Rembrandt van Rijn Man in Oriental Costume (The Noble Slav) 1632

27 million dead Russians. Russia liberated Auschwitz. Not welcome. The Germans built it, the Poles manned it. They are welcome.

Tenpenny

“We’ve got 3-5 years to see the full manifestation of Spike Protein Disease…and autoimmune diseases…and the next 10 years will be unbelievable with what we’ll see…when the antibodies continue to destroy every organ system in the body…” -Dr. Tenpenny pic.twitter.com/3f3V2D7uFA

— Liz Churchill (@liz_churchill8) January 27, 2023

Dowd

https://twitter.com/i/status/1619088768769884160

Bannon

Steve Bannon on the war escalation: "This is a total scam. This is all driven by the defense industry and as a veteran, this is disgusting and revolting."

Watch the conversation on War Room with #SteveBannon: https://t.co/ExmeMRbePv pic.twitter.com/NKnJP1UZz8

— Real America's Voice (RAV) (@RealAmVoice) January 26, 2023

RFKjr

Robert F. Kennedy Jr.: This Is What Anthony Fauci Did To Us & Our Children

Source: https://t.co/VKCohJt2yn pic.twitter.com/4qRqAeYUns— Wittgenstein (@backtolife_2023) January 27, 2023

Nuland Rand Paul

Here's the exchange with Victoria Nuland and Rand Paul where she explains the US position on prosecuting Russian officials. She cites Rwanda, Bosnia, and Kosovo as precedents. Seems very tactful to tell Putin he'll be getting the Milosevic treatment unless he obliterates Ukraine pic.twitter.com/BbqSfSQi5W

— Michael Tracey (@mtracey) January 27, 2023

“But in April, Ukraine’s Western allies [..] refused to support the neutrality agreement and persuaded Ukraine to abandon its negotiations with Russia.”

• US Can Turn Back Doomsday Clock (CN)

The Bulletin of the Atomic Scientists has just issued its 2023 Doomsday Clock statement, calling this “a time of unprecedented danger.” It has advanced the hands of the clock to 90 seconds to midnight, meaning that the world is closer to global catastrophe than ever before, mainly because the conflict in Ukraine has gravely increased the risk of nuclear war. This scientific assessment should wake up the world’s leaders to the urgent necessity of bringing the parties involved in the Ukraine war to the peace table. So far, the debate about peace talks to resolve the conflict has revolved mostly around what Ukraine and Russia should be prepared to bring to the table in order to end the war and restore peace.

However, given that this war is not just between Russia and Ukraine but is part of a “New Cold War” between Russia and the United States, it is not just Russia and Ukraine that must consider what they can bring to the table to end it. The United States must also consider what steps it can take to resolve its underlying conflict with Russia that led to this war in the first place. The geopolitical crisis that set the stage for the war in Ukraine began with NATO’s broken promises not to expand into Eastern Europe, and was exacerbated by its declaration in 2008 that Ukraine would eventually join this primarily anti-Russian military alliance. Then, in 2014, a U.S.-backed coup against Ukraine’s elected government caused the disintegration of Ukraine. Only 51 percent of Ukrainians surveyed told a Gallup poll that they recognized the legitimacy of the post-coup government, and large majorities in Crimea and in Donetsk and Luhansk provinces voted to secede from Ukraine.

Crimea rejoined Russia, and the new Ukrainian government launched a civil war against the self-declared “People’s Republics” of Donetsk and Luhansk. The civil war killed an estimated 14,000 people, but the Minsk II accord in 2015 established a ceasefire and a buffer zone along the line of control, with 1,300 international OSCE ceasefire monitors and staff. The ceasefire line largely held for seven years, and casualties declined substantially from year to year. But the Ukrainian government never resolved the underlying political crisis by granting Donetsk and Luhansk the autonomous status it promised them in the Minsk II agreement.

[..] In March 2022, the month after the Russian invasion, ceasefire negotiations were held in Turkey. Russia and Ukraine drew up a 15-point “neutrality agreement,” which President Volodymyr Zelenskyy publicly presented and explained to his people in a national TV broadcast on March 27th. Russia agreed to withdraw from the territories it had occupied since the invasion in February in exchange for a Ukrainian commitment not to join NATO or host foreign military bases. That framework also included proposals for resolving the future of Crimea and Donbas. But in April, Ukraine’s Western allies — the United States and United Kingdom in particular — refused to support the neutrality agreement and persuaded Ukraine to abandon its negotiations with Russia.

