Vincent van Gogh Outskirts of Paris: Road with Peasant Shouldering a Spade 1887

I have one news article today saying 62% more UK children 6-12 years old have died since their vaccinations started. And a 2nd article that says all children 5-11 in New York must be vaccinated. And I’m wondering: how is that not a completely insane world? How do we fail to connect these things?

Norman Fenton: Spike in all-cause mortality after vaccination

Back to normal then?

• ‘Extremely Mild’ Omicron Is Rapidly Killing Off Much More Deadly Delta (CityAM)

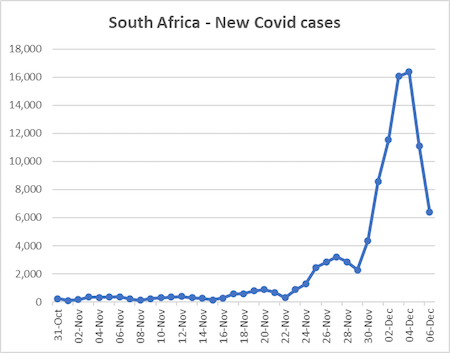

Excitement is growing among Coronavirus experts in Southern Africa and around the world as it increasingly seems that the new Omicron variant is rapidly replacing the much more deadly Delta mutation. Experts are so ecstatic because it seems more and more that the Omicron variant is much more contagious and dominant than Delta, but also much milder and less deadly. Some experts are therefore even urging countries to drop restrictions and let Omicron spread so the more infectious but less severe variant can kill off Delta quicker. Infections in South Africa have started to rise rapidly in recent days, a sign that displacement of the lethal Delta variant is in full swing, according to Adrian Puren, the acting executive director of South Africa’s National Institute for Communicable Diseases (NICD).

“What will outcompete Delta? That has always been the question, in terms of transmissibility at least, … perhaps this particular variant is the variant,” Puren told Reuters in an interview earlier this week. The World Health Organisation (WHO) has said there is early evidence to suggest Omicron has an “increased risk of reinfection” and its rapid spread in South Africa suggests it has a “growth advantage” compared to Delta. Therefore, virologist Marc van Ranst pointed out that “if the omicron variant is less pathogenic but with greater infectivity, allowing Omicron to replace Delta, this would be very positive.” In fact, Omicron could turn out to be “a storm in a teacup” and may blow over within a few weeks, according to a former head of the British government’s vaccine task force.

Clive Dix said that, if the new variant did turn out to be milder but more infectious than Delta, it would be worth easing travel restrictions so to let the milder Omicron mutation spread further. He told UK newspaper i he is “pretty calm and not really worried” about the new variant, adding that “if we look at all the facts that we know so far, none of them are heading in the direction of being a super concern.” “We’re not seeing serious disease yet and we’re not seeing death. The picture looks like it’s now a milder virus – and that’s what you expect with viruses. They mutate to become more transmissible – they’re not looking to be deadly, because otherwise they don’t get transmitted,” Dix explained.

Insanity.

• Excess Mortality Among Children After Vaccine Rollout (Rair)

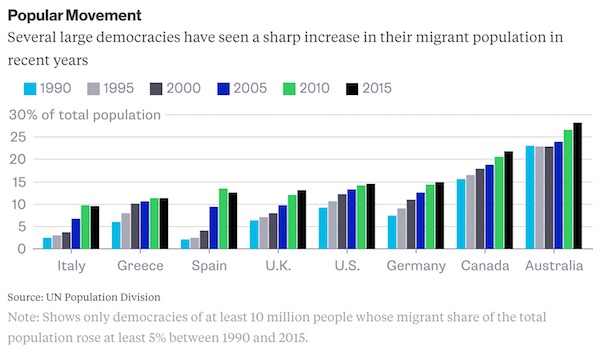

Deaths of children have been on the rise since the UK started vaccinating teenagers from the age of 12 and older. The risk-benefit analysis raises serious doubts about injecting this age group with the experimental drug. On September 20, the British national health service NHS announced that the coronavirus vaccine would be rolled out for children aged 12 to 15. In part of the biggest vaccination drive in the country’s health service history, nearly three million children can receive a first dose of the Pfizer vaccine. According to the NHS, jabs started in hundreds of schools (week 38), with the injection program rolling out to others in the coming weeks.

