Auguste Renoir The umbrellas 1881-6

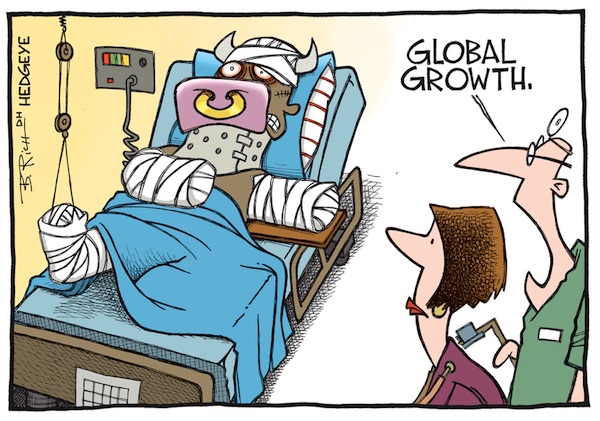

Nap Macgregor

Nap Larry

Lula peace

https://twitter.com/i/status/1647363005099679744

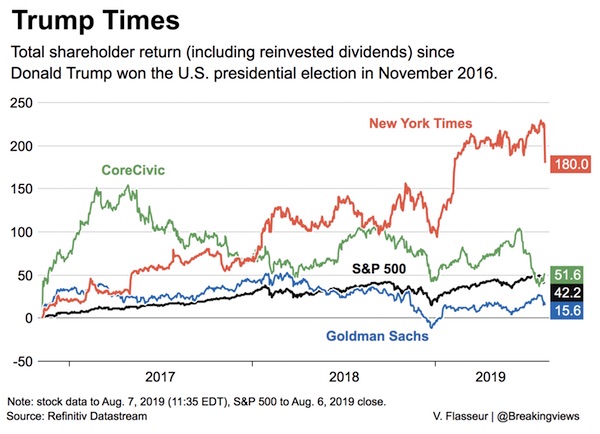

@CheburekiMan: The AFU chief, Zaluzhny, goes to Washington, meets with Sec Def Lloyd Austin and Gen Mark Milley, where he states Ukraine’s KIA at 257K. This was according to Col Doug Macgregor, former Pentagon advisor, citing anonymous inside source(s). The recent major escalation of the Russo-Ukrainian war (actually U.S. proxy war) started Feb 24, 2022, while Zaluzhny’s visit occurred on Jan 16th, 2023. That is a 326 day spread, which works out to ~800 losses per day. Given that Zaluzhny was on a begging mission for long-range weapons and support, he’d have no incentive to underestimate losses. Instead, he’d be appealing to fact, in order to make the case for how Ukraine is paying dearly in lives and that the U.S. must do everything it can to help. According to CIA estimates of manpower fit for military service, Ukraine draws from a theoretical pool of ~7,000,000, while Russia’s is ~23,000,000. This isn’t accounting for the mass exodus of military age Ukrainians to Russia, the West and elsewhere, which could knock millions off the pool numbers. The leaked Pentagon docs indicate a kill ratio of 1:7, meaning that for every one Russian loss there are seven Ukrainian losses.

• West Doesn’t Believe In Kiev’s Crimea Hopes – Former Ukraine MOD Chief (RT)

Most in the US and EU do not believe Ukraine is capable of fulfilling its pledge to retake control of Crimea from Russia, former a Ukrainian defense minister has acknowledged. “The vast majority of Western politicians, analysts and journalists don’t see the liberation of Crimea as a realistic prospect. This is a fact,” Andrey Zagorodnyuk said in an interview with Radio Free Europe/Radio Liberty (RFE/RL) on Thursday. However the former minister, who was part of President Vladimir Zelensky’s government between August 2019 and March 2020, stressed that Western doubts do not mean Kiev should give up on the idea of attacking the peninsula. “We need to persuade them [the West], convince them, put them before a fact, look for different reasoning” to receive the required weapons and other forms of assistance, he insisted.

According to Zagorodnyuk, there are a number of reasons why foreign backers have doubts over Ukraine’s ability to achieve military success in Crimea, which became part of Russia in 2014 following a referendum organized in response to a violent coup in Kiev. “First of all, it will be very difficult to do this because significant Russian forces will be gathered there to prevent its return by military means under Ukrainian rule. The second issue is the integration of Crimea [into Ukraine]. It’s a rather problematic story,” he explained. The minister also said that – when thinking about a Ukrainian operation against Crimea – Kiev’s Western backers are “considering its aftermath in terms of the escalation of the situation” in the conflict overall. During his address on Saturday, dedicated to Orthodox Easter, Zelensky again promised that Ukraine will return Crimea and all other territories it has lost to Russia.

