Alfred Palmer White Motor Company, Cleveland 1941

“Agressive borrowing”. That does not sound good.

• Corporate America’s Epic Debt Binge Leaves $119 Billion Hangover (Bloomberg)

The Federal Reserve’s historically low borrowing rate isn’t benefiting corporate America like it used to. It’s more expensive for even the most creditworthy companies to borrow or refinance even as the Fed has kept its benchmark at near-zero the last seven years. Companies have loaded up on debt. They owe more in interest than they ever have, while their ability to service what they owe, a metric called interest coverage, is at its lowest since 2009. The deterioration of balance-sheet health is “increasingly alarming” and will only worsen if earnings growth continues to stall amid a global economic slowdown, according to Goldman Sachs credit strategists. Since corporate credit contraction can lead to recession, high debt loads will be a drag on the economy if investors rein in lending, said Deutsche Bank AG analysts.

“The benefit of lower yields for corporate issuers is fading,” said Eric Beinstein at JPMorgan. As of the second quarter, high-grade companies tracked by JPMorgan incurred $119 billion in interest expenses over the last year, the most for data going back to 2000, according to the bank’s analysts. The amount the companies owed rose 4% in the second quarter, the analysts said. The risk of default is negligible for companies with good credit. Even so, their health isn’t likely to improve when the Fed finally raises the lending rate, and it could worsen even without a hike, said Ashish Shah at AllianceBernstein. A souring economy or a shocking event such as a prominent terrorist attack could also cause borrowing costs to spike, he said.

The fallout of more borrowing coupled with lower earnings has raised concern among the analysts who track the debt and the money managers who buy it. Yet it seems the companies themselves are acting as if it’s not happening. They’re still paying out record amounts in buybacks and dividends. In the second quarter, the most creditworthy companies posted declining earnings before interest, taxes, depreciation and amortization. Yet they returned 35% of those earnings to shareholders, according to JPMorgan. That’s kept their cash-payout ratio – how much money they give to shareholders relative to Ebitda – steady at a 15-year high. The borrowing has gotten so aggressive that for the first time in about five years, equity fund managers who said they’d prefer companies use cash flow to improve their balance sheets outnumbered those who said they’d rather have it returned to shareholders..

“..global central banks have set up the greatest volatility trade in history.”

• The Economic Doomsday Clock Is Ticking Closer To Midnight (Artemis)

Prisoner’s Dilemma describes when two purely rational entities may not cooperate even if it is in their best interests to do so, thereby replacing known risks for unknown risks. In an arms race when two superpowers possess the ability to destroy each other, the optimal solution is disarmament and peace. If the superpowers do not trust one another completely, the natural course of action is proliferation of conflict through nuclear armament despite great peril to all. This non-cooperation, selfishness, and conflict, ironically results in an equilibrium of peace, but with massive risk. Global central banks are engaged in an arms race of devaluation resulting in suboptimal outcomes for all parties and greater systemic risk.

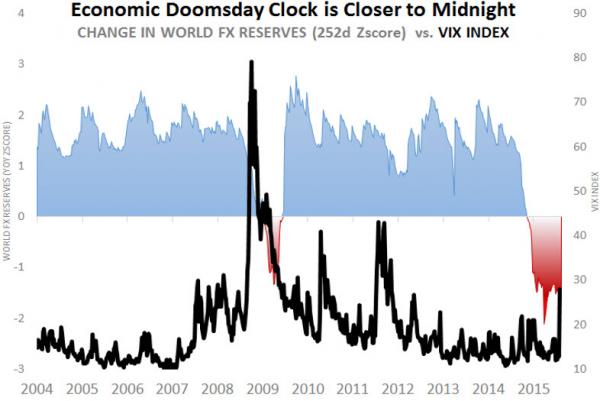

In this year alone 49 central banks have cut rates or devalued their currencies to gain a competitive edge and since 2008 there have been over 600 rate cuts worldwide. Globally we have printed over 14 trillion dollars since the end of the financial crisis. The global economy did not de-leverage from the 2008 crash but instead doubled down as global debt has increased a staggering 40% since 2007. The pace of global growth is slowing with the World Bank lowering GDP projections from 3% to 2.5%, and emerging economies from China to Brazil are struggling. Global currency reserves outside the US have declined over $1 trillion USD from their peak in August 2014 as foreign central banks have sold dollars to offset the ill effects of capital flight and commodity declines.

The last time the world economy experienced declines in reserves of this magnitude was right before the crash of 2008. Cross-asset volatility is rising from the lowest levels in three decades yet markets remain complacent with the expectation that central banks will always support asset prices. Volatility regime change is happening now and is a bad omen for a global recession and bear market. As global central banks compete in an endless cycle of fiat devaluation an economic doomsday clock ticks closer and closer to midnight. The flames of volatility regime change and an emerging markets crisis ignited on the mere expectation of a minor increase in the US federal funds rate that never came to be. The negative global market reaction to this token removal of liquidity was remarkable.

Central banks are fearful and unwilling to normalize but artificially high valuations across asset classes cannot be sustained indefinitely absent fundamental global growth. Central banks are in a prison of their own design and we are trapped with them. The next great crash will occur when we collectively realize that the institutions that we trusted to remove risk are actually the source of it. The truth is that global central banks cannot remove extraordinary monetary accommodation without risking a complete collapse of the system, but the longer they wait the more they risk their own credibility, and the worse that inevitable collapse will be. In the Prisoner’s Dilemma, global central banks have set up the greatest volatility trade in history.

