MC Escher Relativity 1953

Full blast casino.

• ‘Buy the Dip’ Has Never Been More Popular in US Stocks (BBG)

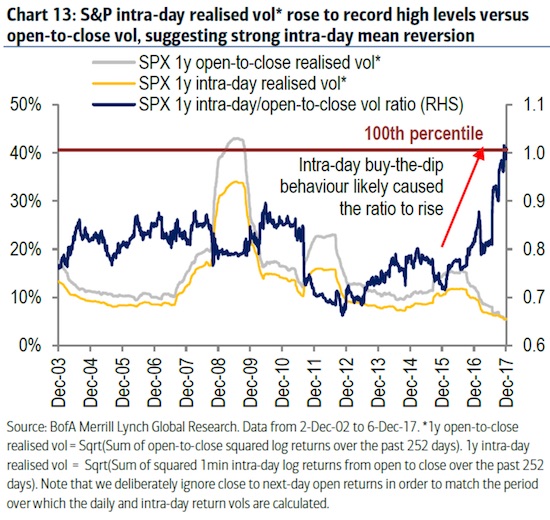

“Buy the dip” has never been so popular. The practice of treating any and all pullbacks in risk assets as opportunities to accumulate more has become entrenched in global equity markets, especially in the U.S., according to analysts at Bank of America Merrill Lynch. “Investors no longer fear shocks but love them,” a team led by global equity derivatives researcher Nitin Saksena wrote in a note Tuesday. “Since 2013, central banks have stepped in (or communicated that they may step in) to protect markets, leaving investors confident enough to ‘buy-the-dip.’” Intraday realized volatility for the S&P 500 Index relative to the realized volatility in the open-close ratio for the benchmark gauge has soared to record highs this year, emblematic of an environment in which buying the dip has become gospel for traders, according to the bank’s analysis of price action going back to 2003.

This ratio is also above the 90th%ile for the Euro Stoxx 50 Index and Nikkei 225. In practice, this suggests any early weakness in stocks is being met with an onslaught of buying that propels the index back to where it opened by the time the closing bell sounds. BofA equity derivatives strategist Clovis Couasnon puts it this way: Imagine the S&P 500 Index is down 1% at midday, only to rebound and finish broadly unchanged. The open-to-close return would be close to zero, but under the surface there were two moves of about 1%. “So if the buy-the-dip behavior is strong enough to cause mean reversion, this will cause intraday vol to be more supported than open-to-close vol,” he explained.

Buy the dip 2.0. Why does this make me feel nervous?

• Bitcoin Bears Soon Able to Short Futures Through Interactive Brokers (BBG)

Interactive Brokers plans to let bitcoin bears bet against the digital currency’s recently debuted futures contracts. Starting this week, the brokerage will allow its users to take short positions on bitcoin futures under certain conditions, according to company spokeswoman Kalen Holliday, who said the decision was made “in response to client demand.” Interactive Brokers has accepted long positions with a margin requirement of at least 50% since the contracts debuted Sunday on Cboe Global Markets Inc. Shorting bitcoin futures, or betting that their price will fall, is potentially an even riskier strategy.

It’s possible to lose an unlimited amount of money on a short position, particularly if the cost of the digital currency and its derivatives continues to climb. Interactive Brokers has a few requirements for shorting bitcoin futures: the spread must be one-to-one, and the short leg must have the earlier expiry date so that once it expires the surviving leg will be long, according to Holliday. Trading won’t be offered in retirement accounts or to Japanese residents.

That’s going to hurt.

• China’s GDP Growth Set To Plunge To Near 30-Year Low In 2018 – ADB (CNBC)

China’s economy will expand a bit faster than expected this year on resilient consumption but growth will stutter in 2018, the Asian Development Bank said Wednesday. Growth on the mainland is now expected at 6.8% in 2017, up from the previous forecast of 6.7%, the Asian Development Bank (ADB) said in its latest forecasts released on Wednesday. Growth prospects in China for 2017 have been revised upward as spending by households has held up reasonably well. Still, persisting headwinds will weigh on economic impulses next year. The world’s second-largest economy is likely to grow by 6.4% in 2018 due to “controlled moderation” in the economy, Joseph Zveglich, ADB’s macroeconomic research director told CNBC. That would mark the slowest pace of expansion since 1990, according to World Bank data.

