Martin Luther King

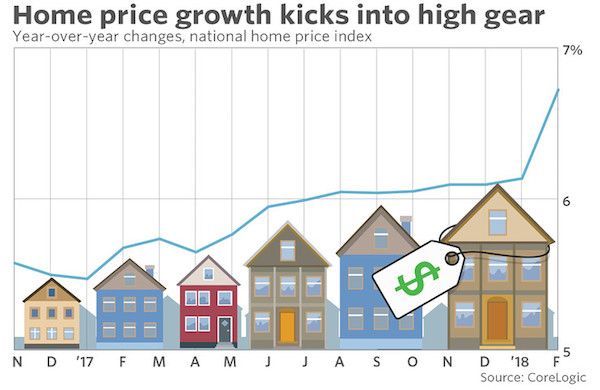

No bubble, 2018 version.

• US Home Prices Go Through The Roof, Defying Forecast Of Tax-Law Hit (MW)

Home prices picked up steam in the first few months of the year, according to a report out Tuesday, defying expectations of a slowdown in price growth after years of scorching-hot gains and the industry-damaging effects of a tax bill that reduced preferential treatment for homeowners. The Home Price Index from real estate data provider CoreLogic showed national yearly price growth of 6.7% in February. That’s up from a 6.1% annual price gain in the prior three months, 6.0% annual price gain in the four months before that and 5.9% growth the month before that… you get the idea. Prices aren’t just rising, they’re accelerating. And that stirs uncomfortable questions about how long such gains can go on, what could happen when they end and what it all means for the housing market.

(It’s worth noting that CoreLogic’s findings are corroborated by price data from the National Association of Realtors, which found year-over-year price changes had increased every month since last October.) After so many years of robust home-price growth, CoreLogic considers nearly half of the 50 largest metropolitan areas “overvalued,” it said in a release. “Family income is rising more slowly than home prices and mortgage rates, meaning that the mortgage payment takes a bigger bite out of income for new homebuyers,” said Frank Martell, CoreLogic’s president and CEO. “Often buyers are lulled into thinking these high-priced markets will continue, but we find that overvalued markets will tend to have a slowdown in price growth.”

[..] Some housing analysts think that surging price gains that exceed what normal macro fundamentals call for suggest that the housing market is more dysfunctional than might be apparent. As one industry veteran told MarketWatch last December, everything from homeowners reluctant to sell because they think they’ll never find such a low mortgage rate again, to institutional investors who buy entry-level homes to rent out could be pressuring prices upward in ways that analysts can’t quantify — and that leave buyers frustrated.

Intellectual property.

• US Plans Tariffs On $50bn In Chinese Imports To Protest Alleged Tech Theft (G.)

The Trump administration has raised the stakes in a growing trade showdown with China by placing 25% tariffs on some 1,300 industrial technology, transport and medical products to try to force changes in Beijing’s intellectual property practices. The US announcement targets about $50bn of estimated 2018 imports and is aimed at hampering China’s efforts to upgrade its manufacturing base. The goods include electronics, aircraft parts, medicine and machinery. The move comes a day after Beijing imposed duties on about $3bn in US exports, itself prompted by Donald Trump’s decision to place tariffs on imports of Chinese steel and aluminium.

“The proposed list of products is based on extensive interagency economic analysis and would target products that benefit from China’s industrial plans while minimizing the impact on the US economy,” the office of the US trade representative, Robert Lighthizer, said in a statement. The list identifies roughly 1,300 goods but remains subject to a 30-day public review process before it can take effect. China’s ministry of commerce condemned the US decision. “Disregarding strong representations by China, the United States announced the tariff proposals that are completely unfounded, a typical unilateralist and protectionist practice that China strongly condemns and firmly opposes,” the ministry said in a statement on Wednesday, according to Xinhua.

“We have the confidence and ability to respond to any US trade protectionist measures,” a spokesperson said. “As the Chinese saying goes, it is only polite to reciprocate.” The ministry did not reveal any specific countermeasures, but economists widely view imports of US soybeans, aircraft and machinery as prime targets for trade retaliation.