” International banks now have $3.6 trillion of exposure to emerging economies compared $1.2 trillion a decade ago..”

• Rich Nations Lose Emerging-Markets Motor (WSJ)

New weakness emerged in China’s economy, heightening concerns that the woes of developing economies are ricocheting back to advanced ones and hurting the fragile recovery. Beijing on Wednesday reported that consumer prices slowed more than expected in September, reflecting weak domestic demand, a day after it said imports fell by one-fifth that same month. And Singapore, whose export-dependent economy is a bellwether for Asia’s health, said it narrowly avoided a recession, as its central bank on Wednesday took action to spur its economy for the second time this year. For years, emerging markets propped up global growth as their developed counterparts stalled. Now, a deepening slowdown in China and other developing markets is upending that scenario.

Central bankers from the U.S. to Japan now point to the emerging world as a risk rather than a cushion. “It’s clear that the slowdown in emerging markets is having an impact on developed markets,” said Adam Slater, a senior economist at Oxford Economics in London. “Emerging markets have been a very positive force for world growth over most of the last 10 years, and now the big contribution is dropping away.” New evidence is emerging that developing countries are buying fewer capital goods and higher-end products from richer countries. In addition to China’s announcement that its consumer-price index rose just 1.6% in September from the same period a year earlier, Indonesia, Southeast Asia’s largest economy, imported 16% fewer goods for its factories in the year through August.

Such grim data is reflected in the eurozone, which on Wednesday blamed a fall in industrial output in August on large developing economies such as China; in Germany, which this month announced a surprise fall in manufacturing orders in August and the lowest exports in seven years; in Japan, whose factory output was weaker than expected in the same period; and in the U.S., where exports for that month were their smallest since 2011. Global risk has risen over the last decade as developed and emerging markets became increasingly intertwined through trade, finance and investments. International banks now have $3.6 trillion of exposure to emerging economies compared $1.2 trillion a decade ago, according to the Bank for International Settlements.

“The growth differential between EM and DM is still narrowing, not necessarily because DM is doing well but because EM is performing miserably…”

• Be Very Afraid: “The 3 Emerging Markets Debacles” Loom, HSBC Warns (Zero Hedge)

[..] this is a story about the fundamentals and the fundamentals for EM are quite simply a disaster:

• Global growth and trade have entered a new era characterized by structural, endemic sluggishness

• Thanks to loose monetary policy that has kept capital markets wide open to otherwise insolvent producers and thanks also to anemic global demand, commodity prices aren’t likely to rebound anytime soon

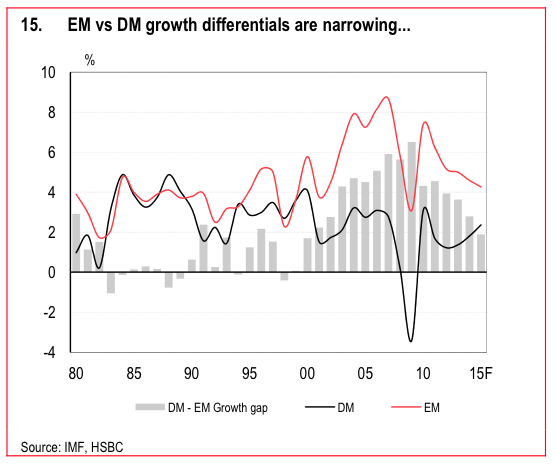

• Because the Fed missed its window to hike, both a hawkish and a dovish Fed are likely precipitate capital outflowsAs it turns out, HSBC went looking for opportunities across EM and came to the same conclusions. First, we have the five reasons for EM malaise: These are, in brief: collapse in global trade cycle, competitiveness problems (rising manufacturing unit labour costs), faltering domestic demand, downside risks posed by China, and the slump in commodity prices. And this is leading directly to a convergence of DM and EM growth, but not because DM is performing well: “The growth differential between EM and DM is still narrowing, not necessarily because DM is doing well but because EM is performing miserably. The leading indicators do not suggest any imminent improvement, either.”

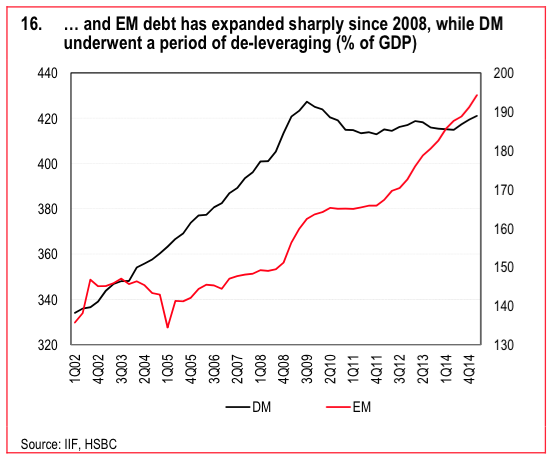

That’s not the only place we’re seeing a “convergence” between EM and DM – they are also starting to look alike in terms of leverage: “The situation becomes even more toxic when the EM leverage cycle is taken into account. Thanks to years of abundant and cheap external liquidity, EM has built up debt very rapidly, while the drivers of economic growth have shifted towards private sector (household and corporate) credit. In many ways, EM is showing similar symptoms to its DM counterparts of weak economic performance and over- reliance on credit. The outcome is what we call the three EM debacles: de-leveraging, depreciation (or devaluation even de-pegging) and downgrades of credit ratings.

