Ray K. Metzker Chicago 1958

The Telegraph changed the title of this Ambrose article overnight to “Fading Trump Rally Threatened By Rare Contraction Of US Credit”.

• Sharpest Credit Plunge Since 2008 Could Spell Disaster For US Economy (AEP)

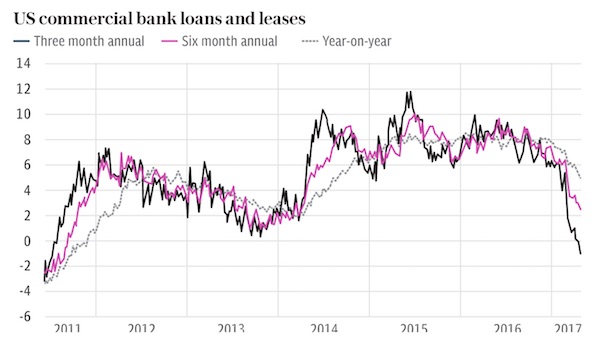

Credit strategists are increasingly disturbed by a sudden and rare contraction of US bank lending, fearing a synchronised slowdown in the US and China this year that could catch euphoric markets badly off guard. One key measure of US corporate borrowing is falling at the fastest rate since the onset of the Lehman Brothers crisis. Money supply growth in the US has also slowed markedly. These monetary and credit signals tend to be leading indicators for the real economy. Data from the US Federal Reserve shows that the $2 trillion market for commercial and industrial loans peaked in December. The sector has weakened abruptly as lenders tighten credit, especially for non-residential property. Over the last three months it has dropped at a rate of 5.4pc on annual basis, a pace of decline not seen since December 2008.

The deterioration in the broader $9 trillion market for loans and leases has been less dramatic but it too is shrinking, falling at a 1.6pc rate on a three-month basis. “Corporate lending has ground to a halt and I am staggered that the Fed is raising rates. They have made a very big mistake,” said Patrick Perret-Green from AD Macro. Credit experts at several big US banks have issued warnings over recent days, albeit sotto voce. “We’ve been surprised how little attention the slowdown in US bank lending has garnered,” said Matt King, global credit strategist at Citigroup.

While they are not yet alarmed, their concerns are worth heeding. Credit has tended to pick up signs of trouble several weeks before equity markets in recent episodes of financial stress. “Without another big dose of momentum, the cracks in the global reflationary consensus are liable to grow bigger. All around, existing trends are being called into question,” he said. Net corporate bond issuance has also stalled, indicating that borrowing by US firms as a whole is in decline. “So much for a Trump-driven expansion. Beneath the surface, we think a seismic battle is taking place,” he said.

Elga Bartsch and Chetan Ahya from Morgan Stanley said the credit squeeze is a warning sign and needs watching closely. “On our estimates, the credit impulse turned negative at the end of 2016. We have not seen such a sharp deceleration in bank lending to US corporates since the Great Financial Crisis,” they said. “Historically, credit downturns have led recessions. The plunge could reignite concerns that a highly leveraged US corporate sector may react strongly to even limited interest rates increases,” they said.

