Andy Warhol Grace Kelly 1984

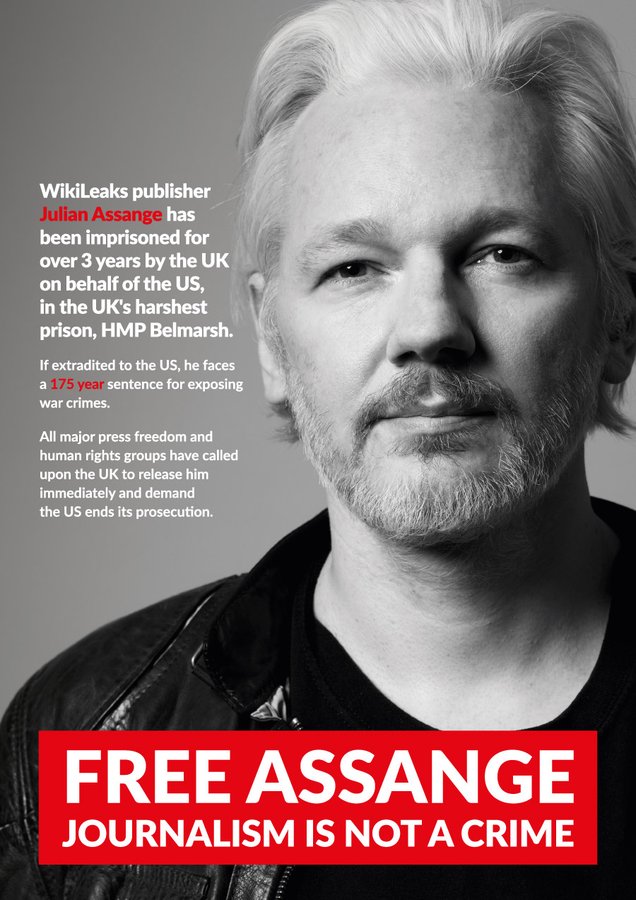

Number of days Julian Assange has been in Belmarsh prison, never charged with anything.

Today, another decision is due in his extradition case.

Zelensky’s statements influenced by what he drinks or smokes – Lavrov

Zelensky’s statements influenced by what he drinks or smokes – Lavrov pic.twitter.com/SDsCiXbbEf

— Wittgenstein (@backtolife_2022) April 20, 2022

Musk

A social media platform’s policies are good if the most extreme 10% on left and right are equally unhappy

— Elon Musk (@elonmusk) April 19, 2022

The only thing you need to know, really.

• There Has Been No Talk Of Peace, Only War (Celente)

Russian President Vladimir Putin said Monday that the Western sanctions that were intended to punish Moscow into submission and end its war with Ukraine have failed and, instead, hurt the very countries who imposed them. Putin used a televised address to tell Russians the sanctions were “expected to quickly upset the financial-economic situation, provoke panic in the markets, the collapse of the banking system and shortages in stores.” But said the West’s “economic blitz” failed and backfired. He said they instead led to a “deterioration of the economy in the West.” Last month, President Joe Biden told reporters that the sanctions imposed on Russia were not intended to prevent the 24 February invasion, but were intended instead to unite Europe and show its resolve.

“That’s the important thing. If you’re Putin and you think that Europe is going to crack in a month or six weeks or two months, [that] they can take anything for another month…We have to stay fully, totally, thoroughly united,” he said. When the White House announced a ban on Russian oil imports, oil prices in the U.S. hit their highest levels since 2008. The Russian central bank on Monday announced that consumer prices were about 16.7 percent higher than the same time period last year. The New York Times, citing international financial organizations, reported that economists believe that the Russian economy will contract up to 15 percent.

Biden, who has called Putin a war criminal, killer, and a brute, has discussed additional sanctions against Russia with European allies on Tuesday, Reuters reported. They also discusses arming Ukrainians with even more weapons. Canada announced Tuesday a new round of sanctions against Russians, including Putin’s two adult daughters, the report said. The repot said: “Among those on the call were Canadian Prime Minister Justin Trudeau, European Commission President Ursula von der Leyen, French President Emmanuel Macron, German Chancellor Olaf Scholz, NATO Secretary General Jens Stoltenberg and British Prime Minister Boris Johnson, as well as the leaders of Poland, Japan and Italy.” There has been no talk of peace, only war.

The narrative needs a new chapter every day, lest people start questioning yesterday’s tale.

• Putin ‘Will Go Nuclear’ Says CIA Boss in Regime Change Set Up (Ransom)

Democrats have invented their own WMD story to support regime change, as the head of the CIA warned about taking Russia’s nuclear capability too “lightly.” Speaking at Georgia Tech in Atlanta, CIA Director William Burns has said that in desperation Russian President Vladimir Putin could use a tactical or low-yield nuclear weapon in Ukraine in order to try to reverse his battlefield mistakes. “Given the potential desperation of President Putin and the Russian leadership, given the setbacks that they’ve faced so far, militarily, none of us can take lightly the threat posed by a potential resort to tactical nuclear weapons or low-yield nuclear weapons,” said Burns, according to Voice of America. Ukraine’s President Volodymyr Zelenskyy has also warned about potential Putin use of nuclear weapons in Ukraine.

Nina Khrushcheva, the great granddaughter to former Soviet dictator Nikita Khrushchev, echoed the comments but said it wasn’t a prediction of the use of nukes, but was just noting the potential is there for Putin to use nuclear weapons, said Newsweek. “Since there are questions about how far Russia can go to create victory, and nuclear weapons have been part of the conversation on both sides, Russian and the West, the tactical atomic option is potentially imaginable,” said Khrushcheva, a professor of International Affairs at The New School in New York City, a progressive hotbed.

