Pablo Picasso Man with arms crossed � 1909

Why? Lack of reforms. Yeah.

• World Economy At Risk Of Another Financial Crash – IMF (G.)

The world economy is at risk of another financial meltdown, following the failure of governments and regulators to push through all the reforms needed to protect the system from reckless behaviour, the International Monetary Fund has warned. With global debt levels well above those at the time of the last crash in 2008, the risk remains that unregulated parts of the financial system could trigger a global panic, the Washington-based lender of last resort said. Much has been done to shore up the reserves of banks in the last 10 years and to put in place more rigorous oversight of the financial sector, but “risks tend to rise during good times, such as the current period of low interest rates and subdued volatility, and those risks can always migrate to new areas”, the IMF said, adding, “supervisors must remain vigilant to these unfolding events”.

A dramatic rise in lending by the so-called shadow banks in China and the failure to impose tough restrictions on insurance companies and asset managers, which handle trillions of dollars of funds, are highlighted by the IMF as causes for concern. The growth of global banks such as JP Morgan and the Industrial and Commercial Bank of China to a scale beyond that seen in 2008, leading to fears that they remain “too big fail”, also registers on the IMF’s radar. The warning from the IMF Global Financial Stability report echoes similar concerns that complacency among regulators and a backlash against international agreements, especially from Donald Trump’s US administration, has undermined efforts to prepare for another downturn.

There’s the US, which is booming, and then there’s everyone else, who are not.

• Soaring US dollar Threatens Trouble For Emerging Markets (G.)

The US dollar continued to soar in value over Wednesday night, signalling the likelihood of more interest rate rises and spelling trouble for developing countries that have borrowed heavily in the greenback. With impressive service sector data published on Wednesday and strong jobs figures in the non-farm payrolls expected on Friday, the dollar hit an 11-month high against the yen and drove US treasury yields to their highest since mid-2011. The pound slipped below $1.30. Rising US bond yields indicate that the Federal Reserve, under its hawkish chairman Jerome Powell, is likely to keep raising interest rates from their current 2.25% well into 2019. They are also unfavourable for emerging markets as they tend to draw away much-needed foreign funds while pressuring local currencies.

The Australian dollar, which is seen as a proxy for emerging Asian markets, slipped below US$0.71 and seems set to dip further. The Indian rupee fell to an all-time low against the dollar on Thursday morning of 73.77 while the Indonesian rupiah has plunged to a 20-year low. China’s currency, which has suffered as the trade war with the US has intensified, was not immune. The offshore yuan rate reached above 6.9 to the dollar. “This is a perfect storm for the rising dollar,” said Chris Weston of the online trading firm Pepperstone in Melbourne. “Strong economic performance and the Fed seen [as] happy to take rates higher. “Lots of countries have issued dollar-denominated debt and as the dollar goes higher, debt levels are exaggerated.”

What happens after bubbles.

• Stocks To Plunge More Than 40% During Next Bear Market – Stovall (CNBC)

Wall Street veteran Sam Stovall is warning stock investors the longest bull market on record will end with an epic meltdown. According to the CFRA chief investment strategist, it’s a side effect of an unprecedented business cycle. “Three conditions: Very long, very high, very expensive,” Stovall said Tuesday on CNBC’s “Futures Now.” “History would imply that be careful because now we’re likely to fall into a very deep bear market when it does finally hit with the average decline being close to 40 percent plus.” His latest thoughts came as the Dow was hitting record highs. The blue chip index is now up more than 8 percent this year. The S&P 500 is performing a tad better — up more than 9 percent for 2018.

Since the bull market began on March 9, 2009, the Dow and S&P 500 have soared more than 300 percent each. For now, Stovall doesn’t see any near-term signs that the win streak is about to end. He remains confident stocks will see a fresh string of new highs in the final months of the year. Referring to history as a guide, Stovall noted that the fourth quarter is pretty strong during midterm election years, and seasonality points to more gains. He believes it will be easy for the S&P to grab another 80 points and break above 3,000 by year-end. However, 2019 may be where the troubles begin. “A lot of the euphoria, a lot of the optimism, is already built into share prices,” he said. “How much more [in earnings] can companies deliver? Expectations are for a 22 percent gain for the entire calendar year 2018. Then it slips to a 10 percent gain in 2019. Those optimistic numbers are already built into the market.”

