Georgia O’Keeffe Street of New York II 1926

From the Read and Weep department.

• Bleak Legacy Of The Greek Crisis (K.)

Quarterly figures released by Greece’s statistical authority (ELSTAT) last week point to a range of interesting, albeit worrying, trends. Beyond the economy (the surpluses, the debt and the gross domestic product, which appears to be on the slow path of recovery after a decade of constant decline), ELSTAT’s “Greece in Numbers” survey highlights a multitude of structural shortcomings and widespread impoverishment that are undermining the country’s long-term prospects. Demographic trends are among ELSTAT’s most alarming findings. According to the survey, Greece’s dependency ratio – which acts as an indicator of the balance between the working population and older people typically supported by it – has increased from 51.8 in 2011 to 55.2 in 2015 (most recent data).

Meanwhile, the aging index, or the proportion of persons aged 60 years and above per 100 persons under the age of 15, rose from 132.9 in 2011 to 145.5 in 2015. Over the same period, the fertility index dropped from 1.5 to 1.3. (2.1 live births per woman is considered the replacement level in developed countries). Greece had a negative birth to death ratio every year in the past five years, as the deficit rose from 16,297 in 2012 to 29,365 in 2015 (the number last year declined to 25,894). In 2016, moreover, the Greek unemployment rate was 23.5% of the workforce (1.195 million people) – the lowest in five years. However, jobless numbers remain extremely high, with the highest figure being recorded in 2013 at 1.33 million unemployed persons, or 27.5% of the workforce.

ELSTAT data on long-term unemployment expose another dramatic dimension of the crisis, as the rate of people out of work for 12 months or more climbed from 59.1% in 2012 to 72% in 2016. The overwhelming majority of these people receive no state benefits. The belt-tightening imposed by the country’s lingering recession is confirmed by data on average monthly household spending on goods and services. Spending has plunged from 1,824.02 euros in 2011 to 1,419.57 euros in 2015. Meanwhile, annual household expenditure on health (which tends to be inelastic) dipped from 114.58 euros to 107.06 euros over the same period. However, annual spending on food has seen a sharp decline from 355.05 euros to 293.30 euros, while spending on hotels, cafes and restaurants has also dropped from 189.11 euros to 141.05 euros.

ELSTAT figures also show a spike in the share of the population that is deprived of at least three out of nine material necessities due to financial difficulties – the ability to pay unexpected expenses, to take a one-week annual holiday away from home, to enjoy a meal involving meat, chicken or fish every second day, to have adequate heating for their home, to purchase durable goods like a washing machine, color television, telephone or car, to cover payment arrears for the mortgage or rent, utility bills, hire purchase installments or other loan payments. This figure rose from 28.4% in 2011 to 38.5% last year (42.3% among persons aged up to 17 years old).

Read more …

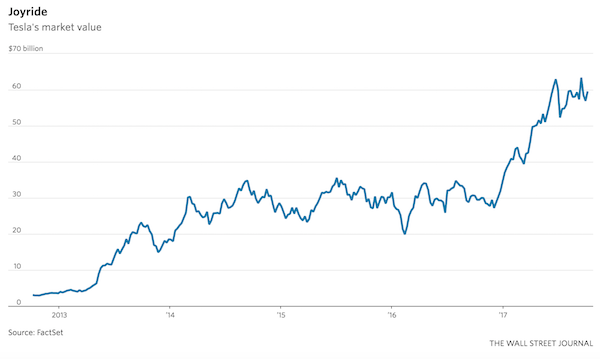

Jim Kunstler not long ago published a book entitled World Made by Hand. Turns out Tesla’s are made by hand. There’s poetic justice in there somewhere.

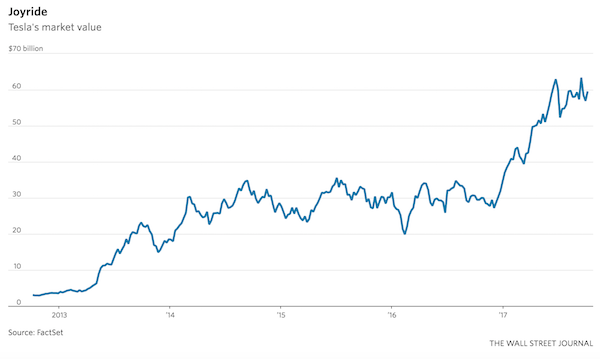

• The Truth Is Catching Up With Tesla (WSJ)

New revelations about Tesla’s production of the highly anticipated Model 3 sedan should shock, but not surprise, investors. The Wall Street Journal reported Friday that Tesla has recently been building major portions of the Model 3 by hand. This comes less than a week after Tesla announced it fell short of its third-quarter production guidance of 1,500 cars by more than 80%. At the time, Tesla attributed the shortfall to “production bottlenecks.” On Friday, Tesla said it would postpone its launch event for a new truck to November to deal with Model 3 issues and to help provide assistance to Puerto Rico. Tesla Chief Executive Elon Musk is known as a risk-taker, which has endeared him to Wall Street analysts and investors alike.