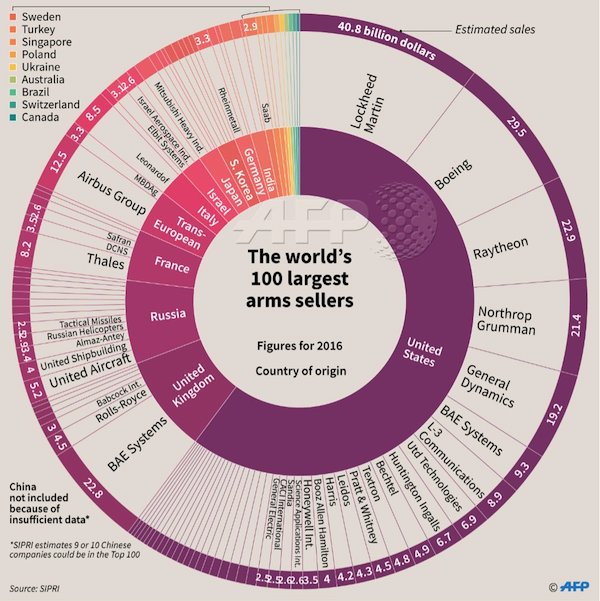

Let’s make it an even $30 billion. $3 billion is hardly enough to pay the bonuses at Raytheon this Christmas

• Yet Another Huge Ukraine Arms Package As Total Military Aid Nears $3BN (ZH)

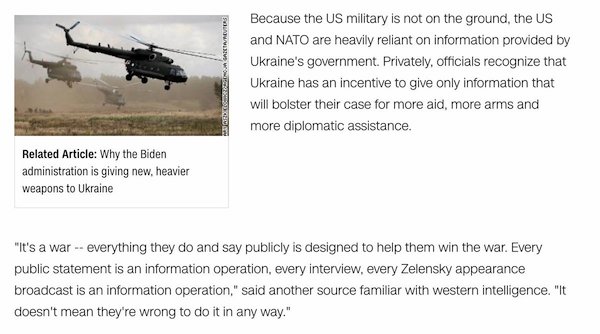

Coming off last week’s approved gargantuan $800 million military package for Ukraine, which the broader public and media seemed to not even bat an eye about (but quite the opposite: positively cheering it), what more is there for Biden to do except sign off on another massive weapons package for Kiev… “The Biden administration is preparing to announce another substantial military aid package for Ukraine this week,” NBC News cited five US officials to report Tuesday evening. “Three officials said the package is expected to be similar in size to the $800 million one the administration announced last week.” Biden previewed the new aid package by answering a simple “yes” when asked by a reporter whether Washington will send more artillery to Ukraine.

The new transfers are expected to include “tens of thousands more artillery rounds” – notes Bloomberg, and likely along with more anti-tank missiles, as has been consistently shipped stretching back even before Russia’s late February invasion kicked off. It appears to be the administration’s response to Moscow launching a ‘new phase’ in the war: a major force buildup and push to take the Donbas region from Ukraine, which the Kremlin reportedly wants to see fully accomplished by May 9, Victory Day, which commemorates the Soviet defeat of Nazi Germany. Without doubt these continual major weapons packages pledged to Ukraine will only push Russia and NATO into increasingly direct confrontation, given the Kremlin’s standing warning that it will target any inbound Western arms transfers.

Meanwhile, on Monday a senior Pentagon official told Reuters of plans to begin training Ukrainian forces on how to use American-supplied howitzers. It was described, however, that the training would occur outside Ukraine, likely in a neighboring friendly country like Poland. White House Press Secretary Jen Psaki confirmed this week that so far the United States has successfully delivered new weapons to the Ukrainians on four flights – this as overall US aid pledged to Ukraine since Feb.24 has totaled about $2.6 billion and counting.

“..the article was published at 10pm local time on the Friday of Easter weekend..”

• Watch Out, Vlad! Here Comes the British Invasion (Tracey)

“You heard it here first”? Within less than 48 hours of publishing my previous article — aptly titled “The UK is Trying to Drag the US into World War III” — the most decisive evidence yet for the thesis conveniently emerged. This was thanks to The Times newspaper, which reported that British “boots on the ground” have been deployed to Ukraine. It’s the first time that the armed forces of any NATO member state were confirmed to be physically present inside Ukraine since the war started on February 24. If the UK Government really does aim to position itself at the “vanguard” of an escalating military intervention, in hopes that it can cajole the US into hotter and hotter warfare — as I reported in the previous article — then this seems like a pretty plausible way of going about it.

Is the US content to just sit around and let itself be one-upped by the British, who have now demonstrated their willingness to boldly send “boots on the ground” in defense of freedom and democracy? While the mighty US dithers impotently on the sidelines? Oddly, the response to the Times revelation has been conspicuously muted. At least from my vantage point here in London. And maybe that’s by design: the article was published at 10pm local time on the Friday of Easter weekend, and as I recently discovered, Easter weekend in England a big four-day Bank Holiday bash. So maybe the article was intentionally “buried” to dampen its effect — or maybe the timing was just an innocent coincidence. Either way, there’s been a curious lack of followup or even significant discussion in the days since the news broke. Maybe some inscrutable code of omertà reigns within the UK press corps? For all the problems with US media, it’s not quite as weirdly incestuous and insular as media in the UK.

“We are talking primarily about an attempt to expand NATO’s presence near our borders.”

