Happy birthday Julian

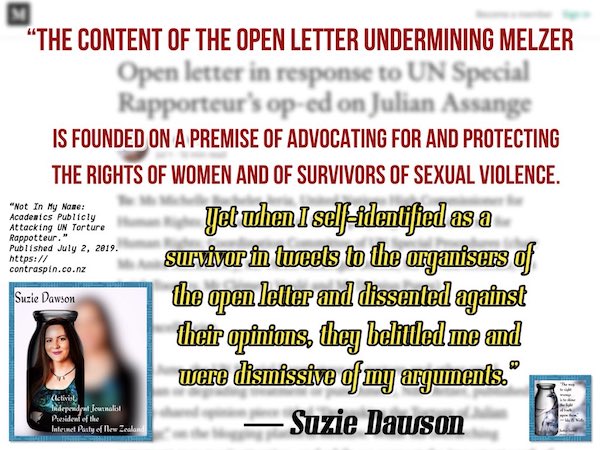

Julian first on his birthday. Here’s Nils Melzer’s response to the 200+ academics who didn’t like how he described the -empty- rape allegations against Assange. These are the last few paragraphs. A man of great integrity.

• Response to Open Letter of 1 July 2019 (Nils Melzer)

Beyond questions of law, you also take issue with my tone, which you deem to be “insensitive to victims”. Please let me assure you that, in two decades of work with victims of war and violence, sometimes under very difficult and dangerous circumstances, I have seen and suffered too much myself to be intellectually or emotionally capable of “mocking” potential victims. The countless testimonies I have collected in prisons, camps and villages throughout the world have marked me deeply, and some of them keep haunting me to this day. Whatever misunderstandings may have resulted from my article, they certainly do not warrant accusing me of “insensitivity to victims” or even a “profound lack of understanding that does a disservice to the mandate”.

Though the tone of my critique may be harsh, it does not aim at the women, but at the gross arbitrariness of the “rape” narrative, which has been wrongly imposed by zealous officials not only on Assange, but also on the two concerned women themselves, and on the general public. The State not only ignored the women’s own experience and interpretation of events, but also consistently declined to take the necessary measures which would have allowed advancing this matter beyond the stage of preliminary investigation, where it has been so conveniently left to simmer for almost a decade. As is well documented, both the two women and Assange fully cooperated with the police and the prosecution from the outset, he was questioned both in Sweden (2010) and in London (2016), and the only reason he refused to be extradited to Sweden was that Sweden declined to guarantee against further extradition to the United States, where I am convinced he would be exposed to serious violations of his human rights.

More generally, I fully share your concerns that sexual allegations against powerful men are often dismissed as attention-seeking or part of a conspiracy to bring them down. I would point out, however, that Assange is not a powerful man shielded by impunity, but an isolated and frail political prisoner persecuted for exposing war crimes and corruption. So, while we all work to safeguard the rights of victims of sexual abuse, let us not blindly dismiss well-founded doubts as to the veracity and / or appropriateness of rape allegations, where there are indications of duress or documented third party interests influencing the process. This holds particularly true in a highly politicized case which, in all involved jurisdictions, is plagued with a pervasive mix of grave and persistent due process violations, concerted public mobbing, humiliation and intimidation, and counterfactual accusations of hacking, spying and even causing death and injury.

Right. The EU nominates two women. One is accused of gross incompetence, the other was convicted of negligence in a case of misuse of public funds, but never sentenced, no criminal record. Highly doubtful she would be seen as “fit and proper” for a commercal bank job. The entire nomination process reminds us about Groucho Marx’ famous line “Those are my principles; if you don’t like them, I have others”. So we get: “Who needs a Spitzenkandidat when you can have a Homecoming Queen?”

• France And Germany Eye Lagarde For ECB and Von Der Leyen For EC President (R.)

German defense minister Ursula von der Leyen may end up as European Commission President while IMF head Christine Lagarde may become new president of the European Central Bank following an agreement between France and Germany, said sources. One diplomatic source with knowledge of the matter said French President Emmanuel Macron had proposed to his German counterpart Angela Merkel that Lagarde should get the top ECB job. The source added that Merkel was “very positive” on the idea of Lagarde heading the ECB.

“Von der Leyen is our weakest minister. That’s apparently enough to become Commission president..”

“..accusations that von der Leyen’s office circumvented public procurement rules in granting contracts worth millions of euros..”