“We continue to see strong levels of activity in investment banking and growth in investment management, and looking ahead, are encouraged by the competitive positioning of our global client franchise.”

• Goldman Sachs Blames Global Market Fears For Earnings Fall (Guardian)

Goldman Sachs announced quarterly earnings that fell short of expectations on Thursday, blaming “renewed concerns” about global growth for the shortfall. Revenues fell to $6.86bn from $8.39bn a year ago. The bank had been expected to announce $7.13bn in revenue. Goldman’s third-quarter net income fell to $1.43bn, or $2.90 a share, from $2.24bn, or $4.57 a share, a year earlier. “We experienced lower levels of activity and declining asset prices during the quarter, reflecting renewed concerns about global economic growth,” said Lloyd Blankfein, chairman and CEO. “We continue to see strong levels of activity in investment banking and growth in investment management, and looking ahead, are encouraged by the competitive positioning of our global client franchise.”

The bank set aside $2.35bn for compensation and benefits for the third quarter of 2015, 16% lower than the third quarter of 2014. Fixed income, currencies and commodities trading revenue fell 33% to $1.46bn for the quarter, while equities trading revenue increased 9% to $1.75bn. Goldman is the latest US giant to announce disappointing results in this earnings season. Yesterday Walmart, the world’s largest retailer, also released results that fell short of expectations. It blamed rising wage costs and online competition for the shortfall. Goldman’s results came as Citigroup too released its latest results. The bank also reported a slowdown in trading but profits jumped 50% to $4.29bn compared to the same quarter last year as its legal bills dropped sharply. Legal and associated costs for the quarter were $376m, down from $1.55bn a year ago, when the bank was preparing for an eventual $5.7bn fine for the manipulation of foreign-exchange rates.

“Goldman Sachs on Thursday reported a 34% decrease in fixed-income trading revenue..”

• Debt Slump Leaves Traders Exposed as European Banks Eye Job Cuts (Bloomberg)

For the new leaders of Deutsche Bank and Credit Suisse, a debt-trading slump in the third quarter could provide fresh incentive to shrink their bond businesses as they reshape the firms to boost profitability. “Trading floors are like morgues at present,’’ Bill Blain at Mint Partners said. “For new CEOs looking to cut and kitchen-sink costs, it’s an easy call to reduce headcount.’’ John Cryan, Deutsche Bank’s co-CEO, and Credit Suisse CEO Tidjane Thiam both took over at mid-year with mandates to rebuild investor trust after their firms’ shares trailed investment-banking peers. Both will present plans this month for overhauls to adapt to stricter capital rules and interest rates stuck at record lows. Deutsche Bank and Credit Suisse got more than 20% of their revenue from trading fixed-income products in the first half, a bigger slice than European rivals such as Barclays and UBS.

That reliance leaves them more vulnerable to a market rout that ensnared assets from junk bonds to emerging-market currencies and dented results at U.S. peers. Credit Suisse publishes third-quarter earnings on Oct. 21, and Deutsche Bank the following week. Goldman Sachs on Thursday reported a 34% decrease in fixed-income trading revenue in the quarter, exceeding the 23% slump at JPMorgan and 11% decline at Bank of America, excluding accounting gains. “September was awful,” said Christopher Wheeler, an analyst at Atlantic Equities in London. “It has to have a read-across to Europe.” Banks’ fixed-income units – most of which trade bonds and products tied to interest-rates, currencies and commodities – were rattled in the third quarter by China’s yuan devaluation, a glut in oil and questions over whether the Fed would increase U.S. interest-rates.

Investors dumped assets including high-risk, high-yield U.S. debt linked to energy companies, which tumbled 16%, according to a Bank of America Merrill Lynch index. Currencies across developing markets – including the Turkish lira and the Brazilian real – fell against the dollar. Clients’ uncertainty prompted them to avoid some fixed-income markets, hurting the revenue of banks that take commissions on every trade, said Blain at Mint Partners. That doesn’t bode well for Deutsche Bank, among the world’s biggest traders of bonds along with securities tied to interest-rates, currencies and emerging markets, according to data from Coalition Ltd. Credit Suisse, one of the biggest traders of securitized products, relied on fixed-income trading for about 21% of revenue in the first half.

From negative to more negative. And nobody dares say the emperor is naked? At sub-zero, he’s freezing his balls off.

