Laura Gilpin The Rio Grande 1947

Stocks have been disconnected from reality. But that can’t last.

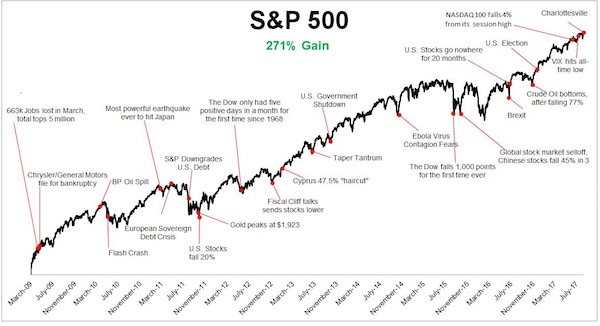

• The ‘Wall Of Worry’ That Stocks Have Climbed To Rally 271% Since 2009 (MW)

This may be the most sedated stock-market rally of our times. Even as tensions heightened between the U.S. and North Korea and violence broke out on the streets of Charlottesville, Va., stocks took the alarming news in stride, continuing to scale the “wall of worry” in defiance of doomsday predictions of an imminent selloff. “It seems like every day the headlines outside of the market get more and more frightening,” said Michael Batnick, director of research at Ritholtz Wealth Management, who illustrated the resilience of the market in the chart below. As the graph shows, since stocks bottomed in March 2009, the S&P 500 index has soared 271% to multiple records, meandering higher through the European debt crisis, Brexit, and the U.S. presidential election.

Batnick had originally published the chart in March but updated it Wednesday given the recent developments. “This year has been the perfect reminder that political volatility does not necessarily translate into the stock market, with this being the quietest year since 1965,” he said. The S&P 500’s daily trading range averaged 0.32% in the first half of the year, the narrowest in over half a century, underscoring the gap between market volatility and the political upheaval that has marked Trump’s presidency so far, according to Batnick.

We can all figure what could happen if you throw $20 trillion or so into non-functional markets. Can we figure what happens when they start to function again?

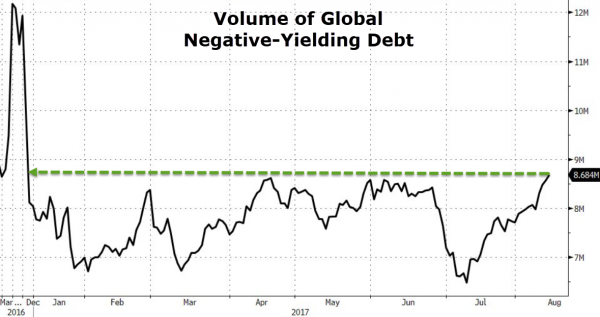

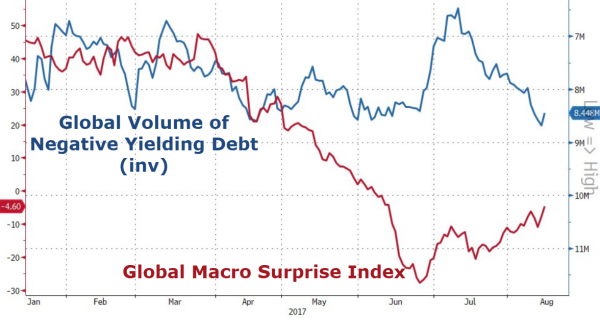

• Global Negative-Yielding Debt Surges To Highest Since October (ZH)

The market value of bonds yielding less than zero percent has jumped by a quarter over the past month to $8.68 trillion, the highest since October… which is odd given the mainstream narrative that everything is awesome and global growth is heading for escape velocity?

“probably nothing”

As Bloomberg notes, slower-than-forecast inflation data and haven demand on geopolitical risk have revived bond bulls around the world. With global borrowing costs already so low, central banks should be prepared to cut interest rates deep into negative territory in the next economic downturn, warn economists including Harvard professor Kenneth Rogoff.

Oh well, it’ summer after all.