Following the government’s vaccine rollout, the UK’s Office of National Statistics shows that the number of deaths between week 38 and week 41 of 2021 among children aged 10-14 were 62% higher than the five-year average for the number of deaths in this age group during the same period. Furthermore, the increase in deaths began when children started receiving the experimental “vaccine.” The trend of increasing deaths among children is continuing. More children in the age group 5-14 years died in week 43 of 2021 than usual. Data from the UK Health Security Agency (UKHSA) recently revealed that so many children died at the end of October that there was excess mortality.

The decision to jab children over twelve came after the four Chief Medical Officers (CMO’s) of the United Kingdom advised the UK Government to offer the Pfizer injection to them. The government decided to go ahead with the injection program despite the Joint Committee on Vaccination and Immunisation (JCVI) previously stating that they could not support universal vaccination of children. Is it just a coincidence that deaths among children have since increased by 62% (up to 400% in vulnerable children) against the five-year average? The CMO admits they do not know the adverse effects the injection will have on children stating, we “acknowledge that there is considerable uncertainty regarding the magnitude of the potential harms.”

When considering whether or not to vaccinate children of that age, the CMO states that the jab will “help prevent classroom outbreaks and further disruptions to education.” However, their reasoning has no factual basis; as the jab has shown, it continuously fails to prevent infection or transmission. Moreover, even Pfizer does not make the CMO’s claim. Therefore, the government’s argument that the benefits outweigh the risks is invalid. Furthermore, the jab is risky for children’s well-being. In May 2021, Pfizer published a 37-page “factsheet” on the safety and use of their vaccine, from which it emerges that 79% of vaccinated children over the age of 12 could expect side effects. Unfortunately, the government ignored Pfizer’s, and the media refuse to report on their admission because it does not seem to fit their current “political narrative.”

Insanity squared.

• De Blasio Requiring Kids 5-11 Show Vaccine Card To Dine Out, See Movies (NYP)

Kids will soon get carded at New York City restaurants and movies — for proof that they’ve been vaccinated against the coronavirus, Mayor Bill de Blasio said Monday. “Vaccination works and vaccine mandates work,” de Blasio said during a remote press briefing on the latest mandate from City Hall. De Blasio said he was taking the “very bold, aggressive action” in response to the lockdown in Germany and other restrictions returning across the globe amid the new Omicron variant — even though the city’s only seen seven cases of it and the overall COVID-19 infection and hospitalization rates here are among the lowest in the nation. Children ages 5 to 11 must show proof of one vaccination dose to eat out, see a show, go to a movie theater, visit a fitness facility, or attend indoor entertainment venues by Dec. 14. Kids over age 12 must have two doses by Dec. 27 unless they received the one-shot Johnson & Johnson vaccine.

De Blasio first launched the “Key to NYC” vaccine mandate for adults at all public indoor venues in August. But the new mandate also applies to many school activities. Kids over 5 must now be vaccinated to attend “high risk” extracurricular activities like band, sports, orchestra and dance in schools. The policy earned quick criticism. “Public health and safety is paramount, but Mayor de Blasio’s announced expansions to the Key to NYC vaccine mandate pose additional challenges for an already beleaguered restaurant industry in need of tourism support and revenues this holiday season,” said Andrew Rigie, who heads the NYC Hospitality Alliance. “U.S. families visiting New York City for scheduled holiday vacations may not be able to meet the vaccination requirements for children or themselves in time, and children aged 5-11 across the globe aren’t universally authorized to get vaccinated.”

