Caravaggio I musici 1595-96

3xvaxxed

Misinformation is dangerous. Silencing doctors is even more so. pic.twitter.com/s2vCEgSC1l

— Texas Truth Foundation (@TexasTruthFound) June 10, 2022

Tulsi woke

https://twitter.com/i/status/1535920648622444545

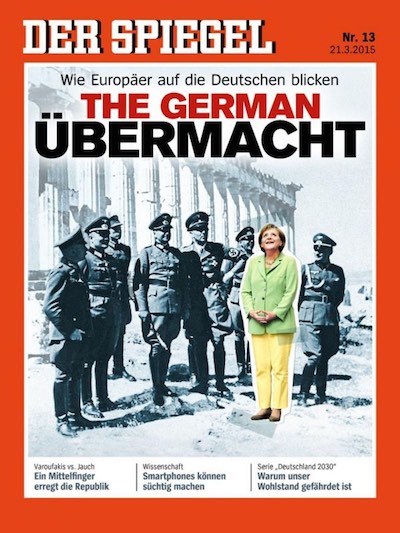

Are the leaders of France, Germany and Italy going to talk some sense into Zelensky?

• Russia Gains More Ground in Donbas Region (WSJ)

The leaders of France, Germany and Italy plan to meet with Ukrainian President Volodymyr Zelensky in Kyiv this week, officials said, as reports showed Russia making gains in the country’s east and Ukrainian officials urgently sought arms from Western nations to hold Russian forces at bay. French President Emmanuel Macron, German Chancellor Olaf Scholz and Italian Prime Minister Mario Draghi were planning to visit the Ukrainian capital on Thursday, said two European officials, who cautioned that plans could yet change. The trip would be the first to Ukraine since the beginning of the war for the three Western leaders.

News of the planned meeting came as Ukrainian officials said Russia had made fresh gains in its efforts to encircle and capture the city of Severodonetsk, which would bring Moscow significantly closer to its goal of controlling the Donbas area in the country’s east, its foremost target recently in the war. Serhiy Haidai, the Ukrainian governor of the Luhansk region, which includes Severodonetsk, said on Sunday that Russians had destroyed a second bridge connecting Severodonetsk to Lysychansk, a Ukrainian stronghold just across the Siverskyi Donets river. Russian forces also shelled a chemical plant in the city’s industrial section, where civilians had taken shelter in bunkers, Mr. Haidai said.

The battlefield advances were the latest evidence that Russia is outgunning Ukrainian forces, using its superior artillery power to steadily take territory. Its gains have thrown added focus onto Ukraine’s pleas for more powerful and longer-range artillery and other weaponry from the West, as well as on Ukraine’s lack of capacity to manufacture ammunition for the Soviet-era heavy weapons in its arsenal.

Why would an economist want to opine on this?

• Should Russia Pay Reparations For The Ukraine War? (Barry Eichengreen)

Russia’s war on Ukraine shows no sign of ending, but it is not too soon to start thinking about how to ensure postwar Ukraine’s stability, prosperity, and security. Already, two discussions are occurring: one about financing economic reconstruction, and the other about affirming Ukraine’s external security. The problem is that these discussions are proceeding separately, even though the issues are intimately related. Reconstruction costs are uncertain because the course of the war is uncertain. Ukraine’s prewar GDP was about $150bn (£120bn). Given a capital-output ratio of three, and assuming that a third of the capital stock will be destroyed, we are again talking about $150bn. As always, alternative assumptions yield alternative scenarios, but $150bn seems like a reasonable starting point.

This is not an impossible amount of aid for donors to commit. It is one-sixth the size of the NextGenerationEU program on which EU states agreed in July 2020. It is one-twelfth the size of the American Rescue Plan Act signed by Joe Biden in March 2021. Still, it seems wrong to ask the US and Europe to repair what Russia has broken. So, it is tempting to suggest that Ukraine’s reconstruction should be financed by garnishing Russian assets. At $284bn, the Bank of Russia’s frozen reserves would certainly fit the bill. True, there is a moral case for reparations: Russia started an unprovoked war and has almost certainly committed war crimes in prosecuting it. There is also an argument grounded in deterrence. As Volodymyr Zelenskiy put it at Davos this year: “If the aggressor loses everything, then it definitely deprives him of his motivation to start a war.”