Scott Ritter

Scott Ritter issues a dire warning: “We are on the cusp of thermonuclear war. Our only chance for global survival is for NATO to go gracefully. If they don’t, it’s been a pleasure knowing you, 2023 will be the last year that we’re alive on this planet.” #RageAgainstWar pic.twitter.com/jdLFFkRS7x

— The People’s Party (@PeoplesParty_US) January 27, 2023

“Almost without firing a shot a Russia-Iran alliance could smash NATO to bits and bring down assorted EU governments..”

• Doomsday Clock: 90 Seconds To Midnight (Escobar)

No one ever accused German Foreign Minister Annalena Baerbock of being brighter than a light bulb. She finally gave the game away, at the Council of Europe in Strasbourg: “The crucial part is that we do it together and that we do not do the blame game in Europe because we are fighting a war against Russia.” So Baerbock agrees with Lavrov. Just don’t ask her what Doomsday Clock means. Or what happened after Operation Barbarossa failed. The EU-NATO combo takes matters to a whole new level. The EU essentially has been reduced to the status of P.R. arm of NATO. It’s all spelled out in their January 10 joint declaration. The NATO-EU joint mission consists in using all economic, political and military means to make sure the “jungle” always behaves according to the “rules-based international order” and accepts to be plundered ad infinitum by the “blooming garden”.

Looking at The Big Picture, absolutely nothing changed in the US military/intel apparatus since 9/11: it’s a bipartisan thing, and it means Full Spectrum Dominance of both the US and NATO. No dissent whatsoever is allowed. And no thinking outside the box. Plan A is subdivided into two sections. 1. Military intervention in a hollowed-out proxy state shell (see Afghanistan and Ukraine). 2. Inevitable, humiliating military defeat (see Afghanistan and soon Ukraine). Variations include building a wasteland and calling it “peace” (Libya) and extended proxy war leading to future humiliating expulsion (Syria). There’s no Plan B. Or is there? 90 seconds to midnight?

Obsessed by Mackinder, the Empire fought for control of the Eurasian landmass in World War I and World War II because that represented control of the world. Later, Zbigniew “Grand Chessboard” Brzezinski had warned: “Potentially the most dangerous scenario would be a grand coalition between Russia, China and Iran.” Jump cut to the Raging Twenties when the US forced the end of Russian natural gas exports to Germany (and the EU) via Nord Stream 1 and 2. Once again, Mackinderian opposition to a grand alliance on the Eurasian landmass consisting of Germany, Russia and China. The Straussian neo-con and neoliberal-con psychos in charge of US foreign policy could even absorb a strategic alliance between Russia and China – as painful as it may be. But never Russia, China and Germany.

With the collapse of the JCPOA, Iran is now being re-targeted with maximum hostility. Yet were Tehran to play hardball, the US Navy or military could never keep the Strait of Hormuz open – by the admission of the US Joint Chiefs of Staff. Oil price in this case would rise to possibly thousands of dollars a barrel according to Goldman Sachs oil derivative experts – and that would crash the entire world economy. This is arguably the foremost NATO Achilles Heel. Almost without firing a shot a Russia-Iran alliance could smash NATO to bits and bring down assorted EU governments as socio-economic chaos runs rampant across the collective West.

“The issue of when wars in general and world wars in particular begin and end is not as clear cut as many believe..”

• World War III: Has It Begun? (Jim Rickards)

That’s a serious question and deserves serious consideration by investors. A wave of analysts and commentators have warned that the war in Ukraine could spin out of control and escalate into World War III. One variation on that theme is that the war could escalate into a nuclear war with tactical nuclear weapons deployed. Most point a finger at Russia as the party that will launch a nuclear strike out of desperation at a failing campaign in Ukraine. Actually, the opposite is true. The Russian campaign is not failing (it has been on hold for several months awaiting the right conditions to launch a winter offensive). You just don’t hear about it in the mainstream media, which is essentially a propaganda outlet for Ukraine. And the party most likely to use nuclear weapons first is the U.S. in order to save face and destabilize Russia once Ukraine is on the brink of collapse.

