Joseph Mallord William Turner Norham Castle, Sunrise 1845

2018 will be something to watch.

• Fed Boosts Benchmark Rate For Third Time This Year (AP)

The Federal Reserve is raising its benchmark interest rate for the third time this year, signaling its confidence that the U.S. economy remains on solid footing 8Ω years after the end of the Great Recession. The Fed is lifting its short-term rate by a modest quarter-point to a still-low range of 1.25% to 1.5%. It is also continuing to slowly shrink its bond portfolio. Together, the two steps could lead over time to higher loan rates for consumers and businesses and slightly better returns for savers. The central bank says it expects the job market and the economy to strengthen further. Partly as a result, it foresees three additional rate hikes in 2018 under the leadership of Jerome Powell, who succeeds Janet Yellen as Fed chair in February. Investors will look to Yellen’s final scheduled news conference as Fed chair for any clues to what the central bank might have in store for 2018 under Powell.

Powell has been a Yellen ally who backed her cautious stance toward rate hikes in his five years on the Fed’s board. Yet no one can know for sure how his leadership or rate policy might depart from hers. What’s more, Powell will be joined by several new Fed board members who, like him, are being chosen by President Donald Trump. Some analysts say they think that while Powell might not deviate much from Yellen’s rate policy, he and the new board members will adopt a looser approach to their regulation of the banking system. Most analysts have said they think the still-strengthening U.S. economy will lead the Fed to raise rates three more times next year. A few, though, have held out the possibility that a Powell-led Fed will feel compelled to step up the pace of rate hikes as inflation finally picks up and the economy, perhaps sped by the Republican tax cuts, begins accelerating.

Two centrally controlled economies.

• PBOC Raises Borrowing Costs In Surprise Move Following Fed Hike (BBG)

China’s central bank edged borrowing costs higher in an unexpected move after the Federal Reserve’s decision to tighten monetary policy. Hours after the Fed’s quarter%age-point move, the People’s Bank of China, citing market expectations, increased the rates it charges in open-market operations and on its medium-term lending facility, though making smaller adjustments than the U.S. Markets took the announcement in stride. Analysts said the modest adjustment shows the PBOC wants to balance the need to tighten monetary policy with avoiding jolting its markets. China’s rate adjustments “help markets form reasonable expectations for interest rates,” the PBOC said in a statement on its website on Thursday.

It also prevents financial institutions from adding excessive leverage and expanding broad credit supply, it said. The cost of seven-day and 28-day reverse-repurchase agreements was raised by five basis points. That followed an increase in mid-March. The PBOC skipped the use of 14-day reverse repos Thursday. The cost of funds lent via MLF was also increased by five basis points, with the 1-year rate raised to 3.25%. “This action seems to follow the Fed,” said Raymond Yeung at Australia & New Zealand Bank. “Since it only lifted the rate by just five basis points the central bank does not want to jeopardize the market with an aggressive hike. It does indicate the tightening bias of the policy makers and this stance will continue in 2018.”

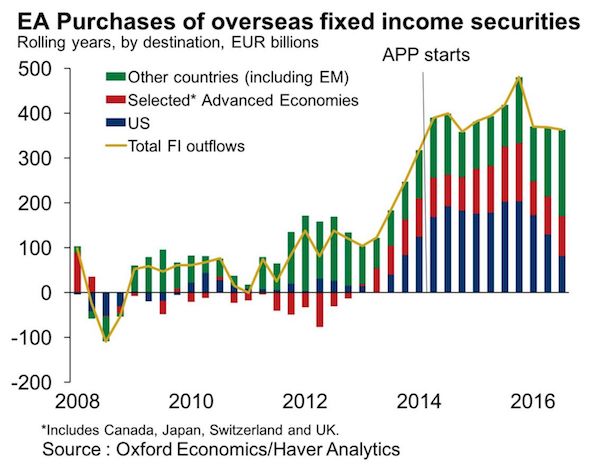

Why does the ECB hold all that American debt? Is that its mandate?