Pretty obvious. You’re being fooled.

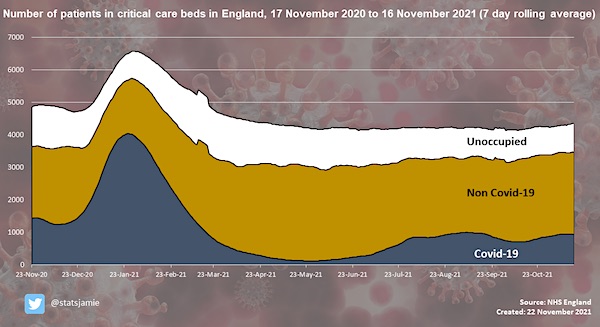

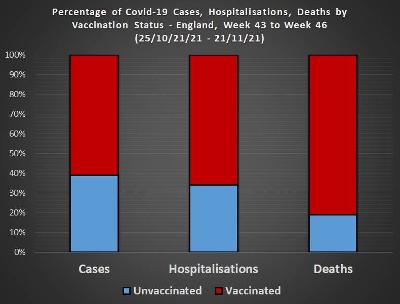

• Most In Critical Care Unvaccinated? – Not According To Data (Jamie)

Each week, NHS England publishes a great deal of information on hospital activity across the country. Within this compilation is the number of patients in critical care beds. Critical care units are specialist hospital wards that treat patients who are seriously ill and need constant monitoring.

The data helpfully splits out how many patients in critical care beds have Covid-19, how many don’t, and how many beds are unoccupied. I recreate this data in the chart below and it shows that currently within England, just over 1 in 5 beds has a critical care patient who has Covid-19. Just under 3 in 5 beds are patients needing care without Covid-19 and the remaining beds are unoccupied. So non-Covid-19 patients make up the bulk of patients across critical care units in the NHS at the moment. Even if every patient with Covid was unvaccinated (more below) the claim that critical care is full of unvaccinated is not supported by the data, based on NHS England’s own data. Of course, the author may refer to a specific unit in the country, but if that was the case, I do not think it should be a headline in a national newspaper.

NHS England does not publish the vaccination status of patients within hospital, but the UK Health Agency gives a snapshot each week within a weekly surveillance report. The report only provides information on those admitted to hospital and does not provide information specific to those in critical care units. Table 4 on page 20 shows that for patients requiring an overnight admission to hospital within 28 days of a positive Covid-19 test, two-thirds were vaccinated and one-third unvaccinated. Remember, not all admissions are because of Covid-19 and NHS England data shows that 1 in 4 admissions are people with Covid but not because of it. If two-thirds of patients going into hospital are vaccinated, it would be remarkable if for those who then required critical care it was the majority unvaccinated. Even more so when most deaths are among vaccinated people.

36%

https://twitter.com/statsjamie/status/1467801344245481476

Just to rub it in a bit more.

• Fact-Check #13: “ICUs Are Filled With The Unvaccinated” (OffG)

A few days ago Dr Hillary Jones, whilst being interviewed on Lorraine Kelly, claimed: “90% of people in hospital are unvaccinated”. Similarly, last week, Kevin Maguire claimed on Jeremy Vine’s show that: “The unvaccinated are filling hospital beds, they’re in ICUs taking up precious resources – there are hospital waiting lists going up because there are so many unvaccinated people in hospitals” Television presenters and news headlines across the United Kingdom have commonly referred to hospitals being filled with unvaccinated covid19 patients. As if it could ever be considered evidence of anything, an anonymous “doctor” wrote a piece for The Guardian, which he filled with nameless anecdotal evidence, and emotively headlined: “ICU is full of the unvaccinated – my patience with them is wearing thin.”