Many people have a hard time believing that. They’ve been told that Putin is the devil incarnate and would probably like to destroy the world. We like to think that in modern times we’re sophisticated and above falling prey to propaganda. Unfortunately, it isn’t true. The fact is the U.S. did wage the only nuclear war in history from Aug. 6–9, 1945 and had a successful outcome. I’m not getting into the morality of it here, one way or the other. I’m just being objective. Either way, another nuclear war could not be contained and it would be tantamount to World War III. It amounts to the same thing. But my point is different. It’s not that we may be headed to World War III; it’s that we’re already there. The issue of when wars in general and world wars in particular begin and end is not as clear cut as many believe. There are many examples.

“In 2019, the think tank provided a blueprint for “overextending and unbalancing” Russia..”

• Pentagon Think Tank Warns Against ‘Long War’ In Ukraine (RT)

While both Moscow and Kiev think they will benefit from continued fighting, such a turn of events does not serve Washington’s best interests, the Pentagon’s think tank RAND Corporation argues in a new report published on Friday. Authored by Samuel Charap and Miranda Priebe, “Avoiding a Long War” accepts the prevailing premises about the conflict, but notes that US interests “often align with but are not synonymous with Ukrainian interests.” According to the authors, the conflict has already inflicted significant economic, military and reputational damage on Russia, so its “further incremental weakening is arguably no longer as significant a benefit for US interests.” The price to the West has not been insignificant either, from the disruption to energy, food and fertilizer markets to the cost of “keeping the Ukrainian state economically solvent,” which will only “multiply over time.”

NATO’s military aid to Ukraine “could also become unsustainable after a certain period,” while Russia may “reverse Ukrainian battlefield gains,” they said. The conflict is “absorbing senior policymakers’ time and US military resources,” distracting Washington from other global priorities, such as China, while pushing Moscow closer to Beijing. In short, the consequences of a long war – ranging from persistent elevated escalation risks to economic damage – far outweigh the possible benefits. The study describes President Vladimir Zelensky’s vision of victory, in which Ukraine would recover all the territories it lays claim to and force Russia to submit to war crimes trials and reparations, as “optimistic” and “improbable.” Moscow, “perceives this war to be near existential” and has signaled “a high level of resolve,” the authors caution, raising the probability it might use nuclear weapons if it feels threatened.

Prospects for some kind of negotiated peace are “poor in the near term,” the report acknowledges, as Kiev believes Western support will continue indefinitely, while Moscow has been given no reason to believe the sanctions will ever be lifted. The US could “condition future military aid on a Ukrainian commitment to negotiations,” while giving Kiev security commitments, but “not as binding as US mutual defense treaties” or NATO membership, the report suggested. Washington should also give Moscow assurances regarding Ukraine’s neutrality and set “conditions for sanctions relief.” Founded in 1948 by the US military-industrial complex, RAND has provided the Pentagon with policy advice for decades. In 2019, the think tank provided a blueprint for “overextending and unbalancing” Russia that included economic sanctions, sending weapons to Ukraine, promoting uprisings in Central Asia and even deploying more nuclear weapons to Europe. By contrast, the advice on how to avoid escalation with Moscow while arming Kiev, from July last year, seems to have had little to no effect.

More on that RAND report.

• Ukraine – RAND Study Sees Risks In Prolonged War (MoA)

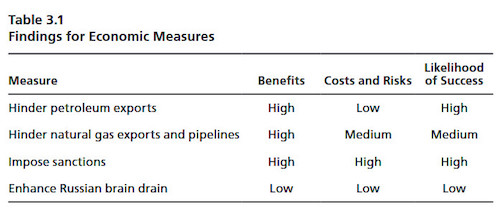

RAND Corp is a government and industry financed large research institute. Founded shortly after the end of the second world war it mostly works for the Pentagon by developing policies and strategies. In April 2019 RAND published a report about Extending Russia The report summary explained its purpose: “As the 2018 National Defense Strategy recognized, the United States is currently locked in a great-power competition with Russia. This report seeks to define areas where the United States can compete to its own advantage. Drawing on quantitative and qualitative data from Western and Russian sources, this report examines Russia’s economic, political, and military vulnerabilities and anxieties. It then analyzes potential policy options to exploit them — ideologically, economically, geopolitically, and militarily (including air and space, maritime, land, and multidomain options).” RAND developed policy options in those four fields. It then evaluated their benefit, cost and risks as well as their likelihood of success. Here is their summary table for economic measures:

