DPC Gillender Building, corner of Nassau and Wall Streets, built 1897, wrecked 1910 1900

“.. 70% of the UK’s publicly listed oil exploration and production companies are now unprofitable..” We can all see what that means for the global industry.

• Third Of Listed UK Oil And Gas Drillers Face Bankruptcy (Telegraph)

A third of Britain’s listed oil and gas companies are in danger of running out of working capital and even going bankrupt amid a slump in the value of crude, according to new research. Financial risk management group Company Watch believes that 70% of the UK’s publicly listed oil exploration and production companies are now unprofitable, racking up significant losses in the region of £1.8bn. Such is the extent of the financial pressure now bearing down on highly leveraged drillers in the UK that Company Watch estimates that a third of the 126 quoted oil and gas companies on AIM and the London Stock Exchange are generating no revenues. The findings are the latest warning to hit the oil and gas industry since a slump in the price of crude accelerated in November when the OPEC decided to keep its output levels unchanged.

The decision has caused carnage in oil markets with a barrel of Brent crude falling 45% since June to around $60 per barrel. The low cost of crude has added to the financial pressure on many UK listed drillers which are operating in offshore areas such as the North Sea where oil is more expensive to produce and discover. Ewan Mitchell, head of analytics at Company Watch, said: “Many of the smaller quoted oil and gas companies were set up specifically to take advantage of historically high and rising commodity prices. The recent large falls in the price of oil and gas could leave the weaker companies in difficulties, especially the ones that need to raise funds to keep exploring.” Losses are expected to be much deeper among privately-owned oil and gas explorers, which traditionally have more debt.

Company Watch has warned that almost 90% in the UK are loss making with accounts that show a £12bn accumulated black hole in their finances. Mr Mitchell said: “Investors in this sector need to focus primarily on the strength and structure of the balance sheet. A critical question is whether the balance sheet is sufficiently robust to keep the company in business until revenues are expected to flow and, crucially are they likely to be able to rely on existing funding lines while they wait? “Our fear is sustained low oil and gas prices will put an intolerable financial burden on the weaker companies, jeopardising many livelihoods.”

The findings of the Company Watch research are the latest downbeat analysis to hit the industry, which is preparing itself for oil prices to fall below current levels of $60 per barrel. Sir Ian Wood, founder of the oil and gas services giant Wood Group, warned earlier this month that the North Sea oil industry could lose 15,000 jobs in Scotland alone and that production could fall by 10% as drillers cut back. According to energy consultancy firm Wood Mackenzie, around £55bn of oil and gas projects in the North Sea and Europe could be shelved should prices fall below their current levels. Ratings agency Standard & Poor’s recently flagged its concern of some of Europe’s biggest oil and gas groups such as Royal Dutch Shell, BP and BG Group. Its primary worry is debt levels which it says have jumped from a combined $162.9bn (£105bn) for the five largest European companies in the sector at the end of 2008 to an estimated $240bn in 2014.

It’s about demand, not supply.

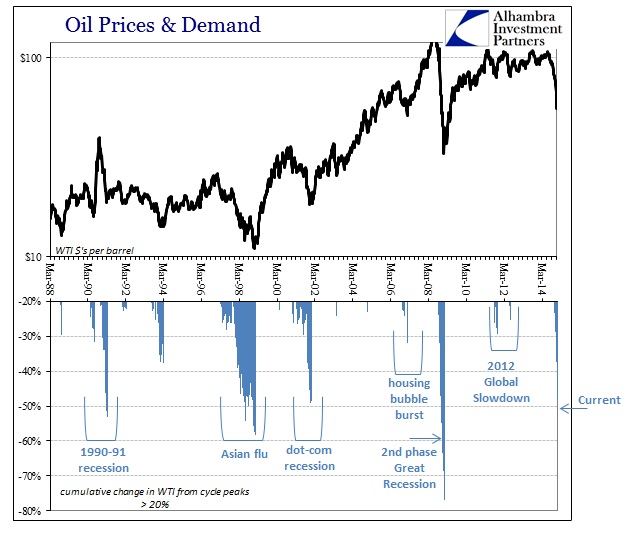

As my colleague Joe Calhoun continually reminds us, everything that happens has happened before. The ongoing “struggle” to define what is driving crude oil prices lower is perhaps another instance of a past “cycle” being reborn. With oil prices now heading much closer to the $40’s than the $60’s, consistent commentary is increasingly swept aside. The move in crude these past six months is now nothing short of astounding. At about $52 current prices (which will probably move in either direction significantly by the time this is posted) the collapse from the recent peak now equals only past, significant global recessions under the oil regime that began in the mid-1980’s.

Fourteen months have passed since the International Energy Agency’s oil analysts alerted the world to the mystery of the “missing barrels.” This new term referred to the discrepancy between the “well-documented” imbalance between supply and demand for oil and the lack of any stock build in the industrialized world’s petroleum supply. In April last year [1998], the IEA’s “missing supply” totaled only 170 million barrels. At the time, the IEA described this odd situation an “arithmetic mystery,” but assured us that these missing barrels would soon show up. As months passed by, stock revisions occasionally too place, but often in the wrong direction. Rather than shrink, the amount of “missing barrels” grew by epochal proportions.

By the publication date of the IEA’s April 1999 Oil Market Report, the unaccounted for crude needed to confirm the IEA’s extremely bearish views of massive oversupply of oil throughout 1997 and 1998 ballooned to an astonishing 647 million barrels of oil. Two months later, the IEA’s June report still presumes that 510 million barrels of oil is still “missing”, and the IEA has officially opined that it all resides in the un-traded storage facilities in the developing countries of the world.