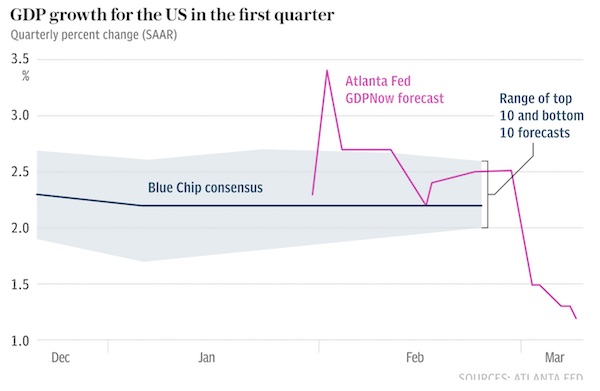

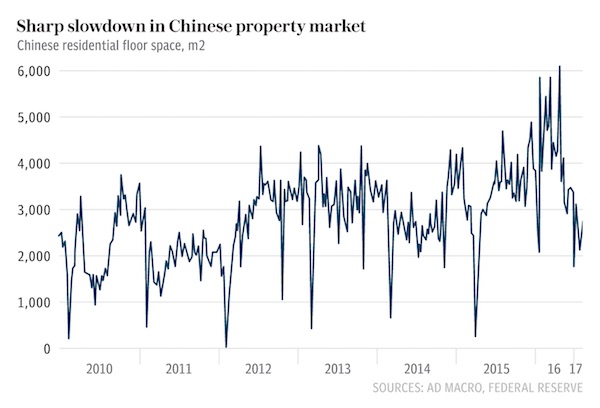

[..] Money and credit are certainly not flashing warnings of an imminent crisis, but they are hard to square with the exuberant view of investors that the world is on the cusp of an accelerating economic boom. That boom may already have peaked. The massive stimulus injected by the global authorities last year to counter the Chinese currency scare and any fall-out from Brexit is by now fading, and it is too early to tell whether business will pick up the baton. Any soft patch could all too easily combine with a slowdown in China as the country taps the brakes after an extreme episode of fiscal prime-pumping in 2016. Regulators are clamping down on property speculation and trying to rein in forms of pyramid lending, causing a sharp rise in Shibor lending rates. The worry in China is a maturity mismatch. Huge sums have been borrowed on the short-term markets. These debts have to be rolled over constantly to cover long-term liabilities. It was this sort of mismatch that brought down Northern Rock and Lehman Brothers.

[..] Weak US indicators are clearly at odds with the Trump rally on Wall Street, which has pushed equity valuations to nose-bleed levels. Kevin Gaynor from Nomura says his model of asset pricing suggests markets are in effect assuming global growth of 5pc and earnings increases of 30pc a year. These are heroic. “There is a time decay on this new temporary equilibrium,” he notes acidly. What is so disturbing is that each extra dollar of new debt now generates just $0.17 of extra GDP in the US, down from around $0.75 in the 1960s. Much of the corporate debt built up in this cycle has been to buy back stock or pay dividends.

“Half could be erased and still exceed historical valuation norms.” Fall 50% and still be overvalued. But not a bubble?!

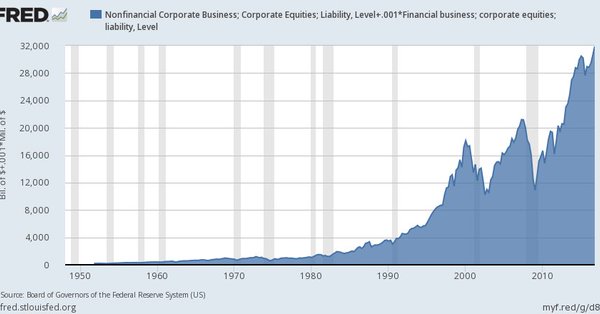

• Paper Wealth In US Stocks Reaches $32 Trillion (Fed)

John Hussman comments: “Paper wealth in U.S. stocks reaches $32 trillion. Half could be erased and still exceed historical valuation norms.”

They can take out $50,000 per year but need ten times that for a golden visa.

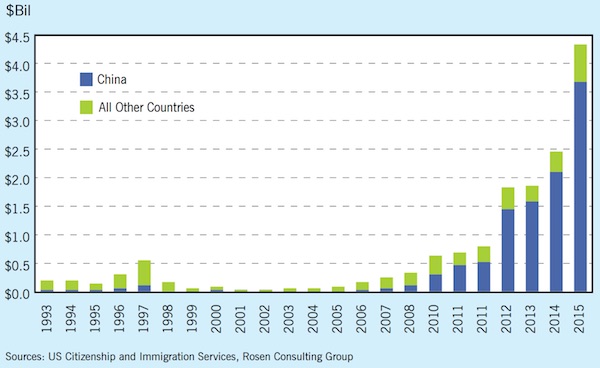

• Rich Chinese Race to Apply for a US Golden Visa (BBG)