There is a fine line, however, between setting aggressive goals and misleading shareholders. Tesla is inching closer to that line. Tesla was making three Model 3s on an average day in the third quarter. Mr. Musk should have known in August, when production guidance was reiterated, that the company wasn’t going to produce 1,500 Model 3s by the end of September. There are other examples. At the Model 3 launch event in July, he told reporters that Tesla had received more than 500,000 customer deposits for the car. Five days later, after a series of questions from The Wall Street Journal, Mr. Musk revised that number to 455,000 on a conference call with investors. The earlier, higher figure he quoted had been “just a guess.”

Read more …

Creative accounting gone berserk.

• DOD, HUD Defrauded US Taxpayers Of $21 Trillion From 1998 To 2015 (MPN)

Last year, a Reuters article brought renewed scrutiny to the budgeting practices of the U.S. Department of Defense (DOD), specifically the U.S. Army, after it was revealed that the department had “lost” $6.5 trillion in 2015 due to “wrongful budget adjustments.” Nearly half of that massive sum, $2.8 trillion, was lost in just one quarter. Reuters noted that the Army “lacked the receipts and invoices to support those numbers [the adjustments] or simply made them up” in order to “create an illusion that its books are balanced.” Officially, the DOD has acknowledged that its financial statements for 2015 were “materially misstated.” However, this was hardly the first time the department had been caught falsifying its accounting or the first time the department had mishandled massive sums of taxpayer money.

The cumulative effect of this mishandling of funds is the subject of a new report authored by Dr. Mark Skidmore, a professor of economics at Michigan State University, and Catherine Austin Fitts, former assistant secretary of housing. Their findings are shocking. The report, which examined in great detail the budgets of both the DOD and the Department of Housing and Urban Development (HUD), found that between 1998 and 2015 these two departments alone lost over $21 trillion in taxpayer funds. The funds lost were a direct result of “unsupported journal voucher adjustments” made to the departments’ budgets. According to the Office of the Comptroller, “unsupported journal voucher adjustments” are defined as “summary-level accounting adjustments made when balances between systems cannot be reconciled.

Often these journal vouchers are unsupported, meaning they lack supporting documentation to justify the adjustment [receipts, etc.] or are not tied to specific accounting transactions.” The report notes that, in both the private and public sectors, the presence of such adjustments is considered “a red flag” for potential fraud. The amount of money lost is truly staggering. As co-author Fitts noted in an interview with USA Watchdog, the amount unaccounted for over this 17 year period amounts to “$65,000 for every man, woman and child resident in America.” By comparison, the cost per taxpayer of all U.S. wars waged since 9/11 has been $7,500 per taxpayer. The sum is also enough to cover the entire U.S. national debt, which broke $20 trillion less than a month ago, and still have funds left over. What’s more, the actual amount of funds lost — measured at $21 trillion – is likely to be much higher, as the researchers were unable to recover data for every year over the period, meaning the assessment is incomplete.

Read more …

Corruption rules the world.

• 1.34 Million Chinese Officials Have Been Punished For Graft Since 2013 (R.)

China’s anti-graft watchdog said roughly 1.34 million lower-ranking officials have been punished since 2013 under President Xi Jinping’s anti-corruption drive. Xi, who is preparing for a major Communist Party leadership conference later this month, has made an anti-graft campaign targeting “tigers and flies,” both high and low ranking officials, a core policy priority during his five-year term. China is preparing for the 19th Congress later this month, a twice-a-decade leadership event where Xi is expected to consolidate power and promote his policy positions.

Those punished for graft since 2013 include 648,000 village-level officials and most crimes were related to small scale corruption, said the Central Commission for Discipline Inspection (CCDI) on Sunday. While much of the country’s anti-graft drive has targeted lower ranking village and county officials, several high-ranking figures have been taken down. In August the head of the anti-graft committee for China’s Ministry of Finance was himself put under investigation for suspected graft.

Read more …

John Mauldin is doing a series on pensions. He covered the US a few weeks ago, this is a chapter from his analysis of Europe.

