�Russell Lee Auto transport passing through Eufaula, Oklahoma Feb 1940

“.. much of Wall Street’s profit engine isn’t sustainable. For most of the last two years, too-big-to-fail bank profits haven’t been driven by banking, they’ve been driven by sharp increases in investment banking”.

• For Wall Street, It’s Not Politicians That Matter, But Profits (MarketWatch)

There’s been much in the way of speculation about how the Republican sweep in Tuesday’s midterms may impact Wall Street — the industry. Some believe a shift in control will help. Others are less sure. Both may miss a bigger point: big financial firms are on a cyclical high that isn’t built to last. David Reilly and John Carney argue that big banks are unlikely to get big breaks from Congress even though Republicans have tended to be softer on regulation. Writing for the Wall Street Journal’s “Heard on the Street” section, Reilly and Carney note “reviving the debate over financial reform could also resurrect the question of what to do about too-big-to-fail banks and renew calls for them to be broken up.” On the flip side, MarketWatch’s Philip van Doorn writes that many banks may be able to lift dividends if the new Republican leadership in the U.S. Senate follows through on promises to ease restrictions on capital requirements. Both camps make strong arguments. And they’re not really in opposition.

Tuesday’s victory by Republicans opens the door for eased banking rules, but it comes with risk of a political backlash. Investors may be better served by looking at some trends in the industry to gauge just how profitable the big six — Bank of America, Citigroup, Goldman Sachs, J.P. Morgan, Morgan Stanley and Wells Fargo may perform in the future. On the plus side, the stream of positive economic data, including Friday’s jobs report, is likely to lead the Federal Reserve to keep its distance from quantitative easing and enter a new phase of rate increases that, in turn, would boost interest rates paid on loans and other credit instruments. This has been a big drag on bank industry profits since the financial crisis and recession. That’s the good news. The potential bad news is that much of Wall Street’s profit engine isn’t sustainable. For most of the last two years, too-big-to-fail bank profits haven’t been driven by banking, they’ve been driven by sharp increases in investment banking: underwriting equity and debt offerings and advising on mergers and acquisitions.

“What do they do with our young people? They send them all around the world, getting involved in wars and telling them they have to have democratic elections ..”

• Ron Paul: Two- Party US Political System In Reality A Monopoly (RT)

Former Congressman Ron Paul told RT in the midst of Tuesday’s midterm elections that the “monopoly” system run by the leaders of the two main parties is all too evident as Americans go to the polls this Election Day. “This whole idea that a good candidate that’s rating well in the polls can’t get in the debate, that’s where the corruption really is,” Paul, the 79-year-old former House of Representatives lawmaker for Texas, told RT during Tuesday’s special midterm elections coverage. “It’s a monopoly…and they don’t even allow a second option,” he said. “If a third party person gets anywhere along, they are going to do everything they can to stop that from happening,” the retired congressman continued.

Paul, a longtime Republican, has been critical of the two-party dichotomy that dominates American politics for decades, and once ran as the Libertarian Party’s nominee for president of the United States. While third-party candidates continue to vie against the left and right establishment, however, Paul warned RT that even the two-party system as Americans know it is in danger. “What do they do with our young people? They send them all around the world, getting involved in wars and telling them they have to have democratic elections,” he told RT. “But here at home, we don’t have true Democracy. We have a monopoly of ideas that is controlled by the leaders of two parties. And they call it two parties, but it’s really one philosophy.”

All hope isn’t lost, however; according to Paul, American politics can still be changed if individuals intent on third-party ideas introduce their ethos to the current establishment. Americans can “fight to get rid of the monopoly of Republicans and Democrats,” Paul said, or “try to influence people with ideas and infiltrate both political parties.” With respect to the midterm elections, though, Paul told RT that he’s uncertain what policies will prevail this year — excluding, of course, an obvious win for the status quo. “I think the status quo is pretty strong right now, and I imagine that the status quo is going to win the election tonight,” he said Tuesday afternoon.

Erosion presented as recovery.