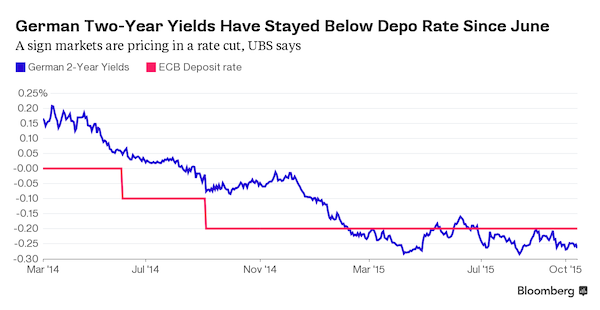

• Markets Expect Eurozone Deposit Rate To Go Deeper Into Negative Territory (BBG)

Debt and money markets are readying for a cut to the ECB’s deposit rate, regardless of what its policy makers say in public. Traders are pricing in a possible reduction to the rate for holding overnight deposits, said UBS and Barclays. ECB officials have declared it’s too early to expand stimulus and President Mario Draghi said more than a year ago that rates have reached their nadir. Economists predict changes to its bond-buying program, or quantitative easing, would come before any adjustment to more conventional monetary tools. With inflation in the euro region once again negative, speculation has swelled that the ECB will tinker with policy, perhaps with the euro in mind. The currency’s recent appreciation has added to downside risks for growth and inflation outlooks, ECB Executive Board member Yves Mersch said.

The central bank won’t hesitate to act if the inflation outlook weakens over the medium term, Mersch said Oct. 13. “The main objective for cutting the deposit rate would be to weaken the euro,” said Nishay Patel, a London-based fixed-income strategist at UBS. “It would not be a substitute for an increase in the QE program, which is able to provide stimulus to the economy.” The deposit rate was set at minus 0.2% in September 2014, after first being cut below zero in June that year. Draghi said at the time rates had reached its “lower bound.” Yields on Germany’s two-year notes were at minus 0.27% on Thursday. The market is pricing in at least a 50% chance of a cut of 10 basis points, or 0.1 percentage point, to the deposit rate, according to UBS strategists.

“New parts necessary to fix some vehicles will probably be ready by next September..”

• VW Forced By Germany To Recall 8.5 Million Diesels in Europe (Bloomberg)

Volkswagen will embark on one of the biggest recalls in European automotive history, affecting 8.5 million diesel vehicles, after German authorities threw out the carmaker’s proposal for voluntary repairs. The Federal Motor Transport Authority, or KBA, demanded a recall of 2.4 million cars in Germany after reviewing proposals Volkswagen filed last week to fix vehicles fitted with software designed to cheat on pollution tests, German Transport Minister Alexander Dobrindt said Thursday in Berlin. The mandatory recall is the basis for callbacks throughout Europe, where diesel accounts for more than half the market. Germany’s rare public snub of its biggest carmaker came after Volkswagen circumvented diesel emissions regulations starting in 2008.

The country’s demands will speed a process that Volkswagen said will last beyond 2016, and give authorities more control. “It’s an unusual measure to be ordering a mandatory recall,” said Arndt Ellinghorst, a London-based analyst with Evercore ISI. “It shows to me that the KBA is losing patience with VW’s slow response on what to do to fix the engines so far. Customers have been left unsettled.” The 8.5 million affected cars represent slightly less than one-third of Volkswagen’s auto deliveries in the region from 2009 through August, based on sales figures the company published for the five divisions involved. The recall is also Germany’s biggest since its current rules took effect in 1997, more than the record 1.9 million cars the entire auto industry brought back in under repair programs last year.

The mandatory recall will be more expensive for Volkswagen because the company will need to work on the cars more quickly, Evercore’s Ellinghorst said. The manufacturer has yet to specify exactly how it will fix the cars, though it has said some will require only a software update while others will need new or rebuilt engine parts. “The KBA’s decision opens up the possibility of a common and coordinated response in all European Union states,” Volkswagen CEO Matthias Mueller wrote Dobrindt on Thursday in a letter obtained by Bloomberg. “Such a unified procedure would be in the European spirit as well as in the interests of customers.” Volkswagen must share technical details of its fix with authorities by mid-November, and the recall will begin in January.

The KBA will test vehicles to ensure the repairs were successful, Dobrindt said. New parts necessary to fix some vehicles will probably be ready by next September, he said. Throughout Europe, Dobrindt has estimated that Volkswagen will probably need to exchange or rebuild parts for about 3.6 million engines. For the sake of customers and the image of the automobile, “we will clear up what happened at Volkswagen,” Enak Ferlemann, state secretary in Germany’s Transport Ministry, said. “Germany will stay the No. 1 auto country.”

Agressive prosecutor?!

• US Pursues Several Paths in Volkswagen Probe (WSJ)

The U.S. attorney’s office in Detroit and the Justice Department’s Fraud Section joined a sweeping federal probe of Volkswagen AG over emissions-test cheating, according to people familiar with the matter, signaling the government’s intent to cast a broad net and explore numerous paths to a possible criminal case. The number of federal offices now involved in the Volkswagen case suggests an investigation could target the German auto maker and its employees for alleged offenses ranging from pollution to misleading government officials to claims made to consumers. The Federal Trade Commission, which investigates fraudulent advertising, confirmed its involvement, suggesting a focus on potentially misleading claims regarding the emissions.

The involvement of the U.S. attorney in Detroit, Barbara McQuade, signals her office may take a significant role in what is expected to be a major case. Ms. McQuade has a reputation as an aggressive prosecutor, having won a corruption case against former Detroit Mayor Kwame Kilpatrick. In sprawling investigations like the Volkswagen probe, the Justice Department has a choice of which prosecutor to assign. David Uhlmann, formerly a top environmental crimes prosecutor who is now a law professor at the University of Michigan, said the number of government offices involved suggested the case would be “of national significance,” with any settlement likely to reach into the billions of dollars.