• European Bond-Buying ‘Tsunami’ Is Set to Fade as ECB Tapers (BBG)

European investors have been plowing so much capital abroad they’ve taken up about half the boom in U.S. corporate debt in recent years, but now that liquidity tap is poised to be shut off, according to Oxford Economics. “The global debt issuance boom is likely to lose steam, given the extent to which it has relied on the support of European investors,” Guillermo Tolosa, an economic adviser to Oxford Economics in London who has worked at the IMF, wrote in a forthcoming research note. “Issuers better seize the opportunities while they last.” ECB asset purchases took up so great a supply of bonds that it pushed euro area investors into markets abroad, to the tune of €400 billion ($473 billion) a year over the past three years, Oxford Economics estimates. With the ECB poised to halve its monthly buying pace to 30 billion euros starting in January, next year might see just €200 billion in European investor outflows, the research group calculates.

“This is a large enough fall to risk causing disruption in some markets, including emerging markets, which have come to rely heavily on European flows recently,” Tolosa wrote. “A global tsunami of euros” benefited borrowers during the past three years, and accounted for a “staggering” 50% of net U.S. corporate-debt issuance, he wrote. European funds have slashed the domestic share of their fixed-income securities holdings by more than 7 percentage points, to less than 70%, since the ECB’s program began. As flows head back into the domestic markets, that could temper the impact of the ECB’s policy normalization on the region’s securities. Upward pressure on European debt valuations may last “for a protracted period,” Tolosa wrote.

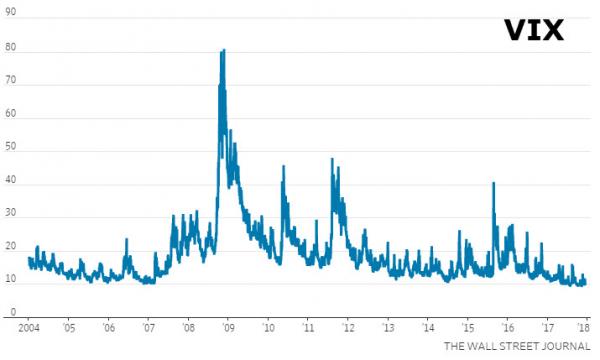

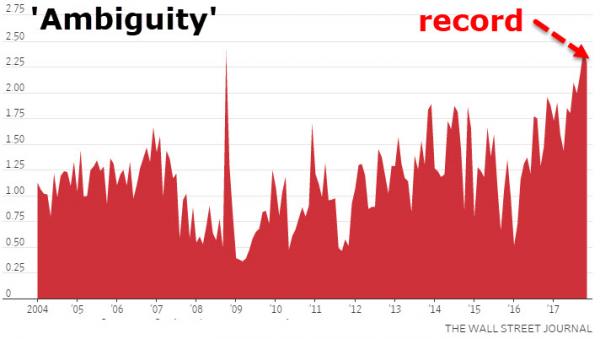

Is VIX as compromised as GDP?

• Risk May Be Low But Uncertainty Just Hit Record Highs (ZH)

The decline in the VIX this year has befuddled investors and traders of all stripes, given the host of geopolitical uncertainties in locations like North Korea and political skirmishes in Washington. Not to mention, stocks have been rising relentlessly for years, unnerving some investors who say that stocks are trading too high relative to expected earnings. As The Wall Street Journal reports, two academics are rolling out a new measure of market fear that suggests investors aren’t nearly as complacent as they seem. In separating out ambiguity from common measures of risk, Menachem Brenner of New York University and Yehuda Izhakian of Baruch College are picking up on a concept that traces back nearly a century.

Economist Frank Knight in 1921 wrote about the difference between risk and uncertainty. If volatility measures the uncertainties for which one can determine a probability, or the “known unknowns,” ambiguity measures the “unknown unknowns,” to use a term popularized by former Defense Secretary Donald Rumsfeld, according to Mr. Brenner. In October, the gauge hit 2.42, its highest reading in monthly data that extends back to 1993. That’s above the gauge’s previous peak of 2.41 at the height of the financial crisis in October 2008. While none of the academics is willing to call a ‘top’ or any imminent decline, it is noteworthy that this new measure quantifies what many have noted – that market-based ‘non-normal’ tail risk remains elevated while ‘normal risk’ is repressed.

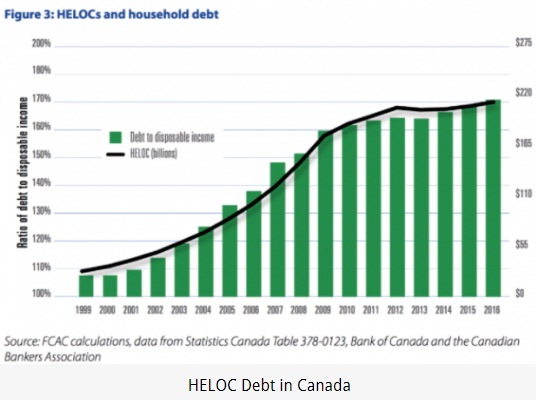

Make your home someone else’s ATM.

