Banksy Steve Jobs, son of a Syrian immigrant 2015

It’s not a bluff, it’s desperation on all sides.

• Russia Calls Saudi Bluff, Plans $40 Oil For Seven Years (AEP)

Russia is battening down the hatches for a Biblical collapse in oil revenues, warning that crude prices could stay as low as $40 a barrel for another seven years. Maxim Oreshkin, the deputy finance minister, said the country is drawing up plans based on a price band fluctuating between $40 to $60 as far out as 2022, a scenario that would have devastating implications for Opec. It would also spell disaster for the North Sea producers, Brazil’s off-shore projects, and heavily indebted Western producers. “We will live in a different reality,” he told a breakfast forum hosted by Russian newspaper Vedomosti. The cold blast from Moscow came as US crude plunged to $35.56, pummelled by continuing fall-out from the acrimonious OPEC meeting last week. Record short positions by hedge funds have amplified the effect.

Bank of America said there was now the risk of “full-blown price war” within Opec itself as Saudi Arabia and Iran fight out a bitter strategic rivalry through the oil market. Brent crude fell to $37.41, even though demand is growing briskly. It is the lowest since the depths of the Lehman crisis in early 2009. But this time it is a ‘positive supply shock’, and therefore beneficial for the world economy as a whole. The International Energy Agency said in its monthly market report that Opec has stopped operating as a cartel and is “pumping at will”, aiming to drive out rivals at whatever cost to its own members. Opec revenues will fall to $400bn (£263bn) this year if current prices persist, down from $1.2 trillion in 2012. This is a massive shift in global wealth.

The IEA said global oil stocks were already at nose-bleed levels of 2,971m barrels, and were likely to increase by another 300m over the next six months as “free-wheeling Opec policy” floods the market. The watchdog played down fears that the world was running out of sites to store the glut, citing 230m barrels of new storage coming on stream. Inventories in the US are still only at 70pc capacity. But this could change once Iranian crude comes on stream later next year. Russia’s $40 warning is the latest escalation in a game of strategic brinkmanship between the Kremlin and Saudi Arabia, already at daggers drawn over Syria. The Russian contingency plans convey a clear message to Riyadh and to Opec’s high command that the country can withstand very low oil prices indefinitely, thanks to a floating rouble that protects the internal budget.

Saudi Arabia is trapped by a fixed exchange peg, forcing it to bleed foreign reserves to cover a budget deficit running at 20pc of GDP. Russia claims to have the strategic depth to sit out a long siege. It is pursuing an import-substitution policy to revive its industrial and engineering core. It can ultimately feed itself. The Gulf Opec states are one-trick ponies by comparison. The deputy premier, Arkady Dvorkovich, told The Telegraph in September that Opec will be forced to change tack. “At some point it is likely that they are going to have to change policy. They can last a few months, to a couple of years,” he said. Kremlin officials suspect that the aim of Saudi policy is to force Russia to the negotiating table, compelling it to join Opec in a super-cartel controlling half the world’s production.

“Wall Street margined the Fed’s gift of collateral, and did so over and over in an endless chain of rehypothecation.”

• December 16, 2015 – When The End Of The Bubble Begins (Stockman)

They are going to layer their post-meeting statement with a steaming pile of if, ands & buts. It will exude an abundance of caution and a dearth of clarity. Having judged that a 25 bps pinprick is warranted, the FOMC will then plant itself firmly in front of the great flickering dashboard in the Eccles Building. There it will repose to a regimen of “watchful waiting”, scouring the entrails of the “incoming data” to divine its next move. Perhaps the waiting won’t be so watchful as all that, however. What is actually coming down the pike is something that may put the reader, at least those who have already been invited to join AARP, more in mind of that once a year hour-long special broadcast by Saturday morning TV back in the days of yesteryear; it explained how the Lone Ranger got his mask.