• The Inconvenient Truth About Ursula Von Der Leyen (Pol.eu)

A polyglot Brussels native who reared seven children and earned a medical degree on the side before storming to the top of German politics. News that this Wunderfrau — aka German Defense Minister Ursula von der Leyen — could become the Commission’s next president left European capitals abuzz on Tuesday. “Finally some good news” was the general tenor. Who needs a Spitzenkandidat when you can have a Homecoming Queen? At first glance, the affable 60-year-old minister with a camera-ready smile looks to be a perfect fit, with the requisite experience, political pedigree and personality to handle the EU’s toughest job. And yet a nagging question remains: Is she too good to be true?

In the German capital, the answer is clear. “Von der Leyen is our weakest minister. That’s apparently enough to become Commission president,” former European Parliament President Martin Schulz seethed in a tweet Tuesday evening. Though Schulz is a Social Democrat, his analysis of the minister’s record is shared by many of von der Leyen’s fellow Christian Democrats, though most are reluctant to criticize her publicly. Instead, they point to the state of the German military. “The Bundeswehr’s condition is catastrophic,” Rupert Scholz, who served as defense minister under Helmut Kohl, wrote last week before von der Leyen was nominated to the EU’s top post. “The entire defense capability of the Federal Republic is suffering, which is totally irresponsible.”

[..] In addition to problems surrounding the German military’s readiness, von der Leyen’s ministry also faces an investigation into suspected wrongdoing surrounding its use of outside consultants, including Accenture and McKinsey. The Bundestag, the German parliament, is currently holding hearings into the affair, including accusations that von der Leyen’s office circumvented public procurement rules in granting contracts worth millions of euros to the firms. Those hearings have taken a dramatic turn in recent days as testimony from key witnesses appeared to confirm suspicions of systematic corruption at the ministry.

On our way to zero percent interest rates. Damn savings and pensions.

• Trump To Nominate Judy Shelton, Christopher Waller To The Fed (CNBC)

President Donald Trump intends to nominate Christopher Waller, executive vice president at the Federal Reserve Bank of St. Louis, and Judy Shelton, an economic adviser to the president during his 2016 campaign, to the Federal Reserve’s board. The announcements, in a pair of tweets late Tuesday, come after Trump’s earlier nominees, Stephen Moore and Herman Cain, both withdrew from consideration. Moore, a conservative pundit, dropped out of consideration in May, citing public scrutiny of his professional and personal lives. Cain, the businessman and former GOP presidential candidate, dropped out of contention for the Fed in late April. Shelton was earlier speculated to be a pick for the Federal Reserve board.

Shelton has previously said that if appointed, she would lower interest rates to 0% in one to two years, echoing calls from Trump to lower rates. Waller has worked at the Federal Reserve Bank of St. Louis since 2009, and previously was a chair of economics at the University of Notre Dame and a chair in macroeconomics and monetary theory at the University of Kentucky. He has written about the dangers of an inverted yield curve, in which short-term Treasury yields outpace long-term yields. The 3-month bond yield topped 10-year yields in May, the widest yield curve inversion since the financial crisis. Some economists and investors believe the curve sends a warning about economic growth. Both nominees will need Senate confirmation.

Interpreting Putin’s words.

• The Death of the Liberal Idea (Dmitry Orlov)

The migrant crisis is a perfect example of how liberalism has outlived its usefulness. Liberalism offers two ways forward, both of which are fatal to it. One approach is distinctly illiberal: halt the influx of migrants by any means necessary; insist that the migrants already in the country either conform to a strict set of requirements, including demonstrated competency in the nation’s language, detailed knowledge of its laws and administrative systems, strict obedience to its laws and demonstrated preference and respect for the customs and culture of the native population—or be not so much deported as expelled. The other approach is liberal at first: allow the influx to continue, do not hinder the formation of foreign ghettos and enclaves which native citizens and officials dare not enter, and eventually surrender to Sharia law or other forms of foreign dictate—guaranteeing the eventual death of the liberal idea along with much of the native population.

Thus, the choice is between killing the liberal idea but saving the native population or letting the liberal idea die willy-nilly, taking the native population along with it. It offers no solution at all. “We all live in a world based on traditional Biblical values,” quoth Putin. “We don’t have to demonstrate them every day… but must have them in our hearts and our souls. In this way, traditional values are more stable and more important to millions of people than this liberal idea which, in my view, is ceasing to exist.” This is true not just of the believers—be they Christian, Moslem or Jewish—but of the atheists as well. To put it in terms that may shock and astound some of you, you don’t have to believe in God (although it helps if you do—to avoid cognitive dissonance) but if you aspire to any sort of social adequacy in a traditional society you have no choice but to sincerely think and act as if God exists, and that He is the God of the Bible—be He Yahweh, Elohim, Jesus and the Holy Trinity or Allah (that’s the Arabic word for “God”).

