Edouard Manet Gypsy with a cigarette 1862

Many such surveys these days.

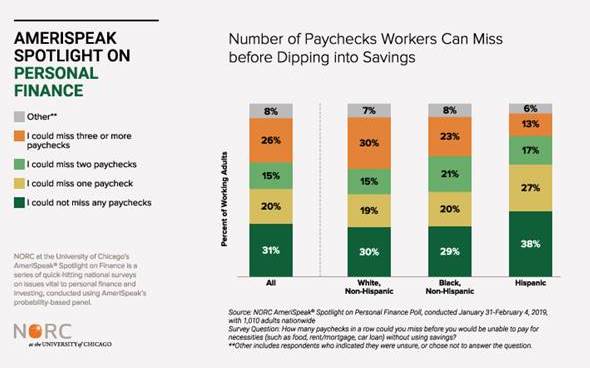

• Half Of Americans Are Just One Paycheck Away From ‘Financial Disaster’ (MW)

Missing more than one paycheck is a one-way ticket to financial hardship for nearly half of the country’s workforce. A new study from NORC at the University of Chicago, an independent social research institution, found that 51% of working adults in the United States would need to access savings to cover necessities if they missed more than one paycheck. [Research from the Federal Reserve found that 4 in 10 Americans couldn’t afford a $400 emergency, and 22% say they expect to forgo payments on some of their bills.]

Certain communities were more prone to economic hardship in the event of missing a paycheck. Roughly two-thirds of households earning less than $30,000 annually and Hispanic households would be unable to cover basic living expenses after missing more than one paycheck, the researchers found. “Even so, notable differences remain across race, ethnicity, education groups, and locations and many individuals still struggle to repay college loans, handle small emergency expenses, and manage retirement savings,” it added. The findings were based on a survey of more than 1,000 adults. The researchers interviewed a nationally representative panel designed to be indicative of the U.S. population.

Record numbers of dirt poor Americans while the rich don’t know what to do with their money. Not a recipe for anything long lasting.

• Record-Setting Art Sales Confirm Global Liquidity Bubble (Colombo)

Art and collectibles prices have exploded in the past decade as a result of the extremely frothy conditions created by central banks. Hardly a week goes by without news headlines being made about ugly, tacky, or just plain bizarre works of art fetching tens of millions, if not hundreds of millions, of dollars at auction houses like Sotheby’s and Christie’s (often sold to rich buyers in China or Hong Kong). Make no mistake: we’re currently experiencing a massive art bubble of the likes not seen since the Japan-driven art bubble of the late-1980s that ended disastrously. Two art market records were made in the past week: the $91.1 million “Rabbit” sculpture by Jeff Koons, which set the record for the highest amount paid for a piece of art by a living artist, and the sale of Monet’s ‘Meules’ painting for $110.7 million, which set a record for an Impressionist work.

[..] In order to understand today’s art bubble, it is helpful to learn about the art bubble of the late-1980s that ultimately crashed and burned. Throughout the 1980s, Japan had a bubble economy that was driven by debt and bubbles in property and stocks. Japan’s economy was seemingly unstoppable – almost everyone in the West was terrified that Japan’s economy and corporations would trounce ours while destroying our standard of living in the process. Of course, few people knew how unsustainable Japan’s economy was at that time.

As a result of hubris and the enormous amount of liquidity that was flowing throughout Japan’s economy in the late-1980s, Japanese businesspeople and corporations started to speculate in art, often bidding previously unheard of sums that Western art collectors would never have dreamed of paying. For example, Yasuda Fire and Marine Insurance paid a record $39.9 million for Vincent van Gogh’s “Sunflowers” at a London auction in 1987. Ryoei “wild fellow” Saito, Chairman of the Daishowa Paper Manufacturing empire, paid $160 million for the world’s two most expensive paintings – a Van Gogh and a Renoir. At the peak of the art market in 1990, Japan imported more than $4 billion worth of art, including nearly half of all Impressionist art that was on the market. Of course, the art market plunged along with Japan’s bubble economy in the early-1990s.

“When vultures grow fat on a corpse, they do not revive it.”

