to look after me and took me for a Covid test, which thankfully was negative … but it still doesn’t explain what the problem is. Maybe I’m having a prolonged reaction to my Covid jab last week.”

That same day she was admitted to the hospital. May 18: “Done being ill now … Couple more tests today! PS — I still don’t like needles — feeling tired.” May 19: Dubois went into a coma. Shaw’s family said in a statement: “Lisa developed severe headaches a week after receiving her AstraZeneca vaccine and fell seriously ill a few days later … She was treated by the [Royal Victoria Infirmary’s] intensive care team for blood clots and bleeding in her head.” According to Britain’s medical watchdog, the Medicines and Healthcare Products Regulatory Agency (MHRA), there have been 332 cases of blood clotting leading to 58 deaths from the AZ vaccine. Statistically, that is very small compared to the estimated 23.9 million first doses of the AstraZeneca vaccine and 9.0 million second doses administered in the U.K. by the same date.

The death of Dubois highlights how much harder it is to attribute deaths to the vaccines than it is to claim death by COVID. Deutsche Welle has even run a fact-check article on other cases titled “No links found between vaccinations and deaths.” The German state broadcaster and publisher sought to debunk claims made in many other countries, including Italy, Austria, South Korea, Germany, Spain, Belgium and the U.S. In a case in a Norwegian nursing home, it quoted the EMA stating: “Pre-existing diseases seemed to be a plausible explanation for death. In some individuals, palliative care had already been initiated before vaccination.” Statens Legemiddelverk of the Norwegian Medicines Agency claimed, “Every day, an average of 45 people die in Norwegian nursing homes … therefore, deaths that occur close to the time of vaccination is expected, but it does not imply a causal relationship to the vaccine.”

Figures for deaths attributed to COVID, meanwhile, are not scrutinized to the same level. Comorbidities are downplayed as causal factors in death when they overlap with COVID — whether the latter is verified or even merely suspected. According to the Office of National Statistics (ONS) in the U.K., “Of the 50,335 deaths that occurred in March to June 2020 involving COVID-19 in England and Wales, 45,859 (91.1%) had at least one pre-existing condition, while 4,476 (8.9%) had none.” The average age of COVID fatalities in the U.K. up to January 2021 was 81. Finding out if COVID was the dominant cause of death is hard to discern without a full autopsy, but the British government document “Guidance for Doctors Completing Medical Certificates of Cause of Death in England and Wales — FOR USE DURING THE EMERGENCY PERIOD ONLY” explains this is not required for COVID cases: “Covid-19 is not a reason on its own to refer a death to a coroner under the Coroners and Justice Act 2009 … Medical practitioners are required to certify causes of death to the best of their knowledge and belief.”

Even medical proof is not necessary under the guidance: “If before death the patient had symptoms typical of COVID- 19 infection, but the test result has not been received, it would be satisfactory to give ‘COVID-19’ as the cause of death … In the circumstances of there being no swab, it is satisfactory to apply clinical judgement.”

Cue VanDenBossche.

• Vietnam Sees Hybrid Of Covid-19 Variants Identified In India And Britain (ST)

Authorities in Vietnam have detected a new coronavirus variant that is a combination of the Covid-19 variants first found in India and Britain, and spreads quickly by air, the health minister said on Saturday (May 29). After successfully containing the virus for most of last year, Vietnam is grappling with a spike in infections since late April that accounts for more than half of the total 6,713 registered cases. So far, there have been 47 deaths. “Vietnam has uncovered a new Covid-19 variant combining characteristics of the two existing variants first found in India and the UK,” Health Minister Nguyen Thanh Long said, describing it as a hybrid of the two known variants.

“That the new one is an Indian variant with mutations that originally belong to the UK variant is very dangerous,” he told a government meeting. The South-east Asian country had previously detected seven virus variants: B1222, B1619, D614G, B117 – known as the variant from Britain, B1351, A231 and B16172 – the variant from India. Mr Long said Vietnam would soon publish genome data of the newly identified variant, which he said was more transmissible than the previously known types.