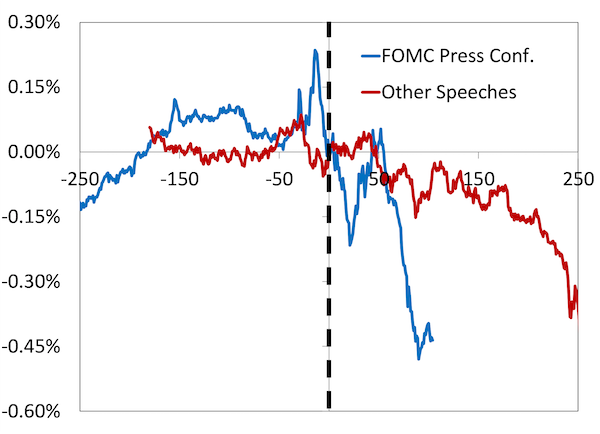

What nonsense. His policies blow a huge bubble, and his speeched deflate that bubble just a little bit.

• Powell Has Cost Stock-Market Investors $1.5 Trillion In 2018 – JPMorgan (MW)

Federal Reserve Chairman Jerome Powell has exacted a mighty toll from stock market investors this year, according to analysts from JPMorgan Chase. According to researchers led by quantitative analyst Marko Kolanovic, stocks have suffered around $1.5 trillion in losses following speeches from the Fed’s top dog. Powell has hosted three news conferences this year following meetings of the rate-setting Federal Open Market Committee. Kolanovic & Co. said they were followed by an average decline of 0.44 percentage point in the S&P 500. Other talks and speeches have resulted in an average fall of 0.40 percentage point, with losses coming in five of the past nine prominent speeches or Congressional testimonies he has delivered. The JPMorgan Chase chart below illustrates the moves, with testimonies represented in red and FOMC news conferences in blue, before and after the start of Powell’s comments:

To be sure, the research team acknowledges that directly attributing a market reaction to Powell’s comments is folly—in other worlds, correlation doesn’t mean causality, as former Fed Chairwoman Janet Yellen was known for saying—but the researchers note that there is an uncanny relationship between Fed chief’s remarks and market action. “While we acknowledge that it is not possible to attribute the market impact of each speech with certainty, simple math indicates that ~$1.5 trillion of U.S. equity market value was lost this year following these speeches,” they wrote in the Wednesday research note.

Confirmation or not, there will be mayhem.

• Senate Sets Key Kavanaugh Nomination Vote For Friday (ZH)

Senate Majority Leader Mitch McConnell filed a cloture on the Supreme Court nomination of Brett Kavanaugh late Wednesday, paving the way for a Friday procedural vote and – if Kavanaugh clears the procedural hurdle – a final vote as early as Saturday. McConnell touched off the process late Wednesday and announced that sometime during the evening, the FBI would deliver to an anxious Senate the potentially fateful document on claims that Kavanaugh sexually abused women, according to the AP. With Republicans clinging to a razor-thin 51-49 majority and five senators — including three Republicans — still vacillating, the conservative jurist’s prospects of Senate confirmation remained in doubt and potentially dependent on the file’s contents, which are supposed to be kept secret.

“There will be plenty of time for Members to review and be briefed on this supplemental material before a Friday cloture vote. So I am filing cloture on Judge Kavanaugh’s nomination this evening so the process can move forward, as I indicated earlier this week,” McConnell said. So far, no Democrat has said they will support Kavanaugh though Sens. Heidi Heitkamp (N.D.) and Joe Manchin (W.Va.) remain undecided. Meanwhile, GOP Sens. Susan Collins (Maine) and Lisa Murkowski (Alaska) have yet to say how they will vote on Kavanaugh. Sen. Jeff Flake (R-Ariz.) previously said he would support Kavanaugh and absent new information from the FBI’s background investigation into several sexual misconduct allegations is expected to be a yes vote, although Flake may revised his initial contract and claim that the FBI probe was not exhaustive enough.

Republicans would need two of out of the three swing votes to support Kavanaugh if every Democrat opposes him in order to get the 50 votes needed to let Vice President Pence break a tie and confirm him.

It’s not about the White House.

• White House Finds No Support in FBI Report for Claims Against Kavanaugh (WSJ)

The White House has found no corroboration of the allegations of sexual misconduct against Supreme Court nominee Brett Kavanaugh after examining interview reports from the FBI’s latest probe into the judge’s background, according to people familiar with the matter. It was unclear whether the White House, which for weeks has raised doubts about the allegations, had completed its review of the FBI interview reports. Officials were expected to be sending the FBI report to the Senate Judiciary Committee late Wednesday. Still, the White House’s conclusions from the report are not definitive at this point in the confirmation process. Senators who will decide Mr. Kavanaugh’s fate are set to review the findings on Thursday, and some of them may draw different conclusions.

The result could leave senators in much the same position as last week—faced with two witnesses providing mutually exclusive accounts and forced to decide between them. The investigation, which concluded two days before its Friday deadline, has faced mounting criticism in recent days from Democrats who have said the probe wasn’t appropriately comprehensive. Investigators spoke to one of the three women who made accusations of sexual misconduct against Judge Kavanaugh. Raj Shah, spokesman for the White House, said in a statement early Thursday morning: “The White House has received the Federal Bureau of Investigation’s supplemental background investigation into Judge Kavanaugh, and it is being transmitted to the Senate.”