As the author of that analysis points out in another piece, those “un-traded storage facilities” being blamed were sometimes ridiculous notions, such as “slow-steaming tankers”, South African coal mines or even Swedish salt domes. In other words, the idea that there was this massive oversupply of oil production driving the almost 60% collapse in global crude prices in 1997 and 1998 was total bunk. Instead, what was driving prices lower was the simple fact of supply and demand balancing to achieve a physical clearing price. That meant, in the broader context far and away from Swedish salt domes, the price of oil was really trading on the collapse in global demand for it. The Asian “flu” was not simply a financial panic among “unimportant”, far-flung isolated economies of tiny nations, but rather a global slowdown across nearly every economy – which sharply lower oil prices simply confirmed.

[..] today, the Saudis are supposedly up to the same tricks, now trying to drive US shale production out of business. The fact that all those increased marginal suppliers more than survived the Asia flu tells you everything you need to know about this wild assertion of “intentional” Saudi action. It is a convoluted rumor that survives solely because it is convenient to those economists and commentators that refuse to accept these more basic connections.

“We’re buying more of it from ourselves, which is a great economic multiplier.” Well, until you start losing 1000s of jobs.

• AAA Says Motorists May Save $75 Billion on Gasoline in 2015 (Bloomberg)

Drivers in the U.S. may save as much as $75 billion at gasoline pumps in 2015 after a yearlong rout in crude oil sent prices tumbling, AAA said today. Americans already saved $14 billion on the motor fuel this year, according to Heathrow, Florida-based AAA, the country’s largest motoring group. Pump prices have dropped a record 97 consecutive days to a national average $2.26 a gallon today, the lowest since May 12, 2009, AAA said by e-mail. A global glut of crude oil and a standoff between U.S. producers and the Organization of Petroleum Exporting Countries over market share has been a boon for consumers. U.S. production climbed this year to the highest in three decades amid a surge in output from shale deposits.

Oil is heading for its biggest annual decline since the 2008 financial crisis. “Next year promises to provide much bigger savings to consumers as long as crude oil remains relatively cheap,” Avery Ash, an AAA spokesman, said by e-mail today. “It would not be surprising for U.S. consumers to save $50-$75 billion on gasoline in 2015 if prices remain low.” U.S. benchmark West Texas Intermediate crude dropped 46% this year while Brent oil, the international benchmark that contributes to the price of gasoline imports, fell 49%. “It’s getting lower because what happened? We drilled in the United States,” Peyton Feltus, president of Randolph Risk Management in Dallas, said today in a telephone interview.

“We’re buying more of it from ourselves, which is a great economic multiplier.” There is “significant uncertainty” over the cost of crude next year as lower prices may force companies to curb production and may also lead to instability in other oil-producing countries, the motoring group said. Gasoline futures fell 48% this year to close at $1.4353 a gallon today on the New York Mercantile Exchange. The average U.S. household will save about $550 on gasoline costs next year, with spending on track to reach the lowest in 11 years, the Energy Information Administration said Dec. 16. “They’ve got more disposable income and they’re going to have even more in the coming months,” Feltus said. “Gasoline prices are going to go lower than anybody thought they could.”

“It’s similar to 2008 when we knew oil at $120, $130 and $140 made no sense, but high prices became the reason for higher prices. It’s the same thing in reverse.”

• Bottom On Oil’s Plunge Unknown (CNBC)

Oil’s massive price drop continues to befuddle industry experts. “We’re at the stupid range,” Stephen Schork, editor and founder of The Schork Report, said in an interview with CNBC’s “Squawk Box.” Schork added this situation is similar to oil’s price spike in 2008 in terms of its uncertainty. “We don’t know how much lower oil can go,” Schork said. “It’s similar to 2008 when we knew oil at $120, $130 and $140 made no sense, but high prices became the reason for higher prices. It’s the same thing in reverse.” Schork also said oil’s price plunge is attracting many investors. “Bets for oil below $30 by June traded over 46,000 contracts over the past two weeks,” he said.

Also on “Squawk Box,” Boris Schlossberg, founding partner of B.K. Asset Management, said an entire year of oil selling at $50 per barrel will create problems for Russia. “Russia is in very serious trouble if oil just stays low,” he said. “We had a bounce in the ruble, and it sort of stabilized right now, but if you have oil staying at $54 for a whole year, it’s really going to create problems over there.” Schlossberg added that this could lead to more capital leaving Russia for other currencies, including the Swiss franc. “There’s a lot of money being moved into the Swiss franc as a safety trade,” he said.

“The move could signal that a full opening of the export ban, which has existed since the oil shock of the 1970s, is imminent.”

• US Eases Oil Export Ban In Shot At OPEC As Crude Price Slumps (Telegraph)

President Barack Obama has fired a shot at the Organisation of Petroleum Exporting Countries (OPEC) in the war to control global oil markets by quietly sanctioning the easing of America’s 40-year ban on exporting crude. The US government has reportedly told oil companies they can begin to export shipments of condensate – a high-grade crude produced as a by-product of gas – without going through the formal approval process. The move could signal that a full opening of the export ban, which has existed since the oil shock of the 1970s, is imminent. Brent crude fell sharply on the news, first reported by Reuters. The global benchmark opened down almost 2% in London at $56.85 per barrel as it closes in on its biggest annual drop since the financial crisis in 2008. Brent has lost 50% of its value since reaching its year-long high in June. The ending of America’s self-imposed embargo on oil exports would mark a serious escalation in the unfolding oil price war with OPEC led by Saudi Arabia.