• Majority Of New October Jobs Pay Below Average Wage (MarketWatch)

The U.S. is becoming an engine of job creation once again, but it’s more like a four-cylinder instead of an eight-cylinder one. The 214,000 gain in new jobs in October marked the ninth straight month in which net hiring topped 200,000. The last time that happened was in 1994. Yet only about 40% of the new jobs created in October were in fields that pay above the average hourly U.S. wage of $24.57. That’s down from 60% in September. The mediocre nature of many new jobs and slow wage growth are perhaps the biggest obstacle to a full-blown economic recovery. The biggest increase in hiring in October occurred at restaurants and bars, which added a seasonally adjusted 42,000 positions. Retailers hired 27,000 workers. Temps accounted for 15,000 jobs. Transport — think package deliverers — took on 13,000 new employees. All these industries pay less than the national average.

Some of the new jobs are also unlikely to last long. Restaurants and retailers, for example, tend to beef up staff ahead of the holidays and slim down after New Year’s. Temp jobs, on the other hand, have often been converted into full-time positions. Companies use temps sometimes as a trial for a full-time job. Whatever the case, it’s not a good idea to give too much weight to the composition of hiring in any one month. Some 60% of the 256,000 jobs created in September, for instance, were in fields that pay above the average U.S. wage. That’s higher than normal. There’s also been a pronounced shift in 2014 toward higher paying jobs vs. the prior year. A MarketWatch analysis shows that roughly 58% of the new jobs created this year pay above the average hourly wage, compared to less than 50% in 2013. Still, both the composition of jobs and the trend in hourly pay bear close watching over the next few months. Both have to improve to get the U.S. economy fully back on track more than five years after the recovery started.

“The unemployment rate is no longer a sufficient statistic.” An accurate gauge of the market, he says, must include people who’ve given up looking for work and those working in part-time or low-paying jobs because they can’t find anything else”.

• When Will Americans Ever Get Raises? (BW)

Americans are overdue for a fatter paycheck: Average earnings haven’t risen in more than six years. The labor market is finally recovering—the unemployment rate is down to 5.9% from 8.2% in July 2012—and that usually pushes up wages. But it’s not clear that job growth will translate into pay increases in 2015. In an August speech, Federal Reserve Chair Janet Yellen speculated that “pent-up wage deflation” might have held wages down during the recovery. What does that mean? “In a downturn, employers may need to cut wages, but they are reluctant to do so,” says San Francisco Fed economist Mary Daly. They prefer laying people off, which they believe tends to have less impact on workforce morale, she says. The result is that when the economy recovers, employers are slower to raise pay than if they had imposed cuts during the slump.

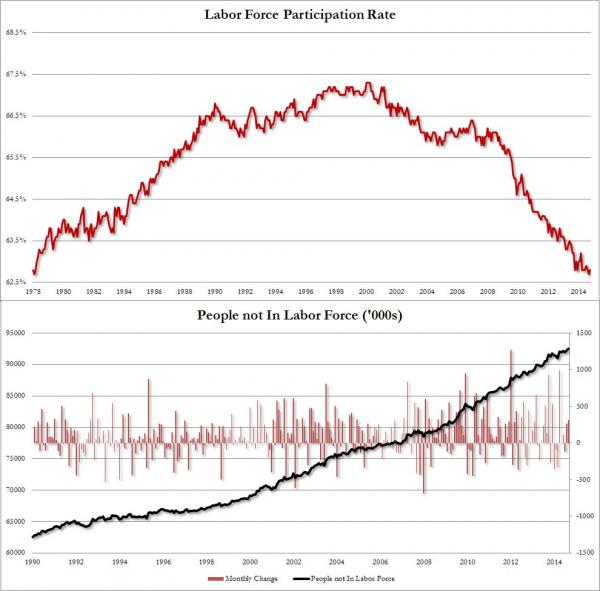

Daly says wages were slow to increase after the past three recessions, too. She estimates that unemployment will have to fall to 5.2% before wages begin rising. Even a drop to that level might not be low enough to spur gains. Dartmouth economist Daniel Blanchflower says the labor market is in worse shape than the unemployment rate suggests. “Something changed in 2010,” he says. “The unemployment rate is no longer a sufficient statistic.” An accurate gauge of the market, he says, must include people who’ve given up looking for work and those working in part-time or low-paying jobs because they can’t find anything else. Measures that include discouraged workers, such as the labor force participation rate, have worsened since 2008. Blanchflower says pay won’t increase until the slack is absorbed, and he can’t predict when that might happen.