• A Greek Canary in a Global Goldmine (Varoufakis)

The eurozone country that has become synonymous with insolvency is today proving to be a treasure-trove for some. Traders who bought Greek assets a few years ago have good reason to celebrate, having banked returns that no other market could have provided. But, as is often the case, an opportunity that seems too good to be true probably is. And this one could portend the next phase of our global crisis. An investor who bought German government bonds in 2013 has, by now, gained a 7% return, whereas a buyer of a Greek government bond issued at the height of the country’s debt crisis in 2012 would have earned a colossal 231% return. Two months ago, the price of the first ten-year bond issued since Greece’s bailout in 2010 surged for seven consecutive days, rising by 2.8% in a week – a better performance than any other government bond issue worldwide.

That bond rally created a psychological slipstream, which, in recent months, pulled the Athens Stock Exchange 26% higher, against the background of a European asset market inexorably bleeding capital. On the strength of these impressive numbers, it is as tempting as it would be false to herald the end of Greece’s crisis. The Greek bond and equity rally is obscuring a growing chasm between a gloomy economic reality and an unsustainably buoyant financial climate. Rather than reflecting Greece’s recovery, the traders’ high profit margins mirror continued deflationary pressures and fragmentation in Europe within a global environment of decreasing debt sustainability. The numbers from Greece, so exciting to investors far and wide, may well prove a harbinger of fresh troubles for Europe’s economy, and perhaps for the world.

Given the gaping gap between Greece’s nominal national income and its public debt, how is it possible that Greek bonds are soaring? Why is the Athens Stock Exchange rising while business remains hampered by punitive taxation, banks labor under a mountain of non-performing loans, declining unemployment reflects only emigration and some precarious jobs, net public investment is negative, and private investment in production of high value-added tradable goods is absent?

One reason is the proverbial dead-cat-bounce. Given how thin Greece’s equity market is – total capitalization is €52 billion ($58 billion) – the modest influx of capital that came in the wake of the bond rally was enough to drive the 26% rise in its index. But, despite this surge, the Greek market remains 81% below its 2009 level. As for the bond rally itself, the paradox quickly disappears once we recall how the first two bailouts shifted Greek public debt from the private sector to the shoulders of Europe’s taxpayers.

I’m very happy I’m not the only one having signaled this for 2+ years. It’s almost worth being called a Trump supporter for. Though that is still an utterly ridiculous allegation in my case. But this is the most dangerous tendency in American society today, not Trump.

• US Media No Longer Reports Facts, But Appeals To Emotions (SHTF)

The mainstream media in the United States has made a shift in the past few decades. Now, they appeal to emotions as opposed to reporting the facts. This “cultural schizophrenia” is tearing the U.S. apart at the seams. Based on the conclusions to a RAND Corporation study, the mainstream media is actively sowing discord in American society, award-winning journalist Chris Hedges tells RT. The media is focusing on making two sides hate each other instead of reporting on the facts, and the majority of the public is unaware and doesn’t care that their minds are being manipulated by their own emotional responses.

The study, which was released by RAND earlier this week, states that between 1987 and 2017, news content has shifted from event- and context-based reporting to coverage that is “more subjective, relies more heavily on argumentation and advocacy, and includes more emotional appeals.” According to RT, prime-time cable news shows and online journalism lead the way in this shift to emotional and hate-based rhetoric. It has been noticed in print journalism as well, the government-funded think tank concluded. This is contributing to what RAND termed “Truth Decay.” This is described as a shift away from facts and analysis in public discourse.

Hedges claims that the deterioration of the mainstream media is “far worse” than the RAND report suggests. And he isn’t alone in that assessment. [American journalist Matt]Taibbi says that the result of this journalistic decay and emotional fear mongering is a public addicted to hating each other. Americans have become addicted to the news that agrees with their bias, and it was set up that way on purpose. The only thing anyone will hear when they turn on the news are stories specifically crafted to manufacture outrage, make you hate the other side, and fuel the addiction to anger. –SHTFPlan

[..] It is becoming difficult to tell apart facts and opinion now, and people believe whatever they want to believe, Hedges explained. “We spent years watching CNN and MSNBC promoting this conspiracy theory that Trump was a Kremlin agent… It was all garbage but it attracted viewers,” Hedges added as an example. And, if you don’t mind your IQ dropping, turn on MSNBC for just a few minutes. It’s likely you’ll still hear something about Russiagate to keep the public pissed off beyond comprehension.