• The Fed Is Asking Questions, Not Providing Answers (BBG)

The Federal Reserve is either lucky or clever. By signaling that it won’t touch interest rates again until December, it’s bought itself time to have a longer – and much needed – conversation about inflation. Good. There are very legitimate doubts that traditional models explain what’s happening or, rather, what’s not happening. Minutes of the Federal Open Market Committee’s July meeting show a growing debate about inflation and why it’s retreating, instead of advancing, in the face of 4.3% unemployment. The central bank is puzzled that prices have been soft for several months. In the absence of any real inflation pressure, the Fed might be reasonably expected to take a break from raising rates while it got a handle on what’s happening. By acting in March and June and hinting that September will be about balance sheet reduction, the Fed gave itself some wiggle room.

Policy makers basically have until December to either see inflation head back toward their 2% target or figure out how to respond if it doesn’t behave. There’s a meeting scheduled for late October, but the Fed’s historical aversion to moving in the absence of new forecasts and a press conference effectively rules out a surprise then. Delaying until December gives officials at least four more months of inflation data. Most still see it returning to its target, in keeping with traditional economic models. And to be fair, as I have written, this isn’t exclusively an American phenomenon. Inflation is weak in Europe and Japan despite a pronounced pickup in growth. (It’s above target in the U.K.; Brexit complicates that particular picture.) But the U.S. is still the world’s largest economy, and the Fed is still the world’s de facto central bank.

The country’s financial markets dwarf others despite frequent predictions of decline. How this inflation mystery ends will matter greatly. What if the book doesn’t have an end? The minutes show some self-doubt starting to creep in alongside the confidence of the majority: Most participants indicated that they expected inflation to pick up over the next couple of years from its current low level and to stabilize around the Committee’s 2% objective over the medium term. Many participants, however, saw some likelihood that inflation might remain below 2% for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside. The account of the July conclave even suggested some heretical questioning of the link between very low unemployment and wages and inflation. The majority are still wedded to the traditional models.

Until we start to see a convincing swing back to the Fed’s target of 2%, we will probably see more of this public questioning of assumptions. Something less contentious was skepticism about the prospects for large-scale fiscal stimulus, the domain of Congress and the White House. A few participants at the Fed meeting doubted it would happen and, if it did, they suspected the boost would be less than might have once been anticipated. That observation went unchallenged. Stay tuned for the last day of August. That’s when the Commerce Department publishes closely watched inflation figures. Enjoy the debate.

Over 1000 utterly useless PhD economists work for the Fed. The world doesn’t behave like my models do!

• Fed Starts to Wonder If Cornerstone Inflation Model Still Works (BBG)

Federal Reserve officials are looking under the hood of their most basic inflation models and starting to ask if something is wrong. Minutes from the July 25-26 Federal Open Market Committee meeting showed a revealing debate over why the economy isn’t producing more inflation in a time of easy financial conditions, tight labor markets and solid economic growth. The central bank has missed its 2% price goal for most of the past five years. Still, a majority of FOMC participants favor further rate increases. The July minutes showed an intensifying debate over whether that is the right policy response. “These minutes to me were troubling,” said Ward McCarthy, chief financial economist at Jefferies in New York. “They don’t have their confidence in their policy decisions; and they don’t have confidence that they can provide the right kind of guidance.”

The FOMC tried hard to avoid that kind of message. In several passages, the minutes asserted that “most” officials were sticking with a forecast that higher inflation would eventually show up. However, the debate over resource slack models and whether standard data sources were telling them the whole story also showed convictions about their forecast are fraying. Price indexes have shown unusual inertia even as the U.S. unemployment rate has fallen, matching a 16-year low of 4.3% in July. The U.S. consumer price index rose 1.7% for the 12 months ending July, while the Fed’s preferred measure, which is tied to consumption, rose 1.4% in June. Another gauge calculated by the Dallas Fed, which trims index outliers to highlight the underlying price trend, rose 1.7% for the 12 months ending June.

That was the same as May, which was down from 1.74% in April. The minutes said “a few” officials described resource slack models as “not particularly useful” while “most” thought the framework was valid. The committee also pondered a number of theories as to why inflation wasn’t responding to tightening labor resources, such as “the possibility that slack may be better measured by labor market indicators other than unemployment.” “It is a battle between data and theory,” said Ethan Harris, head of global economic research at Bank of America in New York.