The federal investigation now includes the Detroit office of the Federal Bureau of Investigation and the Justice Department’s Environment and Natural Resources Division, which investigated BP after the Deepwater Horizon oil spill, people familiar with the probe said. The EPA, which in September disclosed the auto maker’s cheating, could hit Volkswagen with more than $18 billion in fines based on the number of vehicles involved, though it isn’t clear whether the agency will pursue such a large penalty. [..] Europe’s largest auto maker faces not only aggressive investigations by European and U.S. authorities, but also class-action lawsuits from aggrieved customers. Prosecutors in Germany earlier this month raided Volkswagen offices and private homes as part of a criminal inquiry there.

The EPA alleged last month that Volkswagen had violated two parts of the U.S. Clean Air Act. That law exempts auto makers from criminal penalties for illegal pollution, but it does criminalize the conveying of false information to regulators. [..] Federal prosecutors have recently turned to other laws to charge auto makers with crimes. The Justice Department charged GM and Toyota with wire fraud for concealing information on safety defects. In the GM case, prosecutors also used a section of the U.S. code that can hold companies broadly accountable for misleading government officials.

Dare they set a precedent?

• Treasury Considers Plan to Help Puerto Rico (NY Times)

Officials in the Treasury Department are discussing a radical and aggressive response to the fiscal chaos engulfing Puerto Rico that could involve a broad debt exchange assisted by the federal government. The proposal calls for the federal government to help Puerto Rico collect and account for local tax revenues from the island’s businesses and residents, according to people briefed on the matter who spoke on the condition of anonymity because they were not authorized to publicly discuss the proposal. An inability to collect all the taxes owed is widely seen as contributing to Puerto Rico’s debt crisis. The tax proceeds would be placed in a “lockbox” overseen by the Treasury and eventually paid out by the Treasury to the holders of the new bonds that Puerto Rico would issue in the proposed exchange.

Since the Treasury would effectively become the paying agent for the new bonds, they would be more attractive than the bonds that creditors now hold. That would make it easier for Puerto Rico to exchange the new debt with creditors who hold bonds that have been devastated in value since the island warned this summer that it could not pay its debts. The proposal has logistical, political and legal challenges, however, and may never get off the ground. “Right now, Puerto Ricans don’t even like to pay taxes to their own government,” said one person with knowledge of the discussions. If the I.R.S. were to suddenly replace the local tax authorities and try to gather up the money for debt service, “people would say, ‘Go to hell. I’m not paying the U.S. government.’ ”

But the fact that such an unusual idea has been floated between the Treasury and top finance officials from Puerto Rico in recent months suggests a sharp shift in Washington’s approach to the island’s economic crisis. Without addressing the proposal directly, officials from the Treasury said in a statement that it had “no plans to provide a bailout to Puerto Rico.” Until now, the Treasury has provided mostly technical assistance to island officials, while the Republican leaders in Congress have expressed strong reservations about bailing out Puerto Rico. The island’s first choice appears to be a bankruptcy law amendment that would allow the island to send some of its governmental bodies into Chapter 9 municipal bankruptcy court. But bills introduced to that effect have not moved..

“Lenders extended low interest credit to wildcatters desperate for cash, then—perhaps remembering the 1980s oil bust—wheeled the debt off their books by selling new stocks and bonds to investors, earning sizable fees along the way. ”

• Oil Is Killing the Drillers, and the Banks Want Their Cash Back Now (Bloomberg)

When Whiting Petroleum needed cash earlier this year as oil prices plummeted, JPMorgan Chase, its lead lender, found investors willing to step in. The bank helped Whiting sell $3.1 billion in stocks and bonds in March. Whiting used almost all the money to repay the $2.9 billion it owed JPMorgan and its 25 other lenders. The proceeds also covered the $45 million in fees Whiting paid to get the deal done, regulatory filings show. Analysts expect Whiting, one of the largest producers in North Dakota’s Bakken shale basin, to spend almost $1 billion more than it earns from oil and gas this year. The company has sold $300 million in assets, reduced the number of rigs drilling for oil to eight from a high of 24, and announced plans to cut spending by $1 billion next year.

Eric Hagen, a Whiting spokesman, says the company has “demonstrated that it is taking appropriate steps to manage within the current oil price environment.” Whiting has said it will be in a position next year to have its capital spending of $1 billion equal its cash flows with an oil price of $50 a barrel. As for Whiting’s investors, the stock is down 36%, as of Oct. 14, since the March issue, and the new bonds are trading at 94¢ on the dollar. More than 73% of the stocks and bonds issued this year by oil and gas producers are worth less today than when they were sold. Banks’ sell-the-risk strategy underpins the shale oil boom. Lenders extended low interest credit to wildcatters desperate for cash, then—perhaps remembering the 1980s oil bust—wheeled the debt off their books by selling new stocks and bonds to investors, earning sizable fees along the way.

“Everyone in the chain was making money in the short term,” says Louis Meyer at Oscar Gruss. “And no one was thinking long term about what they’re going to do if prices fall.” North American oil and gas producers have sold $61.5 billion in equity and debt since January, paying more than $700 million in fees. Half the money was raised to repay loans or restructure debt, the data show. “Being there for our clients in all market environments, particularly the tough ones, is something we feel very strongly about,” says Brian Marchiony, a JPMorgan spokesman. “During challenging periods, companies typically look to strengthen their balance sheets and increase liquidity, and we have helped many do just that.”