Memory fails, but either 12 or 19 Texas Rangers rode high in the saddle into a box canyon, confident they knew what was around the bend. Soon there was a lot of gunfire and then there was just one, and that was only because Tonto’s pony needed to stop for a drink. Yellen and her posse better pray for a monetary Tonto because they are riding headlong into an ambush in the canyons of Wall Street. To wit, they cannot possibly raise money market interest rates—-even by 75 bps—-without massively draining liquidity from the casino. Don’t they know what happened to the $3.5 trillion of central bank credit they have digitally printed since September 2008? Do they really think that fully $2.8 trillion of it just recycled right back to the New York Fed as excess bank reserves?

That is, no harm, no foul and no inflation? The monetary equivalent of a tree falling in an empty forest? To the contrary, how about recognizing the letter “f” for fungibility. What all that “excess” is about is collateral, not idle money. The $2.8 trillion needed an accounting domicile—so “excess reserves” was as good as any. But from a financial point of view it amounted to a Big Fat Bid for existing inventories of stocks and bonds. Stated more directly, Wall Street margined the Fed’s gift of collateral, and did so over and over in an endless chain of rehypothecation. So that’s why December 16th will be the beginning of the end of the bubble. If the Fed were to actually raise money market rates the honest way, and in the manner employed by central banks for a century or two, it would have to drain cash from the system; and it would have to do so in the trillions in order to levitate the vast sea of money it has pinned to the zero bound.

What excess money will buy you.

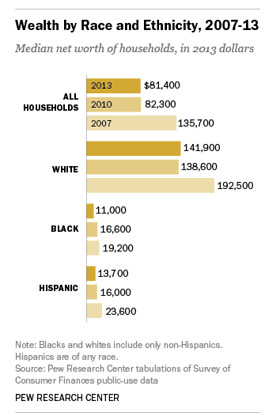

• Stocks Are More Overvalued Now Than At 2000 And 2007 Peaks (MarketWatch)

The stock market currently is even more overvalued than it was at the bull market peaks of both March 2000 and October 2007 — according to not just one, but two, valuation measures. That at least is the message of an analysis released earlier this week by Ned Davis Research, the quantitative research firm. What caught my eye in the firm’s analysis was that, unlike virtually all others that conclude that stocks are overvalued, this one was not based on the Shiller P/E — the cyclically-adjusted P/E ratio championed by Nobel laureate Robert Shiller. That’s noteworthy, since there would be nothing new in reporting that Shiller’s P/E shows stocks to be overvalued. That ratio has been giving this same message for several years now, and skeptics have found many ways of wriggling out from underneath its bearish implications.

But Ned Davis’s latest report focuses on something different: the median stock’s price/earnings and price/sales ratios. The median stock, of course, is the one for which exactly half have higher ratios and half have lower. By focusing on the median, Davis’s findings are immune from the charge that they are being skewed by outliers — such as the terrible earnings among energy companies. The chart at the top of this column summarizes what Davis found. Currently, according to his firm’s research, the median NYSE-listed stock has a price/earnings ratio of 25.6, when calculated based on trailing 12-month earnings. At the bull market peak in October 2007, for example, the comparable ratio was below 20; at the top of the Internet bubble in March 2000, it was even lower. In fact, according to Davis, the price/earnings ratio currently for the median NYSE stock is the highest it’s ever been since his data series began in 1980 — except for the bear-market lows of October 2002 and March 2009, when earnings were depressed by recessions.

Fed mouthpiece Hilsenrath with an pretty astonishing tale: After creating the biggest bubble ever, “the central bank remained ill-equipped to quell [..] dangerous asset bubbles..”

• As Commercial Real-Estate Prices Soar, Fed Weighs Consequences (WSJ)

Federal Reserve officials participating in a “war game” exercise this year came to a disturbing conclusion: Six years after the financial crisis ended, the central bank remained ill-equipped to quell the kind of dangerous asset bubbles that destabilized the savings-and-loan industry during the late 1980s, tech stocks in the 1990s and housing in the mid-2000s. The five officials—gathered at a conference table in Charlotte, N. C.—had to determine if hypothetical booms in commercial real estate and corporate borrowing risked collapse and damaging fallout for the broader economy. The group was asked what to do about it. Fed officials said afterward they saw they lacked clear-cut tools or a proper road map of regulatory measures to help stem the simulated booms.