Today’s unusually high long-term unemployment could keep wages low for years, according to Till von Wachter, an economist at the University of California at Los Angeles. People who’ve been out of work for six months or more “may have seen their skills deteriorate,” he says, “and some job losers found their previous occupation is no longer available and skills not in demand. This happens in every recession, but this last one was worse because there was more job loss.” He estimates that each additional month you’re unemployed after the first month lowers your next job’s pay by almost 1%.

Smells like recovery?!

• Only 92.4 Million Americans Not In Labor Force (Zero Hedge)

Following last month’s total collapse in the participation rate, dropping to 36 year lows, this month there was a modest improvement in the composition of the labor force, with the Household Survey suggesting the ranks of the Employed rose by 683K people, while the Unemployed actually declined by 267K, leading to a drop of the people not in the labor force to 92.378 million from 92.584 million. In other words, a little over 101 million Americans are unemployed or out of the labor force. Still, if only looking at this metric, the Fed would likely have no choice but to proceed with a rate hike in the first half of 2015.

“There’s no doubt about it now. We’re already down 49 rigs since the peak in October. It’ll have fallen by more than 100 rigs by the end of year.”

• US Shale Drillers Idle Rigs From Texas to Utah Amid Oil Rout (Bloomberg)

The shale-oil drilling boom in the U.S. is showing early signs of cracking. Rigs targeting oil sank by 14 to 1,568 this week, the lowest since Aug. 22, Baker Hughes said yesterday. The Eagle Ford shale formation in south Texas lost the most, dropping nine to 197. The nation’s oil rig count is down from a peak of 1,609 on Oct. 10. Drillers are slowing down as crude prices tumbled 24% in the past four months. Transocean said yesterday that its earnings would take a hit by a drop in fees and demand for its rigs. The slide threatens to curb a production boom in U.S. shale formations that has helped bring prices at the pump below $3 a gallon for the first time since 2010 and shrink the nation’s dependence on foreign oil imports. “We are officially seeing the slowdown in oil drilling,” James Williams, president of energy consulting company WTRG Economics, said yesterday. “There’s no doubt about it now. We’re already down 49 rigs since the peak in October. It’ll have fallen by more than 100 rigs by the end of year.”

Orices are down 17% in the past year. Executives at several large U.S. shale producers, including Chesapeake Energy and EOG Resources, have vowed to maintain or even raise production as they reported earnings this week. They say their success in bringing down costs means they can make money even if prices slump further. The oil rig count will drop to 1,325 by the middle of next year amid lower prices, Genscape, an energy data company said in a report. Drillers from Apache to Continental Resources have said this week that they’re laying down rigs in some oil plays. Transocean, owner of the biggest fleet of deep-water drilling rigs, is delaying the release of its Q3 results after saying its earnings would be hit by $2.76 billion in charges from a decline in the value of its contracts drilling business and a drop in rig-use fees. Transocean’s competitors will probably have to take similar measures as “this is going to be an industry wide phenomenon,” Goldman Sachs said in a research note yesterday.

The shale mirage makes its first victims. Many will follow.

• Transocean Takes $2.76 Billion Charge Amid Rig Glut (Bloomberg)

Transocean, owner of the biggest fleet of deep-water drilling rigs, is feeling the effect of an industrywide glut in the expensive vessels just as crude-oil prices tumble. The company will delay posting third-quarter results after saying earnings would be hit by $2.76 billion in charges from a decline in the value of its contracts-drilling business and a drop in rig-use fees. Shares in the Vernier, Switzerland-based company, which pushed back the release of its earnings report to Monday instead of today, fell 0.7% to $29.71 at the close in New York. Oil’s decline to a four-year low in recent months has caused companies to consider spending cuts, which would further reduce demand for rigs and the rates Transocean can charge to lease them to explorers. The drop in prices comes after rig contractors responded to rising demand during the past few years with the biggest batch of construction orders for rigs since the advent of deep-water drilling in the 1970s.