It’s a popular topic.

• Effort to Force Russia to Pay Reparations to Ukraine Faces Uphill Battle (WSJ)

Since Russian forces swept into Ukraine on Feb. 24, swaths of the country’s buildings and infrastructure have been damaged or destroyed, leading to calls for Moscow to pay for the damage. As the leading western backer of Ukraine in the conflict, the U.S., which also holds some of Russia’s frozen assets, would likely be critical to any effort to get Moscow to pay for that damage. Yet even if Washington were to try to force Russia to pay reparations, the Biden administration would have limited options for making Moscow comply, particularly while the war rages on, according to former officials and legal experts. Ukrainian President Volodymyr Zelensky has called on Russia to compensate his country, saying in early May the war had caused more than $600 billion in damage to Ukraine’s infrastructure. The figure has only grown as the war continues.

There is, in theory, a pot of money for the West to draw on if it wants to force Russia to pay. Russian Finance Minister Anton Siluanov said in March that half the country’s gold and foreign-currency reserves were frozen as a result of sanctions, denying Moscow access to roughly $300 billion, according to the TASS news agency. The share of Russia’s foreign-exchange reserves held in Chinese currency wasn’t affected. When the Biden administration in late April submitted its $33 billion supplemental funding request for Ukraine, the White House said it was “proposing legislation to streamline the process to recoup proceeds from seized and forfeited assets and use them to remediate the harm caused in Ukraine.”

Cui bono?

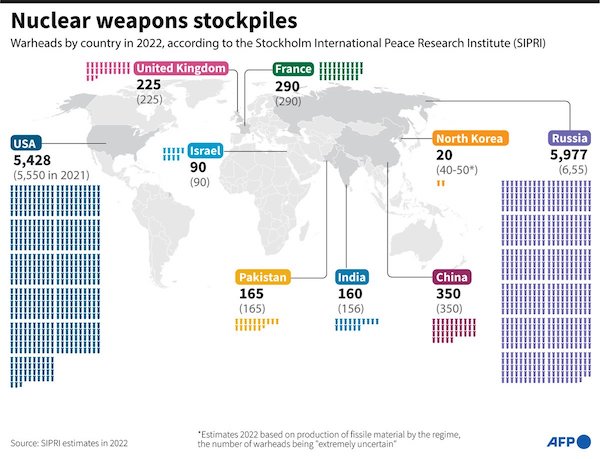

• Global Nuclear Arsenal Set To Grow For First Time In Decades (R.)

The global nuclear arsenal is expected to grow in the coming years for the first time since the cold war, and the risk of such weapons being used is the greatest in decades, a leading conflict and armaments thinktank says. Russia’s invasion of Ukraine and western support for Kyiv has heightened tensions among the world’s nine nuclear-armed states, the Stockholm International Peace Research Institute (Sipri) thinktank said on Monday in a new set of research. While the number of nuclear weapons fell slightly between January 2021 and January 2022, Sipri said that unless immediate action was taken by the nuclear powers, global inventories of warheads could soon begin rising for the first time in decades.

“All of the nuclear-armed states are increasing or upgrading their arsenals and most are sharpening nuclear rhetoric and the role nuclear weapons play in their military strategies,” Wilfred Wan, the director of Sipri’s weapons of mass destruction program, said in the thinktank’s 2022 yearbook. “This is a very worrying trend.” Three days after Moscow’s invasion of Ukraine, which the Kremlin calls a “special military operation”, President Vladimir Putin put Russia’s nuclear deterrent on high alert. He has also warned of consequences that would be “such as you have never seen in your entire history” for countries that stood in Russia’s way.

Russia has the world’s biggest nuclear arsenal with a total of 5,977 warheads, 550 more than the United States. The two countries possess more than 90% of the world’s warheads, though Sipri said China was in the middle of an expansion with more than 300 new missile silos according to the latest estimate. Sipri said the global number of nuclear warheads fell from 13,080 in January 2021 to 12,705 in January 2022. An estimated 3,732 warheads were deployed with missiles and aircraft, and around 2,000 – nearly all belonging to Russia or the US – were kept in a state of high readiness.

No, it’s too rare.