They also disagreed on whether to use higher interest rates to stop bubbles, a blunt instrument affecting the entire economy. “I walked away more sure about the discomfort I originally had,” said Esther George, president of the Federal Reserve Bank of Kansas City and a participant in the June exercise. She and others believe the Fed’s low-rate policies might have played a role in booming asset prices. The worry has turned more concrete. Commercial real-estate prices are soaring and Fed officials face the conundrum of what, if anything, to do. “Signs of valuation pressures are emerging in commercial real-estate markets, where prices have been rising at a solid clip and lending standards have deteriorated, although debt growth has not yet accelerated notably,” Stanley Fischer, vice chairman of the Fed, said in a speech Thursday.

Central bank officials would feel an urgency to act only if they believed the commercial real-estate market could suffer a sharp reversal that destabilizes the financial system or hurts the U.S. economy. That isn’t clear. Commercial real estate is a relatively small segment of the overall economy, and unsustainable debt hasn’t emerged as a problem. But financial bubbles have been root causes of the past three recessions and is a consideration as the Fed nears a decision on interest rates. Officials have signaled they will raise short-term interest rates from near zero at their policy meeting next week with the economy and job market improving. For some officials, the commercial real estate boom—and other financial sector froth—could be an added incentive.

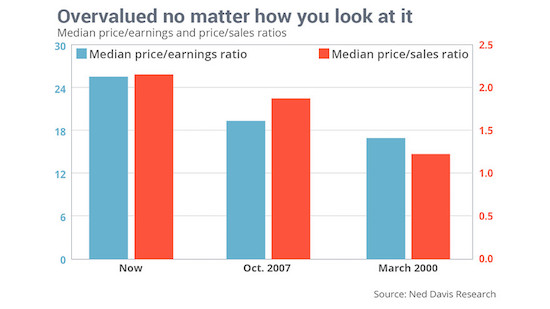

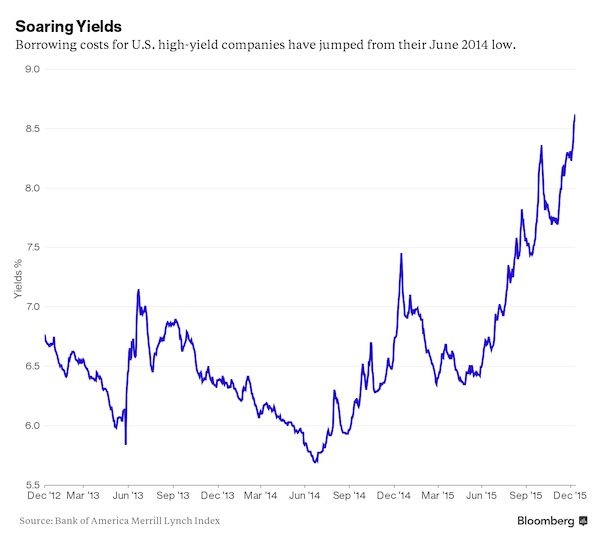

“High-yield bonds have led previous big reversals in S&P 500..”

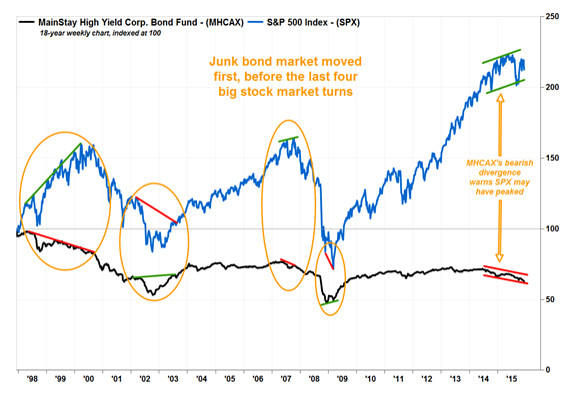

• Why The Junk Bond Selloff Is Getting Very Scary (MarketWatch)