‘That coverup alone suggests that there’s a lot more that we need to know.’

• ‘Wuhan Lab Is Still Conducting The Same Research’: Mike Pompeo (DM)

Mike Pompeo, the former CIA director and secretary of state, has said that Wuhan Institute of Virology was conducting secret military research and claims there is ‘enormous evidence’ that the virus that causes COVID-19 escaped from the lab. Donald Trump’s former top aide also warned that the dangerous experimentation is ongoing at the lab, raising the specter of another potentially deadly virus leak. ‘What I can say for sure is this: we know that they were engaged in efforts connected to the People’s Liberation Army inside of that laboratory, so military activity being performed alongside what they claimed was just good old civilian research,’ Pompeo told Fox News on Saturday. ‘They refuse to tell us what it was, they refuse to describe the nature of either of those, they refuse to allow access to the World Health Organization,’ Pompeo said.

‘That coverup alone suggests that there’s a lot more that we need to know.’ ‘That virology lab is still up and running. It’s still probably conducting the same kinds of research it was conducting that may have well led to this virus escaping from that laboratory,’ he said. ‘Only the Chinese Communist Party knows the answer, the world deserves the answers and they have to tell us, I hope there will be bipartisan push to demand and hold accountable,’ said Pompeo. He spoke after President Joe Biden ordered an intensive 90-day probe to reinvestigate the possibility of a lab leak origin in the pandemic. ‘It’s really unfortunate they took the position early on that there was nothing to see here,’ Pompeo said in response to the new probe.

‘I’m glad now that they’re looking at this. I hope it’s a serious investigation when they say they are giving 90 days for the intelligence community to look at this. The intelligence community has been looking at this for an awfully long time,’ he said. Pompeo, a former CIA spy chief, has promoted the lab leak theory since the early days of the pandemic, a theory that until recently much of the U.S. media and academia scoffed at as a fringe conspiracy theory. ‘I’ve known since spring of last year, 2020, when I first spoke about this that there is enormous evidence that this escaped from that laboratory in Wuhan,’ he said on Saturday. ‘We know there were people who got sick there, scientists who got sick there, we know they were doing the gain of function research — essentially taking viruses and making them more contagious, potentially more lethal, this administration has to get after this.’

Not exactly winning, are they?

• Victoria: 5 New Local Covid Cases, ‘Extremely Concerning’ Mystery Case (G.)

The Morrison government is continuing to declare getting vaccinated is “not a race” even as Victorian health authorities confirmed five new locally acquired infections – including one mystery case in aged care – on day three of the state’s fourth Covid lockdown. The new cases reported on Sunday morning take the total number in the Melbourne-based outbreak to 40. Victoria’s acting premier, James Merlino, announced a $250m support package for businesses on Sunday while stating he was “beyond disappointed” the prime minister and federal treasurer had declined to help workers with financial assistance. The vaccine roll-out was a race, Merlino insisted. Victoria wanted to go faster but was being held back by the federal government failing to secure enough supply, he said.

One of the new positive cases reported on Sunday was a healthcare provider in an aged care home in the western suburb of Maidstone. Colin Singh, the Arcare chief executive, said the worker had received her first dose of a Covid vaccine, was wearing a mask and had not displayed symptoms when she last worked at the centre on Thursday. “I want to assure you that, whilst we hoped that this would not happen again, we are well prepared, and our infection control practices put us in a good place to manage this outbreak effectively,” he said in the statement on Sunday. Arcare Maidstone has capacity for 90 residents, according to its website. It was relatively untouched by Covid last year – compared to other Victorian facilities – recording only seven cases.

Victoria’s Covid commander, Jeroen Weimar, said on Sunday the case in the aged care home was of “extreme concern” because it was a mystery case. “I am concerned that at this point in time we don’t have an original acquisition source,” for the healthcare worker, Weimar told reporters.