A country in mortal moral decline. The level of cynical lying is astounding. The press doesn’t call her on it. The picture(s) say it all.

• Theresa May Pledges End To Austerity In Tory Conference Speech (G.)

Theresa May has made a bold pledge to bring a decade of austerity to a close, as she appealed to the public over the heads of her squabbling party to back her to deliver a Brexit deal. Speaking in Birmingham on Wednesday at the end of the Conservatives’ annual conference, which was marred by repeated clashes over Europe, May cast aside the chancellor’s concerns about the health of the country’s finances and signalled Brexit would mark an end to public spending cuts. Despite widespread speculation about her future, May also made several domestic policy announcements in an attempt to show she has not been blown off course by Brexit or noisy critics led by Boris Johnson.

They include: • Lifting the cap on local authorities borrowing to build new council homes. • Setting new targets for early cancer detection as part of a new “cancer strategy”. • Freezing fuel duty for the ninth consecutive year. But her most eye-catching pledge was the promise to bring to an end the decade-long programme of spending cuts imposed after the banking bailouts. “When we’ve secured a good Brexit deal for Britain, at the spending review next year we will set out our approach for the future,” she said. “A decade after the financial crash, people need to know that the austerity it led to is over and that their hard work has paid off.

“There must be no return to the uncontrolled borrowing of the past. No undoing all the progress of the last eight years. No taking Britain back to square one. But the British people need to know that the end is in sight. And our message to them must be this: we get it.”

India is a huge oil importer. Rupee sinks, oil prices rise.

• India’s Rupee Sinks To Record Lows., Central Bank Won’t Save It (CNBC)

The rupee’s plunge into record-low territory this year is unlikely to slow — even if India’s central bank hikes its rate this week, according to experts carefully watching the Reserve Bank of India. Analysts largely expect India, Asia’s third-largest economy, to raise its benchmark rate by 25 basis points at its meeting this week, with more increases to come this and next year. But while an interest rate hike would normally be expected to support a currency, the rupee “is in for continued losses ahead,” according to Prakash Sakpal, VP of research at Dutch bank ING. “Even if it hikes by 25 (basis points) as expected that’s unlikely to help the currency … The RBI will have to do more, though that looks unlikely on the grounds of on-target inflation and stress in the financial sector,” he said. Sakpal predicted the central bank will merely match the three U.S. Federal Reserve rate hikes this year without giving the rupee any leeway to gain against the dollar.

Many people end up worse off.

• Amazon Cuts Bonuses And Stock Awards As Minimum Wage Increases (CNBC)

Amazon’s minimum-wage increase for its hourly workers comes with a trade-off: no more monthly bonuses and stock awards. Amazon confirmed in an email to CNBC that the company is getting rid of incentive pay and stock option awards as it increases the minimum wage to $15 per hour. The company, however, stressed that the wage increase “more than compensates” for the loss in other benefits. “The significant increase in hourly cash wages more than compensates for the phase out of incentive pay and [restrictive stock units],” Amazon’s spokesperson said in an emailed statement.

“We can confirm that all hourly Operations and Customer Service employees will see an increase in their total compensation as a result of this announcement. In addition, because it’s no longer incentive-based, the compensation will be more immediate and predictable.” Additionally, workers affected by the change will get a chance to review the new pay structures and share any concerns they might have with the company, according to a person familiar with the matter. The confirmation follows multiple reports on Wednesday that some of Amazon’s warehouse employees say they will make less as a result of this change.

The Guardian said warehouse workers currently receive one Amazon share (worth $1,959) at the end of every year, on top of another single share reward every five years. Yahoo News noted that warehouse workers can earn up to 8 percent of their monthly income every month, which could be as much as $3,000 a year for some workers. Workers were notified of the change on Wednesday, according to Bloomberg. Amazon disclosed in its announcement on Tuesday that it is replacing the stock awards program with the minimum-wage increase because employees prefer the “predictability and immediacy of cash” compared with stock awards. The company didn’t say anything about the monthly bonuses.

Laundromat.

• Estonia Says Over $1 Trillion Flowed Through The Country In 2008-2017 (R.)

Banks doing business in Estonia, which has been at the center of a money-laundering scandal involving Danske Bank, handled more than $1 trillion in cross-border flows between 2008 and 2017, according to the country’s central bank. The European Union member country of just 1.3 million people has been rocked by revelations that banks there laundered money from Russia, Moldova and Azerbaijan via non-resident bank accounts. The scandal has forced lenders in Estonia and neighboring Latvia to shut down. The data on cross-border flows, first reported by Bloomberg, suggests that the scale of the money laundering through the small Baltic country may have been larger then previously thought. The news sent Nordic banking shares sharply lower.

