Edouard Manet The absinthe drinker 1859

Malone Candace

Dr. Malone: There was an outbreak of Monkey pox in the US in 2003…we've seen this movie before! pic.twitter.com/xmU1GiKF0o

— LEILA (@LeylaRostami) May 26, 2022

Schwab

Klaus Schwab: WEF can create coordinated responses to challenges pic.twitter.com/bBeExGOoUU

— Wittgenstein (@backtolife_2022) May 26, 2022

These people live in a different world and age

Klaus Schwab and Ursula von der Leyen about Russia pic.twitter.com/MmZ7KHLIwr

— Wittgenstein (@backtolife_2022) May 26, 2022

“It was a gross injustice, and it hurt the United States in many ways, including what we’re seeing in Ukraine these days. It distorted our foreign policy, and so forth..”

• Former Attorney General Bill Barr Says Hillary Guilty Of ‘Sedition’ (CB)

Former United States Attorney General Bill Barr has given a stark warning to former Democrat presidential nominee Hillary Clinton over her “seditious” conspiracy against former President Donald Trump. “I thought we were heading into a constitutional crisis. I think whatever you think of Trump, the fact is that the whole Russiagate thing was a grave injustice. It appears to be a dirty political trick that was used first to hobble him and then potentially to drive him from office,” he said on Glenn Beck’s Blaze TV podcast. “I believe it is seditious,” he said, but he warned that those charges would be tough to prove in a court. “It was a gross injustice, and it hurt the United States in many ways, including what we’re seeing in Ukraine these days. It distorted our foreign policy, and so forth,” the former attorney general said.

He said that he named Special Counsel John Durham to lead the case in private so it would stop President Joe Biden and Attorney general Merrick Garland from interfering with him. “I was highly confident he would remain in office and they wouldn’t touch him,” he said. “The Biden administration had no real interest in protecting either Hillary Clinton or Comey,” he argued. “And at the end of the day, for them to lose the capital and appear to be covering something up that would then never get resolved, I didn’t think was in their interest,” he said. “And I think institutionally that would’ve destroyed the new AG if he had tried that. “If you don’t have the threat of a grand jury, no one will come in and talk to you. You’ll say, the usual thing is, ‘Please come in for a voluntary interview,” the former attorney general said.

“And people come in because they know if they don’t, they’re subpoenaed. “But if there is no grand jury, they say, ‘No, I’m not coming in,’ and there’s nothing you can do,” he said. “And people don’t understand that that state of affairs lasted until the month before the election,” he said of the pandemic that delayed the Durham probe. “So his hands were very much tied as to how far he could push things and how much pressure he could bring on people through most of 2020,” he said.

A glimpse of reality, or just a way to get more weapons into Ukraine?

• Ukrainian Volunteer Fighters In The East Feel Abandoned (WaPo)

Stuck in their trenches, the Ukrainian volunteers lived off a potato per day as Russian forces pounded them with artillery and Grad rockets on a key eastern front line. Outnumbered, untrained and clutching only light weapons, the men prayed for the barrage to end — and for their own tanks to stop targeting the Russians. “They [Russians] already know where we are, and when the Ukrainian tank shoots from our side it gives away our position,” said Serhi Lapko, their company commander, recalling the recent battle. “And they start firing back with everything — Grads, mortars. “And you just pray to survive.” Ukrainian leaders have projected and nurtured a public image of military invulnerability — of their volunteer and professional forces triumphantly standing up to the Russian onslaught.

Videos of assaults on Russian tanks or positions are posted daily on social media. Artists are creating patriotic posters, billboards and T-shirts. The postal service even released stamps commemorating the sinking of a Russian warship in the Black Sea. Ukrainian forces have succeeded in thwarting Russian efforts to seize Kyiv and Kharkiv and have scored battlefield victories in the east. But the experience of Lapko and his group of volunteers offers a rare and more realistic portrait of the conflict and Ukraine’s struggle to halt the Russian advance in parts of Donbas. Ukraine, like Russia, has provided scant information about deaths, injuries or losses of military equipment. But after three months of war, this company of 120 men is down to 54 because of deaths, injuries and desertions.