• Russia Must Prepare For “Possible Aggressive Action” From NATO – Medvedev (ZH)

Following earlier this month both Finland and Sweden signaling their intent to join NATO, close Putin ally and former president Dmitry Medvedev, who serves as deputy chairman of Russia’s Security Council, has warned that the Western military alliance is engaged in a military buildup along Russia’s borders. “A senior Russian official said on Tuesday that NATO’s reinforcement of its borders with Russia was no longer a figure of speech and Moscow should be prepared for possible aggressive action, Russia’s TASS news agency reported,” according to Reuters. “NATO’s expansion near Russia’s borders is no longer a figure of speech or a set of threats, we must be prepared for aggressive action,” he said according to a translation. The fresh words follow Medvedev’s prior threats to position nuclear and hypersonic missiles along Russian’s western border in the scenario that Finland and Sweden join NATO.

The prospect of Finland, which is said to be studying the issue, joining the alliance is especially alarming for the Kremlin, given Russian and its Scandinavian neighbor share a 810-mile border. Sweden, though a little less important geographically, has already announced its intent to join the alliance. “There can be no more talk of any nuclear–free status for the Baltic – the balance must be restored,” Medvedev said previously. But now on Tuesday, he’s heightened the rhetoric further by saying, “We are talking primarily about an attempt to expand NATO’s presence near our borders.” Medvedev stated further according to state-run TASS, based on a rush translation: “And this is no longer a figure of speech today, this is not a set of standard threats. We must be prepared for those aggressive actions that may happen.”

The thrust of his words were toward encouraging the rapid technological advance of the country’s defense capabilities amid the new ‘NATO threat’ – given the remarks were delivered before a national conference on science and education. He stressed that “it is important to build up, among other things, a system that allows you to provide the country with the most modern weapons.” “And this requires reliable, high-tech, powerful equipment – both military and dual-use,” the deputy head of the Security Council added, explaining that the situation did “not arise by itself, especially in those conditions when sanctions have been imposed on the country.”

Cement

In Mariupol, the Ukrainian army sealed the civilians in the basement w cement refused to let them go. If the Russian army bombed them with missiles, the civilians would be buried with them. This video shows the Russian army smashing the cement board saving the civilians. pic.twitter.com/JB1HWhAdYy

— TT (@JustnEqual4all) April 18, 2022

Westphalian Treaty, 1648.

“Russia, China have legitimate spheres of influence and this should be respected. This will involve an end to the gross provocations in the South China Sea and in Poland, Romania, and the Baltics, not to mention the ongoing series of colour revolutions.”

• Two Cheers for Realism (Lee)

As the US and its vassals therefore prepare for war, its populations must be conditioned to believe and accept such an inevitable outcome. The propaganda machine has been stepped up to unprecedented levels. The message is simple. Our side = good, Their side = bad. Our side does good things, their side does bad things. Thus, the media – now an asset of the deep state – plays an essential role of propagating this political construction among the populations of the Anglo-Zionist heartlands. All of which is very reminiscent of Orwell’s short novel Animal Farm. After the Animal Revolution and the eviction of Jones the Farmer, the sheep were instructed by the ruling group – the pigs – into reciting the goodness of the animals and the badness of humans. The short and endless bleat of the sheep went as follows: ‘’Four legs good, two legs bad,’’ repeated endlessly.

That is about the level of western foreign policy. Good guys, bad guys, white hats, black hats, no compromise, no surrender. Result war. The question we must now ask is has this menacing process gone too far to go into reverse? This of course remains an open question. But the thrust of neo-conservative foreign policy would suggest this war would be a logical outcome. Either that or the whole thing is a bluff. Up to this point the US performance in attacking recalcitrant weak states has not been a roaring success. The same goes for Israel. Bombing countries with no air defence or shooting Palestinian kids with sniper rifles is easy-peasy. Taking on Iran is a different matter entirely. The irresistible force seems to be meeting its immovable object.

From a realist as opposed to a neo-conservative foreign policy the idea of an American world empire is frankly deranged. Pursuit of this pipedream can only result in mutually assured destruction; yes, M.A.D. still applies. The United States and its minions might not like it, but it will have to learn to live with other great powers. Russia, China have legitimate spheres of influence and this should be respected. This will involve an end to the gross provocations in the South China Sea and in Poland, Romania, and the Baltics, not to mention the ongoing series of colour revolutions.

“These sociopathic characteristics include superficial charm, untruthfulness, absence of neurosis or anxiety, poverty of emotion, and a lack of remorse or shame. ”

• Telling the COVID Good Guys from the Bad Guys (Hope)

Most recently, Elon Musk has stepped forward, offering to purchase Twitter and remove the censorship from the platform. This move would turn the tables on the Great Reset and restore the voice of the American public. Some are conflicted and see Musk as a potential bad guy due to his billionaire status and work developing technologies that could be used against the populace. However, upon closer inspection, one notices that Musk has been consistent in his views over the last two years. Musk was among the first to tweet about the potential benefits of using HCQ in early 2020. Musk’s position has not changed, while the opposition lies, waffles, and double talks.

In his first interview with Joe Rogan in May of 2020, Musk questioned the lockdowns’ wisdom and insisted that our freedoms should come first. He noted that our liberty and democracy had come at significant cost, and we should not allow them to be eroded so easily. Looking deeper at Musk, one realizes he is not a sociopath like so many other billionaires. Sixteen factors help identify a sociopath – according to the Cleckley Profile as set forth by Dr. Hervey M. Cleckley, the expert considered to be the Father of Psychopathy. He discussed these in his treatise, The Mask of Sanity. These sociopathic characteristics include superficial charm, untruthfulness, absence of neurosis or anxiety, poverty of emotion, and a lack of remorse or shame.

In short, they have cold, reptilian personalities and no conscience. Sociopaths have no anxiety and can often beat lie detector tests because their heart rates and blood pressure can remain stable under questioning that would phase most of us. While our leading health authorities and top vaccine billionaires easily qualify as sociopaths, Musk’s personality does not fit. He tears up at interviews to the extent the cameraman must stop filming; he exhibits great emotion when speaking about his childhood or challenges with his businesses.