The kingdom has made it clear that it is willing to watch the price of oil fall lower in order to protect its share of the global market. OPEC share has fallen to about a third of world supply, down from about half 20 years ago as the flood in shale oil drilling in the US and new supplies from Russia and South America have created a global glut. Meanwhile, the sharp fall in the value of oil is placing economies in major producing nations such as Venezuela and Russia under extreme strain. Venezuela – also a member of OPEC – has fallen into recession after its economy contracted for the first three quarters of the year, while inflation topped 63% in the 12 months to November. The South American oil giant’s economy shrank 2.3% in the third quarter, after contracting 4.8% in the first quarter and 4.9% in the second, the central bank has said.

Recession also looms in Russia, where the economy has fallen into decline for the first time in five years, according to official figures, which show that GDP contracted by 0.5% in the year to November. Falling oil prices are helping the US to exert pressure on the Kremlin over President Vladimir Putin’s support for separatists in Ukraine. Oil also came under pressure on the final day of the year after new data showed that China may miss its growth target for 2014. China manufacturing PMI fell to 49.6, down from final 50.0 in November. This is the first time in the second half of the year that China’s factory sector has contracted and has increased the possibility that 2014 GDP will miss the official 7.5% target. “Weak Chinese manufacturing data also damaged demand sentiment around oil as Brent breached the $57 handle,” said Peter Rosenstreich, head of market strategy at Swissquote.

“When the future arrives, prices will still be low, confounding those who have bought forward.”

• Even $20 Oil Will Struggle To Save Self–Harming Eurozone (Telegraph)

Revisiting the past year’s predictions is, for most columnists – yours truly included – a frequently humbling experience. The howlers tend to far outweigh the successes. Yet, for a change, I can genuinely claim to have got my main call for markets – that oil would sink to $80 a barrel or less – spot on, and for the right reasons, too. Just in case you think I’m making it up, this is what I said 12 months ago: “My big prediction is for $80 oil, from which much of the rest of my outlook for the coming year flows. It’s hard to overstate the significance of a much lower oil price – Brent at, say, $80 a barrel, or perhaps lower still – yet this is a surprisingly likely prospect, the implications of which have been largely missed by mainstream economic forecasters.” If on to a good thing, you might as well stick with it; so for the coming year, I’m doubling up on this forecast.

Far from bouncing back to the post crisis “normal” of something over $100 a barrel, as many oil traders seem to expect, my view is that the oil price will remain low for a long time, sinking to perhaps as little as $20 a barrel over the coming year before recovering a little. I’ve used the word “normal” to describe $100 oil, but in fact such prices are in historic terms something of an aberration. The long term, 20–year average is, in today’s money (adjusting for inflation), more like $60. It wasn’t that long ago that OPEC was targeting $25 oil, which back then seemed a comparatively high price. Be that as it may, for 15 years prior to the turn of the century Brent traded at around the $20 mark in nominal terms. Oil at $20 is a much more “normal” price than $100. The assumption of much higher prices is in truth a very modern phenomenon, born of explosive emerging market demand. For the time being, this seems to be over. Chinese growth is slowing and becoming less energy intensive.

By the by, however, the relatively high prices of the past 10 years have incentivised both a giant leap in supply – in the shape of American shale and other once marginal sources – and continued paring back of existing demand, as consumers, under additional pressure from environmental objectives, seek greater efficiency. Lots of new technologies have been developed to further these aims. Personally, I wouldn’t read much into the present deep “contango” in markets – an unusual alignment whereby futures prices are a lot higher than present spot prices. Some cite this as evidence that the price will shortly rebound. I’d say it’s just a leftover from the old “peak oil” mindset of permanently high prices. When the future arrives, prices will still be low, confounding those who have bought forward. In any case, for now we are faced with an oil glut, and there is no reason to believe that this mismatch between supply and demand is going to close any time soon.

Draghi must leave.

• ECB’s Draghi Says Eurozone Must ‘Complete’ Monetary Union (Reuters)

Euro zone countries must “complete” their monetary union by integrating economic policies further and working towards a capital markets union, European Central Bank President Mario Draghi said. In an article for Italian daily Il Sole 24 Ore on Wednesday, Draghi said structural reforms were needed to “ensure that each country is better off permanently belonging to the euro area”. He said the lack of reforms “raises the threat of an exit (from the euro) whose consequences would ultimately hit all members”, adding the ECB’s monetary policy, whose goal is price stability, could not react to shocks in individual countries.

He said an economic union would make markets more confident about future growth prospects – essential for reducing high debt levels – and so less likely to react negatively to setbacks such as a temporary increase in budget deficits. “This means governing together, going from co-ordination to a common decisional process, from rules to institutions.” Unifying capital markets to follow this year’s banking union would also make the bloc more resilient. “How risks are shared is connected to the depth of capital markets, in particular stock markets. As a consequence, we must proceed swiftly towards a capital markets union,” Draghi wrote.

“An army of critics retort that the underlying picture is turning blacker by the day. Europe’s rescue apparatus is not what it seems. The banking union belies its name. It is merely a supervision union.”

• Greek Expulsion From The Euro Would Demolish EMU’s Contagion Firewall (AEP)

We know from memoirs and a torrent of leaks that Europe’s creditor bloc came frighteningly close to ejecting Greece from the euro in early 2012, and would have done so with relish. Former US Treasury Secretary Tim Geithner has described the mood at a G7 conclave in Canada in February of that year all too vividly. “The Europeans came into that meeting basically saying: ‘We’re going to teach the Greeks a lesson. They are really terrible. They lied to us, and we’re going to crush them,’” he said. “I just made very clear right then: if you want to be tough on them, that’s fine, but you have to make sure that you’re not going to allow the crisis to spread beyond Greece.” German chancellor Angela Merkel did later retreat but only once it was clear from stress in the bond markets that Italy and Spain would be swept away in the ensuing panic, setting off an EMU-wide systemic crisis.