“Ouch,” analysts from Tudor Pickering Holt & Co. wrote in a note to investors today. The announcement “reflects the reality of this oversupplied floater rig market globally.” Other rig owners may also face writedowns, Waqar Syed, an analyst at Goldman Sachs Group Inc., wrote today in a note to investors. Among those that may be affected are Diamond Offshore Drilling, Noble, Ensco, Rowan and Atwood Oceanics, he wrote. “This is going to be an industrywide phenomenon for the next few years,” Syed wrote. “Companies that have spent substantial amounts in the past 10-15 years in upgrading their 1970-1980 vintage rigs may face some writedowns.” Noble regularly does impairment tests on its assets, said John Breed, a company spokesman. “With the current figuration of the Noble fleet, it seems like a major writedown wouldn’t be something we would be looking at.”

More debt. Which is a good thing, right?

• Consumer Credit in US Climbs on Demand for Car, Student Loans (Bloomberg)

Consumer borrowing increased at a faster rate in September as American households took out loans for cars and education. The $15.9 billion increase in credit followed a revised $14 billion advance in August, the Federal Reserve reported today in Washington. Non-revolving loans, including borrowing for motor vehicles and college tuition, rose $14.5 billion in September. Gains in the labor market and stock portfolios, the lowest gasoline prices in four years, and cheap borrowing costs are giving Americans the confidence to borrow. Faster wage growth would provide a bigger boost for households wary of taking on more debt. The September gain in consumer borrowing was in line with the $16 billion median forecast of 34 economists in a Bloomberg survey. Estimates ranged from increases of $12 billion to $22 billion.

The report doesn’t track mortgages, home-equity lines of credit and other debt secured by real estate. Revolving credit, which includes credit-card balances, climbed $1.4 billion after a $201 million decline in August, today’s Fed figures showed. The September gain in non-revolving credit followed a $14.2 billion increase in the prior month. Today’s report showed that student loans in the third quarter increased to $1.3 trillion from $1.27 trillion in the prior three months. Borrowing for the purchase of motor vehicles climbed to $940.9 billion last quarter from $918.7 billion from April through June. Auto sales cooled in September to a 16.3 million annualized rate, capping the best quarter for the industry in more than eight years, according to data from Ward’s Automotive Group.

The guys brought in to dissolve the GSEs now want to keep them running. The neverending nightmare, courtesy of lenders who want to offload shaky loans to the government.

• Fannie-Freddie CEOs Tout Do-It-Yourself Housing Finance Overhaul (Bloomberg)

The top executives of Fannie Mae and Freddie Mac, brought in to be stewards until the government figures out how to shut them down, are increasingly sounding like they think the two companies should continue to exist. Timothy J. Mayopoulos of Fannie Mae and Donald Layton of Freddie Mac today both pointed to steps they’re taking to boost stability and competition in the mortgage market, while stopping short of urging lawmakers to drop plans for an overhaul that would put them out of business. “People should recognize that there’s a lot of reform that’s already underway at Fannie Mae,” Mayopoulos said in a telephone interview. “There have been a lot of proposals for substantial changes to housing finance. People need to make sure whatever is put in place is practical and it can work.”

Fannie Mae and Freddie Mac, which were taken into U.S. conservatorship in 2008 amid soaring losses on subprime loans, reported third-quarter financial results today that will see them send a combined $6.8 billion to the Treasury before the end of the year. The payments stem from terms of their $187.5 billion bailout requiring them to turn over all profits. With the latest installments, Fannie Mae, which had a third-quarter profit of $3.9 billion, and Freddie Mac, which reported $2.8 billion, will have sent taxpayers $38 billion more than they took in the aid. The payments are considered to be a return on the U.S. investment and not a repayment, which means there’s no legal avenue for them to exit conservatorship. Changing the bailout terms is one area where lawmakers could help, Mayopoulos said. “That’s something that Congress will ultimately need to address if this company’s going to continue to operate,” he said. “It’s very difficult without capital.”

‘Fragility’, spoken like a true spinner.