The junk bond market is looking more and more like the boogeyman for stock market investors. The iShares iBoxx $ High Yield Corporate Bond exchange-traded fund dropped 2% on Friday to close at the lowest price since July 17, 2009. Volume 54.1 million shares, or nearly six times the 30-day average of 9.5 million shares, according to FactSet. While weakness in the junk bonds – bonds with credit ratings below investment grade – is nothing new, fears of meltdown have increased after high-yield mutual fund Third Avenue Focused Credit Fund on Thursday blocked investors from withdrawing their money amid a flood of redemption requests and reduced liquidity. This chart shows why stock market investors should care:

The MainStay High Yield Corporate Bond Fund was used in the chart instead of the iShares iBoxx ETF (HYG), because HYG started trading in April 2007. When investors start scaling back, and market liquidity starts to dry up, the riskiest investments tend to get hurt first. And when money starts flowing again, and investors start feeling safe, bottom-pickers tend to look at the hardest hit sectors first. So it’s no coincidence that when the junk bond market and the stock market diverged, it was the junk bond market that proved prescient.

There’s still no reason to believe the run on the junk bond market is nearing an end. As Jason Goepfert, president of Sundial Capital Research, points out, he hasn’t seen any sign of panic selling in the HYG, which has been associated with previous short-term bottoms. “Looking at one-month and three-month lows [in the HYG] over the past six years, almost all of them saw more extreme sentiment than we’re seeing now,” Goepfert wrote in a note to clients.

Icahn likes Trump to ‘shake up the system’.

• Carl Icahn: Junk Bond Market A ‘Keg Of Dynamite’ (CNBC)

Activist investor Carl Icahn renewed his warnings about the high-yield debt market Friday, criticizing a perceived lack of liquidity in junk bond funds. “The high-yield market is just a keg of dynamite that sooner or later will blow up,” he said on CNBC’s “Fast Money: Halftime Report.” Icahn’s comments echoed remarks he has made in recent months about the dangers of high-yield debt. They come as Third Avenue Management looked to block investors from withdrawing money from a nearly $1 billion junk bond fund that it is trying to liquidate. Third Avenue’s troubles could fuel concerns as markets await an interest rate decision next week from the Federal Reserve, another frequent Icahn target.

High-yield funds look perilous because “there’s no liquidity” behind them, Icahn contended. He voiced similar criticism of BlackRock this summer, saying some of its bond funds create an “extremely dangerous situation.” “The average person that goes into this should basically be warned,” he said Friday. Icahn stressed that financial support for some high-yield funds may prove shaky, and investors should be better informed about the risks. He noted that, while he does not support more government intervention, regulators may want to put increased attention on risks in the junk bond market.

Wille the Fed end up bailing out junk bonds?

• It Starts: Junk-Bond Fund Implodes, Investors Stuck (WS)

We have warned about “open-end” bond mutual funds, particularly those with a lot of high-yield bonds. We know some folks who got burned when Charles Schwab’s $13-billion bond fund SWYSX blew up during the financial crisis and lost 60% or so of its value before its data went offline. Schwab settled all kinds of class-action and individual lawsuits for cents on the dollar. It got in trouble over other bond funds. And other purveyors of bond funds got in trouble too. It works like this: When an “open-end” bond fund starts losing money, investors begin to sell it. Fund managers first use all available cash to pay investors. When the cash is gone, they sell the most liquid securities that haven’t lost much money yet, such as Treasuries. When they’re gone, they sell the most liquid corporate paper.

As they go down the line, they sell bonds that have already lost a lot of value. By now the smart money is betting against the fund, having figured out what’s happening. They’re shorting the very bonds these folks are trying to sell. The longer this goes on, the more money investors lose and the more spooked they get. It turns into a run. And people who still have that fund in their retirement account are getting cleaned out. Bond funds can be treacherous – especially if they hold dubious paper, which is never dubious until it suddenly is. And when they get in trouble, you want to be among the first out the door. The $1.8-trillion or so of US junk bonds are everywhere. Investors loved them because they have discernible yields in the Fed-designed zero-interest-rate environment. Junk bonds were hot, and so were the funds.