• Army Official Predicted Vaccines Might Be Paused Over Myocarditis (ET)

A U.S. military official predicted a pause in the administration of the Moderna and Pfizer COVID-19 vaccines could happen if more cases of post-vaccination heart inflammation were detected, according to newly obtained emails. Harry Chang, a U.S. Army lieutenant colonel, made the prediction on April 27, 2021—the same day the director of the U.S. Centers for Disease Control and Prevention (CDC) said the agency was not seeing a safety signal when it came to heart inflammation experienced after getting a COVID-19 vaccine. Chang noted the pause in the administration of the Johnson & Johnson vaccine over blood clots and said an increased number of heart inflammation issues could trigger a similar action.

“A pause of the Pfizer/Moderna administration (much like the J&J blood clot pause) will have an adverse impact on US/CA vaccination rates; assessed as unlikely due to causes of myocarditis can come from multiple sources (eg. COVID, other conditions, other vaccines/prescriptions, etc),” Chang wrote in an email. Myocarditis is a type of heart inflammation. “However, increased reported #s & media attention is likely to trigger a safety review pause by ACIP/FDA,” he added, referring to the Advisory Committee on Immunization Practices, which advises the CDC on vaccines, and the U.S. Food and Drug Administration (FDA), which decides whether to clear immunizations. Chang was talking to Tricia Blocher, an official at the California Department of Public Health, and other California and military officials. He was reacting to a story about the U.S. Department of Defense detecting a higher-than-expected number of cases of heart inflammation in troops following COVID-19 vaccination.”

Montagnier

Another Dr who has started to warn us and was SILENCED FOREVER

He was getting ready to testify against the shots.His name was Luc Montagnier. And he called out VAIDS… Destruction of the immune system by the injections pic.twitter.com/TooVh4EPL5

— Xx (@Xx17965797) June 11, 2022

Very rare,

• 99% Certain Justin Bieber’s Facial Paralysis Caused By Covid Vaccine (Kirsch)

The VAERS data shows that Ramsay Hunt Syndrome (RHS) is 160 times more likely after a COVID vaccination than for all the other vaccines combined in any given year. And if you exclude the anthrax vaccine from that comparison, the likelihood is simply too high to calculate (0 cases in 32 years). So the COVID vaccine should definitely be considered as a possible cause for this rare disease because when you’ve been vaccinated, it’s no longer rare. For example, one doctor tweeted he say 4 cases in a month, but had never seen any cases before in the 32 years he’s practiced medicine. All the cases had gotten the COVID vax 3 to 4 months earlier.

I show below that the estimated rate of RHS after COVID vaccination is likely at least 338 cases per 100,000. The medical literature says it occurs naturally in 5 cases per 100,000. Therefore, because it is much more likely after vaccine than by chance, it is 99% likely that Justin’s RHS was caused by the vaccine, and only 1% chance that he got “unlucky.” Sadly, it’s unlikely Bieber’s doctors will ever acknowledge that so it’s unlikely he’ll get the care he needs (treat both the RHS and the vaccine injury). He’ll simply assume he is just unlucky. The mainstream press isn’t doing its job if they don’t report this (which they won’t).

“..the attack on the Liberty dramatically demonstrates the nature of who exercises actual power in the United States.”

• USS Liberty: A Forgotten Anniversary (Moglia)

It is a property of the past to sink into oblivion, and of unpleasant truths to fade into evanescence. To such past belongs the attack on the USS Liberty. When to the session of sweet silent thought I summon up remembrance of things past, Israel’s 1967 war of Middle East invasion is/was for me but a negligible blip compared to other important personal events. Such as my getting ready to read the thesis for my degree in Electronic Engineering, in Genova, Italy. Therefore, without particular consciousness I submitted to the sentences of the official media without examining the authority of the judge. My first doubts arose not long later when I decided to visit the Eastern Orthodox Saint Catherine’s Monastery, located on the Sinai Peninsula at the very foot of Mt. Sinai. It could then only be reached from Tel Aviv via Sharm-el-Sheikh and a bus trip.