There goes the CDC.

• Wall Street Now Paying Attention to the ‘Trust the Science’ Fraud – Dowd (Wolf)

As Pfizer try to ‘pump their stock’ Hedge Fund guru Dowd, takes us inside what he calls the third great fraud in his lifetime, in this new bombshell interview with Dr Naomi Wolf.

Except, they’re giving the CDC more powers, no matter how badly it failed.

• New CDC Center to Predict Pandemics, Provide ‘Outbreak Analytics’ (CSN)

On Tuesday, the Biden Administration announced the launch of the CDC’s new Center for Forecasting and Analysis (CFA) to predict future pandemics and guide the government’s efforts to address such anticipated infectious disease threats. A center of the Centers for Disease Control and Prevention, the CFA will use “infectious disease modeling and analytics and to provide support to leaders at the federal, state, and local levels,” the CDC explains in its announcement. As “the equivalent of the National Weather Service for infectious diseases,” the CFA will “predict trends and guide decision-making,” the CDC says:

“CFA’s work will be focused into three main pillars: to predict, inform, and innovate. CFA has begun to build a world-class outbreak analytics team with experts across several disciplines to develop faster, richer evidence to predict trends and guide decision-making during emergencies.” According to the CFA website, the new center will also predict the future course of ongoing pandemics, in order to help public health officials to take preemptive measures: “The goal of the Center for Forecasting and Outbreak Analytics (CFA) is to enable timely, effective decision-making to improve outbreak response using data, modeling, and analytics.

“To do so, CFA will produce models and forecasts to characterize the state of an outbreak and its course, inform public health decision makers on potential consequences of deploying control measures, and support innovation to continuously improve the science of outbreak analytics and modeling.” CFA Science Director Marc Lipsitch, hopes to employ regular population sampling, by means like blood draws and swab tests, in order to collect data, the AP reports: “[T]he United Kingdom uses regular population sampling with swab tests and blood draws to get a clearer picture of who’s been infected, said Marc Lipsitch, the new center’s science director. He said similar sampling should be considered in the U.S.”

“..a political DOJ has to wait for a political CDC to determine whether they still have any currency of influence..”

• DOJ To Appeal Court Decision to Overturn Mask Mandate, if CDC Asks (CTH)

On one hand, Joe Biden needs to appease the base of his Covidians who identify themselves through the prism of COVID. On the other hand, the overwhelming majority of Americans are done with the COVID fear mongering. What to do, what to do? Trying to split the baby, Biden’s DOJ announces it will appeal the federal court ruling that overturned the federal Transporation covid mask mandate, but only if the CDC tells them to. “DOJ PRESS RELEASE – […] “The Department of Justice and the Centers for Disease Control and Prevention (CDC) disagree with the district court’s decision and will appeal, subject to CDC’s conclusion that the order remains necessary for public health.” “If CDC concludes that a mandatory order remains necessary for the public’s health after that assessment, the Department of Justice will appeal the district court’s decision.”

Keep in mind, the federal court ruling specifically centered around the arbitrary nature of the original mandate, which exceeded the scope of CDC legal authority, compounded by the CDC breaking its own rules for public feedback in the implementation.The mandate created by Joe Biden did not have legal structure. It was a dictatorial fiat that exceeded the capacity of the executive branch to create. Congress could easily write a law authorizing mechanisms for the CDC and TSA to use in enforcement of a federal Transportation mask mandate; but they won’t – because the public would never support it. So now, a political DOJ has to wait for a political CDC to determine whether they still have any currency of influence amid the politics of COVID.

Just demolish it.

• CDC Removes All Countries From COVID-19 ‘Do Not Travel’ List (Reason)

The Centers for Disease Control and Prevention (CDC) updated its international travel recommendations on Monday, relaxing previous COVID-19 risk assessments.Previously, the CDC’s “Level 4” risk designation applied to destinations with “very high” levels of COVID-19 transmission. On Sunday, 89 countries and territories were listed in this category, with the CDC advising, “Avoid travel to these destinations. If you must travel to these destinations, make sure you are fully vaccinated before travel.” The agency has since named its highest risk category “Level 4: Special Circumstances/Do Not Travel” and removed all countries from it. In a statement last week, the CDC indicated it would reserve this designation for “special circumstances, such as rapidly escalating case trajectory or extremely high case counts, emergence of a new variant of concern, or healthcare infrastructure collapse.”

The CDC’s next highest designation, “Level 3: COVID-19 High,” now includes 122 destinations and advises that travelers are up to date with their COVID-19 vaccinations, but does not advise the fully vaccinated to avoid travel wholesale. Given that there are few places in the world where COVID-19 has not spread widely, it is becoming necessary for the individual traveler to determine his own risk tolerance. Safety does not simply depend on picking the country with no active COVID-19 cases, but rather on taking stock of your vaccination status, your preexisting conditions, and the medical infrastructure at your destination.

The CDC’s new advisory structure makes the point that not all areas with high COVID-19 transmission are irreconcilably dangerous to visit. As recently as Sunday, the CDC advised travelers to exercise the same level of COVID-related caution when visiting Norway and the Central African Republic; South Korea and Papua New Guinea; and Australia and Vietnam. It makes little sense to advise the same level of extreme medical caution across each of these nations, considering how vastly each country’s health capacities may differ. Denmark, Switzerland, and Sweden are said to have some of the best health care in the world, but in terms of COVID contagion, the CDC considered them as risky to visit as Somalia, a country with only one surgeon for every 1 million people and a full COVID vaccination rate of just 8.5 percent.