The volunteers were civilians before Russia invaded on Feb. 24, and they never expected to be dispatched to one of the most dangerous front lines in eastern Ukraine. They quickly found themselves in the crosshairs of war, feeling abandoned by their military superiors and struggling to survive. “Our command takes no responsibility,” Lapko said. “They only take credit for our achievements. They give us no support.”

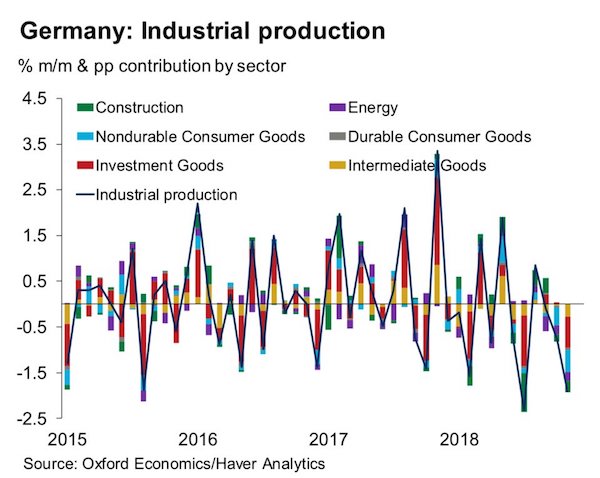

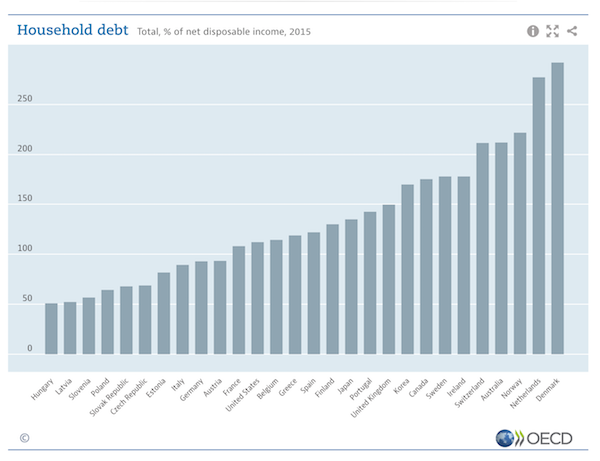

“..Russia’s economy is actually more like the size of Germany’s..”

• Is America the Real Victim of Anti-Russia Sanctions? (Bertrand)

Remember the claims that Russia’s economy was more or less irrelevant, merely the equivalent of a small, not very impressive European country? “Putin, who has an economy the size of Italy,” Sen. Lindsey Graham, R-S.C., said in 2014 after the invasion of Crimea, “[is] playing a poker game with a pair of twos and winning.” Of increasing Russian diplomatic and geopolitical influence in Europe, the Middle East, and East Asia, The Economist asked in 2019, “How did a country with an economy the size of Spain … achieve all this?” Seldom has the West so grossly misjudged an economy’s global significance.

French economist Jacques Sapir, a renowned specialist of the Russian economy who teaches at the Moscow and Paris schools of economics, explained recently that the war in Ukraine has “made us realize that the Russian economy is considerably more important than what we thought.” For Sapir, one big reason for this miscalculation is exchange rates. If you compare Russia’s GDP by simply converting it from rubles into U.S. dollars, you indeed get an economy the size of Spain’s. But such a comparison makes no sense without adjusting for purchasing power parity (PPP), which accounts for productivity and standards of living, and thus per capita welfare and resource use. Indeed, PPP is the measure favored by most international institutions, from the IMF to the OECD.

And when you measure Russia’s GDP based on PPP, it’s clear that Russia’s economy is actually more like the size of Germany’s, about $4.4 trillion for Russia versus $4.6 trillion for Germany. From the size of a small and somewhat ailing European economy to the biggest economy in Europe and one of the largest in the world—not a negligible difference. Sapir also encourages us to ask, “What is the share of the service sector versus the share of the commodities and industrial sector?” To him, the service sector today is grossly overvalued compared with the industrial sector and commodities like oil, gas, copper, and agricultural products. If we reduce the proportional importance of services in the global economy, Sapir says that “Russia’s economy is vastly larger than that of Germany and represents probably 5% or 6% of the world economy,” more like Japan than Spain.

Shoot. Foot.