The central bank said that between 2008 and 2017, cross-border transactions totaled 1.1 trillion euros ($1.27 trillion). The number includes all flows, including resident and non-resident transactions, a spokesman said. Estonia’s entire economic output came to about $25 billion last year – roughly the same as that of Uganda or Nepal – suggesting that much of the money flow was not directly linked to economic activity in the country. The central bank did not say whether it considered any of the flows suspicious. Bloomberg on Wednesday reported figures from the central bank saying that Estonia handled about 900 billion euros in non-resident cross-border transactions between 2008 and 2015.

“Far greater than the threat of human depredation on grizzlies, grim as it is, is the largely ignored imminent elimination of the habitat they must have to survive.”

• Grizzly: The Canary in Our Coal Mine (CP)

The decision was of tremendous import and was not made quickly but it was made decisively. Judge Dana Christensen ruled against the U.S. Fish and Wildlife Service delisting of the Yellowstone Grizzly, and stopped the trophy hunt proposed by Wyoming and Idaho, those retro redneck havens of braindead racism, industrial serfdom, and furious, moron machismo. In shutting down this corrupt, deeply cynical piece of ecological crime on the part of the U.S. Fish and Wildlife Service targeting the Yellowstone grizzly population of 700 bears, the judge kept unerringly to existing law, and ruled narrowly to render his decision unassailable. The key point is that, by law, no delisting action may be taken on a subpopulation of a threatened or endangered species that does not consider the effects on the species as a whole.

In other words, no action can be mandated on one population that does not include all others. This ruling, while it does not prevent a hunt of the entire species should such a despicable act of depravity ever be mandated, does prevent the kind of fatal assault on bear viability that killing them piecemeal–as would have been the case had the Yellowstone hunt gone ahead–represents. Because those who back this sort of blind madness are both stupid and relentless in their twisted perversity, this decision may well be appealed, and when that appeal is lost, the same lunacy may be tested in the NCDE or Cabinet-Yaak, regardless of the dead certainty that it will fail in court. This is the kind of minds one confronts in the fight for ecological sanity.

Beyond the relief and satisfaction and, yes, sheer elation, this decision has evoked in those who care about the viability of the Griz, it is impossible to ignore the dark future that looms for this world iconic creature due directly to human inability to love and live in symbiosis with the natural world. Far greater than the threat of human depredation on grizzlies, grim as it is, is the largely ignored imminent elimination of the habitat they must have to survive. It’s not complicated: without vast, connected areas of truly wild country where all the fatally destructive apparatus of human organization is absent, the bear and all top predators will be swiftly driven to extinction. This is not news. It has been common scientific knowledge for decades. And yet the combination of the utter corruption of our Capitalist politics with obscenely complicit sham enviro outfits known in the trade as Gang Green, has prevented passage of sane, adequate, and sufficient habitat legislation.

Not in his hands, not in ours.

• Attenborough: ‘Population Growth Must Come To An End’ (BBC)

End all trade in wildlife body parts.

• Humanity Is Waging A War Of Terror On Wildlife (G.)

Humanity is waging a war of terror on wildlife across the globe, according to the head of a world-leading research institute who was previously a counter-terrorism expert for the UK government. Dominic Jermey, director general of the Zoological Society of London (ZSL), also spent years in Afghanistan supporting the fight against terror, until leaving his post of UK ambassador in 2017. “Coming to ZSL, I am in a front row seat on a different kind of war, this time on wildlife,” he said in an article for the Guardian. “[It is] a war with catastrophic impacts on people and animals.” “While war and terror atrocities make daily headlines, the terror being waged on wildlife slides under the radar,” said Jermey, ahead of a global summit on tackling the illegal wildlife trade in London in October.

Other leaders are urging rapid action, with Gabon’s president, Ali Bongo, calling the crisis “a blight on humanity” and UK environment secretary Michael Gove saying the “massive global problem” needs the same scale of international response being taken to fight climate change. Illegal hunting and the destruction of wild habitat has resulted in the start of what many scientists consider the sixth mass extinction of life to occur in the Earth’s four-billion-year history. Over 80% of all mammals and half of plants are thought to have been lost since the rise of human civilisation.

Wildlife crime harms both people and animals, said Jermey: “The annihilation of wildlife by organised criminal gangs is violent, bloody, corrupt and insidious. It robs communities of their resources, their opportunities and their dignity. And we are all losers as the creatures with which we share this planet are pillaged to extinction.” One hundred million sharks are killed every year, mostly for their fins, and 20,000 African elephants for their ivory, he said. Losses have been greatest in recent decades, Jermey said, with a 58% decline in wildlife since 1970: “That’s like losing the entire [human] population of Asia from the world.”