A silent coup.

• Goldman Sachs Is Infiltrating The Fed In Ways Most People Haven’t Noticed (BI)

Since when do underlings get to chime in on who their next boss should be? That’s just what William Dudley, president of the Federal Reserve Bank of New York, did in an interview with AP this week. His fairly strong recommendation of Gary Cohn, Donald Trump’s economic advisor and apparent favorite, was especially egregious since Cohn is former president at Goldman Sachs, where Dudley essentially spent most of his career as chief economist and partner. The Fed’s chairperson is appointed by the president of the United States. Dudley should stick to monetary policy and regulating big banks. As a matter of central bank independence and integrity, he has no business opining on future candidates.

As Bloomberg’s veteran Fed watcher, Rich Miller, put it: “It’s rare for Fed officials like Dudley to comment publicly on such personnel matters because they usually want to avoid doing anything that might be seen as undermining the central bank’s political independence.” “AP: On a personal level, Gary Cohn has been mentioned as potentially a Fed Chair if Yellen were not to be reappointed or declined. Did you work with Gary Cohn at Goldman Sachs? What is your impression of him as a potential Federal Reserve Chair? DUDLEY: I don’t want to evaluate the various candidates for the Federal Reserve, except to say that I think Gary is a reasonable candidate. He knows a lot about financial markets. He knows lots about the financial system. I don’t think you have to have a PhD in Economics, which I have, to be a Chair of the Fed or Governor or a President of one of the Federal Reserve Banks. I think it’s important to have a committee that has diversity. That has different backgrounds and perspectives. So I think Gary’s a reasonable candidate.

[..] Despite the clear conflict, he apparently sees nothing wrong with recommending Cohn while saying nothing to praise his current boss, Fed Chair Janet Yellen, who is also supposedly in the running for reappointment (but not really, it’s just another Trump reality TV suspense stunt). Dudley then coyly declines to discuss other names being floated for the post. Dudley has crossed a line, although it’s not a new one for his institution. The New York Fed was home to one of the financial crises most blatant conflicts of interest, and it’s all related to how Dudley was hired to head it in the first place.

This is what happened: Stephen Friedman was chairman of the New York Fed at the height of the crisis — but at the same time he was a member of Goldman Sachs’ board of directors. He also held a significant financial stake in the megabank, even as he was involved in the bank bailout negotiations. Yes, really (The New York Fed is supposed to play a pivotal role in regulating Wall Street). And here’s the kicker: The Fed’s board granted Friedman a waiver to buy Goldman stock just as prices had hit bottom and the central bank was stepping in to make all the banks, including Goldman, whole on their misguided bets on housing and related assets. Friedman was eventually pressured to step down, but that’s about it. In his role as NY Fed board chair, Friedman got to pick its next president. Who did he run with? Bill Dudley.

it’s about foreign reserves.

• Chinese Takeovers Of US Companies Plummet This Year (CNBC)

As the Trump administration looks to take a tougher stance against Beijing, Chinese investments in the U.S. have more than halved this year, according to Dealogic. “Amid growing regulatory scrutiny of China outbound M&A targeting the U.S., volume has seen a 65% year-on-year decline in 2017 year-to-date,” Nicholas Farfan and Karl But of Dealogic Research said in an Aug. 8 note. “In comparison, such deals peaked at $65.2 billion last year, with high-profile deals including HNA’s acquisition of 25% of Hilton Worldwide.” “With tightening restrictions, Chinese buyers may look to stop pursuing or shelve potential acquisitions in the U.S.,” the note said. The pressure and uncertainty are coming from both countries. On Beijing’s side, authorities are reportedly targeting some of the largest Chinese dealmakers to try to keep capital from fleeing the country and contributing to yuan weakness.

On the American side, reports indicate the Committee on Foreign Investment in the United States is looking to use national security concerns to prevent more Chinese purchases of U.S. firms, especially in technology. Anecdotally, Gregory Husisian, chair of the export controls and national security group at law firm Foley & Lardner, noted that an increasing number of clients are concerned about working with Chinese buyers due to the potential for regulatory intervention. The dealmaking industry could also suffer some significant business setbacks. The Dealogic analysts estimate about $9.7 billion in pending Chinese deals to buy U.S. firms could fall under regulatory scrutiny, potentially putting $75 million in advisor fees at risk.