• The Coming Pension Storm May Be The End Of Europe As We Know It (Mauldin)

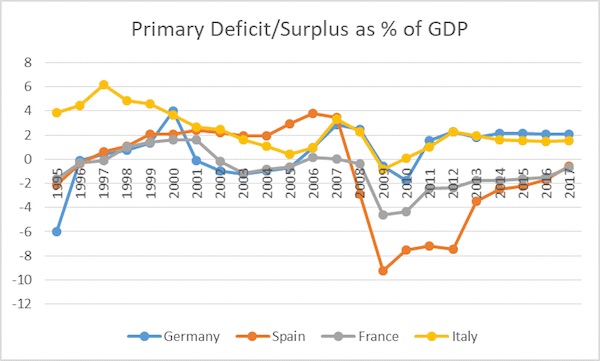

Switzerland and the UK have mandatory retirement pre-funding with private management and modest public safety nets, as do Denmark, the Netherlands, Sweden, Poland, and Hungary. Not that all of these countries don’t have problems, but even with their problems, these European nations are far better off than some others. The European nations noted above have nowhere near the crisis potential that the next group does: France, Belgium, Germany, Austria, and Spain. They are all pay-as-you-go countries (PAYG). That means they have nothing saved in the public coffers for future pension obligations, and the money has to come out of the general budget each year. The crisis for these countries is quite predictable, because the number of retirees is growing even as the number of workers paying into the national coffers is falling.

Let’s look at some details. Spain was hit hard in the financial crisis but has bounced back more vigorously than some of its Mediterranean peers did, such as Greece. That’s also true of its national pension plan, which actually had a surplus until recently. Unfortunately, the government chose to “borrow” some of that surplus for other purposes, and it will soon turn into a sizable deficit. Just as in the US, Spain’s program is called Social Security, but in fact it is neither social nor secure. Both the US and Spanish governments have raided supposedly sacrosanct retirement schemes, and both allow their governments to use those savings for whatever the political winds favor.

The Spanish reserve fund at one time had €66 billion and is now estimated to be completely depleted by the end of this year or early in 2018. The cause? There are 1.1 million more pensioners than there were just 10 years ago. And as the Baby Boom generation retires, there will be even more pensioners and fewer workers to support them. A 25% unemployment rate among younger workers doesn’t help contributions to the system, either. Overall, public pension plans in the pay-as-you-go countries would now replace about 60% of retirees’ salaries. Plus, several of these countries let people retire at less than 60 years old. In most countries, fewer than 25% of workers contribute to pension plans. That rate would have to double in the next 30 years to make programs sustainable. Sell that to younger workers.