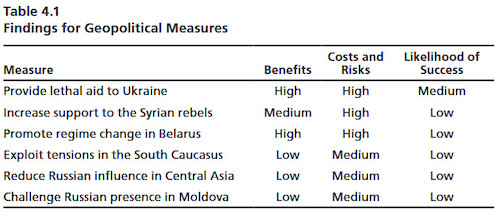

The first three measures were implemented when the war in Ukraine was launched. The geopolitical measures included an option of providing lethal aid to Ukraine. This would create the risk that Russia would respond militarily and eventually take more of Ukraine than the two Donbas republics: Taking more of Ukraine might only increase the burden [for Russia], albeit at the expense of the Ukrainian people. However, such a move might also come at a significant cost to Ukraine and to U.S. prestige and credibility. This could produce disproportionately large Ukrainian casualties, territorial losses, and refugee flows. It might even lead Ukraine into a disadvantageous peace. While they at times underestimate Russia’s capabilities RAND people are not dumb. They knew of the likely outcome of a war. Other geopolitical measure RAND evaluated included more support for ‘Syrian rebels’, regime change per color revolution in Belarus, to exploit tensions in the southern Caucasus and to reduce Russian influence in Central Asia. RAND’s summary for geopolitical measures:

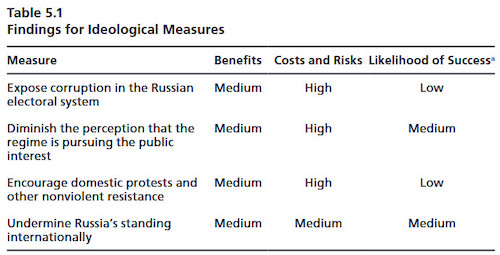

The Trump and Biden administrations both implemented the measures that seemed to have high benefits as well as high risks. The use of ideological measures against Russia was seen as having rather low benefits.

There follow more options, mostly in military categories, that the RAND report developed and evaluated. They emphasize industry pork. The Trump administration took some of the measures RAND provided but seemed not too enthusiastic about them. Its regime change attempt in Belarus failed. The Biden administration changed tact. He endorsed Sviatlana Tsikhanouskaya, the color revolution candidate that had failed the elections in Belarus. Biden also allowed for the delivery of more offensive weapons to Ukraine. The regime in Kiev was encouraged to retake the rebellions Donbas republics. The green light for that was given in early 2022 even as the White House knew that Russia would respond militarily. The consequences for Ukraine that RAND had predicted in 2019 ensued.

“The Ukraine misadventure will disappear from America’s collective consciousness in a New York minute and a Fourth Turning jamboree of serious domestic political disorder will commence in short order..”

We are losing this unnecessary proxy war about as steadily as possible, and actually making Russia look good in the process. Russia could have ended the war in five minutes by turning Kiev into an ashtray, but it spent the first eight months of the operation trying to avoid busting up Ukraine’s infrastructure, so as not to turn it into a failed state (that would present new and worse problems). Mr. Putin made many overtures to negotiate an end to the conflict, all rejected by Ukraine, the US, and its NATO “partners.” So, now Russia is grinding on-the-ground to reduce Ukraine’s ability to continue making war by systematically killing the troops Ukraine foolishly throws into the battle line, and destroying Ukraine’s heavy weapons. Ukraine is about out of its own soldiers and weapons.

Russia is maneuvering to roll over what’s left there and put an end to these pointless and needless hostilities. Contrary to US propaganda, Russia has no ambition to conquer NATO territory. Rather its aim is to restore order to a corner of the world that has been its legitimate sphere of influence for centuries — and more than once been used as a doormat for European armies to invade Russia. Apparently, we can’t allow Russia to clean up this mess we made — or we pretend that we can’t, even though it’s happening anyway, whether we like it or not. So now, the US promises to send thirty-one M1 Abrams tanks to Ukraine. A bold move, you think? Not exactly. By the time these tanks get anywhere in the vicinity of Ukraine, this war is likely to be over.

Never mind the difficult business of training the few remaining eligible Ukrainian men between sixteen and sixty how to operate the tanks, and training maintenance crews, and delivering inventories of spare parts — you see where this is going — not to mention the certainty that the Russians will simply blow them up as fast as they appear on the premises. Anyway, a measly thirty-one tanks that can barely be operated is meaningless compared to hundreds of T-72s backed by newer T-14 tanks the Russians can muster from just over their border with Ukraine. The tank proffer is, sad to say (for the dignity of our country), a joke, kind of a last feeble pretense before the whole thing ends in ignominy for the “Joe Biden” team — whoever that actually is.