This claim is regularly used as an argument for vaccine mandates, and/or unvaxxed-only lockdowns. But is it true? In a word, no. ICUs are not “full” of unvaccinated covid patients, they’re not even full of covid cases. In fact, they’re not even full at all. As of last week, NHS England’s own bed statistics reported that England has 4330 available critical care beds, of which 894 (21%) are being used by Covid patients, 2608 (60%) non-Covid patients and 828 (19%) were empty. So, England’s critical care beds are not even 90% full, let alone 90% full of unvaccinated covid patients. But let’s be charitable and assume these people misspoke or communicated their point badly. Let’s assume they meant 90% of covid hospitalisations are unvaccinated.

That, at least, is true right? Wrong. The actual number is 35.4% According to the UK’s Health Security Agency data (page 31 of this document) 6639 patients were admitted to hospital “with Covid” in the weeks 44-47 of this year. Of those 6639, 2355 were unvaccinated. So unvaccinated people do not even make up the majority of Covid cases, let alone the majority of ICU admissions in general. So, even going by the official statistics – which we’ve previously shown are routinely inflated to make the “pandemic” appear frightening – the claim is incorrect. And that doesn’t even account for the fact that, according to Public Health England, a “Covid hospitalisation” is anyone admitted to hospital for any reason within 28 days of a positive Covid test. This could include people who are admitted to hospital for something else and then happen to test positive while they are there. We could also discuss the tiny number of hospital beds available in this country, which has more than halved since the 1980s, whilst the population has exploded in that time.

“Vaccination for a coronavirus has never been done successfully, so to roll it out without completion of full clinical trials, knowing full well the results of the SARs-CoV1 trials in animal studies, where they all died, was at best negligent but will in time likely be considered a far worse crime.”

• Suspended UK Doctor Unmasks Mask Mandate, Gets Reinstated (ET)

Dr. Sam White, a longstanding critic of the UK government’s coronavirus measures, feels wearing a mask poses its own health risks. He told me: “Non-grade clinical masks, especially in a non-clinical setting do absolutely nothing to protect anyone. In fact, there is a plentiful supply of scientific evidence to show they cause significant harm. For me, this is especially a concern for children, their neurodevelopment and neuroplasticity.” To those who argue that, as medical professionals wear them, they must serve some purpose, White says: “In a hospital setting, a mask is used in a well-ventilated theatre to prevent mucus secretions entering into an open wound or body cavity.

The surgeon is generally not moving, unlike someone working a 12-hour shift rushing around a warehouse where the mask quickly becomes contaminated with bacteria, viruses, and germs. It’s cruel to subject workers to what is an unsafe medical intervention. What is more, COVID is an aerosolized virus not spread by mucus. It’s like using a chain-link fence to keep sand out.” When I asked White what governments can do to deal with the plethora of COVID variants that are being discovered, he told me: “Whilst it mutates, and I am cynical if true gene sequencing has actually been done in each case of a new variant, it will become more transmissible, but symptoms become milder with each variant.” He added: “It never made sense to create a vaccine for a coronavirus as you can never keep up with the mutations. The vaccines do not prevent transmission, or infection.”

At least Johnson accepts White’s last point and he told reporters: “Our scientists are learning more hour by hour, and it does appear that Omicron spreads very rapidly and can be spread between people who are double vaccinated.” White feels he has a solution: “Ivermectin and other safe, proven, effective therapeutics do keep up with variants and actually work.” The helpful benefits of ivermectin were made very clear in the case of Sun Ng, an elderly COVID-19 patient who was thought to be dying but recovered only after being treated with the therapeutic. However, as The Epoch Times recently reported, the hospital in Illinois had to first be taken to court by his relatives before it would allow the drug to be administered.

The average age of deaths from COVID still remains around 82 and White points out that many of those people were severely deficient in vitamin D. He is equally scathing about the way the vaccines were rushed out without being fully tested: “Vaccination for a coronavirus has never been done successfully, so to roll it out without completion of full clinical trials, knowing full well the results of the SARs-CoV1 trials in animal studies, where they all died, was at best negligent but will in time likely be considered a far worse crime. It also vitiates any principle of informed consent with no long-term safety data available and insufficient short-term data.”