Intellectual property and soybeans. An odd couple.

• China Hits Soybeans, Aircraft in Counter-Punch to Trump Tariffs (BBG)

China said it would levy an additional 25 percent tariff on imports of 106 U.S. products including soybeans, automobiles, chemicals and aircraft, in response to proposed American duties on its high-tech goods. Matching the scale of proposed U.S. tariffs announced the previous day, the Ministry of Commerce in Beijing said the charges will apply to around $50 billion of U.S. imports. Officials signaled that the implementation of the proposed measures will depend on when the U.S. applies its own after a period of public consultation.

The step ratchets up tension in a brewing trade war between the world’s two largest trading nations, with the Trump administration’s latest offensive based on alleged infringements of intellectual property in China. In targeting high-tech sectors that Beijing is openly trying to promote, the U.S. has provoked furious rhetoric from Beijing and stronger threats of retaliation than many had anticipated. “China’s response was tougher than what the market was expecting – investors didn’t foresee the country levying additional tariffs on sensitive and important products such as soybeans and airplanes,” said Gao Qi, Singapore-based strategist at Scotiabank. “Investors believe a trade war will hurt both countries and their economies eventually.”

Too big to fail/bail.

• China’s Financial Opening Isn’t Quite What It Seems (BBG)

Although trade tensions between the U.S. and China show no signs of abating, there are some reasons for cautious optimism. One is that the Americans have finally gotten around to giving the Chinese a concrete list of demands – and, on at least one score, China is prepared to deal. The Chinese financial market has long been closed to foreign ownership, despite widespread criticism from the U.S. and others. In November, following Donald Trump’s state visit to Beijing, China’s finance ministry announced that this was set to change in 2018, and now the Trump team is pushing China to make good on that promise. The catch, of course, is that the practical impact of this opening will be minimal – and for China, that’s the point.

It will accelerate its financial opening not because the Americans are demanding it, but because foreign financial firms no longer pose much of a threat. Chinese banks are now too big and too dominant domestically for foreign financial institutions to genuinely compete with them. Consider that the four largest banks in the world are all Chinese state-owned institutions. Together they have $11.9 trillion in assets. The world’s next five biggest banks roughly match up to China’s Big Four, accounting for $11.8 trillion, but they represent the largest institutions in four separate countries – Japan, the U.S., the U.K. and France. No single country has financial firepower on China’s scale.

Just taking America’s banking sector – where the concept of “too big to fail” originated – it would require the combined balance sheets of the top 10 lenders to equal the assets of just China’s top four. Within China, foreign firms own slightly more than 1 percent of total bank assets, compared to a full 36 percent owned by the five major state-owned institutions. Similarly, foreign banks account for less than 1 percent of annual earnings, or the equivalent of about 5 percent of the yearly profit made by just the Industrial & Commercial Bank of China. Starting from such a minuscule base, and up against such huge incumbents, foreign banks will always be relegated to the minor leagues in China, whether market restrictions are eased or not.

The word ‘precise’ is meaningless here, and merely used to keep suspicion alive even as the story fails.

• UK Experts Unable To Verify Precise Source Of Novichok (G.)

British scientists at the Porton Down defence research laboratory have not established that the nerve agent used to poison Sergei and Yulia Skripal was made in Russia, it has emerged. Gary Aitkenhead, the chief executive of the government’s Defence Science and Technology Laboratory (DSTL), said the poison had been identified as a military-grade novichok nerve agent, which could probably be deployed only by a nation state. Aitkenhead said the government had reached its conclusion that Russia was responsible for the Salisbury attack by combining the laboratory’s scientific findings with information from other sources.