The repercussions are liable to be ugly for our country, not necessarily in terms of more military trouble in other lands (which we probably lack the capacity to engage in now), but something more personal: the collapse of the dollar as the world’s reserve currency and a vicious loss of purchasing power here at home. That would provoke a situation worse than the Great Depression of the 1930s, and that’s probably where things are going. The Ukraine misadventure will disappear from America’s collective consciousness in a New York minute and a Fourth Turning jamboree of serious domestic political disorder will commence in short order. If you think “Joe Biden’s” term in office has been a disaster so far, just wait. You ain’t seen nuttin yet.

Want to guess who pays for this?

• Kyiv Improving Airfields Anticipating Western Fighters (Drive)

Unlike the recent influx of promises for western tanks, Ukraine has yet to receive any solid offers of modern fighter jets from allies like the U.S., France, the Netherlands, Denmark and others. But it’s preparing airfields across the country in anticipation of deliveries of multi-role jets like U.S.-made F-16 Fighting Falcons or French Mirage or Rafale fighters. To integrate jets like those into the Ukrainian Air Force would not only require training for pilots and maintainers, but it would also require making sure more modern jets have safe places to operate from. “We have to prepare the airfield infrastructure so that pilots could land safely on the airstrips,” Ukrainian Air Force spokesman Col. Yuri Ignat told reporters Friday at a press briefing in Ukraine. “The works are in progress in different regions of Ukraine with the support of the Ministry of Infrastructure, the Ministry of Defense and other government agencies to support us in the creation of this airfield network.”

With the country under continuing sporadic missile and drone barrages, like the one yesterday, Ignat acknowledged that the work to create the airfield network for new fighters cannot be done “as well as it could have been done in peacetime.” Ignat did not offer any details about where or how many airfields are in the pipeline, or what kind of work needed to be done. But any improvements likely involve upgrading the quality of operating areas and possibly lengthening runways. Ukraine’s Soviet-designed tactical jets were built to operate in conditions that can be considered positively austere when compared to their Western counterparts. The bases they operate from reflect this flexibility. too. As for the aircraft, they have sturdier landing gear, mud guards on their nose wheels, in some cases even intake doors that protect the aircraft from ingesting damaging debris during taxiing. Most Western designs are made to operate from much more pristine surfaces that are meticulously cleared of even small pieces of debris. So if Ukraine wants Western fighters, it needs infrastructure that meets their operational needs.

Not enough! Not fast enough! More more moar!

• Zelensky Issues Warning Over Abrams Deliveries (RT)

President Vladimir Zelensky has criticized Washington’s lack of speed in delivering heavy tanks to Ukraine. In an interview with Sky News on Friday, the Ukrainian leader also warned that Kiev would not be satisfied with a small number of tanks from the West. Zelensky’s comments come after the US promised on Wednesday to supply Kiev with 31 M1 Abrams tanks, but cautioned that the delivery could take several months or more. The White House explained that it expects to acquire the machines from the industry, rather than pulling them directly from its own stocks. However, Zelensky complained that if the American tanks arrive as late as August, it will be “too late.” He insisted that a handful of tanks “won’t make a difference on the battlefield.”

The president told Sky News that Ukraine currently needs “300 to 500 tanks” in order to be able to launch a counter offensive against Russia. “It’s not about politics, it’s about specific results on the battlefield,” he said. Zelensky also thanked the countries that have been delivering weapons to Ukraine and noted that a total of 12 countries have already committed to bolstering Kiev’s tank coalition. Earlier this week, Germany officially approved the supply to Kiev of 14 Leopard 2A6 tanks from its own stocks and also gave permission to other countries to provide their own German-made armor for the needs of the Ukrainian army. Berlin said it expects to deliver the Leopards no later than the end of March. Other countries that have also pledged their heavy armor to Kiev include the UK, Poland, Canada, Spain, Norway and the Netherlands.

“”The German foreign minister said that her country was fighting jointly with other nations against Russia, while her ministry does not consider their own country to be party to the conflict..”