“The more threatening a virus is presumed to be, the more superfluous government force is.”

• Restricting Freedom Didn’t Defeat COVID (ZH)

Let’s travel back in time to March of 2020, when predictions of mass death related to the new coronavirus started to gain currency. One study, conducted by Imperial College’s Neil Ferguson, indicated that U.S. deaths alone would exceed 2 million. The above number is often used, even by conservatives and libertarians, as justification for the initial lockdowns. “We knew so little” is the excuse, and with so many deaths expected, can anyone blame local, state, and national politicians for panicking? The answer is a resounding yes. To see why, imagine if Ferguson had predicted 30 million American deaths. Imagine the fear among the American people then—which is precisely the point: The more threatening a virus is presumed to be, the more superfluous government force is. Really, who needs to be told to be careful if a failure to take precautions could reasonably result in death?

Death predictions aside, the other justification bruited in March of 2020 was that brief lockdowns (two weeks was the number often thrown around) would flatten the hospitalization curve. In this case, the taking of freedom allegedly made sense as a way of protecting hospitals from a massive inflow of sick patients that they wouldn’t have been able to handle, and that would have resulted in a public health catastrophe. Such a view similarly vandalizes reason. Think about it. Who needs to be forced to avoid behavior that might result in hospitalization? Better yet, who needs to be forced to avoid behavior that might result in hospitalization at a time when doctors and hospitals would be so short-staffed as to not be able to take care of admitted patients? Translated for those who need it, the dire predictions made over a year ago about the corona-horrors that awaited us don’t justify the lockdowns; rather they should remind the mildly sentient among us of how cruel and pointless they were.

The common sense that we are to varying degrees born with, along with our genetic predisposition to survive, dictates that a fear of hospitalization or death would have caused Americans to take virus-avoidance precautions that would have well exceeded any rules foisted on them by politicians. To which some will reply with something along the lines of “Not everyone has common sense. In truth, there are lots of dumb, low-information types out there who would have disregarded all the warnings. Lockdowns weren’t necessary for the wise among us; rather they were essential precisely because there are so many who aren’t wise.” Actually, such a response is the best argument of all against lockdowns.

Why is he the only one? 2024.

• DeSantis Pushes Back On Big Tech Social Media Censorship (JTN)

Last week, Florida Gov. Ron DeSantis signed into law a bill that takes on Big Tech companies in his state. The law, however, is taking criticism — from both right and left — that parts of it may be unconstitutional and that its notable exemptions for some big companies undermine its goal of standing up to domineering industry giants. Florida’s “Big Tech Bill” aims to protect social media users — whether political candidates, journalistic outlets or ordinary users — from ideologically selective censorship by internet platforms like Facebook, Twitter and Google.Among its major provisions, the law will:

• Fine companies up to $250,000 per day for suspending political candidates from a platform during the run-up to an election

• Require platforms to make public the rules they use to regulate their user content and provide users with explanations as to why they have been censored

• Require companies to provide users an appeals process or chance to “correct” their flagged content

• Prohibit companies from censoring any “journalistic enterprise based on the content of its publication or broadcast.”Perhaps most importantly, the bill would empower individuals and the office of the Florida attorney general to much more easily sue these companies under the Florida Unfair and Deceptive Trade Practices Act. Yet critics see the law as little more than a symbolic gesture destined to be struck down by the courts on constitutional grounds. “I see this bill as purely performative: It was never designed to be law but simply to send a message to voters,” Santa Clara University Law School professor Eric Goldman told the Washington Post. He argues that the bill will unconstitutionally restrict the editorial discretion of platforms that act as online publishers — a First Amendment violation.

Get ready.

• Climate Crisis Inflicting Huge ‘Hidden Costs’ On Mental Health (G.)