Baffling. They really don’t seem to know their own laws. Which might be a problem if you’re in government?!

• The World’s Most Ridiculous Constitutional Crisis (BBG)

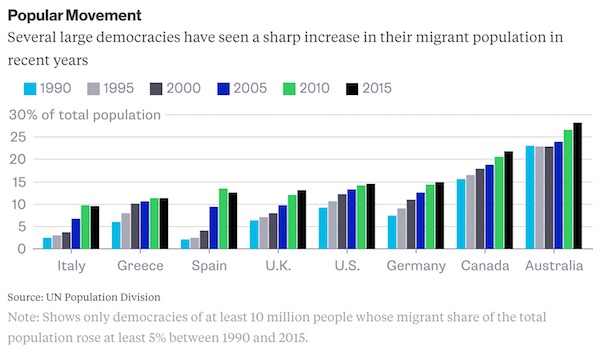

Australia’s parliament is in the grip of the world’s most ridiculous constitutional crisis. The situation threatens the country’s democratic process, which is reason enough for politicians and courts to work to unpick it. More importantly, though, it raises questions the rest of the world would do well to ponder. Over the past month, five members of Australia’s 226-member parliament have admitted that they may have unwittingly held dual citizenship – a condition that, under Australia’s 1900 constitution, disqualifies them from political office in Canberra. The latest blow on Monday ensnared Deputy Prime Minister Barnaby Joyce, putting into jeopardy the government’s one-seat majority in the governing House of Representatives. Joyce’s father was born in New Zealand in 1924. As a result, Kiwis officially consider him one of their own.

Journalists and political staffers have launched a hunt to see who will fall next. The country’s justice minister Michael Keenan took to social media Thursday to confirm he renounced his British citizenship 13 years ago, after the Sydney Morning Herald reported that he may have been a dual citizen. In total, 13 senators and 11 House members were born overseas, equivalent to about 17% and 7.3% of the respective chambers. More may be caught, like Joyce, as a result of their parentage. With both chambers finely-balanced between parties – and renouncing foreign citizenship, in many cases, a long and complex process – the crisis could hamstring the government’s ability to pass legislation. Australia has one of highest proportions of foreign-born residents among democratic countries. Nearly half of permanent residents are first- or second-generation migrants, with about 28% born overseas and 21% having at least one foreign-born parent.

About 4.6% were, like me, born in the U.K.; another 2.6% in China, Hong Kong and Macau, plus 2.2% from New Zealand and 1.9% from India. More than 27% of the population speaks a language other than English at home. That’s a vast population whose ability to serve in parliament is potentially restricted. There are so many different regulations around the world that it’s not always obvious to individuals which countries might claim them as citizens. Larissa Waters, a Greens senator who was born in Winnipeg but has lived in Australia since infancy, quit last month after discovering that a Canadian law that entered into force when she was seven days old meant Canada still considered her a citizen. A week later, Australia’s then-Resources Minister Matthew Canavan was caught out after discovering his mother had once sought Italian citizenship for herself and for him. “Until last week I had no suspicion I could be an Italian citizen,” he wrote on Twitter. “I was not born in Italy and have never been to Italy.”

Your pension has left the building. Those are its foorprints over there.

• Hell Hath No Fury Like An Australian Retiree Scorned (BBG)