• Russian Diplomat Wants Germany To Clarify Status In Ukraine Conflict (TASS)

Russian Foreign Ministry Spokeswoman Maria Zakharova urged the German ambassador to Russia on Friday to clarify Berlin’s position on its status in the conflict in Ukraine. “The German foreign minister said that her country was fighting jointly with other nations against Russia, while her ministry does not consider their own country to be party to the conflict. Taking into account these contradictory statements, the German ambassador to Russia should clarify them,” the Russian diplomat wrote on her Telegram channel. Earlier, Germany’s Foreign Ministry said providing assistance to Kiev did not make Berlin party to the conflict in Ukraine. This was how Germany’s diplomacy commented on a statement by German Foreign Minister Annalena Baerbock who said, addressing the Parliamentary Assembly of the Council of Europe earlier this week, that “we are fighting a war against Russia.”.

More Baerbock.

“..a regional lawmaker from the state of North Rhine-Westphalia, and the president of the German-Hungarian association, Gerhard Papke, accused Baerbock of being “completely politically insane” for making such a statement..”

• German FM Under Fire Over ‘War With Russia’ Comment (RT)

German Foreign Minister Annalena Baerbock has faced a wave of criticism after claiming at the Parliamentary Assembly of the Council of Europe (PACE) that Germany is at war with Russia. The comment led opposition politicians to question whether she is fit for the job. “A statement by Baerbock that Germany is at war with Russia shows that she is not suited for her job,” Sahra Wagenknecht, a German MP and the former head of the Left Party’s faction in the Bundestag, wrote on Twitter on Friday. A foreign minister should be a “top diplomat” and “not act like an elephant in a China shop,” the lawmaker added, accusing Baerbock of “trampling” on Germany’s reputation. During the Tuesday debate, Baerbock said European nations were “fighting a war against Russia” and must do more to defend Ukraine.

Germany needs a foreign minister who is capable of acting “as a responsible diplomat and not a firebrand” amid conflict in Europe, said Alice Weidel, the co-chair of the right-wing Alternative for Germany (AFD) faction in the Bundestag. Weidel accused Baerbock of being incapable of acting on the diplomatic stage, saying Berlin needs a top diplomat who represents Germany’s interests exclusively. Meanwhile, a regional lawmaker from the state of North Rhine-Westphalia, and the president of the German-Hungarian association, Gerhard Papke, accused Baerbock of being “completely politically insane” for making such a statement. Left MP Selim Dagdelen demanded Chancellor Olaf Scholz provide an “immediate” explanation on whether Baerbock had his government’s mandate “for her declaration of war” and suggested the minister was a threat to the security of German citizens.

Neither Baerbock, nor Scholz, have responded to the criticism so far. Germany’s Foreign Ministry maintained Berlin is not a party to the conflict between Kiev and Moscow in a statement to the Bild tabloid. “Supporting Ukraine in exercising its individual right for self-defense… does not make Germany a party to the conflict,” it said, pointing to the UN Charter. It said Moscow’s offensive in Ukraine is “a war against the European peace and order” and this is what Baerbock had meant. In the wake of Baerbock’s Tuesday statement, Moscow said that the German minister’s words only show that the West had been planning this conflict all along for years.

“..to Germany for use in Ukraine..”

• Brazil Refuses To Sell Tank Ammo For Ukraine (RT)

Brazilian President Lula da Silva shot down an offer to sell tank ammunition to Germany for use in Ukraine, Brazilian newspaper Folha de Sao Paulo reported on Friday. A vocal critic of the West’s policy toward Ukraine, Lula has striven to remain neutral on its conflict with Russia. The president allegedly rejected the request at a meeting with Brazilian defense chiefs and Defense MInister Jose Mucio last week. According to the paper’s sources, since-dismissed army commander Julio Cesar de Arruda told Lula that Germany wished to purchase just under $5 million worth of shells for its Leopard 1 tanks.

Lula reportedly considered asking Berlin to guarantee that it would not send the ammunition to Ukraine, but ultimately declined the offer, “arguing that it was not worth provoking the Russians,” as Folha de Sao Paulo put it. Less than a week later, Germany formally announced that it would donate a company-sized force of Leopard 2 main battle tanks to Ukraine, and would allow other countries operating the tanks to transfer them to Kiev. It is unclear whether the ammunition referenced by Folha is compatible with both generations of Leopard tank. Like his right-wing predecessor, the left-wing Lula has taken a neutral position on the conflict in Ukraine.

While Jair Bolsonaro’s government formally condemned Moscow at the UN General Assembly over its military operation, neither president has imposed sanctions on Russia, and each has partially blamed Ukrainian President Vladimir Zelensky for the outbreak of hostilities. Lula has condemned the US for pouring tens of billions of dollars into Ukraine’s government and military, and suggested last year that US President Joe Biden “could have avoided [the conflict], not incited it.” He also declared that NATO leadership should have reassured Russia that Ukraine would never be allowed to join the US-led military bloc, which was one of Moscow’s key demands for peace before it sent troops into the country.

