Jacobello Alberegno The Beast of the Apocalypse 1360-90

Whenever you find yourself on the side of the majority, it’s time to pause and reflect.

– Mark Twain

Or maybe it’s even as high as twice that, 0.2%?!

Here in Greece, as in many other places, all outdoor sites, like restaurant and café terraces, remain closed, forcing people indoors, where the other 99.9% of infections occur.

And when people do go outside, they have to wear a mask. For an 0.1% risk.

• 0.1% Of Covid-19 Cases In Ireland Come From Outdoor Transmission (IT)

Earlier on Tuesday, a professor of immunovirology said figures showing 0.1 per cent of Covid-19 cases in the State come from outdoor transmission may be an underestimate. Prof Liam Fanning of University College Cork said he was surprised by the figures and felt there could be a “slight bias” in the Health Protection Surveillance Centre (HPSC) data on cases linked to outdoor transmission. Figures from the HPSC showed just one confirmed case of Covid-19 in every thousand is traced to outdoor transmission. Of the 232,164 cases of Covid-19 recorded in the State up to March 24th this year, 262 were as a result of outdoor transmission, representing 0.1 per cent of the total, the data revealed. There were 42 outbreaks associated with outdoor gatherings, with one community outbreak accounting for seven cases.

Speaking to Newstalk Breakfast on Tuesday, Prof Fanning said there was an obvious difference in transmission rates of the virus between outdoor and indoor locations. He cautioned that meeting people outdoors still posed a risk, as the virus could be spread if someone infectious was “face-on chatting” to other individuals. People should try to avoid speaking directly face-to-face and instead attempt to speak to each other while side by side when outdoors, a common method used during the Spanish flu, he said. Prof Fanning said financial support to encourage more outdoor dining spaces should also be “much higher”, given the low transmission rates outdoors. At present, restaurants, cafes and bars are restricted to delivery or takeaway services only, with no outdoor dining permitted.

Liberty. It’s an easy concept.

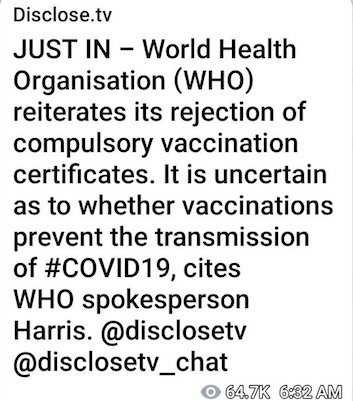

• Ron Paul Urges Americans To ‘Wake Up’ And Reject Vaccine Passports (RT)

Ron Paul has warned that Covid-19 vaccine passports could be used by the US government to restrict freedoms, stirring up an already heated debate over whether such IDs are necessary. The former US congressman and physician said on Monday that requiring certificates to verify vaccination for international travel or daily activities would “solidify the whole idea that our lives belong to the government.” “They own liberty and now you are going to get permission to use a little bit of it. They are going to divvy it out a little bit. You’ll never get back what you should have,” he said while speaking on his program, the Ron Paul Liberty Report. The Biden administration has acknowledged that it is collaborating with tech companies to develop a variety of potential vaccine passport apps.

At the state level, New York has already created its own digital certificate that grants entry to venues. Paul warned that the initiative could be used to regulate nearly all aspects of life, including where you will be allowed to go and what kind of activities you will be permitted to participate in. He said he hoped Americans would “finally wake up” and oppose vaccine IDs. If people don’t “take a stand” now things are going to get “bad,” the former Texas lawmaker predicted. He called on his supporters to reach out to family and friends in order to start a grassroots movement against identification programs, adding that those who choose to do so should understand “what life and liberty is.”

The message resonated with many. Some commenters echoed Paul’s fears that the initiative could be used to usher in a dystopian nightmare. Others said Florida Governor Ron DeSantis’ pledge to ban the use of vaccine passports should be emulated nationwide and expressed hope that the Supreme Court will ultimately rule the IDs unconstitutional. One observer said they opposed storing personal health data in a digital device but saw nothing wrong with doctors issuing paper certificates showing vaccination status. There were plenty who disagreed with Paul, however. “The government is there to serve & protect us,” argued one Twitter user, adding that while passports could potentially lead to discrimination, the spread of Covid-19 poses a greater threat to our freedoms.