The Chinese government is treading a thin line between deleveraging and keeping its debt-fueled economy humming. Growth in the wider region will also be a bit better this year. Stronger-than-expected exports and domestic consumption likely lifted economic growth in developing Asia in 2017, the ADB said. The upgraded outlook saw GDP growth in the region of developing Asia moving up 0.1 percentage point to 6% in 2017. The region includes 45 ADB members including China, Hong Kong, South Korea and Singapore, but excludes Japan. The rosier prediction came after a year of uncertainty due to fears of trade protectionism. There was “stronger-than-expected growth in most of our economies especially in terms of the pickup in trade,” Zveglich said.

Said it often before: China is exporting its credit Ponzi and its overcapacity. The countries along the Belt Road will end up paying.

• Free Money From China Comes With Strings (CNBC)

China giveth, and China taketh away. Across Asia, the world’s second-largest economy has financed infrastructure projects as part of its massive, so-called Belt and Road program. But it’s entirely up to Beijing to decide which countries get funding and when — and Pakistan offers a cautionary tale. Pakistan is home to one of China’s central infrastructure schemes: a near $60 billion collection of land and sea projects known as the China-Pakistan Economic Corridor (CPEC). But Chinese President Xi Jinping’s administration said it would halt funding for three major roads that are part of the corridor, Pakistani newspaper Dawn reported last week, citing an Islamabad official. Beijing will resume funding after it releases “new guidelines,” the newspaper said.

[..] If true, the news is proof of China’s unilateral management style, analysts said. “What Beijing giveth, Beijing can also taketh away,” Ian Bremmer, president and founder of political consultancy Eurasia Group, wrote in a recent note. Unlike the Asian Infrastructure Investment Bank, another China-led program, Belt and Road projects “aren’t transparent or consensus driven,” he said. “The nature of Chinese economic decision-making has the potential to cause significant downside risks for those countries that become most dependent on the Belt Road initiative,” he said. Nations that suddenly fall out of political favor with Beijing, for whatever reason, could subsequently suffer weighty economic consequences.

The Fed hasn’t even started to tighten yet. The feast of liquidity just goes on. But it can’t going forward, or Fed credibility is gone.

• 2700 By Christmas? (Roberts)