Given that Russia will be in control, it would seem wiser to return their funds, so you would get some actual rebuilding done.

• EU Claims To Have Found Way To Access Frozen Russian Funds (RT)

The European Union has told member states that it has legal authority to temporarily leverage a hefty amount of Russian Central Bank assets to pay for the rebuilding of Ukraine, Bloomberg reported on Thursday, citing people familiar with the matter. The mechanism could reportedly involve as much as €33.8 billion ($36.8 billion) of the funds frozen by the bloc as part of the Ukraine-related sanctions imposed on Moscow. According to the EU’s Council Legal Service, the plan is legally feasible if the assets aren’t expropriated and certain conditions are met. These include a termination date, a focus on liquid assets, and clarity that the principal and interest would be returned to Russia at some point, according to people close to the discussions. The Group of Seven (G7) and the EU reportedly failed to find a clear legal basis for simply confiscating Russian assets.

Instead, Brussels is considering the idea of pooling the frozen assets together at EU or international level to generate returns that could be used to finance the rebuilding of Ukraine. According to a number of estimates, the Russian Central Bank’s frozen assets amount to some $300 billion worldwide. EU officials had previously said almost €34 billion ($37 billion) of the funds are sitting in EU-based deposits. The figure is, however, still under assessment. In November, European Commission President Ursula von der Leyen proposed that the bloc’s authorities should create a special structure to manage the frozen Russian funds and invest them with a view to using the proceeds for Ukraine. The Russian government has repeatedly called the freezing of the country’s assets “theft,” and warned that the step contravenes international law. According to Moscow, the very idea of international reserves has been discredited by the use of the US dollar as a weapon in the sanctions war against Russia.

“.. I think that only the successful completion of the special military operation may be the basis for meaningful and fruitful negotiations..”

• Russian Senator On Basis For Productive Talks With Kiev (TASS)

Only the successful completion of the special military operation may serve as the foundation for “meaningful and productive” talks on the situation in Ukraine, says First Deputy Chairman of the Federation Council Committee on Defense and Security, ex-Russian Permanent Representative to the European Union Vladimir Chizhov. “This is my personal opinion. I think that only the successful completion of the special military operation may be the basis for meaningful and fruitful negotiations. Without this, any talks, the results of these talks, will only postpone the resolution of the conflict and threaten to renew or repeat it,” he said at a press conference at TASS on Friday.

Replying to a question about any negotiations currently taking place on settling the situation around Ukraine, the official noted that the “process is not in progress.” “What is more, in order for the talks to go on, they have to start. They haven’t,” the senator stressed. He added that the possibility to launch talks on this issue between Moscow and Washington or Brussels is also not visible at the moment.

“..the West has proved that all the values and mechanisms of globalization that it itself created and promoted, including the inviolability of property, fair competition, the presumption of innocence, can be trampled on at any moment..”

• Russian FM Says BRICS Group To Consider Common Currency (AA)

Russian Foreign Minister Sergey Lavrov said on Wednesday that Brazil, Russia, India, China, and South Africa – BRICS countries – will discuss creating a common currency at the group’s forthcoming summit this August in South Africa. “Serious, self-respecting countries are well aware of what is at stake, see the incompetence of the ‘masters’ of the current international monetary and financial system, and want to create their own mechanisms to ensure sustainable development, which will be protected from outside dictates. “It is in this direction that the initiatives that have been voiced recently … about the need to think about creating our own currencies within the framework of BRICS,” he told a news conference after a meeting with Angolan President Joao Lourenco in the capital Luanda.

The minister added that Russia and Angola have a “firm intention” to develop cooperation in all areas, despite “illegal” Western pressure. Lavrov said the West uses “the same colonial methods with which it exploited developing continents,” and continues using them “to plunder foreign countries and uses resources of global importance to its advantage.” “By its actions, the West has proved that all the values and mechanisms of globalization that it itself created and promoted, including the inviolability of property, fair competition, the presumption of innocence, can be trampled on at any moment, and can also betray its allies at any moment. This is proved by the practice of not so long ago events in Afghanistan, Iraq, and during the Arab Spring of 2011,” he said.