Putin capped off his argument by ever so gently and politely putting the boot in. He said that he has no clue about any of this “transformer-trans… whatever” stuff. How many genders are there? He has lost count. Not that he is against letting consenting adult members of various minority sexual groups do whatever they want among themselves—“Let everyone be happy!”—but they have no right to dictate to the rest. Specifically, Russian law makes homosexual propaganda among those who are under age illegal. Hollywood’s pro-LGBT mavens must be displeased: their choice is either to redact LGBT propaganda from the script, or to redact it from the finished film prior to its release in Russia (and China).

Fun with Bob.

I can think of a few 90-mph sliders I’d like to pitch to Mr. Mueller, some of them already floated in the press: like, why did you allow the GI cell phones of Peter Strzok and Lisa Page to be destroyed shortly after you were informed about their unprofessional and compromising text exchanges, for which they were fired off your “team?” When did you learn that international men-of-mystery Stefan Halper and Josef Mifsud, whose operations spurred your prosecutions, were not Russian agents but rather in the employ of US and British government intel agencies? Your deputy, Andrew Weissmann, was informed by Deputy Attorney General Bruce Ohr in the summer of 2016, months before your appointment, that the predicating documents for your inquiry, known as the Steele Dossier, amounted to a Clinton campaign oppo research digest — when did he happen to tell you that?

You devoted nearly 20 pages of your report to the Trump Tower meeting between the president’s son, Donald, Jr., and two Russians, lawyer Natalia Veselnitskaya and lobbyist Rinat Akhmetshin. Why did you omit to mention that both Russians were in the employ of Glenn Simpson’s Fusion GPS company, candidate Clinton’s oppo research contractor, and met with Mr. Simpson both before and after the Trump Tower meeting? How did it happen that you hired attorney Jeannie Rhee for your team, knowing that she had previously worked as a lawyer for the Clinton Foundation? Under what legal standard did you pronounce Mr. Trump to be “not exonerated” in the obstruction of justice matter, considering you told the Attorney General, Mr. Barr, that it was not based on findings by the DOJ Office of Legal Counsel concerning presidential immunity from indictment?

[..] It’s just possible that Robert Mueller will not be reading chapter and verse from his sacred report, like an old-school Episcopal priest, but rather pleading the Fifth Amendment to avert his own potential prosecution.

Lawyers tell them not to, in case they’d say something stupid. But bordering on criminal behavior.

• Families Of 737 MAX Crash Victims Say Boeing Has Not Contacted Them (BI)

Families of those killed in two fatal crashes involving Boeing 737 Max planes say they have not received any contact from Boeing since the disasters, with no apology or offer of support from the manufacturer. The parents of a woman killed on one of the flights told Business Insider they had received “no condolences” and “no direct communication” from Boeing despite numerous public apologies by the plane maker and said Boeing CEO Dennis Muilenburg “talks to other people but not us, the victims’ families.” Nadia Milleron and Michael Stumo lost their 24-year-old daughter, Samya Stumo, when the Boeing 737 Max 8 jet operated by Ethiopian Airlines crashed in March, killing all 157 people on board.

It was the second crash of a 737 Max plane in five months after a Max 8 operated by the Indonesian carrier Lion Air crashed in the Java Sea in October, killing all 189 people on board. Investigations into both crashes have centered on a software issue that Boeing has since been working to fix, with all its Max aircraft grounded around the world in the meantime. Other attorneys representing more than 50 families of those killed in the crashes told Business Insider their clients’ experience was the same. The Chicago-based aviation attorney Joe Power, the Los-Angeles based attorney Brian Kabateck, and the Miami-based attorney Steve Marks said Boeing had not reached out to their clients.

Marks said that this response was not “unusual” from manufacturers after a crash, but he described Boeing’s reaction as “worse” than a typical response. He said Boeing “came out really quickly after the second tragedy, and said: ‘We own it, it’s our problem.'” But then, he said, the company “has since backed those comments off, in many different ways, which I think has only inflamed the situation, as far as the families are concerned.” Mike Danko, an aviation attorney who is not representing any families in the 737 Max crashes, told Business Insider that Boeing’s action in this case were “not unusual” and that manufacturers typically did not apologize or offer support after fatal plane crashes, but he noted its public apologies.