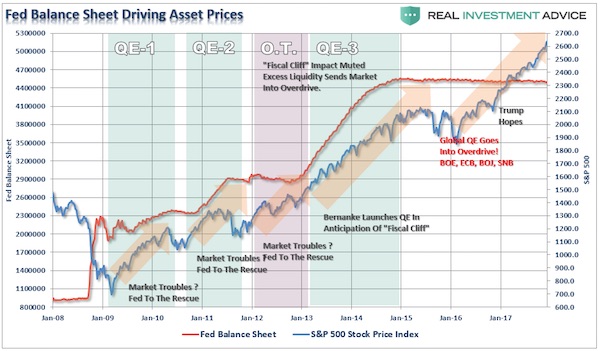

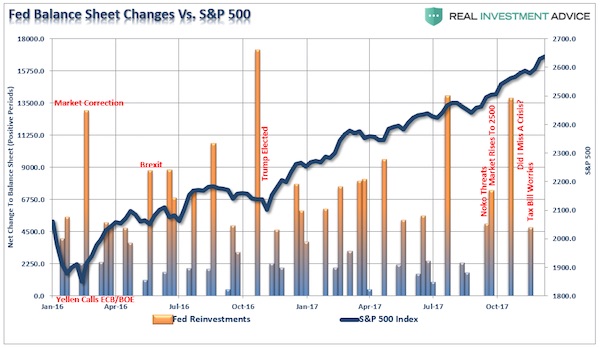

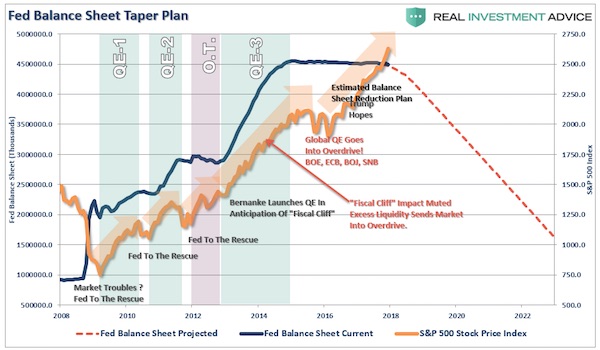

Following the early 2016 correction, the “carry trade” has picked up steam and has continued to force asset prices higher as liquidity seeks opportunity. With the “carry trade” now extremely extended currently, which is also highly leveraged, watch for a triggering of a “sell signal” as a sign to temporarily reduce equity-related risk. But wait, the Fed is reducing their liquidity flows into the financial system, right? Not so much. As shown in the first chart below, the Fed’s balance sheet continues to remain stable even as asset prices surge.

With global Central Banks still flooding the system with liquidity, the Fed has yet to begin rolling off their reinvestments as expected. In fact, the Fed made a timely reinvestment during the “Senate Tax Bill” debacle earlier this month.

Of course, that bump of liquidity sent asset prices rocketing higher. The question becomes just what will happen to the markets when the Fed actually does begin to aggressively decrease their “reinvestments” in the coming year. The projected decline in the balance sheet looks like the following. One can only imagine how a market which has been repeatedly driven higher on a “feast of liquidity,” either from the Fed or other Central Banks, will react to being put on a diet.

“The gain to the US from Nafta: just 0.1 per cent of GDP. If the same effort had gone into creating decent jobs, would we have Trump?”

Globalization automatically leads to Misallocation.

• The Great Globalisation Lie (Rodrik)

According to the celebrated Stolper-Samuelson theorem of trade theory, in places—like the US and western Europe—where skilled workers are plentiful, unskilled workers will see their wages decline under freer trade. Openness to trade always hurts some people in society, except in the extreme case (not relevant for any large economy) where the only things imported are things that are never produced at home. In theory, countries could always compensate their losers by redistributing from the winners, and in practice they sometimes did. With its extensive safety nets, Europe in the second half of the 20th century was relatively well prepared to deal with disruptive trade flows. In addition, trade negotiators initially carved out special regimes for garments and textiles exporters in the advanced economies, limiting their exposure.

Even in the best of circumstances, however, freeing up trade caused pain as well as gain. After the 1980s, the balance began to look worse and worse. When tariffs (like taxes) are too high they distort economic behaviour more, and do more damage to prosperity. Back in the 1950s and 1960s, tariffs were often very high and so their reduction did much to grow the overall economic pie. But four or five decades later, in a world where typical tariffs were in single figures, the picture was different. If you’re starting off with the tariffs of the post-war era, the standard economic models suggest that to achieve an overall net gain of $1 in national income through liberalising trade, you could expect to see around $4 or $5 of income being reshuffled across different groups within a particular country.

But under the tariffs that applied by the end of the 20th century, achieving that overall dollar of gain would be associated with as much as $20 being redistributed, implying the creation of an awful lot of losers. And what’s more, by the 1990s we were into an era of welfare state retrenchment rather than expansion. So it became less plausible than it used to be to believe that those losses will be compensated.

Long read.

• Britain Doesn’t Appear To Be Collapsing As A Result Of Brexit (Bilbo)

Do you remember back to May 2016, when the British Treasury, which is clearly full of mainstream macroeconomists who have little understanding of how the system actually operates released their ‘Brexit’ predictions? The ‘study’ (putting the best spin possible on what was a tawdry piece of propaganda) – HM Treasury analysis: the immediate economic impact of leaving the EU – was strategically released to have maximum impact on the vote, which would come just a month later. Fortunately, for Britain and its people, the attempt to provide misinformation failed. As time passes, while the British government and the EU dilly-dally about the ‘divorce’ details, we are getting a better picture of what is happening post-Brexit as the ‘market’ sorts what it can sort out.

Much has been said about the destructive shifts in trade that will follow Brexit. But these scaremongers fail to grasp that Britain has been moving away from trade with the EU for some years now and that process will continue into the future. I come from a nation that was dealt a major trading shock at the other end of Britain’s ill-fated dalliance with Europe. It also made alternative plans and prospered as a result. The outcomes of Brexit will be in the hands of the domestic policies that follow. Stick to neoliberalism and there will be a disaster. But the opportunity is there for British Labour to recast itself and seize the scope for better public infrastructure, better services and stronger domestic demand. Then the nation will see why leaving the corporatist, austerity-biased failure that the EU has become was a stroke of genius.