How does the FDA still exist?

• FDA Quietly Changes End Date for Study of Heart Inflammation (ET)

The U.S. Food and Drug Administration (FDA) has changed the end date for a key study on post-vaccination heart inflammation without notifying the public. Pfizer was supposed to complete a study on the occurrence of subclinical myocarditis, or heart inflammation, after receipt of its COVID-19 vaccine. The completion date was listed by the FDA in 2021 as June 20, 2022. Pfizer was also supposed to submit the results of the study to the FDA by the end of 2022 as part of a list of requirements the FDA imposed as a condition of approving Pfizer’s jab. But after the deadline passed, the FDA quietly changed the date. Under a list of postmarketing requirements for the Pfizer-BioNTech vaccine, the FDA now says the same study has an “original projected completion date” of June 30, 2023.

The current status of the study is listed as “pending.” The FDA and Pfizer did not respond to requests for comment. Jessica Adams, a former regulatory review officer at the FDA, said the wording amounts to misinformation. “By definition, ‘original’ dates can’t change,” she wrote on Twitter, tagging the agency. “Please correct this ‘misinformation.’” Dr. Vinay Prasad, who has increasingly criticized the FDA over its decisions during the pandemic, said the new timeline “is so slow it will be entirely moot.” “Another FDA failure,” he said on Twitter.

VDB

https://twitter.com/i/status/1615174302319661056

“I’ll pay you $5 for any flight attendant/pilot who signs the petition. So you can earn $50/hr or even more and work your own hours. And you’ll be doing a huge public service..”

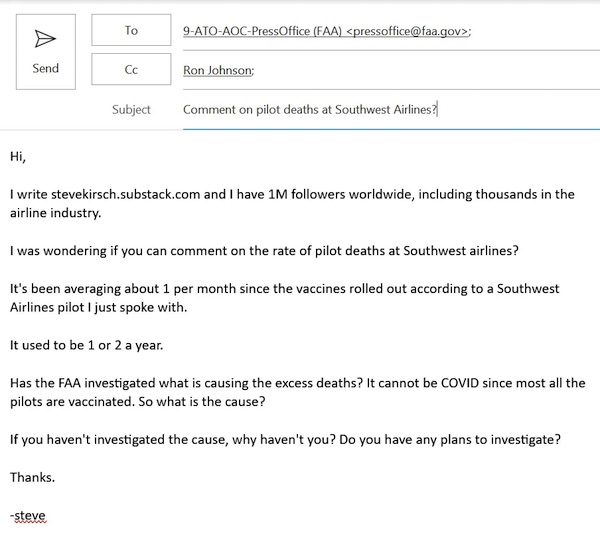

• Pilots Are Dying At Southwest Airlines At Over 6x The Normal Rate (Kirsch)

I thought the vaccines were supposed to reduce death not increase it! I just asked the FAA for their comment on this. Here’s what I wrote:

If they respond, I’ll post their response here. The FAA wants a war, so I’m going to give them one. I’m not going to let the FAA get away with ignoring all the deaths and disabilities. I’m willing to pay people $5 per name who sign our FAA petition to investigate these injuries. All you do is stand right outside the Crew security checkpoint and hand out the fliers. I’ll pay you $5 for any flight attendant/pilot who signs the petition. So you can earn $50/hr or even more and work your own hours. And you’ll be doing a huge public service. I will then pay all costs for 20,000 of these people to come demonstrate outside of FAA headquarters. If 20,000 doesn’t work, then we’ll try 40,000 people. Whatever it takes for these people to investigate. The protest will end when the FAA agrees to investigate the injuries. Please let me know if you are interested in this offer to help me collect names.

Ray Bradbury

In 1974, author Ray Bradbury was asked, “What is space travel going to do for man?” In response, he gave the most mystical, mind-blowing, and strangely moving answer I could have imagined. pic.twitter.com/dbqx3R0jaA

— Benjamin Carlson (@bfcarlson) January 26, 2023

Speed of light

94% of the universe’s galaxies are permanently beyond our reach. If we could travel at the speed of light and left today, we'd still only be able to reach 6% of them

[read more: https://t.co/BoQfTS8kXN]pic.twitter.com/MrASyafblA

— Massimo (@Rainmaker1973) January 27, 2023

Bobcat

https://twitter.com/i/status/1618981127754231808

Begonia pavonina

https://twitter.com/i/status/1619029563895590913

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.