OPCW gone. White Helmets gone. Skripal narrative gone. This is why Assange is so needed. Because we wouldn’t know these things if not for leaks. Assange built the infrastructure for them.

Note: some publications say this concerns an OPCW article. It is not, they tried to hide it.

• OPCW Expert Contradicts Official Douma Attack Analysis (CJ)

[..] a few days ago the Working Group on Syria, Propaganda and Media (WGSPM) published a document signed by a man named Ian Henderson, whose name is seen listed in expert leadership positions on OPCW documents from as far back as 1998 and as recently as 2018. It’s unknown who leaked the document and what other media organizations they may have tried to send it to. The report picks apart the extremely shaky physics and narratives of the official OPCW analysis on the gas cylinders allegedly dropped from Syrian government aircraft in the Douma attack, and concludes that “The dimensions, characteristics and appearance of the cylinders, and the surrounding scene of the incidents, were inconsistent with what would have been expected in the case of either cylinder being delivered from an aircraft,” saying instead that manual placement of the cylinders in the locations investigators found them in is “the only plausible explanation for observations at the scene.”

[..] the kindest possible interpretation of these revelations is that an expert who has worked with the OPCW for decades gave an engineering assessment which directly contradicted the official findings of the OPCW on Douma, but OPCW officials didn’t find his assessment convincing for whatever reason and hid every trace of it from public view. That’s the least sinister possibility: that a sharp dissent from a distinguished expert within the OPCW’s own investigation was completely hidden from the public because the people calling the shots at the OPCW didn’t want to confuse us with a perspective they didn’t find credible.

This most charitable interpretation possible is damningly unacceptable by itself, because the public should obviously be kept informed of any possible evidence which may contradict the reasons they were fed to justify an act of war by powerful governments. And there are many far less charitable interpretations. It is not in the slightest bit unreasonable to speculate that the ostensibly independent OPCW in fact serves the interests of the US-centralized power alliance, and that it suppressed the Henderson report because it pokes holes in the narratives that are used to demonize a longtime target for imperialist regime change. That is a perfectly reasonable possibility for us to wonder about, and the onus is now on the OPCW to prove to us that it is not the case.

Either way, the fact that the OPCW kept Henderson’s findings from receiving not a whisper of attention severely undermines the organization’s credibility, not just with regard to Douma but with regard to everything, including the establishment Syria narrative as a whole and the Skripal case in the UK. Everything the OPCW has ever concluded about alleged chemical usage around the world is now subject to very legitimate skepticism. “The leaked OPCW engineers’ assessment is confirmed as genuine, which means the final report actively concealed evidence that the Douma chemical attack was staged by jihadists and the White Helmets,” tweeted British journalist Jonathan Cook. “The OPCW’s other Syria reports must now be treated as worthless too.”

“Both countries have borrowed themselves into a Twilight Zone of unpayable debt. Both countries are sunk in untenable economic and banking rackets to cover up their insolvency.”

Here’s what will actually happen. These House majority committee chiefs are going to quit their blustering over the next week or so as they discover there is no political value — and plenty of political hazard — in extending the RussiaGate circus. In the meantime, a titanic juridical machine, already a’grinding, will discredit the whole sordid affair and send a number of hapless participants to the federal ping-pong academies. And by then, the long-suffering citizenry will barely give a shit because we will have entered the climactic phase of the Fourth Turning (or Long Emergency, take your pick), in which the operations of everyday business and governance in this country seriously crumble. The Golden Golem of Greatness will be blamed for most of that.

The internal contradictions of Globalism were already blowing up trade and financial relations between the US and China. The Trump tariffs just amount to a clumsy recognition of the fatal imbalances long at work there. As a 25 percent tax on countless Chinese products, the tariffs will punish American shoppers as much as the Chinese manufacturers. Trade wars have a way of escalating into more kinetic conflicts. The sad truth is that both China and the US are beset by dangerous fragilities. Both countries have borrowed themselves into a Twilight Zone of unpayable debt. Both countries are sunk in untenable economic and banking rackets to cover up their insolvency. China’s fate hangs on distant energy supply lines that run through bottlenecks like the Straits of Hormuz and the Straits of Molucca.