• EU Suspends Russia’s Access To Vital Crime Data Sharing Program (ZH)

Amid the unprecedented waves of EU and US sanctions imposed on Russia in the wake of its Ukraine invasion, and as tit-for-tat diplomatic expulsions continue between Moscow and European capitals, among the last frontiers of Russia-Europe cooperation remains in the area of crime monitoring and data sharing. But that too appears to be winding down, as Russian state media has announced the European Union has suspended its drug traffic data sharing program with Russian law enforcement agencies. “The EU has suspended contacts and data sharing with Russia as part of the European Monitoring Center for Drugs and Drug Addiction, a senior Russian Foreign Ministry official said,” TASS reports.

“The European Union has unilaterally suspended expert contacts and data sharing with us” as part of the EMCDDA, Deputy Foreign Minister Oleg Syromolotov confirmed. “The annual OSCE-wide Anti-Drug Conference has been postponed indefinitely,” he added. The Russian official slammed the move as counterproductive, with the inevitable consequence being that drug traffickers will be able to act with greater impunity as a country the size of Russia (literally the world’s largest by land mass and border area) is cut out of the program. “We believe this is a destructive approach. It plays into the hands of drug traffickers, who are taking advantage of the disagreements among countries to increase illicit drug supplies to Europe,” he said.

Russia, however, remains and will likely continue to remain a vital country within INTERPOL – the world’s largest international policing organization, representing 194 member countries. According to the INTERPOL website, “Russia is the world’s largest country by area, and shares borders with countries in northern Asia and Europe. Identifying, investigating and preventing serious crime across Europe and Asia is a large part of the daily work carried out by INTERPOL’s National Central Bureau (NCB) in Moscow.”

It was always idiotic.

• Lockdowns Had ‘Little To No Effect’ On Covid Death Rate (DM)

The first Covid lockdowns saved 10,000 lives in Europe and US had ‘little or no effect’ on the virus death rate, updated analysis suggests. A review by an international team of economists found draconian shutdowns only reduced Covid mortality by 3 per cent in the UK, US and Europe in 2020. The experts, from Johns Hopkins University in the US, Lund University in Sweden and the Danish think-tank the Center for Political Studies, said that equates to 6,000 fewer deaths in Europe and 4,000 fewer in the US. This figures is a revised from the group’s first report last year, which found lockdowns cut Covid deaths by just 0.2 per cent. The team said the updated figure is down to changes in their calculations and new studies. But they still conclude: ‘Stricter lockdowns are not an effective way of reducing mortality rates during a pandemic, at least not during the first wave of the COVID-19 pandemic.’

MailOnline was one of only three major British media outlets to cover the initial findings when they were released back in January. Experts at the time told MailOnline it is unsurprising that some left-wing publications avoided the story because they wanted to ‘maintain fear around the pandemic’. Their 3.2 per cent figure is the average effect of all lockdown measures combined. When looking at stay-at-home orders specifically, the team estimate this had even less of an impact, reducing the death toll by just 2 per cent. Their report does not look at the effect of lockdowns excess deaths, which includes people who died from other causes because hospitals were shut, for example. It did find mask wearing to be the most effective intervention, leading to a 18.7 per cent drop in virus fatalities — however this result was based on just three studies.

Think mob rule.

• The WHO’s Pandemic Treaty (Kheriaty)

The WHO recently announced plans for an international pandemic treaty tied to a digital passport and digital ID system. Meeting in December 2021 in a special session for only the second time since the WHO’s founding in 1948, the Health Assembly of the WHO adopted a single decision titled, “The World Together.” The WHO plans to finalize the treaty by 2024. It will aim to shift governing authority now reserved to sovereign states to the WHO during a pandemic by legally binding member states to the WHO’s revised International Health Regulations. In January of 2022 the United States submitted proposed amendments to the 2005 International Health Regulations, which bind all 194 UN member states, which the WHO director general accepted and forwarded to other member states.

In contrast to amendments to our own constitution, these amendments will not require a two-thirds vote of our Senate, but a simple majority of the member states. Most of the public is wholly unaware of these changes, which will impact the national sovereignty of member states. The proposed amendments include, among others, the following. Among the changes the WHO will no longer need to consult with the state or attempt to obtain verification from the state where a reported event of concern (e.g., a new outbreak) is allegedly occurring before taking action on the basis of such reports (Article 9.1). In addition to the authority to make the determination of a public health emergency of international concern under Article 12, the WHO will be granted additional powers to determine a public health emergency of regional concern, as well as a category referred to as an intermediate health alert.