This includes the People’s Republics of Donetsk and Lugansk, and the Zaporozhye and Kherson Regions, which were incorporated into the Russian state last October, following referendums, in which the local populations voted overwhelmingly in favor of the move. “Our flag will fly on the shores of the Sea of Azov and the Seversky Donets River, over the slag heaps, and [Crimea’s] Ai-Petri mountain. The sun will shine in the south, the sun will shine in the east, the sun will shine in Crimea,” the Ukrainian leader pledged. Last month, former Russian President Dmitry Medvedev, who serves as deputy head of the country’s Security Council, said threats against Crimea by Ukrainian officials were just “propaganda” and should not be treated seriously. However, Medvedev warned that if the peninsula is actually attacked, it could become “the basis for the use of all means of protection, including those provided for by the fundamentals of the doctrine of nuclear deterrence.”

Pesticides… Are they in all the grain exports? Has anyone else tested?

Also, the EU has said countries can’t ban Ukrainian grain to save their own farmers. Only Brussels gets to decide.

• Slovakia To Destroy 1,500 Tons Of Ukrainian Grain (RT)

Slovak authorities have banned the processing and sale of Ukrainian grain after discovering a dangerous pesticide in a shipment, the country’s Agriculture Ministry announced on its website on Thursday. According to the statement, the ban will cover all grain of Ukrainian origin and flour made from it that is currently stored in the country. Earlier this week, Slovak authorities discovered a 1,500-ton shipment of Ukrainian grain to be contaminated with chlorpyrifos, a pesticide subject to an EU-wide ban. “The presence of a pesticide, which is not authorized in the EU and has a negative impact on human health, was confirmed in the controlled sample,” the ministry said. The country’s Agriculture Minister, Samuel Vlcan, said earlier on Thursday that the entire shipment would be destroyed.

The duration of the ban is not specified, but the ministry noted that in the coming days the authorities intend to collect samples of all Ukrainian grain and flour stored in Slovakia to determine whether it is safe for consumption. The ministry stressed that it “does not recommend the import of any Ukrainian grain and its products” at the moment and will notify all EU member states about the findings. Ukrainian grain has been flooding the markets of Eastern Europe in recent months, after Brussels permitted duty-free imports from the country to help the products reach customers in Africa and the Middle East. Much of the produce, however, stayed in the EU due to logistical constraints, sparking complaints from local farmers, who blamed cheap Ukrainian imports for the drop in prices for domestically produced grain.

Last month, the prime ministers of Bulgaria, Hungary, Poland, Romania, and Slovakia demanded action from the European Commission on Ukrainian agricultural imports, calling for the reintroduction of import tariffs. In early April, the countries urged the Commission to buy back accumulated Ukrainian products from them on “humanitarian grounds.” On April 7, Polish Agriculture Minister Robert Telus said his country had reached a deal with Kiev, which would see Ukrainian grain imports to the country halted, while transit will be allowed but closely monitored, ensuring that the grain does not stay in Poland.

“..the exact opposite of a free press envisioned in the US Constitution..”

• Musk Says Twitter Secrets ‘Blew’ His Mind (RT)

The billionaire Twitter owner Elon Musk has claimed that he was shocked to find out the real scale of the US government involvement and access to Twitter communications when he purchased and took full control of the social media giant last year. “The degree to which government agencies effectively had full access to everything that was going on on Twitter blew my mind,” Musk told Fox News’ Tucker Carlson, claiming he “was not aware of that” up until he eventually purchased Twitter for $44 billion last October. Musk confirmed that “everything” includes users’ supposedly private direct messages, but the brief Sunday teaser of the upcoming interview did not show whether Musk went on to call out any particular agencies or their methods. It is also unclear what, if anything, has since changed to limit the scope of the government’s access to people’s private communications.

Elon

JUST IN: Elon Musk has said "Various government agencies effectively had full access to everything that was going on Twitter, including to the users' direct messages." pic.twitter.com/NmDFePkWrY

— unusual_whales (@unusual_whales) April 16, 2023

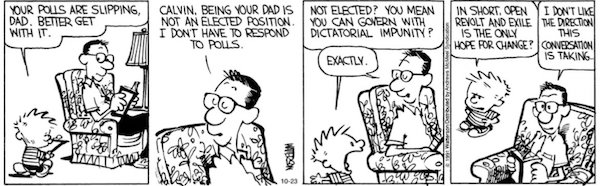

Since purchasing Twitter in October and installing himself as the platform’s new CEO, Musk has been releasing regular batches of internal documents and communications in a bid to shed light on its previously opaque censorship policies and cozy ties with federal law enforcement and intelligence agencies, enlisting independent journalists to break each document dump. Journalist Matt Taibbi, who reported on the first batch of files back in December, recently described the collusion between social media platforms, non-governmental organizations and the US government to suppress information they did not like as the “censorship-industrial complex,” calling it “a bureaucracy willing to sacrifice factual truth in service of broader narrative objectives,” and the exact opposite of a free press envisioned in the US Constitution. Last month, along with fellow Twitter Files journalist Michael Shellenberger, Taibbi was called to testify before the Select Subcommittee on the Weaponization of the Federal Government.

“The Japanese annexed the island from the mainland in 1895, and China sees the reunification of that territory as its right..”