The climate crisis is damaging the mental health of hundreds of millions of people around the world but the huge costs are hidden, scientists have warned. Heatwaves are increasing rates of suicide, extreme weather such as floods and wildfires are leaving victims traumatised, and loss of food security, homes and livelihoods is resulting in stress and depression. Anxiety about the future is also harming people’s mental health, especially the young, the scientists said in a report. Mental health conditions already affect a billion people and cost trillions of dollars a year. The researchers said global heating would worsen the issue unless action was taken. They described a vicious circle where climate impacts increase mental health difficulties, leaving people even more vulnerable to further consequences.

However, they said tackling climate change could turn this into a virtuous circle. Action by individuals, communities and governments not only cuts the impacts of heating but also boosts people’s mental wellbeing by giving them healthier lives and a sense of hope and agency. “Mental health is the unseen impact of climate change at the moment,” said Emma Lawrance of Imperial College London, who led the report. “It is a big problem that is going to affect more and more people into the future, and in particular exacerbate inequality. It is very likely to be a really big unaccounted cost.

“If you have lost your home, if you’re at risk of repeated flooding, if you’re grieving because you’ve lost a family member to a fire or your livelihood because of a drought, that is shock and trauma that translates for some into very prolonged distress and diagnoses of PTSD, anxiety, depression and increased risk of suicide.”

“That was the moment when the establishment elites realized that non-state money had arrived..”

• Could Facebook’s Diem Become FedCoin By Default? (Jeftovic)

I had a reader ask me about Silvergate Capital. They’re a bank holding company with a lot of exposure to the crypto currency space. I hadn’t yet analyzed them deeply, but I did notice that they recently announced a partnership with Facebook on their DiemUSD stablecoin. Diem is Facebook’s rebrand of Libra. Libra was a private crypto currency Facebook proposed to launch which in my mind was a transformative event for nation states and central banks. That was the moment when the establishment elites realized that non-state money had arrived and it posed an existential threat to the status quo. They were able to hold off Facebook’s Libra, for awhile. They fought dirty.

US Senators sent straight up extortion letters to members of Facebook’s Libra Consortium threatening to investigate them for ostensible ties to child pornography on Facebook’s platform if they went through with the project. They all dropped out. My heart didn’t exactly bleed for Facebook, but the incident was instructive. I wrote about it at the time, but I will repeat the salient point here: Should a gigantic platform like Facebook successfully launch their own digital currency, a person’s Facebook account will become more important in their day-to-day lives than their nation state issued passport. Especially if we’re entering an era of drastically curtailed travel for plebeians. The battle between the US, France, et al and Facebook over Libra was an early round in the struggle between waning Nation States and ascendent Network States.

Facebook kept working on their Libra, first under a wallet program called Novi and now as Diem, and Diem USD will be their stablecoin. One can only surmise that behind the scenes something has shifted so that Facebook thinks they can proceed with launching a new stablecoin. This partnership with Silvergate, as well as relocating their Diem Association, which oversees their digital currency projects, from Switzerland back to the United States may be part of that calculus. There have been some rumblings that the US is losing the Central Bank Digital Currency race and that one way to jumpstart a program would be to partner with a private entity who is already further down the road with it. Who would be uniquely situated to provide a solution in some manner of public-private partnership? Facebook, for one.

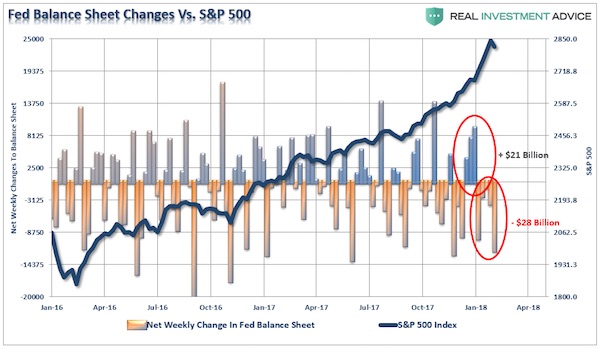

Balance.