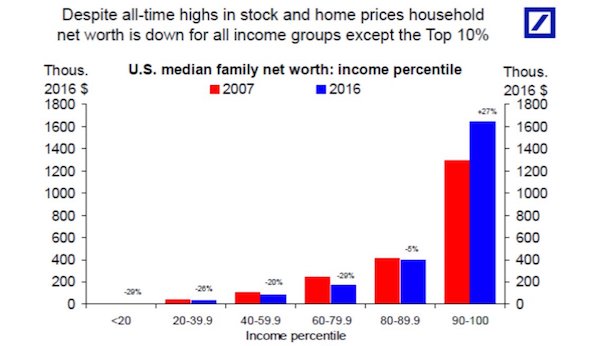

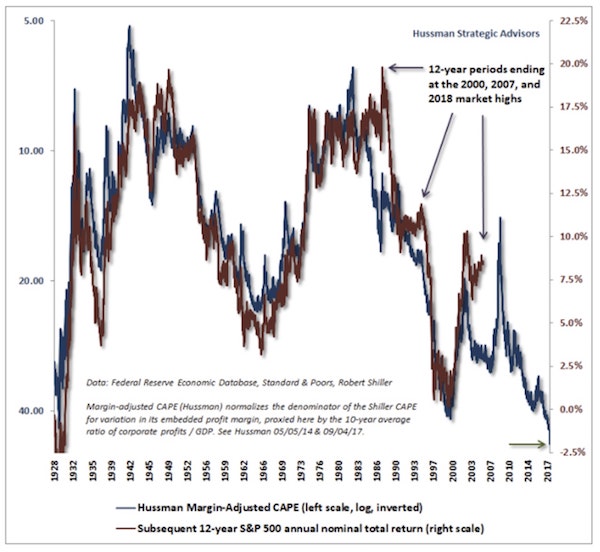

You will own nothing and you will be happy.