They just wasted another 6 weeks, that’s all there is to say.

• May And Corbyn Blame Each Other As Brexit Talks Collapse (G.)

The government and Labour have sought to blame each other after cross-party talks to find a compromise Brexit plan collapsed, leaving any remaining hopes of an imminent solution to the impasse in tatters. While both sides insisted the discussions had taken place in good faith, Theresa May said a sticking point had been Labour splits over a second referendum. Labour in turn said the government had been unwilling to compromise and that May’s imminent departure from Downing Street meant there was no guarantee any promises would be kept by a successor such as Boris Johnson. Nick Boles, the former Conservative MP who helped spearhead efforts to prevent a no-deal Brexit in March, said he now feared such a departure was almost inevitable when the EU27’s latest deadline of 31 October is reached.

“It’s game over,” he said. “We only won by one, and it’s very unclear that we would have the same level of Tory support, and for that matter Labour support. We are absolutely convinced that parliament will not find a way to stop no-deal Brexit.” The conclusion to six weeks of intermittent talks, which had angered many Conservative and Labour MPs who feared the nature of the compromise that might result, came with the release of a letter from Jeremy Corbyn to May on Friday. Despite praising the talks as constructive, the Labour leader wrote: “It has become clear that, while there are some areas where compromise has been possible, we have been unable to bridge important policy gaps between us. “Even more crucially, the increasing weakness and instability of your government means there cannot be confidence in securing whatever might be agreed between us.”

We’re going to have Boris Johnson next. That will not end well.

• Tory Brexiteers Tell May: You Must Quit Now (Ind.)

Theresa May is facing growing clamour from within her own party to quit immediately as prime minister, after the collapse of Brexit talks with Labour sounded the death knell for her EU withdrawal plans. With Tories trailing in fifth place on a humiliating 9 per cent in one poll for next week’s European parliament elections, furious backbenchers predicted certain defeat when the Withdrawal Agreement Bill comes before the Commons in June. Brexiteers said there was no prospect of Ms May averting a “significant” rebellion by tacking towards them on totemic issues like the Irish backstop and free trade. “There’s nothing she can say,” said one former minister. “No one trusts her any more.”

[..] senior Leave-supporting backbenchers said she should scrap the legislation and hand over immediately to a new leader.Nigel Evans urged her to announce she was not waiting three weeks to discuss the timetable for her departure, as agreed with the chair of the influential 1922 Committee Sir Graham Brady, but would go “forthwith”. Asked if the declaration should come within days, the committee’s joint secretary replied: “I would like her to do it now … It’s only right that the new leadership has the opportunity to become established and form a new cabinet prior to us going into the summer recess.” Former minister David Jones said the PM should recognise that “now is the time that she should stand down”. “On the Conservative benches, most people now want the PM to step down as quickly as possible,” he told The Independent. “Prolonging this is just wasting time at a time when we don’t have much time to waste.”

A must read, I gather.

• A Brief History Of Doom: The New Kindleberger And Mackay (Steve Keen)

“If readers take one lesson from this book, I hope it is this: when it comes to financial crises, we’re not in the grip of unseen and hopelessly complex forces. Such crises are neither inevitable nor unpredictable. Runaway private debt and the resulting overcapacity does a better job than any other variable in explaining and predicting financial crises. It is our job to heed those danger signs.” (Vague 2019, p. ix)

This brief book (196 pages, excluding endnotes) on the history and causes of financial crises usurps Kindleberger’s Manias, Panics, and Crashes (Kindleberger 1978) and Mackay’s Memoirs of Extraordinary Popular Delusions and the Madness of Crowds (Mackay 1852) as the definitive work on this vital topic. It surpasses both these works for several reasons, not the least of which is the career and experience of the author. Mackay was a journalist and gifted writer; Kindleberger, an economist with an impressive record in both public service and academia. Both of them observed financial manias and crashes from their respective professional perches, outside the financial system itself.