The only good thing about the Treasury Report was that it was “Printed on paper containing 75% recycled bre content minimum” but even then it was a waste of real resources.

“.. the money that the Fed loaned to the US government (in exchange for a bond) was never there in the first place. The Fed prestidigitated it out of an alternate universe.”

So, the Fed has this thing called a balance sheet, which is actually a computer file, filled with entries that denote securities that it holds. These securities, mostly US government bonds of various categories and bundles of mortgages wrangled together by the mysterious government-sponsored entity called Freddie Mac, represent about $4.5 trillion in debt. They’re IOUs that supposedly pay interest for a set number of years. When that term of years expires, the Fed gets back the money it loaned, which is called the principal. Ahhhh, here’s the cute part! You see, the money that the Fed loaned to the US government (in exchange for a bond) was never there in the first place. The Fed prestidigitated it out of an alternate universe. They gave this money to a “primary dealer” bank in exchange for the bond, which the bank abracadabraed up for the US Treasury.

Well, not really. In fact, the Fed just made a notation on the bank’s “reserve” account that the money from the alternate universe appeared there. Somehow that money was sent via a virtual pneumatic tube to the US Treasury, where it was used to pay for drones to blow up Yemeni wedding parties, and for the Secret Service to visit pole dancing bars when the president traveled to foreign lands. Here’s the fun part. The Fed announces that it is going to shed this nasty debt, at about $10 billion worth a month starting this past October. Their stated goal is to reach an ultimate wind-down velocity of $50 billion a month (cue laugh track). If they ever get there (cue laugh track) it would take 20 years to complete the wind-down. The chance of that happening is about the same as the chance that Janet Yellen will come down your chimney on December 24 with a sack-full of chocolate Bitcoins.

But never mind the long view for the moment. One way they plan to accomplish this feat is to “roll off” the bonds. That is, when the bonds mature — i.e. come to the end of their term — they will cease to exist. Poof! Wait a minute! When a bond matures, the issuer has to send the principal back to the lender. After all, the Fed lent the US Treasury X-billion dollars, the US Treasury paid interest on the loan for X-years, and now it has to fork over the full value of the loan (hopefully in dollars that have magically inflated over the years and are now worth less than when they were borrowed — another magic trick!). But that doesn’t happen.

More calls for more special counsels.

• FBI Officials Said Clinton ‘Has To Win’ Race To White House (R.)

Senior FBI officials who helped probe Donald Trump’s 2016 presidential campaign told a colleague that Democratic Presidential candidate Hillary Clinton had to win the race to the White House, the New York Times reported on Tuesday. Peter Strzok, a senior FBI agent, said Clinton “just has to win” in a text sent to FBI lawyer Lisa Page, the Times reported. The messages showed concern from Strzok and Page that a Trump presidency could politicize the FBI, the report said, citing texts turned over to Congress and obtained by the newspaper.

Justice Department Inspector General Michael Horowitz is investigating the texts in a probe into FBI’s handling of its investigation into Clinton’s use of a private email server for official correspondence when she was Secretary of State under former President Barack Obama, the report added. Strzok was removed from working on the Russia probe after media reports earlier this month suggested he had exchanged text messages that disparaged Trump and supported Clinton. Strzok was involved in both the Clinton email and Russia investigations.

You don’t say.

• Former Facebook Executive: Social Media Is Ripping Society Apart (G.)

A former Facebook executive has said he feels “tremendous guilt” over his work on “tools that are ripping apart the social fabric of how society works”, joining a growing chorus of critics of the social media giant. Chamath Palihapitiya, who was vice-president for user growth at Facebook before he left the company in 2011, said: “The short-term, dopamine-driven feedback loops that we have created are destroying how society works. No civil discourse, no cooperation, misinformation, mistruth.” The remarks, which were made at a Stanford Business School event in November, were just surfaced by tech website the Verge on Monday. “This is not about Russian ads,” he added. “This is a global problem. It is eroding the core foundations of how people behave by and between each other.”