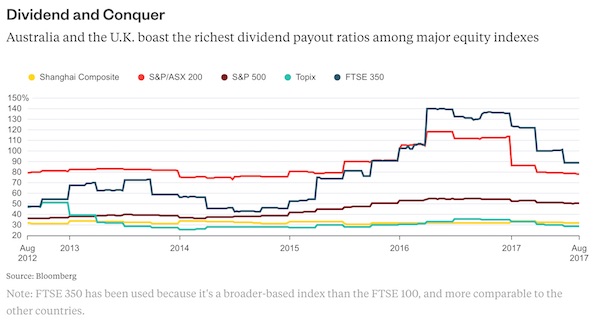

Hell hath no fury like an Australian retiree scorned.Shares in the country’s giant phone company Telstra fell as much as 12% after it announced annual results Thursday, wiping off some A$6.2 billion ($4.9 billion) of value. The reason for this massive hissy fit was a cut to Telstra’s historically lavish dividend policy. Investors who’ve been scraping by on payouts equivalent to about 100% of underlying earnings will in future have to subsist on a mere 70% to 90%. Why should Telstra shareholders be so sensitive about dividends, especially as net income came in ahead of analyst estimates at A$3.89 billion? The answer lies in the nature of Australia’s equity market, and in particular the 1.1 million retirees managing their own investments via self-managed superannuation funds.

Helped by years of tax breaks and laws mandating that companies fund their employees’ retirement savings, Australia’s gray army has built up a A$648 billion piggy bank. The A$340 billion they have in equities and investment funds is equivalent to a fifth of the benchmark S&P/ASX 200 index, and their might is such that some analysts, such as Credit Suisse’s Hasan Tevfik, argue they’ve distorted the investment priorities of the wider market. Retirees’ love of a household-name stock that provides a steady income without the fuss of buying or selling helps explain the Australian share market’s obsession with dividend yield. There’s certainly something unusual in the water: Of the 42 companies in developed markets with dividend yields above 5% and market capitalizations above $10 billion, 11 are Australian, according to data compiled by Bloomberg.

In some ways, this trend is a favorable one. Australia’s big four retail banks and Macquarie, which all meet the key criteria of familiarity and generous payouts, trade on some of the highest price-book multiples in the world. As a result, when they want to raise equity capital – as they all did in 2015, to the tune of an aggregate A$18.5 billion – it works out rather cheap. Still, Telstra’s experience is a lesson that playing footsie on dividends can be a dance with the devil. Its desire to hold back just a thin slice of earnings alongside a 70% to 90% payout ratio would be considered reasonable in most markets. Chinese companies are notoriously stingy, as Gadfly’s Shuli Ren wrote this week. Among major equity indexes, only the U.K. boasts ratios on a par with Australia’s; the Shanghai Composite rarely turns more than a third of earnings into dividends.

No kidding. Conversation is impossible just when it’s most needed.

• Americans Are Rapidly Descending Into Madness (Krieger)

I don’t live in an echo chamber, partly because there aren’t enough people out there who think like me, but also because I constantly and intentionally attempt to challenge my worldview by reading stuff from all over the political map. I ingest as much as I can from a wide variety of intelligent sources, picking and choosing what makes sense to me, and then synthesizing it the best I can. Though I’m certainly grounded in certain key principles, my perspective on specific issues remains malleable as I take in additional information and perspectives. I try to accept and acknowledge my own ignorance and view life as a journey of constant mental, emotionally and spiritual growth. If I’m not growing my capacity in all of those realms until the day I die, I’m doing it wrong. Life should be seen as a battle against one’s own ignorance, as opposed to an obsession with the ignorance of others.

You can’t legislate morality, nor can you legislate wisdom. The only way the world will improve on a long-term sustainable basis is if more of us get wise. That’s a personal journey and it’s our individual duty to accept it. While I’m only in control of my own behavior, this doesn’t mean that the behavior of others is irrelevant to my life. Unfortunately, what I see happening to the population of America right now seems very troublesome and foreboding. What I’m witnessing across the board is hordes of people increasingly separating themselves into weird, unthinking cults. Something appears to have snapped in our collective consciousness, and many individuals I used to respect (on both sides of the political spectrum) are becoming disturbingly polarized and hysterical. People are rapidly morphing into radicalized mental patients.

What’s worse, this environment is providing a backdrop for the most destructive people of my lifetime – neoconservatives and neo liberals – to preen around on corporate media as “the voices of reason.” This is one of the most perverse and dangerous side-effects of the current political climate. If in your disgust with Trump, you’re willing to run into the cold embrace of these destroyers of the middle class and the Middle East, you’ll get what you deserve. In contrast, if we really want to deal with our very real and very systemic problems, the last thing we need is a population-level mental breakdown that leads to a longing for the criminally destructive political status quo, yet that’s exactly what seems to be happening.