“Vaccine passports” must be stopped.

Accepting them means accepting the false idea that government owns your life, body and freedom. pic.twitter.com/nmlP2SN6iw

— Ron Paul (@RonPaul) April 5, 2021

Dormant rights?! Oxymoron.

“..bars and restaurants in Florida and Texas were thronged with people celebrating their long-dormant right to gather outside their homes..”

• Texas Becomes 2nd US State To Ban Vaccine Passports (RT)

Texas Governor Greg Abbott has announced a ban on so-called vaccine passports, becoming the second US governor to officially do so, just a few days after Florida’s Ron DeSantis. The issue has largely broken along political lines. Abbott made an announcement on Tuesday declaring that no Texas government agencies or political entities would be permitted to require “vaccine passports” in the state. “Don’t tread on our personal freedoms,” the governor warned, even as he made clear that he was not against the idea of vaccination in principle, but resented forced vaccination. “Every day Texans return to normalcy as more people get (and become immune to) the spread of Covid-19,” Abbott declared, adding that the jabs “help slow the spread of Covid, reduce hospitalizations and reduce fatalities.”

The Biden administration’s medical adviser, Anthony Fauci, seemed almost displeased with Texas’ refusal to slide down its predicted Covid-streaked death spiral, where “the restaurants and the bars are full and open, the ballparks are full, and yet we’ve seen cases and hospitalizations since then continue to tick downward,” as an MSNBC host put it. “It looks like 2019,” he said in shock, noting that bars and restaurants in Florida and Texas were thronged with people celebrating their long-dormant right to gather outside their homes. Attempting to explain why Texas and Florida’s case counts had dropped despite their having some of the least strict virus regulations, Fauci blamed a “lag,” arguing that the undesirable data everyone was waiting for was still coming – it was just a few weeks down the line.

“We’ve gotta make sure we don’t prematurely judge [the case numbers],” the doctor continued. At least 17 separate vaccine passes are in the works to track travelers’ medical data, the Biden administration told the media earlier this week, though the president has previously insisted that he has no plans for a nationwide vaccine passport. Abbott’s Florida counterpart, Ron DeSantis, unveiled a similar ban on Friday, barring all state agencies and local businesses from issuing “vaccine passports” and banning state government agencies from doing business with private companies that require such passports.

What Fauci doesn’t like.

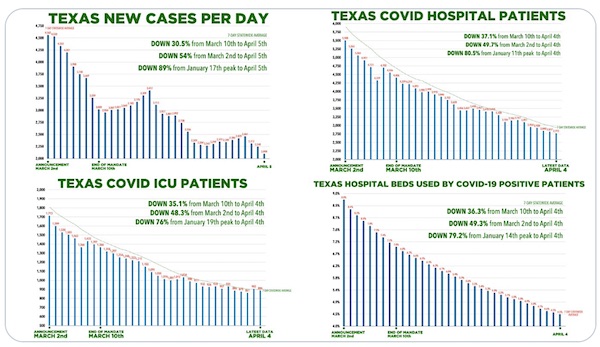

• Yup, Still Waiting for the Maskless Texan Apocalypse (NR)

The day before Texas’s statewide mask mandate ended, March 9, Texas had 5,119 new cases of COVID-19, and the seven-day average for new cases was 3,971. On that day, the state had 126,404 active cases of COVID-19. As of March 9, the seven-day average for new deaths was 104. Yesterday, Texas had 2,906 new cases, and the seven-day average for new cases is 2,815. As of yesterday, the state had 96,640 active cases of COVID-19. As of yesterday, the seven-day average for new deaths was 81. When Texas governor Greg Abbott announced the decision, I argued that he and other state officials were not crazy or exhibiting “Neanderthal thinking.” I noted that masks were not disappearing from public life in Texas.