“The ruling concluded that the tribunal’s decision was “an error of law and a clear misdirection,” meaning the decision was “clearly wrong and cannot stand.”

• Doctor Banned For Questioning Efficacy of Masks Wins High Court Case (SN)

A doctor in the UK who was banned from using social media by the General Medical Council for claiming “masks do nothing” has won his case in the High Court. Dr. Samuel White was slapped with and 18 month ban by the GMC after he posted a video to Instagram and Twitter in June questioning the efficacy of face coverings. In the video, White said why he could no longer tolerate working in his previous roles because of the “lies” around the NHS and the government’s response to the pandemic, which were “so vast” he could no longer “stomach” them. White also committed the ultimate sin of remarking, “masks do nothing” to stop the spread of COVID, despite this being the consensus medical opinion at the start of the pandemic before it mysteriously switched almost overnight.

The doctor also expressed concerns about the safety of vaccines and the reliability of COVID tests. White took his case against the GMC to the High Court on the basis of his freedom of expression “to engage in medical, scientific and political debate and discussion,” White’s barrister, Francis Hoar, told a hearing at the Royal Courts of Justice. Hoar added that White’s opinions were “supported by large bodies of scientific and medical opinion” and had been “statements of fact and opinions about pharmaceutical and non-pharmaceutical interventions in response to the pandemic.” GMC’s Alexis Hearnden claimed that White’s views were not only misinformation, but posed a “risk” to the public because they didn’t align with official pronouncements.

However, the court ruled in favor of White, asserting that the tribunal which banned him from speaking had violated the 1998 Human Rights Act. The ruling concluded that the tribunal’s decision was “an error of law and a clear misdirection,” meaning the decision was “clearly wrong and cannot stand.”

Dr. Samuel White – conspiracy theory or…. pic.twitter.com/twTncANbZZ

— Deleuze (@Kukicat7) September 24, 2021

Next up: Jesus, Joseph and Mary.

• Supermarket Ad Showing Santa With A Vaccine Pass Cleared By Regulators

A supermarket advert that depicts Santa Claus only being able to enter Britain with a vaccine passport has been cleared by regulators, who insist that it doesn’t ‘break our rules’. The short for the Tesco chain of supermarkets in Britain quickly became the second most complained about advert in history as it features the threat of Christmas being cancelled and Santa being quarantined because of COVID restrictions. Over 5000 complaints were registered after the ad, titled “This Christmas, Nothing’s Stopping Us”, also showed Santa averting the crisis by flashing his vaccination status passport, showing that he is fully vaxxed against the virus. In a statement, the Advertising Standards Authority (ASA) in Britain announced that “Having carefully assessed the 5,000 complaints we received about the Tesco Christmas ad campaign, we have concluded it doesn’t break our rules and there are no grounds for further action.”

The statement further noted “We consider that the depiction of Santa displaying a proof of vaccine status in an airport is likely to be seen as a humorous reference to international travel rules people have experienced this year. It is unlikely to be interpreted as a message about these rules or the Covid-19 vaccine more widely.” Many of the complaints argued that the advert was overtly politicising Christmas, and that it encourages ‘medical discrimination’ against those who are not vaccinated, and promotes the need to take COVID vaccines in order for society to keep functioning.

“While we understand that some people disagree with the vaccine programme and may find the ad in poor taste, we have concluded that the ad is unlikely to be seen as irresponsible or cause serious or widespread offence on the basis suggested,” the ASA statement further noted. While some earlier had celebrated the ‘removal’ of the ad, Tesco says it has not dropped the campaign. A previous ad campaign by Ryan Air that promoted the sale of summer flights with the slogan “Jab & Go!” was later banned by the ASA after thousands of people complained it was misleading.

