Gustave Courbet The bathers 1853

And that’s not going to fly. So back to QE in 2018? Or will they wait so long the damage becomes irreversible (I know it already is, but still..)

• Central Banks Want World To Party On As They Remove Punch Bowl (BBG)

Central bankers are gingerly trying to take away the punch bowl without interrupting the party. Led by interest-rate increases by the Federal Reserve and the People’s Bank of China, central banks around the world shifted toward a tighter monetary stance this week. Yet the moves were either so well-telegraphed, or so tiny, and the language about future action so hedged, that there was barely a ripple in financial markets. “They’re terrified of upsetting the markets,” said Paul Mortimer-Lee, chief market economist at BNP Paribas. So “they’re all exiting quite slowly from emergency settings” on monetary policy. The likely result of this leisurely approach: another year of synchronized global growth in 2018.

Indeed, both the Fed and the ECB revised up their forecasts for the growth of their respective economies next year even as they signaled that they would be slowly scaling back the stimulus they are providing. “The global economy is doing well,” Fed Chair Janet Yellen told reporters on Wednesday after the U.S. central bank raised interest rates for the third time this year. “We’re in a synchronized expansion. This is the first time in many years that we’ve seen this.” [..] Policy makers though played down fears that asset price bubbles were building that could threaten the financial system and the economy. “When we look at other indicators of financial stability risks, there’s nothing flashing red there or possibly even orange,” Yellen said.

[..]“Central banks, who’ve been pumping money into the system for the past decade or so, are going to be removing it,” said Iain Stealey, fixed-income portfolio manager at JPMorgan Asset Management in a Bloomberg Television interview on Thursday. “It’s going to be slow to start with, very gradual, but it’s going to be a real change in rhetoric.”

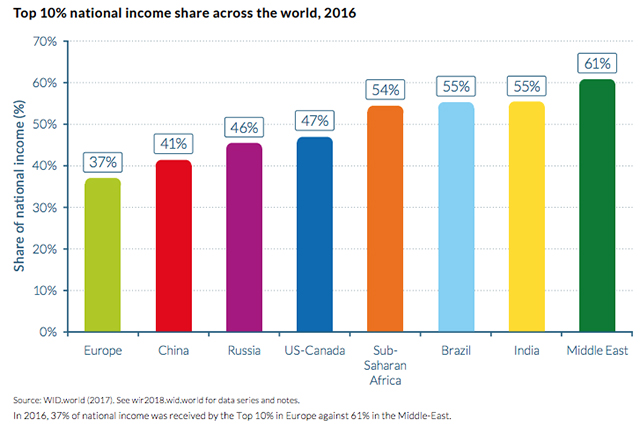

The course of inequality is very different from one continent to the other.

• This Is What Happened To The American Dream – It’s Not Pretty (MW)