As members of Congress in Washington debate raising the minimum required to obtain a U.S. immigrant investor visa from $500,000 to $1.35 million, concern about the hike has set off a scramble among wealthy would-be participants in China. “Some clients are demanding that we make sure their applications are submitted before April 28,” the date the program expires unless extended or amended by Congress, said Judy Gao, director of the U.S. program at Can-Reach (Pacific), a Beijing-based agency that facilitates so-called EB-5 Immigrant Investor visas. “We’re working overtime to do that.” China’s wealthy, using not-always-legal means to skirt capital controls to get their money out and at the same time gain residency in the U.S., are continuing to dwarf all others as the largest participants in the EB-5 program, despite heightened measures by the Chinese government.

[..] Because Chinese individuals are limited to exchanging $50,000 worth of yuan a year, a 10th of what the EB-5 program requires, some agents are advising clients who don’t already have assets offshore to use a means nicknamed “smurfing” to move their money. “Our suggestion to the client is to open three to four personal accounts in the U.S. or line up three to four friends’ accounts, so they can split the money and wire it to different personal accounts without being put on a blacklist by the Chinese authorities,” said a Shanghai-based real estate agent who gave the surname Dong. “It may require a trip to the States to do so to facilitate the process.” [..] While the government in Beijing spent much of 2016 working to stop its citizens sending money abroad in order to stabilize its declining currency and foreign reserves, Chinese investors’ use of EB-5 continued anyway, totaling $3.8 billion in the fiscal year that ended Sept. 30.

The sanctions and hysteria allow and force Russia to break the chains and be creative.

• Russia’s Banking System Has SWIFT Alternative Ready (RT)

If the Society for Worldwide Interbank Financial Telecommunication (SWIFT) is shut down in Russia, the country’s banking system will not crash, according to Central Bank Governor Elvira Nabiullina. Russia has a substitute. “There were threats that we can be disconnected from SWIFT. We have finished working on our own payment system, and if something happens, all operations in SWIFT format will work inside the country. We have created an alternative,” Nabiullina said at a meeting with President Vladimir Putin on Wednesday. She also added that 90% of ATMs in Russia are ready to accept the Mir payment system, a domestic version of Visa and MasterCard. Izvestia daily reported that as of January 2016, 330 Russian banks had been connected to the SWIFT alternative, the system for transfer of financial messages (SPFS).

In 2014 and 2015, when the crisis in relations between Russia and the West were at their peak over Crimea and eastern Ukraine, some Western politicians urged disconnecting Russia from SWIFT. In November 2015, Nabiullina said the SPFS was close to being completed. The central bank’s website says the system was established “as an alternative channel for interbank cooperation with the aim of ensuring the guaranteed and uninterrupted provision of services for the transmission of electronic messages on financial transactions.” At present, the system has some drawbacks. It doesn’t work from 9pm to 5am Moscow time and costs up to five cents per wire transfer, which is regarded expensive.

Schäuble is not all stupidity.

• Erdogan Setting Back Integration In Germany By Years: Schaeuble (R.)

Turkish President Tayyip Erdogan, who accuses Chancellor Angela Merkel of using “Nazi methods” against Turks in Germany, is setting back their integration by years, Finance Minister Wolfgang Schaeuble has said. Berlin is growing increasingly frustrated about Erdogan repeatedly accusing it of applying “Nazi methods” by banning rallies aimed at drumming up support among Turks in Germany for a referendum that would strengthen the power of his presidency. Turks workers began moving to Germany in the 1960s and the country now has about 3 million people of Turkish background. Some are fully integrated while others live in ethnic communities with less contact with the majority population.