“‘Dispatches’ said Pfizer’s manufacturing costs were just 76 pence ($1.01) per jab, but the company was charging the UK government £22..”

• Pfizer Accused Of ‘Sabotaging’ AstraZeneca Jab (RT)

US drugsmaker Pfizer is denying any wrongdoing after a British TV documentary showed that a presentation made on its behalf had criticized a rival Covid-19 vaccine manufactured by AstraZeneca as being potentially unsafe. Teasers for a Channel 4 ‘Dispatches’ investigative program, shown on Monday, say a Pfizer presentation described AstraZeneca’s vaccine against Covid-19 as unsafe for patients with compromised immune systems and as having the potential to cause cancer. The speech was delivered in Canada sometime last year, but it was unclear whether it was a one-off event or the speaker had made the claim multiple times. The program, titled ‘Vaccine Wars: The Truth About Pfizer’, airs on Friday.

Pfizer responded to say the presentation had been “wrongly attributed” to it and had been delivered by a third party. “We refute any suggestion that Pfizer has sought to undermine others’ scientific endeavors,” a company spokesman told the Daily Mail. “Our priority has always been getting high-quality, well-tolerated and effective vaccines to patients all over the world as quickly as possible and to help put an end to this deadly pandemic.” The spokesperson explained that Pfizer had paid a third-party agency to create an educational program about vaccines in Canada, after the government in Ottawa had approved Pfizer’s product for use in the country.

‘Dispatches’ said Pfizer’s manufacturing costs were just 76 pence ($1.01) per jab, but the company was charging the UK government £22 ($29.17) per dose – a 3,000% markup. Pfizer said the estimate was “grossly inaccurate” and did not account for the cost of clinical studies, “manufacturing on a massive scale,” and global distribution. AstraZeneca, which developed its jab in cooperation with the University of Oxford, has reportedly sold its vaccine at cost for £3.60 ($4.77), losing out on £21 billion ($27.84 billion) in potential revenue, while Pfizer has seen a windfall from the vaccines. However, the AstraZeneca jab has been dogged by reports of potentially fatal blood clots in certain populations, and the UK has since ordered twice as many Pfizer vaccines instead.

Pfizer CMO

Pfizer CMO: Other vaccines have caused death not Pfizers pic.twitter.com/sHcvopbwxt

— Deleuze (@Kukicat7) December 4, 2021

“[..] .. and the ruling class is determined to cover up this undeniable reality..”

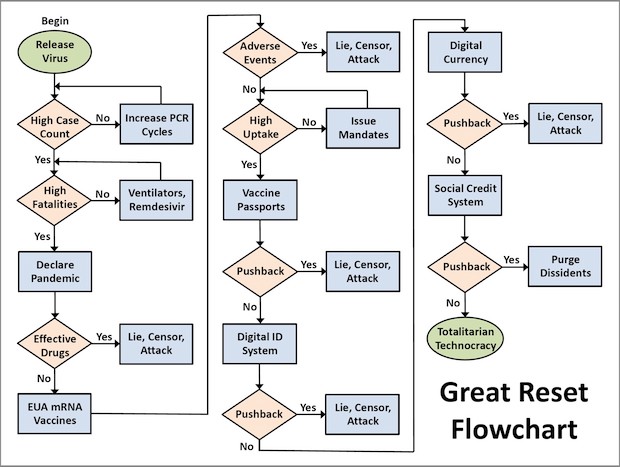

• The War On A Virus Has Resulted In Colossal Failure (Schachtel)