Posobiec T-Mobile

Jack Posobiec – Deutsche Telekom to build global COVID vaccine verification app for WHOhttps://t.co/KwCxD5SrlY pic.twitter.com/Et92FCV9XD

— Wittgenstein (@backtolife_2022) May 26, 2022

“If you are not prepared to act on interest rates, you may as well get out of town.”

• Jerome Powell’s Volcker Deficit (Stephen Roach)

Poor Jerome Powell. With US inflation close to a 40-year high, the Federal Reserve chair knows what he needs to do. He has professed great admiration for Paul Volcker, his 1980s-era predecessor, as a role model. But, to paraphrase US Senator Lloyd Bentsen’s famous 1988 quip about his vice-presidential rival, Senator Dan Quayle, I knew Paul Volcker very well, and Powell is no Paul Volcker. Volcker was the quintessential US public servant. He smoked cheap cigars, wore rumpled off-the-rack suits, and had a strong distaste for the glitz of Washington power circles. His legacy was a single-minded discipline in attacking a pernicious Great Inflation.

Unlike the modern Fed, which under Ben Bernanke’s intellectual stewardship created a new arsenal of tools – balance-sheet adjustments, special lending facilities, and the “forward guidance” of outcome-dependent policy signals – the Volcker approach was simple, blunt, and direct. Monetary policy, in Volcker’s view, started and ended with interest rates. He once said to me, “If you are not prepared to act on interest rates, you may as well get out of town.” Volcker, of course, raised US interest rates to unheard-of levels in 1980-81, and there were many who did want him to get out of town. But howls of protest from builders, farmers, citizens’ groups, and members of Congress demanding his impeachment did not dissuade him from an unprecedented tightening in monetary policy. It was long overdue.

Under Volcker’s predecessor, Arthur Burns, the Fed had become convinced that inflation was part of the US economy’s institutional fabric. The price level was thought to have less to do with monetary policy than with the power of labor unions, cost-of-living wage indexation, and regulatory pressures on costs stemming from environmental protection, occupational safety, and pension benefits. Burns argued that oil and food-price shocks reinforced the institutional biases of an inflation-prone US economy. In other words, blame the system, not the Fed. The Fed’s research staff, which at the time included me, squirmed but raised no objections.

Volcker did more than squirm when he took over as Fed chair in August 1979. At the time, the consumer price index was surging by 11.8% year on year, on its way to 14.6% in March 1980. Volcker was determined to find the interest-rate threshold that would break the back of US inflation. Using the political cover provided by the 1978 Humphrey-Hawkins Act, which formalized the Fed’s price-stability mandate, and drawing operational support from a shift to targeting the money supply, Volcker went into action. The Fed increased its benchmark federal funds rate from 10.5% in July 1979 to 17.6% in April 1980. Volcker then reversed course during an ill-advised but short-lived experiment with credit controls in the spring of 1980, before resuming a monetary-policy tightening that eventually pushed the funds rate to a monthly peak of 19.1% in June 1981. Only then did the fever of double-digit inflation break.

By late 1982, with the US in deep recession, annual headline CPI inflation had slipped below 4%, and the Fed started to reduce the benchmark policy rate. Mindful of the deeply entrenched inflationary psychology still gripping America, the Fed moved slowly and cautiously. Volcker, having broken the back of inflation, was not about to “leave town” until the Fed’s mission was complete.

Martha Mitchell.

• Leaking Information Is a Key Tenet of Democracy. Just Look at the Past (NW)

The art of leaking, as recent events suggest, are integral to upholding American values when the upper echelons of power seek to denigrate them. The story of Martha Mitchell, the wife of Nixon’s attorney general John Mitchell, is a case in point to why whistleblowing must be protected under American law at all costs. Her story is being recounted via a Starz miniseries that pays tribute to her whistleblowing efforts and pours scorn on those who treated her with contempt. Mitchell offered the press a behind the palace walls glimpse into the goings-on in the White House, and her vivacious truth-telling was key to the unravelling of the Watergate scandal that consequently cost Nixon the presidency.

