Horacio Coppola Obelisco, Buenos Aires 1936

I like the suggestion that Trump can read the memo out loiud tonoght in SOTU. Though it’s been discussed so much already, it can only disappoint probably.

• House Intel Votes To Make “Shocking” FISA Memo Public (ZH)

In a highly anticipated decision, on Monday evening the House Intelligence Committee voted to make public the memo alleging what some Republicans say are “shocking” surveillance abuses at the Department of Justice regarding the Trump presidential campaign. In immediate response to the vote, the Committee’s top democrat Adam Schiff said that “we’ve crossed a deeply regrettable line”, adding that the “committee voted to put the president’s interest above the interest of the country.” The decision [ends] weeks of speculation over whether the memo, which was drafted by staff for committee chairman Devin Nunes (R- Calif) would be made public. At the same time, it intensifies the dispute over what Democrats say is an all-out assault by Republicans to undermine special counsel Robert Mueller’s probe into Russian interference in the 2016 election.

Now the fate of the 4-page FISA memo is in the hands of Donald Trump: as we discussed earlier, the document will not be immediately released as under the House rule Republicans used to override the classification of the four-page memo, President Trump now has five days to review and reject its publication. But, as per Bloomberg’s reporting earlier, the White House has signaled support for the document’s release and is widely expected to defy the DOJ in allowing the publication to go forward. The DOJ has opposed the release of the document, reportedly infuriating President Trump. While Nunes has described the memo as “facts,” Democrats have slammed it as a collection of misleading talking points they are unable to correct without exposing the highly classified information underpinning the document.

As Bloomberg disclosed earlier on Monday, releasing the memo without allowing them to review it on those grounds, Assistant Attorney General Stephen Boyd wrote to Nunes, would be “extraordinarily reckless.” Of course, the reason for the DOJ – and the Democrats’ fury – is well-known: Republicans who have read the memo have hinted heavily that it contains information that could unravel the entire Mueller investigation, long described by the president as a “witch hunt.” In an amusing twist, now that transparency appears to be the watchword, the Republican controlled House Intel Committee also plans to release the transcript of the business meeting dealing with releasing the FISA memo.

Russia has pledged to read the list ‘without letting emotion get in the way’.

• Trump Administration Holds Off On New Russia Sanctions (R.)

The Trump administration said on Monday it would not immediately impose additional sanctions on Russia, despite a new law designed to punish Moscow’s alleged meddling in the 2016 U.S. election, insisting the measure was already hitting Russian companies. “Today, we have informed Congress that this legislation and its implementation are deterring Russian defense sales,” State Department spokeswoman Heather Nauert said in a statement. “Since the enactment of the … legislation, we estimate that foreign governments have abandoned planned or announced purchases of several billion dollars in Russian defense acquisitions.” Seeking to press President Donald Trump to clamp down on Russia, the U.S. Congress voted nearly unanimously last year to pass a law setting sweeping new sanctions on Moscow.

Trump, who wanted warmer ties with Moscow and had opposed the legislation as it worked its way through Congress, signed it reluctantly in August, just six months into his presidency. Under the measure, the administration faced a deadline on Monday to impose sanctions on anyone determined to conduct significant business with Russian defense and intelligence sectors, already sanctioned for their alleged role in the election. But citing long time frames associated with major defense deals, Nauert said it was better to wait to impose those sanctions. “From that perspective, if the law is working, sanctions on specific entities or individuals will not need to be imposed because the legislation is, in fact, serving as a deterrent,” she said in a statement.

Next recession: Dow plunge by 2/3.

• Measure What Is Measurable (John Hussman)