Major grocery chains and Walmart and Target still required them, as did many public-school districts, some localities, and so on. Austin, Dallas, Houston, San Antonio, and El Paso would require them in city-owned buildings. Since early March, I have noted that Texas COVID-19 statistics keep gradually getting better instead of worse, the opposite trend of what many mask advocates and all-purpose critics of Texas expected. Every time, folks on social media told me that it’s just too early to tell, and that the catastrophic consequences of the rescinding of the Texas statewide mask mandate are just around the corner. And yet, here we are, a month later, and all of the measuring sticks show significant improvement.

I am sure many people will declare that the huge crowd at yesterday’s Texas Rangers game is a potential “super-spreader” event. Before the event, President Biden called the stadium and state policies “not responsible.” And maybe yesterday’s large attendance will turn out to be a bad decision. But some other large gatherings, where people intermittently followed social-distancing guidelines if they followed them at all, did not turn into super-spreader events, like the crowds of thousands of people around the Super Bowl in Tampa. This pandemic is unpredictable, and the data rarely line up perfectly with people’s expectations or yearning for confirmation of their partisan preferences. By far the sharpest increase in cases occurring right now is in Michigan, where the masking and lockdown policies have been comparably strict.

Dr. Jayanta Bhattacharya and Dr. Martin Kulldorff.

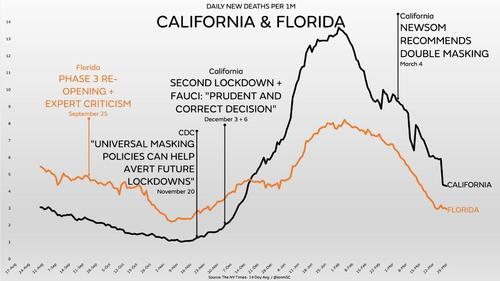

• California’s Failed Response To COVID (Bhattacharya/Kulldorff)

From the beginning, the Golden State has taken an aggressive stance toward the epidemic, including imposing the earliest shelter-in-place order in the nation; ceasing in-person schooling for the vast majority of public-school kids; shuttering churches, parks, and playgrounds; mandating masks, with hefty fines for violators; and forcing the closure of “non-essential” businesses that cannot operate using distancing technologies, such as videoconferencing. Even Disneyland has been closed since March 2020. In short, California has followed one of the strictest lockdowns in the country. Though the state’s response received high marks in July from the “covidian” high priesthood, including Dr. Anthony Fauci, the state has seen exploding coronavirus cases and deaths.

Through March 28, 2021, 8.9 percent of all Californians have been identified as COVID cases – 3.6 million cases. Since most infections are not recognized as cases, a much larger fraction of the population has been infected with COVID. Through March 29 this year, nearly 57,800 people have died in California with COVID. To put these numbers in perspective, it helps to have a comparison state that has followed a very different policy. For that, we should consider Florida, which partially lifted its lockdown in May 2020 and then further relaxed restrictions in September (based in part on focused protection ideas advocated by us).

In sharp contrast to California, in Florida most schools and universities have been open for in-person instruction since the fall, normal human activities—sports, church going, visits to the park—occur with regularity, and businesses have been open for in-person activities. Local ordinances can recommend masks and social distancing and impose indoor-capacity limitations but cannot mandate closures, as is the case in California. Disneyworld has been open since July. At the same time, Florida increased testing and protection within its nursing homes to reduce the risk of COVID among its most vulnerable residents.

The Florida policy has drawn sharp criticism from Fauci, who said it “opened up too quickly” in July. However, the infection control results to date look remarkably similar to California’s, and in some ways better. Through March 28, 9.5 percent of Floridians have been identified as COVID cases. Once we account for the fact that Florida has one of the oldest populations in the country and California has one of the youngest, the death rates with COVID through March 28 are lower in Florida than in California. In fact, the COVID death rate for the under-65 population and the over-65 population are both lower in Florida than in California.

How can anyone inject a child with a untested substance?