My, are we surprised.

• Billions Are Laundered Through British Banks, Treasury Admits (Times)

Investigations into corrupt cash flowing through Britain barely scratch the surface of the problem, the first official report on the scale of money laundering revealed yesterday. The national risk assessment, published by the Treasury, said “hundreds of billions of pounds of international criminal money” is laundered through British banks every year. Investigations into international corruption by the National Crime Agency covered cases limited to “millions of pounds of assets in the UK . . . and financial flows that span the globe”, it added. The publication of the risk assessment forms part of the government’s anti-corruption agenda, which saw the prime minister warn this summer of the threat to the British economy and the City of London posed by “dirty money”.

Much more work was required, the report’s authors admitted, if Britain was to create a “hostile environment for illicit finance”. They wrote: “The assessment shows that the collective knowledge of UK law enforcement agencies, supervisors and the private sector of money laundering and terrorist financing risks is not yet sufficiently advanced.” The campaign group Transparency International said the report was “a clear and unambiguous recognition of the risks posed by money laundering in the UK and the weaknesses in the UK’s system for detecting illicit and corrupt money flowing into a wide range of sectors”.

“..under Bank of England rules on the separation of retail operations from riskier investment banking.”

• UK Banks May Need $5.1 Billion of Capital for Ring-Fencing (Bloomberg)

The U.K.’s largest banks may face higher capital requirements under Bank of England rules on the separation of retail operations from riskier investment banking. The BOE’s Prudential Regulation Authority estimates that so-called ring-fencing could mean an additional capital requirement of £2.2 billion pounds ($3.4 billion) to £3.3 billion pounds by 2019, when the rules kick in. The move is aimed at ensuring that financial services crucial to the U.K. economy, such as deposit-taking, payments and overdrafts, will be protected if riskier units incur losses and have to be shut down.

The additional burden is due to the protected unit being measured on a standalone basis for its capital needs. In addition, any transactions between the ring-fenced unit and other parts of the institution will be classed as third-party deals, meaning capital will have to be held against them. “The PRA recognizes that applying this approach may result in increased capital requirements for some firms,” it said in a consultation paper published in London on Thursday. The rules will probably apply to HSBC RBS, Lloyds, Barclays, Santander and Co-operative Bank.

A second Snowden.

• The Drone Papers: The Assassination Complex (Intercept)

Drones are a tool, not a policy. The policy is assassination. While every president since Gerald Ford has upheld an executive order banning assassinations by U.S. personnel, Congress has avoided legislating the issue or even defining the word “assassination.” This has allowed proponents of the drone wars to rebrand assassinations with more palatable characterizations, such as the term du jour, “targeted killings.” When the Obama administration has discussed drone strikes publicly, it has offered assurances that such operations are a more precise alternative to boots on the ground and are authorized only when an “imminent” threat is present and there is “near certainty” that the intended target will be eliminated.

Those terms, however, appear to have been bluntly redefined to bear almost no resemblance to their commonly understood meanings. The first drone strike outside of a declared war zone was conducted more than 12 years ago, yet it was not until May 2013 that the White House released a set of standards and procedures for conducting such strikes. Those guidelines offered little specificity, asserting that the U.S. would only conduct a lethal strike outside of an “area of active hostilities” if a target represents a “continuing, imminent threat to U.S. persons,” without providing any sense of the internal process used to determine whether a suspect should be killed without being indicted or tried. The implicit message on drone strikes from the Obama administration has been one of trust, but don’t verify.

The Intercept has obtained a cache of secret slides that provides a window into the inner workings of the U.S. military’s kill/capture operations at a key time in the evolution of the drone wars — between 2011 and 2013. The documents, which also outline the internal views of special operations forces on the shortcomings and flaws of the drone program, were provided by a source within the intelligence community who worked on the types of operations and programs described in the slides. The Intercept granted the source’s request for anonymity because the materials are classified and because the U.S. government has engaged in aggressive prosecution of whistleblowers. The stories in this series will refer to the source as “the source.”

The source said he decided to provide these documents to The Intercept because he believes the public has a right to understand the process by which people are placed on kill lists and ultimately assassinated on orders from the highest echelons of the U.S. government. “This outrageous explosion of watchlisting — of monitoring people and racking and stacking them on lists, assigning them numbers, assigning them ‘baseball cards,’ assigning them death sentences without notice, on a worldwide battlefield — it was, from the very first instance, wrong,” the source said.

What goood would that do?

• ‘Drone Papers’ Revelations Mandate a Congressional Investigation (FP)

This morning, the reporting team at the Intercept published an impressive eight-part series on the policies and processes of U.S. drone strikes, called “The Drone Papers.” Some of the newly reported information is purportedly based upon “a cache of secret slides that provides a window into the inner workings of the U.S. military’s kill/capture operations … between 2011 and 2013.” Intercept journalist Jeremy Scahill writes that the slides “were provided by a source within the intelligence community.” [..] this reporting could awaken or reintroduce interested readers to how the U.S. national security apparatus has thought about and conducted counterterrorism operations since 9/11. The reporting is less one big “bombshell” and more of a synthesis of over a decade’s worth of reporting and analysis, bolstered by troubling new revelations about what has become routine. [..]