“Erdogan’s rhetoric makes me stunned,” Schaeuble, a veteran member of Merkel’s Christian Democratic (CDU) party, told the Welt am Sonntag weekly newspaper. “In a short time, it wilfully destroys the integration that has grown over years in Germany. The repair of the damage will take years,” he said. Erdogan said in a speech in Istanbul on Sunday: “You call the president of the Turkish Republic a dictator. When we call them fascists, they get annoyed. When we call them Nazis, they get annoyed.” “You are fascists, you are. Be annoyed as much as you want with Nazi practices. If you draw swastikas on the walls of our mosques and don’t hold anyone accountable, you cannot take off this stain,” Erdogan said.

According to Le Monde, one third of French (43% under 35) doesn’t know if they’re going to vote at all. And half still don’t know who to vote for. Beware the polls.

• France’s Le Pen Says The EU ‘Will Die’, Globalists To Be Defeated (R.)

The European Union will disappear, French presidential candidate Marine Le Pen told a rally on Sunday, aiming to re-enthuse core supporters in the final four weeks before voting gets underway. Buoyed by the unexpected election of Donald Trump in the United States and by Britain’s vote to leave the EU, the leader of the anti-EU and anti-immigrant National Front (FN) party, told the rally in Lille that the French election would be the next step in what she called a global rebellion of the people. “The European Union will die because the people do not want it anymore,” Le Pen said to loud cheers and applause. “The time has come to defeat globalists,” she said, adding: “My message is one of emancipation, of liberation … a call for all the patriots to gather behind our flag.”

Opinion polls forecast that Le Pen will do well in the April 23 first round of the presidential election only to lose the May 7 run-off to centrist Emmanuel Macron. Its anti-EU, anti-euro stance is one of the FN’s standard-bearing policies, both a mark of its anti-establishment stance that pleases grass-roots supporters and attracts voters angry with globalization, and a likely obstacle to its quest for power in a country where a majority oppose a return to the franc. Le Pen has over the past few months tried to accommodate this opposition to leaving the euro by continuing to criticize the unpopular EU while telling voters she would not abruptly pull France out of the bloc or the euro but instead hold a referendum after six months of renegotiating the terms of France’s EU membership.

On Sunday she told the rally she would seek to replace the EU by “another Europe,” which she called “the Europe of the people,” based on a loose cooperative of nations. “It must be done in a rational, well-prepared way,” she told Le Parisien in an interview published earlier on Sunday. “I don’t want chaos. Within the negotiation calendar I want to carry out … the euro would be the last step because I want to wait for the outcome of elections in Germany in the fall before renegotiating it.”

But is the economic failure caused only by wrong policies?

• Populism Is The Result Of Global Economic Failure (G.)

The rise of populism has rattled the global political establishment. Brexit came as a shock, as did the victory of Donald Trump. Much head-scratching has resulted as leaders seek to work out why large chunks of their electorates are so cross. The answer seems pretty simple. Populism is the result of economic failure. The 10 years since the financial crisis have shown that the system of economic governance which has held sway for the past four decades is broken. Some call this approach neoliberalism. Perhaps a better description would be unpopulism. Unpopulism meant tilting the balance of power in the workplace in favour of management and treating people like wage slaves. Unpopulism was rigged to ensure that the fruits of growth went to the few not to the many.

Unpopulism decreed that those responsible for the global financial crisis got away with it while those who were innocent bore the brunt of austerity. Anybody seeking to understand why Trump won the US presidential election should take a look at what has been happening to the division of the economic spoils. The share of national income that went to the bottom 90% of the population held steady at around 66% from 1950 to 1980. It then began a steep decline, falling to just over 50% when the financial crisis broke in 2007. Similarly, it is no longer the case that everybody benefits when the US economy is doing well. During the business cycle upswing between 1961 and 1969, the bottom 90% of Americans took 67% of the income gains. During the Reagan expansion two decades later they took 20%.