• Beijing Would Take Early Control Of Taiwanese Skies – Pentagon Leaks (RT)

Washington has concerns over Taiwan’s capacity to defend itself in the event of an attack from Beijing, according to leaked documents that have shaken the US military intelligence infrastructure, the Washington Post reported on Saturday. Responding to the concerns outlined in the documents, a spokesperson for Taiwan’s Defense Ministry told the Post that it “respects outside opinions about its military preparedness” but its defense protocols are “carefully constructed based on enemy threats.” The papers, which were allegedly uploaded to a gaming web forum by a 21-year-old US National Guardsman, suggest that Beijing would very likely gain early air supremacy over Taiwan should a conflict break out in the vicinity of the Taiwan Strait.

The leaked Pentagon assessments also indicate that Taipei’s military leadership has doubts surrounding its own ability to “accurately detect missile launches,” and that only around 50% of its aircraft are capable of effectively engaging Beijing’s more advanced air force. China’s tactic of obscuring the movement of military hardware within civilian infrastructure – such as passenger ferries – has impeded US intelligence-gathering efforts, the report claims. The Pentagon has been critical of Taiwan’s defensive preparedness, according to the leaks, particularly as it relates to problems in relocating Taiwanese military assets to make them less vulnerable to airstrikes. Washington, the Post adds, is also concerned by the prospects of Taiwan translating its military drills into real-world, live-action scenarios.

However, Taiwan’s Defense Ministry added in its statement to the Post that its military forces are “absolutely capable, determined and confident” that it can ensure security on the island. The damning reports on Taiwan’s defensive efficiency comes days after it held military drills in which it planned an array of responses to attacks by missiles and chemical weapons. These took place after Beijing conducted its own exercises, which reportedly included a scenario involving the ‘encirclement’ of the island.

Washington’s concerns regarding Taipei’s apparent security problems coincide with frustration in Beijing about apparent US meddling in the region. China upped its military drills last year following a visit to Taiwan by then-House Speaker Nancy Pelosi, while Beijing also expressed anger when the island’s leader, Tsai Ing-wen, held a meeting with current Speaker Kevin McCarthy in California earlier this month. Beijing, which views Tsai as a separatist, considers Taiwan to be a breakaway province which will one day be returned to full rule. Washington has diplomatically acknowledged Beijing’s position that there is only one Chinese government under its ‘One China’ policy, though it has maintained unofficial ties with the island. The Biden administration has also suggested that it would aid Taiwan should China attempt to take it by force.

“..and trying to repeat it is a grave mistake..”

• China’s Century Of Humiliation Is Over (Fomenko)

The century of humiliation is understood as the era when foreign colonial powers subjugated, coerced and exploited the declining Qing Dynasty, forcibly opening up China in order to economically exploit and attain political influence over it. The period is typically considered to have begun with the opium wars of the mid-1800s, whereby the Qing’s refusal to import opium from British India led to war, which ended with the signing of an “unequal” Treaty of Nanking. This not only forced British trade interests on Chinese ports, but also annexed Hong Kong island. The opium wars were followed by many other conflicts directed against Beijing, including the forcefully created “treaty ports” that were quasi-colonial annexes where foreign law was applied over Chinese law, and atrocities such as the 1860 burning of the Old Summer Palace occurred.

The impact of the century of humiliation unleashed ideological and political change in China and led to the birth of new revolutionary ideologies which sought to revive the country, one of which became the Communist Party. On obtaining power following the 1927-1949 civil war, the Communist Party framed itself as the driving force of China’s revival and modernization, and the “humiliation” of the past as a backdrop to the rebirth of the country bringing the country to where it is today. In doing so, China’s leaders consider American attempts at containment of the country as an effort to impose a new century of humiliation. US efforts in blockading the rise and development of China through military encirclement and technological embargoes and sanctions are designed to prevent it from overtaking the US as the world’s largest economy. This naturally draws comparisons in China to the old foreign aggression against it. The US does not want China to do well, it wants to politically and economically dominate it to its own advantages, but it has only hardened the political resolve in Beijing that the failures of the past must not be repeated.

In doing so, China’s leaders consider American attempts at containment of the country as an effort to impose a new century of humiliation. US efforts in blockading the rise and development of China through military encirclement and technological embargoes and sanctions are designed to prevent it from overtaking the US as the world’s largest economy. This naturally draws comparisons in China to the old foreign aggression against it. The US does not want China to do well, it wants to politically and economically dominate it to its own advantages, but it has only hardened the political resolve in Beijing that the failures of the past must not be repeated. China’s determination to be an independent world power, in itself, immensely raises the risk of war and conflict.

Beijing is not seeking hegemony, as some Western commentators choose to portray it, but is nonetheless seeking to restore what it deems its rightful status following its national decline in the past. China does not want sagas such as the opium wars to ever be repeated, and in doing so is likely to accelerate its own military development and size in a bid to deter the US and its allies. Critical to all this is that Taiwan remains an unresolved legacy of what Beijing perceives to be part of the century of humiliation. The Japanese annexed the island from the mainland in 1895, and China sees the reunification of that territory as its right, and sees attempts to block such reunification, such as those by the US, as an effort towards a new humiliation.

“… while the US only understands sanctions, militarism and confrontation..”