Palihapitiya’s comments last month were made a day after Facebook’s founding president, Sean Parker, criticized the way that the company “exploit[s] a vulnerability in human psychology” by creating a “social-validation feedback loop” during an interview at an Axios event. Parker had said that he was “something of a conscientious objector” to using social media, a stance echoed by Palihapitaya who said that he was now hoping to use the money he made at Facebook to do good in the world. “I can’t control them,” Palihapitaya said of his former employer. “I can control my decision, which is that I don’t use that shit. I can control my kids’ decisions, which is that they’re not allowed to use that shit.” He also called on his audience to “soul-search” about their own relationship to social media. “Your behaviors, you don’t realize it, but you are being programmed,” he said. “It was unintentional, but now you gotta decide how much you’re going to give up, how much of your intellectual independence.

It often seems that the only thinking people are in courts.

• Japan Court Bars Restart of Nuclear Reactor Shut After Fukushima (BBG)

A Japanese court overturned a ruling that allowed a nuclear reactor in the country’s south to operate, frustrating the government’s push to bring online dozens of plants shut in the wake of the 2011 Fukushima disaster. The decision by the Hiroshima High Court, which cited risks from nearby volcanoes, sides with local citizens and reverses a lower court’s ruling that had cleared the way for Shikoku Electric Power to operate its Ikata No. 3 unit, according to an emailed statement Wednesday from the company. The reactor, which restarted last year under stricter safety regulations, has been shut for maintenance and was scheduled to restart on Jan. 20. Shikoku Electric fell as much as 11% in Tokyo, the biggest decline in more than four years, before paring the drop to 8.3%.

The injunction issued by the court is a blow to Prime Minister Shinzo Abe’s goal of having nuclear power account for as much as 22% of the nation’s electricity mix by 2030. Public opposition through local courts and municipal governments has emerged as one of the biggest obstacles to that plan. Just four of Japan’s 42 operable nuclear reactors are currently online. The ruling was the first time a high court in Japan has overturned a lower court on the issue of nuclear restarts since the Fukushima disaster. A district court in Hiroshima sided with the utility in March in deciding not to issue a temporary injunction. Shikoku called Wednesday’s ruling “unacceptable” and said it will try to get it reversed. The injunction is effective through Sept. 30, 2018, according to court documents.

That loud sucking sound.

• Greeks Crushed By Tax Burden (K.)

Tax authorities have confiscated the salaries, pensions and assets of more that 180,000 taxpayers since the start of the year, but expired debts to the state have continued to rise, reaching almost €100 billion, as the taxpaying capacity of the Greeks is all but exhausted. In the month of October, authorities made almost 1,000 confiscations a day from people with debts to the state of more than €500. In the first 10 months of the year, the state confiscated some €4 billion, and the plans of the Independent Authority for Public Revenue provide for forced measures to be imposed on 1.7 million state debtors next year. IAPR statistics show that in October alone, the unpaid tax obligations of households and enterprises came to €1.2 billion. Unpaid taxes from January to October amounted to €10.44 billion, which brings the total including unpaid debts from previous years to almost €100 billion, or about 55% of the country’s GDP.

The inability of citizens and businesses to meet their obligations is also confirmed by the course of public revenues, which this year have declined by more than €2.5 billion. The same situation is expected to continue into next year, as the new tax burdens and increased social security contributions look set to send debts to the state soaring. Notably, since 2014, there has been a consolidated trend of a €1 billion increase each month in expired debts to the state. There are now 4.17 million taxpayers who owe the state money. This means that one in every two taxpayers is in arrears to the state, with 1,724,708 taxpayers facing the risk of forced collection measures. Of the €99.8 billion of total debt, just €10-15 billion is still considered to be collectible, as the lion’s share concerns debts from previous years, in many cases of bankrupt enterprises and deceased individuals.

“It’s a spot where one can buy and sell drugs, or the bodies of underage boys who are stuck in Greece thanks to a recent law change that dictates they must stay here until they come of age.”