During the Greenspan housing bubble of 2001 to 2007, they got just two cents in every extra dollar of national income generated while the richest 10% took the rest. The US economist Thomas Palley* says that up until the late 1970s countries operated a virtuous circle growth model in which wages were the engine of demand growth. “Productivity growth drove wage growth which fueled demand growth. That promoted full employment, which provided the incentive to invest, which drove further productivity growth,” he says.

China doesn’t want war. Neither does Russia.

• The West is Becoming Irrelevant (Vltchek)

China, one of the oldest and greatest civilizations on Earth, went through the terrible period of ‘humiliation’. Divided, occupied and plundered by the West, it has never forgotten nor forgiven. Now the Chinese Communist state and its mixed economy are helping countries in virtually all parts of the world, from Oceania and Latin America, to the Middle East and especially Africa, to survive and to finally stand on their own feet. Despite all the vitriolic propaganda regurgitated by the West (those people in Europe or North America who know close to zero about Africa or China,habitually passing ‘confident’ and highly cynical ‘judgments’ about China’s involvement in the poor world; judgments based exclusively on the lies and fabrications produced by the Western media), China has been gaining great respect and trust in virtually all corners of the globe.

The Chinese people and their government are now standing firmly against Western imperialism. They will not allow any recurrence of the disgraceful and dreary past. The West is provoking this mighty and optimistic nation, pushing it into a terrible confrontation. China doesn’t want any military conflict. It is the most peaceful, the most non-confrontational large nation on Earth. But it is becoming clear that if pushed against the wall, this time it will not compromise: it will fight. In the last years I have spoken to many Chinese people, as I traveled to all corners of the country, and I’m convinced that by now the nation is ready to meet strength with strength. Such determination gives hope to many other countries on our Planet. The message is clear: the West cannot do whatever it wants, anymore. If it tries, it will be stopped. By reason or by force!

Russia is ready again, too. It is standing next to China, enormous and indignant. Go to Novosibirsk or Tomsk, to Khabarovsk, Vladivostok or Petropavlovsk in Kamchatka. Talk to Russian people and you will soon understand: almost nobody there believes or respects the West, anymore. Throughout history, Russia was attacked and ransacked from the West. Millions, tens of millions of its people were murdered, literally exterminated. And now, the nation is facing what some consider to be yet another imminent attack. Like the Chinese people, Russians are unwilling to compromise, anymore. The old Russian forecast is once again alive, that very one professed by Alexander Nevsky: Go tell all in foreign lands that Russia lives! Those who come to us in peace will be welcome as a guest. But those who come to us sword in hand will die by the sword! On that Russia stands and forever will we stand!

By dismantling domestic privacy laws, ….

• The US Will Lose Control Of The Global Internet (Morozov)

The numerous paradoxes that will haunt Donald Trump in the coming months were on full display during the recent Senate vote to undo privacy legislation that was passed in the last few years of the Obama administration. As part of a broader effort to treat internet service providers and telecoms operators as utility companies, Obama imposed restrictions on what these companies could do with all the user data from browsers and apps. Emboldened by Trump, the Republicans have just allowed these businesses to collect, sell and manipulate such data without user permission. From the short-sighted domestic perspective, it seems like a boon to the likes of Verizon and AT&T, especially as they increasingly find themselves confronting their data-rich counterparts in Silicon Valley.

Telecoms companies have been complaining (not entirely without reason) that the Obama administration favoured the interests of Google and Facebook which, invoking the lofty rhetoric of “keeping the internet free” only to defend their own business agenda, have traditionally faced somewhat lighter regulation. The Democrats, always happy to attack Trump, have jumped on the issue, warning that the Senate vote would foster ubiquitous and extensive surveillance by the telecoms industry – and Silicon Valley, of course, would never commit such sins. Under the new rules, complained Bill Nelson, a senator from Florida, “your broadband provider may know more about your health – and your reaction to illness – than you are willing to share with your doctor”.