On welcoming the tourists on the bus the guide announced with pride that the Sinai was “now and forever an unalienable part of Israel.” I found the declaration irrelevant, if not odd, but I consider that moment as the beginning of my associated historical interest. The official US line is that, on Jun 8, 1967, the Israelis mistakenly attacked by air, and torpedoed by sea, an unarmed US intelligence ship, killing 34 sailors and wounding 171 others. 2022 marks the 55th anniversary of that attack. Following are some details of the ship, of the episode and of its aftermath. For, similar to occasions that perhaps we all have felt, a detail that uncalled-for returns to mind, rekindles fuller memories of a larger connected event, not otherwise spontaneously recalled. The detail is the inspired arrogance of the Israeli guide I mentioned. More in general, I think that the attack on the Liberty dramatically demonstrates the nature of who exercises actual power in the United States.

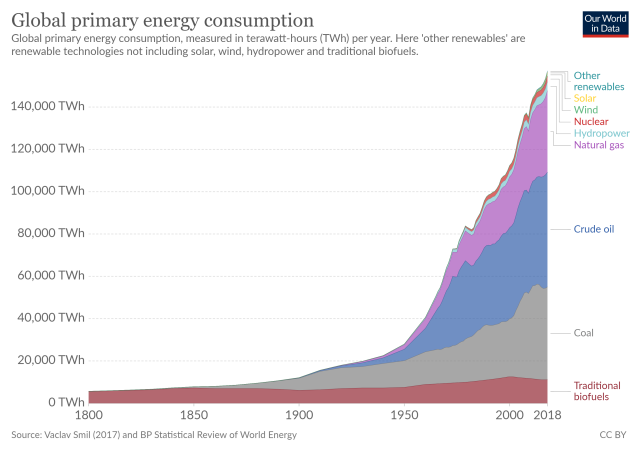

“..there is simply no way of maintaining even a fraction of the western standard of living in the event that anyone were foolish enough to remove the fossil fuels..”

• Greens Unlikely To Survive The Coming Winter (CoS)

By 2017, real-life James Bond Villain Klaus Schwab was inviting celebrities, representatives of the technocracy, the godzillionaires and the political class to fly their carbon-belching private jets to Switzerland to learn about The Fourth Industrial Revolution, and to discuss how they could get the little people to cut their carbon footprints. By 2020, this had morphed in to the Green New Great Reset in which we – but not they, of course – would own nothing, and allegedly be happy as we ate our insects, spent our central bank digital basic incomes, and were driven around in a new fleet of corporate-owned, hydrogen-powered self-driving cars. There was – to paraphrase Captain Blackadder – just one teensy-weensy problem with the Great Plan adopted by the Davos crowd… it was bollocks!

Only by ignoring the physicists, engineers and technicians who were expected to make it happen, and by listening instead to the siren voices of climate NGOs, bankers and economists, could the technocracy convince itself that the world could seamlessly transition to the proposed bright green future. And to our cost, politicians of all stripes who bought into this nonsense are now grappling with the inevitable economic consequences. The problem, at is simplest, is that much of what was considered “green” was largely a conjuring trick. States like Britain and Germany, which claim to be world leaders simply offshored their most polluting industries (and a large part of the waste) to less prosperous parts of the world where governments were happy to load the environmental costs onto the indigenous population in exchange for tradable foreign currency.

This was the only politically-acceptable means of hiding the fact that there is simply no way of maintaining even a fraction of the western standard of living in the event that anyone were foolish enough to remove the fossil fuels which make up some 80 percent of the energy mix in the UK, and 85 percent of the global economy. Even this is a simplification of the problem because each fuel source has its uses in specific niches of the global economy and so is not interchangeable. Wind and solar, for example, cannot generate the heat required to manufacture steel (although they can recycle it) or, ironically, to produce the silicon wafers and high-grade glass required in solar panels.

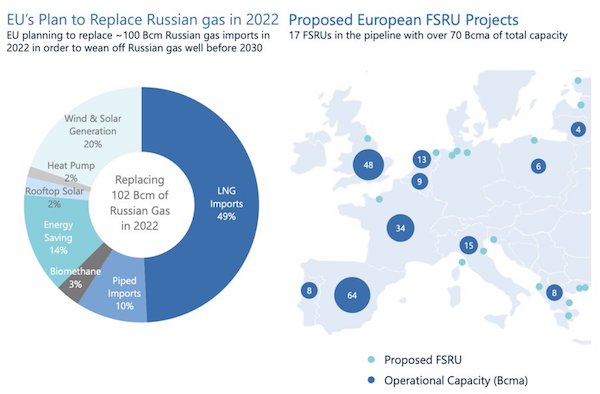

In 2021, LNG was maybe 10% of EU gas. It will have to be much more going forward. Disaster assured.