Not surprising.

• Chinese Border Guards Put Secret Surveillance App On Tourists’ Phones

Chinese border police are secretly installing surveillance apps on the phones of visitors and downloading personal information as part of the government’s intensive scrutiny of the remote Xinjiang region, the Guardian can reveal. The Chinese government has curbed freedoms in the province for the local Muslim population, installing facial recognition cameras on streets and in mosques and reportedly forcing residents to download software that searches their phones. An investigation by the Guardian and international partners has found that travellers are being targeted when they attempt to enter the region from neighbouring Kyrgyzstan.

Border guards are taking their phones and secretly installing an app that extracts emails, texts and contacts, as well as information about the handset itself. Tourists say they have not been warned by authorities in advance or told about what the software is looking for, or that their information is being taken.

Maritime law. Don’t play with it.

• Italian Judge Rules Sea Watch Captain Carried Out Duty To Protect Lives (EN)

An Italian judge ruled on Tuesday that the German captain of a rescue charity ship had not broken the law when she forced a naval blockade at the weekend, saying she had been carrying out her duty to protect human life. Carola Rackete, a 31-year-old German national, disobeyed Italian military orders and entered the port of Lampedusa on Saturday to bring some 41 African migrants to land in the Dutch-flagged Sea-Watch boat. She was immediately detained and placed under house arrest, but in a blow for Italy’s hardline interior minister, Matteo Salvini, Judge Alessandra Vella ruled that Rackete had been carrying out her duty and had not committed any act of violence.

Rackete still faces possible charges of helping illegal immigration, but Vella ordered her immediate release. Salvini said in a statement he had hoped for a tougher response from the Italian justice system and promised to expel Rackete as soon as possible. Rackete appeared before the Agrigento court on Monday and apologised for hitting the patrol boat, saying it had been an accident and explaining that her sole concern was the well-being of the migrants who had been at sea for more than two weeks.

Question is: can they, or does EU law prevail?

• Austria Becomes First EU Country To Ban Glyphosate (RT)

Austria has voted to ban glyphosate, the main ingredient in Bayer-Monsanto’s notorious Roundup weedkiller, becoming the first EU country to outlaw the chemical and creating a PR disaster for the troubled German company. “The scientific evidence of the plant poison’s carcinogenic effect is increasing. It is our responsibility to ban this poison from our environment,” Social Democratic Party leader Pamela Rendi-Wagner said in a statement on Tuesday. The resolution passed with the cooperation of her party, the right-wing Freedom Party and the liberal Neos Party, and remains only to be signed by President Alexander van der Bellen, a former Green Party leader, unless the upper house of Parliament objects.

“We want to be a role model for other countries in the EU and the world,” said Erwin Preiner, another Social Democrat MP who worked on the ban. Austria has embraced organic farming more than any other European country – nearly a quarter of its farmland is organic – and is thus not a major market for glyphosate-based herbicides, using only a few hundred tons per year. While a ban will have minimal direct impact on Bayer’s sales, the optics of the German company’s next-door neighbor nation exiling its flagship herbicide are likely to cause a few headaches at Bayer HQ.

Austria’s ministry for sustainability and tourism claims a total ban on glyphosate violates EU law, as the chemical is cleared for sale and use across the EU until 2022, but the bill’s backers have pointed to other examples of individual countries banning specific chemicals as proof of their right to legislate against the herbicide. France banned Roundup Pro 360, one type of Monsanto’s popular glyphosate weedkiller, earlier this year, and President Emmanuel Macron has pledged to phase out the use of glyphosate entirely within three years. “National bans on glyphosate-based plant protection products or restrictions on their use would be possible,” the European Commission declared in 2016, confirming that “the EU states do not have to hide behind the European Commission” in deciding whether or not to ban a particular formulation of an herbicide.

“..cockroaches who survived treatment with one insecticide developed immunity not just to that chemical, but to other chemicals they hadn’t even been exposed to – increasing their resistance “four- to six-fold in just one generation..”

• Cockroach ‘Superbugs’ Evolve To Resist Pesticides In One Generation (RT)

Cockroaches will soon be impossible to kill with standard pesticides, as they can develop cross-resistance to poisons they’ve never encountered within a single generation, an ominous new study has found.