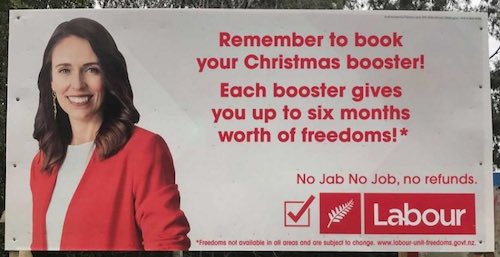

The war on a virus is long lost, and the sunk costs keep piling up. Whether you believe that this was all to bring about a Great Reset or some of the actors involved genuinely wanted to stop a virus, the result is now clear. The war on COVID-19 is over and it has resulted in colossal loss. Not a single battle was won. They lost the war, they know they lost the war, and now the losing side of the war — the global “elite” — is attempting to cover up this reality by any means necessary, even if it means dragging the entirety of humanity down with them. Movement Passes for 5 year olds in New York City and San Francisco. Prison for the non compliant in Austria and Germany. Detention centers for troublesome citizens in Australia and New Zealand. What do all of these places have in common?

First and foremost, as The Dossier readers know well by now, none of these measures are backed by any legitimate scientific precedent. The global “elite” forcibly drafted billions of people into fighting a “war on a virus,” and that war has been an abysmal failure. Now, almost two years into this war, the ruling class won’t give it up. Far from surrendering this unwinnable war, the “generals” of this struggle have decided to attempt to bring us down with them into colossal defeat. The people, organizations, and governments in charge of fighting our “war on a virus” have lost in devastating fashion. Far from a successful global effort to stop a virus, these ruling factions and power centers have failed the billions of people drafted into this war without the consent of the governed.

From Los Angeles to Sydney to Moscow to Rio to New York to Paris to London and everywhere in between, almost every government on every level across the world, with very few exceptions, committed incredible harm against their populations in the name of stopping a virus. And they have absolutely nothing to show for it. They threw every “public health expert” class instrument in the book at the COVID-19 pandemic, and nothing worked. But the people in charge don’t want to be blamed for the chaos they wrought. That’s bad politics, and not an ideal situation for those who believe that they are the personification of science itself. So instead of admitting to gross, criminally negligent and now purposeful failure, these maniacal saboteurs are doubling, tripling, and quadrupling down on sunk costs for the masses. The “elites” know nothing is working, but they’d rather take everyone down with them than to admit to wholesale failure.

“The catch is, they’ve given themselves until February to enforce their foolish vaccine mandates.”

• A Brief History of Epic Mass Madness (Kunstler)

Remember: the Progressive-Woke-Marxist-Jacobins liked nothing better than inflicting punishment. In fact, when you swept away all their ideological bullshit and the associated hustles, the movement was strictly about coercion, about pushing other people around, making them do as the Woke commissars willed. And there was a clearly sado-masochistic edge to all that. They relished cancelling people, wrecking careers, destroying reputations, livelihoods, marriages, families. Their political leaders had no qualms about exterminating hundreds of thousands of small businesses in Covid-19 lockdowns orchestrated by Woke heroes like Mayor Bill de Blasio of New York City and Governors Gavin Newsom of California and Jay Inslee of Washington State. And, of course, their darlings of the streets, BLM and Antifa, bashed-in shopfronts, looted all the merch, and burned down the buildings with mad glee.

But, most importantly, Covid-19 gave the political Left something else to focus its angst on once Mr. Trump was finally swept off the scene in the janky election. And until just the last few weeks of 2021, the virus has furnished endless opportunity for ever greater enactments of coercion and tyranny. Except now, suddenly, it’s all falling apart. In America, the claque behind the phantom president “Joe Biden” pulled the trigger on mandating vaccinations — complete with harsh punishments for the vaxx-averse — but then two things happened: 1) Federal Judge Terry Douglas in Louisiana issued an injunction against the mandate that applies in all fifty states; and 2) the news finally started leaking out — despite every effort of the US public health officialdom to hide it — that the vaccines carried an unprecedented risk of harm for medicines enlisted so casually into emergency use among so many millions of people, in addition to their negligible efficacy in preventing illness and contagion.