People went for them, with no idea that they were putting their nest egg in a fund larded with explosives. A significant part of Corporate America is junk rated, well-known names like Chrysler, Valeant Pharmaceuticals, or iHart Communications, yup, the LBO wunderkind owned by private equity firms and weighed down by $8.9 billion in debt that is now “distressed.” They issue debt because they’re cash-flow negative and need new money, or because they gorge on M&A, or have to fund share-buybacks and special billion-dollar dividends back to the private equity firms that own them. During the boom years of the credit bubble, nothing could go wrong. And now, as ever more junk bonds wither, crash, default, and cause their owners to tear out their hair – just then, a bond fund implodes. And the next crisis hasn’t even started yet.

Gundlach stands to lose big.

• Gundlach Says ‘Never Just One Cockroach’ In Any Credit Meltdown (Reuters)

Jeffrey Gundlach, the widely followed investor who runs DoubleLine Capital, warned Friday that crumbling credit markets could expose more fund debacles such as Third Avenue Management’s junk bond portfolio and the Federal Reserve should take note of deteriorating financial conditions. “I’d have to believe that if they met today that they wouldn’t raise rates,” Gundlach told Reuters in a telephone interview. “I mean, Wow. Look at the chart of JNK (The SPDR® Barclays High Yield Bond ETF). It’s accelerating to the downside.” Thursday, Martin Whitman’s Third Avenue Management said it was barring investor withdrawals while it liquidated its high-yield bond fund, an unusual move that highlights the dangers of loading up on risky assets that are hard to trade even in good times.

“There’s never just one cockroach” in any kind of credit meltdown, said Gundlach, who oversees $80 billion at the Los Angeles-based DoubleLine Capital. Investors have been on “credit overload,” in a reach for yield, Gundlach said. “People are too long credit and the credit is melting down and the stock market is whistling through the graveyard. It is so similar to 2007, it’s scary.” The junk-bond fund blowup comes ahead of next week’s Federal Reserve’s Open Market Committee meeting on December 15 and 16, at which time policy makers are expected to raise rates from near-zero levels for the first time in nearly a decade. Gundlach, who has been warning that the U.S. Federal Reserve should not tighten monetary policy next week, said: “They’re just hell-bent on raising rates. They talked that they would do it and they want to do it – and yet nominal GDP is lower than it was in September of 2012.” “Yet they did QE3 in September 2012,” Gundlach said.

Cockroach no. 1. Or is it no. 2?

• Third Avenue Redemption Freeze Sends Chill Through Credit Market (BBG)

Investors who piled into the riskiest corners of the credit markets during seven years of rock-bottom interest rates are getting a reminder of how hard it can be to cash out. With outflows from U.S. high-yield bond funds running at the fastest pace in more than a year, Martin Whitman’s Third Avenue Management took the rare step of freezing withdrawals from a $788 million credit mutual fund on Dec. 9. The firm’s assessment that meeting redemptions would be impossible without resorting to fire sales has put a spotlight on the dangers for junk-bond investors as the Federal Reserve prepares to lift interest rates as soon as next week. “It’s definitely a dark cloud over the market,” said Anthony Valeri at LPL Financial. Investor withdrawals “are driving the high yield market now more than anything.

Institutions – hedge funds and mutual funds – are being forced to get out and unfortunately that’s pressuring the entire market.” The selloff in riskier debt, fueled by tepid global economic growth and a collapse in earnings at commodity companies, deepened on Thursday as news of Third Avenue’s decision rattled investors. Yields on U.S. high-yield debt climbed to the highest in almost four years, putting the market on pace for its first annual loss since 2008, a Bank of America Merrill Lynch index shows. Growing tumult in credit markets comes eight years after BNP Paribas helped spark a global financial crisis by freezing withdrawals from three investment funds because it couldn’t “fairly” value their mortgage holdings.

While Third Avenue said its positions have the potential to deliver returns over a longer investment horizon, Berwyn Income Fund’s George Cipolloni said the similarities between today’s markets and those before the crisis are getting too big to ignore. “A lot of this looks like late 2007 or early 2008,” when the credit crunch began to take root, said Cipolloni, whose fund has outperformed 72% of peers tracked by Bloomberg over the past five years. “But instead of housing and mortgages, it’s energy and materials leading the decline.”