• China Speaks The Language Of Pragmatism (Fomenko)

Once upon a time, US diplomacy was pragmatic and shrewd. China, of course, is the chief example of that. In the 1970s Richard Nixon and Henry Kissinger masterfully paved the way to opening relations with Mao Zedong’s China, believing it could be incorporated as a critical strategic partner in the Cold War, despite itself having once been a Communist adversary. It was arguably one of the smartest diplomatic moves of the 20th century. Yet somehow its lessons have been forgotten by the current crop of foreign policymakers in Washington DC, who have become obsessed with a zero-sum rendering of American hegemony that is ideologically zealous and eschews the concept of pragmatism, compromise and engagement in its dealings with other countries.

Bloated by the corrosive influence of the military-industrial complex and their affiliated neoconservative extremists, contemporary American foreign policy doctrine revolves around the perpetual creation and prolonging of tensions and conflict to force countries into its geopolitical orbit, framing every single dilemma as a “good vs. evil” conflict in which the US presents itself as the only good force. It is a mindset which consolidated following America’s victory in the Cold War, and the belief its hegemony over the world is a divine right. In this twisted world view, peace is derided as “appeasement” and anyone who does not sign up to the agenda of perpetual war and arms races is derided as morally corroded. Allies are not to be listened to, but coerced into following America’s will by hook or by crook.

This foreign policy fanaticism has crippled the US ability to build pragmatic relationships with countries for the greater good outside its own ideological disposition, precisely what China is deploying in its diplomacy with countries across the world, and by an ironic twist this has limited America’s ability to secure its interests, get what it wants, or “sit at the table.” What is very telling, for example, is how China was able to broker a normalisation of ties between Saudi Arabia and Iran. The US has shown no diplomatic capacity to do so in its current outlook, because its entire Middle East policy, for one, is based on an aversion to peace, perpetually antagonizing Iran as a “threat” and therefore leveraging its own military capabilities as a security guarantor for its own strategic and commercial gain.

Likewise, this bizarre militarist zealotry is why the US has been set on prolonging the conflict in Ukraine in the belief that Russia can never be offered a particle of compromise, while simultaneously attempting to repeat the same process in the Taiwan Strait. But what happens if other countries have different ideas? Or no longer buy into this agenda? If a nation such as China, by virtue of maintaining good ties with as many nations as possible, is able to shape the international outlook? The US has forgotten the meaning of diplomacy, knowing only the language of sanctions, containment, militarism and confrontation, and in doing so has found itself on the back foot against China, which appreciates the importance of true mutual interests, and leverages its influence to that end accordingly.

Had the current crop of US leaders been in the White House in the 1970s, the great geopolitical rapprochement with Beijing would never have happened, because the only objective could have been hegemony, hegemony, and more hegemony. Thus, in the present day, the belief that the US can in any way work with China for the greater good is derided. But when you don’t sit at the table, you cannot expect to have the meal, and it is these delusions of grandeur which increasingly make China look like a kingmaker, and America like an unhinged zealot.

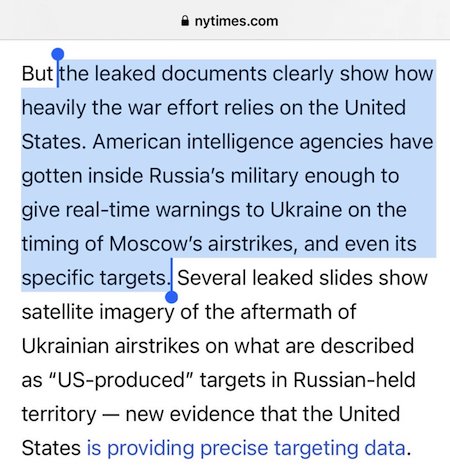

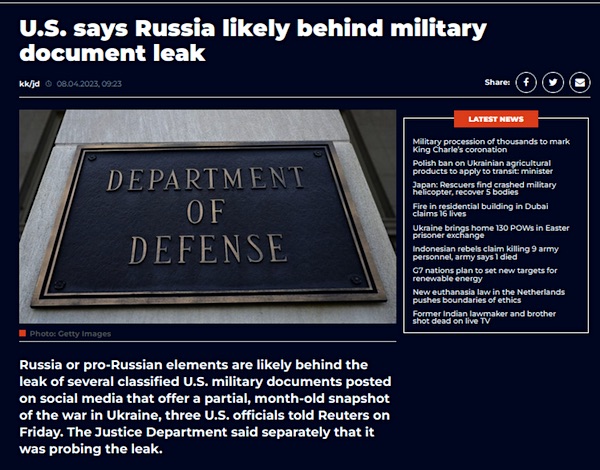

“..precisely the same as that which came over from Daniel Ellsberg’s original Pentagon Papers leak 50 years ago – that the public is being lied to about how the war is going.”