• Freeport LNG Explosion Raises Risk Of European Winter Energy Crisis (CNN)

A fire at one of the world’s biggest suppliers of liquefied natural gas has thrown Europe’s fragile energy security into doubt and spooked global gas markets. Freeport LNG, a liquefied natural gas (LNG) producer in Texas, will shut its doors for at least three weeks, the company confirmed to CNN Business. “The cause of the fire at Freeport LNG’s liquefaction facility on Quintana Island remains under investigation,” Heather Browne, a company spokesperson, said.

Europe has snapped up global stocks of LNG in recent months as it attempts to sharply pivot away from Russia’s natural gas exports. The region, including the United Kingdom, imported 28.2 million tons between February and April, according to Independent Commodity Intelligence Services — up 29% from the same period last year.

The United States is the world’s largest supplier of LNG, accounting for just over a fifth of global exports, according to data from analytics firm Vortexa. Output from the Freeport LNG facility makes up 18% of these exports. With no direct pipeline between the United States and Europe, American energy companies cool their natural gas for export to -260 degrees Fahrenheit and place the liquefied gas on tanker ships for overseas transport. That process, though more complex than land transport, has become crucial to Europe meeting its energy demands during Russia’s invasion of Ukraine. The Freeport blast could deal a blow to that stopgap solution, particularly if the facility fails to come back online soon. “Despite the initial estimate of three weeks of downtime by the operator, the production impact is likely to stretch into July,” Felix Booth, head of LNG at Vortexa, told CNN Business.

Adam Schiff is back.

• Jan. 6 Committee Caught ‘Lying and Altering Evidence’ (TH)

The January 6 committee is facing pressure as details reveal it lied and altered evidence to favor Democrat’s radical narrative of the Capitol Hill protests. Rep. Jim Jordan (R-OH) called out the committee for changing text messages between him and former White House chief of staff Mark Meadows during an interview on Fox News. A spokesperson admitted that the messages Rep. Adam Schiff (D-CA.) showed during the hearings had been adjusted to support the idea that Meadows wanted former Vice President Mike Pence to overturn the election results. In a statement, the spokesperson confessed that “the Select Committee on Monday created and provided Representative Schiff a graphic to use during the business meeting quoting from a text message from ‘a lawmaker’ to Mr. Meadows.

The graphic read, ‘On January 6, 2021, Vice President Mike Pence, as President of the Senate, should call out all electoral votes that he believes are unconstitutional as no electoral votes at all.’ In the graphic, the period at the end of that sentence was added inadvertently. The Select Committee is responsible for and regrets the error.” Jordan fired back saying “this committee has altered evidence and lied to the American people about it, so much so that they had to issue a statement which says, ‘We regret the error,’ which is government speak for, ‘We got caught lying.’” The “error” was that Schiff presented the message out of context by cutting out key words and ending it with a period.

According to the Federalist, the original text message was a summary of a legal briefing Jordan forwarded from lawyer Joseph Schmitz to Meadows the day before the Capitol protests, meaning that a “lawmaker” did not write the message at all. Jordan has been blocked from taking part in the committee by House Speaker Nancy Pelosi (D-CA.). He is now undergoing his own investigation of the events that took place that day last year.

“..the ability of governments to respond to this cost-of-living crisis via either tax cuts or increased benefits is limited due to the hit to public finances caused by lockdown-induced government spending.”

• Cost of Living Crisis a Result of Lockdowns, Experts Tell MPs (DS)

The cost of living crisis and runaway inflation are a result of imposing ruinous lockdowns on society, experts have told MPs and Peers. The comments came in the latest meeting of the the Pandemic Response and Recovery All-Party Parliamentary Group (APPG). Chaired by the Rt Hon Esther McVey MP, the group heard from experts about the societal consequences of closing businesses and schools, prohibiting healthcare, ordering the public to stay at home and unchecked money printing. One businessman told the group how government COVID-19 policies personally affected him, costing him £120,000, destroying his previously thriving business and leaving him in debt. Professor of Industrial Economics at the University of Nottingham Business School, David Paton, explained why lockdowns are at the root of the current crisis:

“Eye-watering sums of money were spent during lockdowns, on furlough and business support schemes which helped mask the inevitable economic consequences we are now seeing. Many of our current problems could have been avoided had the government carried out an effective cost-benefit analysis of lockdowns and other restrictions. Quite simply, the lack of spending opportunities during lockdown contributed to a build up of personal and corporate savings. As restrictions eased, people began to spend these savings and, combined with the supply chain issues that built up in the meantime, sustained inflation became the inevitable result. Even worse, having spent about £70 billion, paying healthy people not to work and some £150 billion in total on support measures, the ability of governments to respond to this cost-of-living crisis via either tax cuts or increased benefits is limited due to the hit to public finances caused by lockdown-induced government spending.”

Gasparino doesn’t appear to like Musk.

• Elon Musk’s Twitter ‘Best’ Offer Looks Bogus (Gasparino)

[..] here’s the viewpoint of two bankers, one who has worked with his Tesla board, and another at a firm involved in his Twitter financing machinations. They say virtually the same thing. Musk is telling people he still wants Twitter. He thinks he can make it work as a private company, clean up the bot problem and sell it at a profit sometime in the next five years. But Musk wants the company (like everything else) on his terms, which are always in flux. He doesn’t read balance sheets but goes by his gut and has no issue with flouting conventional banker norms (i.e. your word is your bond) to get his prize. His gut told him to waive due diligence. It’s now telling him that even though he signed a deal leaving him on the hook for the $1 billion breakup fee and maybe more in damages, he can get Twitter to the table and agree to his terms, aka a much lower purchase price.

He might be right. Twitter first said it would enforce the initial deal terms, maybe even go to court, but now appears to be playing ball with Musk. It recently said it will turn over more data on its bot issue — a move that means talks are back on. The bankers tell me the Twitter board knows that finding another suitor will be difficult even at around the $40 a share it’s trading at now. The board can’t just accept anything, but also can’t tell Musk to just pound sand. So the thinking among my two guys is that Twitter agrees to a lower price, possibly significantly lower, and Crazy Elon gets his public square, albeit for much cheaper. That means the deal is on, right? Seems so. But no one really knows with Crazy Elon.

Kissinger and Niall Ferguson. Not my favorite people, but here goes…

• Henry Kissinger At 99: How To Avoid Another World War (Ferguson)

Henry Kissinger turned 99 on May 27. Born in Germany at the height of the Weimar hyperinflation, he was not yet ten years old when Hitler came to power and was just 15 when he and his family landed as refugees in New York City. It is somehow almost as astonishing that this former US secretary of state and giant of geopolitics left office 45 years ago. As he heads towards his century, Kissinger has lost none of the intellectual firepower that set him apart from other foreign policy professors and practitioners of his and subsequent generations. In the time I have spent writing the second volume of his biography, Kissinger has published not one but two books — the first, co-authored with the former Google CEO Eric Schmidt and the computer scientist Daniel Huttenlocher, on artificial intelligence, the second a collection of six biographical case studies in leadership.

We meet at his rural retreat, deep in the woods of Connecticut, where he and his wife, Nancy, have spent most of their time since the onset of Covid. The pandemic had its silver linings for them. It was the first time in 48 years of marriage that the compulsively peripatetic Dr Kissinger came to an enforced halt. Cut off from the temptations of Manhattan restaurants and Beijing banquets, he has shed pounds. Though he walks with a stick, depends on a hearing aid and speaks more slowly than of old in that unmistakable bullfrog baritone, his mind is as keen as ever. Nor has Kissinger lost his knack for infuriating the liberal professors and progressive or “woke” students who dominate Harvard, the university where he built his reputation as a scholar and public intellectual in the 1950s and 1960s.

Bach

In 2011, Japanese telecom company Docomo created one of the most beautiful adverts we've ever seen. A giant xylophone in Kyushu playing Bach's "Jesu, Joy of Man's Desiring" with a wooden ball rolling down its keys [full video, HD: https://t.co/8tyG7wPeLa] pic.twitter.com/bqjinVPcdh

— Massimo (@Rainmaker1973) June 12, 2022

Mariupol

Mariupol pic.twitter.com/WLHJh34CMa

— Spriteer (@spriteer_774400) June 12, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.