Losers. Big losers.

• Stone Lion Capital Partners Suspends Redemptions in Credit Hedge Funds (WSJ)

Stone Lion Capital Partners said it suspended redemptions in its credit hedge funds after many investors asked for their money back. The move, nearly unprecedented in the hedge-fund industry since the financial crisis, is the latest example of the sudden crunch facing traders across Wall Street looking to sell beaten-down positions. On Thursday, Third Avenue stunned investors with the announcement it was barring withdrawals while it liquidates a high-yield bond mutual fund, a move that intensified a selloff sweeping the junk-bond world. Stone Lion, founded in 2008 by Bear Stearns veterans Gregory Hanley and Alan Mintz, is in a similar malaise, facing heavy losses on so-called distressed investments including junk bonds, post reorganization equities and other special situations, people familiar with the matter said.

Its oldest set of credit funds, which manage $400 million altogether, received “substantial redemption requests,” precipitating the decision, the firm said in a statement. The firm didn’t give a time frame for when the money would be returned. A Stone Lion spokesman said suspending redemptions was the only way to “ensure fair and equitable treatment for all” investors. The firm continues to operate several other funds, including one that bets on Puerto Rico’s economic recovery. Stone Lion’s hedge funds were down about 7% through the end of July, when it cut off many prospective investors from receiving updates, people familiar said. In a midyear letter to investors, Messrs. Hanley and Mintz professed optimism in the “ultimate recovery figures underpinning our investment theses.” But the funds have suffered significant losses since then, the people said; investor documents indicate the funds manage 24% less now than they did at the end of July.

Beggar thy neighbor. And thyself?

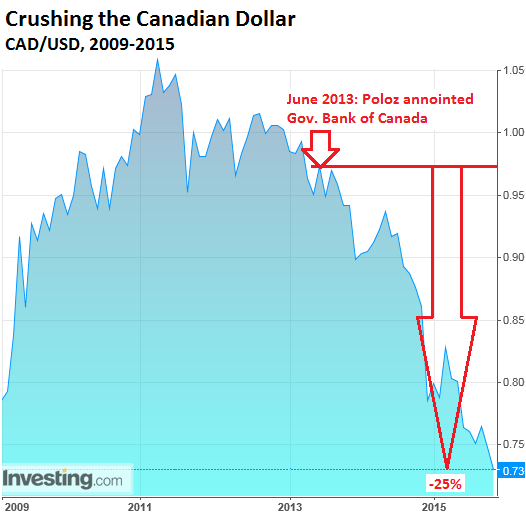

• Bank of Canada Crushes Loonie, Creates Mother of All Shorts (WS)

The Canadian dollar swooned 1% against the US dollar on Friday, to US$0.7270, after having gotten hammered for the past six of seven trading days. It’s down 5% in November so far, 15.5% year-to-date, and 31% from its post-Financial Crisis peak of $1.06 in April 2011. It hit the lowest level since June 2004. The commodities rout would have been bad enough. Given the importance of commodities to the Canadian economy, the multi-year decline in the prices of metals, minerals, and natural gas, and then starting in mid-2014, the devastating plunge of the price of oil, would have been sufficient in driving down the loonie. That the Fed has tapered QE out of existence last year and has been waffling and flip-flopping about rate hikes ever since made the until then beaten-down US dollar, at the time the most despised currency in the universe, less despicable – at the expense of the loonie.

Those factors would have been enough to knock down the loonie. But it wasn’t enough, not for the ambitious Bank of Canada Governor Stephen Poloz. The man’s got a plan. He is in an all-out currency war. He’s out to crush the loonie beyond what other forces are already accomplishing. He’s out to pulverize it, and no one knows how far he’ll go, or where he’ll stop, or if he’ll ever stop. He has singlehandedly created the short of a lifetime. It should spook every Canadian with income and assets denominated in Canadian dollars and those wanting to buy a home in Canada (we’ll get to that bitter irony in a moment). Poloz has been in office since June 2013, and this is what he has accomplished so far:

One reason for pulverizing the Canadian dollar is to boost revenues and earnings of exporters. They get to translate their foreign-currency revenues into Canadian dollars on their financial statements. And analysts love that. It doesn’t matter how the bigger numbers got there, whether by inflation or devaluation, as long as they’re bigger. And Canadian stocks could use some help. Despite the destruction of the loonie, the Toronto Stock Exchange index TSX has plunged 18% since its peak in June 2014 and is now back where it had been in September 2013.