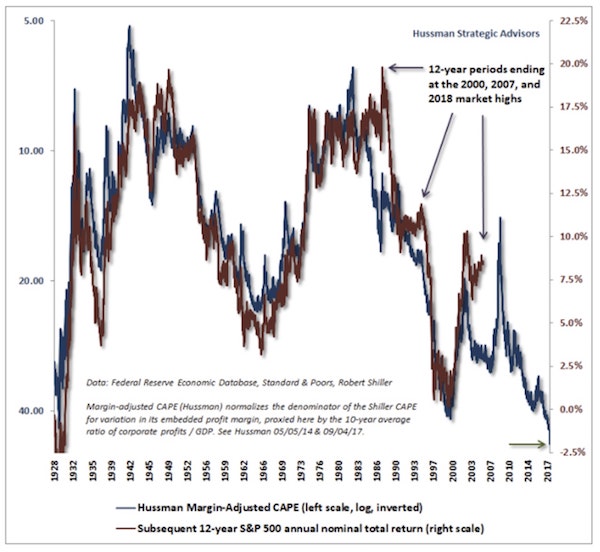

[..] it’s true that when we examine pre-crash extremes, like 2000 and 2007, we’ll typically find that actual returns over the preceding 12-year period were higher than the returns that one would have expected on the basis of valuations 12 years earlier. No surprise there. The only way to get to breathtaking valuations is to experience a period of surprisingly strong returns. Those breathtaking valuations are then followed by dismal consequences. Likewise, when we examine secular lows like 1974 and 1982, we’ll find that actual returns over the preceding 12-year period fell short of the returns one would have expected on the basis of valuations 12 years earlier.

The chart below offers a reminder of what this looks like, in data since the 1920’s. Look at the “errors” in 1988, 1995, and 2006. Count forward 12 years, and you’ll find the major valuation peaks of 2000, 2007 and today that were responsible for the overshoot of actual returns. The 2000 and 2007 instances were both followed by losses of 50% or more in the S&P 500. Look at the “errors” in 1937, 1962, 1966, and 1970. Count forward 12 years, and you’ll find the market lows of 1949, 1974, 1978 and 1982 that were responsible for the undershoot of actual returns. Those market lows turned out to be the best buying opportunities of the post-war era. When market cycles move to extreme overvaluation or undervaluation, they become an exercise in borrowing or lending returns to the future, and then surrendering or receiving them back over the remaining half of the cycle.

Put simply, in my view, stock prices are rising not because Wall Street has thoughtfully quantified the effect of taxes, interest rates, corporate profits, or anything else. Instead, Wall Street is mesmerized by the self-reinforcing outcomes of its own speculation, relying on verbal arguments, optimistic projections lacking grounds in observable data, and enthusiastic assertions about cause-effect relationships that are accepted without the need for any evidence at all (much less decades of it).

Back to Galileo. Measure what is measurable, and make measurable what is not so. When we do this, come to understand the current speculative extreme as the tension between two observations that are not actually contradictory – just uncomfortable. One is that stock prices are indeed three times the level at which they are likely to end the current market cycle. The other is that there is no pressure for valuations to normalize over shorter segments of the cycle, as long as risk-seeking speculative psychology remains intact.

It’s starting to feel as if we passed an inflection point.

• Global Bond Yields Spike as Inflation Fears Rise (Street)

Global government bond markets continued to sell-off Monday, taking U.S. Treasury yields to the highest level in four years amid renewed bets on faster inflation in the world’s biggest economy and hawkish comments on growth and inflation from central bank officials in Europe. The bond market moves have clipped early gains for stocks and raised the spectre of a correction in inflation assumptions as the global economy roars to life and oil and commodity prices continue to climb amid a surge in manufacturing activity. The selling was also accelerated, in part, by a Goldman Sachs research note which suggested that Wednesday’s meeting of the U.S. Federal Reserve, the last under the leadership of outgoing chairwoman Janet Yellen, could plant the early seeds for a March hike in benchmark borrowing costs.

“We expect the FOMC to issue a generally upbeat post-meeting statement that includes an upgrade to the balance of risks and a slightly hawkish rewording of the inflation assessment,” the note read, adding that public remarks since the December meeting “bolster the case for an upgrade, and by our count, at least half of the Committee has recently referenced upside risks to growth.” Benchmark 10-year U.S. Treasury yields were marked at 2.72% in early Monday trading, the highest since early 2014, while 2-year note yields were seen at 2.15%, the highest since 2008. Those gains followed Friday closing levels that showed the widest yield gap between so-called TIPS, or Treasury Inflation Protected Securities, and benchmark 10-year notes since Sept. 2014.

In Europe, five-year German bunds yields traded in positive territory for the first time since 2015 amid a solid assessment of the region’s growth prospects last week from ECB President Mario Draghi and comments over the weekend from Dutch central bank governor Klaas Knot that he saw “no reason whatsoever” to continue the Bank’s €2.55 trillion ($3.16 trillion) quantitative easing program beyond its September deadline. Both U.S. and European investors are bracing for faster inflation in the months ahead as global commodity prices – particularly crude oil – continue to rise. Brent crude futures for March delivery, the benchmark for prices around the world, were marked at $69.87 Monday, down from their Friday close of $70.52 but still some 28% higher from the same period last year, suggesting a big upside import into headline inflation readings over the first half of this year.