• China Export, Import Growth Slows, Reinforcing Signs Of Fragility (Reuters)

Annual growth in China’s exports and imports slowed in October, data showed on Saturday, reinforcing signs of fragility in the world’s second-largest economy that could prompt policymakers to roll out more stimulus measures. Exports have been the lone bright spot in the last few months, perhaps helping to offset soft domestic demand, but there are doubts about the accuracy of the official numbers amid signs of a resurgence of speculative currency flows through inflated trade receipts. Exports rose 11.6% in October from a year earlier, slowing from a 15.3% jump in September, the General Administration of Customs said. The figure was slightly above market expectations in a Reuters poll of a 10.6% rise.

A decline in China’s leading index on exports in October pointed to weaker export growth in the next two to three months, the administration said. “The economy still faces relatively big downward pressure as exports face uncertainties while weak imports indicate sluggish domestic demand,” said Nie Wen, an economist at Hwabao Trust in Shanghai. “The central bank may continue to ease policy in a targeted way.” Imports rose an annual 4.6% in October, pulling back from a 7% rise in September, and were weaker than expected. That left the country with a trade surplus of $45.4 billion for the month, which was near record highs.

Really? Recovery?

• El-Erian: Strong Dollar Could Derail The Recovery (CNBC)

Mohamed El-Erian, the chief economic adviser to Allianz, has warned that policymakers don’t understand how much of a risk a strong dollar and volatile currency markets could pose to market “soundness” and the economic recovery. The former Pimco chief executive and co-chief investment officer said volatility had returned to currency markets as central banks diverge in their response to lackluster growth and deflation. This could result in “excessive movements” in currencies becoming a risk themselves, he said. “This (the strong dollar) is a key issue and I don’t think this is an issue that the markets or the policy makers have understood enough as yet—we have gone from a world where there was relative harmony in what central banks were doing—to a world where there was diverging direction and for good reasons: the economies are doing different things,” he told CNBC on Friday.

“If the other parts of the policy apparatus do not respond, then the only market that accommodates these divergent trends is the currency markets. I could tell you that, as someone who participates in the markets, this poses a threat to volatility and market soundness as a whole and the sorts of excessive movements that may result in currencies becoming a risk themselves to economic recovery,” he added. El-Erian’s comments come as the the Russian rouble tumbled to new lows on Friday before bouncing back. The rouble hit its weakest-ever level against the U.S. dollar early on Friday, sliding to 48.6, before recovering to trade at 46.2 within a few hours – 1.3% higher on the day.

There are far more tricks than regulators.

• G20 Experts To Act On Corporations’ Internal Loans That Help Cut Tax (Guardian)

Tax experts responsible for the G20-led shakeup of international tax rules are discussing radical measures to bar global corporations from using internal loans, that bear no relation to their borrowing needs, in order to avoid tax. If adopted, the move could wipe out vast swaths of the financial industry at a stroke in countries such as Switzerland and Luxembourg, which have for years courted the intra-group financing offices of multinational firms by operating friendly local tax regimes. Raffaele Russo, one of the OECD tax experts leading the reform programme that has come in response to increasingly aggressive tax planning by multinationals, told the Guardian that if the proposals were backed, “this will be the end of [tax] base erosion and profit shifting using intra-group financing”. Measures to tackle multinationals taking large tax deductions for interest payments on loans within the same group are hinted at in a report published in September.

It said: “A formulary type of approach which ties the deductible interest payments to external debt payments may lead to results that better reflect the business reality of multinational … groups.” While other measures are also on the table, pressure to take radical steps to stamp out intra-group loans contrived for tax avoidance has grown this week after revelations about tax agreements rubber-stamped by the Luxembourg tax office. Luxembourg finance minister Pierre Gramegna used a public session during a meeting of European finance ministers in Brussels to deliver a statement in reaction to this week’s revelations about tax agreements with multinationals. “My country [has] come under scrutiny in the latest days. The rulings of Luxembourg are being done according to the national laws of Luxembourg and also according to international conventions. What is being done is totally legal.” He acknowledged rulings and weak tax treaties had led to “situations where companies are paying no taxes or very little taxes [which] is obviously not a good result”.

Sounds dull. But profitable.