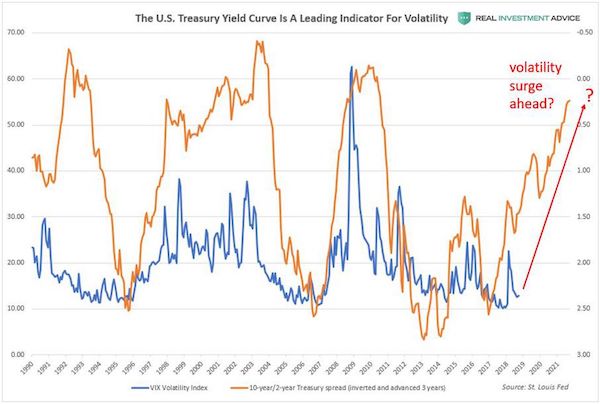

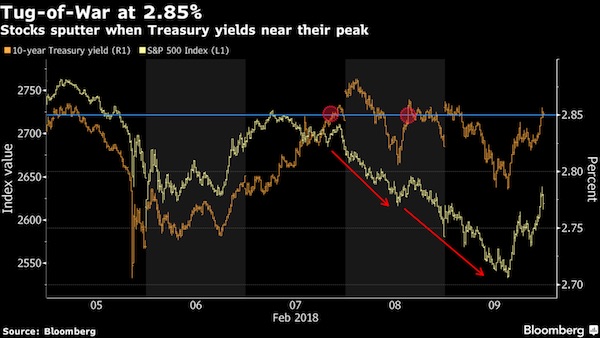

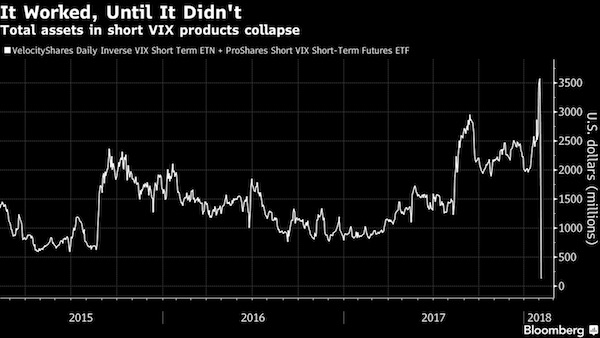

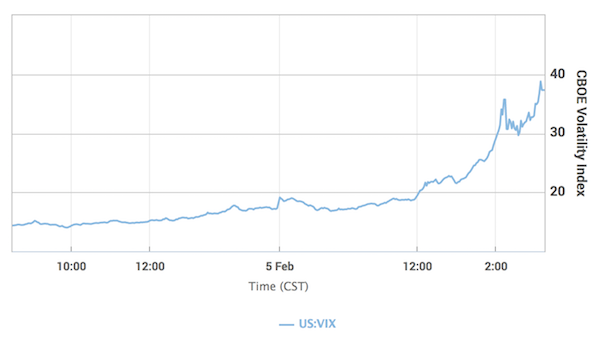

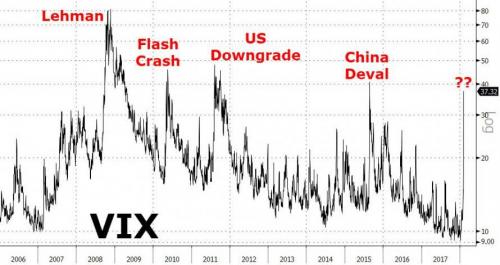

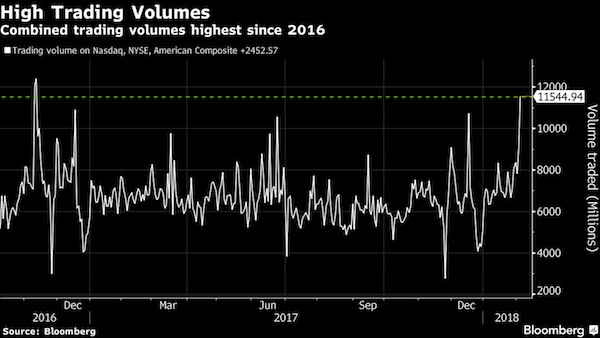

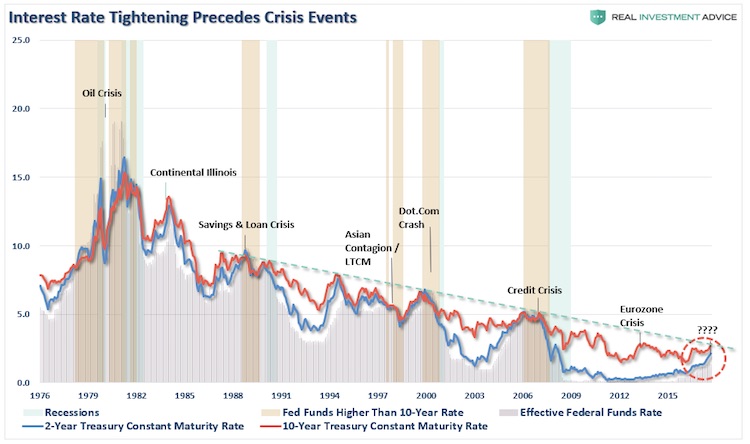

• Increasingly Chaotic Volatility Ahead (CHS)

The standard debate about the future of the economy is: which will we get, high inflation or a deflationary collapse of defaults and asset bubbles popping? The debate goes round and round in widening circles of complexity as analysts delve into every nuance of the debate. A recent conversation with my friend A.T. raised a third possibility few seem to consider: increasingly chaotic volatility will be the new normal, as wild swings between inflation and deflation will increase in amplitude and ferocity as the system destabilizes. Increasingly chaotic volatility is a classic sign of a system that has lost equilibrium and is attempting to regain its dynamic stability by going into overdrive. The amplitude and violence of these fluctuations increase as each attempt to restore stability fails.

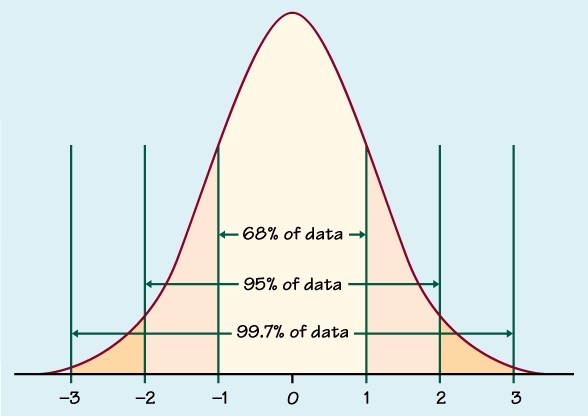

This loss of stability is not what people expect. The experience of the past 60 years has been that any hiccup in financial stability–a recession or market crash–is temporary, as the system responds with monetary and fiscal stimulus which quickly restores the system’s stability. That the era of stability has ended and a new era of increasingly chaotic volatility has begun is not on anyone’s radar as a possibility. Human physiology offers a useful analogy: blood glucose homeostasis, which is the system of insulin production and sensitivity that maintains the dynamic stability of glucose in our bloodstream for use as energy. Insulin is produced as needed after a meal to regulate the level of glucose within the ideal bandwidth of homeostasis, i.e. the range of dynamic stability that optimizes insulin production and glucose levels. (3.5 to 5.5 mmol/L or 70 to 130 mg/dL)

In metabolic disorders, the body’s sensitivity to insulin declines, and in response the body increases the production of insulin to compensate for the decline in sensitivity. As the disease progresses, sensitivity drops further, forcing the production of insulin into overdrive. Eventually this overdrive degrades the body’s ability to produce insulin and the regulatory system managing glucose levels crashes.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.