Yields go up, then so do mortgage rates.

• US Mortgage Rates Jump To The Highest Point In 4 Years (CNBC)

A huge sell-off in the bond market is about to make buying a home more expensive. Mortgage rates, which loosely follow the yield on the 10-year Treasury, have been rising for the past few weeks, but are seeing their biggest move higher Monday. “Bottom line, rate sheets are going to be ugly this morning,” wrote Matthew Graham, chief operating officer of Mortgage News Daily. “Some lenders will be at 4.5% on their best-case-scenario 30-year fixed quotes.” That is the highest rate since 2014. The average rate on the popular 30-year fixed started the year right around 4% but then began to climb on positive news in the U.S. economy, solid company earnings reports and a shift in foreign central bank policies which appear to now be following the Federal Reserve’s tightening of monetary policy.

The rate was at 4.28% by the end of last week. “Apart from central banks, there’s a ton of bond market supply coming down the pike due to infrastructure and tax bill spending,” Graham said. That new supply will send yields and, consequently, mortgage rates higher. While mortgage rates are still historically low, they were even lower in the years following the financial crisis. That not only helped juice the sharp increase in home prices, but it has also given borrowers a new sense of normal. Both will hurt affordability this spring on several fronts. “Today is one more reason for Realtors and buyers to move up their spring schedule,” said Chris Kopec, a mortgage loan consultant at Chicago-based Lakeside Bank.

Why investigate Trump, but not Hillary et al?

• Stormy Weather (Jim Kunstler)

It’s hard not to be impressed by the evidence in the public record that the FBI misbehaved pretty badly around the various election year events of 2016. And who, besides Rachel Maddow, Anderson Cooper, and Dean Baquet of The New York Times, can pretend to be impressed by the so far complete lack of evidence of Russian “meddling” to defeat Hillary Clinton? I must repeat: so far. This story has been playing for a year and a half now, and as the days go by, it seems more and more unlikely that Special Prosecutor Robert Mueller is sitting on any conclusive evidence. During this time, everything and anything has already leaked out of the FBI and its parent agency the Department of Justice, including embarrassing hard evidence of the FBI’s own procedural debauchery, and it’s hard to believe that Mr. Mueller’s office is anymore air-tight than the rest of the joint.

If an attorney from Mars came to Earth and followed the evidence already made public, he would probably suspect that the FBI and DOJ colluded with the Clinton Campaign and the Democratic Party to derail the Trump campaign train, and then engineer an “insurance policy” train wreck of his position in office. Also, in the process, to nullify any potential legal action against Clinton, including the matter of her email server, her actions with the DNC to subvert the Sanders primary campaign, the Steele dossier being used to activate a FISA warrant for surveillance of the Trump campaign, the arrant, long-running grift machine of the Clinton Foundation (in particular, the $150 million from Russian sources following the 2013 Uranium One deal, when she was Secretary of State), and the shady activities of Barack Obama’s inner circle around the post-election transition. There is obviously more there there than in the Resistance’s Russia folder.

What Britain can quarrel about this week.

• Leaked Brexit Report Shows Damage To UK Growth (G.)

Brexit would leave the UK worse off under three possible scenarios: a comprehensive free trade deal, single market access and no deal at all, according to a leaked government analysis of the economic impact of leaving the EU. The document was meant to be shown confidentially to cabinet ministers this week but was leaked in an embarrassing development for Theresa May and David Davis, the Brexit secretary. It said national income would be 8% lower under a no deal scenario, around 5% lower with a free trade agreement with the EU and about 2% lower with a soft Brexit option of single market membership over a 15-year period. The government would not comment on leaked documents but sources stressed the analysis did not cover May’s preferred option of a bespoke deal amounting to a “deep and special partnership” with the EU.

The document suggested that chemicals, clothing, manufacturing, food and drink, and cars and retail would be the hardest hit and every UK region would also be affected negatively in all the modelled scenarios, with the north-east, the West Midlands and Northern Ireland facing the biggest falls in economic performance. It comes after Davis refused to release impact assessments covering 58 sectors of the economy when requested to by parliament, claiming they did not in fact exist. Remain supporters said the report, seen by BuzzFeed News, was concerning but in line with what they had feared.