Read more …

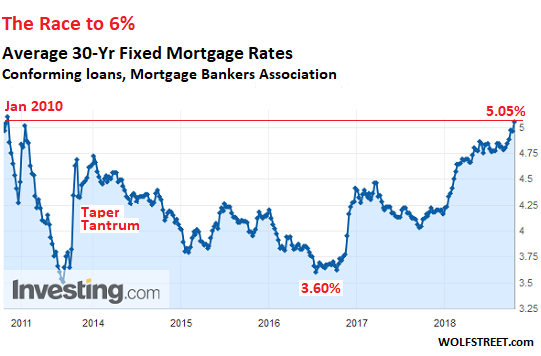

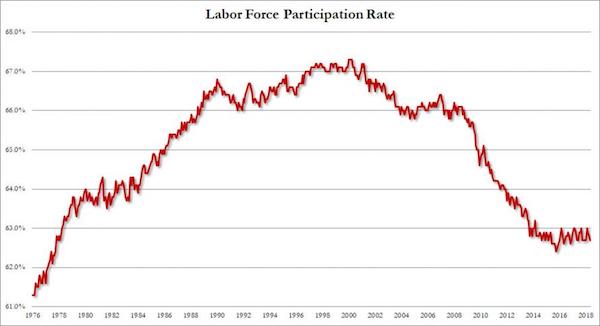

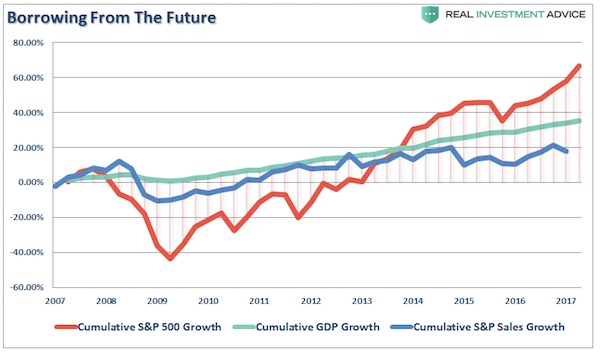

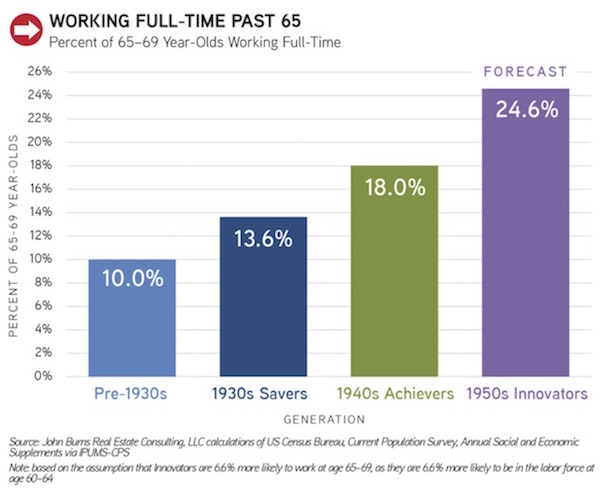

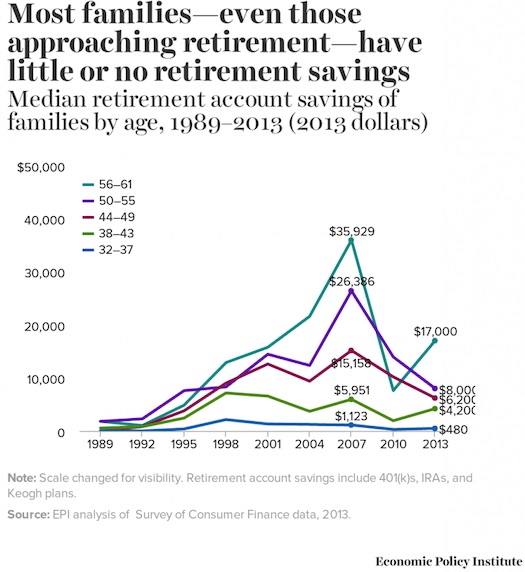

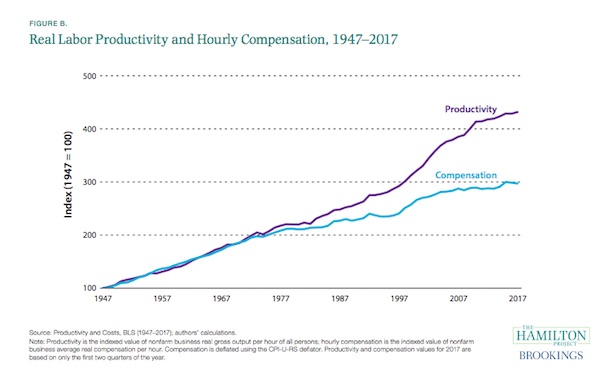

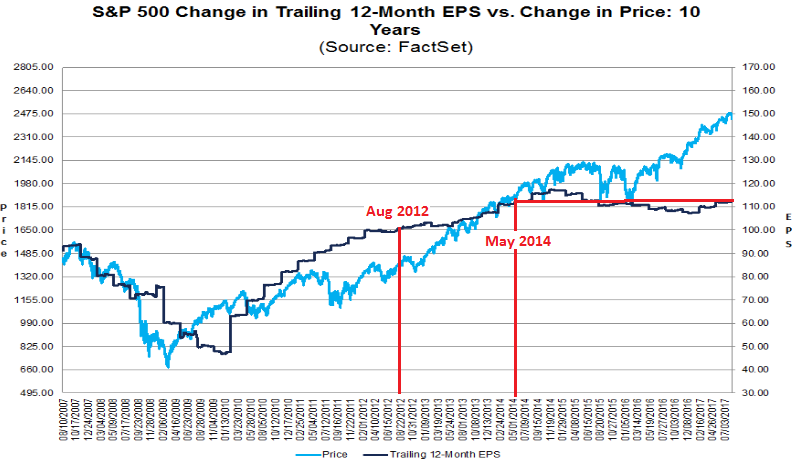

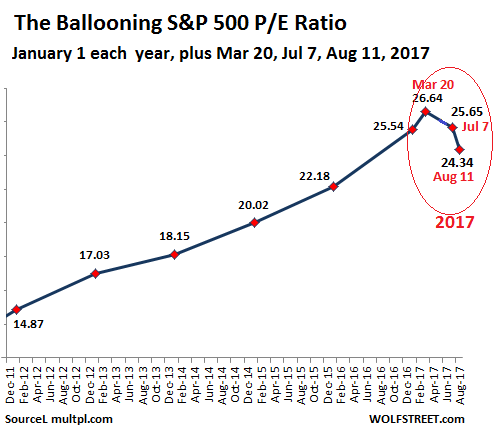

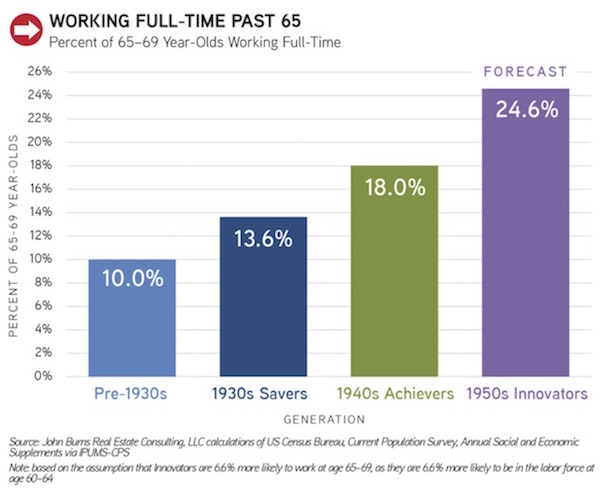

Here’s Mauldin on US pensions etc. I added a graph which shows that individuals save less just as Uncle Sam loses control of promises made.

• Uncle Sam’s Unfunded Promises (Mauldin)

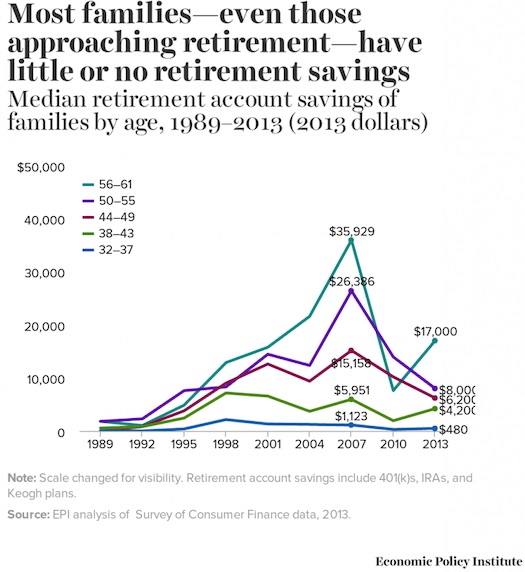

I have to warn you: You may be hopping mad when you finish reading this. In the United States we have two national programs to care for the elderly. Social Security provides a small pension, and Medicare covers medical expenses. All workers pay taxes that supposedly fund the benefits we may someday receive. That’s actually not true, as we will see in a little bit. Neither of these programs is comprehensive. Living on Social Security benefits alone is a pretty meager existence. Medicare has deductibles and copayments that can add up quickly. Both programs assume people have their own savings and other resources. Nevertheless, the programs are crucial to millions of retirees, many of whom work well past 65 just to keep up with their routine expenses. This chart from my friend John Burns shows the growing trend among generations to work past age 65. Having turned 68 a few days ago, I guess I’m contributing a bit to the trend:

Limited though Social Security and Medicare are, we attribute one huge benefit to them: They’re guaranteed. Uncle Sam will always pay them – he promised. And to his credit, Uncle Sam is trying hard to keep his end of the deal. In fact, he’s running up debt to do so. Actually, a massive amount of debt. Federal debt as a percentage of GDP has almost doubled since the turn of the century. The big jump occurred during the 2007–2009 recession, but the debt has kept growing since then. That’s a consequence of both higher spending and lower GDP growth. In theory, Social Security and Medicare don’t count here. Their funding goes into separate trust funds. But in reality, the Treasury borrows from the trust funds, so they simply hold more government debt.