The Intercept series, at a minimum, reconfirms and illuminates much of what we knew, thought we knew, or suspected about drone strikes. For example, there is “not a bunch of folks in a room somewhere just making decisions,” as President Barack Obama put it in 2012, but indeed a clear chain of command that is displayed in a slide with the heading: “Step 1 — ‘Developing a target’ to ‘Authorization of a target.’” Also, it is clear that the Obama administration strongly prefers killing suspected terrorists rather than capturing them, despite claiming the opposite. Additionally, it is evident that the military and intelligence communities do not have the intelligence, surveillance, and reconnaissance platforms that they claim they need.

Finally, the documents support that military commanders have a strong bias against seemingly endless and pointless drone strikes, strongly preferring a “find, fix, finish, exploit, analyze, and disseminate” (F3EAD) approach, which allows a command staff to continuously improve its situational awareness of an environment through capturing and interrogating suspected militants and terrorists. As one secret study declares: “Kill operations significantly reduce the intelligence available from detainees and captured materials.” One military official described to me the normalcy of killing with drones in 2012, saying, “It really is like swatting flies. We can do it forever easily and you feel nothing. But how often do you really think about killing a fly?”

Chafee: “That’s what the federal courts have said; what Snowden did showed that the American government was acting illegally for the Fourth Amendment. So I would bring him home.”

• The Multitude Of False Statements In Hillary’s Snowden Answer (New Yorker)

I’ve already given my instant verdict on Tuesday night’s Democratic debate: in terms of the horse race, Hillary Clinton was the clear winner, although Bernie Sanders also did pretty well. But it was a long discussion about serious issues, and some of the exchanges bear closer inspection—including the one about Edward Snowden, the former National Security Agency contractor who is currently languishing in Russia. The exchange began with host Anderson Cooper asking Lincoln Chafee, a former governor of Rhode Island, “Governor Chafee: Edward Snowden, is he a traitor or a hero?” Chafee replied that he would bring Snowden home without forcing him to serve any jail time. “The American government was acting illegally,” he continued. “That’s what the federal courts have said; what Snowden did showed that the American government was acting illegally for the Fourth Amendment. So I would bring him home.”

Chafee was stating a truth. In May of this year, a three-judge panel at the U.S. Court of Appeals for the Second Circuit, in Manhattan, ruled that the N.S.A., in routinely collecting the phone records of millions of Americans—an intelligence program that Snowden exposed in 2013—broke the law of the land. The Patriot Act did not authorize the government to gather calling records in bulk, the judges said. “Such expansive development of government repositories of formerly private records would be an unprecedented contraction of the privacy expectations of all Americans,” the decision read. The ruling overturned one that had been handed down in December, 2013, in which a federal judge, William Pauley, said that the N.S.A.’s collection of metadata was legal. After Chafee spoke, Cooper turned to Hillary Clinton and asked, “Secretary Clinton, hero or traitor?”

Clinton, who earlier in the debate had described herself as “a progressive who likes to get things done,” replied, “He broke the laws of the United States. He could have been a whistle-blower. He could have gotten all of the protections of being a whistle-blower. He could have raised all the issues that he has raised. And I think there would have been a positive response to that.” “Should he do jail time?” Cooper asked, to which Clinton replied, “In addition—in addition, he stole very important information that has unfortunately fallen into a lot of the wrong hands. So I don’t think he should be brought home without facing the music.” From a civil-liberties perspective—and a factual perspective—Clinton’s answers were disturbing enough that they warrant parsing.

This should have been done at least a year ago.

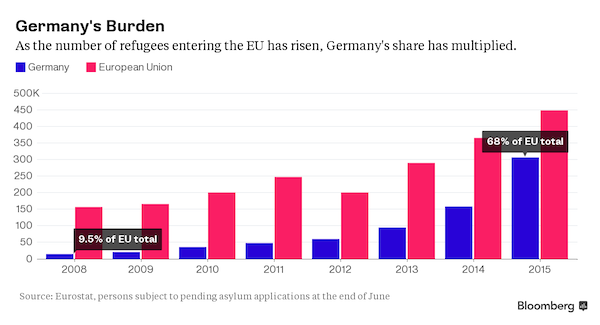

• Merkel Prepares Germans for Historic Challenge of Refugee Crisis (Bloomberg)

German Chancellor Angela Merkel, facing growing criticism from within her own party for her handling of the refugee crisis, urged lawmakers to prepare for the long haul as asylum seekers continue to surge into Europe. “It’s not an exaggeration to describe this task as a historic test for Europe,” Merkel said in a speech to parliament in Berlin Thursday ahead of a European Union summit. “I expect from this council that everyone does his part.” The chancellor, who was lambasted at a town-hall event Wednesday by members of her party accusing her of encouraging migration and failing to control the nation’s borders, also called on fellow legislators to back proposals to provide additional funding for refugees and tighten the country’s asylum rules. “I’ve said that we need to give every person a friendly welcome. And I’m not changing my mind on that.”