Every single Bitcoin transaction uses as much energy as 15 UK households do daily. Whatever you think about crypto, that is a problem no matter what.

• A Primer On Bitcoin: The Ultimate Fiat Currency (Lebowitz)

Cryptocurrency is an independent, digital currency that uses cryptology to maintain privacy of transactions and control the creation of the respective currency. While not recognized as legal tender, cryptocurrencies are becoming more popular for legal and illegal transactions alike. Bitcoin (BTC), developed in 2009, is the most popular of the cryptocurrencies. It accounts for over half the value of the more than 750 cryptocurrencies outstanding. In this article we refer to cryptocurrencies generally as BTC, but keep in mind there are differences among the many offerings. Also consider that, while BTC may appear to be the currency of choice, Netscape and AOL shareholders can tell you that early market leadership does not always translate into future market dominance.

Before explaining how BTC is created, acquired, stored, used and valued, it is vital to understand blockchain technology, the innovation that spawned BTC. [..] Blockchain is an open database or book of records that can store any kind of data. A blockchain database, unlike all other databases, is stored real time and is accessible for anyone to view its complete history of data. The term block refers to a grouping of transactions, while chain refers to the linkages of the blocks. When a BTC transaction is completed BTC “miners” work to solve the cryptology algorithm that will enable them to link it to the chain of historical transactions. As a reward for being the first to solve the calculation, the miner receives “newly minted” BTC. As the chain grows, the effort needed to solve and verify the algorithms increase in complexity and demand greater computing power. As an aside consider the following statement by Bitcoin Watch (courtesy Goldman Sachs):

“BTC worldwide computational output is currently over 350 exaflops – 350,000 petaflops – or more than 1400 times the combined capacity of the top 500 supercomputers in the world.”

Needless to say, a tremendous amount of computing resources and energy are being used by BTC miners, and it is still in its infancy. Could these resources be better employed in other industries, and if so, how much productivity growth is BTC leeching from the economy? The takeaway is that blockchain is an open, real-time database that provides anonymity to its users. It is not controlled or regulated (yet) by any government. BTC miners, driven by the incentive to earn BTC, and fees at times, verify and authenticate the database. Blockchain technology is incredibly powerful and will likely revolutionize data management regardless of whether cryptocurrencies thrive or disappear.

New Bitcoins are created as payment to BTC miners that solve the aforementioned calculations that verify transaction data and link it to the blockchain. This ingenious reward system incentivizes miners to compete to perform these calculations, enabling the blockchain to exist. Currently there are approximately 16 million bitcoins outstanding out of a proposed limit of 21 million. As the blockchain grows, the calculations required to mine BTC and add to the chain become more complex, making each bitcoin harder and more costly to earn than the prior one.

The value of life, all life. must trump all else. Or else.

• Spain Rescues 600 Migrants, Refugees In Busiest Day as 120 Drown (BBC)

Spain’s coastguard says it has rescued 600 migrants crossing from Morocco in a 24-hour period amid a spike in the number of migrant arrivals. The rescued migrants were in 15 vessels including toy paddleboats and a jet ski and included 35 children and a baby. The UN says more than 9,000 people have arrived in Spain so far this year – three times as many as the previous year. More than 120 people are believed to have drowned attempting the crossing. The increase in crossings means Spain could overtake Greece this year in the number of migrants arriving by sea, the UN’s International Organization for Migration (IOM) said earlier this month.

Most are sailing across the 12km (seven-mile) Strait of Gibraltar and many are choosing cheap, child-sized paddle boats without motors that allow them to bypass people smuggling networks and their fees. Some migrants are using social media to contact the Spanish authorities and inform them of their location once they are in territorial waters, the BBC’s Gavin Lee in the Spanish city of Tarifa says. However, a much larger number – nearly 100,000 – have crossed from Libya to Italy since the start of the year. The IOM says 2,242 people have died on that route. In June, about 5,000 people were rescued in one day in the Mediterranean off Libya, Italian coastguards said.