• Snowden and Texeira: Ten Years of Disaster (Craig Murray)

Ten years ago Edward Snowden was helped to escape by Wikileaks and to publish his revelations by The Intercept, Guardian, New York Times and others. In 2023 Jack Texeira is tracked down by UK secret service front Bellingcat in conjunction with the New York Times and in parallel with the Washington Post, not to help him escape or help him publish or tell people his motives, but to help the state arrest him. Those outlets have accessed a cache of at least 300 additional secret documents in doing so – and have kept them secret, with the exception of a couple of snippets that forward the official state narrative. That contrast with ten years ago tells a very real and glaring truth. The idea that the legacy media in any way serves the truth or the public interest is now completely buried. The legacy media serves the state, and the state serves the billionaires.

Wikileaks is now so hamstrung by attacks on its finances, personnel and logistics as to be almost inoperable. Propaganda outfit Bellingcat was conceived as a way to counter it, by producing material with the frisson of secret access but actually as an outlet for the security services. An astonishing amount of “liberal opinion” falls for it. Similarly the Intercept, like the Guardian, was subject to an internal takeover that delivered it entirely into the hands of the neo-conservatives. Neither the alleged journalists of New York Times, Washington Post, nor Bellingcat did the most basic things a real journalist would do. They did not contact Texeira, speak to him, ask him to explain his motivation, and look through the other secret material to which he had access, to get Texeira’s view on its meaning and implications, and to publish what in it was in the public interest.

Instead they simply shopped him to the FBI and closed down the remaining documents. I am not at all surprised by Bellingcat, which is plainly a spook organisation. I hope this enables more people to see through them. But the behaviour of the New York Times and Washington Post is truly shocking. They now see their mission as to serve the security state, not public knowledge. In the ten years between Snowden and Texeira, the world has changed hugely for the worse. Not only has a huge amount of freedom disappeared, freedom’s former Guardians have been subverted. It has been ten years of disaster. A cache of twitter images of some of the leaked documents is here. I am not aware of any broader cache – feel free to insert links to any in the comments. The initial reaction to the leaked documents was to rubbish them with the memes routinely applied to all information embarrassing to the state nowadays – they were either “Russian hacks” or “faked or amended disinformation”.

These attacks were particularly important as the message that came over clearly from these Texeira leaks was precisely the same as that which came over from Daniel Ellsberg’s original Pentagon Papers leak 50 years ago – that the public is being lied to about how the war is going. (It is worth reflecting that in today’s world the NYT and Washington Post would have condemned Ellsberg and emphasised those bits of the Pentagon Papers which reflect badly on the VietCong). Ukraine was particularly concerned about US official figures showing Ukrainian casualties much higher, and Russian casualties much lower, than the Ukrainian official figures the US ostensibly endorsed. I have to say I always find both Ukrainian and Russian casualty figures laughably false. The idea that either side is telling the truth appears to me one that no half-sensible person could entertain. I had presumed that was the general view.

“These companies could trigger shareholder revolts if the moves continue to spark boycotts or diminish sales.”

• Disney Reportedly Lost Over $250 Million on Two Woke Movies (Turley)

We have been discussing the right of shareholders to push back on the social and political campaigns of corporations that reduce share value or damage brands. The concern over the “Go Woke, Go Broke” trend is greatest with companies like Disney, which has been particularly open about its corporate advocacy. That has proven most controversial not just in its announced opposition to the Florida education bill, but children movies that contained controversial sexual elements. Now, Deadline has released an analysis showing that Disney lost a staggering quarter of a billion dollars on two of these woke movies: Lightyear and Strange World. According to Deadline, Lightyear lost $106 million and Strange World lost a whopping $152 million.

“Strange World” is about an explorer family named the Clades. The movie, however, caused a great deal of buzz due to young Ethan talking to his grandfather about his same-sex crush on another boy. Then there is the actual “Buzz.” In Buzz Lightyear, Disney featured a same-sex kiss. Pixar initially removed the scene. However, after the controversy over the Florida education bill, it was put back into the movie as a reported statement of solidarity. For many parents, the sexuality elements were a statement that they did not want to address with their young children. The movies bombed at the box office to the tune of a quarter of a billion dollar loss. Disney has even entered the fray over racial reparation with a controversial children’s episode.

Obviously Disney has company these days in being the subject of a public backlash. In the case of Bud Light, a boycott over its its sponsorship deal with controversial transgender influencer Dylan Mulvaney. While Anheuser-Busch InBev CEO Brendan Whitworth issued a non-apology apology, customers are reportedly shunning not just Bud Light but other Anheuser-Busch products. That led to continued backlash. For its part, Nike is unapologetic and pushed back on critics over its campaign featuring Mulvaney. It told consumers that they needed to be “kind” and “inclusive” while declaring “hate speech, bullying, or other behaviors that are not in the spirit of a diverse and inclusive community will be deleted” from its sites. These companies could trigger shareholder revolts if the moves continue to spark boycotts or diminish sales.

Google is a spy agency worldwide.

• South Korea Orders Google To Disclose Data Gathered By US Spy Agencies (RT)

South Korea’s Supreme Court has ordered Google to disclose any personal data it has collected on South Korean citizens and shared with third parties, including US intelligence agencies. The decision is binding, even as the case against the tech giant continues in a lower court. Thursday’s ruling came after several South Korean plaintiffs sued Google and its local branch, Google Korea, seeking to force the company to reveal whether it had gathered or shared their data. They alleged that personal information was passed to the US National Security Agency (NSA) through its ‘PRISM’ program, which collects a massive amount of data from the internet, including private communications, as well as from service providers directly.