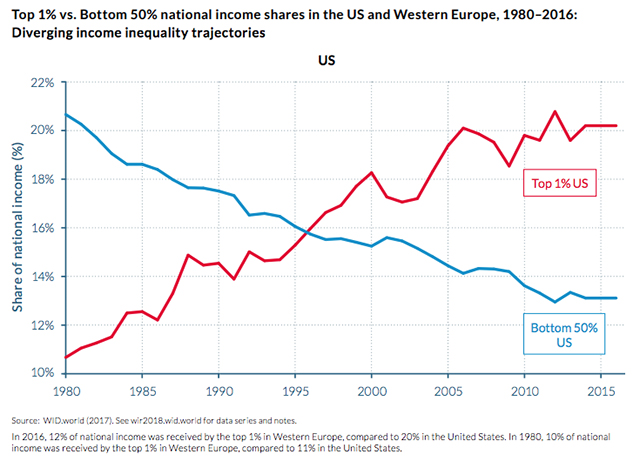

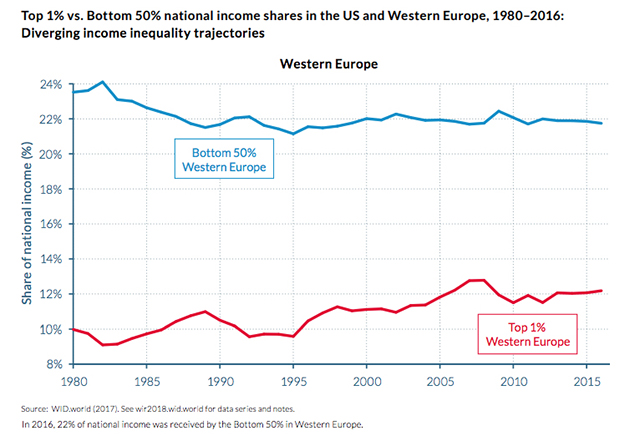

There’s one area where there’s been huge growth in the U.S. — the gap between the rich and poor. The divergence in the levels of inequality has been “extreme” between Western Europe and the U.S., according to the 2018 World Inequality Report, released by the World Inequality Lab, a research project in over 70 countries based at the Paris School of Economics, and co-authored by the French economist Thomas Piketty. “The global middle class has been squeezed,” it said. In 1980, the U.S. and Western Europe had similar levels of inequality. And today? Not so much. While the top 1% of earners made up just 10% in both regions in 1980, it increased slightly to 12% in 2016 in Western Europe, but doubled to 20% in the U.S. “Since 1980, income inequality has increased rapidly in North America, China, India, and Russia,” it said.

“The income-inequality trajectory observed in the U.S. is largely due to massive educational inequalities, combined with a tax system that grew less progressive despite a surge in top labor compensation since the 1980s,” it found. In Europe, tax and wage inequality was moderated by educational and wage-setting policies that were more favorable to low and middle-income groups. In the U.S., out of 100 children whose parents are among the bottom 10% of income earners, only 20 to 30 of them actually go to college. However, closer to 90 out of 100 children go to college if their parents are within the top 10% earners. What’s more, research has shown that when elite colleges open their doors to students from poor backgrounds, academic performance at the institution doesn’t decline.

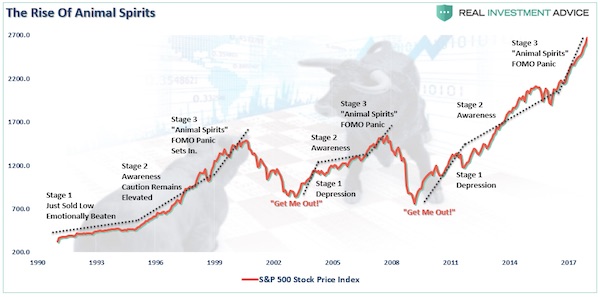

“Animal spirits”, “irrational exuberance”, “value investing”, “momentum chase”. What is this, verbal bankruptcy?

• The Rude Awakening Of Slumbering Bulls (Roberts)

Here’s a little secret, “Animal Spirits” is simply another name for “Irrational Exuberance,” as it is the manifestation of the capitulation of individuals who are suffering from an extreme case of the “FOMO’s” (Fear Of Missing Out). The chart below shows the stages of the previous bull markets and the inflection points of the appearance of “Animal Spirits.” At the peak of previous bull market advances, the markets have entered into an accelerated phase of price advances.

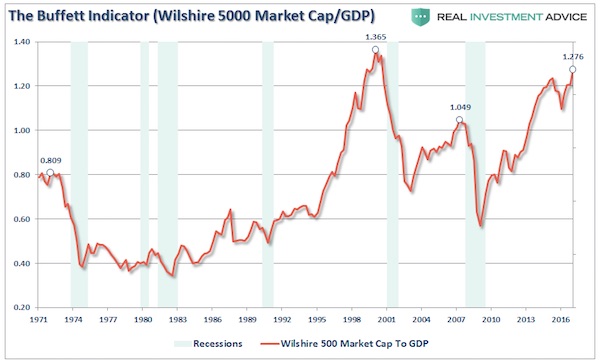

Since “the price you pay day is the value you receive tomorrow,” as famously noted by Warren Buffet, it should not come as a surprise that “value investing” is lagging the “momentum chase” in the market currently. But again, this is something that has historically, and repeatedly occurred, during very late stage bull market advances as the “rationalization” for a “never-ending bull market” is promulgated.