The Treasury Department tracks all this, and you can read about it on their website, updated daily. Presently it looks like this: • Debt held by the public: $14.4 trillion • Intragovernmental holdings (the trust funds): $5.4 trillion • Total public debt: $19.8 trillion. Total GDP is roughly $19.3 trillion, so the federal debt is about equal to one full year of the entire nation’s collective economic output. In fact, it’s even more when you consider that GDP counts government spending as “production,” even when Uncle Sam spends borrowed money. Of course, that total does not count the $3 trillion-plus of state and local debt, which in almost every other country of the world is included in their national debt numbers. Including state and local debt in US figures would take our debt-to-GDP above 115%. And rising.

An old statute requires the Treasury to issue an annual financial statement, similar to a corporation’s annual report. The FY 2016 edition is 274 enlightening pages that the government hopes none of us will read. Among the many tidbits, it contains a table on page 63 that reveals the net present value of the US government’s 75-year future liability for Social Security and Medicare. That amount exceeds the net present value of the tax revenue designated to pay those benefits by $46.7 trillion. Yes, trillions. Where will this $46.7 trillion come from? We don’t know. Future Congresses will have to find it somewhere. This is the fabled “unfunded liability” you hear about from deficit hawks. Similar promises exist to military and civil service retirees and assorted smaller groups, too. Trying to add them up quickly becomes an exercise in absurdity.

Read more …

Must read. Dutch anthropologist Joris wrote about the City for the Guardian. You’d almost wish this had been his topic instead for those 5 years.