German cockroaches – the small, quick-scurrying type whose traces can be found in 85 percent of US urban homes – are rapidly becoming impervious to pesticide chemicals, developing cross-resistance to a variety of insecticides within a single generation, a study published in Scientific Reports has demonstrated. And even the researchers who conducted the experiment are creeped out by the evolutionary capabilities of the ubiquitous six-legged pests. “We didn’t have a clue that something like that could happen this fast,” Michael Scharf, chair of the Entomology Department at Purdue University and co-author of the study, said in a statement last week.

“Cockroaches developing resistance to multiple classes of insecticides at once will make controlling these pests almost impossible with chemicals alone.” One experiment in which 10 percent of cockroaches started off resistant to a particular pesticide actually saw populations grow over the six months during which the researchers sprayed, a disconcerting result in itself. But it was the multi-chemical experimental groups that really caused a stir – cockroaches who survived treatment with one insecticide developed immunity not just to that chemical, but to other chemicals they hadn’t even been exposed to – increasing their resistance “four- to six-fold in just one generation,” Scharf marveled.

N’importe quoi: “The industry has said deep-sea mining is essential to extract the materials needed for a transition to a green economy..”

• Deep-Sea Mining To Turn Oceans Into ‘New Industrial Frontier’ (G.)

The world’s oceans are facing a “new industrial frontier” from a fledgling deep-sea mining industry as companies line up to extract metals and minerals from some of the most important ecosystems on the planet, a report has found. The study by Greenpeace revealed that although no mining had started on the ocean floor, 29 exploration licences had been issued covering an area five times bigger than the UK. Environmentalists said the proposed mining would threaten not only crucial ecosystems but the global fight against climate breakdown.

Louisa Casson, an ocean campaigner at Greenpeace, said: “The health of our oceans is closely linked to our own survival. Unless we act now to protect them, deep-sea mining could have devastating consequences for marine life and humankind.” The licences, issued by a United Nations body, the International Seabed Authority, have been granted to a handful of countries that sponsor private companies. They cover vast areas of the Pacific, Atlantic and Indian Oceans, totalling 1.3m sq km (500,000 sq miles). If the mining goes ahead, large machines will be lowered on to the seabed to excavate cobalt and other rare metals.

Campaigners said that, as well as destroying little understood regions of the ocean floor, the operations would deepen the climate emergency by disrupting carbon stores in seafloor sediments, reducing the ocean’s ability to store it. The industry has said deep-sea mining is essential to extract the materials needed for a transition to a green economy by supplying raw materials for key technologies including batteries, computers and phones. Its advocates say deep-sea mining is less harmful to the environment and workers than most existing mineral and mining operations.

“They want to send gigantic bulldozers, decked out with rotating grinders and mammoth drills straight out of Robot Wars, into the deepest parts of the ocean, disturbing the home of unique creatures and churning up vital stores of carbon. ”

• The Seabed Should Be Off-Limits To Mining Companies (Chris Packham)

When I was filming Blue Planet Live, I was struck by just how much of the ocean has been altered by humans. From industrial fisheries ensnaring ocean giants in kilometres-long lines, to finding our trash at some of the deepest parts of the ocean: it’s clear that however vast the seas are, we are causing profound harm. Yet at this point in history, when the oceans are facing more pressures than ever before, a secretive new industry is seeking to move into the deep sea, the largest ecosystem on the planet, to start mining for metals and minerals.

They want to send gigantic bulldozers, decked out with rotating grinders and mammoth drills straight out of Robot Wars, into the deepest parts of the ocean, disturbing the home of unique creatures and churning up vital stores of carbon. This is quite clearly an awful idea. As someone fascinated by weird and wonderful wildlife, the deep sea is a dream come true. Stoplight loosejaws, bearded sea-devils and vampire squid are just a few of the fantastically named creatures that make the deep ocean their home. On practically every mission down to the deep, scientists discover new species.

We know more about the surface of Mars and the moon than about the bottom of the ocean. Mining the deep sea sounds just as ludicrous as mining the moon. Far too often, industry has plundered the natural world before science has explored and understood its importance. Parts of the deep sea have already been ravaged by destructive fisheries. These ecosystems stand practically no chance of recovery if mining is allowed to start. Researchers who returned 30 years later to one mining test site on the Pacific sea floor could still see the wounds on the seabed – and warned of irreversible loss of some ecosystem functions.

A deep-sea blackdevil. Photograph: Alamy Stock Photo