• Luxembourg, The Country Where Accountants Outnumber Police 4:1 (Guardian)

Welcome to Luxembourg, where accountants outnumber the police by four to one – and people enjoy some of the highest living standards in the world. “Conquer the world from your Luxembourg headquarters,” is the title of one government-sponsored marketing brochure promoting the Grand Duchy and its “business-friendly legal and fiscal framework”. “Political decision-makers are very accessible to companies,” it promises. The big four accountancy firms tend to agree, if a 2009 presentation by PricewaterhouseCoopers is anything to go by: the authorities are “flexible and welcoming”, “easily contactable” and offer “a readiness for dialogue and quick decision-making” it said in the document, part of a trove of documents obtained by the International Consortium of Investigative Journalists and shared with the Guardian. The big four are huge global enterprises that employ 750,000 people in total and have combined earnings of $117bn (£74bn), according to the latest figures – making them bigger than the economy of Angola.

Their footprint is especially large in Luxembourg, where they employ 6,200 people – among a population of 550,000. The Grand Duchy’s economy has come to be dominated by high finance since the decline of its steel factories. Today, financial services are Luxembourg’s biggest earner, accounting for more than a third of the national income. Almost half the workforce are foreigners, with 44% of employees commuting in daily from France, Germany and Belgium. Despite the financial crisis, accountancy has been booming. Deloitte has increased its Luxembourg staff by 142% in less than a decade to 1,700. PwC is comfortably ahead of Deloitte, its nearest rival. The biggest of the big four, which once described itself as “an ambassador of Luxembourg abroad”, it employs more people in Luxembourg than the country’s police force: it has 2,300 staff, while the gendarmerie has 1,600 officers. That makes it the country’s ninth largest employer, behind steelmaker ArcelorMittal and French bank BNP Paribas.

Good to see Taibbi back at Rolling Stone, and back to what he does best.

• The $9 Billion Witness: Meet JPMorgan Chase’s Worst Nightmare (Matt Taibbi)

She tried to stay quiet, she really did. But after eight years of keeping a heavy secret, the day came when Alayne Fleischmann couldn’t take it anymore. “It was like watching an old lady get mugged on the street,” she says. “I thought, ‘I can’t sit by any longer.'” Fleischmann is a tall, thin, quick-witted securities lawyer in her late thirties, with long blond hair, pale-blue eyes and an infectious sense of humor that has survived some very tough times. She’s had to struggle to find work despite some striking skills and qualifications, a common symptom of a not-so-common condition called being a whistle-blower. Fleischmann is the central witness in one of the biggest cases of white-collar crime in American history, possessing secrets that JPMorgan Chase CEO Jamie Dimon late last year paid $9 billion (not $13 billion as regularly reported – more on that later) to keep the public from hearing.

Back in 2006, as a deal manager at the gigantic bank, Fleischmann first witnessed, then tried to stop, what she describes as “massive criminal securities fraud” in the bank’s mortgage operations. Thanks to a confidentiality agreement, she’s kept her mouth shut since then. “My closest family and friends don’t know what I’ve been living with,” she says. “Even my brother will only find out for the first time when he sees this interview.” Six years after the crisis that cratered the global economy, it’s not exactly news that the country’s biggest banks stole on a grand scale. That’s why the more important part of Fleischmann’s story is in the pains Chase and the Justice Department took to silence her.

She was blocked at every turn: by asleep-on-the-job regulators like the Securities and Exchange Commission, by a court system that allowed Chase to use its billions to bury her evidence, and, finally, by officials like outgoing Attorney General Eric Holder, the chief architect of the crazily elaborate government policy of surrender, secrecy and cover-up. “Every time I had a chance to talk, something always got in the way,” Fleischmann says. This past year she watched as Holder’s Justice Department struck a series of historic settlement deals with Chase, Citigroup and Bank of America. The root bargain in these deals was cash for secrecy. The banks paid big fines, without trials or even judges – only secret negotiations that typically ended with the public shown nothing but vague, quasi-official papers called “statements of facts,” which were conveniently devoid of anything like actual facts.

Going strong. What sanctions?