• How I Learnt To Loathe England (Joris Luyendijk)

When I came to live in London with my family in 2011 I did not have to think of a work or residency permit. My children quickly found an excellent state primary school, and after a handful of calls we enjoyed free healthcare, and the right to vote in local elections. The only real bureaucratic hassle we encountered that warm summer concerned a permit to park. It all seemed so smooth compared to earlier moves to the United States, Egypt, Lebanon and Israel/Palestine. Then again, this time we were moving in with our cousins—weren’t we? We had arrived as fellow Europeans, but when we left this summer to return to the Netherlands we felt more like foreigners: people tolerated as long as they behave. At best we were “European Union nationals” whose rights would be subject to negotiations—bargaining chips in the eyes of politicians.

As we sailed from Harwich, it occurred to me that our departure would be counted by Theresa May as five more strikes towards her goal of “bringing down net immigration to the tens of thousands.” The Dutch and the British have a lot in common, at first sight. Sea-faring nations with a long and guilty history of colonial occupation and slavery, they are pro free-trade and have large financial service industries—RBS may even move its headquarters to Amsterdam. Both tend to view American power as benign; the Netherlands joined the occupations of Afghanistan and Iraq. Shell, Unilever and Elsevier are just three examples of remarkably successful Anglo-Dutch joint ventures. I say “remarkably” because I’ve learned that in important respects, there is no culture more alien to the Dutch than the English (I focus on England as I’ve no experience with Wales, Scotland or Northern Ireland).

Echoing the Calvinist insistence on “being true to oneself,” the Dutch are almost compulsively truthful. Most consider politeness a cowardly form of hypocrisy. Bluntness is a virtue; insincerity and backhandedness are cardinal sins. So let me try to be as Dutch as I can, and say that I left the UK feeling disappointed, hurt and immensely worried. We did not leave because of Brexit. My wife and I are both Dutch and we want our children to grow roots in the country where we came of age. We loved our time in London and have all met people who we hope will become our friends for life. But by the time the referendum came, I had become very much in favour of the UK leaving the EU. The worrying conditions that gave rise to the result—the class divide and the class fixation, as well as an unhinged press, combine to produce a national psychology that makes Britain a country you simply don’t want in your club.

Read more …

Also from Prospect magazine, like the previous article.

• Imperialism Still Stops Britain From Grasping How It Looks To The World (PM)

Amongst politicians as well as writers, a passing reference to fallen empires could invoke the aura of national decline far more efficiently than any statistic. As the 1950s gave way to the 60s, decolonisation picked up pace, and Ian Macleod, the pragmatic Colonial Secretary, did not stand in the way. But he did—perhaps ruefully—recall how the vanishing empire had once brought “consolation” to “this bright little, tight little island.” What was at stake was not any specific longing for a particular colonial enclave, but a generalised feeling of relegation to the confined spaces of England. Many a contemporary British observer advocated “going into Europe” as the only way to break this cycle of confusion and self-hatred. It took three attempts, with first Harold Macmillan and then Wilson being given the “Non” before Edward Heath finally secured entry in 1973.

With a bold commitment to a new corporate enterprise, it was hoped Britain’s lost latitude could at last be restored. Any material prosperity at stake seemed almost incidental to the emotional shock therapy that lay in store. The deed was done with little regard for the future of Australian butter or New Zealand lamb, but these were sentimental hankerings that most in Britain could happily do without. More recently, however, the tables have turned. The once liberating tonic of “Europe” has come to be seen as the cause of Britain’s confinement. What the likes of Hartley would have made of the current fetish for “Global Britain” leaves little to the imagination. Despite the passing of nearly 60 years, concerns about the proper scale of Britain not only permeate the airwaves but also play directly into political decision-making.

Take the overwhelming support for Trident in the House of Commons, for example, and the widespread belief, which defies publicly-available information about how its maintenance entirely depends on US goodwill, that it constitutes an “independent” nuclear deterrent. Consider, too, the endlessly-repeated claim, earnestly mouthed by ministers of all stripes as a self-evident truth, that the UK must somehow “punch above its weight on the world stage.” And consider, most pressingly, the suggestion that the rest of the world will be excited by the chance to haggle a bespoke British trade deal, despite ample indications to the contrary and the obvious perils of jeopardising access to the world’s largest single market for such risky returns.

Read more …

Main protests this weekend are aimed at getting parties to talk. Can Rajoy continue to resist that? Will Merkel let him?