The Europeans, on the other hand, slid ever-deeper into despotic measures not seen since the Gestapo terrorized the continent. The Europeans face the same primal source of anxiety that the Americans do: the running down of their techno-industrial economies, except their predicament is arguably a little bit keener than ours is, since they have hardly any oil and natural gas of their own to run things on, and suffer terrible uncertainty about who will furnish it for them. If they had not gone out of their minds over what has turned out to be a pretty punk-ass virus — when treated early with a menu of cheaply available drugs — and hadn’t deified the false savior vaccines, they might be a whole lot more concerned about how they are going to heat their homes, fertilize their crops, and produce things of value — in short, remain civilized. The catch is, they’ve given themselves until February to enforce their foolish vaccine mandates.

The Omicron variant may help, too, since it is proving so far to be a grossly over-hyped development, discrediting the paranoia ginned up in the media. Can their courts act as ours have and put a stop to the madness? Between now and then we’re likely to see the defeat of the mass formation psychosis in America, at least, as the country is forced to face the truth of what it has done to itself.

And 40 years later he’s the head of US health care. Madness assured.

• Sen. Ron Johnson Is Right About Dr. Anthony Fauci & AIDS (AS)

Dr. Anthony Fauci’s own words buttress Senator Ron Johnson’s claim that he “overhyped” AIDS during the 1980s. But decades after he issued them neither Rolling Stone nor the Hill nor the Daily Beast bother to question, let alone investigate, Johnson’s accusation. Instead, those publications just take Fauci’s 2021 words at face value and pretend he did not say what he said in 1983. “By the way, Fauci did the same exact thing with AIDS,” Senator Ron Johnson told Brian Kilmeade of Fox News last Wednesday. “He overhyped it. He created all kinds of fear, saying it could infect the entire population when it couldn’t, and he’s doing, he’s using the exact same playbook with COVID: ignoring therapy, pushing a vaccine.” To respond, Fauci retreated, for the second week in a row, to a sycophantic Sunday host.

Last week, Fauci claimed that Republicans criticize him not because of his many errors but because “I represent science.” Just as the jaw-dropping arrogance Fauci displayed on Face the Nation last week did not even raise one of Margaret Brennan’s eyebrows let alone drop her jaw, Jake Tapper seemed dismissive this week of the idea that the senator knew something that maybe a television presenter did not. Instead of digging into Johnson’s claim, he asked Fauci to respond to the senior senator from Wisconsin’s “bizarre and false assertion.” “How do you respond to something as preposterous as that?” Fauci told Tapper. “Overhyping AIDS? It’s killed over 750,000 Americans and 36 million people worldwide. How do you overhype that?”

The way people overhyped AIDS during the 1980s involved scare stories that one could contract the disease by using the wrong pay phone or public restroom. Fauci contributed to that hysteria. He knows he did this. He knows he received criticism for doing it from many quarters, including the late Randy Shilts, a voice generally friendly toward Fauci, in And the Band Played On. He knows exactly what Johnson refers to but he feigns ignorance. “The finding of AIDS in infants and children who are household contacts of patients with AIDS or persons with risks for AIDS has enormous implications with regard to ultimate transmissibility of this syndrome,” Anthony Fauci explained to the American public in 1983. “If routine close contact can spread the disease, AIDS takes on an entirely new dimension.”

But infants and children did not contract the virus that causes AIDS from “routine close contact.” A responsible doctor does not make such a public proclamation. A bureaucrat, more concerned with saving his job than lives, does. It struck as a typical, CYA pronouncement way back when. Beyond this, bureaucrats — whether in defense or health or welfare or education — tend to hype problems to engorge the coffers of their agencies. Fauci based his remarks on nothing scientific but instead on speculation. Thirty-eight years later, Fauci counted on his journalistic cheerleaders to forget what they probably never remembered in the first place. They came through for him.

Galileo: ‘The sun doesn’t revolve around the earth.’

Twitter: ‘This claim is misleading. Learn why religious officials believe the sun revolves around the earth.’

Diamant (activate subtitles)

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.