While South Korean law mandates that internet service providers must respond to customer inquiries related to their own personal data and whether it has been shared with third parties, an appeals court previously ruled that Google had the right to reject such requests so long as the decision was in line with US law. However, the Supreme Court partially overturned that ruling, finding that Google must disclose the relevant information upon request regardless of American law, though it nonetheless returned the case to a lower court to continue litigation. “Comprehensive consideration should be given to whether the need to respect foreign laws is significantly superior to the need to protect personal information,” the court said in a statement. The top court also ruled that even if personal data was transferred to a foreign intelligence service for legitimate reasons, companies still must disclose that fact after the person in question is no longer under investigation.

In a statement, Google Korea said it would review Thursday’s decision “carefully,” and claimed that user privacy was a priority for the company. The PRISM program was first revealed to the public in 2013, after NSA contractor Edward Snowden leaked a massive trove of classified documents showing, among other things, the extent of domestic mass surveillance in the United States. According to the leaked material, PRISM was once “the number one source of raw intelligence used for NSA analytic reports” after it was launched in 2007 under President George W. Bush. The program has come under fire by privacy advocates for its sweeping scope, with Snowden deeming it “dangerous” and accusing the NSA of “nakedly, aggressively criminal acts.”

Curious article. And sad.

• South Korea Starts Paying Single Citizens $500 Monthly (Az.)

The South Korean Ministry of Gender Equality and Family will provide up to 650,000 Korean won (about $500) per month to isolated social recluses, in a bid to support their “psychological and emotional stability and healthy growth,” Report informs referring to CNN. About 3.1% of Koreans aged 19 to 39 are “reclusive lonely young people,” defined as living in a “limited space, in a state of being disconnected from the outside for more than a certain period of time, and have noticeable difficulty in living a normal life,” according to the ministry’s report, citing the Korea Institute for Health and Social Affairs.

The new measures specifically target young people as part of the larger Youth Welfare Support Act, which aims to support people extremely withdrawn from society, as well as youths without a guardian or school protection who are at risk of delinquency. The monthly allowance will be available to reclusive lonely young people aged 9 to 24 who live in a household earning below the median national income — defined in South Korea as about 5.4 million won (about $4,165) per month for a household of four people.

“Restricting the Emergence of Security Threats that Risk Information and Communications Technology Act, or RESTRICT Act..”

• The Orwellian RESTRICT Act Is A Chilling Echo Of ‘1984’ (Cheong)

In an eerie semblance to George Orwell’s ‘1984’, the Restricting the Emergence of Security Threats that Risk Information and Communications Technology Act, or RESTRICT Act, looms as a dark cloud over American liberties. Branded as a mere “TikTok ban,” this act possesses a sweeping reach that would empower the federal government to designate any nation a “foreign adversary,” ban online services and products even indirectly controlled by an entity within their jurisdiction, and severely punish Americans who engage in almost any transaction with them. Sponsored by Sen. Mark Warner (D-VA), the RESTRICT Act not only targets the Chinese-linked TikTok platform but also has the potential to dismantle the very foundations of American freedom.

One cannot help but draw comparisons to Orwell’s dystopian masterpiece, where pervasive government surveillance and control are the norm. In a frightening twist, this proposed legislation could make such nightmarish fiction a stark reality. The chilling provisions of the RESTRICT Act would impose a civil penalty of up to $250,000 by the Secretary of Commerce on individuals who conduct transactions that violate the act. The bill’s definition of a transaction is disturbingly broad, encompassing activities such as acquisitions, importation, data transmission, software updates, repairs, data hosting services, and other transactions designed to evade or circumvent the act’s application. However, as in the oppressive world of ‘1984’, the $250,000 fine is only the beginning. American citizens found to be in violation of the act could face a criminal fine of up to $1 million and a jail sentence of up to 20 years.

The parallels to Orwell’s vision are striking, as the RESTRICT Act essentially serves as a tool of control and punishment. It is a sobering reminder of the dystopian fate that awaits the public if it allows government unchecked power in the name of security from foreign nations. Moreover, the bill allows the federal government to seize and access various devices and services belonging to American citizens, including phones and computers, internet access points, e-commerce technology and services, cryptocurrencies, and even advanced technologies like quantum computing, post-quantum cryptography, advanced robotics, and biotechnology. To add insult to injury, the government is granted immunity from public oversight by restricting Freedom of Information Act (FOIA) requests related to the enforcement of the bill.

In this regard, the RESTRICT Act resembles an American version of China’s “Great Firewall,” which isolates its citizens from a significant portion of the World Wide Web. However, unlike in China, where VPN usage does not automatically lead to imprisonment and many citizens use it to access popular apps and video games without repercussions, the RESTRICT Act imposes much more severe penalties on those who violate its provisions. Already, conservatives are sounding the alarm on the dangers of the bill, including Tucker Carlson, who dedicated a monologue warning that it would provide the government the ability to “punish American citizens and regulate how they communicate on the Internet.”