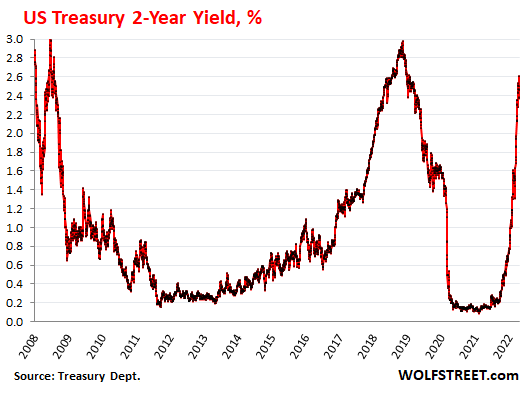

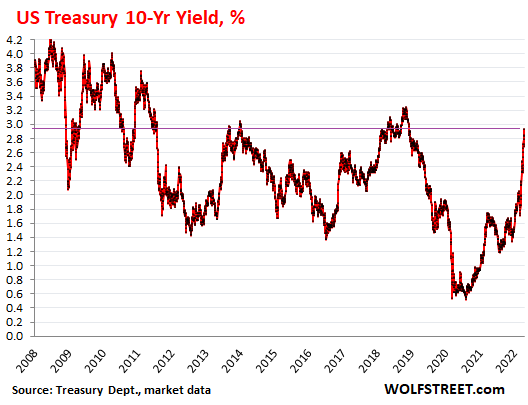

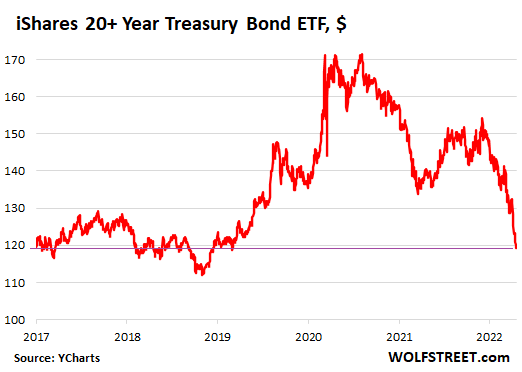

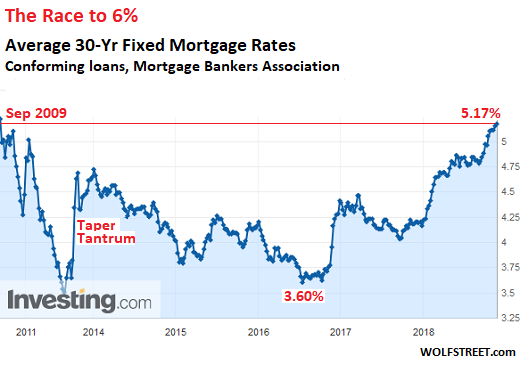

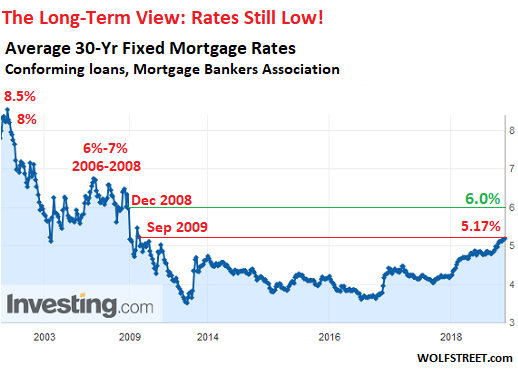

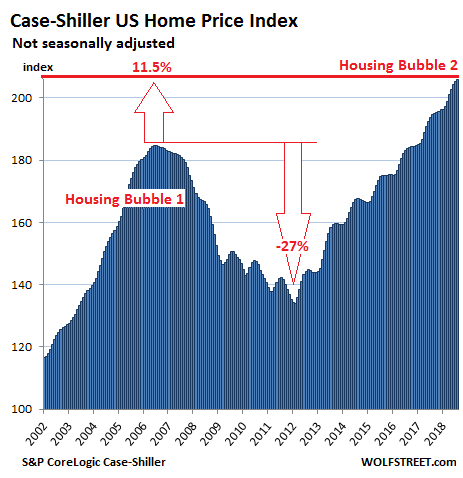

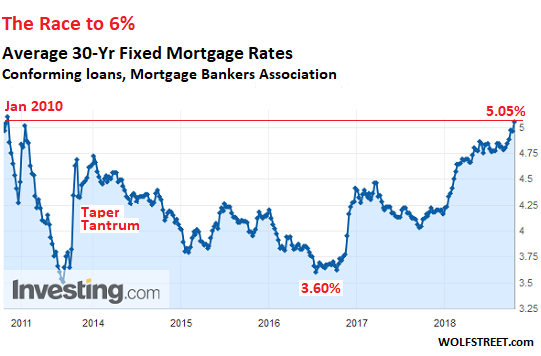

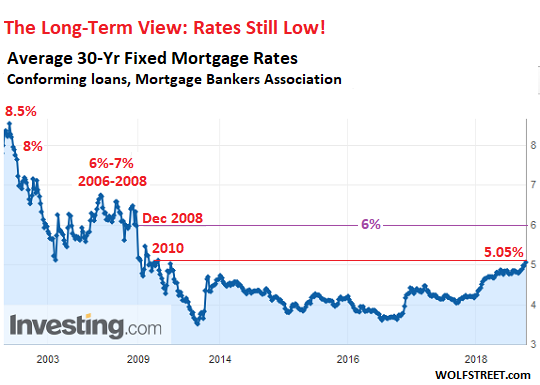

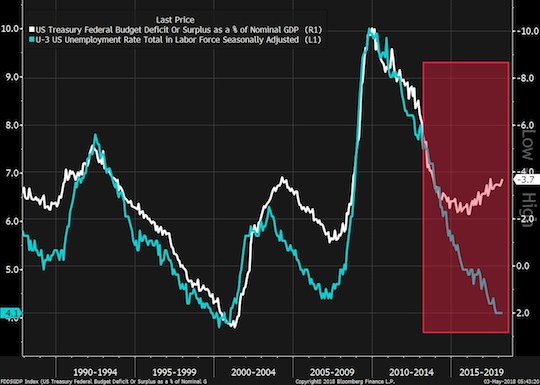

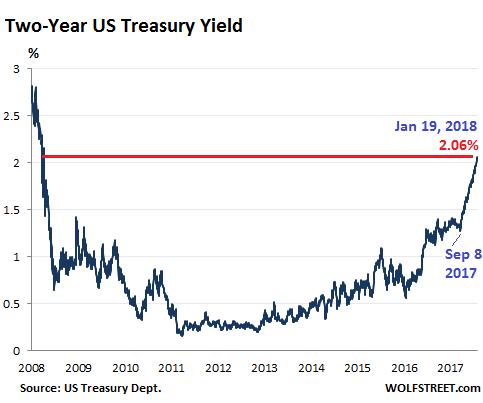

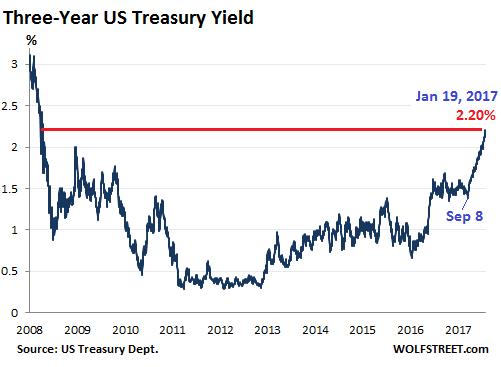

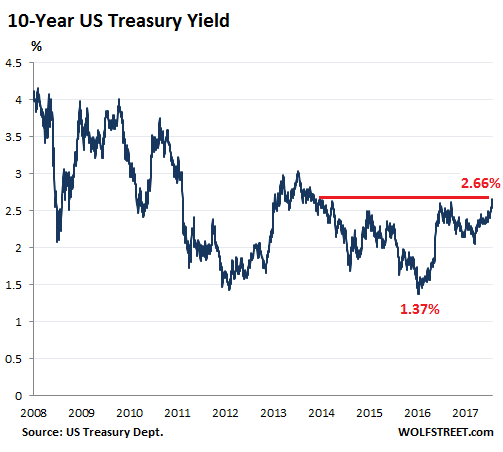

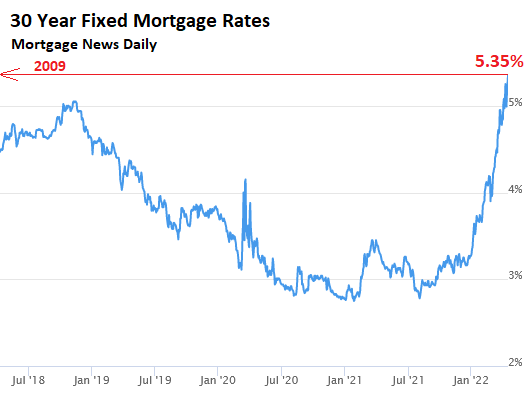

• Treasury Bond Massacre, Mortgage Rates Hit 5.35%, and it’s Only April (WS)