The prevailing view in Berlin and even Brussels is that no such risk exists today: Europe has since created a ring of firewalls; debtor states have been knocked into shape by their EMU drill sergeants. The democratic drama unfolding in Greece this month is therefore a local matter. If Syriza rebels win power on January 25 and carry out threats to repudiate the EU-IMF Troika Memorandum from their “first day in office”, Greece alone will suffer the consequences. “I believe that monetary union can today handle a Greek exit,” said Michael Hüther, head of Germany’s IW institute. “The knock-on effects would be limited. There has been institutional progress such as the banking union. Europe is far less easily blackmailed than it was three years ago.” This loosely is the “German view”, summed up pithily by Berenberg’s Holger Schmieding: “We’re looking at a Greece problem, the euro crisis is over. I do not expect markets to seriously contest the contagion defences of Europe.”

It sounds plausible. Bond yields in Italy, Spain and Portugal touched a record low this week. Yet it rests on the overarching assumption that the Merkel plan of austerity and “internal devaluation” has succeeded. An army of critics retort that the underlying picture is turning blacker by the day. Europe’s rescue apparatus is not what it seems. The banking union belies its name. It is merely a supervision union. Each EMU state bears the burden for rescuing its own lenders. Europe’s leaders never delivered on their promise to “break the vicious circle between banks and sovereigns”. The political facts on the ground are that the anti-euro Front National is leading in France, the neo-Marxist Podemos movement is leading in Spain, and all three opposition parties in Italy are now hostile to monetary union.

Creative accounting intended to fool the German court system(s). Good luck with that.

• Europe’s Shadow Budget Venture Could Lead To Spiralling Debt (Sinn)

More details about the European commission’s €315bn (£247bn) investment plan for 2015-17 have finally come to light. The programme, announced in November by the commission’s president, Jean-Claude Juncker,amounts to a huge shadow budget – twice as large as the EU’s annual official budget – that will finance public investment projects and ultimately help governments circumvent debt limits established in the stability and growth pact. The borrowing will be arranged through the new European fund for strategic investment, operating under the umbrella of the European Investment Bank. The EFSI will be equipped with €5bn in start-up capital, produced through the revaluation of existing EIB assets, and will be backed by €16bn in guarantees from the European commission. The fund is expected to leverage this to acquire roughly €63bn in loans, with private investors subsequently contributing around €5 for every €1 lent – bringing total investment to the €315bn target.

Though EU countries will not contribute any actual funds, they will provide implicit and explicit guarantees for the private investors, in an arrangement that looks suspiciously like the joint liability embodied by Eurobonds. Faced with Angela Merkel’s categorical rejection of Eurobonds, the EU engaged a horde of financial specialists to find a creative way to circumvent it. They came up with the EFSI. Though the fund will not be operational until mid-2015, EU member countries have already proposed projects for the European commission’s consideration. By early December, all 28 EU governments had submitted applications – and they are still coming. An assessment of the application documents conducted by the Ifo Institute for Economic Research found that the nearly 2,000 potential projects would cost a total of €1.3tr, with about €500bn spent before the end of 2017. Some 53% of those costs correspond to public projects; 15% to public-private partnerships (PPPs); 21% to private projects; and just over 10% to projects that could not be classified.

The public projects will presumably involve EFSI financing, with governments assuming the interest payments and amortisation. The PPPs will entail mixed financing, with private entities taking on a share of the risk and the return. The private projects will include the provision of infrastructure, the cost of which is to be repaid through tolls or user fees collected by a private operator. Unlike some other critics, I do not expect the programme to fail to bolster demand in the European economy. After all, the €315bn that is expected to be distributed over three years amounts to 2.3% of the EU’s annual GDP. Such a sizeable level of investment is bound to have an impact. But the programme remains legally dubious, as it creates a large shadow budget financed by borrowing that will operate parallel to the EU and national budgets, thereby placing a substantial risk-sharing burden on taxpayers.

A note from Morgan Stanley h/t Durden.

• Implications for the ECB and Its Preparation for Sovereign QE (Elga Bartsch)

Even though my colleagues, Daniele Antonucci and Paolo Batori, do not expect the ECB and the National Central Banks (NCBs) to be subject to haircuts in the event of a Syriza-led debt restructuring, this is unlikely to be clear-cut for some time to come. As a result, the Greek political turmoil complicates matters for the ECB and its preparation of a sovereign QE programme. In my view, a sovereign default in the eurozone and the prospect of the ECB potentially incurring severe financial losses is likely to intensify the debate on the Governing Council, where purchases of government bonds remain highly controversial. This could make a detailed announcement and the start of a buying programme already at the January 22 meeting look even more ambitious than it seemed. The spectre of default does not only make the issue of sovereign QE less certain again than the market believes, it also could create new limitations in its implementation.

One of the decisions that the Governing Council will need to take is whether to include the two programme countries (Greece and Cyprus), the only ones that are not investment grade at the moment, in its sovereign QE. In our view, it is unlikely that the ECB will deviate from the conditions imposed in the context of the ABSPP and CBPP3, i.e. the countries need to have under a troika programme (and the programme needs to be broadly on track). This would mean though that for some eurozone countries, sovereign QE would become conditional – just as OMT was. If governments across the eurozone and the financial constructs they are backing with off-balance sheet guarantees are being haircut and the resulting losses start to show up in national budgets, the political opposition to sovereign QE might increase materially.