Donald Trump Jr. wrote on Twitter: “Nothing is ever as it seems. The uniparty wants more power to control what we do and see. And now we’re going to give the Biden goons the ability to throw us in jail for 20 years if they decide we’re in violation of this craziness? No thanks.”

No, it won’t happen over night. Butt it doesn’t have to.

• Yellen Says Sanctions May Risk Hegemony Of US Dollar (AFP)

Economic sanctions imposed on Russia and other countries by the United States put the dollar’s dominance at risk as targeted nations seek out an alternative, Treasury Secretary Janet Yellen said Sunday. “There is a risk when we use financial sanctions that are linked to the role of the dollar that over time it could undermine the hegemony of the dollar,” Yellen said on CNN. “Of course, it does create a desire on the part of China, of Russia, of Iran to find an alternative,” she told the network’s Fareed Zakaria in an interview. “But the dollar is used as a global currency for reasons that are not easy for other countries to find an alternative with the same properties.”

The robust US capital markets and rule of law “are essential in a currency that is going to be used globally for transactions,” she added. “And we haven’t seen any other country that has the basic… institutional infrastructure that would enable its currency to serve the world like this.” Yellen noted that sanctions are an “extremely important tool,” all the more so when used by the United States and its allies as “a coalition of partners acting together to impose these sanctions.” Asked about the possibility of using frozen Russian assets to rebuild war-ravaged Ukraine after Moscow’s invasion, Yellen said that “Russia should pay for the damages that it’s caused.” But she noted there are “legal constraints on what we can do with frozen Russian assets, and we’re discussing with our partners what might lie in the future.”

At the same time that Germany closes three. Where’s the logic?

• Europe’s Largest Nuclear Reactor Launches 14 Years Behind Schedule (RT)

The Olkiluoto 3 (OL3) nuclear reactor in southwest Finland has begun electricity production, the head of the plant’s operator Teollisuuden Voima (TVO) said in a statement on Sunday. After a lengthy testing phase at the facility in Eurajoki, regular output was scheduled to start on Monday, but was instead launched at 2am on Sunday. The 1.6 gigawatt OL3 is the most powerful nuclear reactor in Europe, and the third largest in the world. According to TVO President Jarmo Tanhua, it is expected to operate for at least 60 years and meet around 14% of Finland’s electricity demand. “The production of Olkiluoto 3 stabilizes the price of electricity and plays an important role in the Finnish green transition,” Tanhua stated. The construction of OL3 was launched back in 2005, and it was due to start producing electricity in 2009, but setbacks in the design work and a string of legal disputes resulted in a 14-year delay in its launch.

The reactor was connected to Finland’s national power grid in March last year and started test production, but several technical glitches forced TVO to postpone its transition to regular operation several times. OL3 is the third reactor at the Olkiluoto nuclear power plant. The first two units, OL1 and OL2, were commissioned in 1978 and 1980, respectively. During 2021, the Olkiluoto facility produced 14.4 terrawatt hours of power, roughly one sixth of Finland’s total electricity consumption. The newly completed reactor is expected to help Finland cut its reliance on power imports from Sweden and Norway, and make up for the supplies lost after Russia stopped power exports to the country last May, when Russian utility Inter RAO stopped receiving payments for electricity sold to Finland via the pan-European exchange Nord Pool.

“Kerry has flown over 180,000 miles as ‘Climate Czar,’ emitting 10 million pounds of carbon.”

• Climate Czar Kerry Boasts There’s ‘No Rolling Back’ Clean Energy Transition (TP)

U.S. climate czar John Kerry claimed in an interview on Sunday that “so much has been invested in clean energy that there can be no rolling back of moves to end carbon emissions,” according to an interview with the Associated Press. Kerry claimed that if countries phase out petroleum-based fuels, the world can purportedly limit average global warming to 1.7 degrees Celsius (2.7 degrees Fahrenheit). “We’re in a very different place than where we were a year ago, let alone two and three years ago,” Kerry said. “But we’re not doing everything we said we’d do,” he said, after attending a meeting of energy and environment ministers of the Group of Seven wealthy nations. “A lot of countries need to step up including ours to reduce emissions faster, deploy renewables faster, bring new technologies online faster all of that has to happen.”

Kerry said the G-7 talks in northeastern Japan’s Sapporo were “really constructive” in attempting to forge a consensus on eliminating carbon-based fuels. “The United States and all the developed world has the responsibility to help the developing world through this crisis,” he said. “Those countries will really determine what happens. If they will reduce, if they will take the lead, if they will start deploying the new technologies, if they will stop using unabated fossil fuels, we’ll up the chance of winning this battle.” On Thursday, President Joe Biden is scheduled to attend a Major Economies Forum, which includes leaders of 20 nations that account for more than three-quarters of global carbon emissions. The summit offers another opportunity for committing resources to the goal of reaching zero emissions by 2050, Kerry said. “We agreed that we need to get back together personally, visit and try to see what we can find to work on together to accelerate the process. Is that doable? I hope so,” Kerry said.