Never mind that Google and Facebook already know all this – and much more – and generate little outrage from the Democrats. The Democrats, of course, only have themselves to blame for such ineptitude. From the early 1980s onwards, centre-left movements on both sides of the Atlantic no longer discussed technology policy in terms of justice, fairness or inequality. Instead, they preferred to emulate their neoliberal opponents and frame choices – about technology policy, but also about many other domains – in terms of just one goal that rules supreme above all other: innovation. The problem with building a political programme on such flimsy economistic foundations is that it immediately opens the door to competing narratives of just what kind of policy produces more innovation.

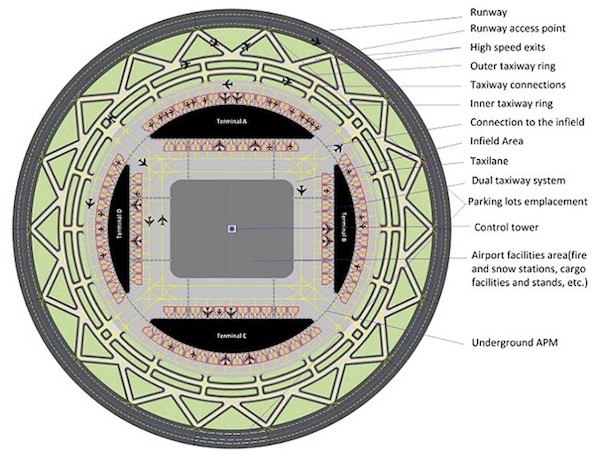

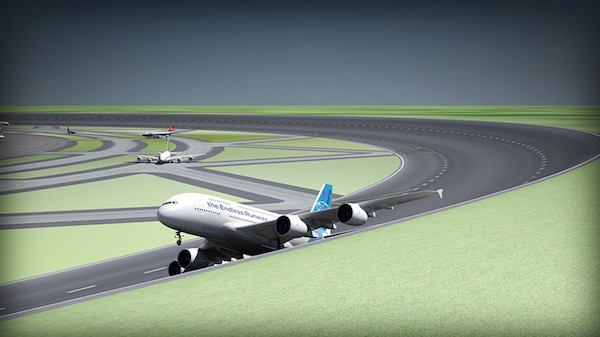

I watch the increase in global aviation with a very heavy heart. But this is smart.

• Circular Runways Proposed For Airport Efficiency (Curbed)

While airport terminal architecture has a solid history of style and innovation, rarely is a proposal put forth to utterly redesign the runway. But that’s precisely the aim of Henk Hesselink, a Dutch scientist working with the Netherlands Aerospace Centre. Dubbed the “endless runway”, Hesselink’s brainchild is a 360-degree landing strip measuring more than two miles in diameter. Since airplanes would be able to approach and take off from any direction around the proposed circle, they wouldn’t have to fight against crosswinds.

And three planes would be able to take off or land at the same time. Hesselink’s team uses flight simulators and computerized calculations to test the unconventional design, and have determined that round airports would be more efficient than existing layouts. With a central terminal, the airport would only use about a third of the land of the typical airport with the same airplane capacity. And there’s an added benefit to those living near airports: Flight paths could be more distributed, and thereby making plane noise more tolerable. So far, there have been no plans to actually build a circular runway, but Hesselink’s research continues on.

The Better Than God crowd is not done with you just yet.

• Trump Presidency “Opens Door” To Planet-Hacking Geoengineer Experiments (G.)

Harvard engineers who launched the world’s biggest solar geoengineering research program may get a dangerous boost from Donald Trump, environmental organizations are warning. Under the Trump administration, enthusiasm appears to be growing for the controversial technology of solar geo-engineering, which aims to spray sulphate particles into the atmosphere to reflect the sun’s radiation back to space and decrease the temperature of Earth. Sometime in 2018, Harvard engineers David Keith and Frank Keutsch hope to test spraying from a high-altitude balloon over Arizona, in order to assess the risks and benefits of deployment on a larger scale. Keith cancelled a similar planned experiment in New Mexico in 2012, but announced he was ready for field testing at a geoengineering forum in Washington on Friday.