With Germany expecting at least 800,000 refugees and migrants this year, including many from Syria, Merkel is bucking pressure from political allies and the public to shift her principled stance and limit the influx. After a decade in power, Europe’s biggest refugee crisis since World War II has the chancellor on the defensive as she urges other EU countries to do more to share the burden. The outbursts at a meeting of her Christian Democratic Union on Wednesday offer a snapshot of public resistance to Merkel’s open-door policy that’s eroding her poll ratings and voter support for her party. Audience members at the two-hour event in eastern Germany accused the chancellor of failing to do her job, portrayed refugees as ingrates and blamed the crush of arrivals for a housing shortage in the nearby city of Leipzig.

“This is the biggest task I’ve faced in my life as chancellor,” responded Merkel, who earlier told the audience that human dignity is universal and sought to put the refugee crisis in an international context. “I know that it’s a difficult situation. But I wouldn’t give up. Let us be confident and optimistic.” Several lawmakers in Merkel’s 311-member parliamentary group in Berlin criticized her at a closed meeting on Tuesday for failing to stem the influx, prompting her to respond that a refugee quota is impossible to set, according to two party officials who attended. Merkel said Thursday that confronting the migrant crisis will require a global approach that includes working to solve the conflict in Syria and aiding Turkey, where she will travel over the weekend, to stem the flow of refugees.

Tusk puts things on their head: “If we are not able to find humanitarian and efficient solutions then others will find solutions which are inhuman, nationalistic and, for sure, not European..” Reality is, the EU has already created an inhuman situation simply by doing nothing.

• EU Bid to Stem Refugee Influx Stalls on How Much to Give Turkey (Bloomberg)

European leaders failed to reach a final agreement on recruiting Turkey to help stem the flow of refugees from the Middle East, with some eastern member states dragging their heels over how much aid to grant their neighbor. Angela Merkel told a news conference that the European Union had a draft accord with Turkey on curtailing the flow of migrants and refugees. She said the figure of €3 billion in EU aid to Turkey was discussed at a summit in Brussels, but that the issue had yet to win full support from the 28-nation bloc. With more than a million migrants set to reach the EU in 2015 and Russian bombing raids on Syria threatening even greater flows for next year, some member states are recoiling at the sacrifices they’ll have to force on their voters.

The summit underscored the challenge facing the EU with the leaders attempting to woo Turkey, already harboring more than 2 million refugees itself, after cold-shouldering the country’s requests to join the bloc for the past decade. “If we are not able to find humanitarian and efficient solutions then others will find solutions which are inhuman, nationalistic and, for sure, not European,” EU President Donald Tusk said at a news conference after the meeting. The day that ended with a stalemate over money had begun with Merkel calling on her EU partners to pay their share of the costs of helping refugees. Afterward the chancellor described the progress made in cautious terms, saying that “outlines of cooperation” with Turkey were becoming “quite visible.”

Turkey has spent more than €7 billion euros on refugees in the last three or four years, Merkel noted, so the EU helping out was “burden-sharing.” She said there was “a general sense” among leaders that it was right “to shelter refugees closer to their home rather than financing them here in our own countries.” While the member states agreed to send hundreds more border guards to help Frontex and other joint agencies patrolling the bloc’s borders, leaders made little progress on how to redesign the system of distributing immigrants, forming an EU border guard corps or on how to ensure arrivals are properly processed. “These are all divisive issues and the goal today was to have the first serious exchange,” Tusk said.

Mass tort.

• US Lawsuits Build Against Monsanto Over Alleged Roundup Cancer Link (Reuters)

Personal injury law firms around the United States are lining up plaintiffs for what they say could be “mass tort” actions against agrichemical giant Monsanto that claim the company’s Roundup herbicide has caused cancer in farm workers and others exposed to the chemical. The latest lawsuit was filed Wednesday in Delaware Superior Court by three law firms representing three plaintiffs. The lawsuit is similar to others filed last month in New York and California accusing Monsanto of long knowing that the main ingredient in Roundup, glyphosate, was hazardous to human health. Monsanto “led a prolonged campaign of misinformation to convince government agencies, farmers and the general population that Roundup was safe,” the lawsuit states.

The litigation follows the World Health Organization’s declaration in March that there was sufficient evidence to classify glyphosate as “probably carcinogenic to humans.” “We can prove that Monsanto knew about the dangers of glyphosate,” said Michael McDivitt, whose Colorado-based law firm is putting together cases for 50 individuals. “There are a lot of studies showing glyphosate causes these cancers.” The firm held town hall gatherings in August in Kansas, Missouri, Iowa and Nebraska seeking clients. Monsanto said the WHO classification is wrong and that glyphosate is among the safest pesticides on the planet. “Glyphosate is not a carcinogen,” company spokeswoman Charla Lord said.

“The most extensive worldwide human health databases ever compiled on an agricultural product contradict the claims in the suits.” Roundup is used by farmers, homeowners and others around the globe and brought Monsanto $4.8 billion in revenue in its fiscal 2015. But questions about Roundup’s safety have dogged the company for years. Attorneys who have filed or are eying litigation cited strong evidence that links glyphosate to non-Hodgkin lymphoma (NHL). They said claims will likely be pursued collaboratively as mass tort actions. To find plaintiffs, the Baltimore firm of Saiontz & Kirk advertises a “free Roundup lawsuit evaluation” on its website. The Washington, D.C. firm Schmidt & Clark is doing the same, as are other firms in Texas, Colorado and California.