[..] Eloise Todd, the chief executive of anti-Brexit organisation Best for Britain, added: “According to the government’s secret analysis, even the softest Brexit scenario will mean a 2% hit to growth. “Almost every community, region and sector of the economy included in the analysis would be negatively impacted. The case for or against Brexit should be about more than balance sheets, but it’s painfully clear that the numbers are a gloomy part of the story. And behind these numbers are thousands of jobs, businesses and homes that are at risk. “The government are calling this document embarrassing but it’s more than that. It is a colossal act of economic self harm, written down clearly, in black and white. We are reading about an economy facing the abyss.”

After Janet, the flood.

• Janet Yellen Sets Interest Rates One Last Time. How Will History Rate Her? (G.)

Janet Yellen, the Federal Reserve chair, begins her final rate-setting meeting at the helm of the US central bank on Tuesday, before she is replaced by Donald Trump’s chosen successor, Jerome Powell. The first woman to lead the Fed arrived in February 2014 at a time when the money-printing machine of quantitative easing was whirring at full-tilt under her predecessor, Ben Bernanke. QE, which involved the Fed buying bonds from financial institutions, pumped billions of dollars into the US economy to keep it afloat after the financial crisis. Yellen leaves next month with a legacy as the Fed chair who began the long process of turning off the QE machine, and for raising interest rates for the first time in seven years in 2015.

Powell will have a tough act to follow, with the stock market currently sitting at a record high and as economic growth continues to strengthen and unemployment stands at the lowest level since 2000. No increase in interest rates is expected this month, although further hikes are forecast for later this year. James Knightley, senior economist at ING Bank, said: “She has followed up [Bernanke] with strong leadership and solid decision making that led to the robust economic performance we see today. Given all these successes, Jay Powell has been set a very tough bar to match.”

Emotional by Caitlin Johnstone. We should have a piece that lists his topics through the years. And someone should pick up his legacy.

• On The Death of Robert Parry (CJ)

The legendary journalistic titan Robert Parry has died, and I still haven’t quite figured out how to live with that. I did not know Parry and never had any kind of interaction with him, but I can’t stop crying. This is an immense loss and it feels deeply personal, just as one of the countless individuals his work has profoundly impacted. I’ve often recommended Parry’s outlet Consortiumnews as the overall best source of anti-war, anti-establishment information in the English-speaking world, and I cite its content constantly in my own work. This just sucks, and I’m a mess, and this might just be me getting sloppy and emotional for a few paragraphs, but this is all I can really be right now.

In a beautiful tribute to his father, Nat Parry describes a man who was driven not by self-interest, nor even ultimately by any ideology or conceptual values system, but by a deeply held commitment to humanity born out of concern for the future of our species. Parry’s journalistic integrity and ferocious dedication to the truth at all costs appear to have been a byproduct of that fundamental desire for humanity to survive and thrive, and an inability to be comfortable with our horrifying flirtation with extinction. “But besides this deeply held commitment to independent journalism, it should also be recalled that, ultimately, Bob was motivated by a concern over the future of life on Earth,” writes the younger Parry. “As someone who grew up at the height of the Cold War, he understood the dangers of allowing tensions and hysteria to spiral out of control, especially in a world such as ours with enough nuclear weapons to wipe out all life on the planet many times over.”

Brussels, Paris and Berlin only care when it suits their careers.

• Refugee Relocations From Italy And Greece Drawing To A Close (DW)

Germany’s Interior Ministry said on Monday that it will only resettle a small number of migrants from Italy and Greece in the coming weeks, as the EU’s migrant relocation program draws to a close. An Interior Ministry spokesperson told DW that far fewer people had fulfilled the necessary criteria for relocation than first expected. “There are now virtually no more asylum seekers in Greece who could be considered for resettlement,” according to the Ministry. To qualify, applicants had to be from a country where the chances of asylum are at least 75%. Last month, some 500 migrants were still waiting to be relocated from Italy to Germany, while in Greece the number less than 40. “The relocation scheme ended in September 2017, meaning all applicants arriving after that date will no longer be eligible for resettlement,” Annegret Korff, a speaker for the Interior Ministry, said.

“Germany largely completed all outstanding relocations by the end of 2017. In the coming weeks, Germany will only carry out the odd resettlement case that was left outstanding from last year.” The program to relocate migrants landing in Greece and Italy was launched by the European Union in the wake of the 2015 migrant crisis. Initially, EU member states agree to relocate some 160,000 refugees between them from the bloc’s two main points of entry by September 2017. The number was revised to just under 100,000 after officials found that fewer people were eligible under the scheme that first expected. Although the temporary progam has since passed its deadline, the final few migrants that qualify for resettlement are still awaiting asylum.

Home › Forums › Debt Rattle January 30 2018