The UK government moved quickly to make it clear that the prime minister, Theresa May, had always been clear the assessment from Porton Down was “only one part of the intelligence picture”. The comments came hours before an extraordinary meeting in The Hague of the executive council of the Organisation for the Prohibition of Chemical Weapons (OPCW), called by Russia. Speaking to Sky News, Aitkenhead said it was not possible for scientists alone to say precisely where the novichok had been created. He said: “It’s a military-grade nerve agent, which requires extremely sophisticated methods in order to create – something that’s probably only within the capabilities of a state actor.”

He denied Russian claims that the substance could have come from Porton Down, which is eight miles from Salisbury, saying: “There’s no way that anything like that would ever have come from us or leave the four walls of our facilities.” Aitkenhead said: “We were able to identify it as novichok, to identify it was a military-grade nerve agent. We have not verified the precise source, but we have provided the scientific information to the government, who have then used a number of other sources to piece together the conclusions that they have come to.”

[..] two weeks ago Boris Johnson was asked by an interviewer on Deutsche Welle, Germany’s public international broadcaster, how the UK had been able to find out the novichok originated from Russia so quickly. He replied: “When I look at the evidence, the people from Porton Down, the laboratory, they were absolutely categorical. I asked the guy myself, I said: ‘Are you sure?’ And he said: ‘There’s no doubt.’ So we have very little alternative but to take the action that we have taken.”

The British should demand an explanation from May. Can Boris Johnson keep his job?

• Russia Says Spy Poisoning ‘Grotesque Provocation’ By UK, US (AFP)

The head of Russia’s SVR foreign intelligence agency said Wednesday the poisoning of a Russian former double agent in Britain was a “grotesque provocation” by the British and US security services. “Even when it comes to the grotesque provocation with the Skripals that was crudely concocted by the British and American security services, a number of European countries are in no rush to unquestioningly follow London and Washington but prefer to look into what has happened in detail,” SVR chief Sergei Naryshkin said at a security conference. He also warned that Moscow and the West must avoid the risk of escalating their current standoff to the dangerous levels reached at the height of the Cold War.

“It’s important to stop the irresponsible game of raising stakes and to stop the use of force in relations between states, not to bring matters to a new Cuban Missile Crisis,” he said, referring to the 1962 standoff between the Soviet Union and the United States that brought the world to the brink of nuclear war. Naryshkin said that for Washington, “fighting the non-existent so-called Russian threat has become a real fixation” comparable in scale to the Cold War era. “It has reached such proportions and developed such ludicrous characteristics, that it’s time to talk about the return of the grim times of the Cold War,” Naryshkin said.

[..] Putin’s spokesman Dmitry Peskov said on a visit to Ankara late Tuesday that Britain’s “theory will not be confirmed in any case because it is not possible to confirm it.” “The British foreign secretary who has made accusations against President Putin, (and) the British prime minister will have to somehow look their EU colleagues… in the eye,” Peskov said. “Somehow they will have to apologise to the Russian side,” Peskov added. “It will certainly be a long story, the idiocy has gone too far.”

“The meeting comes after Moscow also received and analysed samples of the Novichok agent used in the attack.”

• Chemical Watchdog To Meet Over Spy Nerve Agent Claims (AFP)

The world’s chemical watchdog is to meet behind closed doors Wednesday, after a British laboratory said it had not proved that Russia manufactured a deadly nerve agent used to poison a former Russian spy. The talks at the Organisation for the Prohibition of Chemical Weapons (OPCW) have been requested by Moscow which said it wanted to “address the situation around the allegations… in regards to the incident in Salisbury.” “We hope to discuss the whole matter and call on Britain to provide every possible element of evidence they might have in their hands,” Russia’s ambassador to Ireland, Yury Filatov, told reporters.

On Tuesday, the British military facility analysing the nerve agent used on former Russian double agent Sergei Skripal and his daughter Yulia, said it was not in a position to say where the substance had originated. Skripal, who has lived in Britain since a spy swap in 2010, and his daughter have been in hospital since the March 4 poisoning that London and its major Western allies have blamed on Russia. The 41 member states of the OPCW’s executive council are to convene at 10:00 am (0800 GMT) at the organisation’s headquarters in The Hague. The meeting comes after Moscow also received and analysed samples of the Novichok agent used in the attack. “Russia is interested in establishing the whole truth of the matter,” Filatov said.