• Canadian Homeowners Take Out HELOCs to Fund Subprime Buyers (WS)

The HELOC (Home Equity Line of Credit) has been a blessing and a curse for Canadian households. While it has helped spur house prices and simultaneously provided consumers the ability to tap into their new found equity, it has also crippled many Canadian households into a debt trap that seems insurmountable. Between 2000 and 2010, HELOC balances soared from $35 billion to $186 billion, according to the Financial Consumer Agency of Canada, an average annual growth rate of 20%. As of 2016, HELOC balances sit at $211 billion, a 500% increase since the year 2000. While also pushing Canadian household debt to incomes to record highs of 168%. Scott Terrio, a debt consultant, says the situation is a full blown “extend and pretend,” meaning borrowers are just continuously refinancing or taking on more and more debt in order to sustain their lifestyle.

Canadians can extend their debt repayment terms and pretend to live a lifestyle they can’t otherwise obtain. What the HELOC has also been able to do is help spur the private lending space which has ultimately supported rising house prices. Seth Daniels of JKD Capital, one of the most astute Canada-Watchers, says there’s a growing trend where “a homeowner acts as a sub-prime lender by drawing a HELOC at 3% interest only, and lends it to a subprime borrower at 8-12% for one year (interest only).” This is something I’ve been hearing on an ongoing basis from mortgage brokers and lawyers who help facilitate these deals. Especially since mortgage lending conditions tightened, starting with OSFI’s first mortgage stress test back in November, 2016. The financial regulator required “high-ratio” borrowers (those with less than 20% down payment) to qualify for a mortgage at the borrowing rate plus 2%. So basically you’re getting qualified on what you can borrow at 5% even though you’re borrowing at 3%.

Probably inevitable, but it doesn’t feel good.

• These Guys Want to Lend You Money Against Your Bitcoin (BBG)

The woes of an early bitcoin investor. Until recently, people who paid virtually nothing for the virtual currency and watched it soar had only one way to enjoy their new wealth – sell. And many weren’t ready. Lenders on the fringe of the financial industry are now pitching a solution: loans using a digital hoard as collateral. While banks hang back, startups with names like Salt Lending, Nebeus, CoinLoan and EthLend are diving into the breach. Some lend – or plan to lend – directly, while others help borrowers get financing from third parties. Terms can be onerous compared with traditional loans. But the market is potentially huge. Bitcoin’s price hovered around $17,000 much of this week, giving the cryptocurrency a total market value of almost $300 billion.

Roughly 40% of that is held by something like 1,000 users. That’s a lot of digital millionaires needing houses, yachts and $590 shearling eye masks. “I would be very interested in doing this with my own holdings, but I haven’t found a service to enable this yet,” said Roger Ver, widely known as “Bitcoin Jesus” for his proselytizing on behalf of the cryptocurrency, in which he in one of the largest holders. People controlling about 10% of the digital currency would probably like to use it as collateral, estimates Aaron Brown, a former managing director at AQR Capital Management who invests in bitcoin and writes for Bloomberg Prophets. “So I can see a lending industry in the tens of billions of dollars,” he said.

One problem is that bitcoin’s price swings violently, which can make it dangerous for lenders to hold. That means the terms can be steep. Someone looking to tap $100,000 in cash would probably need to put up $200,000 of bitcoin as collateral, and pay 12% to 20% in interest a year, according to David Lechner, the chief financial officer at Salt, which has arranged dozens of loans.

“Every serious deflation I’ve looked at is preceded by an asset bubble and then it bursts..”

• Druckenmiller: Central Banks Are Financial World’s ‘Darth Vader’ (CNBC)

Stanley Druckenmiller believes the overly easy monetary policies by global central banks will have disastrous consequences. “The way you create deflation is you create an asset bubble. If I was ‘Darth Vader’ of the financial world and decided I’m going to do this nasty thing and create deflation, I would do exactly what the central banks are doing now,” he told CNBC’s Kelly Evans in an exclusive interview airing Tuesday on “Closing Bell.” “Misallocate resources [with low interest rates], create an asset bubble and then deal with the consequences down the road,” he said. The investor noted how this boom-and-bust cycle has happened time and time again. “Deflation just doesn’t appear out of nowhere and it doesn’t happen because you are near the zero bound. Every serious deflation I’ve looked at is preceded by an asset bubble and then it bursts,” he said.