Vague is an ex-banker, whose fortune was carved in the financial crisis emanating from the bursting of the 1979 oil shock bubble, whose hands-on management established two of America’s biggest consumer credit card companies (First USA, which he sold Bank One in 1997, and Juniper Financial, which he sold to Barclays PLC in 2004), and whose professional access to the voluminous data he saw on the explosion in mortgage debt – from $6 trillion in 2002 to $9 trillion in 2005 – led him to anticipate the Subprime Crisis and exit banking altogether. Vague has seen financial crises from the inside – and not merely survived but prospered.

In the hands of most Americans, this experience would lead to a “How to Get Rich” book. Vague’s ambition with this book is very different: to make society richer by understanding what causes financial crises, and thereby preventing them in the first place. Vague’s banker’s perspective gives him an incomparable advantage over not only MacKay and Kindleberger, but over me as well: having seen the booms and busts of banking from the inside, he knew where to look, and what to look for. For example, I dismissed the possibility of a real-estate bubble as a catalyst to the Great Depression, because Robert Shiller’s data (Figure 1) seemed to show that house prices were flat during the 1920s, and if anything, declining. That was as far as my investigations went.

He must be on some hit lists.

• Cristiano Ronaldo Donates $1.5 million to Palestine for Ramadan (21Wire)

Portuguese footballer and Juventus striker , Cristiano Ronaldo, has donated US $1.5 million to people of Palestine during the holy month of Ramadan. Regarded as one of the world’s greatest-ever professional football players, Ronaldo is said to have made his generous donation in solidarity with the Palestinian people suffering en mass, and in particular the millions who are currently suffering under the brutal punitive ‘air, land and sea’ economic and humanitarian blockade in Gaza – where Israeli forces have been conducting regular bombing raids which have killed thousands of innocent civilians in recent years. Although sports media rarely highlights this facet of the soccer star, Ronaldo has always been close to the Palestinian cause, publicly rejecting the illegal and genocidal incursions of the Israeli regime on several occasions.

In November 2012, while Gaza was being blanketed with bombs by Israel in their Operation Pillar of Defense, Ronaldo auctioned off his Golden Boot, the prestigious award given to the best European strikers of the season, to raise funds that were later donated to the Palestinian children. The following year, in March 2013, at the end of the match between Portugal and Israel for the 2014 World Cup qualifiers, he refused to exchange his shirt with an Israeli player. Although he shook hands, he excused himself by explaining that he could not wear a shirt with that country’s flag, as reported in the press.

Keep driving.

• Air Pollution May Be Damaging ‘Every Organ In The Body’ (G.)

Air pollution may be damaging every organ and virtually every cell in the human body, according to a comprehensive new global review. The research shows head-to-toe harm, from heart and lung disease to diabetes and dementia, and from liver problems and bladder cancer to brittle bones and damaged skin. Fertility, foetuses and children are also affected by toxic air, the review found. The systemic damage is the result of pollutants causing inflammation that then floods through the body and ultrafine particles being carried around the body by the bloodstream. Air pollution is a “public health emergency”, according to the World Health Organization, with more than 90% of the global population enduring toxic outdoor air. New analysis indicates 8.8m early deaths each year – double earlier estimates – making air pollution a bigger killer than tobacco smoking.

But the impact of different pollutants on many ailments remains to be established, suggesting well-known heart and lung damage is only “the tip of the iceberg”. “Air pollution can harm acutely, as well as chronically, potentially affecting every organ in the body,” conclude the scientists from the Forum of International Respiratory Societies in the two review papers, published in the journal Chest. “Ultrafine particles pass through the [lungs], are readily picked up by cells, and carried via the bloodstream to expose virtually all cells in the body.” Prof Dean Schraufnagel, at the University of Illinois at Chicago and who led the reviews, said: “I wouldn’t be surprised if almost every organ was affected. If something is missing [from the review] it is probably because there was no research yet.”

Australia has elections this weekend

https://twitter.com/i/status/1129530852000403457

Home › Forums › Debt Rattle May 18 2019