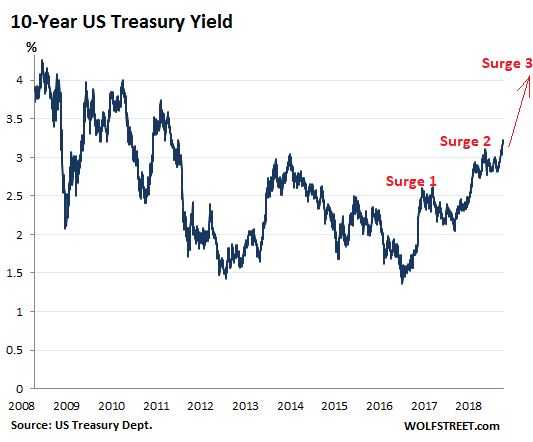

The interesting thing is that no one at the Fed is trying to talk down those spikes in Treasury yields and mortgage rates. It shows that those yields are going where the Fed wants them to go, and that the Treasury market is coming around to the Fed’s rate-hike plan, and that those yields have a long ways to go, given that CPI inflation is 8.5%, a gigantic mess that has unfolded over the past 15 months, finally, after 12 years of money-printing. The two-year Treasury yield spiked by 15 basis points today to 2.61%, the highest since January 2019. This has been a huge move in just seven months. When the two-year yield goes over 2.83%, it will be in territory not seen since 2007, as the Treasury market begins to price in the Fed’s coming policy action to crack down on inflation:

Even the biggest doves at the Fed are now fully on board the rate-hike train, and it’s only a question of how fast and how long. Chicago Fed President Charles Evans, one of the biggest doves, is “comfortable” with 25-basis-point hikes at every meeting this year (there are seven more), and even he is “open” to 50-basis-point hikes: “we want to be humble and nimble, and get to neutral before too long – maybe 50 helps, I’m open to that,” he said. The 10-year Treasury yield rose by 8 basis points to 2.93% at the close today, the highest since December 2018. The magic number there is 3.24%, beyond which yields are back in 2011 territory:

When yields rise, it means prices of those bonds fall, and prices fall the hardest of bonds with the longest remaining maturities. And it’s a massacre for people who invested in what they thought was a very conservative and prudent instrument, namely a bond fund tracking long-term Treasury securities, when in fact it turned out to be a highly risky wager on long-term Treasury yields always going lower forevermore. The iShares 20+ Year Treasury Bond ETF [TLT], which tracks an index of Treasury securities with at least 20 years of remaining maturities, dropped another 0.75% today, is down 19.5% year-to-date, and has plunged by 30.6% from the peak in August 2020, which was when long-term Treasury yields had hit historic lows, and which was – with hindsight – the moment the greatest bond-market bubble in US history began to implode:

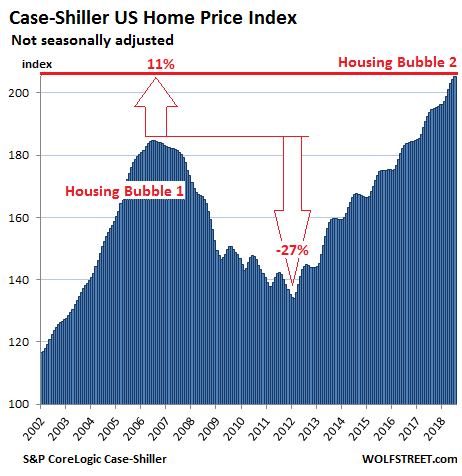

Holy moly Mortgage rates. The average 30-year fixed mortgage rate spiked to 5.35% today, the highest since 2009! This daily measure of mortgage rates by Mortgage News Daily had briefly hit 5.05% in November 2018, with inflation at or below the Fed’s target, and with markets tanking left and right, before the Fed made its infamous U-Turn, and mortgage rates dove. Now the Fed is just getting started, with inflation at 8.5%. There is no one that can persuade me that this jump in mortgage rates isn’t going to have a serious impact on the housing market. It’s the Fed’s way of getting the housing bubble under control before it tears up the financial system again:

They’re getting lost in their own narratives.

• Clinton Campaign: Fusion GPS Provided Legal Advice (Techno Fog)

The battle over documents and e-mails in the Michael Sussmann case just got hotter. Back in August 2017, Fusion GPS co-founder Glenn Simpson testified to the Senate Judiciary Committee, explaining how his firm was retained to gather “lots of facts about Donald Trump.” He admitted that Fusion GPS met with reporters leading up to the 2016 election to spread opposition research against then-candidate Trump. The context of Perkins Coie’s retention of Fusion GPS was further explained in a book co-authored by Simpson and Fusion GPS co-founder Peter Fritsch. They documented an April 20, 2016 meeting with Mark Elias (Perkins Coie partner and counsel for the DNC/Clinton Campaign), where Elias requested their services for opposition research.

Now the stories have changed. Fusion GPS is no longer an opposition research firm, and they weren’t hired to dig-up dirt against Trump. Instead, they would have you believe, after the phony dossier and the Alfa Bank hoax, that Fusion GPS was retained to provide legal advice to the Hillary Clinton Campaign. Remarkable. On April 6, Durham filed [a] motion to compel in the Michael Sussmann case, requesting the court require the production of “emails and attachments between and among” Perkins Coie, Rodney Joffe, and Fusion GPS. These emails and documents, according to Durham, “appear or involve or relate to” Fusion GPS’s provision of research and media services to Hillary for America, the DNC, and Perkins Coie. (Some documents had been produced pursuant to grand jury subpoenas dating back to the 2021.)

Faced with this pressure, today there was a flurry of filings from interested entities in the Sussmann case, seeking to intervene to petition the court to keep these emails and documents secret. The DNC, Rodney Joffe, Perkins Coie, and Hillary for America all filed motions to intervene and memorandums in opposition to Durham’s motion to compel. Notably, we saw arguments to the court that Fusion GPS wasn’t retained for opposition research. Hillary for America, for example, asserted “attorney-client privilege and work product protection over communications and work product of its attorneys (at Perkins Coie) and their consultant (Fusion GPS).” In support of that motion, Hillary for America included declarations from John Podesta, Robby Mook, and their attorney, Marc Elias. Declarations which contradict the public record.