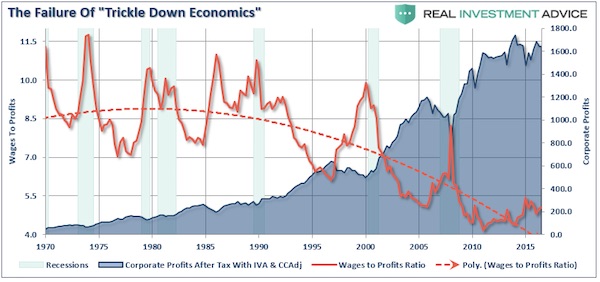

Given the length of the economic expansion, the risk to the “bull market” thesis is an economic slowdown, or contraction, that derails the lofty expectations of continued earnings growth. While tax reform legislation may provide a bump to earnings growth in the near-term, it is the longer-term growth rates of the economy that matters. Furthermore, while providing a tax cut to corporations will certainly boost their bottom line, there is little evidence, historically speaking, “trickle-down economics” actually occurs. If it did, wages as a share of corporate profits wouldn’t look like this.

With an economy that is 70% driven by the 90% of the population who don’t benefit from corporate tax cuts, the long-term effects of a deficit and debt busting tax bill should be worrying investors. But, for now, that is not the case as the rise in “animal spirits” is simply the reflection of the rising delusion of investors who frantically cling to data points which somehow support the notion “this time is different,” a point recently made by Sentiment Trader: “We’ve discussed a multitude of momentum studies in the past month or two, with an almost universal suggestion that the types of readings we’ve seen this year are rare and hard to bust. This unrelenting bid has been one of, if not THE, most compelling bullish argument, and it shows little sign of stopping.”

K-Street has taken over Brussels too.

• MiFID’s Cautious Start on Bond-Price Rules Shows Lobbying Impact (BBG)

For years, the bond industry argued that price-disclosure requirements in MiFID II were unsuited to the market and would hinder trading. With less than 1% of notes affected when the rules kick in on Jan. 3, that lobbying seems to have paid off. The European Securities and Markets Authority said last week that 566 bond instruments out of 61,761 it analyzed were sufficiently liquid to fall under the pre- and post-trade transparency rules in the MiFID II package. Most were sovereign bonds, which are used as collateral in everything from repurchase agreements to derivative trades. About 150 corporate securities made the list, issued by financial firms such as CaixaBank, Italian power giant Enel and telecommunications company Wind Tre. But the small number of securities initially captured by MiFID II means the law’s goal of shedding light on the market may not be achieved anytime soon.

“ESMA’s approach will contribute very little towards improving transparency in this notoriously opaque market segment,” said Christian Stiefmueller, who’s in charge of banking for Finance Watch, a public-interest watchdog in Brussels. “ESMA’s approach is a present to market makers, i.e. traders at the major investment banks, who thrive on a lack of transparency.” As part of its efforts to prevent another financial crisis, the EU is implementing rules designed to shift trading on to exchanges where regulators can track it, boost transparency to protect individual investors and level the playing field for professionals. MiFID II transparency rules require market operators and investment firms that run a trading venue to make public “current bid and offer prices and the depth of trading interests at those prices” continuously during trading hours for some bonds and other non-equity securities.

People only get poorer, the dream is over.