But Britain’s foreign ministry accused Russia of requesting the meeting to undermine the OPCW’s investigation. “This Russian initiative is yet again another diversionary tactic, intended to undermine the work of the OPCW in reaching a conclusion,” the ministry said in a statement. “Of course, there is no requirement in the Chemical Weapons Convention for the victim of a chemical weapons attack to engage in a joint investigation with the likely perpetrator,” it said.

“..a distinction without a difference..”

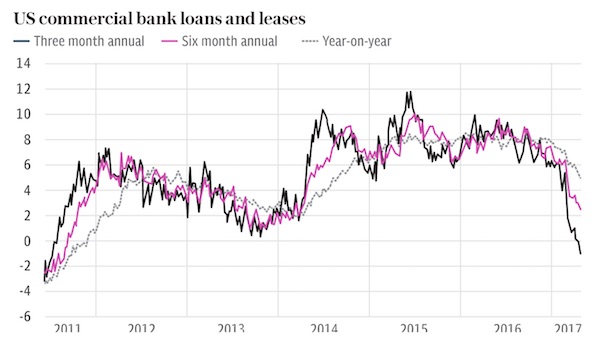

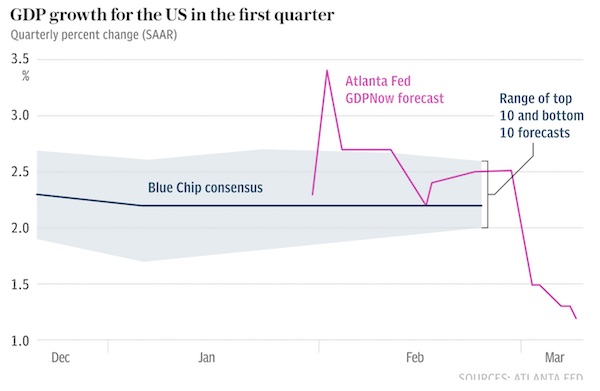

• It’s The Trump Slump – But Don’t Blame The Donald! (Stockman)

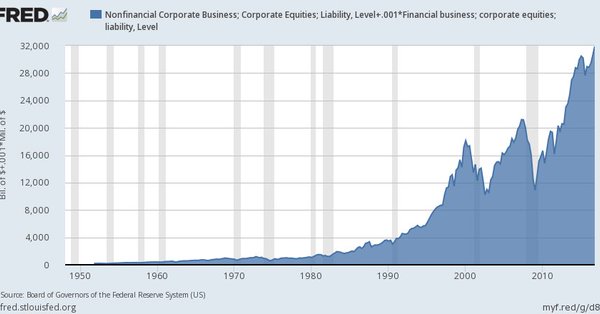

[..] the Donald is definitely not guilty because he hasn’t been around nearly long enough to take the blame or the praise for anything related to the economy. The phony stock market boom has been gestating for three decades owing to central bank monetary madness; the up-leg since election day reflects nothing more than the final phase of an horribly metastasized financial bubble that has now reached its sell-by date. In fact, our clueless medicine show impresario has confused the last gasp of the robo-machines and dip-buyers for an endorsement of his cockamamie brew of protectionism, nationalism, populism and unhinged Keynesian borrow and spend.

So rather than puncturing the bubble he accurately identified during the campaign, he’ll soon be dripping with implosion splatter from comb-over to toe. Likewise, the market’s post-election rip has nothing to do with a putative Trump economic boom because there hasn’t been one. A 2.0% or lower real GDP growth rate is now virtually baked into the cake for Q1 based on the economic releases to date. That would amount to a $75 billion gain over the Q4 annualized level of real GDP. Accordingly, the first five quarters of the Trump Economy will have generated an average real GDP gain of $102 billion per quarter. Then again, during the previous three years (2014-2016) the quarterly growth rate was $99 billion per quarter.