“..a dangerous fiction crippling the West..”

“..the economic growth and well-being in Europe and the United States are more threatened by extremist and delusional environmental policies than by global warming.”

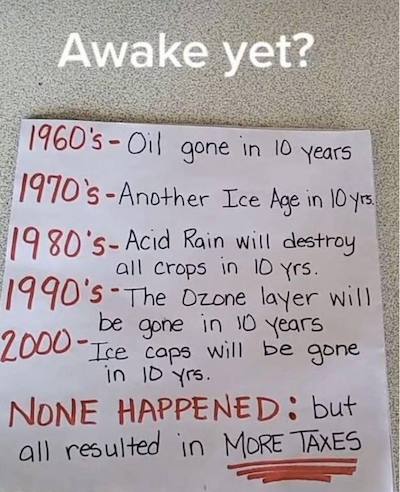

• Think Tank Insists Climate Change Alarmism Is ‘a Lie that Must Stop’ (BB)

Alarmism over a so-called “climate emergency” is a dangerous fiction crippling the West, declares the Gatestone Institute, a non-partisan international policy council and think tank. The West is unilaterally destroying its energy generating capabilities while the rest of the world continues to take advantage of readily available and relatively inexpensive fossil fuels, Gatestone notes in an April 14 report. As an example of this, China has been opening an average of two new coal-fired power plants a week and global CO2 emissions in the entire non-Western world continue to rise since there is not yet “any available, inexpensive alternative to fossil fuels,” states the report, written by Drieu Godefridi.

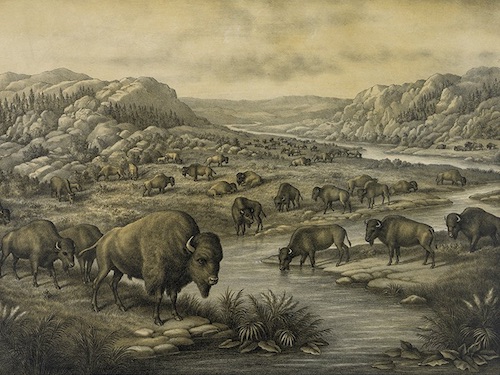

The 16th century was the coldest century of the last 9,000 years. This occurred at a time when 100 million bison roamed the Great Plains emitting methane. According to cultists of the #ClimateScam, a comparable number of cattle now is heating the earth out of control.

Citing data from the most recent study by the Intergovernmental Panel on Climate Change (IPCC), Gatestone asserts that “the economic growth and well-being in Europe and the United States are more threatened by extremist and delusional environmental policies than by global warming.” In other words, efforts to combat climate change in the West are doing more harm than anything seen from climate change itself. Dangerously diminished energy security has been starkly evident over the past year during the Russian aggression against Ukraine, as energy prices have soared and Western nations have found themselves scrambling to meet demand by seeking assistance from unfriendly regimes.

Attempts to transition to so-called renewables have also produced a “a cruel increase in Europe’s dependence on China’s rare earth minerals,” which Beijing will use to full advantage, the report argues. Zealous climate alarmist Frans Timmermans, First Vice-President of the European Commission, for instance, has multiplied “measures, initiatives, and declarations aimed at drastically reducing European CO2 emissions — even at the cost of Europe’s economic devastation,” the report contends, as well as “at the cost of freedom.” The report concludes by asserting that future generations “will judge us harshly for allowing extremist environmental activism to enfeeble us in the West, while a hostile East – China, Russia, North Korea and Iran — continue to advance their industrial and military capabilities.”

RFK jr

“Only 30 million Americans will die in the war against Russia. But we will kill 130 million Russians”— how US military generals, Pentagon, CIA etc. tried to sell their plans to President JFK.

The same kind of psychopaths — only more emboldened now — are still running the US.… pic.twitter.com/AbAcLV1Uw4

— S.L. Kanthan (@Kanthan2030) April 14, 2023

Indonesia’s remote Sumba Island is famous for a great many things, but above all its uniquely shaped mangroves, dubbed “dancing trees” for the way they seem to sway with the setting sun in the background

Deinosuchus is an extinct genus of alligatoroid crocodilian, related to modern alligators and caimans, that lived 82 to 73 million years ago. The largest adults measuring 10.64 m

Trunk

An elephant uses its trunk for a very wide spectrum of activities: for breathing and exploring things, to pick up and throw objects, as a snorkel when swimming under water and even to rub an itchy eye

[read more: https://t.co/uWYuWo6fuI]pic.twitter.com/yVGaYtfeg9

— Massimo (@Rainmaker1973) April 16, 2023

The story of the tiger that in 1997 was wounded by a poacher who also stole part of its kill: the tiger found the poacher’s cabin, destroyed his belongings, waited at least half a day for him to return, then killed and ate him [read more: https://buff.ly/2IhMG4w]

Photographer Karmen Jones-Cox captured this stunning shot of a whale shark off the Big Island of Hawaii, providing an idea of the scale of the filter-feeding fish compared to a diver [source: https://buff.ly/3AB1mHc]

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.