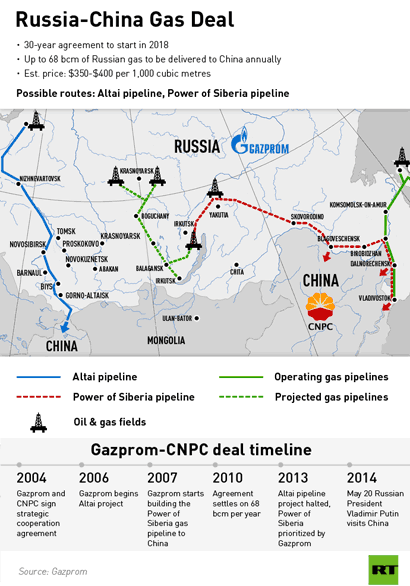

• Russia, China Close To Reaching 2nd Mega Gas Deal (RT)

Moscow and Beijing have agreed many of the aspects of a second gas pipeline to China, the so-called western route. It’s in additional to the eastern route which has already broken ground after a $400 billion deal was clinched in May. “We have reached an understanding in principle concerning the opening of the western route,” the Russian President told media ahead of his visit on November 9-11 to the Asia Pacific Economic Conference (APEC). “We have already agreed on many technical and commercial aspects of this project laying a good basis for reaching final arrangements,” the Russian President added.

In May, China and Russia signed a $400 billion deal to construct the Power of Siberia pipeline, which will annually deliver 38 billion cubic meters (bcm) of gas to China. The Power of Siberia, the eastern route, will connect Russia’s Kovykta and Chaynda fields with China, where recoverable resources are estimated at about 3 trillion cubic meters. The opening of the western route, the Altai, would link Western China and Russia and supply an additional 30 bcm of gas, nearly doubling the gas deal reached in May. When the Altai route is complete China will become Russia’s biggest gas customer. The ability to supply China with 68 bcm of gas annually surpasses the 40 bcm it supplies Germany each year.

The victor writes the history.

• Catalans Recast Spanish History in Drive for Independence (Bloomberg)

In a former market hall in Barcelona, Catalans are busy championing a historic defeat. A museum and cultural center built around the 300-year-old ruins of the city aims to educate visitors about the 1714 siege during the War of Spanish Succession. The battle lasted more than a year and destroyed the old neighborhood amid “epic and heroic resistance,” according to the center’s pamphlet. For Catalan nationalists, the defeat marks the end of their region’s freedom and the beginning of their domination by Madrid. For others, there’s a catch: the version of events on display at the museum, funded by the regional government that’s been pushing for an independence referendum, is unrecognizable to most historians outside Catalonia. “It’s science fiction,” said Alejandro Quiroga, a lecturer in Spanish history at Newcastle University in England who comes from Madrid. “The distortions are tremendous. That’s part of the process of nation building.”

As they develop a narrative around national identity, arguments over the interpretation of history have for decades dogged the Catalan nationalists. Barcelona’s leadership gained control of education under the constitutional settlement that followed the death in 1975 of General Francisco Franco, who had banned the use of the Catalan language. The movement has transformed into a full-blown campaign to leave Spain over the past three years. This weekend, activists will hold an unofficial independence vote in defiance of a Spanish court ruling and the Madrid government. “It fits in with my nationalistic feelings,” said Eugenio Suarez, 61, an industrial engineer who visited the museum on Oct. 14, a little over a year after it first opened. “I am a nationalist for other reasons, so I come here to remember what Barcelona and Catalonia was and still is.” In the northeast of the country, Catalonia is the largest economic region, where output per capita is 17% above the European Union average compared with 5% below for Spain as a whole.

The risk of political upheaval temporarily halted a rally in Spanish bonds last month. Unionists and some historians say that successive regional governments have contributed to building a Catalan majority by promoting a partial, at times false, version of the region’s history through its schools and cultural institutions. In Spanish history books, Felipe V’s troops overran Barcelona at the end of a 14-month siege, bringing an end to the war. The way the Catalan nationalists tell it, that defeat marks the end of a golden age for Catalonia. The attack “led to the capitulation of Barcelona and the loss of Catalonia’s freedoms,” says the leaflet handed out to visitors at the center in the El Born district. The museum shows “the vibrant and dynamic Barcelona of 1700,” while the defeat “is a symbol of the historic fight of the citizens to defend the constitutions and institutions of the country.”