Mitchell was drugged and kidnapped by her husband’s coterie of sycophants for her role in trying to expose Nixon’s unjust involvement in the break-in of the Democratic National Committee headquarters. She was tainted as mentally unfit by the White House in their bid to tarnish a critic ready to spill information on corruption at the highest level. Why must the nation of the free world, a purported bastion of democratic principle, hasten to launch a smear campaign against anyone who seeks to divulge the truth? There’s been a smear campaign like no other against Wikileaks founder and thorn-in-the-side of American cover-ups, Julian Assange, for years. Assange is currently held in a maximum security prison in the U.K., awaiting his fate by the Home Office on whether he will be extradited to the U.S. over disclosure of national security information.

Wikileaks uncovered numerous scandals committed by the American establishment, but it’s the establishment that attempts to absolve itself by lamenting the website as treasonous. Assange’s willingness to reveal dark secrets emboldened other whistleblowers to follow suit. Former Army intelligence analyst Chelsea Manning was responsible for releasing a tranche of classified materials by the U.S. military, which included videos of merciless airstrikes in Iraq and thousands of U.S. diplomatic cables. Manning was castigated by international governments, as was Edward Snowden for leaking to The Guardian documents on global surveillance programs headed by the National Security Agency. Both have become polarizing figures in world history where critics call them cowards, while others hail them as patriots.

The leak of the Supreme Court’s draft opinion is the latest in a long line of events committed to uncovering the truth and subsequently holding those in power accountable. This leak is timely, with a milestone that marks a period of reflection for the whistleblowers at the center of the Watergate affair, particularly those like Mitchell who were routinely admonished. The leaker within the Supreme Court, alongside the art of whistleblowing itself, must be protected under democracy without question. Decisions are currently being made that will affect Americans for generations to come. If it wasn’t for those who have the courage to blow the whistle, crimes committed by an increasingly autocratic America would continue to imperil the thriving democracy it claims to be.

He tried his best to lose $100 billion.

• Twitter Investors Sue Elon Musk For “Manipulating Stock Price Lower” (ZH)

Among the headaches that Elon Musk faces regarding his proposed takeover of Twitter is now an investor lawsuit claiming that Musk “manipulated the company’s stock price downward” during the course of his involvement in the company. Investors are alleging that Musk saved himself $156 million by not reporting, in a timely fashion, that he had purchased more than 5% of Twitter by March 14, a new report from Bloomberg/Yahoo says. The investors also asked to be certified as a class and to be awarded both punitive and compensatory damages. In addition to Musk, Twitter was also named as a defendant, as investor agued that the company didn’t do enough to look into Musk’s conduct. The suit alleges his conduct was to “drive Twitter’s stock down substantially in order to create leverage.”

“Musk’s market manipulation worked. Twitter has lost $8 billion in valuation since the buyout was announced,” the lawsuit reads, according to a follow up writeup by Bloomberg Law. The suit alleges that Musk continued to buy stock after not disclosing his stake, amassing a 9.2% stake. “By delaying his disclosure of his stake in Twitter, Musk engaged in market manipulation and bought Twitter stock at an artificially low price,” the lawsuit says. It also claims that Tesla’s drop has hampered Musk’s ability to consummate the transaction. The lawsuit alleges that Musk’s Tweets about Twitter – namely allegations that the company had too many spam bots and the resultant decision to put the buyout “temporarily on hold” – also were an attempt to drive the share price lower.

Musk’s motive may have been to stave off a margin call, the report notes: According to the proposed class action, Musk’s moves were aimed at staving off the risk of a margin call stemming from the fluctuating value of shares in Tesla, the electric vehicle maker he leads, which is “worth much less now than when Musk agreed to buy Twitter” after a 37% drop over the past month. The suit came the same day Musk disclosed that he was partly restructuring the transaction to offset that risk by providing more than $6 billion in additional equity financing.

Imran Khan

We have entered Punjab and will InshAllah be heading towards Islamabad.

No amount of state oppression and fascism by this imported govt can stop or deter our march.#حقیقی_آزادی_مارچ pic.twitter.com/NMRNRU2F3G— Imran Khan (@ImranKhanPTI) May 25, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.