“The context for discussing solar geoengineering research has changed substantially since we planned and funded this forum nearly one year ago,” a forum briefing paper noted. While geoengineering received little favour under Obama, high-level officials within the Trump administration have been long-time advocates for planetary-scale manipulation of Earth systems. David Schnare, an architect of Trump’s Environmental Protection Agency transition, has lobbied the US government and testified to Senate in favour of federal support for geoengineering. He has called for a multi-phase plan to fund research and conduct real-world testing within 18 months, deploy massive stratospheric spraying three years after, and continue spraying for a century, a duration geoengineers believe would be necessary to dial back the planet’s temperature.

“Clearly parts of the Trump administration are very willing to open the door to reckless schemes like David Keith’s, and may well have quietly given the nod to open-air experiments,” said Silvia Riberio, with technology watchdog ETC Group. “Worryingly, geoengineering may emerge as this administration’s preferred approach to global warming. In their view, building a big beautiful wall of sulphate in the sky could be a perfect excuse to allow uncontrolled fossil fuel extraction. We need to be focussing on radical emissions cuts, not dangerous and unjust technofixes.” [.] “Geoengineering holds forth the promise of addressing global warming concerns for just a few billion dollars a year,” he said in 2008, before helping launch a geoengineering unit while he ran the right-wing think tank American Economic Enterprise. “We would have an option to address global warming by rewarding scientific innovation. Bring on American ingenuity. Stop the green pig.”

We need to do Bob Geldof all over again? We are a disgrace.

• UN’s Famine Appeal Is Billions Shy of Goal (NYT)

A month ago, the secretary general of the United Nations, António Guterres, warned that 20 million people would fall into famine if his aid agencies could not corral $4.4 billion by the end of March. It is almost the end of March, and so far, the United Nations has received less than a tenth of the money – $423 million, according to its Office for the Coordination of Humanitarian Affairs. The funding appeal, and the paltry response, comes as the Trump administration is poised to make sharp cuts to its foreign aid budget, including for the United Nations. Historically, the United States has been the agency’s largest single donor for humanitarian aid. For all four countries at risk — Nigeria, Somalia, South Sudan and Yemen – the United States has given $277 million so far this year, not all of it for famine relief.

The conditions for famine are specific and not easy to meet, which is why the last time a famine was declared was in Somalia in July 2011, after 260,000 had died of hunger and related complications. The three criteria for declaring a famine are when one in five households in a certain area face extreme food shortages; more than 30% of the population is acutely malnourished; and at least two people for every 10,000 die each day. A famine has already been declared in a swath of South Sudan. A similar risk looms over Somalia, still reeling from years of conflict, and Yemen, where Houthi insurgents are battling a Saudi-led coalition supported by the United States and Britain. In northern Nigeria, a famine could already be underway, according to an early warning system funded by the United States Agency for International Development.

But the security situation is so bad there that aid workers have been unable to assess levels of hunger. On Thursday, Somalia’s newly elected president, Mohamed Abdullahi Mohamed, told the Security Council by videolink from Mogadishu that half the population faces acute food shortages. The United Nations says it needs the $4.4 billion to deliver food, clean water and basic medicine like oral rehydration salts to avert diarrhea deaths among children. Only 8% of the money the agency needs for Yemen has been funded; for Nigeria, 9%; for South Sudan, 18%; and for Somalia, 32%. Of the 20 million who are at risk of famine are 1.4 million children, who are most vulnerable. To put the $4.4 billion appeal in perspective, Britain has made slightly less, $4.1 billion, from weapons sales to Saudi Arabia in the two years since the war began in Yemen.

The most insane idea to come out of the EU yet. And there’s a lot of competition for that.