• Federal Police Stay, No Talks & No Independent Catalonia – Spanish PM (RT)

Madrid will use all legal means to stop Catalonia’s secession, PM Mariano Rajoy said, ruling out talks with separatists and vowing to keep federal police in the region, where 800 people were injured in a crackdown on last week’s independence referendum. In an interview with El Pais newspaper on Saturday, Spanish Prime Minister Rajoy indicated that he is not going to back down from his tough stance on Catalonia’s independence, reiterating that until the regional government abandons its intention to proclaim independence, no talks can take place. “As long as it does not go back to legality, I certainly will not negotiate,” Rajoy said, adding that while the Spanish government appreciates proposals to mediate between the national and Catalan governments, it will have to reject them.

“I would like to say one thing about mediation: we do not need mediators. What we need is that whoever is breaking the law and whoever has put themselves above the law rectifies their position,” the PM said. Rajoy further said that the national government will do whatever it takes to ensure that an independent Catalonia never happens. “We are going to prevent independence from occurring. That is why I can tell you with absolute frankness that it will not happen,” he said, adding that Madrid is within its rights to “take any decisions that the laws allow us,” depending on the way the crisis unravels. One of the actions that the Spanish government is considering taking if necessary is the enforcement of Article 155 of the Spanish Constitution, which enables the prime minister to dissolve the Catalonian government and call for snap local elections.

“I do not rule out anything that the law says,” Rajoy said of the option, adding that there is “no risk at all” that Spain will disintegrate. “Spain will not be divided and national unity will be maintained. We will use all the instruments that the legislation gives us,” he said. [..] The Catalonia dispute should be considered a challenge not only to Spain but also to the “great European project,” Rajoy argued, calling it “the battle of Europe.” “The battle of European values is under way and we have to win it,” he said, drawing parallels between such challenges to the European project from populist and separatist sentiments that have been gaining traction in Europe recently.

Read more …

January 1 2018, Bulgaria takes over EU presidency. They don’t want any immigrants.

• Splits In EU Could See Bloc Topple: Polish President (PAP)

Poland does not agree to the European Union ordering countries to accept “forcibly relocated” migrants, President Andrzej Duda has said, warning that splits in the bloc could bring about its collapse. After Thursday’s talks with his Bulgarian counterpart in Warsaw, Duda said the European Union’s rules of unity mean “we work together … we do not try to force other countries into acting against their will and against their people”. “Which is why we do not agree to being dictated to, against the Polish people’s will, as regards the quota system, as regards forcible relocation of people to Poland,” Duda added.

In September 2015, when an earlier government was in power in Warsaw, EU leaders agreed that each country would accept a number of migrants over two years to alleviate the pressure on Greece and Italy, which have seen the arrival of tens of thousands of people from the Middle East. EU leaders agreed to relocate a total of about 160,000 migrants of more than two million people who arrived in Europe since 2015. But after coming to power in 2015, Poland’s conservative Law and Justice party, from which Duda hails, refused to honour that commitment. Poland now faces action from Brussels, which has threatened possible sanctions.

Speaking at a press conference after his meeting with Bulgarian President Rumen Radev, Duda said the future of the European Union was the main topic of talks, as Bulgaria prepares to take over the rotating presidency over the bloc at the beginning of next year. He added that Poland and Bulgaria had “the same position” on Europe’s migration crisis. Duda said that both countries want “preventative action”, which means protecting the European Union’s borders and sending aid to refugees and potential migrants “close to their countries”.

Read more …

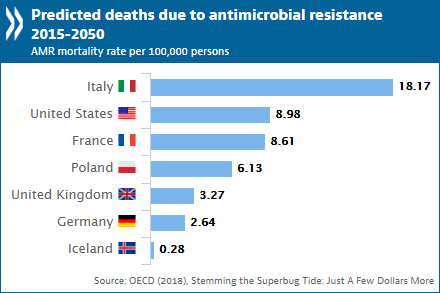

Standard hospital procedures will become impossible.

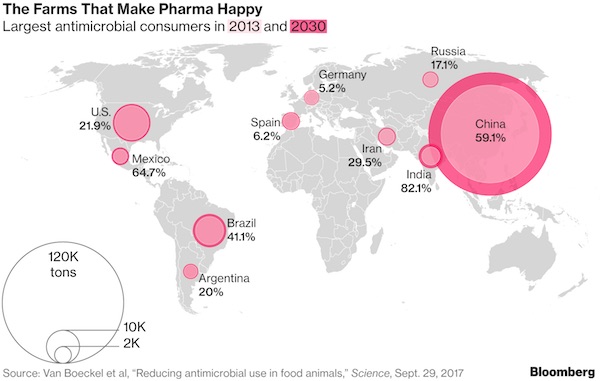

“The world will face the same risks as it did before Alexander Fleming discovered penicillin in 1928.”

• Antibiotic Apocalypse (G.)