• Why American Capitalism Doesn’t Work For All Americans – Deaton (MW)

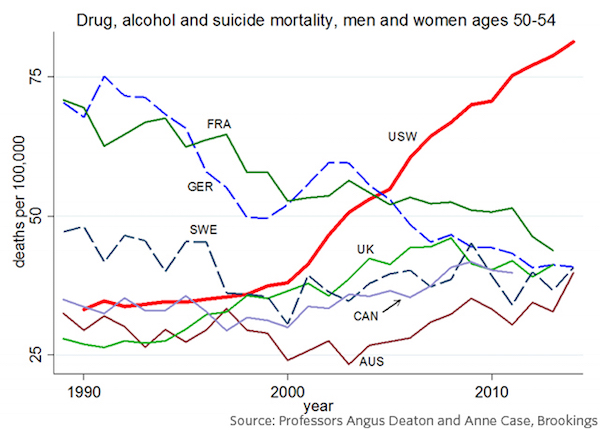

MarketWatch: I want to make the bridge from your findings to the economy. You have said that white working class workers are facing a loss of their way of life.

Deaton: This is much more hypothetical because of course, you are saying “what is doing this?” Tying it to the economy is tricky because it is certainly not true that it was the Great Recession that made this happen, for example. And in fact even if you go back to the late 1990s, the patterns of income and so on are not that different across groups. They don’t match up. Any simple story that said “it is the economy stupid,” is stupid. So we trace this back sort of a long way, and if you look at birth cohorts it is like each successive birth cohort is doing worse. They are more susceptible to these deaths throughout life, and the deaths rise with age more rapidly for younger cohorts, so we’re attracted by this idea that there is a cumulative process going on which is steadily getting worse over time. And, you know, the destruction of the way of life of the white working class is maybe a good way of thinking about this.

I mean we are very attracted by that. You know, the ultimate poison may be in the labor market, but, it works through a lot of other bad stuff that is going on — like the decline in marriage rates, the increase in out-of-wedlock childbearing, and all those sort of things. It is those things that get to middle age and your life has not worked out the way you thought, not just in terms of the salary you earned, but also your marital relationship, your kids who you may not know anymore and who are living with someone else. So there are a lot of people who in their 50s that find that their life has just sort of come apart. One story is just that there has been this slow loss of the white working class life. There has been stagnation in wages for 50 years. If you don’t have a university degree, median wages for those people have actually been going down. So it is just like that model, whereby American capitalism really delivered to people who were not particularly well-educated, seems to be broken.

“..the phenomenon whereby weak banks can destabilize governments that support them and over-indebted governments can push banks holding their bonds over the precipice..”

• Europe’s Sovereign-Bank ‘Doom Loop’ Can’t Be Broken (BBG)

Ever since the financial crisis, the European Union has grappled with how to solve the so-called sovereign bank doom loop – the phenomenon whereby weak banks can destabilize governments that support them and over-indebted governments can push banks holding their bonds over the precipice. The widely touted solution is the European Banking Union, which the European Commission wants completed by 2018. New rules introduced European bank supervision, a new resolution framework that limits sovereign support and a pan-EU deposit insurance scheme as a means of breaking the interdependence between banks and sovereigns. The first problem with this approach is that it’s actually not possible to break the doom loop. The second is that trying to do so through the banking union may actually increase risks in the European Union.

Euro zone banks, who are legally required to hold safe and liquid assets, often buy disproportionately large chunks of their home country sovereign debt because these are often the most familiar safe assets, and the sovereign yield curve is used as a baseline for pricing most credit. However, if the price of these bonds plummets – or, worse, if these bonds have to be restructured – banks get into trouble, as Greek banks found. The doom loop works in other ways too. Rating agencies have a separate methodology for rating banks wherein the possibility of state support raises bank ratings between one and six notches above what these would be on a standalone basis. A weak government means that investors discount the ability of the sovereign to support a bank in times of trouble, so a bank’s rating will also fall.

That explains why, during the euro zone crisis, badly run German landesbanken (a group of state-owned banks) had a better credit rating compared to Santander, one of Europe’s best-run banks, headquartered in Spain. Sometimes the bill for bailing out banks is so large that an otherwise healthy sovereign itself needs to be bailed out, as Ireland found out. Finally, the doom loop can kick in if depositors doubt that governments can honor their guarantees. Rumors of a bank being in trouble can be self-fulfilling, leading to the withdrawal of short-term funding and deposits. It was a fear of such a run on deposits in Spanish banks that prompted ECB President Mario Draghi to say the ECB would do “whatever it takes” to stem the crisis. Deposit guarantee schemes are important in reducing the risks of such a run on the bank. But these guarantees are only as good as a government’s ability to pay.