• AstraZeneca Trial Involving Minors Halted As EMA Links Jab to Blood Clots (ZH)

Just days after Australia’s deputy chief medical officer, Michael Kidd, acknowledged that there was likely a connection between rare blood clots and the COVID vaccine developed by AstraZeneca and Oxford, officials from the EMA, Europe’s top pharmaceutical regulator, have finally acknowledged the link, even if the agency’s official stance – that there’s no evidence of a link, but no evidence to rule it out – remains unchanged. The EMA declared at the conclusion of a hasty “safety review” last month that the benefits of the AstraZeneca jab (which is expected to to be the workhorse of the global vaccination rollout as Covax, the WHO/Gates Foundation program to vaccination developing countries, expects to heavily rely on the jab) far outweighed any risks, while saying it couldn’t definitively rule out the possibility that the blood clots and the vaccine might be connected.

But researchers from Norway, Germany and elsewhere insisted they had found evidence of a connection. And after the UK acknowledged more than 2 dozen new cases of the rare clots – 9 of them fatal – it seems the dam has finally broken. New findings from the EMA show that there is indeed a link between the “very rare” blood clots in the brain and the AstraZeneca vaccine, but the exact possible causes are still unknown, according to a senior EMA official, who made the comments in an interview with the Italian newspaper Il Messagero. Here’s a Reuters summary of that report. “In my opinion, we can now say it, it is clear that there is an association (of the brain blood clots) with the vaccine. However, we still do not know what causes this reaction,” Marco Cavaleri, chair of the vaccine evaluation team at the EMA, told Italian daily Il Messagero.

Cavaleri provided no evidence to support his comment.[…] Cavaleri said the EMA would say in its review that there is a link but was not likely to give an indication this week regarding the age of individuals to whom the AstraZeneca shot should be given. In a separate interview, Armando Genazzani, a member of the EMA’s Committee for Medicinal Products for Human Use, told another Italian newspaper, La Stampa, that a connection between the jab and the clots was “plausible.” The EMA is officially investigating 44 cases of the brain blood clots, an ailment known as a cerebral venous thrombosis (or CVST). More than 9.2M people in the EU have received the vaccine in total.

In response to Cavaleri’s comments, the Amsterdam-based EMA said in a statement on Tuesday: “EMA’s Pharmacovigilance Risk Assessment Committee (PRAC) has not yet reached a conclusion and the review (of any possible link) is currently ongoing.” While the EMA refused to confirm the comments made by individual officials, WSJ reported Tuesday that the University of Oxford had decided to pause trials of the vaccine in the UK that involved children between the ages of 12 and 15. An Oxford spokesman said Tuesday that while no safety issues have arisen in the trial, broader concerns about rare clotting problems in adults have triggered further regulatory reviews in the UK and Europe to investigate any potential link with the vaccine.

“All states have the power to require vaccination among students attending school; many do for diseases like polio and measles.”

Yes, but those are tested and approved actual vaccines.

• Only Half Of Americans Intend To Vaccinate Their Children Against Covid (F.)

Only half of Americans intend on getting their children immunized against Covid-19 as soon as vaccines become available, according to a new Axios/Ipsos survey published Tuesday, another potential barrier towards expanding vaccine access ahead of schools returning in fall. 48% of parents surveyed in April said they are not likely to have their children vaccinated against Covid-19 when the shots first become available. The figure contrasts with growing adult acceptance of the vaccines, which has grown from around 38% in September and October to nearly 70% today. Vaccine hesitancy remains a problem, however, and polls throughout 2021 show that one in five Americans consistently say they are unlikely to get vaccinated.

The Axios poll found Republicans (31%) and those with a high school education or less (28%) to be most resistant to vaccines. Vaccinating children is going to play a major role in ending the pandemic and getting life back to normal as schools return in fall. While children and young teens don’t often get seriously sick from Covid-19, they can and do: 227 children have died from Covid-19 in the U.S., according to the New York Times. They can also pass on the virus to others, notably adults who are likely to be much more vulnerable. A vaccine for this age group would help cut the risk of illness, limit transmission from children and better contain outbreaks. Now that adult vaccination drives are well under way, manufacturers are starting to trial shots in younger people.