” .. a warning for Greek politicians to “stop promising people things that we cannot deliver. Then things are going to go wrong.”

• Greek Minister: Markets Are Sending Us A Message (CNBC)

As Greece waits to hear whether it will be allowed to withdraw early from a bailout program that saved the country from insolvency, its minister of public order said a recent rise in Greek interest rates is a warning that the country can’t undo reforms. Minister Vassilis Kikilias, on a visit to New York and Washington, D.C., said investors’ negative reaction toward Greece in recent weeks wasn’t due only to its attempt to leave the bailout ahead of schedule, but also about “global” events in the markets. He did add, however, that it was also a warning for Greek politicians to “stop promising people things that we cannot deliver. Then things are going to go wrong.”

Greek stocks and government bonds sold off when Greek Prime Minister Antonis Samaras announced he would try to leave the multibillion-dollar bailout program early. The European Commission took up consideration of the proposal this week. But yields also rose on fears there will be snap elections in the spring and the leader of the radical left, Alexis Tsipras, might win the election. He is currently leading in the polls. Kikilias said he hopes and believes there won’t be an election next year. A goal of the government, he said, is to change the structure of the Greek government in order to have more consistent elections cycles.

“Go to a tropical island for the rest of the year!”

• Danish Women Urged to Drop Work Till 2015 to Protest Pay Gap (Bloomberg)

Women, take today off! In fact, take the rest of the year off! Danish unions representing more than 1.1 million private and public employees, at least half the country’s workforce, are urging women members to do just that – and only half in jest – to protest a 17% pay gap to men. “It’s a way to remove the gender pay gap in a split second,” Lise Johansen, head of the campaign for the Danish Confederation of Trade Unions, said in a telephone interview. “Go to a tropical island for the rest of the year!” While “everyone knows it’s a joke,” the protest, now in its fifth year, highlights the challenges Denmark faces even as it ranks among the countries with the smallest pay disparities, Johansen said.

Scandinavian countries have been the most successful in closing the gender gap, the World Economic Forum said in a report last week. Denmark ranked number five in the study of 142 countries, trailing Iceland, Finland, Norway – where the government has recently made military service mandatory for women – and Sweden. Yet in terms of wage equality for similar work, Denmark ranked 38, according to the report.

This weird story just keeps going. Latest drone was spotted yesterday.

• Drones Over French Nuclear Sites Prompt Parliamentary Probe (Bloomberg)

French parliament will hold hearings this month on the threat posed by drones to nuclear installations even as the mystery of who is behind a series of flights over more than a dozen sites remains unsolved. Reactor builder Areva confirmed today a drone had been spotted over one of its sites while two more plants operated by Electricite de France (EDF) were visited by the remote-controlled flying objects this week. Over a little more than a month, drones have been seen at 14 of EDF’s 19 plants, according to a person familiar with the events. The flights are “irresponsible,” deputy Jean-Yves Le Deaut, a member of the Socialist Party, said by telephone. “It’s giving people ideas and suggests parallels with cyber-attacks.”

The lawmaker will head a one-day public hearing Nov. 24 into whether drone flights can be dangerous to atomic installations. Organized by the parliament’s office for evaluation of scientific and technological choices, OPECST, it will include representatives from the country’s nuclear and drone industries as well as security experts, he said. “Nuclear isn’t for staging a video game,” Le Deaut said. “It’s urgent to stop this mess.” The flights haven’t so far inflicted damage nor has anyone publicly claimed responsibility. While Interior Minister Bernard Cazeneuve has said an inquiry is underway, the flights have continued for more than a month, the latest at the Areva installation last night. Two men are being investigated for flying an aircraft in a protected zone near EDF’s Belleville-sur-Loire nuclear plant, AFP reported, citing Bourges prosecutor Vincent Bonnefoy. The incident isn’t related to the flights at other nuclear sites, he was quoted as saying.

Home › Forums › Debt Rattle November 8 2014