He’s probably right.

• Jim Chanos: We Think Tesla Is Worth Zero (CNBC)

Famed short seller Jim Chanos took another shot at Tesla on Thursday, saying the company’s equity is worth nothing. “Let’s just say Tesla and Mr. Musk have a broad interpretation of the truth,” Chanos, founder of Kynikos Associates, told CNBC’s Kelly Evans. “There have been all kinds of announcements that this company has made … that turned out not to be true.” Chanos mentioned the unveiling of Tesla’s electric Semi truck and roadster last month as examples. The short seller noted that Tesla CEO Elon Musk said “the Semi would be available in 2019 and the roadster in 2020. Where is he producing those? Those production lines have to be up and approved years before we get into production.”

Chanos has been short Tesla for a long time. On Nov. 14, he said he added to his short position against the electric vehicle maker throughout the year. However, Tesla shares are up sharply this year, advancing nearly 60%. “To me, where the stock is now is not the story,” Chanos said. “I don’t care that it came from $30 or $200 or $300. That’s just meaningless.” “We think the equity is worthless,” he said in the interview on “Closing Bell.”

Politics will trump the legal system, wanna bet?!

• WikiLeaks Recognised As A ‘Media Organisation’ By UK Tribunal (G.)

A British tribunal has recognised Julian Assange’s WikiLeaks as a “media organisation”, a point of contention with the United States, which is seeking to prosecute him and disputes his journalistic credentials. The issue of whether Assange is a journalist and publisher would almost certainly be one of the main battlegrounds in the event of the US seeking his extradition from the UK. The definition of WikiLeaks by the information tribunal, which is roughly equivalent to a court, could help Assange’s defence against extradition on press freedom grounds. The US has been considering prosecution of Assange since 2010 when WikiLeaks published hundreds of thousands of confidential US defence and diplomatic documents. US attorney general Jeff Sessions said in April this year that the arrest of Assange is a priority for the US.

The director of the CIA, Mike Pompeo, after leaks of emails from the US Democratic party and from Hillary Clinton, described WikiLeaks as “a non-state hostile intelligence service often abetted by state actors like Russia”. He added Assange is not covered by the US constitution, which protects journalists. But the UK’s information tribunal, headed by judge Andrew Bartlett QC, in a summary and ruling published on Thursday on a freedom of information case, says explicitly: “WikiLeaks is a media organisation which publishes and comments upon censored or restricted official materials involving war, surveillance or corruption, which are leaked to it in a variety of different circumstances.” The comment is made under a heading that says simply: “Facts”.

The tribunal’s definition of WikiLeaks comes in the 21-page summary into a freedom of information case heard in London in November. An Italian journalist, Stefania Maurizi, is seeking the release of documents relating to Assange, mainly in regard to extradition, and had lodged an appeal with the tribunal. While the tribunal dismissed her appeal, it acknowledged there issues weighing in favour of public disclosure in relation to Assange. But it added these were outweighed by a need for confidentiality on the matter of extradition.

A long cold lonely winter.

• EU Leaders Clash Over Refugees (R.)

Two years after the Mediterranean migrant crisis blew a hole in the European Union, a tentative effort to patch up differences over what to do with refugees underlined continuing rifts among the bloc’s leaders. A free-wheeling discussion over a Brussels summit dinner that began on Thursday night and spilled into the wee hours of Friday was intended to clear the air and see if there was a way to reconcile opposing views on how to reform defunct asylum rules. But leaders emerging from nearly three hours of talks made clear that while there was little of the angry passion of 2015, when a million people flooded into Greece and headed for Germany, the “frank and sober” discussion failed to blunt sharp rifts pitting some eastern states against many of the rest.