After promising preliminary results from a clinical trial in late March, Pfizer said it plans to apply for an expanded emergency use authorization for young teens in Europe and the U.S. in coming weeks. Moderna also has several ongoing trials exploring its vaccine’s effectiveness in young children and adolescents. Experts are still debating whether the B.1.1.7. variant of the virus, first found in the U.K., is able to infect children more readily. Though few states have started to fully grapple with the idea of requiring vaccination for Covid-19 in children—Tennessee and Pennsylvania have said vaccination will remain optional—some school districts have signaled an intent to mandate it, setting the stage for wider conflict if and when vaccines are approved for use, especially if resistance remains high. All states have the power to require vaccination among students attending school; many do for diseases like polio and measles.

Does New Zealand even have vaccines?

• Travel Bubble Between New Zealand And Australia To Start On 19 April (G.)

After nearly a year shut off from the world, New Zealand is cracking open its borders, with a trans-Tasman travel bubble allowing two-way quarantine-free travel with Australia. The NZ prime minister, Jacinda Ardern, announced on Tuesday the bubble would open from 19 April, allowing quarantine-free travel between the two nations. Travellers from New Zealand have been able to enter selected Australian states without quarantining since October but the arrangements did not apply in the other direction. Australia’s prime minister, Scott Morrison, applauded Ardern’s announcement while airlines in both countries hurriedly advertised hundreds of weekly flights and routes. However, tourism operators warned the benefits would be muted in the short term, as the first passengers would likely be low-spending travellers visiting family.

At a press conference on Tuesday, Ardern said she was “confident not only in the state of Australia, but in our own ability to manage a travel arrangement”. More than 600,000 New Zealanders live in Australia, and many families straddle the border. “One sacrifice that has been particularly hard for many to bear over the past year has been the separation from friends and family who live in Australia, so today’s announcement will be a great relief for many,” Ardern said. “This is the next chapter.” Ardern said the arrangement – of two countries, both maintaining a full elimination strategy for Covid-19 opening up to international travel – was potentially unique in the world. The plan has been in the works for months now, but was paused repeatedly after outbreaks of Covid-19 on either side of the border.

Australia has some vaccines, but not enough.

• Australia Calls On EU To Supply Outstanding Astrazeneca Vaccine Doses (G.)

Scott Morrison denies his government has presented the public with overly rosy assessments about the state of its Covid-19 vaccine rollout, as he steps up calls for the European Union to allow 3.1m outstanding AstraZeneca doses to be shipped to Australia. While declaring that vaccine supply issues were a matter of “straightforward maths”, the prime minister also attempted to calm a growing diplomatic dispute between Australia and the EU, insisting he had not made any criticism of Brussels over its handling of the matter. Earlier on Wednesday, the Morrison government issued a statement accusing the European Commission of “arguing semantics” by saying just one shipment of 250,000 AstraZeneca doses had been formally blocked.

The government said the commission had signalled it would block other applications to export vaccine doses from the region. The government also complained that the European Commission has not responded to Australia’s request for 1m doses of the AstraZeneca vaccine to be made available to Papua New Guinea, one of the countries hardest hit in the region. The latest statements follow comments by a European Commission spokesman on Tuesday that the only export request rejected out of nearly 500 received has been a shipment of 250,000 doses to Australia in March. Morrison told reporters on Wednesday the government was asking AstraZeneca to resubmit its application to the European Commission to export the remaining 3.1m of the 3.8m contracted vaccine doses to Australia.

He was seeking further talks with the commission president, Ursula von der Leyen, to discuss the issue. The prime minister said he was “pleased to hear that the European Union overnight has indicated that they are not seeking to restrict these vaccines to Australia”. He said the government would therefore encourage Brussels to allow the rest of the 3.8m does to come to Australia, including 1m “to provide support to our Pacific family in Papua New Guinea that are undergoing a humanitarian crisis”. He also wanted the remaining doses to “be part of the vaccination rollout here in this country”.