• ‘We Reached Our Limits’: Greece To Stop Taking Back Refugees (RT)

Greece will cease taking back refugees under the controversial Dublin Regulation, as the country’s limited capacities to host people are already on the brink of collapse, the Greek migration minister announced in an interview. As the European Commission pressures Athens to re-implement the Dublin Regulation – stipulating that refugees can be returned to the first EU state they arrived in – the Greek migration minister told Spiegel his country is not in a position to do so. The agreement was put on hold for Greece back in 2011 over problems in the country’s asylum system. “Greece is already shouldering a heavy burden,” Ioannis Mouzalas, the migration minister, said. “We accommodate 60,000 refugees… and it would be a mistake to make Greece’s burden heavier by the revival of the Dublin agreement,” he said, also adding that Germany, the primary destination for most refugees, “wants countries where refugees arrive first to bear a large portion of the burden.”

Under the Dublin Regulation, the European state where the asylum-seeker first arrives in the EU is responsible for examining an asylum claim. Refugees are fingerprinted in their first country of arrival to ensure irrefutable evidence of their entry. However, rights groups warn that imminent transfers from other EU countries back to Greece in line with the regulations are likely to cause more refugees than ever to go underground in western European countries, as many are desperate to stay there because of family links or successful attempts to start a new life. The scheme also adds even greater pressure to existing refugee facilities in Greece and beyond. Asked if Athens is ruling out implementation of the Dublin Regulation, Mouzalas answered in the affirmative, adding, “I want the Germans to understand that this is not because of political or ideological reasons, or failure to appreciate Germany’s assistance.” “Greece simply has no capacities to cope with additional arrival of refugees,” he said.

Erdogan will not like this. And the US must realize that the EU squeezing Greece bone dry does not help such proposals. For good cooperation, you need strong and stable partners.

• Greek-US Ties Set To Strengthen Significantly (K.)

Greece is examining US proposals for military cooperation which would widen ties to an extent not seen in the last three decades, Kathimerini understands. According to sources, Washington’s desire for stronger ties stems from its view that Greece has a significant geopolitical role to play as a pillar of stability in a volatile region. More specifically, Washington has proposed the participation of a Greek military vessel in a carrier battle group (CVBG), which consists of an aircraft carrier and a large number of escort vessels. According to the US proposals, the participation of a Greek vessel in the CVBG will be accompanied by the renewal of the Mutual Defense Cooperation Agreement (MDCA) between the two countries.

The MDCA is of utmost significance as it is through this pact that American military forces are permitted to use the Souda naval base on Crete. During a meeting last week US Secretary of Defense James Mattis and Defense Minister Panos Kammenos discussed the option of renewing the agreement for five to 10 years instead of each year, as has been the case to date. The Americans reportedly want to renew the deal every five years, as they want to expand the scope of their activities at the base. Sources have told Kathimerini that the only possible obstacle to the deal’s renewal on a five-year basis is that it must receive approval in Parliament, and the leftist-led coalition fears the possibility of dissent emanating from lawmakers of ruling SYRIZA.

And why not: recovery is not possible anyway.

• Greece Considers Capital Control Tightening (K.)

The capital controls were originally supposed to be a one-off measure that would be removed in a matter of months, with Prime Minister Alexis Tsipras stating in September 2015 that they would be lifted in early 2017. Today, 21 months since they were imposed, the capital controls are still here, and with the drop in bank deposits, it appears more likely they will be tightened than relaxed or lifted. The truth is that a full Greek recovery will not be possible as long as the capital controls remain, but the economy remains mired in uncertainty and the banks have not seen their CCC+ credit rating improve.

Bank officials note it will be a long time before the restrictions are removed, and this will require the consolidation of a basic sense of confidence among citizens that the worst is over. This is particularly difficult today given that few bailout reviews have been completed according to schedule in the last seven years – and the ongoing second review of the third bailout program was supposed to have finished 13 months ago, in February 2016. Banks therefore fear that if deposit outflow continues as it has done in the first quarter of the year, further controls are quite likely.

Home › Forums › Debt Rattle March 27 2017