“We have a lot of work to do,” German Chancellor Angela Merkel told reporters. “The positions have not changed.” Divisions over how to share out relatively small numbers of refugees have poisoned relations in the EU, complicating efforts to present a united front in talks with London on Brexit and to agree an EU budget out to 2028. New Polish and Czech leaders stuck to lines shared with Hungary and Slovakia that their ex-communist societies cannot accept significant immigration, especially of Muslims. Czech Prime Minister Andrej Babis called the debate “quite stormy” and told reporters that Greek Prime Minister Alexis Tsipras had been “quite aggressive.” But, he said, the eastern allies would not let the majority impose obligatory refugee quotas on them.

Merkel and Italian Prime Minister Paolo Gentiloni were among those who demanded that all countries take in a mandatory share of people requiring asylum, who have been concentrated on the Mediterranean coast, or after chaotic movements across Europe, in the richer northwest of the bloc.

Only viable in countries that provide the good example.

• Palau Makes All Visitors Sign Pledge To Respect Environment (G.)

The tiny Pacific island nation of Palau has introduced a new law requiring visitors to sign a pledge not to harm the environment before entering the country. The pledge will be stamped into the passports of international arrivals from this month. Visitors will be required to sign before proceeding through immigration, making a formal promise to the children of Palau to “preserve and protect your beautiful and unique island home”, and to “tread lightly, act kindly and explore lightly”. Almost 6,000 people signed in the first two weeks. It’s the first time such a pledge has been written into a country’s immigration policies, but Palau has long been vocal about the environment. The country has already reported larger tides and an increase in severe tropical storms. The sea level around its 700 islands has risen by about 9mm a year since 1993, almost three times the global average rate.

President Tommy Remengesau is a vocal environmental campaigner. He told a United Nations climate forum in 2014 that if the world failed to act to curb its carbon emissions, “our global warming doomsday is already set in stone”. In 2015 Palau created the world’s sixth-largest marine sanctuary, protecting 80% of its maritime territory, an area of tuna-rich ocean the size of California, from both fishing and oil drilling. Remengesau said he hoped that requiring visitors to sign a pledge to protect the environment would create a cultural shift among tourists and make them aware of the fragility of the environment. “While Palau may be a small-island nation, we are a large ocean-state and conservation is at the heart of our culture,” he said. “We rely on our environment to survive and if our beautiful country is lost to environmental degradation, we will be the last generation to enjoy both its beauty and life-sustaining biodiversity.”

Not surprising.

• Arctic Warming So Rapid That Computer Measuring It Rejected The Results (Ind.)

Climate change in the Arctic has “outrun” a computer designed to measure it. So rapid was the temperature change at a weather station in Alaska, the computer analysing the data detected an error and stopped recording the correct temperature. In a blog post, US National Oceanic and Atmospheric Administration (NOAA) climate scientist Dr Deke Arndt explained the recent incident, referring to it as “an ironic exclamation point to swift regional climate change in and near the Arctic”. The weather station is located in Utqiagvik, the most northerly town in the US. Low levels of sea ice in the region caused the air temperatures to rise quickly. The computers NOAA use to automatically record climate data have in-built algorithms that ensure the information they record is accurate.

This algorithm is meant to be triggered if the instruments measuring temperatures are damaged, or if there is an artificial change in the environment surrounding them. In this case, the temperature change was such a shock to the system that the computer “disqualified itself” from the Alaskan temperature analysis. This left northern Alaska “analysed a little cooler than it really was”, wrote Dr Arndt. The data from the station was missing for all of 2017, and the last few months of 2016. “In this case, instead of a station move, or urban sprawl, or an equipment change, it was actually very real climate change that changed the environment, by erasing a lot of the sea ice that used to hang out nearby,” wrote Dr Arndt. The Arctic is warming at twice the rate of the global average, meaning the effects of climate change are felt particularly keenly in polar regions.

Home › Forums › Debt Rattle December 15 2017