Of course there’s resistance.

• Comedy Club Pulls Out Of Covid Safety Trial After Online ‘Hate Campaign’ (G.)

A comedy club has pulled out of a trial to test how venues can operate safely after it said the government failed to clarify whether it would involve Covid-19 vaccine passports. The Hot Water comedy club in Liverpool said it was subjected to a “hate campaign” online after reports suggested it was working with the Department for Digital, Culture, Media and Sport (DCMS) to trial Covid-status certification. Club co-owner Binty Blair said he had tried to contact DCMS to clarify whether vaccine passports would be trialed in the pilot event, but to no avail. The club has subsequently cancelled its event, which was due to be the first in the pilot. It had been due to take place on 16 April with an audience of 300 at Liverpool’s M&S Bank Arena Auditorium. “The reason for us backing out is the government wasn’t clear about the Covid passports,” Blair told the PA news agency.

“The problem is we don’t know what we signed up for.” On Tuesday evening, the government confirmed there will be no requirement for participants in the initial pilot events to have received a vaccination in venues like a comedy club. DCMS announced over the weekend that a series of pilot events were planned for the coming months as officials look to find a way for venues such as football grounds and nightclubs to reopen without the need for social distancing. It said Covid-status certification would be trialled as part of the programme, while detailing a number of events on an initial list of pilots, including Hot Water comedy club. Blair said he had agreed to take part in the pilot in March but only learned of the government’s plans to trial Covid-19 vaccine passports two days ago. He said four acts had lost £300 each as a result of the cancelled event.

Brought to you by the same people stoking unrest in Ukraine.

• In Biden Change Of Tune, US Mulling Boycott Of 2022 Beijing Olympics (ZH)

As if US-China relations weren’t bad enough at this moment, things are about to escalate further – potentially taking the Biden White House past even beyond the low-point of the trade war during the Trump presidency. State Department spokesman Ned Price told reporters during a daily briefing on Tuesday that the US and its allies are discussing a joint boycott of the 2022 Winter Olympics in Beijing. = It’s not the first time the issue has been addressed, and previously it was mainly Republicans pressuring action regarding the Olympics and China’s egregious human rights record. In early February the White House had indicated it “had no plans” for a boycott, with Jen Psaki asserting at the time, “We’re not currently talking about changing our posture or our plans as it relates to the Beijing Olympics.”

But “plans” have clearly changed, especially following the March 22 coordinated sanctions slapped on top Beijing officials over the Uighur crackdown by the US, UK, EU and Canada. The Canadians in particular have been the most vocal in parliament for urging an international boycott of the 2022 games, which has riled China. Here’s what the State Department’s Ned Price said in the Tuesday afternoon comments: “It [a joint boycott] is something that we certainly wish to discuss,” …he told reporters when asked about the Biden administration’s plans ahead of the international games. “A coordinated approach will not only be in our interest but also in the interest of our allies and partners,” he added.

Price said that the United States has not yet made a decision but was concerned about China’s egregious human rights abuses. The Olympic Games are due to take place between Feb. 4 to Feb. 20. When pressed over a possible timeline of when such a decision would be reached, Price added: “We’re talking about 2022, and we are still in April of 2021, so these Games remain some time away.” “I wouldn’t want to put a time frame on it, but these discussions are underway.”

It’s almost too funny.

• Biden Admin Mulls Restarting Border Wall Construction (ZH)

Less than 90 days after President Biden signaled his immense virtue by halting construction on Trump’s border wall and canceling future contracts, Biden’s beleaguered Department of Homeland Security is exploring whether to restart border wall construction in order to ‘plug gaps’ in the current barrier, according the Washington Examiner, citing DHS Secretary Alejandro Mayorkas. This of course would make Biden a xenophobic tyrant, if we’re playing by the Trump-era media guidebook. “In a conversation with Immigration and Customs Enformcement employees last week Mr. Mayorkas was asked about his plans for the wall and he said that while President Biden has canceled the border emergency and halted Pentagon money flowing to the wall, “that leaves room to make decisions” on finishing some “gaps in the wall.”