In fact, elected politicians in creditor countries might have a preference for the ECB taking a hit as well given that the Bank has considerable risk provisioning that could absorb these losses which national budgets don’t have. This debate could also materially influence how a sovereign QE programme by the ECB is structured, notably on whether the risks associated with such a programme should be shared by all NCBs. Even ahead of the latest developments in Greece, the Bundesbank was already pushing for there not being risk-sharing in a sovereign QE programme. This position is unlikely to only relate to Greece though, I think. It is much more likely to relate to the concerns voiced by the German Constitutional Court regarding the implicit fiscal transfers between countries in the event of purchases of government bonds. In the view of Court, this could amount to establishing a fiscal transfer mechanism that is outside the ECB’s mandate.

Ugo!

• Seven Shocking Events Of 2014 (Ugo Bardi)

Being involved with peak oil studies should make one somewhat prepared for the future. Indeed, for years, we have been claiming that the arrival of peak oil would bring turmoil and big changes in the world and we are seeing them, this year. However, the way in which these changes manifest themselves turns out to be shocking and unexpected. This 2014 has been an especially shocking year; so many things have happened. Let me list my personal shocks in no particular order

1. The collapse of oil prices. Price oscillations were expected to occur near the oil production peak, but I expected a repetition of the events of 2008, when the price crash was preceded by a financial crash. But in 2014 the price collapse came out of the blue, all by itself. Likely, a major financial crisis is in the making, but that we will see that next year.

2. The ungreening of Europe. My trip to Brussels for a hearing of the European parliament was a shocking experience for me. The Europe I knew was peaceful and dedicated to sustainability and harmonic development. What I found was that the European Parliament had become a den of warmongers hell bent on fighting Russia and on drilling for oil and gas in Europe. Not my Europe any more. Whose Europe is this?

3. The year propaganda came of age. I take this expression from Ilargi on “The Automatic Earth”. Propaganda is actually much older than 2014, but surely in this year it became much more shrill and invasive than it had usually been. It is shocking to see how fast and how easily propaganda plunged us into a new cold war against Russia. Also shocking it was to see how propaganda could convince so many people (including European MPs) that drilling more and “fracking” was the solution for all our problems.

4. The Ukraine disaster. It was a shock to see how easy it was for a European country to plunge from relative normalcy into a civil war of militias fighting each other and where citizens were routinely shelled and forced to take refuge in basements. It shows how really fragile are those entities we call “states”. For whom is the Ukraine bell tolling?

5. The economic collapse of Italy. What is most shocking, even frightening, is how it is taking place in absolute quiet and silence. It is like a slow motion nightmare. The government seems to be unable to act in any other way than inventing ever more creative ways to raise taxes to squeeze out as much as possible from already exhausted and impoverished citizens. People seem to be unable to react, even to understand what is going on – at most they engage in a little blame game, faulting politicians, immigrants, communists, gypsies, the Euro, and the great world conspiracy for everything that is befalling on them. A similar situation exists in other Southern European countries. How long the quiet can last is all to be seen.

6. The loss of hope of stopping climate change. 2014 was the year in which the publication of the IPCC 5th assessment report was completed. It left absolutely no ripple in the debate. People seem to think that the best weapon we have against climate change is to declare that it doesn’t exist. They repeat over and over the comforting mantra that “temperatures have not increased during the past 15 years”, and that despite 2014 turning out to be the hottest year on record.

7. The killing of a bear, in Italy, was a small manifestation of wanton cruelty in a year that has seen much worse. But it was a paradigmatic event that shows how difficult – even impossible – it is for humans to live in peace with what surrounds them – be it human or beast.

“Our democracy just isn’t going to survive in this type of atmosphere ..”

• For the Wealthiest Political Donors, It Was a Very Good Year (Bloomberg)

Here’s a bit of perspective on the ever-rising cost of elections, and the big-money donors who finance them: Three of the country’s wealthiest political contributors each saw their net worth grow in 2014 by more than $3.7 billion, the entire cost of the midterm elections. And as the 2016 presidential election approaches, almost all of those donors have even more cash to burn. The only top political donor who lost money in 2014, Sheldon Adelson, still has a fortune greater than the annual gross domestic product of Zambia, so playing in U.S. politics remains well within his financial range. The Bloomberg Billionaires Index tracks the daily gains and losses in the net worth of the financial elite, and with the final hours of trading for this year ticking away, we’ve reviewed the bottom line for 2014 for the politically active super-wealthy. In total, 11 of the donors that Bloomberg tracks added a combined $33 billion to their wealth in a single year. (The index does not include Michael Bloomberg, founder and majority owner of Bloomberg LP.)

The tab for the House and Senate elections came to $3.7 billion, according to the nonpartisan Center for Responsive Politics in Washington. Warren Buffett, Larry Ellison, and Laurene Powell Jobs each could have covered all of that with the wealth they accumulated in the past 12 months. James Simons and George Soros would have come pretty close. Some of that wealth, combined with loosening campaign-finance restrictions and a political class growing ever more comfortable with the new world of virtually unlimited donations, could start flowing to campaigns in the next few months as candidates prepare for the 2016 presidential race. Wealthy donors will have even more giving options after Congress voted to raise the limits on how much individuals can give to political parties, creating a political landscape that horrifies some good-government groups.