To prove my point, John Podesta declared that to his knowledge, Perkins Coie has “consistently maintained” confidentiality, despite the fact that Perkins Coie (Sussmann in particular) assisted in distributing to the press the materials and allegations prepared by Fusion GPS and other researchers. Not to be outdone, Robby Mook (Hillary’s campaign manager) told the court that he believed that contractors for Perkins Coie – which would include Fusion GPS – were providing “legal services and legal advice” to the Clinton campaign. Unfortunately for Hillary for America, Mook’s belief is insufficient for the purposes of privilege. Clinton lawyer Mark Elias also submitted a declaration, stating the role of Fusion GPS was to “provide consulting services in support of the legal advice” Perkins Coie and Elias were providing their clients. This contradicts the Elias’s own statements cited above.

“Taylor Lorenz is not the ultimate problem. The problem is news outlets and infotainment companies using their outsize power and vast budgets to harass and doxx private citizens they disagree with. ”

• Taylor Lorenz Is Simply Following The New Rules Of Journalism (Miller)

Much has been said about Taylor Lorenz, the 30-something-year-old journalist for the Washington Post and former New York Times Slack channel gossipmonger. Still, her lack of media ethics is now unambiguous. On Tuesday, we learned about Lorenz’s doxxing of those behind a viral social media account she personally dislikes. Lorenz published a story on the popular “LibsofTikTok” Twitter account. This account curates and highlights content from the extreme fringes of the cultural and political Left on TikTok and other platforms. The account isn’t much different from the “Right Wing Watch” account on Twitter, which does mostly the same thing from a politically left perspective. The difference is simply who is protected by most of the media and who isn’t. That’s what much of the discourse around the public revealing of the person behind the LibsofTikTok account is missing.

Taylor Lorenz is what the media are now. In 2017, CNN’s Andrew Kaczynski tracked down an anonymous Reddit user who had created a gif of President Donald Trump clotheslining a wrestler at a WWE event, with the CNN logo replacing the opposing wrestler’s head. CNN found this to be doxx-worthy simply because it was retweeted by Trump. In 2019, when a joke video of a “drunk” Nancy Pelosi (the creator simply reduced the speed of the video) spread around, Kevin Poulsen of the Daily Beast tracked down and doxxed the person who did it, revealing he is an ex-con living in the Bronx who was working as a forklift operator. These details were not newsworthy. The video itself was not newsworthy. But the Daily Beast published his name and employment anyway.

In 2018, HuffPost writer Luke O’Brien doxxed and revealed the identity of a pro-Trump Twitter user, including information regarding a popular Brooklyn deli that her siblings owned and was not related to her social media posts. The deli was soon threatened with boycotts and negative Yelp reviews. These are just three examples of what has become an industry standard. It’s a standard that now has some reporters comparing LibsofTikTok to Harvey Weinstein and the Watergate scandal. However, in singling out Taylor Lorenz, what the political Right doesn’t understand is this is about politics and shutting down opposing speech. That is to say, speech that Lorenz or Kaczynski or the Daily Beast are ideologically opposed to. Of course, this is also about media power.

CNN is a multibillion-dollar media conglomerate that used the full weight of its corporate power to threaten a private individual with a Reddit account. In a newspaper owned by Jeff Bezos, Lorenz publishes a story with an individual’s name, professional license, and address information. It’s a struggle between one of the richest, most powerful men on the Earth and someone behind a Twitter account with less than a million followers (although that follower count is almost certainly about to increase). Taylor Lorenz is not the ultimate problem. The problem is news outlets and infotainment companies using their outsize power and vast budgets to harass and doxx private citizens they disagree with. It’s a new journalistic model for an industry that sees its grip loosening on what news it can control and create (see the media freak-out over Elon Musk buying their favorite toy). Taylor Lorenz, for all her theatrics, is simply leading the charge.

Tucker Libs of TikTok

They think doxxing me is going to intimidate me into silence. I can assure you, that’s never going to happen. pic.twitter.com/Icxz7tg5yL

— Libs of Tik Tok (@libsoftiktok) April 20, 2022

Gates Nov 2019

https://twitter.com/CovidMemo/status/1516444224622927882

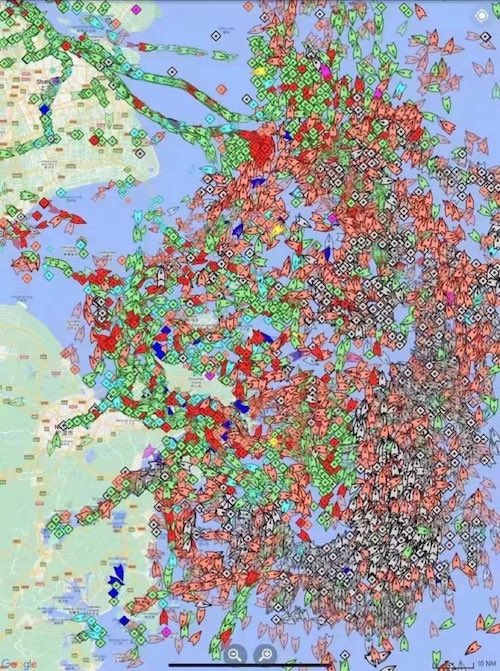

Ships waiting to dock in Shanghai.

NATO ad

NATO advertisement pic.twitter.com/B8mTcpiBOr

— Wittgenstein (@backtolife_2022) April 19, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.