“Think about the ’20s, a big asset bubble that burst, you have the Depression. Think about Japan. Asset bubble in the ’80s. It burst. You have the consequences follow. Think about 2008, 2009.” Druckenmiller said if the Federal Reserve raised interest rates more quickly, the U.S. would have avoided the worst of the housing bubble and last recession. “If they had moved earlier and more aggressively in the early 2000s, we would have had a recession in ’08 and ’09, but not a financial crisis,” he said. The investor believes the Fed should raise rates and normalize monetary policy as soon as possible. “The longer this goes on, the worse it’s going to be,” he added. “The sooner they can stop what’s going on … the better.”

She might as well step down now.

• Theresa May’s EU Summit Marred By Embarrassing Defeat in Commons (Ind.)

Theresa May is set to arrive in Brussels for a key EU summit on Thursday having suffered a damaging defeat in Parliament over her central piece of Brexit legislation. The Prime Minister is to use the EU event to try and make the case for moving Brexit talks on to trade negotiations quickly, but European leaders will now be left wondering if she still has the political support in London to deliver any deal. There were cheers from opposition MPs in the House of Commons when it emerged the Government had been forced to accept changes to its EU Withdrawal Bill, which it is now claimed will guarantee Parliament a “meaningful” final vote on any Brexit deal Ms May agrees. he embarrassing defeat – the first inflicted on Ms May as she pushes through her Brexit plans – came after Jeremy Corbyn ordered Labour MPs to back an amendment to her legislation proposed by ex-Conservative attorney general Dominic Grieve.

The result immediately exposed deep divisions on the Conservative benches, with reports of a heavy-handed Government whipping operation creating tension, blue-on-blue clashes in the Commons and one Tory rebel sacked from his senior party position within moments of opposing Ms May. Rebels braced themselves for a wave of abuse from the Brexit-backing media, but insisted they had no choice but to put principle before party and vote against the Government. Ms May was supposed to enjoy something of a victory at the EU council summit on Thursday, expected to rubber-stamp the judgment that “sufficient progress” has been made on divorce issues to move on to the next phase of talks. But with difficult obstacles already arising in Brussels, the defeat in London lays bare the difficulties Ms May will have in delivering anything she agrees on the continent.

“..cryptocurrencies are built upon an establishment designed framework, and they are entirely dependent on an establishment created and controlled vehicle (the internet)..”

• The Virtual Economy Is The End Of Freedom (Smith)

Millenials and others think that they are going to rebel and “take down the banking oligarchs” with nothing more than digital markers representing “coins” tracked on a digital ledger created by an anonymous genius programmer/programmers. Delusional? Yes. But like I said earlier, it is an appealing notion. Here is the issue, though; true money requires intrinsic value. Cryptocurrencies have no intrinsic value. They are conjured from nothing by programmers, they are “mined” in a virtual mine created from nothing, and they have no unique aspects that make them rare or tangibly useful. They are an easily replicated digital product. Anyone can create a cryptocurrency. And for those that argue that “math gives crypto intrinsic value,” I’m sorry to break it to them, but the math is free.

In fact, for those that are not already aware, Bitcoin uses the SHA-256 hash function, created by none other than the National Security Agency (NSA) and published by the National Institute for Standards and Technology (NIST). Yes, that’s right, Bitcoin would not exist without the foundation built by the NSA. Not only this, but the entire concept for a system remarkably similar to bitcoin was published by the NSA way back in 1996 in a paper called “How To Make A Mint: The Cryptography Of Anonymous Electronic Cash.” The origins of bitcoin and thus the origins of crytpocurrencies and the blockchain ledger suggest anything other than a legitimate rebellion against the establishment framework and international financiers. I often cite this same problem when people come to me with arguments that the internet has set the stage for the collapse of the globalist information filter and the mainstream media.

The truth is, the internet is also an establishment creation developed by DARPA, and as Edward Snowden exposed in his data dumps, the NSA has total information awareness and backdoor control over every aspect of web data. Many people believe the free flow of information on the internet is a weapon in favor of the liberty movement, but it is also a weapon in favor of the establishment. With a macro overview of data flows, entities like Google can even predict future social trends and instabilities, not to mention peek into every personal detail of an individual’s life and past. To summarize, cryptocurrencies are built upon an establishment designed framework, and they are entirely dependent on an establishment created and controlled vehicle (the internet) in order to function and perpetuate trade. How exactly is this “decentralization”, again?