We’d call that a distinction without a difference. Indeed, the notion that there has been some-kind of Trump fostered economic acceleration is, well, Fake News. In fact, what we have is a plodding business expansion that is freighted down by debt and financial engineering—both gifts of a rogue central bank that has been inflicting harm on the main street economy for decades.

Your privacy is not up to him to decide. That is just crazy.

• Facebook CEO Stops Short Of Extending European Privacy Globally (R.)

Facebook Chief Executive Mark Zuckerberg said on Tuesday that he agreed “in spirit” with a strict new European Union law on data privacy but stopped short of committing to it as the standard for the social network across the world. As Facebook reels from a scandal over the mishandling of personal information belonging to millions of users, the company is facing demands to improve privacy and learn lessons from the landmark EU law scheduled to take effect next month. Zuckerberg told Reuters in a phone interview that Facebook was working on a version of the law that would work globally, bringing some European privacy guarantees worldwide, but the 33-year-old billionaire demurred when asked what parts of the law he would not extend worldwide.

“We’re still nailing down details on this, but it should directionally be, in spirit, the whole thing,” Zuckerberg said. He did not elaborate. His comments signal that U.S. Facebook users, many of them still angry over the company’s admission that political consultancy Cambridge Analytica got hold of Facebook data on 50 million members, could find themselves in a worse position than Europeans. The European law, called the General Data Protection Regulation (GDPR), is the biggest overhaul of online privacy since the birth of the internet, giving Europeans the right to know what data is stored on them and the right to have it deleted. Apple and some other tech firms have said they do plan to give people in the United States and elsewhere the same protections and rights that Europeans will gain.

[..] When GDPR takes effect on May 25, people in EU countries will gain the right to transfer their data to other social networks, for example. Facebook and its competitors will also need to be much more specific about how they plan to use people’s data, and they will need to get explicit consent. GDPR is likely to hurt profit at Facebook because it could reduce the value of ads if the company cannot use personal information as freely and the added expense of hiring lawyers to ensure compliance with the new law. Data is central to Facebook’s advertising business, and it has not yet sketched out a satisfying plan for how it plans to comply, said Pivotal Research analyst Brian Wieser. “I haven’t heard any solutions from Facebook to get ahead of the problem yet,” Wieser said. Failure to comply with the law carries a maximum penalty of up to 4% of annual revenue.

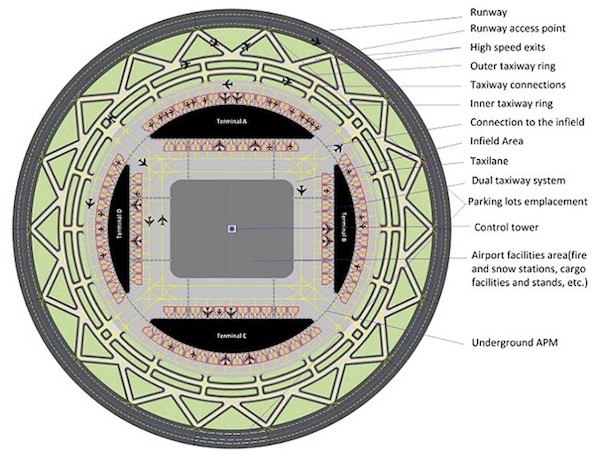

I would have understood this better if it had been published on April 1. Now I’m thinking: some idiot is actually going to do this.

• Developing Nations To Study Ways To Dim Sunshine, Slow Warming (R.)

Scientists in developing nations plan to step up research into dimming sunshine to curb climate change, hoping to judge if a man-made chemical sunshade would be less risky than a harmful rise in global temperatures. Research into “solar geo-engineering”, which would mimic big volcanic eruptions that can cool the Earth by masking the sun with a veil of ash, is now dominated by rich nations and universities such as Harvard and Oxford. Twelve scholars, from countries including Bangladesh, Brazil, China, Ethiopia, India, Jamaica and Thailand, wrote in the journal Nature on Wednesday that the poor were most vulnerable to global warming and should be more involved.