They point to a reality: A wealthy donor can now almost singlehandedly bankroll a candidate, as Adelson did for former House Speaker Newt Gingrich in 2012, raising questions about whether these financial commitments ultimately will influence future policy. “Our democracy just isn’t going to survive in this type of atmosphere,” said Craig Holman, a lobbyist for Public Citizen, a group that advocates for stricter campaign-finance limits. “The United States, throughout history, has worked on a very delicate balance between capitalism in the economic sphere and democracy in the political sphere. We no longer have that balance. The economic sphere is going to smother and overwhelm the political sphere.”

David Keating, president of the Center for Competitive Politics, a group that argues the limits on political spending are arbitrary, sees it differently. “Big money in politics can actually make the electorate better informed,” he said. Besides, he added, there are enough billionaires to go around. For example, “you’ve got billionaires funding gun control and billionaires paying for groups that oppose gun control. It’s all pretty much a wash.” The sheer amount of money some donors made on paper in 2014 rewrites the context of “big” money in politics. For a political race, a $1 million cash infusion could change the outcome. For America’s big-money clique, it’s a fraction of what some billionaires can make or lose in a single day.

That’s your money.

• Pension Funds Triple Stake In Reinsurance Business to $59 Billion (NY Times)

Billions of dollars from pension funds and other nontraditional players have been moving into the reinsurance business in recent years, according to a report released on Wednesday by the Treasury Department. The report did not identify individual pension funds or other providers of what it called “alternative capital” for reinsurance. But it found that such newcomers had put about $59 billion into the $570 billion global reinsurance market as of June 30. That was more than three times their stake in 2007. The report also said that more than half the capital standing behind reinsurance innovations now comes from “pension funds, endowments and sovereign wealth funds, generally through specialized insurance-linked investment funds.” By contrast, hedge funds and private equity firms now provide about one-fourth of the money for such investments.

The report said that alternative reinsurance arrangements were increasingly being pitched to investors as “mainstream products” and said that “exposure to such risks could be problematic for unsophisticated investors.” The purpose of the Treasury report was not to assess risks or spotlight potential problems but to describe the overall state of the reinsurance industry, which is familiar to experts but almost unknown to everyone else. In fact, the report stressed that reinsurance brings many benefits and that some reinsurance programs are operated by the states, like Florida’s Hurricane Catastrophe Fund and California’s Earthquake Authority. The report was issued by the Federal Insurance Office, an arm of the Treasury established in the wake of the 2008 financial crisis.

Normally the states regulate insurance, but the Federal Insurance Office has been looking at parts of the industry that extend beyond state regulators’ reach. Reinsurance frequently transfers risks offshore, for example, to jurisdictions where the states’ capital and other requirements do not apply. Increasingly, some states have been creating alternative regulatory frameworks to attract some of the offshore reinsurance business back to the United States. That can bring investment and jobs to those states, but it has also raised concerns that a poorly understood and risky “shadow insurance” sector is taking shape. “Regulatory concerns about this widespread practice continue to receive attention within the national and international insurance supervisory community,” the report said.

Whatever anybody says, the Russians feel deeply betrayed by the west. That’s what drives their actions.

• Inside Obama’s Secret Outreach to Russia (Bloomberg)

President Barack Obama’s administration has been working behind the scenes for months to forge a new working relationship with Russia, despite the fact that Russian President Vladimir Putin has shown little interest in repairing relations with Washington or halting his aggression in neighboring Ukraine. This month, Obama’s National Security Council finished an extensive and comprehensive review of U.S policy toward Russia that included dozens of meetings and input from the State Department, Defense Department and several other agencies, according to three senior administration officials. At the end of the sometimes-contentious process, Obama made a decision to continue to look for ways to work with Russia on a host of bilateral and international issues while also offering Putin a way out of the stalemate over the crisis in Ukraine.

“I don’t think that anybody at this point is under the impression that a wholesale reset of our relationship is possible at this time, but we might as well test out what they are actually willing to do,” a senior administration official told me. “Our theory of this all along has been, let’s see what’s there. Regardless of the likelihood of success.” Leading the charge has been Secretary of State John Kerry. This fall, Kerry even proposed going to Moscow and meeting with Putin directly. The negotiations over Kerry’s trip got to the point of scheduling, but ultimately were scuttled because there was little prospect of demonstrable progress.

In a separate attempt at outreach, the White House turned to an old friend of Putin’s for help. The White House called on former Secretary of State Henry Kissinger to discuss having him call Putin directly, according to two officials. It’s unclear whether Kissinger actually made the call. The White House and Kissinger both refused to comment for this column. Kerry has been the point man on dealing with Russia because his close relationship with Russian Foreign Minister Sergei Lavrov represents the last remaining functional diplomatic channel between Washington and Moscow. They meet often, often without any staff members present, and talk on the phone regularly. Obama and Putin, on the other hand, are known to have an intense dislike for each other and very rarely speak.

Draghi for president!

• Italian President to Resign, Posing Challenge for Renzi (Bloomberg)

Italian President Giorgio Napolitano said he’ll resign “soon,” setting up a challenge for Premier Matteo Renzi, who will now need to form alliances among lawmakers to push through his own candidate for the job. “It’s my duty not to underestimate the signs of fatigue,” Napolitano, 89, said in his traditional Dec. 31 end-of-year speech, giving his age among the reasons for his resignation. He also cited the need to “return to constitutional normalcy” putting an end to his prolonged term. He gave no exact date for his resignation in the televised address. Napolitano, who took office in 2006, reluctantly accepted a second term in April 2013 after inconclusive elections led to a hung parliament which failed to strike a deal on his successor for days. The president had signaled from the start that he wouldn’t serve a full seven-year term.