“Mr. Mayorkas, according to notes of the ICE session reviewed by The Washington Times, said Customs and Border Protection, which oversees the wall, has submitted a plan for what it wants to see happen moving forward.” -Washington Examiner. “It’s not a single answer to a single question. There are different projects that the chief of the Border Patrol has presented and the acting commissioner of CBP presented to me,” said Mayorkas, adding “The president has communicated quite clearly his decision that the emergency that triggered the devotion of DOD funds to the construction of the border wall is ended. But that leaves room to make decisions as the administration, as part of the administration, in particular areas of the wall that need renovation, particular projects that need to be finished.”

According to Mayorkas, the work would cover “gaps,” “gates,” and areas “where the wall has been completed but the technology has not been implemented.” Former President Trump’s acting commissioner of CBP, Mark Morgan, said Mayorkas’ comments were “more spin and misdirection,” and that the agency has always given the administration options on how to proceed with the wall. When Trump left office, around 460 miles of border wall was completed – most of which being improvements in areas with existing wall and/or outdated designs, or vehicle checkpoints that people could simply walk around.

“..by preventing failure in economies in the short term, Creative Destruction has only moved — now to the level of our international economic system..”

Breakthroughs, that step-change our lives for the better, invariably come from something that most people couldn’t see. Our belief of how the world should exist and operate is shaped from looking backwards, not forward, so it makes sense that new paradigms that change everything — face resistance in our minds. Because most people don’t see them, breaking through an existing paradigm needs to provide enough compelling value for users to disrupt an old paradigm. Apple’s iPhone for instance, didn’t copy the market leader, Research in Motion’s Blackberry design of needing a keyboard or selling to businesses who required RIM’s security. It created a digital interface when that wasn’t ‘needed’ and created an entirely new platform that changed the industry as a result.

Along the way, the Blackberry died, unable to compete with the value for users, that was now increasing exponentially on Apple’s platform. That process describes “Creative Destruction” a paradoxical term first coined by Joseph Schumpeter in 1942 to describe how Capitalism works in a “free market.” Entrepreneurs innovate and “create” value for society — and that value gained by society also often “destroys” the former monopoly power. That process and its importance is at the centre of how all modern economies have evolved and given rise to most of the benefits to society we take for granted today. New winners become so valuable that they disrupt existing market power or structures. It is all driven from a near-constant flow of innovative entrepreneurs with bold ideas and the capital backing them that go up against the status quo and are only successful, “if’’ they create value for society.

For the process to work, failure is critical! Both for entrepreneurs and the capital in them whose business doesn’t work, and for legacy businesses that get disrupted by them if their innovation brings better value to society. And while failure is hard, preventing failure is much worse. Why? Because by preventing failure, market incentives become warped, and in doing so, eventually put a small number of people (government/central banks) in charge of choosing who gets what, instead of the free market. Unfortunately, preventing failure has been the policy makers tool for the last 20 years and it has enormous consequences.

By socializing losses and preventing failure in our economies, central banks and governments have all but ensured that the existing monetary system of the world collapses — and is replaced by something new. In other words, by preventing failure in economies in the short term, Creative Destruction has only moved — now to the level of our international economic system. I believe with what is to come, Bitcoin has a higher than average probability of overcoming all barriers and becoming a global reserve currency. More importantly, I believe it gives humanity its best chance for a peaceful transition to the future. A world where the abundance gained from our technological progress is more widely distributed. It is not hyperbole to say that almost everything changes as a result of this innovation.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Ricky Gervais

Happiness is amazing.

It’s so amazing it doesn’t matter if it’s yours or not.

There’s that lovely thing –

‘A society grows great when old men plant trees the shade of which they know they will never sit in’.AFTER LIFE#RickyGervais #PenelopeWilton

— Michael Warburton (@mikewarburton) April 7, 2021

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.