“Developing countries must lead on solar geo-engineering research,” they wrote in a commentary. “The overall idea (of solar geo-engineering) is pretty crazy but it is gradually taking root in the world of research,” lead author Atiq Rahman, head of the Bangladesh Centre for Advanced Studies, told Reuters by telephone. The solar geo-engineering studies would be helped by a new$400,000 fund from the Open Philanthropy Project, a foundation backed by Dustin Moskovitz, a co-founder of Facebook, and his wife, Cari Tuna, they wrote.

[..] Rahman said the academics were not taking sides about whether geo-engineering would work. Among proposed ideas, planes might spray clouds of reflective sulfur particles high in the Earth’s atmosphere. “The technique is controversial, and rightly so. It is too early to know what its effects would be: it could be very helpful or very harmful,” they wrote. A U.N. panel of climate experts, in a leaked draft of a report about global warming due for publication in October, is skeptical about solar geo-engineering, saying it may be “economically, socially and institutionally infeasible.”

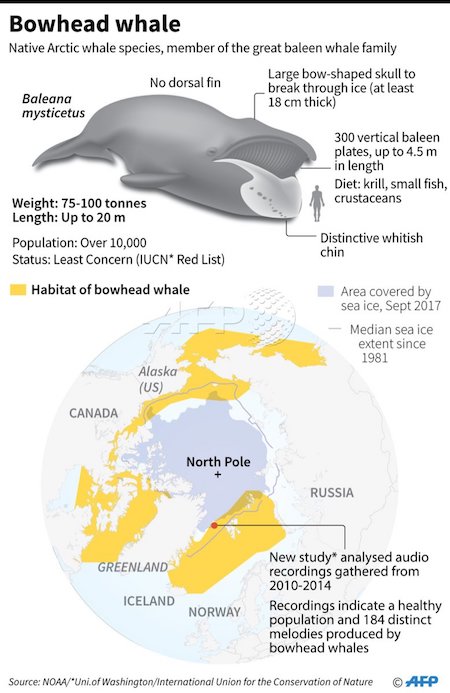

Article says “..hunted to the edge of extinction..”. Graph says healthy population. Source for both is AFP.

• Bowhead Whales Are The Coolest Cats (AFP)

How do bowhead whales in the unbroken darkness of the Arctic’s polar winter keep busy during breeding season? They sing, of course. From late autumn to early spring, off the east coast of Greenland, some 200 bowheads, hunted to the edge of extinction, serenade each other with compositions from a vast repertoire of song, according to a study published on Wednesday. “It was astonishing,” said the lead author, Kate Stafford, an oceanographer at the University of Washington’s Applied Physics Laboratory in Seattle, who eavesdropped on these subaquatic concerts. “Bowhead whales were singing loudly, from November until April” – non-stop, 24/7 – “and they were singing many, many different songs.”

Stafford and three colleagues counted 184 distinct melodies over a three-year period, which may make bowheads one of the most prolific composers in the animal kingdom. “The diversity and inter-annual variability in songs of bowhead whales in this study are rivalled only by a few species of songbirds,” the study found. Unlike mating calls, songs are complex musical phrases that are not genetically hard-wired but must be learned. Only a handful of mammals – some bats and a family of apes called gibbons, for example – vocalise in ways akin to bird song, and when they do it is quite repetitive.

The only other whale that produces elaborate songs is the humpback, which has been extensively studied in its breeding grounds near Hawaii and off the coast of Mexico. The humpback’s melody is shared among a given population over a period of a year, and gives way to a new tune each spring. Bowhead whales, it turns out, are far more versatile and would appear to improvise new songs all the time. “If humpback whale song is like classical music, bowheads are jazz,” Stafford said in a statement. “The sound is more free-form.”