• The Refugee Crisis In Greece Hasn’t Gone Away And Our Leaders Don’t Care (NS)

It’s just after nine on an ordinary Thursday night. About 50 people are gathered next to the main entrance of Pedion Tou Areos, the park at the northern limits of central Athens. The weather is now unmistakably cold, but the refugees gathering every night here seem to be increasing in number. It’s a spot where one can buy and sell drugs, or the bodies of underage boys who are stuck in Greece thanks to a recent law change that dictates they must stay here until they come of age. Both the drugs and the boys are cheap. A few euros for a hit of sisa, a synthetic drug called “the cocaine of the poor”, and a tenner for a session in the park’s bushes with kids as young as 14. The faces change, but the situation remains the same, or worse.

A 14-year-old boy from Afghanistan called Mohammed who was working in the park disappeared over the summer without a trace. He most probably made his way towards the border, to be smuggled out. If he’s lucky he will have made it to northern Europe. If not, he will just be one of thousands who have vanished in the Balkan corridor. It’s now December and winter is being felt across the country. Storms in October and November flooded parts of Greece, turning the open air camps that still hold thousands of refugees in more than 50 locations into mudpits. A video shared by refugees currently staying in Moria, the camp on the island of Lesvos that sits at the forefront of the Greek refugee crisis, shows a small child crying while walking through the camp’s grounds. Tents provided by the UNHCR and the Greek state are in bad shape.

Some have caved in. Floors are under mud and water. “They are trying to turn the island into Greece’s Guantanamo,” said the mayor of Mytilene, the capital of Lesvos, at a press conference. If you climb up a little hill on the side of the camp, you can get a good view of the compound. A year ago, the refugees had mostly been staying in prefabs, but fires, accidents and overcrowding brought the tents back. [..] An emergency relief programme is relocating people from Lesvos to camps across Greece, 30 to 50 at a time. But the rest of the camps are in is no better shape. Recently, a nine-year-old boy from Afghanistan tried to commit suicide on Chios, another Greek island. The doctors treating him suspected he had been abused inside the camp. It’s no suprise. Médecins Sans Frontières Greece said that “in our clinic in Lesvos, we have at least ten people per day who have self-harmed or attempted suicide. The situation in the islands is beyond desperate.”

“The Arctic has traditionally been the refrigerator to the planet, but the door of the refrigerator has been left open..”

• Arctic Permafrost Thawing Faster Than Ever (AP)

Permafrost in the Arctic is thawing faster than ever, according to a new US government report that also found Arctic seawater is warming and sea ice is melting at the fastest pace in 1,500 years. The annual report released on Tuesday by the National Oceanic and Atmospheric Administration showed slightly less warming in many measurements than a record hot 2016. But scientists remain concerned because the far northern region is warming twice as fast as the rest of the globe and has reached a level of warming that’s unprecedented in modern times. “2017 continued to show us we are on this deepening trend where the Arctic is a very different place than it was even a decade ago,” said Jeremy Mathis, head of NOAA’s Arctic research program and co-author of the 93-page report.

Findings were discussed at the American Geophysical Union meeting in New Orleans. “What happens in the Arctic doesn’t stay in the Arctic; it affects the rest of the planet,” said acting NOAA chief Timothy Gallaudet. “The Arctic has huge influence on the world at large.” Permafrost records show the frozen ground that many buildings, roads and pipelines are built on reached record warm temperatures last year nearing and sometimes exceeding the thawing point. That could make them vulnerable when the ground melts and shifts, the report said. Unlike other readings, permafrost data tend to lag a year. Preliminary reports from the US and Canada in 2017 showed permafrost temperatures are “again the warmest for all sites” measured in North America, said study co-author Vladimir Romanovsky, a professor at the University of Alaska in Fairbanks.

Arctic sea ice usually shrinks in September and this year it was only the eighth lowest on record for the melting season. But scientists said they were most concerned about what happens in the winter – especially March – when sea ice is supposed to be building to its highest levels. Arctic winter sea ice maximum levels in 2017 were the smallest they’ve ever been for the season when ice normally grows. It was the third straight year of record low winter sea ice recovery. Records go back to 1979. About 79% of the Arctic sea ice is thin and only a year old. In 1985, 45% of the sea ice in the Arctic was thick, older ice, said NOAA Arctic scientist Emily Osborne

Home › Forums › Debt Rattle December 13 2017