How much longer can the Mueller vehicle last?

• Trey Gowdy: “What The Hell Is Going On?” (YT)

Tyler Durden: “If there is any remaining doubt in your mind that Special Counsel Mueller’s probe is anything but a farcical, politically-motivated witch hunt, then you’ll be summarily relieved of those doubts after watching the following exchange from earlier this morning between Trey Gowdy (R-SC) and Deputy Attorney General Rod Rosenstein.”

There are much higher sums floating around.

• Germany Owes Greece €185billion In WWII Reparations – German Researchers (KTG)

Does Germany owe indeed Greeks billions of euros in World War II reparations for the damages and the enforced loan during the occupation of the country by the Nazis? So far, Berlin has vehemently rejected any Greek claims. However, two German researchers dug into the documents of the dispute. have discovered and calculated that the German state owes Greece 185 billion euros. Of this not even a 1% has been paid to Greece. In their book “Reparation debt. Mortgages of German occupation in Greece and Europe” publishers Karl Heinz Roth, a historian, and Hartmut Rübner, a researcher, unfold the documents of the dispute and come to the conclusion that the reparations issue was not solved in 1960, as Berlin has been claiming.

According to the book review published in German conservative daily Sueddeutsche Zeitung, Roth and Rübner have researched German documents only and came to the conclusion that: USA allies and “the power elites of West Germany” have systematically ignored Greece’s demands for WWII reparations. In SZ article “Athens – Berlin: Open Bill, Open Wounds” it is said among others that: At the Paris Reparations Conference in 1946, the Greek government presented a damage record of $7.2 billion – eventually earning a share of $25 million. The leitmotiv of the book is that an alliance between the US and the “West German power elite” has systematically ignored Greek demands for decades.

“Undeniable, however, is the diplomatic arrogance with which the Federal Republic rejected the Greek demands for decades. If you do not believe it, you are welcome to make your own impression in Hartmut Rübner’s carefully edited extensive documentary appendix,” SZ notes. In the first part of the book, Roth analyzes the decades-long efforts of Athens to receive reparations. When the Wehrmacht withdrew from Greece in October 1944 after three and a half years of occupation, it literally left behind “scorched land”: the economy, currency and infrastructure were completely destroyed. The health of the surviving population was catastrophic – by the end of the war about 140,000 people had died as a result of malnutrition.

Long read. First step: ban all pesticides.

• ‘A Different Dimension Of Loss’: Inside The Great Insect Die-Off (G.)

The Earth is ridiculously, burstingly full of life. Four billion years after the appearance of the first microbes, 400m years after the emergence of the first life on land, 200,000 years after humans arrived on this planet, 5,000 years (give or take) after God bid Noah to gather to himself two of every creeping thing, and 200 years after we started to systematically categorise all the world’s living things, still, new species are being discovered by the hundreds and thousands. In the world of the systematic taxonomists – those scientists charged with documenting this ever-growing onrush of biological profligacy – the first week of November 2017 looked like any other. Which is to say, it was extraordinary. It began with 95 new types of beetle from Madagascar. But this was only the beginning. As the week progressed, it brought forth seven new varieties of micromoth from across South America, 10 minuscule spiders from Ecuador, and seven South African recluse spiders, all of them poisonous.

A cave-loving crustacean from Brazil. Seven types of subterranean earwig. Four Chinese cockroaches. A nocturnal jellyfish from Japan. A blue-eyed damselfly from Cambodia. Thirteen bristle worms from the bottom of the ocean – some bulbous, some hairy, all hideous. Eight North American mites pulled from the feathers of Georgia roadkill. Three black corals from Bermuda. One Andean frog, whose bright orange eyes reminded its discoverers of the Incan sun god Inti. About 2m species of plants, animals and fungi are known to science thus far. No one knows how many are left to discover. Some put it at around 2m, others at more than 100m. The true scope of the world’s biodiversity is one of the biggest and most intractable problems in the sciences. There’s no quick fix or calculation that can solve it, just a steady drip of new observations of new beetles and new flies, accumulating towards a fathomless goal.

Home › Forums › Debt Rattle December 14 2017