So Poloz is trying to get Canadian workers to be able to compete with workers in Mexico and China and Bangladesh, and with those beaten-down wages in the US. His tool is to pulverize the currency. Alas, the Mexican peso too has gotten crushed. But ironically, the Bank of Mexico is spinning in circles to halt the decline. It’s selling its limited dollar reserves and buying pesos to prop up its currency, even as Canadians watch helplessly as their own currency descends into banana-republic status – something the US dollar used to excel at when the Fed was on its path of total dollar destruction.

Of course, more debt will solve everyhting.

• China Property Firms’ Debt Issuance Jumps, More To Come (Reuters)

China’s real estate companies have sharply increased the amount of funds raised from debt so far this year compared with 2014 as borrowing costs hit historical lows, and they are planning to borrow more. Property developers have raised 495 billion yuan ($77 billion) from domestic Chinese bonds, almost double 2014 levels, Barclays Capital estimates. Goldman Sachs suggests property companies have issued more than 400 billion yuan ($62.5 billion) in domestic bonds, over seven times total issuance in 2014. It uses a different set of companies as the basis of its estimate. “Conditions are great for these developers who should take this opportunity to strengthen their balance sheets and deleverage in a disciplined manner, rather than leverage up,” said Dhiraj Bajaj at Lombard Odier Singapore.

After tightening regulations in recent years to dampen a hot property market, regulators have moved this year to make it easier for developers to raise debt in the hope a lift for the real estate market will boost the wider economy. The property sector drives about 15% of gross domestic product and could help support an economy that many analysts predict will grow this year at its slowest pace in more than two decades. Historically low interest rates are helping to fuel the rush. The central bank has cut its benchmark interest rates six times since November by 1.65%age points and reduced banks’ reserve requirements three times this year.

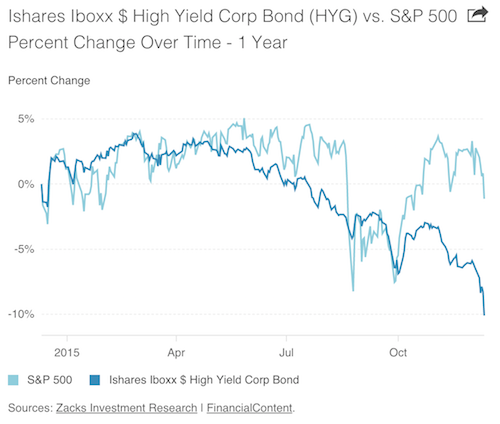

Two nations under the same flag.

• Even the Mafia Wants Out of Italy’s South (BBG)

A large portion of Italy is being left behind. The economic gap between Italy’s prosperous north and its depressed south has widened so much that the difference between Lombardy near the Swiss Alps and Calabria in the toe of the boot-shaped peninsula is wider than that between Germany and Greece. “With the latest recession, a whole chunk of the south’s productive structure has disappeared,” said Stefano Prezioso, head of forecasts at research institute Svimez, which seeks to promote industry in the south. “The process of decoupling that began in 2001 has quickened and it may now take many years to get back to a growth pace similar to the north.”

Italy has suffered through two recessions in seven years and its recovery is lagging behind other euro-area countries. That means a large part of the country’s population living in the south, known as Mezzogiorno, may not even see an improvement in economic conditions. Bank of Italy Director General Salvatore Rossi, who comes from the southern city of Bari, highlighted the issue in a Dec. 3 speech by saying the regional disparity is at a record and widening. Successful companies in northern Italy were increasingly subjected to “contamination” by organized-crime groups, including those from the south, as the businesses tried to weather the effects of the nation’s recession, Milan-based Assolombarda, the Lombardy industrialists’ association, said earlier this year. Prosecutors have also said the Mafia and other organized crime gangs are moving more of their operations to the north.