Scientists attending a recent meeting of the American Society for Microbiology reported they had uncovered a highly disturbing trend. They revealed that bacteria containing a gene known as mcr-1 – which confers resistance to the antibiotic colistin – had spread round the world at an alarming rate since its original discovery 18 months earlier. In one area of China, it was found that 25% of hospital patients now carried the gene. Colistin is known as the “antibiotic of last resort”. In many parts of the world doctors have turned to its use because patients were no longer responding to any other antimicrobial agent. Now resistance to its use is spreading across the globe. In the words of England’s chief medical officer, Sally Davies: “The world is facing an antibiotic apocalypse.”

Unless action is taken to halt the practices that have allowed antimicrobial resistance to spread and ways are found to develop new types of antibiotics, we could return to the days when routine operations, simple wounds or straightforward infections could pose real threats to life, she warns. That terrifying prospect will be the focus of a major international conference to be held in Berlin this week. Organised by the UK government, the Wellcome Trust, the UN and several other national governments, the meeting will be attended by scientists, health officers, pharmaceutical chiefs and politicians. Its task is to try to accelerate measures to halt the spread of drug resistance, which now threatens to remove many of the major weapons currently deployed by doctors in their war against disease.

The arithmetic is stark and disturbing, as the conference organisers make clear. At present about 700,000 people a year die from drug-resistant infections. However, this global figure is growing relentlessly and could reach 10 million a year by 2050. The danger, say scientists, is one of the greatest that humanity has faced in recent times. In a drug-resistant world, many aspects of modern medicine would simply become impossible. An example is provided by transplant surgery. During operations, patients’ immune systems have to be suppressed to stop them rejecting a new organ, leaving them prey to infections. So doctors use immunosuppressant cancer drugs. In future, however, these may no longer be effective.

Or take the example of more standard operations, such as abdominal surgery or the removal of a patient’s appendix. Without antibiotics to protect them during these procedures, people will die of peritonitis or other infections. The world will face the same risks as it did before Alexander Fleming discovered penicillin in 1928. [..] “In the Ganges during pilgrimage season, there are levels of antibiotics in the river that we try to achieve in the bloodstream of patients,” says Davies. “That is very, very disturbing.”

Read more …

What are we waiting for?

• Want To Avert The Apocalypse? Take Lessons From Costa Rica (G.)

A beautiful Central American country known for its lush rainforests and stunning beaches, Costa Rica proves that achieving high levels of human wellbeing has very little to do with GDP and almost everything to do with something very different. Every few years the New Economics Foundation publishes the Happy Planet Index – a measure of progress that looks at life expectancy, wellbeing and equality rather than the narrow metric of GDP, and plots these measures against ecological impact. Costa Rica tops the list of countries every time. With a life expectancy of 79.1 years and levels of wellbeing in the top 7% of the world, Costa Rica matches many Scandinavian nations in these areas and neatly outperforms the United States. And it manages all of this with a GDP per capita of only $10,000, less than one fifth that of the US.

In this sense, Costa Rica is the most efficient economy on earth: it produces high standards of living with low GDP and minimal pressure on the environment. How do they do it? Professors Martínez-Franzoni and Sánchez-Ancochea argue that it’s all down to Costa Rica’s commitment to universalism: the principle that everyone – regardless of income – should have equal access to generous, high-quality social services as a basic right. A series of progressive governments started rolling out healthcare, education and social security in the 1940s and expanded these to the whole population from the 50s onward, after abolishing the military and freeing up more resources for social spending. Costa Rica wasn’t alone in this effort, of course.

Progressive governments elsewhere in Latin America made similar moves, but in nearly every case the US violently intervened to stop them for fear that “communist” ideas might scupper American interests in the region. Costa Rica escaped this fate by outwardly claiming to be anti-communist and – horribly – allowing US-backed forces to use the country as a base in the contra war against Nicaragua. The upshot is that Costa Rica is one of only a few countries in the global south that enjoys robust universalism. It’s not perfect, however. Relatively high levels of income inequality make the economy less efficient than it otherwise might be. But the country’s achievements are still impressive. On the back of universal social policy, Costa Rica surpassed the US in life expectancy in the late 80s, when its GDP per capita was a mere tenth of America’s.

Today, Costa Rica is a thorn in the side of orthodox economics. The conventional wisdom holds that high GDP is essential for longevity: “wealthier is healthier”, as former World Bank chief economist Larry Summers put it in a famous paper. But Costa Rica shows that we can achieve human progress without much GDP at all, and therefore without triggering ecological collapse. In fact, the part of Costa Rica where people live the longest, happiest lives – the Nicoya Peninsula – is also the poorest, in terms of GDP per capita. Researchers have concluded that Nicoyans do so well not in spite of their “poverty”, but because of it – because their communities, environment and relationships haven’t been ploughed over by industrial expansion.

Read more …