Now Renzi, 39, will have to find a name appealing enough to at least half of an over 1000-member electoral college in order to push through a candidate of his liking. While Italy’s head of state is largely a ceremonial figure, the role and powers are enhanced at times of political crisis as the president has the power to dissolve parliament and designate prime minister candidates. Napolitano picked Renzi to lead a new government in February and his efforts to guarantee political stability have supported the prime minister’s reform package aimed at lifting Italy out of recession. After Napolitano steps down, Senate Speaker Pietro Grasso will act as caretaker head of state until his successor is elected.

National lawmakers and 58 regional delegates make up the electoral college of more than 1,000 members that will vote for the new president. The procedure can take several days as just two rounds of voting are held each day by secret ballot. To win in any of the first three rounds, a candidate must secure two-thirds of the vote, whereas from the fourth round a simple majority suffices. [..] Names circulated for the post so far in the Italian press include European Central Bank President Mario Draghi, former Italian Prime Minister Romano Prodi, Finance Minister Pier Carlo Padoan, and Bank of Italy Governor Ignazio Visco. Napolitano, a former communist, known for once praising the Soviet Union’s crushing of the 1956 reformist movement in Hungary, is credited with helping restore market confidence in Italy during Europe’s 2011 debt crisis.

Can she save her ass from the Petrobras scandal? She headed the company for years, for Pete’s sake.

• Rousseff Begins Second Term as Brazil Economic Malaise Hits Home

Dilma Rousseff will be sworn in today for her second term as Brazil’s president as a corruption scandal involving the country’s biggest company, above-target inflation and the slowest economic expansion in five years undermine her support. Since Rousseff took over from her mentor Luiz Inacio Lula da Silva four years ago, the budget deficit has more than doubled to 5.8% of gross domestic product and economic growth has come to a standstill from 7.5% growth in 2010. Inflation has remained above the center of the target range throughout her first term. Rousseff, who won an Oct. 26 runoff election by the narrowest margin of any president since at least 1945, has appointed a new economic team and announced spending cuts.

The central bank increased the key lending rate twice since the election to contain consumer price increases. While such measures are a first step to prevent a credit rating downgrade, the question is whether Rousseff will have the political support to hold the course, said Rafael Cortez, political analyst at Tendencias, a Sao Paulo-based consulting firm. “The economic malaise will spread to consumers and the corruption scandal will impose a negative legislative agenda,” Cortez said in a phone interview. “In a best-case scenario, she’ll manage to recover some investor credibility and pave the wave for moderate growth; the worst case is that we’ll have a lame duck president in a year or two.”

Rousseff is scheduled to be sworn in today and address Congress in Brasilia this afternoon. Designated Finance Minister Joaquim Levy pledges to pursue a budget surplus before interest payments of 1.2% of gross domestic product this year and at least 2% of GDP in 2016 and 2017, after Brazil’s credit rating in 2014 suffered a downgrade for the first time in more than a decade. The primary budget balance turned to a deficit of 0.18% of GDP in the 12 months through November, the first such annual shortfall on record. On Dec. 29 the government announced cuts to pension and unemployment benefits that will save an estimated 18 billion reais ($6.8 billion). Authorities also have increased the long-term lending rate for loans granted by the state development bank BNDES to 5.5% from 5%.

A 79-year old crown prince. And millions of unemployed 16 to 24-year old testosterone bombs. Nice contrast.

• Eyes On Saudi Succession After King Hospitalized (CNBC)

The Saudi stock market fell after King Abdullah bin Abdulaziz Al Saud was hospitalized Wednesday, but any succession for the throne would likely be smooth for the country. The Saudi royal family announced in March that 79-year-old Crown Prince Salman would succeed the king, and experts said those plans have eased most concerns about an impending transition. In fact, Saudi watchers told CNBC that the country’s oil, domestic and geopolitical policies should remain virtually unchanged when Salman takes over. “This is very predictable,” Bilal Saab, senior fellow for Middle East security at the Atlantic Council, said of the transition. Still, he reflected, “the markets just react in unpredictable ways.” Although King Abdullah has been perceived as a champion of domestic reform, his departure would not signal the reversal of any of his (relatively) progressive policies, Saab said.

Salman, who has assumed many state duties while currently serving as deputy prime minister and minister of defense, is relatively well-liked by regional neighbors and in Washington, according to Karen Elliott House, author of “On Saudi Arabia: Its People, Past, Religion, Fault Lines—and Future.” Given that the transition of duties has partially begun, experts said that there would likely be little political drama when Salman takes the throne. Still, the issue of his successor could prove a contentious moment for the perpetually stable kingdom. The royal family officially announced in March that Prince Muqrin bin Abdulaziz, the youngest surviving half brother of the king and Salman, would be given the role of deputy crown prince – in effect naming him the successor to Salman.

House said that could provide a moment of tension for the royal family: A successor has traditionally been picked by an ascending king, and some family members were reportedly less than pleased about Muqrin’s appointment. Still, those concerns pale in comparison to the current succession worries in Oman, Saab said. That country’s sultan, Qaboos bin Said Al Said, has no formal successor plan, and political chaos after his death could be problematic for the region, he said. “This is someone who has a much more influential role, not just in his country, but in the region with the Iranians,” Saab said. “The concerns over succession are much more pronounced in Oman than in Saudi Arabia”

A bit of infighting among the family’s scores of princes would be funny. Whatever happens in the family, the House of Saud faces domestic turmoil.