“We’re One Giant Step Closer To The End Of Antibiotics..”

• New Superbug Resistant To All Antibiotics Linked To Imported Meat (Forbes)

Just last month, Yi-Yun Liu’s team discovered the mcr-1 gene, which conveys resistance to colistin, an antibiotic of last resort. They were doing a surveillance project on E. coli bacteria from food animals in China. A whopping 15% of meat samples and 21% of animals tested between 2011 and 2014 also had bacteria that carried this gene. The researchers from South China also found this resistance gene in E. coli and Klebsiella pneumonia isolates from 16 hospitalized patients’ blood, urine or other sites. The isolates were all very resistant ESBL bacteria to begin with, so now were resistant to all antibiotics. It gets worse. This week, Frank Aarestrup’s team, from the Danish National Food Institute, reported that they also searched their collection of bacteria, looking for this new gene.

They found the mcr-1 gene in the blood of a patient and in 5 poultry samples that originated in Germany between 2012-14. The patient had not left the country and was believed to have become infected by eating contaminated meat. The genes found in the poultry were identical to those from the Danish patient and from China. Why is this important? The mcr-1 gene transfers resistance to E. coli, Klebsiella, Pseudomonas—common bacteria—by plasmids, small bits of DNA that can be transferred to different types of bacteria. Previously, colistin resistance was transferred on chromosomes, and therefore affected only those bacteria and their descendants. Plasmid-borne resistance genes are more likely to be rapidly spread widely, and can spread between species of bacteria. According to George Washington University’s Dr. Lance Price, it’s a bit less likely to be a problem with Salmonella for now, as “we don’t have those bordering on pan-resistance like E. coli.”

One of the problems is that colistin is widely used in China’s agriculture industry. Co-author Professor Jianzhong Shen explains, “The selective pressure imposed by increasingly heavy use of colistin in agriculture in China could have led to the acquisition of mcr-1 by E. coli.” The WHO called for limiting the use of colistin in 2012, calling it a critically important antibiotic. Yet most of the 12,000 tons of colistin fed to livestock each year is in China. In Europe, polymyxins (the colistin class) were the 5th most heavily used type of antibiotic in agricultural use in 2013. Colistin is not widely used in the U.S., but it is not prohibited either. Colistin is a nasty antibiotic. Until the past few years, when we were desperate for options for treating carbapenem resistant bacteria (CRE), it was not used due to its toxicity. I’ve had to use it a rarely, resulting in inevitable renal failure in the patients receiving it.

Interesting artist.

• Banksy Uses Steve Jobs Artwork To Highlight Refugee Crisis (Guardian)

Banksy has revealed a new artwork, sprayed on a wall in the Calais refugee camp called “the Jungle”, intended to address negative attitudes towards the thousands of people living there. The work depicts the late Steve Jobs, the founder of Apple, with a black bin bag thrown over one shoulder and an original Apple computer in his hand. The work is a pointed reference to Jobs’s background as the son of a Syrian migrant who went to America after the second world war. In a rare statement accompanying the work, Banksy said: “We’re often led to believe migration is a drain on the country’s resources but Steve Jobs was the son of a Syrian migrant. Apple is the world’s most profitable company, it pays over $7bn (£4.6bn) a year in taxes – and it only exists because they allowed in a young man from Homs.”

The graffiti is one of a series of works Banksy has created in response to the refugee crisis. During his trip to Calais, the artist covered several walls across the French port with related graffiti, including a riff on Theodore Gericault’s Raft of the Medusa, featuring a luxury yacht. This summer, his temporary “bemusement” park in Weston-Super-Mare featured an installation of boats filled with bodies. On the closing night of Dismaland, Banksy also invited Pussy Riot to debut their song criticising the global failure to help the migrants entering Europe. Since the park closed in September, the artist has been shipping leftover infrastructure from Dismaland to help build emergency housing for the 7,000 migrants, mainly from Syria, Eritrea and Afghanistan, now living on the site of a former rubbish tip in Calais.