• Saudi Succession Plan About Continuity (CNBC)

Oil investors are closely watching the health of Saudi Arabia’s king, who was hospitalized Wednesday. However, while some wonder about how an eventual change in leadership might impact the global oil markets, two Middle East experts told CNBC they don’t expect much difference in how a new monarch would govern. “They’ll pursue the same security arrangements with the United States. They’ll maintain Saudi Arabia’s commitment to fight the Islamic State. They’ll also be pumping oil because there are broader strategic interests the kingdom is pursuing,” David Phillips, former senior advisor to the State Department and a CNBC contributor, said in an interview with “Street Signs.”

King Abdullah bin Abdulaziz Al Saud, thought to be 91, was admitted to the hospital on Wednesday for medical tests, according to state media, citing a royal court statement. A source told Reuters he had been suffering from breathing difficulties, but was feeling better and in stable condition. The news sent the Saudi stock exchange down as much as 5%, before it recovered slightly to close almost 3% lower. The king has “been in bad health for the past several years,” and the government has been anticipating his passing for some time, said Phillips, now the director of the Peace-building and Human Rights Program at Columbia University. “There are policies and personalities in place in order to maintain continuity,” he added.

From Glenn Greenwald’s people.

• Sony Hackers Threaten US News Media Organization (Intercept)

The hackers who infiltrated Sony Pictures Entertainment’s computer servers have threatened to attack an American news media organization, according to an FBI bulletin obtained by The Intercept. The threat against the unnamed news organization by the Guardians of Peace, the hacker group that has claimed credit for the Sony attack, “may extend to other such organizations in the near future,” according to a Joint Intelligence Bulletin of the FBI and the Department of Homeland Security obtained by The Intercept. Referring to Sony only as “USPER1”and the news organization as “USPER2,” the Joint Intelligence Bulletin, dated Dec. 24 and marked For Official Use Only, states that its purpose is “to provide information on the late-November 2014 cyber intrusion targeting USPER1 and related threats concerning the planned release of the movie, ‘The Interview.’ Additionally, these threats have extended to USPER2 —a news media organization—and may extend to other such organizations in the near future.”

In the bulletin, titled “November 2014 Cyber Intrusion on USPER1 and Related Threats,” The Guardians of Peace threatened to attack other targets on the day after the FBI announcement. “On 20 December,” the bulletin reads, “the [Guardians of Peace] GOP posted Pastebin messages that specifically taunted the FBI and USPER2 for the ‘quality’ of their investigations and implied an additional threat. No specific consequence was mentioned in the posting.” Pastebin is a Web tool that enables users to upload text anonymously for anyone to read. It is commonly used to share source code and sometimes used by hackers to post stolen information. The Dec. 20 Pastebin message from Guardians of Peace links to a YouTube video featuring dancing cartoon figures repeatedly saying, “you’re an idiot.”

No mention of a specific news outlet could be found by The Intercept in any of the GOP postings from that date still available online or quoted in news reports. “While it’s hard to tell how legitimate the threat is, if a news organization is attacked in the same manner Sony was, it could put countless sensitive sources in danger of being exposed—or worse,” Trevor Timm, executive director of the Freedom of the Press Foundation, told The Intercept. Timm points out, however, that media are already commonly targeted by state-sponsored hackers.“This FBI bulletin is just the latest example that digital security is now a critical press freedom issue, and why news organizations need to make ubiquitous encryption a high priority,” he said.

“Consider, first, how a competent response to Ebola might have played out ..”

• Next Year’s Ebola Crisis (Bloomberg ed.)

One of the many ways the world failed to distinguish itself in 2014 was with its response to the Ebola crisis. It cannot afford to be so late, slow and fatally inadequate next year — with Ebola, which continues to kill people in West Africa, or with the next global pandemic. Consider, first, how a competent response to Ebola might have played out: A year ago, the health workers in Guinea who saw the first cases would have had the training to recognize it and the equipment to treat it without infecting themselves and others. They didn’t, and the disease spread quickly to Liberia and Sierra Leone. Ideally, then, doctors there would have diagnosed Ebola, and traced and quarantined everyone who had contact with the victims. Crucially, they would have alerted the World Health Organization. As it happened, the WHO wasn’t told of the outbreak until March.

At that point, in a best-case scenario, with local health-care systems overwhelmed, the WHO would have intervened with a team of well-equipped doctors and nurses. Such a team didn’t exist, and it took the WHO until August even to declare a public-health emergency, and several weeks beyond that to come up with a response plan. And so the total number of infections is now more than 12,000, with some 7,700 dead. This might-have-been story reveals how countries and the WHO need to change before the next outbreak – of Ebola, SARS, bird flu or whatever it turns out to be. Every country needs hospitals and laboratories capable of diagnosing, safely treating and monitoring disease. The WHO needs improved surveillance and reporting systems, as well as the capacity to send medical teams when needed. The World Health Assembly, the international body that sets policy for the WHO, cannot waste any time seeing that these changes are made.

What’s frustrating is that world leaders have long recognized the need to be ready for outbreaks of infectious disease. In 1969, they signed a pact known as the International Health Regulations, meant to make sure preparations would be in place. The most recent update to this accord – in 2005, after the SARS epidemic – called for all 196 countries to have the laboratories, hospitals and medical expertise to detect, treat and monitor epidemics. One glaring weakness in this framework, however, is that countries have been allowed to monitor their own readiness. An outside body – either the WHO or an independent organization – must be appointed to keep track of their progress toward building sturdy medical infrastructure. And at least until all 196 countries are up to snuff, the WHO needs to have the authority to step in.

Home › Forums › Debt Rattle New Year’s Day 2015